Abstract

The budgetary system of the Russian Federation is composed of federal, regional and municipal budgets. Municipal budgets are budgets of municipalities (urban districts, urban and rural settlements). Municipal budgets are an integral part of the financial system of the Russian Federation. They play an important role in the socio-economic development of Russia, funding kindergartens, schools, medical and other social institutions. The development of local self-government is of great importance to solve local problems and improve living standards of the population. In the context of local self-government reformation, the governments of urban and rural settlements are gaining experience in independent management. The study aims to find ways to strengthen the revenue base of local budgets in the current tax system. The problem of rational use of revenues is important, since they are the basis for the life support of the population. Local authorities are as close as possible to the population living in the municipality. Therefore, the rational use of revenues is a relevant issue. The study analyzes the resource potential and the process of distribution of budget allocations by sections and subsections of the functional classification of expenses of the rural settlement. Measures aimed to improve the system of financial resources of the local budget have been developed.

Keywords: Budget, fiscal potential, municipality

Introduction

Local budgets are a prerequisite for strengthening the economic basis for the independent socio-economic development. The main objectives of the budgetary policy are to ensure that the local budget performs its functions; and to improve the financial stability of local budgets (Vinnichenko & Esmanov, 2014).

The level of social protection of citizens and investment opportunities of local budgets depend on the quality of the local budget and its parameters. The problem of rational use of revenues and expenditures of municipalities is important in modern conditions, since they are the basis for the life support of the population. Local authorities are as close as possible to the population living in the municipality. Therefore, the issue of the rational use of revenues is relevant (Zimniakova, 2015).

Problem Statement

In the market economy, the efficiency of the system of budgetary relations is one of the priority tasks whose solution affects the results of budgetary reforms. The unstable situation in the global economy as a whole, which directly affects the situation in the Russian economy, causes the insufficiency of financial resources at all budgetary levels. One of the important conditions for the full implementation of the tasks assigned to local governments is the systematic formation and distribution of budgetary funds throughout the entire budgetary process (Nikulina & Sinenko, 2013).

It is at the municipal level that the financial flow of the country originates. The solution of national tasks is ensured by meeting the needs of the population at the local level. The role of the municipal budget throughout the entire reproduction process cannot be overestimated, which is why independence, flexibility and a high degree of efficiency are keys to the successful development of society, production and business.

Research Questions

The financial autonomy of local authorities entails the independent status of municipalities in the federal state. Local governments should be able to independently determine their revenues and expenses. When the local authorities cannot rely on their financial resources, they are unable to solve everyday tasks. Local self-government needs a stable solid financial base (Bochko, 2016).

For the effective execution of local tasks, it is not enough to strengthen the financial base; a competent policy of local authorities in the municipal finance management is required (Roznina et al., 2020).

Purpose of the Study

The autonomy of municipal budgets is affected by a number of problems, including low revenue collection, ineffective spending of budget funds, lack of control over the quality of municipal finance management and clear instructions and methods for regulating interbudgetary relations. The main goal is to analyze the process of execution of the municipal budget to develop improvement measures.

Research Methods

The following research methods were applied: the statistical research method was used in collecting and summarizing quantitative data and identifying patterns of change in indicators for assessing the budgetary and tax potential of a municipality; the comparative method was used when comparing indicators of the base and reporting years (Table 1).

Findings

Municipal finance is a system of economic relations for distributing, redistributing and using the national income for the implementation of functions assigned to local governments (Kuklin & Agarkov, 2007; Nikulina & Sinenko, 2013).

The social and economic processes are being rationalized. They are regulated by local budgets. This has an impact on the role of the regional financial system and expands the scope of its application. The finances of municipalities are used to regulate the economy, stimulate the economic growth, implement regional programs, and reproduce the labor force (Yusupov et al., 2019).

Generation and use of financial resources by rural settlements

The research object is the Administration of Krasnoleninsky rural settlement of the Khanty-Mansi Autonomous District-Yugra (Zimniakova, 2015).

The main activity indicators decreased: one can observe a decrease in the value of property by 2 million 372 thousand rubles, the cost of fixed assets by 161 thousand rubles, a net operating result by 30 million rubles.

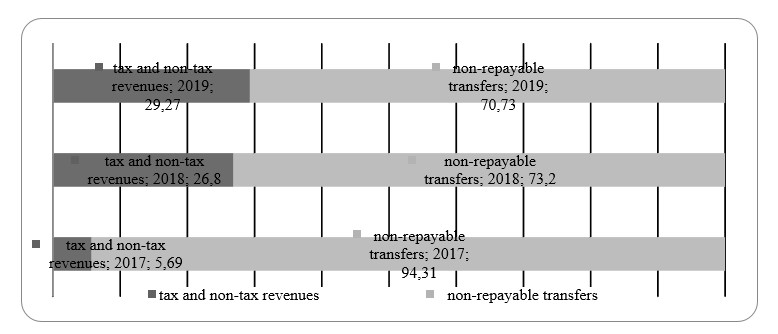

The regional budget revenues are generated in accordance with the budgetary legislation of the Russian Federation and the Khanty-Mansiysk Autonomous Okrug - Yugra, the legislation of the Russian Federation and the Khanty-Mansiysk Autonomous Okrug - Yugra on taxes, fees and other obligatory payments, decisions of the Krasnoleninskaya Rural Duma on taxes, fees and other mandatory payments and the forecast of the socio-economic development of Krasnoleninsky settlement (Figure 1) (Roznina et al., 2020).

In the structure of executed revenues of the consolidated budget of the Krasnoleninsky rural settlement, the largest share belongs to the non-repayable transfers - 94.31% in 2017, 73.20% in 2018 and 70.73% in 2019 The share of tax and non-tax revenues in amounted to 29.27% in 2019.

The municipality relies on the local budgetary fund (Perko & Grudinova, 2011; Voroshilov & Gubanova, 2014; Zimniakova, 2015).

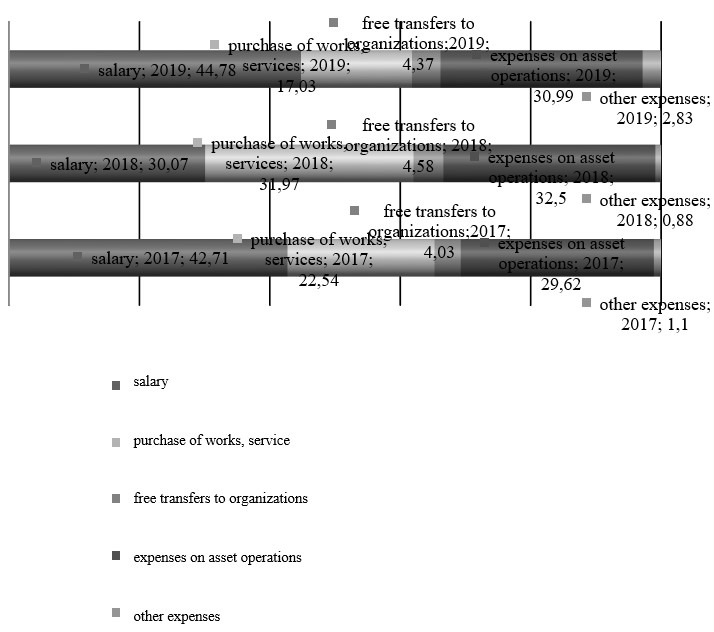

Consider the distribution of budget allocations by sections and subsections of the functional classification of expenditures of the rural settlement in Table 2.

The total amount of approved budgetary allocations is more than 12 million rubles, and the amount of allocated funds is 3 million 138 thousand rubles.

In the structure of expenses, the largest share falls on salaries - 76% for 2017-2019.

In 2018-2019, the net operating result was negative: -2.3 million and -1.9 million rubles; in 2017, the result was positive - 28 million rubles (Table 3).

This trend is due to the fact that the amount of revenues decreased by more than 27 million rubles, and the amount of expenses increased by 2.6 million rubles. The total amount of revenues is decreasing, while the amount of expenses is increasing. This affected the financial result of the settlement.

Measures to improve the system of generation und use of financial resources by the rural settlement

To improve the system of generation and use of financial resources of Krasnoleninsky, four measures can be implemented (as shown in Table 4).

1. Determination of the tax base for individual property taxes by the cadastral value, which will increase revenues by 89 thousand rubles.

2. Measures aimed to increase the property tax will increase the budget revenues by 53 thousand rubles.

3. Expenditure reduction by implementing the energy saving system which will increase the budget revenues by 150 thousand rubles.

4. Implementation of the geographic information system (GIS) containing data on all land plots which will increase the collection of land tax by 496 thousand rubles, and the budget revenue will increase by 81 thousand rubles.

The amount of revenues will increase by 639.08 thousand rubles, and the amount of expenses will decrease by 450 thousand rubles. This will increase the net operating result by 374.67 thousand rubles, and per employee - by 34.06 thousand rubles (as shown in Table 5). Thus, the measures developed will have a positive impact on the budget of Krasnoleninsky settlement.

Conclusion

The relevance of the study is due to the need for each municipality to generate and execute the budget with the least loss of financial resources. Local budgets are in deficit; therefore, it is important to finance their expenditure powers from higher-level budgets. The proposed measures will have a positive impact on the budget system of Krasnoleninsky settlement.

References

Bochko, V. S. (2016). Economic independence of regions in the context of the new reality.Economy of the region, 12(2), 342-358.

Kuklin, A. A., & Agarkov, G. A. (2007). The optimal ratio of economic and administrative measures to counteract the shadow economy of the regions.Economy of the region, 1, 54-59.

Nikulina, N. L., & Sinenko, A. I. (2013). Diagnostics of the financial security of the region. Manager, 4(44), 54-59.

Perko, N. V., & Grudinova, I. A. (2011). Formation of a budgetary strategy as the most important element of effective management in the field of ensuring the financial and budgetary security of the region (municipality). Bulletin of the Financial University, 3(63), 47-50.

Roznina, N. V., Karpova, M. V., Dunicheva, S. G., & Ovchinnikova, Yu. I. (2020). Assessment of the administration's activities in the formation and execution of the budget. In Digital economy and knowledge management: problems and development prospects: collection of scientific papers of the International Scientific and Practical Conference (pp. 158-16.). Publishing house of the Vyatka State Agricultural Academy.

Vinnichenko, N. V., & Esmanov, A. M. (2014). Assessment of the state of financial security in Ukraine. Ekonomichny chasopis-XXI, 3-4-2, 47-51.

Voroshilov, N. V., & Gubanova, E. S. (2014). Assessment of the level of socio-economic development of municipalities in the Vologda region. Economic and social changes: facts, trends, forecast, 6(36), 54-69.

Yusupov, K. N., Yangirov, A. V., Timiryanova, V. M., & Toktamysheva, Yu. S. (2019). Assessment of the impact of territorial location on the development of municipalities. Economy of the region, 15(3), 851-864.

Zimniakova, T. S. (2015). Certain aspects of the financial security of the region on the example of the Krasnoyarsk territory (krai). Journal of Siberian Federal University. Humanities and Social Sciences, 8(11), 2385-2397.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Karpova, M. V., Roznina, N. V., Borovinskikh, V. A., Shulgina, A. V., & Zhukova, V. F. (2022). Generation And Use Of Financial Resources By Rural Municipalities. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 564-570). European Publisher. https://doi.org/10.15405/epsbs.2022.02.72