Abstract

Local budgets currently act as the main conduits of state and municipal services from the relevant government to the population. They require a significant amount of resources to implement their assigned powers and obligations. Until recent times, the primary way to increase the financial resources of municipalities has had to transfer certain income sources to the lower level in the form of financial assistance. However, all available types of financial assistance are essentially devoid of a stimulating effect. In this connection, there was no increase in real financial resources, but only their inter-territorial and interspecific redistribution. It is possible to ensure real income growth at all levels of the budget system only in conditions of increasing the tax potential, which will become the basis for improving the financial situation of the entire budget system of the country. The tax potential is considered as a derivative of various types of territorial potentials (economic, demographic, natural and climatic). To achieve its sustainable growth, it is necessary to take a comprehensive approach to assessing the basic potentials, taking into account the main growth factors and taking measures to consolidate those that have the highest possible positive impact on the tax potential of the municipality.

Keywords: Inter-budgetary relations, investments, investment policy, local budget, tax potential

Introduction

Tax potential is of great importance for municipalities. On the one hand, it characterizes the amounts that can never be received in the corresponding budget. But, on the other hand, it allows you to see possible benchmarks for the growth of income sources. It makes it possible to build the most competent, well-thought-out financial policy for the municipality (Gnezdova et al., 2020; Volkova, 2016).

Problem Statement

Local budgets are currently implementing a huge range of services for the population of the country. A significant amount of funds is required to fulfill all the assigned powers (Volkova, 2016). However, in practice, these funds are not enough. The current fiscal policy in Russia recognizes the importance of territorial budgets. But in fact, real management decisions go against the guidelines defined at the state level and, as a rule, do not allow the sub-federal level management bodies to conduct a stable financial and budgetary policy. The preferred direction is the strict centralization of budget resources with their further redistribution among all the subjects of the federation and municipalities. Such an approach is quite justified in the context of the development of crisis situations as a measure that can prevent the occurrence of a large-scale critical decline in the revenue component of the budget and is aimed at curbing the growth of unjustified budget expenditures. But this approach has the most adverse effect on economic growth. The formation of dependent attitudes among regions and municipalities does not allow us to give an impetus to development, does not develop the desire to expand the tax base, including in the agricultural sector of the economy. This becomes the main problem hindering the strengthening of the tax potential of local budgets of agricultural regions (Nikitin & Antsiferova, 2020; Popova, 2015).

Research Questions

The issues discussed during the study are focused on finding ways to increase the tax potential of municipalities in the context of modern legislation, including in terms of inter-budgetary relations.

In this regard, it is important to consider such topical issues in relation to the tax potential of the municipality as:

- analysis of the value of tax revenues in general and its individual elements for municipal budgets;

-assessment of the main directions of development of municipalities that ensure the increase of the tax potential of the relevant territory;

- substantiation of directions for strengthening the tax potential of local budgets, primarily by expanding investment sources for the development of agricultural production.

Purpose of the Study

The purpose of the study is to identify the most significant areas of strengthening the tax potential of local budgets, including strengthening through increased investment in the agricultural sector of the economy, in the current financial and budget legislation.

Research Methods

The basis of the study is formed by data on local budgets of the Tambov region for 2018-2020. In the course of the study, monographic, economic-statistical, abstract-logical research methods were used.

Findings

The tax potential belongs to those categories that are recognized as significant, but, at the same time, there is no real interest in it due to the underdevelopment of financial and budgetary relations at the sub-federal level. The tax potential is the maximum amount of tax revenue that can be accumulated in the relevant territory, taking into account the current financial and budgetary legislation. Also, the tax potential can be assessed from the perspective of the transformation of legislation, the implementation of investment policy (Popova & Fetskovich, 2015; Sorokina, 2021).

The most serious problem for municipalities, which hinders the process of building tax capacity, is the low share of tax revenues in the revenue structure of municipalities. Thus, data on the dynamics of the share of tax revenues in the total amount of municipal budget revenues are presented in Table 01.

Tax revenues in the total amount of income sources occupy an extremely low share. Moreover, there is an uneven distribution by type of municipality. Thus, a lower indicator is observed for urban districts. This is primarily due to the lower standard of deductions from the personal income tax. At the same time, in municipal districts, we can state a generally low level of income sources (including gratuitous transfers), which characterizes insufficient financial security. In general, over the entire period of the study, the share of tax revenues increased slightly in terms of average indicators (Antsiferova et al., 2019). But for 14 of the 30 municipalities (46.7%), there is a decrease in the share of tax revenues. Thus, contrary to the national policy aimed at strengthening the financial foundations of municipalities, the situation is becoming more complicated and requires radical measures to correct it.

The main directions of strengthening the tax potential of municipalities of agricultural regions are presented in three major areas. First of all, it is necessary to use purely fiscal instruments for the growth of tax revenues, which imply the prevention of the formation of tax arrears, as well as the search for optimal ways to collect arrears on tax payments. This source assumes the implementation of strict measures in the field of tax administration, the tightening of the general system of tax control. For municipalities, the most important thing is to build an optimal system for dealing with local tax arrears (Melikhov et al., 2021).

The second mechanism is focused on the use of inter-budgetary instruments, that is, the formation of such an order of inter-budgetary redistribution, which would achieve the most equitable redistribution of resources at the levels of the budget system. For municipalities, we are talking about transferring individual tax revenues to local budgets. The most priority in this direction is the transfer of part of the corporate income tax to the jurisdiction of local self-government bodies. This will lead to a serious increase in their interest in the development of the subordinate territory, creating the most comfortable conditions for the successful activities of economic entities.

The most important indicator that characterizes the tax potential is the total wage fund of the territory, including the municipality. The implementation of investment projects, especially large-scale ones, implies the growth of budget revenues already at the very first stages of its implementation. This is reflected in the emergence of new jobs. Therefore, all municipalities should focus their efforts as much as possible on attracting investors to the territory of the city or district. On the territory of the Tambov region, the most actively developing organizations of the agricultural sector of the economy. They ensure the successful development of not only the agricultural sector, but also create conditions for the stability of the social sphere. However, assistance from the region and the federal center is also needed. This assistance should be implemented in the form of a unified state investment policy, focused primarily on the municipalities of agricultural regions.

The result of a well-thought-out federal policy in the field of investment in the agricultural sector of the economy should be, among other things, to curb the process of internal migration outflow of the population from rural areas and small towns to larger cities and federal centers. An additional effect is the smoothing of social tension in the country due to the growth of real incomes of citizens and the prevention of a sharp income gap between different segments of the population in the country as a whole and between individual regions. Therefore, it is necessary to distribute investments through the redistribution of labor resources on the basis of an even state plan.

Competent investment policy of municipalities assumes unity and interrelation of the investment concept, the investment program and the action plan. The concept should determine the key direction, the goal that should be achieved as a result of the implementation of the designated investment policy. The investment program is a specific task, the solution of which together can ensure the achievement of the stated goal. In turn, the action plan is a set of well-thought-out, precise actions aimed at solving the tasks of the investment program. Thus, there should be a single model, all the elements of which are interconnected and focused on solving the global investment goal of a particular municipality. In the event of a break in this chain, the achievement of a single goal becomes impossible. At the same time, federal policy at the municipal level is implemented through the interaction of local self-government bodies and regional authorities (Kholodova & Podgorskaya, 2020).

Great hopes in terms of strengthening the tax potential were placed on the introduction of a non-real estate tax. A pilot project was implemented to introduce it on the territory of Tver and Veliky Novgorod in 1997-1998.

The main tasks set before the experiment:

-to construct a unified real estate tax instead of the current three taxes (land tax, tax on property of physical persons, the tax on property of legal entities),

-to assess the market price of all properties,

-enter the tax rate the same for all participants of tax relations (the legal and natural persons),

-to pass on this tax to the jurisdiction of the local authorities.

A huge number of publications and studies were devoted to the generalization and analysis of the results obtained. But the final results of the experiment did not receive a comprehensive assessment and determination of the amount of funds necessary for its introduction. In addition, there are virtually no real calculations of the necessary amount of funds for the implementation of this tax. The main conclusion drawn from the results of the experiment is that no municipality can carry out preparatory measures for the introduction of real estate taxes in the relevant territory. In addition, there is no interest in this tax on the part of the region, since the budgets of the subjects of the federation may lose part of the revenue sources (the tax on the property of legal entities).

The highest value for the budgets of municipalities is the tax on personal income. The growth of the tax potential in relation to this revenue source can be achieved both by administrative methods and by economic ones. But the most effective is, of course, their combination and the implementation of a comprehensive economic and administrative method.

Administrative resources involve the use of opportunities to increase the standard of deductions to the budgets of municipalities. The following measures are also significant administrative levers:

- comprehensive work with individual entrepreneurs on the issue of legalizing labor relations;

- active promotion of "white" wages;

- analysis of the average industry salary and deviations from it in relation to individual organizations and individual entrepreneurs.

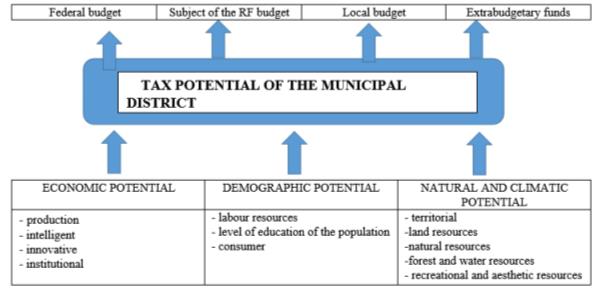

The tax potential can really grow only in the conditions of stable functioning of its basic components, which should include economic potential, demographic, as well as natural and climatic (Figure 01).

Conclusion

Thus, the integrity of any municipality, in the future-the region, and, as a final reference point, - the integrity of the state, can be achieved only with the effective use of the maximum amount of available resources. At the same time, the tax potential of the municipality is the basis of budget revenues at all levels of government, as well as extra-budgetary funds.

References

Antsiferova, O. Yu., Myagkova, E. A., & Tolstoshein, K. V. (2019). Formation of the development strategy of the agro-industrial complex of the Tambov region on the basis of the scenario approach. IOP Conference Series: Earth and Environmental Science, 274, 012084. DOI:

Gnezdova, J. V., Semchenkova, S. V., & Kuchumov, A. V. (2020). State Backing of Modernization of Main Funds of Agricultural Purpose within a Matter of Increasing Food Security of Russia. IOP Conference Series: Earth and Environmental Science, 459(6), 062061.

Kholodova, M., & Podgorskaya, S. (2020). Project management methods in agriculture. E3S Web of Conferences, 210, 11007.

Melikhov, V. V., Novikov, A. A., Kozenko, K. Yu., & Komarova, O. P. (2021). Institutional peculiarities of agricultural technoparks formation in Russia. IOP Conference Series: Earth and Environmental Science, 624(1), 012163.

Nikitin, A. V., & Antsiferova, O. Yu., (2020). Cooperation and Integration in the Region. Periódico do Núcleo de Estudos e Pesquisas sobre Gênero e Direito. Centro de Ciências Jurídicas - Universidade Federal da Paraíbam, 9(05), Special Edition. http://periodicos.ufpb.br/ojs2/index.php/ged/index

Popova, V. B. (2015). Statistical analysis of economic data. Bulletin of the University of the Russian Academy of Education, 4, 13-20. (In Rus)

Popova, V. B., & Fetskovich, I. V. (2015). Statistical analysis of agricultural production in the Tambov region. Finance and Credit, 23(647), 40-51. (In Rus)

Sorokina, E. (2021). Mechanisms and sources of investment development of agriculture in resource-deficient regions: Russian and foreign experience. E3S Web of Conferences, 254, 10019.

Volkova, L. G. (2016). Influence of the mechanism of inter-budgetary relations on the economic development of municipalities in modern conditions. Collection of scientific papers dedicated to the 85th anniversary of Michurinsk State Agrarian University, 50–53.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Kirillova, S. S., & Rodyukova, A. S. (2022). Ways To Strengthen The Tax Potential Of Local Budgets Of Agricultural Regions. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 349-355). European Publisher. https://doi.org/10.15405/epsbs.2022.02.44