Abstract

Any commercial institution seeks to maximize profits from its activities. However, profit is the final result, which is combined with various components. One of the components is price and the process of price assessment is pricing or price management. The author chose to study pricing in the banking market sector in the research. The services provided by loan companies have certain peculiarities and pricing methods as well. Despite the special activity, pricing management provides profitability and controls the level of market movement of financial resources, capitalization of these resources. The relevance of bank pricing is high, among other things because, at present, there is decreasing availability of early income observed. This is especially true for one of the main profitable banking products that are loans. Based on the studied data of theoretical foundation, the author has observed the nature of pricing, pricing methods in commercial banks of the Russian Federation, as well as the consequences of errors in pricing. In the context of applied examples, PJSC Sberbank was selected for the study. Illustrated by PJSC Sberbank, the features of pricing in the banking market, pricing methods, and review of financial and economic activities are focused. Based on the results of the work performed, the author proposed recommendations for improving pricing methods.

Keywords: Bank accommodations, economic development, movement of financial resources, pricing of banking services

Introduction

Commercial banks, like any other commercial institutions, tend to increase their profit margins, improve their competitiveness and expand their market share. One of the main factors influencing the volume of income acquired is price. Therefore, price and pricing, among other things, is a criterion of effective bank management.

Pricing is an internal process of regulating the price of credit products, but the pricing process is not free from external instruments.

Pricing is dependent on the market changes, namely, demand and supply fluctuations. In addition to demand, the monetary policy of the government affects the pricing of credit institutions. In particular, interest rates on credits depend on the value of the key rate set by the Bank of Russia. (Miroshnichenko et al., 2020). Under different conditions set by contemporary reality, bank managers use different pricing methods (Bolshakov et al., 2021).

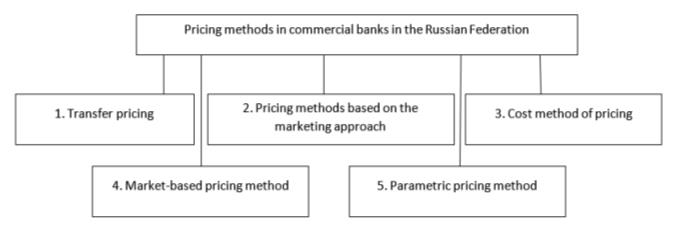

Figure 1 shows the main pricing methods used in Russia (Abdul-Azalova, 2019; Burkova, 2019; Milenkov, 2019).

In practice, banks use the environment of pricing methods. As competition intensifies, the pricing priority shifts from one group of methods to another. The smaller the bank and the less financially integrated it is with its client the more marked the shift is.

The main feature when pricing corporate loans is considered to be a reference to the official discount rate of the Central Bank of Russia. However, the Bank of Russia does not impose any direct restrictions on the size of interest rates, so this issue is addressed by banks in different ways.

The analysis of methods of pricing credit products for corporate clients of a commercial bank find out the following pricing methods for lending to corporate customers:

- cost method (total dependence on the cost of the banking company);

- market method (total dependence on the market environment in the banking sector)

- parametric method (total dependence on the performance of the regulatory requirements on the costs of banking companies for each banking product separately).

To study the theoretical content, the author used scientific research of contemporary scientists, and also conducted an analysis of the financial and economic activity of PJSC Sberbank and one of the pricing policies for corporate customers. Based on the results, the author discovered the problems caused by the imperfect pricing methods used.

For example, among the main problems in servicing corporate clients in PJSC Sberbank are such problems as:

1. An imperfect line of credit products for small and medium-sized businesses;

2. High collateral requirements for securing a loan for small entrepreneurship;

3. Incomplete matching of quality of provided services to the needs of corporate clients;

4. Lack of separate banking products targeted the need of corporate clients to settle a payroll card contract with the bank.

For these problems, the author has emphasized several recommendations, which allow the pricing and receiving client input from the segment which was blocked by the mentioned problems optimize.

Problem Statement

- Examine the nature and characteristics of pricing in the banking market.

- Develop recommendations for improving pricing methods.

Research Questions

The subject of the study is the pricing methods for credit products for corporate clients of a commercial bank. In general, it is necessary to answer several questions to find out the core of the research subject:

- What shapes the pricing of loan companies;

- What are the risks for a bank and consumers if the pricing is not correct;

- What pricing methods are there;

- What problems do corporate clients of Sberbank face;

- How can the problems of working with corporate clients be solved by improving the pricing system?

Purpose of the Study

The purpose of the study is to examine the core, pricing credit products methods and suggest ways to improve them.

Research Methods

The following general scientific research methods were used in preparing the material: logical analysis, the author defines the range of notions according to which the issue is observed, description and generalization methods, the method of analysis by which the author concluded the financial performance indices.

Findings

Pricing in the banking sector is the most important part of the process when serving corporate clients, and it is the pricing policy that influences the efficiency of a commercial bank.

Pricing of the bank consists of setting prices for various banking services and changing them according to the changing market environment. The objects of the bank pricing are interest rates, commissions, bonuses, discounts, and minimum deposit amount (Parusimova et al., 2019).

In the conditions of market relations development, the development of a pricing policy of a loan company is considered to be a key tool to provide their keen competitive position. By using effective pricing methods, cost advantages and the revenue position of commercial banks increases. The methods of pricing are considered to be a kind of a control mechanism for managing the reliability and financial stability of the loan institution (Yeshugova et al., 2019).

The peculiarity of bank pricing is the lack of a clear connection between the consumer value of the banking service and its price (Kovshova & Gakelberg, 2019). Under these conditions, the bank has an opportunity to manoeuvre prices within rather elastic limits, conducting different pricing policies for different clients, using prices as an important means of attracting customers and promoting services.

When considering pricing in the banking market, the core and peculiarities referred to serving corporate clients were covered (Gantimurova, 2019). These problems are also observed in the largest banks in the country, for example, in PJSC Sberbank, despite the high financial performance, nevertheless, there are certain problems related to the efficiency of the loan products offered to corporate clients (Kulumbetova, 2019) as shown in Table 1.

Based on the results of the period under review, profit growth testifies to the efficient financial and economic activities of PJSC Sberbank (Konsolidirovannaya..., 2019)

Despite the high financial results, there are certain problems related to the efficiency of the loan products offered to corporate clients.

In particular, the problems have been revealed due to the imperfect pricing methods used. For example, among the main problems when servicing corporate customers in PJSC Sberbank are such problems as:

- An imperfect line of credit products for small and medium-sized businesses;

- High collateral requirements for small business loans;

- Incomplete correspondence to the quality of services provided with the needs of corporate clients;

- Lack of separate banking products focused on the need of corporate clients to conclude a payroll project with the bank (Smirnov, 2021).

The results of the study highlighted the application of pricing methods as a way to correct the covered problems.

Based on the results of the work performed, the author developed several recommendations to improve pricing methods for credit products when dealing with corporate clients:

To solve problems 1 and 2, it is proposed to improve the Funds Transfer Pricing (FTP method) (Graseck et al., 2018; Schnarr & Pfeiffer, 2015) used in Sberbank (this method allows to decide on the contribution of each business department to the bank net interest income).

Based on the analysis of foreign banking experience, such a promising pricing method as the Cost-Benefit Pricing Model has been identified. This model has a proper feature, which is expressed in a more thorough distribution of corporate clients – borrowing customers into groups, by criteria of their needs and opportunities while developing various credit products, differing in cost (price).

To solve the problem of improving the line of credit products for small and medium-sized businesses, it was proposed:

(a) To create a specialised department in PJSC Sberbank to work only with micro-business clients;

(b) To develop special credit scoring for this category of borrowers;

c) To expand the product line for micro-business loans.

To address the high collateral requirements for small businesses, it is proposed to introduce a new loan product – contracted lending. Based on calculations, it has been found that a single micro-business department would provide loans worth RUB 250 million quarterly. It will generate a net interest income of RUB 15 million. If this loan product is scalable in Russia and around 100 micro-business departments are expected to be established, the bank would gain around RUB 1500 million per quarter or RUB 6000 million per year.

It was also mentioned that the proposed loan product accepts certain risks for a bank. The following requirements for a borrower, a contract and a customer would help to mitigate these risks:

- Mandatory verification of the financial responsibility of borrowers; they are to be existing (returning) bank customers, and it is preferable to have an international rating for foreign economic activity participants;

- at least two sold contracts available;

- a payment under the contract is only through the account of the borrower from Sberbank.

- In addition, to reduce risks, the cost of contracted lending should is to be higher than the cost of secured loans.

Thus, the introduction of the new loan product ‘Contracted Loans’ will provide growth opportunities for existing clients of Sberbank and attract new clients, including those engaged in foreign economic activity. Through all this, Sberbank will increase its loan book and volumes, and, consequently, revenues from transactional business will grow (Minakov & Ivanova, 2021). Such a loan product will give an opportunity for the entrepreneurs to implement a contract quickly and continuously throughout its duration, as well as the opportunity to extend an uncovered credit.

To solve problems 3 and 4, it is proposed to improve the market-based pricing method used in Sberbank (the price is set concerning the prices of competitors operating in the banking sector). Based on the analysis of foreign banking experience, a promising method of pricing, such as the contractual method of pricing, has been defined. This method consists of conducting a flexible interest rate policy by the bank concerning strategic, important partners (VIP clients). It is aimed at attracting and retaining corporate clients who are key borrowers and apply to the credit institution for large amounts of money.

As part of improving the market-based pricing method, it was proposed to switch to a contract-based pricing method, which is more flexible and takes more account of the specific activities and interests of corporate clients representing medium and large businesses. Moreover, the Bank developed and proved economically the introduction of a new payroll product for the above category of corporate customers.

The process of preparing and introducing the new banking product was divided into four successive stages:

1. Design of the concept of a new banking product.

2. Design of a new banking product.

3. Introduction of a new banking product in the bank.

4. Assessment of possible economic effects from the introduction of the new product.

According to the projected values of Sberbank, the introduction of a new payroll product can provide an economic effect of about 522 million roubles.

Conclusion

The pricing process is influenced by external factors. They are the economic environment in the country, global economic trends, demand for banking products, etc.

The key to successful pricing is based on the study of these instruments using market research methods. The results obtained, as a rule, determine which pricing methods should be applied in a given situation. But it should be taken into account that costs set the minimum price level and decide on the base price, while the level of demand determines the upper price level of banking services (Novoseltseva, 2020). In commercial bank practice, the present value method and the follow-the-leader method are commonly used. However, it is more effective not to consider competitors’ prices in full, but to offer a unique set of conditions to customers, thereby allowing for the targeted revenue.

In general, the recommendations that have been formulated by the author are based on the flexible use of a set of pricing methods that aim at putting favourable and most reasonable prices for banking services and products.

References

Abdul-Azalova, M. Y. (2019). Vliyaniye blokcheyn tekhnologii na razvitiye platezhnykh instrumentov elektronnogo biznesa [The impact of blockchain technology on the development of e-business payment instruments]. Automation and Software Engineering, 4(30), 66-71.

Bolshakov, S. N., Grigoriev, A. N., & Pritula, O. D. (2021). Monitoring udovletvorennosti naseleniya konkurentosposobnost'yu finansovykh organizatsiy regiona [Monitoring Public Satisfaction with the Competitiveness of Financial Institutions in the Region]. Regional Problems of Economic Transformation, 3(125), 108-122.

Burkova, A. Yu. (2019). Chto pochem i pochemu. Spravedlivoye tsenoobrazovaniye na rynke finansovykh uslug [What is the price and why. Fair pricing in the financial services market]. Banking, 4, 30-33.

Gantimurova, D. S. (2019). Protsentnaya politika kommercheskikh bankov [The interest rate policy of commercial banks]. Theory and practice of socio-humanitarian sciences, 1(5), 113-119.

Graseck, B., Stoklosa, M., Cyprys, M., Hamilton, B., Sharma, A., Gosalia, M., Miotto, G., Kenny, R., Edelmann, C., Davis, J., Rosberg, M., Holroyd, B., Gorski, J., & Lambert, O. (2018). Wholesale banks and asset managers: Winning under pressure. Morgan Stanley.

Konsolidirovannaya finansovaya otchetnost' PAO «Sberbank» i yego docherniye organizatsii za 2019 god s auditorskim zaklyucheniyem nezavisimogo auditora [Consolidated financial statements of Sberbank and its subsidiaries for 2019 with independent auditor's report]. (2019). https://financemarker.ru/fa/fa_reports/2019/SBER2019YMSFO.pdf

Kovshova, T. P., & Gakelberg, T. B. (2019). K voprosu o prognoze protsentnoy marzhi kommercheskogo banka [On the forecasting of commercial bank interest margin]. Herald of Siberian Institute of Business and Information Technologies, (4(32)), 46-52.

Kulumbetova, D. B. (2019). Bankovskoye kreditovaniye otrasley ekonomiki [Bank lending to the economy sectors]. Scientific Journal: Finance, Banks, Investments, 4(49), 37-43.

Milenkov, A. V. (2019). Vliyaniye finansovo-bankovskogo sektora na sotsial'no-ekonomicheskoye razvitiye regionov [The impact of the financial and banking sector on the socio-economic development of regions]. Bulletin of the State University of Management, (12), 173-180.

Minakov, A. V., & Ivanova, L. N. (2021). Puti razvitiya ekvayringa v Rossii [Ways of acquiring development in Russia]. Journal of Applied Research, 4(3), 6-14.

Miroshnichenko, O. S., Voronova, N. S., & Gamukin, V. V. (2020). [The development of macroprudential regulation of bank household lending in Russia.] Finance: Theory and Practice, 24(4), 75-87.

Novoseltseva, M. M. (2020). Sravneniye avtokreditov i potrebitel'skikh kreditov s pozitsii ekonomicheskoy vygody dlya kliyentov [Comparison of car loans and consumer loans from the perspective of economic benefits for customers]. Economics and business: theory and practice, (10-2), 77-81.

Parusimova, N. I., Krolivetskaya, L. P., & Krolivetskaya, V. E. (2019). Kreditnyye otnosheniya Rossiyskikh bankov s zayemshchikami real'nogo sektora ekonomiki [Credit relations of Russian banks with borrowers of the real economy sector]. Intellect. Innovation. Investment, (6), 75-87.

Schnarr, T., & Pfeiffer, M. (2015). Delivering excellence in corporate banking: How to protect the business model and improve performance. Oliver Wyman.

Smirnov, V. D. (2021). Improving banks’ operating efficiency with corporate clients. Finance: Theory and Practice, 25(1), 130-142.

Yeshugova, S. K., Dorgushaova, A. K., Chinazirova, S. K., & Kostenko, R. V. (2019). Tsifrovaya transformatsiya bankovskogo sektora [Digital transformation of the banking sector]. New technologies, (4), 4-14.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

03 June 2022

Article Doi

eBook ISBN

978-1-80296-125-6

Publisher

European Publisher

Volume

126

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1145

Subjects

Social sciences, education and psychology, technology and education, economics and law, interdisciplinary sciences

Cite this article as:

Kim, A. G., Loksha, A. V., & Petrova, N. I. (2022). The Core And Peculiar Features Of Price Management In The Banking Sector. In N. G. Bogachenko (Ed.), AmurCon 2021: International Scientific Conference, vol 126. European Proceedings of Social and Behavioural Sciences (pp. 489-495). European Publisher. https://doi.org/10.15405/epsbs.2022.06.54