Abstract

Organic agriculture is the most popular alternative to traditional agriculture in the world; the volume of the global organic food market has been increasing annually for a long time. An analytical review of the state of the world and national markets for organic agricultural products is presented in various aspects: agricultural land area, concentration of producers, international trade. The place of Russia in the world market of organic agricultural products has been determined. The key trends, problems and prospects for the development of organic agricultural production in Russia are highlighted. The presented data demonstrate the continuation of the positive trend in demand for organic products in developed countries. The Russian market is characterized by the following: high average annual growth rates of organic lands; increasing the share of land for the production of organic agricultural products; unstable number of producers; stabilization of the volume of the internal market for organic products at the level of 120 million euro; stabilization of the export volume of organic products at the level of 4 million euro. The production of organic products is advisable in local product markets, since the production of organic products is a product with high added value, increased requirements for certification of organic products and a narrow segment of consumers.

Keywords: Agriculture, certification, development, local market, organic, perspective

Introduction

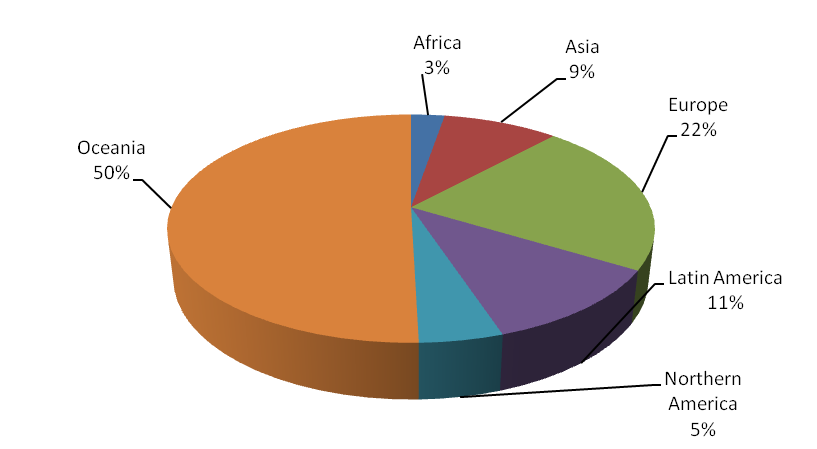

According to the Research Institute of Organic Agriculture in 2018, the largest share of land for organic production is located in Oceania and Europe (Figure 01).

About half of the world's agricultural organic land is concentrated in Oceania; the leader is Australia (35.69 million hectares), most of it is pasture. Russia in 2018 ranked 16th in terms of the area of organic land (606.9 million hectares), it is worth noting a significant increase in land for the period of 2008-2018 (FiBL statistics, 2020). The presence of a reserve of land resources can become the main prerequisite for the development of the national organic sector in the presence of stable demand in the external and internal markets. Considering the functioning of the local market as an organizational and economic mechanism, one must get keen on explanation of the particulars of the arrangement of the agricultural sector market. A new segment stands out for the organic product market, which is formed by a complex of micro-markets that have their own development parameters in terms of factor elements (Kovalev, 2017).

Problem Statement

The organic market in Russia is not developing as intensively as the European one. On the one hand, this can be explained by low effective demand. On the other hand, there is insufficient supply due to the imperfection of the regulatory framework, the lack of individual measures to support producers of organic agricultural products, including during the transition from the traditional type of production and other barriers. One of the most important problems in the development of the organic market is the issue of product certification.

Research Questions

In this study, the authors investigates the development trends of the global and national market for organic agricultural products, special attention is paid to barriers to the development of the national market and the certification of organic food.

Purpose of the Study

In connection with relatively high growth rates of organic agriculture in the world, the purpose of this study is to study the development trends of the Russian organic food market and determine the combination of factors that impede its development.

Research Methods

The theoretical and methodological basis of this study was the works of domestic and foreign scientists-economists dedicated to the development of industry-specific product sub-complexes. The information base of the study was made up of statistical data from the Federal State Statistics Service, the Unified Interdepartmental Information Reference System, the Territorial Body of the Federal State Statistics Service for the Altai Territory, materials of scientific and practical conferences on the problem under consideration, periodicals and special publications. The study used the following methods: abstract logical, economic and statistical, monographic, as well as methods of system analysis, economic comparison, expert assessments, economic modeling.

Findings

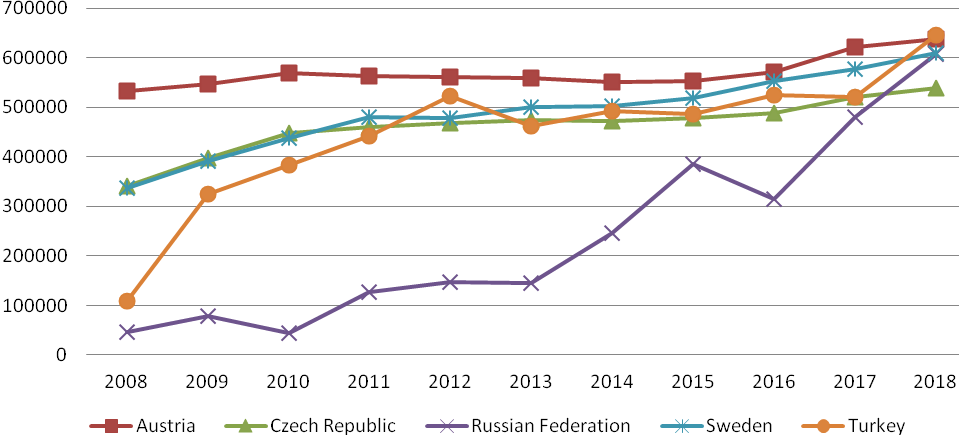

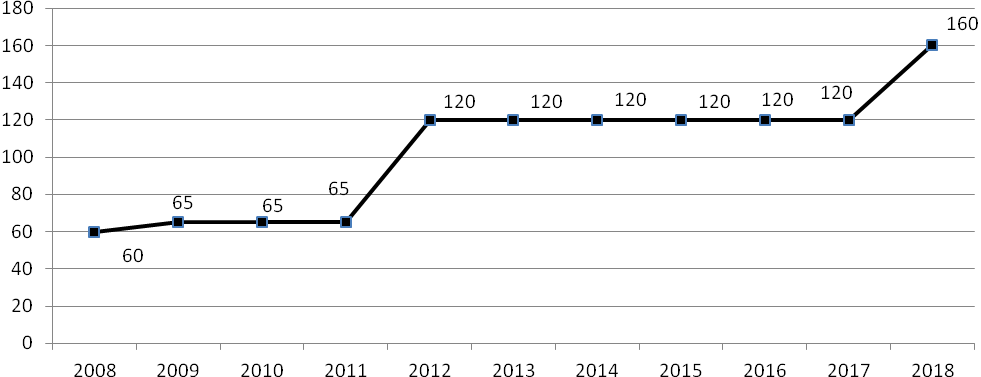

The volume of the world market for organic food continues to grow from year to year; as a result, there is an increase in the area under the cultivation of organic products in many countries (Reganold, 2016). Russia in 2018 ranked 16th in terms of the area of organic land (606.9 million hectares), it is worth noting a significant increase in land for the period of 2008-2018. The presence of a reserve of land resources can become the main prerequisite for the development of the organic sector in the presence of stable demand in the external and internal markets. In 2018, the closest countries in terms of organic land area: Austria, Sweden, Turkey and the Czech Republic. The change in the area of organic land for the period of 2008-2018 is shown in Figure 02. The highest value of the average annual growth rate is observed in the Russian Federation (129.16%) and Turkey (119.44%), the smallest (101.83%) in Austria; according to others, considered countries also observe a tendency to increase the area of organic land at an average annual growth rate of 105-106%.

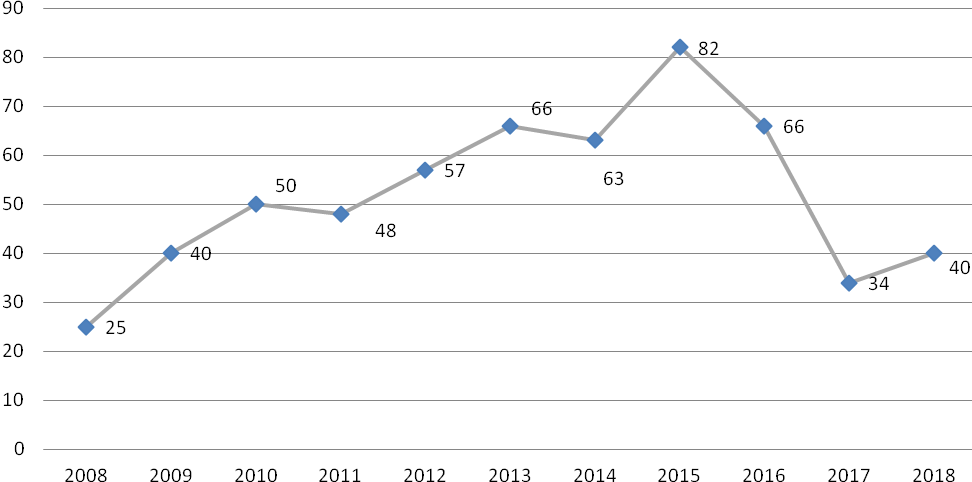

In 2018, more than 80% of organic producers are concentrated in Asia, Africa and Latin America (The world of organic agriculture, 2020). It is worth noting that most of the research results in organic agriculture are published in relation to developed countries, where the production of organic food is focused on the domestic market. At the same time, there is a lack of information on the development of the organic sector in developing countries, which are the main producers and exporters of organic food. The country with the largest number of producers is India, followed by Uganda and Mexico. In Russia, since 2015, there has been a decrease in the number of producers of organic agricultural products (Figure 03). The main types of organic products produced in the Russian Federation are beans, flax, corn, lentils, peas, rice and soybeans.

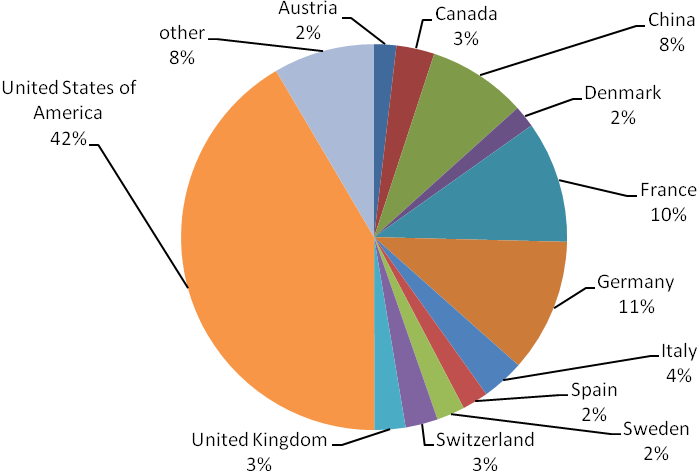

The country with the largest organic food market is the United States, followed by Germany, France and China (Figure 04). The highest consumption of organic products per capita is in Switzerland, Denmark, Sweden.

Retail sales of organic products in the Russian Federation tend to increase since 2008 (Figure 05), for the period of 2012-2018 according to the data presented, the organic market over the past five years has not developed as intensively as the American and European ones. This can be explained by low effective demand, as the world experience shows, the average premium for organic products relative to those produced within the framework of the traditional approach is about 30-50%.

According to the data on the value of exports, the leaders are Australia and New Zealand. In many parts of Africa, Asia and Latin America, organic products are produced exclusively for export, the same trend is observed for the countries of Eastern Europe, which is associated with the unpreparedness of the domestic market for environmental consumption due to low living standards. The development potential of production in these countries is associated with a lower level of environmental pollution and lower production costs. One of the main importers of organic agricultural products is the EU, the main importing countries are China, Ecuador, Dominican Republic, Ukraine, Turkey.

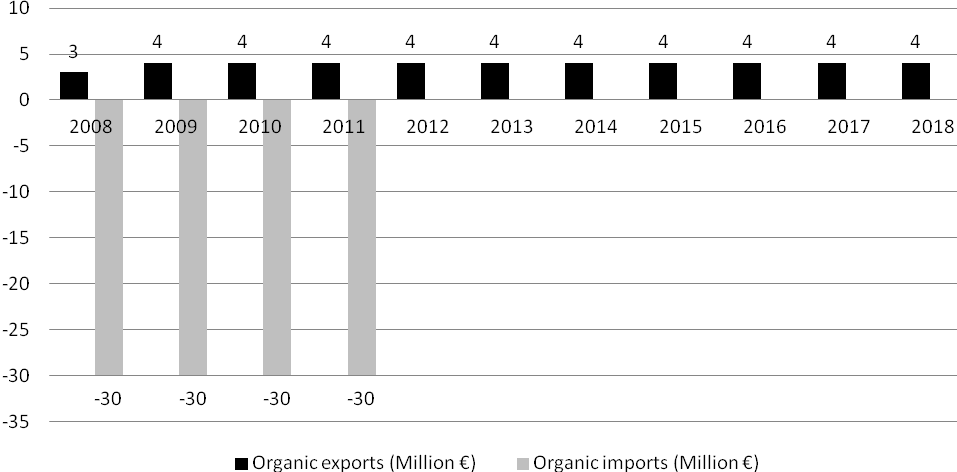

Data on the value of export-import in the Russian Federation are presented in Figure 06. For the period of 2009-2018 the volume of exports of organic products remained at the same level – 4 million euro, imports for the period of 2008-2011 amounted to 30 million euro annually, from 2012 to 2018 no import data.

One of the most important problems in the development of the organic market is the issue of product certification. In connection with the adoption of the national standard GOST R 56508-2015 «Organic products. Rules of production, storage, transportation», which was put into effect on January 1, 2016. The main issue on the cost of certification remains uncertain, since the cost of certification is determined only after receiving applications. Depending on the products being manufactured, the cost of certification is different in each specific case (Kovaleva & Kovalev, 2016). Objects and categories of organic certification of food and agricultural products distinguish the following:

– Organic – products grown and produced only in ecologically clean conditions and conditions of biodynamic farming. Products must meet GOST R 56508-2015.

– Natural – products containing at least 95% of ingredients of natural origin. Also, the products may contain no more than 25% of the maximum permissible concentration of harmful substances, pesticides and agrochemicals. The equivalent of GOST R 56508-2015 is used, but with some restrictions.

– Manufacturer – manufacturer of organic food and agricultural products, production must meet the requirements of GOST R 56508-2015.

– Seller is a seller of organic food and agricultural products. Awarded if there is at least 75% of certified organic products in the assortment. All requirements are set out in GOST R 56508-2015, certification rules – in GOST R 57022-2016, terms and definitions in GOST R 56104-2014. For the certification of products supplied abroad, EU regulations 834/2007 and 889/2008 are applied. Organic product certification includes the following elements:

1) A sample of organic labeling applied to products (applied since September 2014). The assigned product status (organic, etc.) is applied in a convenient place on the label or nearby.

2) Documents: the main regulatory document is the Federal Law of August 3, 2018 No. 280-FZ «On organic products and on amendments to certain legislative acts of the Russian Federation», which entered into force on 01.01.2020; GOST 33980-2016 Organic products. Rules for production, processing, labeling and sale; GOST R 56508-2015 «Organic products. Rules of production, storage, transportation»; GOST R 57022-2016 «Organic products. The procedure for conducting voluntary certification»; GOST R 56104-2014 «Organic food products terms and definitions»; additions and amendments No. 8 to SanPin 2.3.2.1078-01 hygienic requirements for the safety and nutritional value of food products (Sanitary-Epidemiological Rules and Norms SanPin 2.3.2.2354-08)

According to TR CU, food processing enterprises must be certified according to GOST R ISO 22000 (ISO 22000). It is possible to simultaneously pass certification according to ISO 22000 and organic. This greatly reduces the cost of obtaining certificates.

To successfully pass certification of organic products, the enterprise must implement an organic production system in accordance with the current standard GOST R 57022-2016 «Organic products. The procedure for conducting voluntary certification». The preliminary stage includes an assessment of the possibility of carrying out organic certification. At this stage, the possibility of carrying out organic certification of products and the rules for the production of organic products is being investigated. After submitting the application and providing a set of necessary documentation, a preliminary analysis of the state of production and products is carried out. Based on the analysis, a decision is made on the possibility or impossibility of certification. If certification is refused, the reasons for the refusal are listed. After elimination of these reasons, it is possible to re-submit the application for certification. If a positive decision on certification is made, the first stage of certification begins.

Stage I: conclusion of a certification agreement. Request for additional information on certified objects and processes, carrying out the necessary laboratory analyses. Making a decision on the possibility of carrying out the next stages of certification.

Stage II involves an on-site inspection of the certified objects; a visit to the enterprise of an inspector (inspectors) to check the conformity of the certified objects; the final decision on certification.

Stage III: making a decision on certification. In case of a positive decision – issuance of a certificate. In case of a negative decision, the certification body issues recommendations on the identified deficiencies to eliminate them. After elimination of the identified deficiencies, the applicant can submit an application for re-certification. It is possible to issue a certificate in the presence of minor violations of GOST, subject to the implementation of corrective actions to the nearest inspection control.

Conclusion

Organic agriculture is the most popular alternative to traditional agriculture in the world (Reganold, 2016); the volume of the global organic food market has been increasing annually for a long time. The presented data demonstrate the continuation of the positive trend in demand for organic products in developed countries. The Russian market is characterized by the following: high average annual growth rates of organic lands; increasing the share of land for the production of organic agricultural products; unstable number of producers; stabilization of the volume of the domestic market and the volume of exports of organic products. Measures for the development of organic agriculture, namely the improvement of legislation, the structure of certification and supervisory institutions, the provision of financial, information and marketing support are advisable to carry out within a separate strategic direction.

Acknowledgments

The article completed within the framework of RFBR research project No. 19-510-44011 «Development of the concept of organic agriculture based on progressive methods and technologies».

References

FiBL statistics (2020). Research Institute of Organic Agriculture FiBL. Retrieved from https://statistics.fibl.org/

Kovalev, A. (2017). Development of the organizational and economic mechanism of the local market of the dairy-food subcomplex. Bulletin of Altai State Agrarian University, 3(149), 183-188.

Kovaleva, I., & Kovalev, A. (2016). Development of integration processes in dairy cattle breeding. Successes of modern science, 11, 48-50.

Reganold, J. (2016). Can we feed 10 billion people on organic farming alone? Retrieved from https://www.theguardian.com

The world of organic agriculture (2020). Retrieved from https://www.ifoam.bio

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Galkin, D. G., & Kovaleva, I. V. (2022). The Development Organic Agriculture: Problems And Perspective. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 516-523). European Publisher. https://doi.org/10.15405/epsbs.2022.02.66