Comparative Analysis Of Bashkortostan Republic And Chechen Republic Population Welfare And Investments

Abstract

The article analyzes the current trends in the development of fixed capital investment in Russia. A comparative characteristic takes place in the regional context of the Chechen Republic and the Republic of Bashkortostan. An assessment of the processes of organizing the development of investments in fixed assets and the population welfare based on local initiatives in 2020–2021 is made. The results of the implementation of regional practices are considered. It was revealed that in 2020 the number of implemented projects in the framework of the Real Deeds program was significantly reduced due to the threat of the spread of a new coronavirus infection (COVID-2019) in the Republic of Bashkortostan, similarly to the Our Village program, the number of applications submitted had decreased by more than three times. In this regard, new directions for the growth of the population welfare and investment activity in the region are proposed: The implementation of the initiative budgeting projects through the information and telecommunication network the Internet in the face of the threat of the spread of a new coronavirus infection (COVID-2019) in the Republic of Bashkortostan; implementation of initiative budgeting projects related to the involvement of historical and cultural places of human settlement in the economic circulation, with the expansion of the tourism potential of the territories; creation of a production and construction cluster, development and implementation of new technologies on the basis of the technology parks.

Keywords: Construction industry, economic growth, housing, income, population welfare, standard of living

Introduction

Given the uneven development of Russian regions, fluctuations in the dynamics of income and consumer purchases in 2018–2020 and early 2021 were noticeable, but did not change the overall ratio of the levels of regional consumption of families. In 2019, there was a slight increase in the share of food purchases in the whole country and most types of the regions – this trend will be more noticeable in 2020. The economic recovery will largely depend on a return to non-food shopping and consumer services. The consumption structure by types of goods and services, most likely, will retain traces of changes that occurred during the quarantine period. Housing construction can become the engine of the economy, creating hundreds of new jobs, including small businesses. On average, in all regions of Russia, fixed capital investments had increased by only 1.3 % compared to 2013. Among the priority tasks of social and economic development is the task of creating an affordable housing market by increasing the effective demand of the population for housing through the development of housing lending and increasing investment in fixed capital, which is reflected in the proposed article.

Problem Statement

A significant contribution to the development of a base for scientific and practical support for the implementation of mechanisms for changing housing provision and opportunities for improving the living conditions of the population in the transition period was reflected in the works of Polidi and Tumanova (Polidi, 2014; Puzanov et al., 2012).

Publications of Bobkov and Kanaev (2006), Bobkov and Odintsova (2012), Lozovskaya (2011), Kazakov (2010) are devoted to the analysis of the differentiation of the Russian Federation regions in terms of the level of provision of the population with housing, housing affordability, and the scale of housing construction (Pigou, 1932).

Belchuk (2012), Belchuk and Sergeeva, (2013) provide an assessment of the federal districts and constituent entities of the Russian Federation, reveal regional features and spatial heterogeneity of housing provision.

The problems of the implementation of federal targeted housing programs and their quality in the regions, the possibility of developing regional housing programs are addressed by such authors as Borovskikh and Kozlova (2012a; 2021b).

Differences in access to economic and social benefits are also provoked by a different level of well-being in terms of their consumption (Pigou, 1932), both at the individual level and in society as a whole. However, the growth of the welfare of each member of society, according to the concept of a mass consumer society (Galbraith, 1962; Rostow, 1960; Samuelson & Nordhaus, 2008) invariably leads to an increase in the level of social welfare.

Research Questions

Previously published article analysis had shown that considerable attention has been paid to the implementation of investment mechanisms and population welfare growth, but the aspects of scientific and practical support for the implementation of welfare growth mechanisms at the regional level remain insufficiently studied, which determines the relevance of this study.

Purpose of the Study

The purpose of the article is to analyze current trends in the development of investment activity in the Republic of Bashkortostan and develop recommendations to increase the welfare of the population in the region.

Research Methods

The theoretical foundations of the study of the practice of investing in fixed assets and the population welfare were based on the fundamental concepts of foreign and domestic scientists. The sources of statistical data were the official data of the Federal State Statistics Service of the Russian Federation, the Ministry of Finance of the Russian Federation.

The following methods were also used in the study: methods of comparative analysis of social and economic processes, generalization and systematization of facts, logical and historical methods of scientific research. In general, the choice of research methods was based on a comprehensive analysis of Russian and foreign experience in studying the practices of the relationship between investments in fixed assets and the population welfare. The use of all the above methods ensured the objectivity of the results obtained and the validity of the conclusions. The object of the study was the processes of investing in fixed assets in the Republic of Bashkortostan.

Findings

A whole range of factors influenced the development of the housing construction industry in 2020. A key role, both at the national and regional levels, was played by a significant increase in demand, largely due to the operation of preferential mortgage programs. It outpaced supply growth, which was limited by the portfolio of projects launched in the previous year. Some influence on the prices was rendered also by growth of costs of builders. As a result, there was a deficit in the housing market in 2020, which led to an acceleration in price growth compared to 2019. At the same time, it was characterized by high regional heterogeneity and was largely influenced by local factors.

In 2020, the housing construction industry had developed under the influence of various factors. A significant increase in economic uncertainty in the context of the coronavirus pandemic, as well as a sharp drop in the population income in the second quarter of 2020 due to the restriction of business activity to control the spread of the infection led to a decrease in demand, including housing. However, it was temporary in nature and in the second half of 2020 it was replaced by growth. The demand for housing was largely stimulated by the easing of monetary policy, as well as measures to support the industry in the context of the coronavirus pandemic, including a program of preferential mortgage lending at 6.5 % per annum.

The transition to project financing of housing construction at the end of 2019 also had a significant impact on the industry development. These factors set general trends in the housing market in most macroregions. However, the situation differed significantly from region to region. A significant role was played by local factors (the number of projects with a high degree of readiness, the presence of regional preferential mortgage programs, etc.), which was reflected in a significant spread in the growth rates of both construction volumes and housing price dynamics.

Despite the decline in real incomes of the population in 2020, in most macro-regions there is an increase in demand for residential real estate. It was associated with two groups of factors. The first was to increase the availability of mortgages. That was indicated by enterprises of all macroregions, mainly noting the role of the program of preferential mortgage lending at 6.5 % (see Figure 1).

A set of preferential mortgage programs supported the demand in most macroregions, in terms of scale, significantly offset the effects of lower incomes, and increased the economic uncertainty. At the same time, in the Republic of Bashkortostan and the Chechen Republic, the rise in housing prices in response to a significant increase in demand has already largely or even completely offset the positive effect of concessional lending on the affordability of housing for buyers.

The second reason for the growth in demand for real estate in 2020, in addition to the increase in the availability of credits, is a shift in the savings preferences of the population. Against the backdrop of lower deposit rates and volatility in the foreign exchange market, the attractiveness of real estate as an asset used by households as a store of value has increased.

The experience of developed countries shows that housing construction can become a ‘locomotive’ for the growth of related industries and have a positive impact on the growth of real incomes of the population. In the context of high housing prices and a decline in real incomes of households, it is necessary to search for new institutions, the implantation of which would allow households to become homeowners even in conditions of macroeconomic instability.

In general, in 2020, the housing construction market faced a significant increase in housing prices in almost all regions. In 2021, given the announced deadline for the completion of the comprehensive 6.5 % concession program by 1 July 2021, most businesses expect demand to gradually return to sustainable levels, which should help slow down and normalize housing price growth. In the context of significant unevenness in development of Russian regions, fluctuations in the dynamics of income and consumer purchases in 2018–2019 and early 2020 were noticeable, but did not change the overall ratio of the levels of regional consumption of families. In 2019, there was a slight increase in the share of food purchases in the whole country and most types of regions – this trend should be more noticeable in 2020. The economic recovery would depend to a large extent on a return to non-food shopping and consumer services. The structure of consumption by types of goods and services, most likely, will retain traces of those changes that occurred during the quarantine period.

The coronavirus infection (COVID-19) pandemic and the quarantine measures introduced to contain it had a significant impact on consumer demand as well as on the social situation of the population.

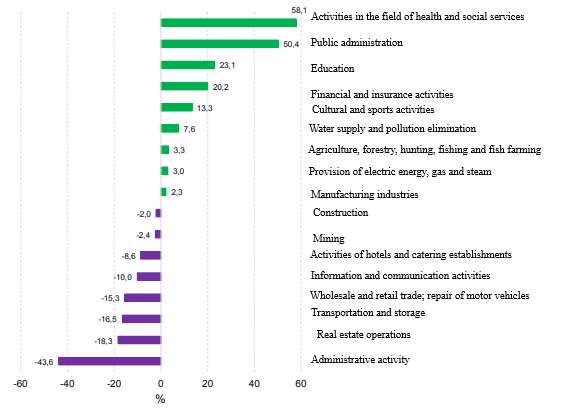

The leading group includes activities in the field of healthcare and social services (+58.1 %) in terms of the investment dynamics in the first half of 2020. According to experts, the COVID-19 pandemic has increased interest in medical technologies and led to an increase in investments in healthcare. In many countries, including Russia, the authorities jointly with businesses, have begun to launch additional projects to develop a vaccine against COVID-19, provide rapid diagnostics and screening, and prevent the spread of the virus through innovation. Startups also continued to be active in the field of telemedicine, remote treatment and monitoring, online pharmacies, artificial intelligence and data analysis, robotic technology and telemetry. For example, Russian Venture Company JSC and the Ministry of Industry and Trade of Russia opened a specialized venture fund for high-tech medical projects, the volume of which is 4.5 billion rubles. The COVID-19 pandemic has affected most sectors of the economy, in particular the education sector. The closure of schools and universities due to forced quarantine restrictions provoked an increase in investment in this industry in the first half of 2020 by 23.1 %. The growth of investments was especially noted in technological educational projects (EdTech startups). In addition, in the first half of 2020, investments showed growth in public administration (+50.4 %), financial and insurance activities (+20.2 %), cultural and sports activities (+13.3 %), and in agriculture and forestry (+3.3 %). On the contrary, the investments in construction (–2.0 %), activities of hotels and catering enterprises (–8.6 %), wholesale and retail trade (–15.3 %), transportation and storage (–16.5 %), activities in real estate transactions (–18.3 %), as well as in administrative activities (–43.6 %) decreased. Despite the fact that, in general, the investments in information and communication activities have shown a reduction of 10.0 %, the subtypes of this activity are of interest. For example, the investments in publishing increased by 16.6 % in annual terms, information technology – by 36.7 %. As for the investments in communications, they decreased by 19.0 %, which had the greatest negative impact on this sector of the economy.

The key components of the attracted funds are budgetary funds (federal and regional), as well as bank loans (Russian and foreign banks). Budgetary funds, as a rule, are directed to socially significant projects. Despite the spread of coronavirus infection and forced quarantine restrictions in the first half of this year, the share of budget funds showed an increase of 2.2 p.p. in annual terms.

The dynamics of key indicators of the industry in comparison with the federal level and the level of the Volga Federal District and the North Caucasus Federal District are shown in Table 1.

As it can be seen from the table, the fixed capital investment peak of construction organizations and the total volume of construction work was observed in the period of 2015–2016, which was mainly due to deferred demand. However, in general, from 2015 to 2017 the construction market of the Republic of Bashkortostan was in recession, which is clearly seen from the indicator decrease in 2017. The market and the industry managed to overcome the consequences of the crisis only at the end of 2018, when there were trends towards an increase in key indicators (see Table 2).

The data in Table 01 show that the volume of investments in fixed capital of enterprises of the Republic of Bashkortostan, after a decrease in 2017, had slightly increased in 2018 (by 7.9 billion rubles). However, against the background of higher growth rates of the all-Russian indicator, the share of the Republic remained at the previous level of 1.6 %. By 2016 and 2015, the overall decline of this indicator (when deferred demand was implemented) amounted to –86.4 and –49.1 billion rubles, respectively.

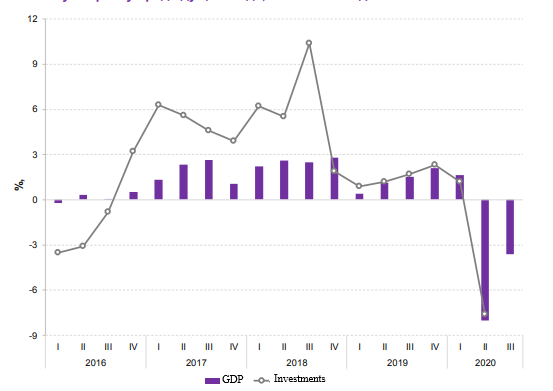

In September 2020, the Ministry of Economic Development of Russia had increased the indicators of the forecast for the social and economic development of the Russian economy for the coming years. More optimistic estimates compared to the earlier forecasts were also given in relation to investments in fixed assets. The agency expected a fall in fixed asset investment by 6.6 %, which is 3.8 p.p. better than previous estimates of the decline. Despite this fact, the Russian Ministry of Economic Development did not expect a quick recovery in investment activity, in part because the optimization of federal and regional budgets would largely affect the investment spending. In this regard, according to the Office, the volume of the indicator would reach the pre-crisis level only in 2022 (see Figure 2).

At the end of Q1 2020, the growth rate of gross fixed capital formation had slowed down and amounted to +1.2 % compared to the same period in 2019. The slowdown in the growth of fixed capital investment in the first three months of this year was due to a sharp drop in oil prices as a result of the lifting of production restrictions on March 6 under the OPEC + agreement, as well as a deterioration in the global situation in March against the backdrop of an increase in the number of countries introducing restrictive measures to fight new coronavirus infection. Nevertheless, since the spread of coronavirus infection in Russia has not yet been so critical and large-scale, the dynamics of the investment remained in the zone of growth.

Conclusion

The experience and practice of implementing projects of investment activity of citizens in fixed assets in the region prove significant economic and social effects from their implementation:

- Greater number of tools for solving issues of regional importance, significant problems of municipalities of the Republic of Bashkortostan.

- Growth in the share of the population involved in the processes of investment activity.

- Improved financial literacy of households.

- More efficient spending of funds.

The main directions for the development of practices for investing in fixed capital and increasing the welfare of citizens in the region could be directions that are developing in other regions of the Russian Federation and in the world:

- Implementation of fixed capital investment projects based on youth initiatives.

- Implementation of the investment projects through the information and telecommunications network the Internet.

- Implementation of the investment projects and growth of the welfare of citizens related to the involvement in the economic circulation of historical and cultural places of human settlement, with the expansion of the tourism potential of the territories.

Improvement of expert advice, creation of a production and construction cluster, development and implementation of new technologies based on technology parks.

References

Belchuk, E. V. (2012). Analysis of regional differentiation of social field in Russia. Economic Analysis: Theory and Practice, 32, 11–18.

Belchuk, E. V., & Sergeeva, O. I. (2013). Spatial heterogeneity of housing provision of the population of Russia. Bulletin of the Russian Economic University. G.V. Plekhanov, 2, 92–102.

Bobkov, V. N., & Kanaev, I. M. (2006). The structure of society (by income and housing). The Economist, 9, 42–52.

Bobkov, V. N., & Odintsova, E. V. (2012). Social structure of Russian society according to the criteria of income and housing provision. The standard of living of the population of the regions of Russia, 1, 20–28.

Borovskikh, O. N., & Kozlova, E. V. (2012a). Implementation of social housing programs as a tool to increase the provision of housing to the population. News of the Kazan State University of Architecture and Civil Engineering, 4, 431–436.

Borovskikh, O. N., & Kozlova, E. V. (2012b). Problems of choosing key indicators in assessing the effectiveness of measures to increase the affordability of housing for the population. Bulletin of Economics, Law and Sociology, 4, 23–26.

Galbraith, J. (1962). The Affluent Society. Penguin Books.

Kazakov, V. N. (2010). Housing affordability and the level of housing provision of the population: interregional analysis. Proceedings of the St. Petersburg University of Economics and Finance, 2, 101–105.

Lozovskaya, A. N. (2011). Statistical analysis of housing affordability for the population in the regions of Central Federal District. Economics, Statistics and Informatics Technologies. Vestnik UMO, 2, 185–190.

Pigou, A. (1932). The Economics of Welfare. Macmillan and Co.

Polidi, T. D. (2014). Russia’s Accumulated Housing Investment Shortfall: Threats to Prospects. Questions of Economics, 4, 37–55.

Puzanov, A. S., Kosareva, N. B., Polidi, T. D., & Tumanov, A. A. (2012). Analysis of changes in housing provision and opportunities for improving housing conditions during the transition to a market economy. The standard of living of the population of the regions of Russia, 1, 29–41.

Rostow, W. (1960). The Stages of Economic Growth: A Non-Communist Manifesto. University Press.

Samuelson, R., & Nordhaus, W. (2008). Economics. McGraw Hill Education.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

23 December 2022

Article Doi

eBook ISBN

978-1-80296-128-7

Publisher

European Publisher

Volume

129

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1335

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Beschastnova, N., Beguev, S., & Vasilyeva, Z. (2022). Comparative Analysis Of Bashkortostan Republic And Chechen Republic Population Welfare And Investments. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization- ISCKMC 2022, vol 129. European Proceedings of Social and Behavioural Sciences (pp. 219-227). European Publisher. https://doi.org/10.15405/epsbs.2022.12.28