Abstract

Historically agriculture was developing extensively but the further we go, the clearer it appears – the necessity of total change to intensive way becomes obvious. Venture capital has always been associated with technologies and innovations. These are the exact things to be implemented into agriculture for the transfer from extensive and mostly unprofitable sector to intensive and highly profitable. On the basis of plural reports of venture capital associations, the paper presents data on venture investment volume of agriculture and food technologies industry in the world. It goes on analyzing the structure of funds invested in agriculture, indicates the leading countries and the trends of the industry’s direct high-risk investments. Shares of upstream and downstream funding are calculated and analyzed. Experience of governmental support of venture investment in agriculture is described in the research as well as. The results of the study are applied to the conclusions: ways of improving the situation in venture infrastructure of Russia and instruments for increasing investment attractiveness of agriculture for venture capital market. In perspective the research might be continued to analyze Russian infrastructure of venture capital and determine the leading industries within the country to assess the reason of their success. Implementation of the recommendation will allow making agricultural industry of Russia profitable and decreasing import of products.

Keywords: Agri-Food Tech, high risk investment, investment in agriculture, venture capital, venture investment

Introduction

Venture capital investment is the main catalyst for the development of high-tech industries such as IT, mechanical engineering (rocketry, electric cars, etc.). Agricultural production and processing enterprises, influenced by natural and weather conditions, macroeconomic policies and fluctuations of the global market, represent an industry with a high investment risk (Zhang, 2012). At the same time, not only the leading industries, but agriculture as well has begun to develop in an intensive manner over the past decades. It leads to general applying of the industry 3.0 (in some cases - 4.0). Modernization of the agricultural sector becomes more and more notisable, not just increasing the opportunities for investment in agriculture, but also providing good investment value for agriculture (Wang & Tang, 2010). Globally, both climate change and growing depletion of agricultural land are driving the need of increased returns on investment (ROI) in agricultural land. Every day, the world's population grows by 200,000 people, but on the same day, 30,000 hectares of agricultural land are lost. FAO has predicted that global food productivity needs to double to meet global food demand by 2050.

In countries with a strong culture of high-risk direct investment, there has been a significant increase of fundraising in the agricultural sector. In this article, we will analyze the advanced foreign experience of venture investment in the agricultural sector based on a statistical analysis of the venture capital investments volume dynamics for the period 2012-2019.

Problem Statement

Having a lack of investments in agricultural industry, this sphere is developing with a huge gap in comparison to leading venture capital directions, such as IT, for instance, or biotechnologies. This fact leads to the necessity of attracting more venture capital attention to Agri-Food Tech, increasing the productivity and innovative technologies in agriculture.

Research Questions

The idea of intensive development of agriculture is a common knowledge, but at the same time it is hard to say how exactly this transition can be made. The main question is to evaluate the possibility of reaching the new type of Agri-Food Tech development with venture investments using a leading tool.

Purpose of the Study

The main purpose of the study is to evaluate foreign experience of venture capital in Agri-Food Tech industry, assess the reasons for its success and to determine best practices to be implemented in Russian agriculture for increasing fundraising within the sector.

Research Methods

To analyze venture capital investment abroad, various annual analytical reports prepared by venture capital associations, such as Russian Venture Capital Association (RVCA), NVCA (National Venture Capital Association), EVCA (European Venture Capital Association) were used. In addition, international audit firms also share a number of annual data compilations on venture capital investments.

For the analysis of venture funds in Agri-FoodTech the main resouse used – reports of AgFunder (the company dealing with direct high-risk investments in Agri-FoodTech). To compare the results of the analysis results evaluation, we note that in foreign analytical reports, agriculture belongs to the category “agriculture and food technologies” (Agri-FoodTech), which also includes restaurant business, various online resources selling food and modern products for healthy nutrition. Moreover, very often in the annual venture associations (RAWI, NVCA, EVCA) reports and research, Agri-FoodTech is included into the section “other”, which means there is a reasonably insignificant share of agricultural investments, and therefore practically it can not be a subject to analysis. The fact leads to the need to adjust the analysis and conclusions results of this study.

Methodology of the research is based on the application of general scientific methods of cognition, such as analysis, synthesis, induction and deduction. Among some private scientific methods used there are regression, time series analysis, graphical method of information presentation.

Findings

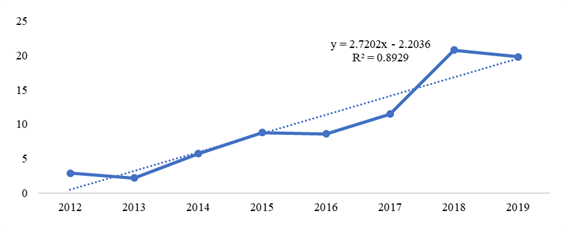

We considered the dynamics of the total venture capital investments volume in Agri-FoodTech for 2012-2019.

Figure 01 shows there is a tendency towards an increase in venture funds in the field of agriculture and food products in absolute terms (by 6.8 times over 8 years). The regression coefficient in the equation obtained with a high coefficient of determination – 89.29%, shows that the average annual increase of venture capital investments in Agri-FoodTech amounted to 2.72 bln USD in the period of 2012-2019. In 2019, the volume of venture capital investments decreased in accordance with the general trend (the total volume of fundraising in 2019 also decreased compared to 2018), which was caused by the global decline of the Chinese venture capital market in 2019.

In 2018, the Chinese venture capital market almost reached the level of the American one for the first time in history. Until the fourth quarter of 2018, China demonstrated such growth pace that it could even exceed the US fundraising indicators. But at the end of 2018, the Chinese venture industry was influenced by a general slowdown in the economy, as well as a consequence of political situation difficulties. Though in 2018 China reached the benchmark of 105 bln USD in venture capital investments (6 bln USD in 2013) and the USA – 111 bln USD (48 bln USD in 2013). With the benchmarks of 2018, China's share in the global startup investment market reached 45%, then in 2019 it fell to 15%, which is a record low for recent years (https://vc.ru/finance/105043-glavnye-venchurnye-i-ne-tolko-itogi-2019-goda).

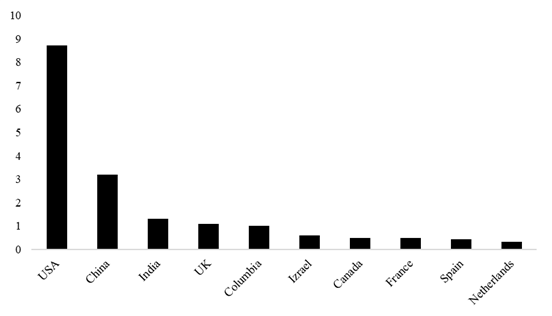

The collapse of the Chinese market led to the fact that at the end of 2019 the global venture capital market went down after a decade of growth (Cai, Chen, Huang, Hu, Pray, 2020). This was reflected in the volume of venture capital investments in the Agri-Food sector, since China ranks second after the United States in terms of direct high-risk investments in agriculture (Figure 02).

According to the AgFunder report, the number of deals in Agri-FoodTech decreased by 15%, and the volume of investments - by 4.8%, which indicates an increase in the average price of one deal in the industry (https://agfunder.com/research/agfunder-agrifood-tech-investing-report-2019/).

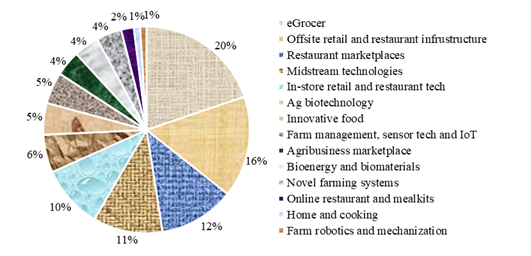

If we consider the diversification of investments within the industry, then a large share of all venture capital funds falls to eGrocery. This is online stores and marketplaces for sale and delivery of processed and un-processed agricultural products to consumer. This share is 20% of the total volume of investments in Agri-FoodTech, followed by Cloud Retail Infrastructure (On-demand enabling technologies, ghost kitchens, last mile delivery robots & services) - 16% (figure 03).

Relatively classic production segments such as Ag Biotechnology (On-farm inputs for crop and animal ag including genetics, microbiome, breeding, animal health), Bioenergy and Biomaterials (Non-food extraction and processing, feedstock technology, cannabis pharmaceuticals), Farm Robotics, Mechanization and Equipment (On-farm machinery, automation, drone manufacturers, grow equipment), Midstream Technologies (Food safety and traceability technologies, logistics and transport, processing tech), and Novel Farming Systems (Indoor farms, aquaculture, insect, and algae production) are called upstream. They together make up only 1/3 of the total volume of venture investments in Agri-FoodTech. It means that despite the high level of total investments in Agri-FoodTech in the world, downstream (non-production) prevails.

Keeping in mind that venture capital investment is far less susceptible to short‐term price and valuation fickleness and it is long‐term by nature (Batterson & Freeman, 2017) we are able to make the following conclusion. The production sector still requires global support of the state and various organizations, since ROI in distribution is much higher and faster, which is undoubtedly a key factor for investment venture funds and business angels (Sarkisyan & Borkhunov, 2014). There is a certain level of uncertainty and complexity in the firm's choice of venture capital portfolio companies in agricultural manufacturing and processing enterprises. For instance, longer production timeline, lower product price, cyclical fluctuations, government intervention, market potential (Pinskaya et al., 2016). These uncertainties increase the risk of making decisions on venture investments in agricultural production and processing enterprises.

Knowing the preferable nature of downstream sector, let us make a hypothesis: due to higher risks and longer timelines of upstream projects investors prefer to make lower costing deals in this sphere, putting more affords and means into downstream deals though the need of agricultural development is more focused on upstream projects while downstream has less to be invented.

Analysis of the average deal cost and check of the the number of deals in upstream and downstream spheres. The average cost of deal shows prefereces of venture investments and the number of deals demonstrates the innovations market potential. In 2019, 7.6 bln USD were invested in 1039 upstream projects. Downstream is 12 bln USD for 781 deals, so the average deal cost in downstream projects turned out to be higher as supposed – 15.3 mln USD, while the average deal cost in upstream projects was more than doble low – 7 mln USD. While the number of deals in upstream was higher by 33% than the number of deals in downdtream sphere. This confirms the hypothesis above: presence of higher risks, complexity and long-term projects in the upstream segment act as a deterrent for investors, which leads to lower average investment in a project while the volume of uptream market is higher.

Analysis of foreign experience makes it possible to point out the United States of America as a leader of the venture capital investment market in general and agriculture in particular – American share of the venture capital investment market in agriculture and food products in 2019 accounted 44%. Firstly, historically the United States is the birthplace of venture capital, and secondly, also historically and geographically, the country has a highly developed agricultural industry. At the same time, in addition to the factors discussed above, the United States has built and is effectively implementing a system of state support for both the industry itself and its venture capital investment. Most sectors of American economy are independent and invest in R&D themselves, however, when it comes to agriculture, even the fact that the state hires thousands of scientists and experts in this field for its development can be considered as state support. This certainly pedals the inflow of investments into agricultural industry. This initiative can be classified as a capacity build, one of the key instruments of state support for the development of venture capital infrastructure.

Along with the capacity build in the United States, at different periods of time, all the key instruments of state support for the venture investment industry have been and are being used: government-run funds, tax incentives, funds of funds, and co-investment funds.

Conclusion

The venture capital industry in Russia occupies an important position in the complex of measures for the transition to an innovative scenario of development as well as for the creation of a competitive technical base that forms the prospects for the growth of the Russian economy (Rada et al., 2020). When building a Russian venture capital industry, it is necessary to take into account the successful foreign experience in this area, adapting it to Russian conditions.

The main barrier in the development of the venture capital market in Russia can be called the lack of venture investment infrastructure: regulatory framework, high-quality project assessment system, scientific and technical infrastructure, innovative companies, presence of associations of various players in the venture capital market and regional venture capital funds (Pinskaya et al., 2016).

In addition, it should be noted that for various regions and sectors of the economy, there should be used diversified instruments of state support of venture investment. For instance, in the regions with leading indicators in agriculture, it is worth creating regional co-investment funds for venture investors in agriculture and providing additional tax incentives for investors in agricultural sector of these regions, as it is used in the United States of America. This will attract additional interest of venture investors to the Agri-FoodTech sector.

References

Batterson, L., & Freeman, K. M. (2017). Why should you invest in venture capital. Building Wealth through Venture Capital: A Practical Guide for Investors and the Entrepreneurs they Fund, 236. DOI:

Cai, J., Chen, W., Huang, J., Hu, R., & Pray, C. E. (2020). The Evolving Structure of Chinese R&D Funding and Its Implications for the Productivity of Agricultural Biotechnology Research. Journal of Agricultural Economics, 71(2), 287-304. DOI:

Pinskaya, M., Tikhonova, A., Sheredeko, E., & Alisevich, M. (2016). The Effective System Of The State Support For Agribusiness. International Journal of Economic Perspectives, 10(4), 291-299.

Pinskaya, M. R., Melnichuk, M. V., Frumina, S. V., & Tikhonova, A. V. (2016). Problems Of Creating A Favorable Investment Climate In Russian Regions. International Journal of Economics and Financial Issues, 6(S8), 300-306.

Rada, N., Liefert, W., & Liefert, O. (2020). Evaluation Agricaltural Productivity and Policy in Russia. Journal of Agricultural Economics, 71(1), 96-117. DOI:

Sarkisyan, M., & Borkhunov, N. (2014). World venture business asn development of agro ecomomics. AIC: Economics and Management, 6, 85-93.

Wang, Z., & Tang, X. (2010). Research of Investment Evaluation of Agricultural Venture Capital Project on Real Options Approach. Agriculture and Agricultural Science Procedia, 1, 449-455. DOI: 10.1016/j.aaspro.2010.09.056

Zhang, X. (2012). Study on Venture Capital Investment Risk Avoiding Base on Option Pricing in Agricultural Production and Processing Enterprises. Physics Procedia, 33, 1580-1587. DOI: 10.1016/j.phpro.2012.05.255

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Sarkisyan, M. A. (2022). Expirience Of Venture Capital Investment In Agriculture Abroad. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 743-749). European Publisher. https://doi.org/10.15405/epsbs.2022.02.92