Abstract

Nowadays, relations between states are developing in the context of globalization. The international community is exposed to various challenges and risks. The goal of the institutions of global economic governance in these conditions is ensuring the stability of the world economy and stimulating its growth. To develop an effective strategy, it is necessary to increase the speed and efficiency of responding to economic challenges and crisis situations. The relevance of the study is determined by the complexity, contradictions and dynamism of the system of international economic and political relations. The purpose of the research is to evaluate the work of international institutions of global governance by the example of the IMF and WTO. For this, we consider their new models for regulating the world economy. In conclusion, the urgent need to reform global governance institutions is noted. Two main problems of ineffective functioning of global governance institutions are identified. Every strong state should be interested in achieving solid results. Each member state of world organizations should aim at establishing interstate interaction and mutual understanding. The world needs transformation in the interests of security and the soundness of politics and economics. We believe that a new complex, developed system of international relations is the basis of all regulatory world processes of the present and future.

Keywords: Economics, globalization, internationalization, national economy, world crisis

Introduction

Today, relations between states are developing in the context of globalization and the multipolar world. The international community is exposed to numerous challenges and risks that must be dealt with effectively. The task of the institutions of global economic governance is to ensure the stability of the world economy and stimulate its growth. However, in order to develop an effective strategy, it is necessary to increase the speed and efficiency of responding to economic challenges and crisis situations.

The relevance of the study lies in the complexity, contradictions and dynamism of the system of international economic and political relations. This is especially felt in the present post-pandemic period, when every state is trying to restore a shattered macro economy.

Let us turn to the experience of the world financial crisis of 2007-2009. It was then that it became clear that the world institutions of global governance were not coping with the crisis situation. Therefore, from this time on we can talk about the process of reforming the global institutions of economic management.

Problem Statement

The undermining of the US monetary system has put the issue of reducing the dominance of the dollar in international transactions on the agenda. Therefore, the prospect of the development of national currencies begins to emerge. Now we are also talking about the possibility of creating a separate independent monetary unit that provides capital turnover, for example, cryptocurrency (Nazarova & Palaev, 2017).

Research Questions

The financial crisis has taught the world a lesson by showing that it is impossible to cope with any global challenges and crises alone. It is important to note that the economic shifts that have taken place were only a manifestation of the deeper problems of the world community.

Therefore, after the global financial crisis, the most important goal is to create new contours of the global financial system. To do this, it is necessary to be able to maintain the stability of macroeconomic indicators in the face of new global challenges and risks, instability of the economic order. Such world global governance institutions as the IMF, WB, WTO have been seriously developing plans for modernizing the regulatory system for several years now.

Purpose of the Study

The purpose of the work is to evaluate the work of international institutions of global governance by the example of the IMF and WTO. To do this, we consider their new models for regulating the world economy.

Research Methods

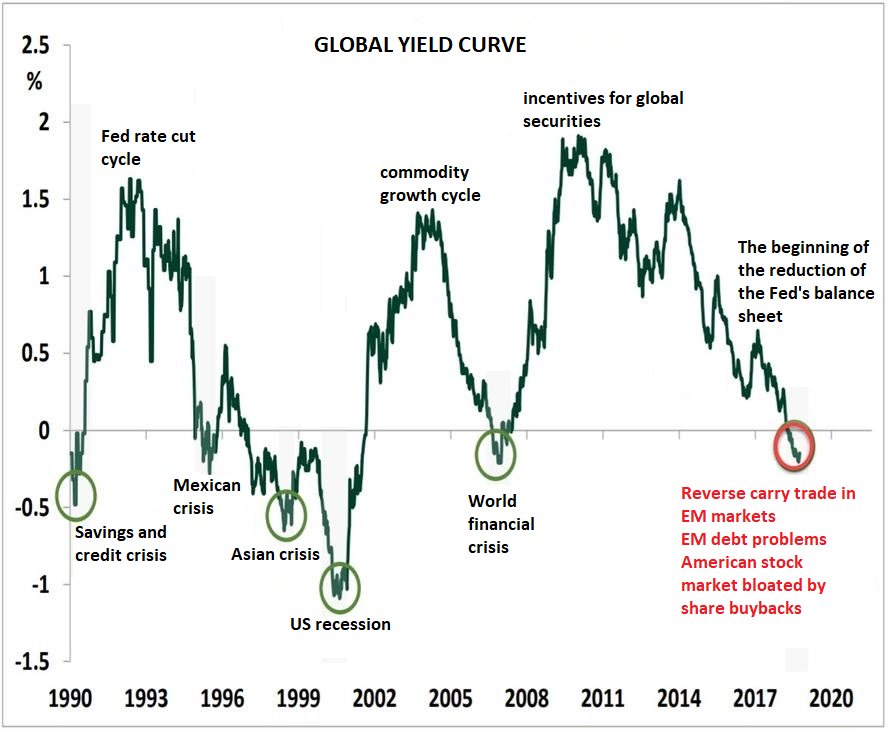

Investors continue to track individual news and market drivers that are indeed causing a lot of concern in the exchanges. However, market participants may be missing the big picture that global liquidity continues to shrink alarmingly, as evidenced by two key indicators. The first half of this year was dominated by tighter global financial conditions amid reduced global dollar liquidity, with the stronger US dollar having a significant impact on the performance of risky assets, especially in emerging markets (EM). This trend is reflected in the dynamics of global bond yields against the background of tightening global financial conditions, which is illustrated by the graph shown in Figure 01.

It is no secret that in 2019, due to the spread of the viral disease COVID-19, the world faced a severe economic crisis, the consequences of which are still being experienced by many.

Despite the fact that the borders of the states were temporarily closed and the trade communication was suspended, the outbreak of COVID-19 makes us again recall the importance of collective action to overcome the disastrous situation. The need to reform the institutions of global governance has intensified for the following reasons.

The first response could only have been urgent and accelerated action to finance low-income countries with weak markets. The United States became the main creditor, and it provided loans at a zero rate to many countries (Gabov & Romanova, 2017).

The integrated response of the EU and WHO to crises was belated and significantly lagged behind the real situation. Moreover, investments were insufficient (Strizhenok & Korelskiy, 2016). Nobody imagined that everything would become so serious.

The preference of their national interests to the interests of the world community greatly delayed the process of overcoming the crisis. The isolation of citizens of states from each other was expressed in the limitation of international trade, which negatively affected global economic growth and development. However, it should be admitted that due to the inability to purchase foreign goods, the domestic market began to develop much more actively.

Another impetus to reforming the institutions of global governance was the lack of a single institution for global cooperation (Grosse, 2012). In this regard, the UN has become a victim of fragmentation and numerous discussions between the participating countries, carried away by their national problems.

The global governance deficit is also attributed to the US's refusal to fund WHO and with its aggressive unilateral sanctions and inconsistent protectionism. When the United States was needed most, it turned its back on the world.

Since the tasks of reforming the institutions of global governance, which were set even after the financial crisis of 2007-2009, have not been resolved, the world community is heading for an urgent revision of control systems. This primarily concerns the IMF and the WTO.

In addition to solving the general problem of poverty in backward countries, stimulating international trade, ensuring comfortable and fair conditions for relations, the institutions of global governance are solving a number of individual narrow issues.

The International Monetary Fund is the foremost intergovernmental organization in the global governance system. It regulates monetary, credit relations between the member states and provides them with financial assistance in foreign exchange difficulties by providing short- and medium-term loans in foreign currency.

Findings

Until a certain time, the IMF system was effective, but due to the still existing outdated statute of the organization, adopted back in the 1940s, in connection with the development of technology and the complication of the global financial system, some shortcomings of this organization became visible. Let us list the main ones (Ardashkin et al., 2014).

First, outdated exchange rates of currencies for the dollar create difficulties in ensuring financial stability and mobility of financial flows. Therefore, there is a program that suggests replacing the US dollar with local regional or national currencies or creating an independent monetary unit to provide financial turnover between countries.

During the global financial crisis, interest in the IMF on the part of the world community was evident. There was a need to reform the world financial market. Namely, there is a need to ensure transparency of financial flows and information, stability and adequacy of control over cooperation of regulatory bodies. From now on, the reorganization of institutions should be carried out in accordance with the redistribution of forces in the world economy. In 2008, developing countries began to provide flexible loans without any difficult conditions. In addition, in principle, a softer policy began to be pursued with respect to developing countries.

Further, the IMF began to seriously monitor the economic, financial and monetary policies of the member states. Thus, it became possible to identify potential risks to domestic and international stability and use the negative experience of previous years to prevent the repetition of similar situations.

Third, the IMF usually used external instruments to stabilize the economy. Recently, it has begun to pay special attention to the role of structural reforms in stimulating the potential growth of national economies. This additional impetus, according to IMF researchers, should help strengthen macroeconomic indicators. The IMF is developing an analytical framework and tool for diagnosing structural reform successes and sharing experiences among member countries. To this end, the IMF has also begun collaborating with other institutions on structural reforms that fall outside the purview of the Fund.

Providing loans to countries affected by the pandemic at a low rate is not the only decision of the IMF to overcome the 2019-2020 crisis. The Fund is working with the World Bank to address debt transparency and sustainability issues and to create a new financing strategy.

The World Trade Organization is central to the regulation of world trade. Thanks to the WTO, the process of liberalization of international trade in goods, services and intellectual property is under way. An important area of the WTO's activity is combating discrimination in foreign policy relations by monitoring compliance with agreements and monitoring the trade policies of countries. The WTO seeks to mitigate and regulate economic conflicts between countries and maintains the stability of international trade.

However, in recent years, especially after the 2007-2009 global crisis, the WTO's activities have come under serious criticism. In fact, the problems then faced by the WTO have been maturing gradually during the Doha Round since 2000. By 2013, the G20 agreed that the WTO needed the support of the least developed countries and the simplification of customs procedures. In other words, trade liberalization has become a priority (Loshkarev & Chernyshov, 2013).

How can the situation be changed?

First, it is necessary to create working conditions for the WTO in accordance with the present balance of power.

After the financial crisis of 2007-2009 the problem of the spread of ideas of protectionism arose, in connection with which there was a threat of the existence of global governance organizations and organizations involved in ensuring international trade. The situation worsened in 2019 due to the temporary suspension of international trade links.

Much of the dissatisfaction with the functioning of the WTO stems from discrimination against developing countries in matters of trade communications - they are engaged in the least because they play a lesser role in maintaining strong global economic ties. However, developing countries increasingly began to enter the world financial and economic arena.

It is also worth moving away from the principle of consensus as soon as possible in the decision-making process in discussions (Malozyomov et al., 2014). For example, the negotiation process is supposed to be limited only by resolving issues on which reaching a compromise is most realistic and necessary in the current situation. The rest of the questions will be carried over to the next round. This initiative was called "Plan B" (Malozyomov et al., 2014). Thus, the WTO is trying to gradually move away from the principle of comprehensive problem solving and the outdated principle of "consensus", which to a large extent slows down the negotiation process.

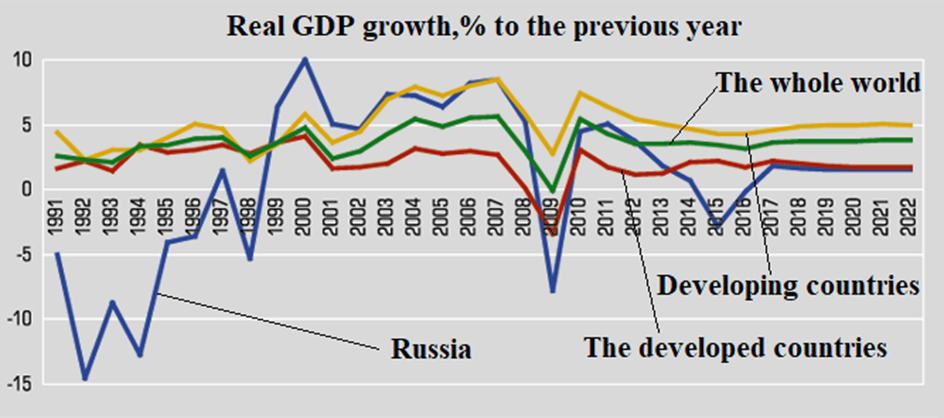

The age-old syndrome of resource allocation in accordance with the level of economic development of countries generates discontent in developing countries. Therefore, most attention is now being paid to the process of trade liberalization. In Figure 02, the World GDP growth rate is shown.

Conclusion

Summing up, it is worth noting that the need to reform global governance institutions usually appears in a crisis when traditional methods are not able to eliminate the problem.

There are two main problems of ineffective functioning of global governance institutions.

First, the failure of traditional regulatory instruments is in the context of developing globalization and the current balance of power. Dramatic changes in the global community require a quick response and innovative regulation.

Second, the spread of ideas of protectionism and regionalism really slows down the process of recovery of a shattered economy. If we pay attention only to the problems arising within the state and give preference to them, then the very purpose of the existence of global institutions of governance is called into question. The nationalization of economic difficulties diverts attention from the world's priority problems.

It cannot be said exactly when all the tasks set for reforming the institutions of global governance will be solved, but a number of scientific studies suggest that the completion of this process can be expected by the 2030s. However, by that time, the processes of globalization will move to a new level, and most likely it will be necessary to revise the models for regulating economic shifts again. Although, scientists and economists express the hope that the updated structures will be universal and will make it possible to predict the occurrence of possible risks.

Another thing is that the West still dominates in world global processes. However, the gradual strengthening of the positions of developing countries, which sooner or later will come to regional leadership, makes it clear that their opinion should be taken into account. This will avoid discrimination in conversational processes and help solve problems in the world faster and more efficiently.

Finally, every strong state should be interested in achieving real results. Each member state of world organizations should aim at establishing interstate interaction and mutual understanding. The world needs transformation, first, in the interests of security and the soundness of politics and economics. A new complex, developed system of international relations is the basis of all regulatory world processes of the present and future.

References

Ardashkin, I. B., Yakovlev, A. N., & Martyushev, N. V. (2014). Evaluation of the resource efficiency of foundry technologies: Methodological aspect. Advanced Materials Research, 1040, 912-916. DOI:

Gabov, V. V., & Romanova, V. S. (2017). Investigation of Layer-by-layer Destruction of Rocks in High-frequency Cone Crusher IOP Conference Series: Earth and Environmental Science, 87, 22006. DOI:

Grosse, K. U. (2012). Non-destructive testing and technology for monitoring the technical condition of structures for quality control and supervision of construction sites. ALITinform: Cement. Concrete. Dry mixes, 6, 62-77.

Loshkarev, I. Yu., & Chernyshov, A. S. (2013). Unbrakable control. Features of methods of nondestructive testing. Actual problems of power engineering of agrarian and industrial complex Materials of IV International scientific and practical conference, 184-186.

Malozyomov, B. V., Babaeva, O. V., & Andreev, A. I. (2014). Posteriori analysis of the reliability of transport systems. Scientific problems of transport in Siberia and the Far East, 1-2, 93-95.

Nazarova, M. N., & Palaev, A. G. (2017). Diagnostics and repair of centrifugal oil transfer pump rotor shaft. IOP Conference Series: Earth and Environmental Science, 87, 092016.

Strizhenok, A. V., & Korelskiy, D. S. (2016). Assessment of the state of soil-vegetation complexes exposed to powder-gas emissions of nonferrous metallurgy enterprises. Journal of Ecological Engineering, 17(4), 25-29.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 February 2022

Article Doi

eBook ISBN

978-1-80296-123-2

Publisher

European Publisher

Volume

124

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-886

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Sukhodaeva, T. S., Akberov, K. C., Shuraev, I. A., Malozyomov, B. V., Rusinovich, O. V., & Mamedli, F. B. (2022). Crisis Of Global Governance Institutions At The Beginning Of The Xxi Century. In D. S. Nardin, O. V. Stepanova, & E. V. Demchuk (Eds.), Land Economy and Rural Studies Essentials, vol 124. European Proceedings of Social and Behavioural Sciences (pp. 816-822). European Publisher. https://doi.org/10.15405/epsbs.2022.02.101