Abstract

This study examines the influence of corporate social responsibility (CSR) on the capital structure (LEV) of 331 companies listed on twenty emerging markets for the periods 2005-2019. The LEV is measured by the total liabilities divided by total assets. The CSR performance is proxied by the environmental, social and governance (ESG) ratings obtained from Thomson Reuters DataStream. The firm size is introduced as a potential moderator on the CSR and LEV relationship. The analysis results showed that there is no direct evidence that CSR performance effects LEV. Moreover, the firm size negatively and significantly moderates the relationship between corporate governance performance (GPS) and social performance (SPS) and LEV. Additionally, the profitability is negatively and significantly, and asset tangibility is positively and significantly related to LEV. Our results confirm that CSR performance facilitates financing through debt for small and medium size companies and decreases cost of equity for large companies. These findings are consistent with the recent studies.

Keywords: Corporate social responsibility, capital structure, emerging markets, firm size

Introduction

The aim of this study is to explore the effects of corporate social responsibility (CSR) on capital structure (LEV) of listed companies in emerging markets. The related literature has shown that there are different explanations for the CSR applications: it reduces the firm's risk (Cheng et al., 2014; Dhaliwal et al., 2011; Doh et al., 2010; El Ghoul et al., 2011; Jo & Na, 2012; McGuire et al., 1988; Orlitzky & Benjamin, 2001) and adds value to companies (Eccles et al., 2013; Luo & Bhattacharya, 2009; Waddock & Graves, 1997). Prior research has extensively examined whether superior CSR quality had the effects of increasing capital market return for firms, reducing cost of capital and reducing the information asymmetry. The results showed that there is a positive and strong relationship between CSR and stock returns and market capitalization (Anderson & Frankle, 1980; Caroline, 2013; Freedman & Stagliano, 1991).

Although, the different topics relating to the CSR has been studied in the past, mostly CSR and corporate financial performance (CFP) were explored by many academicians. Most of these studies revealed a non-significant relationship. Some researchers found a negative relationship or no clear relationship at all between CSR and CFP (Aksoy et al., 2020; Griffin & Mahon, 1997; Harrison & Freeman, 1999; McWilliams & Siegel, 2000; Makni et al., 2008; Waddock & Graves, 1997), others found a positive relationship between CSR and CFP (Artiach et al., 2010; Ameer & Othman, 2012; McGuire et al., 1988; Margolis & Walsh, 2003; Peloza, 2009; Ziegler & Schröder, 2010).

As stated earlier by McWilliams and Siegel (2001), these differences in results, are not surprising. This difference in findings can be explained by the specification of the econometric models used, the differences in the markets studied, the proxies used to measure social and financial performance and a lack of clear direction of causality between social and financial performance (Griffin & Mahon, 1997; Waddock & Graves, 1997; Lin et al., 2008; McWilliams & Siegel, 2000). As the awareness of the stakeholders about CSR increases, the reputation of companies with high CSR performance increases. This increases sales and customer loyalty (Fombrun & Gardberg, 2000; McWilliams & Siegel, 2001). And the firm becomes attractive to high-quality employees (Turban & Greening, 1997; Greening & Turban, 2000). And all these benefits indirectly effect financial performance (Saeidi et al., 2015). A group of academics with this perspective have stated that CFP can be explained by the relationship between CSR and LEV (Benlemlih, 2017; Girerd-Potin et al., 2011; Pijourlet, 2013).

This study addresses two research questions for the emerging markets: does the CSR performance affect the LEV? Does the firm size affect the association between LEV and CSR? In this study, the terms “capital structure” and “leverage” were used interchangeably. In our sample we have 331 firms listed on 20 emerging markets for the period 2005-2019. We couldn´t find the direct evidence that CSR performance influences the LEV. However, we find the convincing evidence that the firm size negatively and significantly moderates the relationship between CSR and LEV. Additionally, the profitability is negatively and significantly, and asset tangibility is positively and significantly associated with LEV. Our results confirm that CSR performance facilitates financing through debt for small and medium size companies and decreases cost of equity for large companies.

The aim of this study is to clarify the importance of CSR performance for firm’s LEV. Since this work analyzes how environmental, social, and governance (ESG) grades affect LEV, managers will consider the importance of ESG notes when making financing decisions. This would also help management to realize how the investments needed to get an ESG rating and sustainability reporting affect the firm's LEV decisions and the firm's value. To our knowledge, the size-moderated relationship between CSR performance and LEV using ESG notes for emerging markets has not been studied before.

We proceed through the discussion of the literature in the second part. In the third part, the data and the methodology are explained. In the fourth part, the results of the empirical findings are reported and discussed. In the last part, the conclusions reached on the basis of the research findings are explained.

Literature

There are a range of factors that determine the capital structure (LEV) and there are also different theories as to why a firm prefers a certain type of financing. One of these theories is the Tradeoff Theory. Kraus and Litzenberger (1973) argues that in a competitive market where bankruptcy costs are found and company profits are taxed, the company's optimal LEV is formed at a balancing point between the tax advantage of debt and bankruptcy costs. Firms with stable and tangible assets and remarkably high incomes prefer a higher debt ratio since interest paid can be used as a tax shield, while companies with less profit and riskier, having intangible assets prefer equity financing.

The Pecking Order Theory which was developed by Myers and Majluf (1984) is another theory about LEV. According to the theory, the firm's managers follow a hierarchy in the form of financing with retained earnings, financing with debt and financing through new equity issuance, when meeting the firm´s financing needs. The issuance of new stocks may indicate that the firm's shares are overvalued or that the firm is facing financial problems. Company managers have more information about their companies than investors, and LEV decisions depend on the concept of asymmetric information.

Both theories mentioned above make one think that, in cases where debt financing is preferred to equity financing, companies can reduce their debt costs and risk of bankruptcy by improving their CSR performance. There are many studies examining the role of CSR in determining the optimum LEV of companies. CSR applications are one of the factors that can reduce the cost of financing. In literature, it is discussed that high CSR performance reduces the cost of capital (Chava, 2014; Dhaliwal et al., 2011; El Ghoul et al., 2011; Girerd-Potin et al., 2014; Pijourlet, 2013; Verwijmeren & Derwall 2010).

Verwijmeren and Derwall (2010) investigated whether firms with higher employee satisfaction have lower debt ratios. They claimed that firms consider the well-being of their employees when deciding on leverage and they found supporting evidence. In their analysis, Verwijmeren and Derwall (2010) used data from KLD database on employee well-being for the period 2001-2005 and they reported that the debt-assets ratio was inversely related to employee well-being. By taking advantage of CSR's opportunity to them, high CSR companies prefer equity financing and lower their debt ratios.

Maksimovic and Titman (1991) have proposed a theory about the association between firm´s LEV and firm’s incentives to sustain its reputation for producing high quality products. There are many implicit claims other than product quality such as treating employees fairly. According to their theory, stakeholders are concerned that companies with high leverage may experience financial difficulties and fail to achieve their implicit claims. The firm’s reputation for treating employees fairly is positively correlated with low debt ratio. Bae et al. (2011) also explores how a company's behavior towards its employees and the incentives it offers to its employees are associated with its LEV. They found that firms with higher scores in the employee treatment index had lower financial leverage. Based on this argument, it is expected a negative relationship between leverage and employee benefits.

Girerd-Potin et al. (2011) proposed a LEV model for firms based on firms´ social score. They conducted an empirical study using Vigeo data to support their proposed model. They found statistically significant and negative relationship between leverage and CSR performance. They couldn´t find any relation between the firm’s social score and its cost of debt , supporting that companies with poor CSR performance prefer debt financing. They concluded that CSR performance is decisive in the financial structure of firms.

Pijourlet (2013) also focuses on the relation between CSR and LEV, as well as the size of its equity issuances. Using a worldwide dataset in their analysis, they found that companies with high CSR performance have lower cost of equity thus choose equity financing. In addition to this finding, another interesting result is that companies with good CSR performance are not affected by market conditions during equity offerings and they issue equity in larger amounts. The results of this study show that companies consider CSR levels when determining financing decisions.

Considering the results of previous studies in the literature, we proposed the following two hypotheses:

H1a: There is a negative relation between LEV and GPS.

H2a: There is a negative relation between LEV and SPS.

In literature, studies examining the relationship between financial leverage and firm size have found a positive relationship (Daskalakis & Psillaki, 2008; Degryse et al., 2012; Heyman et al., 2008; Köksal et al., 2013; Ozkan, 2001). Large firms can access the capital markets more easily and borrow money at lower interest rates (Ferri & Jones, 1979). According to Degryse et al. (2012), large firms know more about different financing methods and can better bargain with lenders because they employ more specialist staff in these matters. Daskalakis and Psillaki (2008) argue that since there is more diversification in large firms, bankruptcy risk is lower when it is compared with small firms. Studies conducted in the literature have shown that companies that make large amounts of profit tend to have a lower degree of leverage (Demirgüç-Kunt, & Maksimovic, 1999; Friend & Lang, 1988; Frank & Goyal, 2009; Wald, 1999).

A tangible asset is always considered a guarantee of a loan. In addition, the existence of tangible assets can reduce the cost of bankruptcy and credit risks (Dasilas & Papasyriopoulos, 2015). Therefore, both pecking order theory and trade-off theory expects that there is a positive relationship between tangible assets and the leverage. Previous studies have also found that firms having high degree of tangible assets tend to work with a higher leverage ratio (Jong et al., 2008; Frank & Goyal, 2009; Korteweg, 2010).

In CSR literature, there are studies proposing that the effect of CSR on firm value depends on firm size (D'Amato & Falivena, 2020; McWilliams & Siegel, 2001; Perrini et al., 2007; Udayasankar, 2008). First small firms may not have enough financial resources to invest in CRS projects. Second, CSR initiatives involve complex processes and require large scale to be effective, size is an important factor for them to be successful (Youn et al., 2015). Third, the large firms often devote more resources to sustainability reporting and providing ESG data (Drempetic et al., 2020).

Therefore, the following hypothesis was proposed to investigate the effect of firm size on the relationship between LEV and CSR.

H1b: The firm size negatively moderates the relationship between LEV and GPS.

H2b: The firm size negatively moderates the relationship between LEV and SPS.

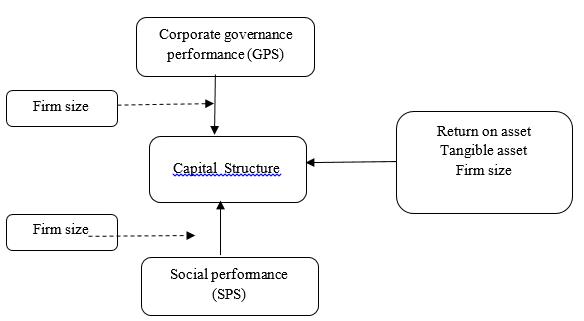

The conceptual framework was shown in Figure 1.

Data and methodology

In our sample we have 331 companies with 3291 observations from twenty emerging markets for the period 2005-2019. We made the analysis with the unbalanced panel data set. The financial data were downloaded from DataStream. The environmental, social and governance performance scores (ESG) of the companies were downloaded from the Thomson Reuters DataStream Asset4 database. The ESG score, which is an aggregate measure of company performance in environmental, social and governance issues, has become a standardized approach to measuring a company's sustainability performance.

The dependent variable is the capital structure. The capital structure (LEV) is measured by the total liabilities divided by total assets. The corporate governance performance (GPS) and the social performance (SPS) are independent variables. We also used three control variables, including return on asset (ROA), tangible asset (TA) and firm size (SIZE). Table 1 displays the sample companies. The ROA is measured by the net income divided by total assets, TA is measured by tangible assets divided by total assets and SIZE is measured by natural logarithm of total assets.

We analyzed the effect of GPS and SPS on LEV by estimating the following models with a panel regression analysis.

(1)

(2)

Empirical results

In Table 2, we present the summary of descriptive statistics and correlation matrix. The highest correlation is 0.47. The variance inflation factor (VIF) scores are less than the threshold value of 10. These results show that the multicollinearity is not a problem.

Before estimating the regression equations, some tests were carried out to determine the correct model. As a first step, we ran the fixed effects model and F-test. The F-test results showed that the ordinary least square model cannot be used. As a second step, we ran the Hausman test. The test results showed that fixed effects model was the most suitable model. After deciding the correct model, we also checked for the presence of any heteroscedasticity, autocorrelation, and cross-sectional dependence. Durbin-Watson (DW) and the Baltagi-Wu (LBI) tests showed that the panel did not exhibit autocorrelation. However, the modified Wald test showed that there was heteroscedasticity and Pesaran’s (2004) test showed that there was cross-sectional dependence. For that reason, we decided to estimate fixed effects model with Driscoll-Kraay standard errors (Driscoll & Kraay, 1998). We report the results in Table 3.

According to the CSR literature, high CSR companies prefer equity financing because of the low cost of their equity capital (El Ghoul et al., 2011; Chava, 2014; Girerd-Potin et al., 2014). Thus, we expect a negative relationship between leverage and CSR performance. However, the independent variable GPS was found to be positive and insignificant (p>0.10) in Model 1a, not holding up the hypothesis H1a. Then again, the variable SPS was negative and insignificant (p>0.10) in Model 2a, not supporting the hypothesis H2a. These results showed that there was no significant relationship between LEV and GPS and SPS for our sample.

Table 3 (Model 1b and Model 2b) shows that firm size plays a significantly (p<0.05) negative role in moderating the association between GPS and SPS and LEV, supporting our hypothesis H1b and H2b. The results found for large firms are consistent with the literature. The large firms have more financial resources to invest in CSR projects thus they have high CSR performance. And high CSR companies prefer equity financing consistent with the literature.

From our control variables, ROA, TA, and SIZE were found to be significant (p<0.01). ROA was negatively, SIZE and TA were positively associated with LEV in all Models (1a, 1b, 2a, 2b). The firm size is positively related to the LEV. This finding endorses the prior studies (Daskalakis & Psillaki, 2008; Degryse et al., 2012; Heyman et al., 2008; Köksal et al., 2013; Ozkan, 2001). The tangibility is also positively related to the LEV. These results are in line with the previous studies (Jong et al., 2008; Frank & Goyal, 2009; Korteweg, 2010).

Robustness checks

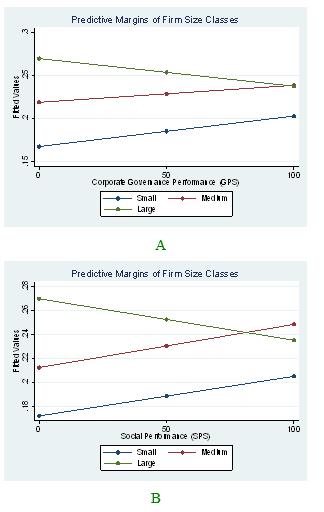

As a robustness check, we tested the effects of CSR on LEV across different firm size classes. Following González and González (2012), companies were categorized as small, medium, and large on the basis of natural log of their total assets. Companies with values in the first quartile were considered small firms. Similarly, companies involved in the fourth quartile were referred to as large firms, while companies that remained in the second and third quartile were considered medium-sized firms. Figure 2 displays marginal effects. We report the regression results for firm size classes in Table 4. In Figure 2, there is a negative relationship between firm size and leverage (comparing CSR levels) for large companies. In Table 4, Model 1c and Model 2c show that large companies prefer equity financing because of their lower cost of equity. Table 4 also shows that the small size companies increase their leverage through GPS (in Table 4, Model 1a). Similarly, the medium size companies increase their leverage through SPS (in Table 4, Model 2b).

It is difficult for small companies to obtain financing through debt. For small and medium size companies, increased transparency with CSR applications can reduce the informational asymmetry between stakeholders and management. And this may improve the firm's reputation in the eyes of the stakeholders and allow them to have higher leverage.

Conclusion and implications

This study investigates the CSR and capital structure (LEV) relationship for a sample of 331 firms listed on twenty emerging markets. The analysis period covers 2005-2019. Analysis results showed that there was no significant relationship between LEV and corporate governance (GPS) and social performance (SPS) within the context of emerging markets. When we introduce the firm size as a potential moderator on the CSR and LEV relationship, we found a significant and negative moderating effect. We also run robustness test. The analysis results showed that large companies prefer equity financing because of their lower cost of equity. In addition, we found that the small size companies increase their leverage through GPS, and the medium size companies increase their leverage through SPS. The analysis results also showed that, the profitability is negatively and significantly, and asset tangibility is positively and significantly related to capital structure.

Finally, our results confirm that CSR performance improves leverage for small and medium size companies and decreases cost of equity for large companies. Moreover, the investments in sustainability reporting are as important as sustainability activities. Our findings provide valuable information for managers to review policies regarding sustainability activities and capital structure decisions. The use of ESG scores as a proxy for sustainability performance in the analysis is one of the limitations of this study. Future works may use other sustainability metrics to validate the results. In a further study, similar hypotheses can be evaluated for the crisis periods.

References

Aksoy, M., Yilmaz, M. K., Tatoglu, E., & Basar, M. (2020). Antecedents of corporate sustainability performance in Turkey: The effects of ownership structure and board attributes on non-financial companies. Journal of Cleaner Production, 276, 124284. https://doi.org/10.1016/j.jclepro.2020.124284

Ameer, R., & Othman, R. (2012). Sustainability practices and corporate financial performance: a study based on the top global firms. Journal of Business Ethics, 108(1), 61-79.

Anderson, J. C., & Frankle, A. W. (1980). Voluntary social reporting:An iso-beta portfolio analysis. The Accounting Review, 55, 467–479. https://www.jstor.org/stable/246408

Artiach, T., Lee, D., Nelson, D., & Walker, J. (2010). The determinants of corporate sustainability performance. Accounting and Finance, 50, 31-51.

Bae, K. H., Kang, J. K., & Wang, J. (2011). Employee treatment and firm leverage: A test of the stakeholder theory of capital structure. Journal of financial economics, 100(1), 130-153.

Benlemlih, M. (2017). Corporate social responsibility and firm debt maturity. Journal of Business Ethics, 144(3), 491-517.

Caroline, F. (2013). Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Academy of Management Journal, 56(3), 758–781.

Chava, S. (2014). Environmental externalities and cost of capital. Management science, 60(9), 2223-2247.

Cheng, B., Ioannou, I., & Serafeim, G. (2014). Corporate social responsibility and access to finance. Strategic Management Journal, 35(1), 1 – 23.

D'Amato, A., & Falivena, C. (2020). Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corporate Social Responsibility and Environmental Management, 27(2), 909-924.

Dasilas, A., & Papasyriopoulos, N. (2015). Corporate governance, credit ratings and the capital structure of Greek SME and large listed firms. Small Business Economics, 45(1), 215-244.

Daskalakis, N., & Psillaki, M. (2008). Do country or firm factors explain capital structure? Evidence from SMEs in France and Greece. Applied financial economics, 18(2), 87-97.

Degryse, H., de Goeij, P., & Kappert, P. (2012). The impact of firm and industry characteristics on small firms’ capital structure. Small business economics, 38(4), 431-447.

Demirgüç-Kunt, A., & Maksimovic, V. (1999). Institutions, financial markets, and firm debt maturity. Journal of financial economics, 54(3), 295-336.

Dhaliwal, D., Li, O., Zhang, A., & Yang, Y. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: the initiations of corporate social responsibility reporting. Accounting Review, 86(1), 59–100.

Doh, J. P., Howton, S. D., Howton, S. W., & Siegel, D. S. (2010). Does the market respond to an endorsement of social responsibility? The role of Institutions, Information and legitimacy. Journal of Management, 36(6), 1461-1485.

Drempetic, S., Klein, C., & Zwergel, B. (2020). The influence of firm size on the ESG score: Corporate sustainability ratings under review. Journal of Business Ethics, 167(2), 333-360.

Driscoll, J. C., & Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Review of economics and statistics, 80(4), 549-560.

Eccles, R. G., Ioannou, I., & Serafeim, G. (2013). The impact of a corporate culture of sustainability on corporate behaviour and performance. HBS Working Paper No. 12-035. Retrieved November 07, 2022, from http://www.consulenzasostenibile.it/wp-content/uploads/2012/12/ImpactOfCsrOnPerformanceHarvardBusinessSchool2012.pdf

El Ghoul, S., Guedhami, O., Kwok, C. C., & Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35(9), 2388-2406.

Ferri, M., & Jones, W. (1979) Determinants of financial structure: a new methodological approach, Journal of Finance, 34, 631–44. Retrieved November 07, 2022, from https://www.jstor.org/stable/2327431

Fombrun, C. J., & Gardberg, N. (2000). Who's tops in corporate reputation? Corporate reputation review, 3(1), 13-17.

Frank, M. Z., & Goyal, V. K. (2009). Capital structure decisions: Which factors are reliably important? Financial Management, 38(1), 1-37.

Freedman, M., & Stagliano, A. J. (1991). Differences in social-cost disclosures: A market test of investor reactions. Accounting, Auditing and Accountability Journal, 4(1), 68–83.

Friend, I., & Lang, L. H. P. (1988). An empirical test of the impact of managerial self-interest on corporate capital structure. Journal of Finance, 43(2), 271-281.

Girerd-Potin, I., Jimenez-Garces, S., & Louvet, P. (2011). The link between social rating and financial capital structure. Finance, 32(2), 9-52.

Girerd-Potin, I., Jimenez-Garcès, S., & Louvet, P. (2014). Which dimensions of social responsibility concern financial investors? Journal of Business Ethics, 121(4), 559-576.

González, V. M., & González, F. (2012). Firm size and capital structure: Evidence using dynamic panel data. Applied Economics, 44(36), 4745-4754.

Greening, D. W., & Turban, D. B. (2000). Corporate social performance as a competitive advantage in attracting a quality workforce. Business & society, 39(3), 254-280.

Griffin, J. J., & Mahon, J. F. (1997). The corporate social performance and corporate financial performance debate, twenty-five years of incomparable research. Business and Society 36(1), 5-31.

Harrison, J. S., & Freeman, R. E. (1999). Stakeholders, social responsibility, and performance: Empirical evidence and theoretical perspectives. Academy of Management Journal, 42(5), 479–485.

Heyman, D., Deloof, M., & Ooghe, H. (2008). The financial structure of private held Belgian firms. Small business economics, 30(3), 301-313.

Jo, H., & Na, H. (2012). Does CSR reduce firm risk? Evidence from controversial industry sectors. Journal of Business Ethics, 110(4), 441-456.

Jong, A., Kabir, R., & Nguyen, T. T. (2008). Capital structure around the world: The roles of firm and country specific determinants. Journal of Banking and Finance, 32, 1954-1969.

Köksal, B., Orman, C., & Oduncu, A. (2013). Determinants of capital structure: evidence from a major emerging market economy. MPRA Paper, 48415. Retrieved November 07, 2022, from https://ecomod.net/system/files/Koksal,%20Orman,%20Oduncu%20(2013)_0.pdf

Korteweg, A. (2010). The net benefits to leverage. The Journal of Finance, 65(6), 2137-2170.

Kraus, A., & Litzenberger, R. H. (1973). A state-preference model of optimal financial leverage. The journal of finance, 28(4), 911-922. Retrieved November 07, 2022, from https://www.jstor.org/stable/2978343

Lin, C., Yang, H., & Liou, D. (2008). The impact of corporate social responsibility on financial performance: Evidence from business in Taiwan. Technology in Society, 31(1), 1–8.

Luo, X., & Bhattacharya, C. B. (2009). The debate over doing good: Corporate social responsibility, strategic marketing levers and firm idiosyncratic risk. Journal of Marketing, 73(6), 198–213.

Makni, R., Francoeur, C., & Bellavance, F. (2008). Causality between corporate social performance and financial performance: evidence from Canadian firms. Journal of Business Ethics, 89, 409-422.

Maksimovic, V., & Titman, S. (1991). Financial policy and reputation for product quality. The Review of Financial Studies, 4(1), 175-200.

Margolis, J. D., & Walsh, J. P. (2003). Misery loves companies: rethinking social initiatives by business. Administrative Science Quarterly, 48(2), 268-305.

McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854-872.

McWilliams, A., & Siegel, D. (2000). Corporate social responsibility and financial performance: Correlation or misspecification? Strategic Management Journal, 21(5), 603–609. https://doi.org/10.1002/(SICI)1097-0266(200005)21:5<603::AID-SMJ101>3.0.CO;2-3

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of management review, 26(1), 117-127.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of financial economics, 13(2), 187-221.

Orlitzky, M., & Benjamin, J. D. (2001). Corporate social responsibility and firm risk: a meta-analytic review, Business and Society, 40(4), 369–396.

Ozkan, A. (2001). Determinants of capital structure and adjustment to long run target: evidence from UK company panel data. Journal of business finance & accounting, 28(1‐2), 175-198.

Peloza, J. (2009). The challenge of measuring financial impacts from investments in corporate social performance. Journal of Management, 35(6), 1518-1541.

Perrini, F., Russo, A., & Tencati, A. (2007). CSR strategies of SMEs and large firms. Evidence from Italy. Journal of business ethics, 74(3), 285-300.

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. University of Cambridge, Faculty of Economics, Cambridge Working Papers in Economics No. 0435. https://docs.iza.org/dp1240.pdf

Pijourlet, G. (2013). Corporate social responsibility and financing decisions. JEL classification G, 32, M14. Retrieved November 07, 2022, from https://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2013-Reading/papers/EFMA_avril_2013.pdf

Saeidi, S. P., Sofian, S., Saeidi, P., Saeidi, S. P., & Saaeidi, S. A. (2015). How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of business research, 68(2), 341-350.

Turban, D. B., & Greening, D. W. (1997). Corporate social performance and organizational attractiveness to prospective employees. Academy of management journal, 40(3), 658-672.

Udayasankar, K. (2008). Corporate social responsibility and firm size. Journal of business ethics, 83(2), 167-175.

Verwijmeren, P., & Derwall, J. (2010). Employee well-being, firm leverage, and bankruptcy risk. Journal of Banking & Finance, 34(5), 956-96.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance-financial performance link. Strategic Management Journal, 18(4), 303-319. https://doi.org/10.1002/(SICI)1097-0266(199704)18:4<303::AID-SMJ869>3.0.CO;2-G

Wald, J. K. (1999). How firm characteristics affect capital structure: An international comparison. Journal of Financial Research, 22(2), 161-187.

Youn, H., Hua, N., & Lee, S. (2015). Does size matter? Corporate social responsibility and firm performance in the restaurant industry. International Journal of Hospitality Management, 51, 127-134.

Ziegler, A., & Schröder, M. (2010). What determines the inclusion in a sustainability stock index? : A panel data analysis for European firms. Ecological Economics, 69(4), 848-856.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2022

Article Doi

eBook ISBN

978-1-80296-129-4

Publisher

European Publisher

Volume

130

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-270

Subjects

Strategic Management, Leadership, Technology, Post-Pandemic, New frontiers

Cite this article as:

Aksoy, M. (2022). Does Firm Size Influence the Relationship Between CSR and Capital Structure?. In E. N. Degirmenci (Ed.), New Frontiers for Management and Strategy in the Post-Pandemic Era, vol 130. European Proceedings of Social and Behavioural Sciences (pp. 1-13). European Publisher. https://doi.org/10.15405/epsbs.2022.12.02.1