Abstract

This article aims to prove that not only in theory but also in practice there is a linear relationship between the internal audit effectiveness and sustainable development of enterprise. And as a result of this, a definitive answer to the question “Whether and to what extent does internal audit affect the sustainable development of an enterprise?” is given. Understanding the contribution of internal audit is considered as an initial basis to make useful recommendations for improving the effectiveness of the internal audit department as well as of the entire enterprise. In order to serve attaining these research purposes, this article also proposes an assessment model of the internal audit effectiveness by evaluating four objectives determined based on the Concept of Internal Control of The Committee of Sponsoring Organizations of the Treadway Commission and the Stakeholder Theory of Edward Freeman and suggests a new methodology for assessing the sustainable development of enterprise lean on achievement assessment of the 17 Sustainable Development Goals of United Nations using an approach of integration between GRI standards and The Sustainable Development Goals. The research subject is companies with state participation in Vietnam. Research data is collected from objective sources disclosed by these enterprises and handled with the support of SPSS Statistics.

Keywords: GRI standards, Internal audit effectiveness, sustainable development, The Sustainable Development Goals of United Nations

Introduction

Although more than three decades have passed since the Brundtland Report entitled “Our common future” was released in 1987 by The World Commission on Environment and Development, the concept of sustainable development (SD) continues to be the central topic of discussion in the scientific forums. If at the global level the application of this concept has not brought significant results, at the enterprise level there are some positive (Klarin, 2018). Especially when 17 sustainable development goals (SDGs) of the United Nations (UN) become the strategic objectives of the leading enterprises, and they actively integrate these goals into their long-term plans. However, at the present, the “3H ISSUEs”, stands for three questions relating to sustainable development: How to achieve the SDGs? How to assess the level of goal achievement? How to report these results?, has not yet got a proper answer with the consensus of stakeholders. To solve the first problem “How to achieve the SDGs?” many management frameworks such as Business Excellence Models, guidelines, and standards business, in turn, are suggested and internal audit is one of these research directions, which have received increasing attention from scientific community around the world..

Problem Statement

Internal audit is considered an effective instrument to ensure SD of enterprises because it possesses the necessary qualities and competencies to be able to demonstrate its recognized role (Kabashkin & Annaeva, 2010). By implementing a systematic literature review combined with inductive logic, numerous studies have clearly shown a significant contribution of internal audit to enterprise performance, which includes both the construction and realization of the Corporate Social Responsibility strategies (Al-Matari et al., 2013; Dineva, 2019). Added to that, being an indispensable pillar in the sustainability management system, as well as a factor facilitating the formation of good corporate governance, internal audits indirectly help enterprises achieve SD strategy (Puci & Guxholli, 2018; Zou, 2019).

Besides, to increase the persuasiveness of their own judgment, many scholars have collected data by using questionnaires and determined the correlation coefficient as well as the beta coefficient. Research results confirmed the existence of the relationship between internal audits and the enterprise efficiency and effectiveness (Akeem et al., 2019; Eleazer & Mark, 2021; Fatah et al., 2021; Shamsuddin & Bakar, 2021; Yuvaraj et al., 2018), between internal audits and the quality of non-financial reporting, such as integrated reporting and sustainability reporting (Desimone et al., 2020; Engelbrecht et al., 2018). Apart from that, internal audit has a positive influence on the quality of corporate governance, and it also creates added value to enterprises by helping them achieve SDGs. However, according to most Chief Audit Executives, Chief Accountants, Board of Directors, managers, and auditors, who participated in the research surveys, in fact, the contribution of internal audit is still limited and does not meet the expectations of stakeholders. On the other hand, based on data collected from objective sources instead of depending on the subjective opinion of the respondents, a number of other scholars also agree with the statement about the important and incontrovertible role of internal audit (Liao & Ji, 2019; Mamaile, 2020; Yuvaraj et al., 2017;).

However, it is worth noting that at last there is still not a specific answer about the real contribution of internal audit to the sustainable development of enterprises. Because, it is easy to realize that the dependent variable studied by scholars is not sustainable development, but often only one of three major aspects of sustainability, namely the economic aspect. The enterprise performance is measured by key financial indicators, such as net profit and return on assets. Although a number of studies have mentioned sustainable development, they only focused on the presentation and disclosure of results relating to the implementation of those SDGs. Moreover, in some research internal audit was viewed as a moderating variable that affected the other considered relationship (Yuvaraj et al., 2018).

Research Questions

Therefore, in order to convince administrators also the stakeholders that internal audit is an effective instrument and investing in enhancing its performance is the necessary condition to achieve sustainability, there are two issues that need to be solved:

- In practice, does internal audit affect the sustainable development of an enterprise?

- To what extent is internal audit crucial for the sustainable development of an enterprise?

Purpose of the Study

This article aims to quantify the relationship or in other words to answer the above-mentioned questions and to assess whether the actual contribution of internal audit is commensurate with its ability and expectations of society. At the same time, the research results will become a prerequisite for expanding the geographic scope and diversifying types of enterprises of following studies in order to help stakeholders clearly understand the role of internal audit, as well as recommend new directions to promote the strengths of internal audit as an effective instrument to ensure sustainable development of enterprise.

Research Methods

The relationship between internal audit and sustainable development of the enterprise is measured through the simple linear regression model written as the following equation:

SDE = β0 + β1 IAE + ɛ, where:

SDE – Level of sustainable development of enterprise

IAE – Internal audit effectiveness

β0, β1 – Regression coefficients

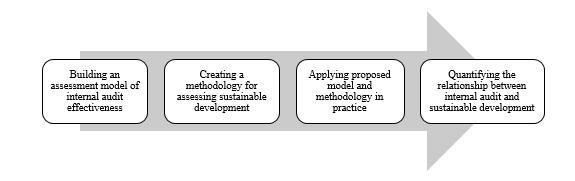

Currently, relating to the evaluation of internal audit effectiveness, there is still no official guideline having the mandatory nature of professional organizations. Consequently, there exist different methods with the diversity of indicator systems determined based on the input, process, output, and outcome framework (Phan, 2020). This leads to inconsistency and imprecision of evaluation results of internal audit activities. Not only that, a lot of research homogenizes evaluation criteria belong with the factors affecting the internal audit quality and the majority of them focus on aspects of input, process, and output, instead of outcome one. Besides, most of the proposed evaluation models are not able to pass subjective barriers, because data collection techniques are mainly based on expert assessment, even if they are used for both quantitative criteria. Therefore, building an assessment model of internal audit effectiveness in order to eliminate the above-mentioned shortcomings is the first step in the research process (Figure 01). Objectivity and feasibility are the two basic principles premise for the design and choice of a suitable assessment model.

Compared with an internal audit, the sustainable development assessment of the enterprise is in the stages of backbone formation for subsequent perfection. Therefore, there is still no official definition of sustainable enterprise, as well as an assessment methodology considered as a generally accepted standard for the business community. Hundreds of Socially Responsible Investment Indexes have been launched by credit institutions or rating agencies and are viewed as the main assessment frameworks. While choosing the standard for disclosure of non-financial information is voluntary, GRI standards become one of the most popular guidelines applied by the business community in the world. According to the report of the KPMG, in 2020 around three-quarters (73 %) of the world's largest 250 enterprises and two-thirds (67 %) of the 5200 enterprises comprising the largest 100 firms in 52 countries use GRI standards (The time has come…, 2020). At the same time, as mentioned earlier, the section “The contribution to achieving the 17 UN SDGs” is also gradually become an indispensable component in the sustainability report. Ignoring the incompatibility of content as well as the disclosed indicators, the non-financial statement is really an abundant and useful data source. Therefore, to take advantage of this source creating a methodology for assessing sustainable development of enterprise based on achievement assessment of the 17 SDGs, instead of the economic, social, and environmental sustainability as the previous models, becomes the next step. This methodology is founded on the idea of integration between GRI standards and the SDGs of the United Nations.

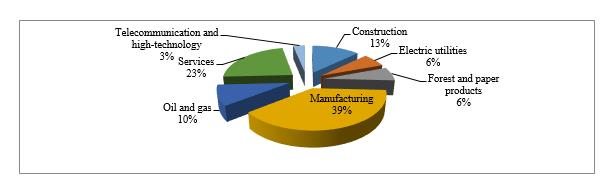

The data for the research is collected primarily from the report system published by enterprises on their official websites, such as financial statements, independent audit reports, annual reports, non-financial statements, and reports of other related agencies such as state auditors, government inspectors, tax authorities, etc. With both political and financial powers, hybrid organizations as the companies with state participation are the government’s right-hand man to achieve sustainable development. While the performance and contribution of these enterprises remain controversial, finding an effective instrument to increase economic value is essential. Therefore, a sample consisting of 31 companies with state participation in Vietnam (N = 149) disclosing non-financial information (21 %) is chosen for applying the proposed model and methodology in practice (Figure 02).

The number of companies with state participation are defined based on data released by State Capital and Investment Corporation, Commission for the Management of State Capital at Enterprises and Government Portal. Finally, quantifying the relationship between internal audit and sustainable development is implemented with the support of software IBM SPSS Statistics 20.

Findings

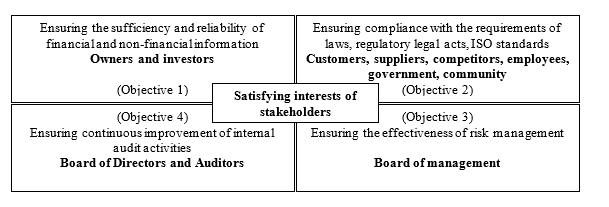

First, assessment of the internal audit effectiveness is based on the level of achievement of objectives. Through the combination of The concept of Internal Control released by The Committee of Sponsoring Organizations of the Treadway Commission (COSO) and Stakeholder theory of Edward Freeman (1984) four objectives used as a framework to identify the criteria and indicators of the assessment model are presented in detail in the figure below (Figure 03).

The number of criteria and indicators used to assess the sufficiency and reliability of financial statements and sustainability reports (5 criteria and 20 indicators) is more than the remaining objectives (2 criteria and 4 or 6 indicators). Therefore, the maximum converted score is 30 points, including 5 minus points related to the impact level of incorrect information that is the basis for the auditor's opinion. The table below shows formulas for calculating specific indicators and the rules of score conversion (Table 01). The total maximum score, that an effective internal audit function reaches, is 100 points, and they are classified into four categories, respectively: [0, 59] – Poor, [60, 74] – Average, [75, 89] – Good, [90, 100] – Excellent.

Secondly, integration between GRI standards and the UN SDGs is one of the prerequisites to help improve the quality of non-financial information. This process aims to identify concretely “Which indicators proposed by the GRI standards can be used to assess the achievement level of a UN SDG?”.

According to the GRI, each standard offers a specific topic and the corresponding number of different indicators. In this context, several standards on different topics can be combined to disclosure information related to one UN SDG, and conversely, one standard with a specific topic can reflect information related to some UN SDGs. Sustainable development of enterprise is measured by the geometric mean of the achievement level of 17 SDGs, which is calculated using the formula:

SD = , m =

The achievement level of the UN SDG is the weighted arithmetic mean of converted scores respectively of the economic, environmental and social indicators, which are the results of integration between GRI standards and 17 UN SDGs (Table 02). The actual value of a specific indicator is converted according to the100-points scale. Weights are determined by the percentage of indicators belonging to the economic, environmental and social topics in the total number of indicators suggested by the GRI standards (Table 03).

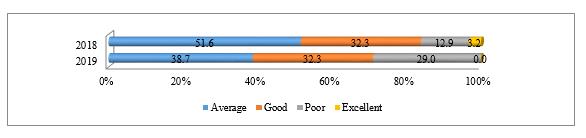

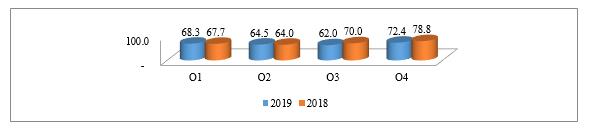

Result of the application of the proposed assessment model shows that the internal audit effectiveness of 31 companies with state participation in Vietnam only reaches the average level in 2019 with the dominant proportion of enterprises rating “average – poor” (67.7 %). No enterprise is eligible to achieve an excellent score at the time of this study. Notably, the effective level of internal audit tends to decrease in comparison to 2018 (Figure 04). Here are the signs that the internal audit activities at companies with state participation have not received proper attention and investment. As a consequence, the internal audit quality has not achieved expected outcomes.

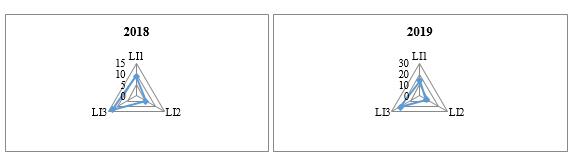

Analysis of the achievement level of internal audit objectives indicates that internal auditors are not enough good at ensuring the effectiveness of risk management and compliance with the provisions of law, the ISO standard and the internal requirements (Figure 05). Only more than 32 % of enterprises achieve a set of goals. At the present, risk management relating to accounts receivable as well as financial investments is not effective. The average ratio of provisions for doubtful debts to total accounts receivable is approximately 9 % (the largest percentage – more than 40 %) and this ratio tends to increase gradually with growth rate of 24 % in 2019 compared to 2018.

The average ratio of provisions for impairment of financial investments to total financial investments reaches more than 1 % (the largest percentage reaches more than 22 %). Besides, the control procedures designed to manage tangible assets at the companies with state participation are also not working, because of high frequency of occurrence of damage or shortage of the property. The average ratio of missing assets to total assets in 2019 accounted for nearly 0.3 % and increased by almost 20 % compared to 2018. Over half of the researched enterprises lost assets without clear reasons. In particular, most enterprises had trouble in improving the effectiveness of risk management, because the dominant number of enterprises did not achieve the “LI3” indicator (Figure 06).

Besides, the companies with state participation in Vietnam frequently arise issues related to laws on management and use of public property and tax law than the remaining ones. The enterprises operating in the oil and gas industry or construction usually face with disputes arising with negative results (over 60 % of the total of the disputes).

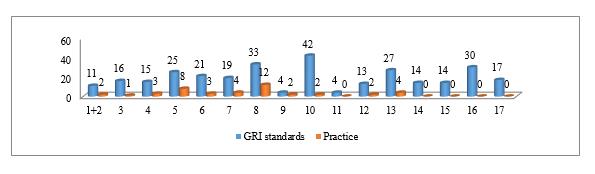

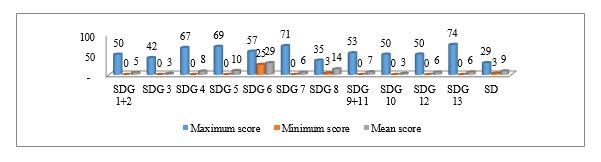

In comparison to the total number of proposed indicators for assessing the sustainable development of enterprise by the GRI standards, only 14 % of the indicators are selected by most enterprises (Figure 07). These results demonstrate an actual situation of non-financial report: lack of compatibility. Not surprisingly, when the sustainable development of companies with state participation in Vietnam based on the achievement level of the 17 UN SDGs only reaches the “poor – fair” level with a really low average converted score, specifically only 6 points (Figure 08).

The maximum converted score reaches only 29 points. In comparison with the remaining goals, SDG 6 and SDG 8 receive much more interest of enterprises when they get better average scores. Although, the maximum converted score are quite high (SDG 13, SDG 7, SDG 5, etc.), the average score very low and there is the huge gap between enterprises. Most minimum converted score is equal to zero, because of the lack of necessary information.

Therefore, the achievement level of the UN SDG 14, 15, 16 and 17 can not be determined. At the same time, there is also reason to apply the arithmetic mean to assess the sustainable development of enterprise, instead of the geometric mean as initially proposed methodology (Table 04).

Studying the correlation between the achievement level of the UN SDGs is the basis for the enterprise, which want to design business plan and strategic directions in accordance with their vision and mission. Typically, the sustainable economy is the first condition to be able to achieve environmental and social sustainability. However, these companies with state participation struggle to improve economic efficiency so that economic indicators affect indicators not much as expected.

The largest correlation coefficient expresses the relationship between SDG 8 and SDG 3 only reaching 0.323 at significance level of 0.05 (Table 05). Meanwhile, the correlation coefficient between SDG 3 and SDG 13 is pretty high (Pearson correlation = 0.72) at significance level 0.01.

Finally, using SPSS Statistics to handle data obtained from the application of proposed assessment model of the internal audit effectiveness and methodology for evaluating sustainable development of enterprise, the results are presented in the following tables. The Sig. of F value is equal to 0.001 (< 0.01), therefore, the simple linear regression model is a good fit (Table 06). Adjusted R Square value is equal to 0.169, which indicates that the internal audit effectiveness decides nearly 17 % of the sustainable development of enterprise (Table 07).

Because the Sig. is less than 0.01, the regression coefficient of independent variable IAE is different from zero at significance level of 0.01 and IAE has an impact on the dependent variable SDE (Table 08). The simple standardized linear regression model initially proposed can be rewritten as follows: SDE = 0.428 IAE + ɛ. Notably, the negative coefficient β0 can explain to the necessary role of internal audit in helping enterprises achieve the UN SDGs in particular and sustainability in general.

Conclusion

Based on the research results, it can be stated definitely that there is a positive linear relationship between the internal audit effectiveness and sustainable development of the enterprise. However, the regression standardized coefficient and adjusted R Square value received from the data handling of a sample consisting of 31 companies with state participation in Vietnam are lower than the original expectations about the decision of the internal audit to business success. A part can be explained by the ineffectiveness of the internal audit department in these enterprises at present. Consequently, its contribution is not commensurate with the available resources, and companies with state participation contribute insignificantly to achieving SDGs, or the sustainability of the country. Therefore, the government, participants in corporate governance, and other stakeholders need to cooperate to research and suggest the necessary solutions to improve the internal audit activities as well as the business operations. And the assessment model of the internal audit effectiveness and methodology for assessing sustainable development of enterprise proposed by this study is considered an effective instrument.

On the other hand, this study is only based on a quite small sample and the research subject is limited to the companies with state participation in Vietnam. Besides, the lack of non-financial information published by these enterprises is also an important factor to decide the research outcome. Therefore, to have a correct conclusion about this relationship as well as the actual role of internal audit in the sustainable development of enterprise, in addition to expanding the sample size, subject, geographic scope, etc., enterprises need to properly invest in the process of non-financial information disclosure. This study is considered a starting point and opens a new direction for the further research in the future.

References

Akeem, L. B., Olawumi, L. B., & Ajayi-Owoeye, A. O. (2019). Relationship between internal audit and organization’s performance: Evidence from money deposit banks in Nigeria. Management Science and Engineering, 13(1), 5–11.

Al-Matari, E. M., Al-Swidi, A., & Fadzil, F. H. B. (2013). The effect of the internal audit and firm performance: A proposed research framework. International Review of Management and Marketing, 4(1), 34–41. https://econjournals.com/index.php/irmm/article/view/669

Desimone, S., Donza, G., & Sarens, G. (2020). Correlates of internal audit function involvement in sustainability audits. Journal of Management and Governance, 1–31. DOI:

Dineva, V. (2019). The role of internal audit in corporate social responsibility strategies. Economic Alternatives, 2, 287–295.

Eleazer, F. O., & Mark, A. (2021). Assessing the moderating effects of corporate governance and government policy in the relationship between internal audit function and financial performance of banks in Ghana. International Journal of Innovative Finance and Economics Research, 9(1), 24–26. https://seahipaj.org/journals-ci/mar-2021/IJIFER/full/IJIFER-M-3-2021.pdf

Engelbrecht, L., Yasseen, Y., & Omarjee, I. (2018). The role of the internal audit function in integrated reporting: A developing economy perspective. Meditari Accountancy Research, 26(4), 657–674. DOI:

Fatah, N. A., Hamad, H. A., & Qader, K. S. (2021). The role of internal audit on financial performance under IIA standards: A survey study of selected Iraqi banks. Qalaai Zanistscientific Journal, 6(2), 1028–1048. DOI:

Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach. Pitman.

Kabashkin, V. A., & Annaeva, A. A. (2010). The role of internal audit in ensuring sustainable development. International Accounting, 18(150), 45–49.

Klarin, T. (2018). The concept of sustainable development: From its beginning to the contemporary issues. Zagreb International Review of Economics and Business, 21(1), 67–94. DOI:

Liao, F., & Ji, X. W. (2019). Firms’ sustainability: Does economic policy uncertainty affect internal control? Sustainability, 11, 1–26. DOI:

Mamaile, L. J. (2020). The role of internal audit functions at State owned enterprises in South Africa. University of South Africa.

Phan, T. T. Q. (2020). Assessment of internal audit performance: Method and criteria. Audit, 11, 17–24.

Puci, J., & Guxholli, S. (2018). Business internal auditing – An effective approach in developing sustainable management systems. European Journal of Sustainable Development, 7(2), 101–112.

Shamsuddin, N., & Bakar, N. S. (2021). Influence of the internal audit function towards Zakat performance. Ijiefer International Journal of Islamic Economics and Finance Research, 4(1), 77–93. http://ijiefer.kuis.edu.my/ircief/article/view/50

The time has come: The KPMG Survey of Sustainability Reporting. (2020). KPMG Impact, 1–63.

Yuvaraj, G., Gugass, K., & Muhammad, M. (2018). The moderating role of internal audit function on the relationship between board of director characteristics and business performance in Malaysia. Global Business and Management Research: An International Journal, 10(1), 356–378.

Yuvaraj, G., Yew, W. H., Amar, H. J., & Fathyah, H. (2017). Corporate governance and sustainability reporting practices: The moderating role of internal audit function. Global Business and Management Research: An International Journal, 9(4), 159–179.

Zou, J. J. (2019). On the role of internal audit in corporate governance. American Journal of Industrial and Business Management, 9, 63–71. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

23 December 2022

Article Doi

eBook ISBN

978-1-80296-128-7

Publisher

European Publisher

Volume

129

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1335

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Thanh Quyen, P. T., & Sidorova, M. I. (2022). The Relationship Between Internal Audit And Sustainable Development: Quantitative Study. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization- ISCKMC 2022, vol 129. European Proceedings of Social and Behavioural Sciences (pp. 838-851). European Publisher. https://doi.org/10.15405/epsbs.2022.12.109