Abstract

The paper considers integral indicators in the form of sums of dimensionless quantities of three blocks: quantitative (A), qualitative (B) and process (c). The relationship between them was found by means of correlation-regression analysis and the graphical method when choosing patterns. The general formula combines all three blocks. It allows us to optimize the parameters, using the mathematical apparatus for studying the functions of several variables. The aim of the work was to identify integral indicators based on non-correlated ones and to identify the relationship between the compiled integral information significant indicators in the future. The following tasks have been solved in the process of achieving the goal. At the initial stage we have selected 30 indicators for 10 in each of the three blocks and considered the relationship between them, i.e. we have narrowed the search process to 15 indicators, for 5 in each block, and have achieved their zero dimension. At the second stage, we have left 9 indicators from 15 ones, for 3 in each block when selecting by independence. At the third stage of the study, by summarizing these indicators, we have found a pairwise and common relationship between them, combining all three integral indicators, which made it possible to optimize them

Keywords: Correlation-regression analysis, graphs, quantity, quality, process, regression line

Introduction

The paper considers the period of financing the education system after the crisis since 2008: secondary, secondary-professional, higher education. Indicators in the form of ratios of expenses or costs to persons or the duration of training were determined for their comparability in the analysis as dimensionless quantities. The financial block is named as a quantitative block for further research along the chain of the quantity-quality-process, which again closes at the beginning, namely financing. The five indicators that we have selected characterize the processes in the information - scientific - educational - production environment at the first stage, namely, the creation of conditions for qualitative transformations in the socio-economic system.

Problem Statement

The article reveals the problem of poor quality of education and the inefficiency of existing approaches toimprove it, which required the optimization of indicators to determine the productivity of the education system as a whole.

Research Questions

It is possible tointroduce the concept of an information-scientific-educational-production environment and blocks (ISEPE). These are IQBI - information-quantitative block indicators; IQBaI - information-quality block indicators; PBI - process block indicators and by identifying dimensionless indicators in them. Then we combine them into an integral one as follows:

A - amount of funding per student in the system of secondary school, secondary vocational school and higher school, corresponding to the quantitative IQBI;

B - amount of percentage of employed population with higher education, secondary vocational education in the workforce and by specialty per student with higher education and vocational education;

С - amount of training costs, retraining, advanced training, as well as the ratio of wages per unit of the productivity index and the percentage of the employed population in lifetime education per person who has graduated from secondary school.

Purpose of the Study

The aim of the work was to identify integral indicators based on non-correlated ones and to identify the relationship between the compiled integral information-significant indicators in the future.

Research Methods

In the study,graphical, statistical, and correlation-regression methods of research were used.

Findings

We have found the relationship between the indicators of blocks A, B, C, namely: B = f (A), B = f (c); A = ȷ (c).

= 1.577± 0.422

3.034±0.651

=0.300±0.0265

δ =

δ =

δ =

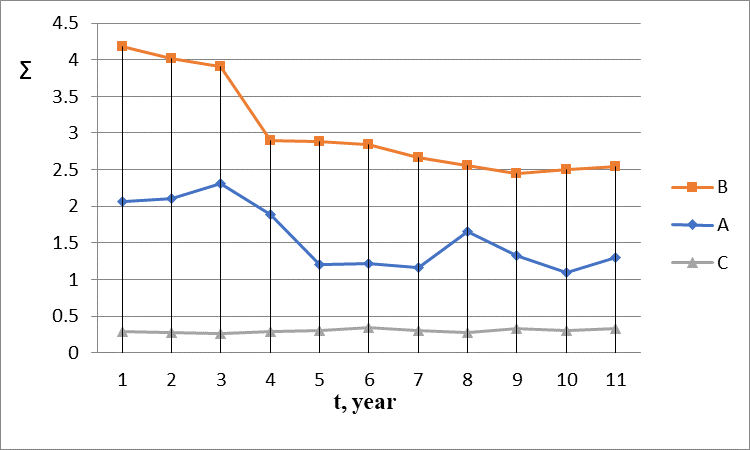

From the analysis of the graphs in Figure 1, we can see that there is a relationship between A and B, which is confirmed by the value of the correlation coefficient.

rAB =

bB/A =

В- 3.034=1.3055(А-1.577);

В=1.3055 ·А+0.9752.(1)

When A is increased by one, the value of B increases by 1.3055 units (Beresford, 2011; Forner & Marhuenda, 2013; Johnstone et al., 2011).

It underlines that the funding block is very closely connected with the block of retraining and employment of the population. Let us find the connection between B and C by determiningrСB:

rСB = .

There is a very close relationship between the integral indicators of the process block and the qualitative one. We will build a regression line (Frank et al., 2011).

bB/С =

В-3.034=-20.8481(С-0.3);

В=-20.8481·С+9.2884. (2)

Increasing the integral indicator of the process block as a whole by one unit, including participation in lifetime education, the cost of this education and the ratio of wages per unit of the productivity index, it can be seen that it becomes less by 20.8481 units. That is, the employment of the population with higher education and vocational education is decreasing, including in the specialty per person (Hodder et al., 2011; Largay et al., 2011).

As for the quantitative indicator, from the value of the correlation coefficient equal to rСА = -0.814 the relationship between it and the integral process indicator is very close.

rСА=

rСА=

The regression line takes the form of:

bА/С =

A-1.577=-12.9375 (С-0.3);

A=-12.9375·С+5.4582. (3)

Increasing the integral indicator C by 1, the indicator A decreases by 12.9975 units.

It can be explained by the fact that the cost of higher education and secondary vocational education requires fewer expenses when upgrading or undergoing refresher training.

Thus, the integral indicators of the blocks were closely related to each other (Table 3).

А·В=(-12.9375·С+5.4582)·(1.3055·А+0.9752);

АВ=-16.8899·А·С+7.1257·А-12.6167·С+5.3228;

АВ-7.1257·А-5.3228=С(-16.8899·А-12.6167);

С= .

Blocks, or rather their integral indicators are linked by a single formula:

С= . (4)

We would like to find out more beautiful expression like:

A • B = K • C,

but experimentally, formula (4) reflects the processes under study, since the financial component is definite both in the quantitative B and in the process C blocks (Hirshleifer & Hong Teoh, 2013; Liu et al., 2013; Sivak & Volkova, 2020);

Conclusion

1. The integral indicators (Table 01, Table 02) of IQBI, IQBaI and PBI blocks are very closely related to each other (Table 03) and characterize the processes occurring in the socio-economic system of the innovative economy (Fig. 1).

2. Dependencies of paired integral indicators determine their interaction according to formulas (1) - (3) and a single relationship according to formula (4). They show that changes in one of them lead to an increase or decrease in another indicator. Therefore, they can be optimized depending on the purpose of the study.

3. The optimization process can be started by examining the function of the process block C = f (A, B), and the approach A = f (C, B) or B = f (C, A) is possible, depending on the optimization of the indicators of the block of interest to the researcher (Malkiel, 2013; Pardo & Valor, 2013; Shleenko et al., 2020; Siegel, 2013).

4. It is advisable to carry out the research in a complex, i.e. taking into account the productivity of the entire system. After all, only productive models are interesting when applied to an innovative economy in a socio-economic system.

References

Beresford, D. R. (2011). Congress looks at accounting for business combinations. Accounting horizons, 73-86.

Forner, C., & Marhuenda, J. (2013). Contrarian and momentum strategies in the spanish stock market. European financial management, 67-88.

Frank, K. E., Hanson, R. K., & Lowe, D. J. (2011). Cpa's perceptions of the emerging multidisciplinary accounting/legal practice. Accounting horizons, 35-38.

Hirshleifer, D., & Hong Teoh, S. (2013). Herd behaviour and cascading in capital markets: a review and synthesis. European financial management, 25-66.

Hodder, L., Koonce, L., & McAnally, M. L. (2011). Sec market risk disclosures: implications for judgment and decision making. Accounting horizons, 49-70.

Johnstone, K. M., Sutton, M. H., & Warfield, T. D. (2011). Antecedents and consequences on independence risk: framework for analysis. Accounting horizons, 1-18.

Largay, J. A. (2011). Three rs and four ws. Accounting horizons, 71-72.

Liu, W., Strong, N., & Xu, X. (2013). Post-earnings-announcement drift in the uk. European financial management, 89-116.

Malkiel, B. G. (2013). Passive investment strategies and efficient markets. European financial management, 1-10.

Pardo, A., & Valor, E. (2013). Spanish stock returns: where is the weather effect? European financial management, 117-126.

Shleenko, A. V., Volkova, S. N., & Sivak, E. E. (2020). Formation of comfortable urban environment in Russia based on international experience. IOP Conference Series: Materials Science and Engineering. 2020 International Conference on Construction, Architecture and Technosphere Safety, ICCATS 2020, 032088

Siegel, J. J. (2013). What is an asset price bubble? An operational definition. European financial management, 11-24.

Sivak, E., & Volkova, S. (2020). Transformation of land resources as a result of anthropogenic impact. E3S Web of Conferences, 13, 06002.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Sivak, E. E., Morozova, V., Tanygin, O., & Pashkova, M. (2022). Relationship Between The Integral Indicators Of Innovative Economy. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 97-102). European Publisher. https://doi.org/10.15405/epsbs.2022.02.13