Abstract

The article examines the measures taken by the Government of the Russian Federation, the Central Bank of the Russian Federation, commercial banks in the context of the spread of the COVID-19 pandemic to change the mechanism of financial support for concessional lending, loan restructuring, and credit holidays for agricultural enterprises. The amount of funds allocated for concessional lending to the agribusiness in 2020 was increased by 37.3%, with the minimum interest rates on concessional loans set below 5%. During the coronavirus pandemic, banks promptly restructured their internal programs aimed at creating conditions for the continued functioning of their agricultural clients. PJSC Sberbank, JSC Rosselkhozbank, PJSC VTB and many other banks launched online services that could be used by agricultural clients remotely. The coronavirus pandemic pushed the digitalization of financial flows in the agricultural sector and the transition of agribusiness customers to online services. Although the forward movement of the anti-viral digitalization of financial flows in the agribusiness in 2020 was noticeable with the naked eye, it had to deal with lots of challenges. It became obvious that many agricultural enterprises and especially small businesses were not ready to use the ecosystems, marketplaces, and digital platforms offered by banks. To maintain and support the growth rate of digitalization of the agribusiness, it is necessary to provide preferential lending agricultural companies and organize training of IT specialists for agricultural business in agricultural universities.

Keywords: Agribusiness, digitalization, financial flows, financial support

Introduction

Over the past 12 months, the rapid spread of the coronavirus around the world has stopped the economies of many countries, brought down the world market, forcing businesses and people to adapt to a new “closed” reality – “self-isolation” with no end in sight. Although the Russian agribusiness did not stop its work even in March-June 2020, when a coronavirus lockdown was imposed in Russia, it still could not avoid the negative impact of the general economic situation in the world and the country. The coronavirus pandemic has impacted the agro-industrial sector of the economy, from small businesses to large agro-industrial companies. The main problem for the agribusiness was the devaluation of the ruble, which led to an increase in foreign exchange costs for agricultural producers. Not a single economic crisis can do without devaluation. Although it cannot be compared with that of 1998, when the ruble collapsed 3.5 times against the US dollar, while in 2020 the ruble fell against the dollar by only 22%, this was the most significant devaluation of the ruble over the past 5 years. On average, the share of imports (machinery, seeds, feed and feed additives, herbicides and pesticides) in the cost of crop and livestock products in Russia is 20% to 50%. According to the National Union of Poultry Farmers, the share of imported components in the production of eggs and poultry meat reaches 25-30%. These are hen flocks, feed additives, premixes, process equipment and machines. In 2020, due to the devaluation of the ruble, prices for components of the feed industry, vitamins, some types of amino acids that are not produced in the Russian Federation increased by 30-50%, which led to an increase in the cost of compound feed, the share of which in the cost of milk and meat in Russia reaches 75%. According to Rosstat (2020), in 2020 the average retail price for milk and dairy products increased by 9.8%, for chicken eggs - by 20.1%. The growth leaders were fruit and vegetable products, which increased in price by 17.4%, sunflower oil increased in price by 25.99%, granulated sugar increased in price by 64.5% over the year.

Problem Statement

The issues of digitalization of the banking sector and the agribusiness are widely discussed in the works of Vartanova (2019), Vartanova and Drobot (2019), Kozubenko and Balabanov (2017), Kulikov and Kudryavtseva (2017), Molotkova et al. (2018), Strukova and Kulikov (2019), Samorodova et al. (2019), etc. However, the intensification of innovation during the spread of the coronavirus pandemic became a key factor in the digitalization of financial flows in the agribusiness, which made it possible to ensure stable financing of agribusiness and maximum safety of its employees. In the context of the COVID-19 pandemic, the priority was the immediate reorientation of the existing financial flows of the agribusiness to a digital platform. Banks, providing digital platforms through Internet services, allow agribusiness enterprises to enter new sales markets and open access to millions of consumers, providing a new level of competitive advantages and new opportunities for the development of the agricultural sector of the economy.

Research Questions

Research aims to look at directions and forms of digitalization of financial flows in agribusiness, development of incentive mechanisms for agricultural producers, assessment and application of the best practices for digitalization of financial flows in agribusiness. Modern conditions for the formation of a short-term and long-term comprehensive program for digitalization of agribusiness make it possible to analyze the management decisions made by the government, the Central Bank of the Russian Federation, commercial banks, as well as to determine statistical data characterizing the process of digitalization of financial flows during the COVID-19 pandemic and in the post-period period, and to identify the main problems and factors causing influence on the growth of digitalization in agribusiness, substantiate an increased role of the government in the digitalization of agribusiness and show what is necessary for the formation of the economic environment in Russia to change the paradigm of agribusiness transition from the existing model to the digital model.

Purpose of the Study

The purpose of the study is to assess the scope and significance of digitalization of financial flows in agribusiness during the COVID-19 pandemic and in the post-pandemic period; to identify the main financial and economic problems that hinder the digitalization of financial flows in agribusiness, and justify the need to strengthen financial support from the government, as well as substantiate the main forms and methods of government incentives for digitalization of agribusiness.

Research Methods

The research materials were statistical data and analytical information from Rosstat, the Ministry of Agriculture of the Russian Federation, the Federal Customs Service of the portal of foreign economic information, regulations of federal and regional authorities on financial support for the agro-industrial complex, as well as personal developments of the authors.

The methodological and theoretical basis of the study is the works of domestic and foreign scholars on the digitalization of the agribusiness and the banking sector. The research used the methods of system analysis, economic and statistical tools, the expert assessments, data analysis, synthesis of the data obtained based on the principles of interconnectedness, consistency and proportionality.

Findings

Since the agribusiness is focused on the basic needs of the population and the processing industry, the industry is completely dependent on the effective demand of the population. In the current situation of the spread of the coronavirus pandemic, the structure of consumer demand has begun to change, forcing the population to save on the purchase of many products. Consumer demand has begun to shift from more expensive to cheaper products. According to Rosstat, in 2020 there was a decrease in demand for products of a more expensive price group: fish, seafood, boneless chilled meat, fresh fruits and vegetables. As follows from the Rosstat report on the socio-economic situation in Russia in 2020, the real disposable monetary income of citizens decreased by more than 3.5% compared to 2019 and was 10% lower than in 2013 (the last year of steady growth in household income). In the current conditions, agricultural producers, in order to “survive”, had to take into account the decrease in real incomes of the population and use various mechanisms to level their own significant costs in such a way that they did not have a significant impact on the final price of products.

Despite the general financial instability during the spread of the coronavirus pandemic, agricultural enterprises also faced border closures, which turned out to be quick, unexpected and absolute. This means that imports from abroad, vital for the agribusiness, were under threat - from European day-old chickens and seeds of food crops to imported food ingredients and food, and imported equipment and spare parts not produced in Russia. The devaluation of the Russian ruble stimulated the growth of exports of agricultural products. It was necessary to quickly adapt to the changing logistics in the domestic and global markets. In Russia, a significant segment of agribusiness has developed, focused on the export of foodstuffs from Russia, and which is now one of the priorities of the government. Thus, the main strategic objective of the international cooperation and export national project is to achieve the export volume of agricultural products in the amount of $ 42 billion per year by 2025.

According to the Federal Center “Agroexport” of the Ministry of Agriculture of Russia, the export of agricultural raw materials and food in 2020 exceeded $ 30 billion, which is 20% more both in physical terms and in monetary terms compared to 2019 and is 2 times higher than in 2013. For the first time in the last 30 years, the volume of foodstuffs exported by the agro-industrial complex has exceeded the volume of foodstuffs imports to Russia. All agro-industrial companies was forced to take into account the new conditions, to build its plans and investment projects, to revise the sources of financing, marketing strategies for working with banks, with counterparties, exporters and importers of agricultural products, to continue supplying finished products to store shelves in order to prevent the breakdown of production chains and to provide stable financing and economic stability.

While a lot of businesses reduced their business activity, and certain sectors of the economy and even entire industries stopped their activities, the sowing campaign was in full swing among the agricultural producers. Spring for farmers is the most important and tough time, and the financial performance for the whole year largely depend on this. During the sowing campaign, it was vital to ensure that the entire production cycle was running, the funding was timely and they employees were healthy. Taking into account the daily changing situation, decisions were promptly made at the level of the government, banks and agricultural enterprises on the transition of agricultural producers to work under the conditions of restrictive measures. Some of the employees who were not directly involved in the production cycle of agricultural enterprises (accountants, economists, and financiers) were transferred to a remote mode of work; within a few days, remote jobs were created to work with banks, tax authorities and counterparties.

For the agricultural business, the following questions became topical: how to pay both interest and the main debt on an existing loan, how to restructure the loan and on what terms, how to apply for credit holidays, how to get bank loans and how to deal with banks during a period of restrictions and isolation.

In April 2020, the Government of the Russian Federation introduced a number of changes to the concessional lending mechanism in its resolution dated December 29, 2016, aimed at supporting agricultural enterprises in the context of a deteriorating situation in the economy during the spread of the coronavirus epidemic.

1. The amount of funds allocated for concessional lending to the agro-industrial complex in 2020 was increased by 37.3%; minimum lending rates for soft loans were set up to 5% per annum.

2. An extension of the repayment period of a previously granted soft loan for up to 1 year was allowed if the term of such a soft loan expired by the end of 2020.

3. For small agribusinesses, a deferral of payments on accrued interest on a previously provided preferential short-term loan was provided for up to 1 year, if the term of such a loan expired by the end of 2020.

4. For agribusinesses, a deferral of payments for the payment of the principal debt and accrued interest on the previously granted investment preferential loan for 2020 was provided. For such purposes as the construction of greenhouses and facilities for the primary and deep processing of pork meat, the prolongation was granted for up to 12 years of the term of the previously provided investment preferential loan.

5. The maximum size of a short-term concessional loan was increased to 1.2 billion rubles to one borrower on the territory of each constituent entity of the Russian Federation. Preferential lending to agricultural enterprises was carried out by authorized banks.

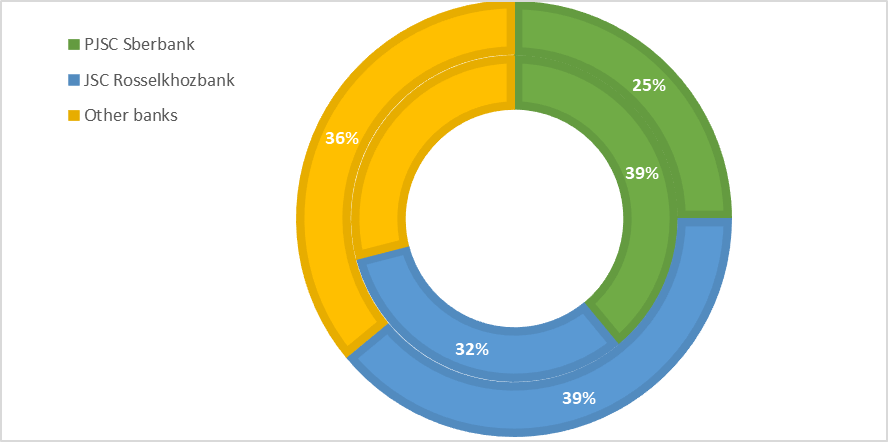

It should be noted that due to the pandemic, banks promptly restructured their internal programs aimed at creating conditions for the continued functioning of the business of their agricultural clients. For example, from the first days of the coronavirus pandemic Sberbank offered online lending to farmers within the framework of its programs “Credit in 3 minutes” and “Credit in 7 minutes”. In 2020, Sberbank issued online loans to agricultural enterprises in the amount of over 60 billion rubles. JSC Rosselkhozbank, PJSC VTB and many other banks launched online services that could be used remotely by agricultural clients. Banks promptly began to implement the program of concessional lending for agribusiness (Table 01, Fig. 01).

The mobile bank covers about 95% of all banking operations of agribusiness clients on a daily basis. The share of agribusiness clients using online banking in 2020 increased 1.7 times compared to 2019 and reached 86%, remote account opening exceeded 73%, the share of online loans to small businesses in the agricultural sector is 54%, remote issuance of bank guarantees reached 96%. All these services were delivered by banks to a digital platform. The volume of sales of their products by medium and large agricultural enterprises via the Internet increased 1.7 times in 2020 and their share in total sales reached 6% against 3.7% a year earlier.

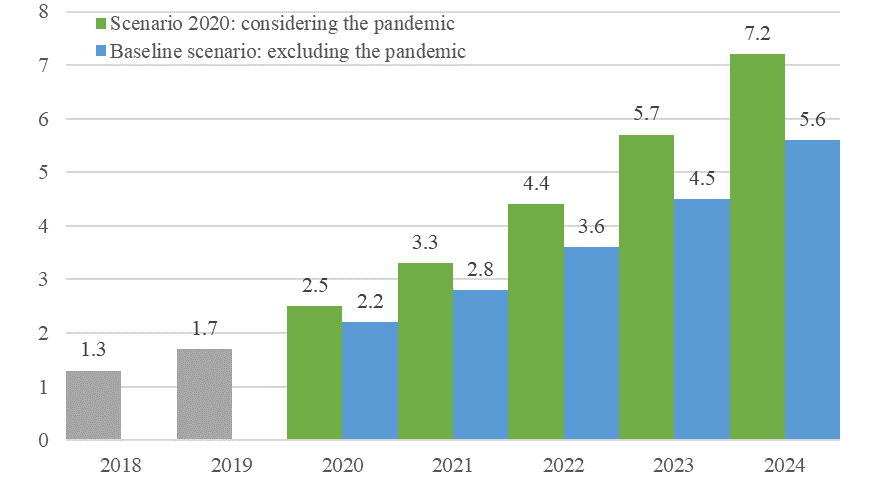

As a result of the spread of the COVID-19 pandemic, factors have emerged that will have an impact for many years to come. The volume of online sales created by the factors of the coronavirus pandemic in 2024 will amount to 1.6 trillion rubles, of which half of the amount will be accounted for by food (Fig. 02).

Banks, providing digital platforms through Internet services and ecosystems that combine these platforms, allow agricultural producers to enter new markets for their products, take on customer support and marketing functions, offering sellers their IT platforms (ecosystems), the independent creation of which required would from farmers of significant investment, and open access to millions of consumers. And for consumers, goods and services are becoming much more affordable, their choice is much wider, and less and less time should be spent on choosing and buying.

In 2020, Sberbank created the marketplace for small agribusinesses, which makes it possible to automate the process of purchasing products from farmers by sellers. This marketplace allows you to reduce the costs that are required for the maintenance and training of the sales department, since this platform works instead, where all information about the product is received. The farmer can only react to the price prevailing in the market, master the science of marketing, deliver goods to a trading enterprise, establish logistics and keep automated records on his farm. The bank also provides the farmer with a commodity loan on this platform, and itself (the bank) receives additional profit through the merchant acquiring services and commodity credits.

Rosselkhozbank has created an ecosystem for farmers “Svoe Rodnoe”, on the platform of which farmers can place their products for sale. The ecosystem of Rosselkhozank also includes an aggregator of goods needed by farmers, online services to support agribusiness (legal advice, 1C cloud accounting), services that increase the efficiency of an agricultural enterprise (recruitment, seed material, precision farming, a directory of plant diseases, monitoring birth of calves, chickens, agritourism and others), information platforms and services for interaction with government agencies. With the help of the Svoe Rodnoe ecosystem, Rosselkhozbank offers small and medium-sized agribusiness entrepreneurs digital technologies that will help them become successful and efficient, and the population to buy and consume useful products expressed in the neighboring settlement. The ecosystem of Rosselkhozank allows the farmer to get everything he needs to live and work in one place.

As part of the national project “International Cooperation and Export”, a new information platform called “One Window” was launched in test mode. With its help, the agro-industrial complex enterprises from just one point, the exporter’s personal account, gained access to government and other services online. The information system “One Window” freed exporters from the huge and complex paperwork. In November 2020, the first two online services were launched in the “One Window” system: “Customs Declaration” and “Confirmation of a zero VAT rate”. During 2021, the state plans to combine 28 more online services for business in all major areas in this system. The coronavirus pandemic has become an integral factor that pushed the digitalization of banking products and services and the transition of agribusiness customers to online services. With the introduction of self-isolation and restrictions, banks were forced to quickly launch their digital capabilities, although this process has been going on quite intensively over the past 5 years. Self-isolation made it possible for banks to acquaint agricultural clients with online channels and to create a user experience for these clients, who traditionally preferred visiting a bank branch to remote servicing. Most banks have expanded the functionality of mobile applications, which laid the foundation for the digital transformation of banking services. The functionality of the applications made it possible not only to remotely open accounts, issue loans, but also receive certificates, statements, transaction history.

Sberbank now has its own chat bots and corporate messaging solutions for corporate agro-industrial clients. They can be used in the industrial safety system and in contact centers, as well as on platforms for interaction with customers on electronic services. Sberbank has an innovative product for the agribusiness of the Cognitive Pilot Company - an unmanned aerial vehicle based on artificial intelligence. In 2020, the fast payment system became one of the key directions for the development of mobile banking. Some banks (VTB-Bank, Tinkoff Bank, Sberbank, Alfabank, Promsvyazbank, Otkritie) launched payments for agribusiness through a fast payment system, when customers were able to buy equipment, seeds, feed, fuel and more, paying from their mobile applications with just one click. The digitalization of banking services has become an effective tool for the development of online client services and ensured a reduction in the distance between the bank and the client. But, on the other hand, the specificity of the banking sector, and especially in the corporate segment, requires a direct face-to-face meeting of a bank representative with a client.

Direct negotiations between the client and the bank's representative are an integral part of the client-oriented approach of the bank, since they (negotiations) make it possible to make the client a specific individual offer, which allows the most effective solution to the client's problems. In the context of the restrictive measures of the coronavirus pandemic and geographical remoteness, banks began to use video banking in their work with agribusiness, offering almost the same products and services online as in personal communication with a teller. The video banking system enables banks to provide financial services to their customers and at the same time ensures the safety of their employees and customers, observing the requirements of social distance without rejecting human participation in the process. Almost all transactions for agribusiness entities can be carried out through online services. Currently, individual solutions using artificial intelligence are increasingly being used to improve and accelerate digital financial flows. According to the IDC study, by 2024 about 75% of all loans addressed to small business will be issued through automated processes of scoring and processing of a client's loan application with the support of artificial intelligence.

Conclusion

Today, modern business representatives do not want to spend a lot of time communicating with a large number of agricultural producers who come to them with an offer of their products, but want to be able to know more about the client using digital technologies. Moreover, their agricultural clients want to see not individual elements of digitalization, robotization or the “Internet of things”, but an integrated approach at all levels from production to sales of products. For example, in crop production, ranging from seed quality with digital prototyping to improve product quality and operational efficiency, to the optimization of finished product sales and financial control based on supply chain management, using machine learning models and robotic document processing, implementation of electronic invoices and creating e-commerce sites.

Today, a large set of online tools for digital sales has appeared, providing better analysis of the consumer market based on “big data”, tracking advertising information on the Internet and conducting all calculations online. From the point of view of digitalization of the agribusiness, it is in its infancy, but farmers are showing great interest in digital products. According to the Ministry of Agriculture of Russia, the agribusiness is in the TOP-3 sectors of the Russian economy, which will actively implement the digital transformation of the industry in 2021-2025 years and for these purposes it is planned to spend more than 250 billion rubles.

The Department of Digital Development of the Chamber of Commerce and Industry conducted a survey in all federal districts of representatives of agribusiness on the problems of digital transformation of the agro-industrial complex. More than 70% of the interviewed agribusiness entrepreneurs said that they are already introducing digital services into their activities, which work in the enterprise management system, carrying out all calculations online, electronic document management, precision farming and sensors. About 40% of the implemented digital technologies are Russian, about 75% of the surveyed agribusiness entrepreneurs spent from 1 to 5 million rubles on digitalization. Most of the respondents noted a lack of qualified personnel in rural areas to implement the digital transformation of the agro-industrial complex both at the stage of implementation and at the stage of its operation, as well as a lack of financial resources, since agro-industrial enterprises are forced to carry out digital transformation of the industry at their own expense, the inaccessibility of information on digital technologies that are currently available to agribusiness and the latest, perhaps most importantly, is the lack of understanding of the benefits of digital technologies. Almost 85% of agricultural producers do not receive financial support from the state for the implementation of digital programs of their enterprises, and this is especially true for small and medium-sized agribusiness. One of the mechanisms for solving this problem could be concessional lending for the digital transformation of agribusiness. To do this, it is necessary to amend the Decree of the Government of the Russian Federation on the provision of concessional loans to companies for the introduction of Russian digital technologies, including in this decree and agricultural enterprises, and the Ministry of Agriculture of the Russian Federation to impose control over the implementation of concessional lending.

Many regions have started digital transformation of the agricultural sector as part of the implementation of the target project of the Ministry of Agriculture of the Russian Federation “Digital Agriculture”. For example, a research and education center (REC) was organized in the Tambov region, which included the Administration of the Tambov region, Tambov State Technical University, Michurinsk State University with the participation of the Ministry of Agriculture of the Russian Federation. The REC objective is to ensure the digital transformation of the agribusiness of the Tambov region. One of the main directions of the center is the creation of an educational center to train highly qualified IT professionals for agricultural producers and the region as a whole. The center is also engaged in the development and implementation of more than 20 digital platforms of Russian production for agricultural enterprises. Within the framework of scientific and practical solutions, the implementation of digital scientific and technical projects is planned: the creation of gas cylinders for gas motor fuel of a new generation, as well as a number of projects for autonomous agriculture - the creation of a “smart field” for testing digital platforms in the agribusiness in the Tambov region. Another digital project is successful export of agricultural products, as well as projects to automate the process of purchasing agricultural products by sellers from producers and automated accurate accounting. A platform is being developed using artificial intelligence for the needs of the agribusiness, which will create a digital twin of the Tambov region by 2025.

Similar centers are currently operating in the Altai Territory, Belgorod, Rostov Regions and a number of other regions.

Today, a number of problems hinder the digital transformation of the agribusiness:

– there is no comprehensive approach to digital transformation in the Russian Federation;

– agribusiness enterprises carry out digitalization mainly at their own expense, financial support is needed both at the federal and regional levels, and this support is especially necessary for small and medium-sized agribusinesses;

– the lack of IT professionals in rural areas and poor infrastructure significantly hinder the digitalization of the agribusiness;

– insufficient training of university graduates, especially in IT for rural needs. IT professionals in agriculture should become as important as they are for the information technology industry;

– the implementation of digital transformation of the agribusiness should be based on Russian digital solutions, while using them to increase not only the efficiency of management, but also the efficiency of the entire production process. To stimulate the interest of agribusiness entrepreneurs in digitalization, it is important to show the effect of the digital transformation of the agribusiness through specific digital platforms;

– and the last but not least, when solving the problems of digital transformation of the agribusiness, it is necessary to take into account macroeconomic changes in the world and in Russia, monitor changes in consumer preferences of the population, take into account the prospects for the development of digital technologies in Russia and the world and solve the key problem - how to bring the production chain closer to the final consumer.

References

Bank of Russia (2020). Analytics. Retrieved from https://cbr.ru/eng/analytics/

Kozubenko, I. S., & Balabanov, I. V. (2017). “Internet of Things” in the management of the agro-industrial complex. Machinery and equipment for the village, 8, 46-48.

Kulikov, N. I., & Kudryavtseva, Yu. V. (2017). Breakthrough IT technologies of Sberbank PJSC in the banking services market. Modern trends in the development of management theory and practice in Russia and abroad, 135-151.

Ministry of Agriculture of the Russian Federation (2020). Analytics. Retrieved from https://mcx.gov.ru/analytics/

Molotkova N. V., Kulikov N. I., Kudryavtseva Yu. V., & Pecherskaya E. P. (2018). Innovative technologies as a new social challenge in the labor market. European Proceedings of Social and Behavioural Sciences, GCPMED 2018, 1259-1268.

Rosstat (2020). Official statistics. Retrieved from https://rosstat.gov.ru/folder/10705

Samorodova, L. L., Shutko, L. G., & Yakunina, Yu. S. (2019). Digital ecosystems and the economic complexity of the region as factors of innovative development. Questions of innovative Economy, 2, 401-410. DOI:

Strukova, M. A., & Kulikov, N. I. (2019). Anti-crisis strategy as a basis for the financial stability of the organization. Economics and Entrepreneurship, 11(112), 714-717.

Vartanova, M. L. (2019) Digitalization in Russian agribusiness: problems and ways to solve them. Environment and Health, 16-19.

Vartanova, M. L., & Drobot, E. V. (2019) Regulation of digital financial assets and the use of blockchain technologies in agriculture. Creative Economy, 1, 37-48. DOI: 10.18334/ce.13.1.39778

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Kulikov, N. I., Kulikova, M. A., Parkhomenko, V. L., & Syrbu, A. P. (2022). “Anti-Viral” Digitilization Of Financial Flows In Agribusiness: Opportunities And Challenges. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 442-451). European Publisher. https://doi.org/10.15405/epsbs.2022.02.57