Abstract

Potential as a category is commonly addressed within two levels – attained (real) and advanced (perspective). Resources and capacity that today are available to economic entities highlight a level attained. They are a real component of economic potential. Economic potential is not only a stock of available resources, but also a current or potential ability to make effective use of resources available. In order to identify the period when tax potential was first calculated, it is necessary to trace the development of inter-governmental relations as such. Different economists provide different definitions of the term “tax potential”. Differences in definitions are due to the fact that different authors have different goals and objectives, thereby dealing with different aspects of the category. Tax potential plays a crucial role in improving inter-governmental relations, as well as in determining the procedure for granting transfers. A considerable value of this category is that authorities have an incentive to increase their own revenue base. Thus, there are some institutional views on the development of tax policy including fiscal, functionally stabilizing, investment. The functionally stabilizing view is currently essential for the Russian tax policy, whereas regional tax policies pay special attention to the features of regional tax legislation, tax planning in the region, as well as the system of tax administration. Therefore, with a prevailing type of tax policy to be applied in a particular subject at a certain moment, one can identify trends in the implementation of tax potential.

Keywords: Economic potential, region, tax potential

Introduction

In the late 20th century, the category of potential or economic potential was introduced in economics. Earlier, the concept of productive capacity was emphasized for assessments of industrial enterprises. Soon a broader concept of economic potential appeared (Basnukaev & Musostov, 2020).

Problem Statement

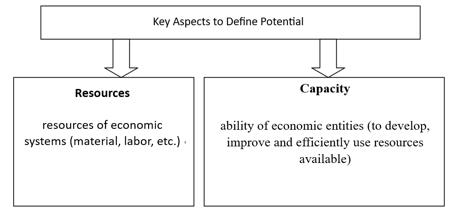

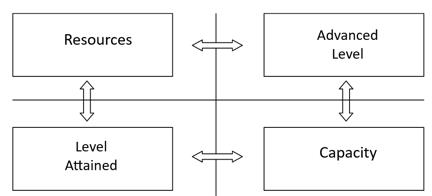

The key aspects that define the category of potential are shown in Figure 1. Potential is addressed within two levels – attained (real) and advanced (perspective). The resources and capacity that an economic entity has today highlight the level attained. They are a real component constituting economic potential. The advanced level is maximum possible amount of company resources, with the involvement of all available opportunities and reserves.

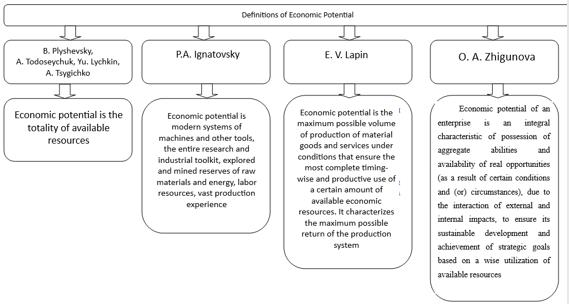

The relationship between the key aspects of potential and its levels is shown in Figure 02. The relationship between aspects and levels of potential, presented in the figure above, resulted in various concepts of the concept “economic potential”. Figure 03 shows some interpretations of the concept.

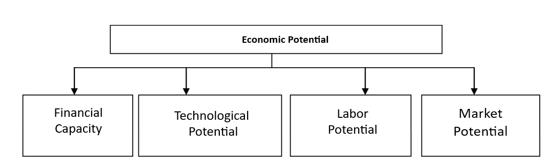

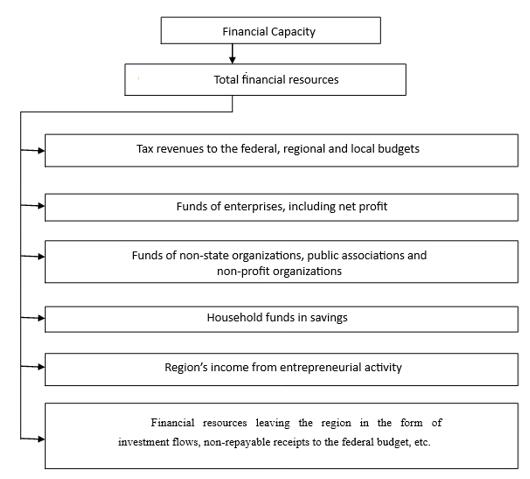

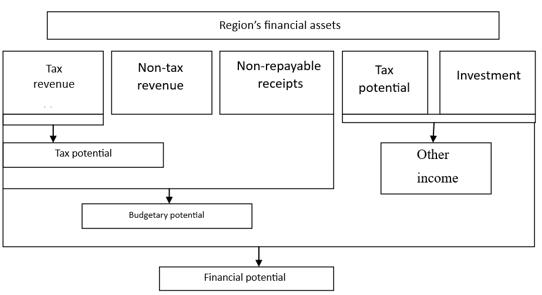

Thus, economic potential is not only a stock of available resources, but also a current or potential ability to make effective use of resources available. The elements that make up economic potential is shown in Figure 04, and the financial capacity – in Figure 05. The way tax, budgetary and financial potentials interact is shown in Figure 06.

Research Questions

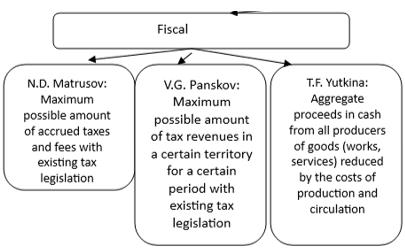

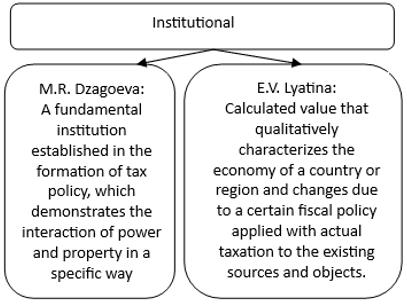

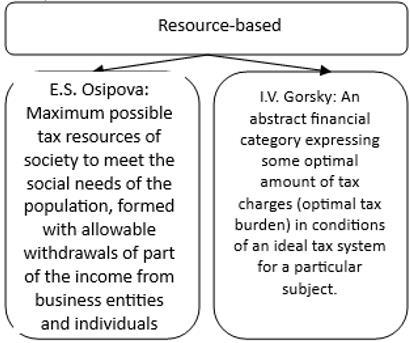

Let us consider the definition of “tax potential”. There are different views on the definition of this category (Figure 07 a, b, c).

The data shown in Figure 08 suggests that different economists have different views on the definition of the term “tax potential”. Differences definitions of the above term are due to the fact that different authors have different goals and objectives, thereby dealing with different aspects of the category (Kozaeva & Betrozova, 2020).

Purpose of the Study

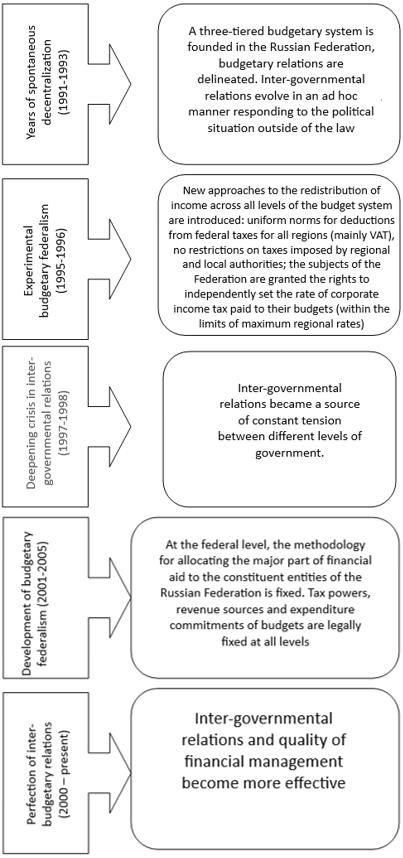

In order to identify the period when tax potential was first calculated, it is necessary to trace the development of inter-governmental relations as such (Kirillova & Rodyukova, 2020) (see Figure 08).

Research Methods

The paper used some general research methods including historical, system analysis, measurement, analogies and generalizations, comparisons, as well as structural and functional approaches and special ones like economic analysis, statistical, correlation and regression analysis.

Findings

Tax potential plays a crucial role in improving inter-governmental relations, as well as in determining the procedure for granting transfers. The most considerable value of this category is that authorities have an incentive to increase their own revenue base (Bushinskaya et al., 2020).

Thus, tax potential of a region is a component of financial potential of the region. In addition, it acts as a framework for the development of tax revenues of the regional budget and features the maximum possible amount of tax revenues to the regional budget within the existing taxation system. (Basnukaev, 2021).

One of the main criteria for the development of tax potential of a subject is also the quality of tax planning. It should be based on a scientific approach to the development of society at this stage, with due account for the established priorities. Moreover, the existing economic development of a particular subject should be assessed based on previous correct assessments of the potential, reserves and a strategic development plan.

Conclusion

Thus, there are some institutional views on the development of tax policy including fiscal, functionally stabilizing and investment. The functionally stabilizing view is currently essential for the Russian tax policy, whereas regional tax policies pay special attention to the features of regional tax legislation, tax planning in the region, as well as the system of tax administration. Therefore, with a prevailing type of tax policy to be applied in a particular subject at a certain moment, one can identify trends in the implementation of tax potential.

Acknowledgments

The study was carried out within the framework of RFBR project No. 20-310-90063.

References

Basnukaev, M. S. (2021). System establishment in taxation: causes and impacts on transformations and changes in the tax base. Economic and Humanitarian Sciences, 4(351), 40–45.

Basnukaev, M. S., & Musostov, Z. R. (2020). Sustainable development: enterprise management. In I. V. Penkova (Ed.), Collection of scientific papers of the III International Scientific and Practical Forum Russia, Europe, Asia: Digitalization of the Global Space (pp. 101–106). https://www.elibrary.ru/item.asp?id=44747289

Bushinskaya, T. V., Ageeva, A. Y., Dyda, A. A., & Kunina, M. G. (2020). Regional tax policy: problems of formation and implementation. Bulletin of the Tula Branch of the Financial University, 1, 13–16. http://www.fa.ru/fil/tula/science/Documents/%D0%92%D0%B5%D1%81%D1%82%D0%BD%D0%B8%D0%BA%20%D0%A2%D0%A4%20%D0%A4%D0%B8%D0%BD%D1%83%D0%BD%D0%B8%D0%B2%D0%B5%D1%80%D1%81%D0%B8%D1%82%D0%B5%D1%82%D0%B0%202020%20%E2%84%961.pdf

Kirillova, S. S., & Rodyukova, A. S. (2020). Achieving a balance of local budgets in conditions of instability. The Bulletin of Michurinsk State Agrarian University, 2(61), 188–192. http://ecobez.guu.ru/wp-content/uploads/sites/26/2020/06/%D0%92%D0%B5%D1%81%D1%82%D0%BD%D0%B8%D0%BA-%E2%84%96-2-2020.pdf#page=191

Kozaeva, O. T., & Betrozova, M. A. (2020). The role of local taxes in the formation of local budget revenues. Economics and Entrepreneurship, 3(116), 413–417.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

23 December 2022

Article Doi

eBook ISBN

978-1-80296-128-7

Publisher

European Publisher

Volume

129

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1335

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Basnukaev, M. S., & Musostov, Z. R. (2022). Scientific Views On The Essence And Content Of Local Potential. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization- ISCKMC 2022, vol 129. European Proceedings of Social and Behavioural Sciences (pp. 156-164). European Publisher. https://doi.org/10.15405/epsbs.2022.12.21