Abstract

The urgent task for the federal authorities of the Russian Federation is to increase the GRP level, ensure economic growth, and subsequently increase tax revenues to the regional budget. To assess the effectiveness of the measures, the growth rates of the Chechen Republic GRP in the context of the subjects of the North Caucasian Federal District, its structure with regards to the main types of economic activity are considered. The consolidated budget of the Chechen Republic is made up of tax and non-tax revenues as well as non-repayable revenues. The Chechen Republic is still a highly subsidized region and the specificity of the consolidated budget is that non-repayable revenues being financial assistance from the federal budget significantly prevail over tax and non-tax revenues. However, the federal authorities possess the most powers determining the elements of regional taxes and fees taxation. The taxable item, tax base, tax period and the procedure for calculating tax are regulated by the tax code of the Russian Federation and are not subject to change. Due to the small amount of regional taxes established by the tax code and administered by the authorities of the constituent entities of the Russian Federation, the tax authorities of the Chechen Republic are faced with the task of ensuring proper control over the correct tax amounts calculation and the timeliness of payment to the budget, which will entail positive changes in the structure of the region’ revenues.

Keywords: Budget, GRP, region, tax, tax revenues

Introduction

Today, the Chechen Republic is one of the dynamically developing regions of the North Caucasus. After two military campaigns, the republic’s economy was completely destroyed, there were no revenues and non-repayable revenues generated the entire budget. In 2000, the process of re-establishment of the tax authorities in the region began. Along with other actions it enabled to initiate the construction of financial and tax policy in the republic. In those years, all taxes and fees collected from the territory of the Chechen Republic were sent to the federal budget due to the lack of a regional treasury (Maslennikova, 2020).

In 2001, a year after the tax authorities’ re-establishment, the total amount of realized revenues amounted to 1,276.4 million rubles. The generation of the regional budget in 2002 enabled to credit tax deductions to the region’s treasury since 2003. The tax deductions amounted to almost 4 billion rubles. For twenty years, the potential of the region has been restored.

Problem Statement

The order of the Government of the Chechen Republic dated December 6, 2016, approved a set of measures aimed to increase the GRP for the period up to 2020. To increase the GRP level, ensure economic growth, and subsequently increase tax revenues in the regional budget, the following tasks were set:

- to develop the economic and tax potential of the Chechen Republic in the process of annual monitoring of the effectiveness of socio-economic programs implemented in the republic;

- to monitor the activities of enterprises and organizations of small and medium-sized businesses in the Chechen Republic with the objective to identify the reasons for low profitability and unprofitability;

- to conduct a continuous inventory aimed to increase the efficiency of using land plots leased out or under agreement of unlimited duration by residents of the Chechen Republic;

- to arrange purchases of agricultural products manufactured by organizations and enterprises of the Chechen Republic and to guarantee subsidizing at interest rates of bank loans with the objective to increase the growth of agricultural enterprises productivity and other support measures;

- to attract investments in the economic and innovative development of the Chechen Republic.

Research Questions

The main objective of the tax policy of the Chechen Republic is to increase its own revenues by developing the region’s tax potential and economic growth in general, by taking whatever measures to increase the total amount of taxes and fees collected in the republic (Basnukayev, Isanbaeva et al., 2020).

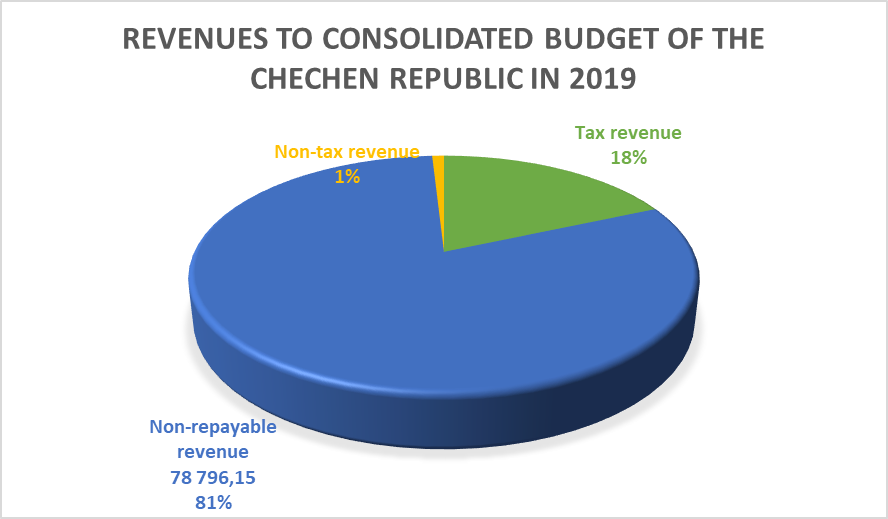

The consolidated budget of the Chechen Republic is generated by tax and non-tax revenues as well as non-repayable revenues. The Chechen Republic is still a highly subsidized region. Its consolidated budget is characterized by the fact that non-repayable revenues being financial assistance from the federal budget significantly prevail over tax and non-tax revenues. The structure of the consolidated budget revenues of the Chechen Republic in 2019 is shown in Figure 01.

The above diagram (Figure 01) reflects all the revenues of the consolidated budget of the republic, which in 2019 in total amounted to 97,643.93 million rubles, including: non-repayable revenues – 81 %, tax revenues – 18 %, non-tax revenues – 1 %.

Non-repayable revenues entering the budget of the republic comprise grants (40.04 %), subventions (11.85 %), subsidies (15.54 %) and other non-repayable revenues (3.29 %).

According to the law of the Chechen Republic on the republican budget for 2020 and planned budget for 2021 and 2022, the consolidated budget of the Chechen Republic in 2020 was expected to receive revenues in the amount of 115,918.07 million rubles, which was 18,724.14 million rubles more than the revenues in 2019.

As part of our research, we will investigate the revenues composition and dynamics and factors affecting the generation of tax revenues of the consolidated budget of the Chechen Republic.

According to the principle of tax federalism, all existing taxes and fees as well as powers in the field of taxation are divided according to the levels of the country’s budget system (Boboshko, 2011).

Revenues from regional taxes are subject to 100 % crediting to the regional budget. The executive authorities of the Chechen Republic have the right to change some elements of regional taxation taking into account the peculiarities of the region development. Table 1 shows the distribution of powers in the area of regional taxes and fees.

According to table 1, the federal authorities have the most of the powers to determine the elements of regional taxation and fees. The taxable items, tax base, tax period and the procedure for calculating tax are regulated by the tax code of the Russian Federation and are not subject to a change. The regional authorities are empowered to change only the following elements of taxation: the reporting period, procedure and timing of tax payment. As well, they have the right to establish tax incentives for regional taxes (Goncharenko & Melnikova, 2017).

Revenues from regional taxes are budget-generating in any territorial-administrative unit of the country (Malis, 2018). There are practically no revenues from the gambling business tax to the regional budget of the Chechen Republic due to four gambling zones determined by the Government of the Russian Federation on Altai and Primorsky Territories, in the Kaliningrad Region and Sochi.

The transport tax is one of the main taxes of the constituent entities of Russia and is the most significant in the system of withholding property taxes from citizens and legal entities (Kuzimov et al., 2020). Currently, the tax on registered cars is withheld from almost all citizens, since very few organizations and individuals manage without it.

In the budget of the Chechen Republic, transport tax revenues from both individuals and legal entities are rather tenuous, and at the moment can be considered only as a promising source of strengthening the financial independence of the region.

As Table 2 illustrates, transport tax revenues to the consolidated budget of the Chechen Republic depend to a greater extent on individuals than on organizations. Transport tax revenues from individuals in 2019 increased by 2.5 times compared to 2016 and amounted to 312,171 million rubles. The sharp increase in tax payments to the budget of the Chechen Republic is explained by the increase in tax rates in 2017–2019 for passenger cars with the engine power from 100 to 150 hp and from 150 to 200 hp. It should be noted that the part of cars with the specified capacities in the total amount of vehicles registered with the tax authorities of the Chechen Republic is about 60 %, which stipulates the increase in revenues.

The corporate property tax is among the property taxes, which have the greatest fiscal effect for the generation of the Chechen Republic’ own revenues of the consolidated budget. The tax authorities of the republic pay greater attention to solving problems related to the calculation and payment of this tax. Table 3 shows the corporate property tax income, as well as the dynamics of its growth.

In general, for the entire period under review, there is a positive dynamics of income tax on the property of organizations in the republic, with the exception of 2017, when the amount of income compared to the same period in 2016 decreased by 154,768 million rubles (92.7 %). This decrease was due to the non-payment of the calculated amount of tax indicated in tax declarations for the tax on the property of organizations.

In 2018, there was an increase in revenues, which in percentage terms amounted to 111.8 %, in absolute terms to 232,051 million rubles. Among the reasons for the growth in corporate property tax revenues are the following:

- increase in the number of taxpayers for this type of tax;

- reduction of tax benefits provided to taxpayers amid the growth in federal tax benefits;

- increase in the average annual and cadastral value of the property;

- revenue assurance towards repayment of debt of the previous years.

The largest increase in revenues for the entire study period occurred in 2019. The amount of revenues amounted to 2,490,509 thousand rubles, which was 117.7 % higher than the receipts of the previous year.

Purpose of the Study

Thus, the increase in revenues from regional taxes is directly dependent on decisions taken at the federal level (Basnukayev, Khadzhieva et al., 2020).

Regarding the small number of regional taxes established by the Tax Code and administered by the authorities of the constituent entities of the Russian Federation, the tax authorities of the Chechen Republic are faced with the task of ensuring proper control over the correct calculation of tax amounts and the timeliness of payment to the budget, which will entail positive changes in the structure of the region’s own revenues.

Research Methods

Within the framework of the study, the following methods were used: analytical and comparative methods, methods of scientific classifications, etc.

Findings

Let us further consider federal tax revenues classified as regulatory revenues credited to the consolidated budget of the Chechen Republic in accordance with the established standards. Having analyzed the data presented (table 04), the following conclusions can be drawn. One of the budget-generating taxes of the consolidated budget of the Chechen Republic is personal income tax. In 2019, the increase in receipts in relation to 2016 amounted to 119 % in relative terms. Year in year out there has been a positive trend in receipts from this tax.

Running second to personal income tax in terms of budget revenues is the corporate income tax. In 2017–2018, the revenues from this tax were stable, there were no deviations, and the relative increase was 100 %, in absolute terms it amounted to 137 thousand rubles more in 2018. In 2019, there was a 147.8 % increase in revenues compared to 2018.

The mining resources extraction tax is also a key element in the structure of tax revenues of the Chechen Republic. Taxpayers of the republic pay tax on such extracted minerals as oil and gas. In 2019, there was a 83,298 rubles decrease in revenues compared to the previous year. The reason for this was the decrease in the extracted mineral resources in the study period.

A very interesting situation is observed in the dynamics of VAT rvenue. Negative dynamics of VAT in 2018 in the amount of 1,412,906 thousand rubles was due to VAT refunds after crossed office tax audits.

Local taxes are one of the sources for generating tax revenues of the consolidated budget of the Chechen Republic. They are significant in ensuring the financial stability of the budgets of the regional municipalities. In this regard, ensuring the growth of local tax revenues is a common objective of the tax authorities and the municipal authorities.

Having analyzed the data in Table 5 covering the return of local taxes to the consolidated budget of the republic, the positive dynamics of tax return both from organizations paying land tax and from individuals paying tax on their property and land plots can be noted.

There was an increase in revenues for the personal property tax in the period from 2016 to 2018. However, in 2019 there was a decrease in revenues from this tax by 1,121 thousand rubles, and subsequently an increase in debt due to the difference between the calculated amount of tax based on the data contained in the automated information system AIS Tax-3 and revenues from individuals.

In 2019, the increase in land tax revenues amounted to 133.4 %, in absolute terms it amounted to 43,133 thousand rubles. Throughout the entire period under consideration, the dynamics was positive. In 2018, there was a low ratio of tax revenues to the same period in 2017 due to late payment of tax.

Conclusion

At the same time, the main factors leading to an increase in local tax revenues are as follows:

- an increase in the number of individuals’ assets subject to taxation;

- the activity of the tax authorities of the Chechen Republic to eliminate duplicate TIN for the same taxpayers, and then unite all taxable items belonging to the taxpayer by one TIN.

Having examined the structure of the consolidated budget of the Chechen Republic, the following conclusions can be drawn:

- wholesale and retail trade, vehicle washing, construction and education are the most significant in the structure of the region’s GRP;

- the republic is one of the highly subsidized regions of Russia. 81 % of the republic’s budget amounts to non-repayable revenues. The region’s own income is 19 %.

- the main budget-generating taxes are personal income tax and corporate income tax. Revenues from indirect taxes (VAT and excise taxes) in the structure of other taxes are insignificant, and there have been no budget revenues from excise taxes in recent years.

References

Basnukayev, M. Sh., Isanbaeva, D. V., & Tashanova, Z. Ya. (2020). Regional tax policy as a structural element of social and economic policy. Bulletin of the Academy of Knowledge. Economics and management of the national economy (by industry and spheres of activity), 28(2), 44–49.

Basnukayev, M. Sh., Khadzhieva, Kh. Kh., & Chandaeva, M. D. (2020). Features of building a reasonable regional policy in the depressive republics. Bulletin of the Academy of Knowledge. Economics and management of the national economy (by industry and spheres of activity), 28(2), 49–53.

Boboshko, N. M. (2011). Assessment and control in the system of property taxation: theory and methodology [Monograph].String.

Goncharenko, L. I., & Melnikova, N. P. (2017). On new approaches to the policy of applying tax benefits and preferences in order to stimulate economic development. Economics. Taxes. Right, 2, 96–104.

Kuzimov, A.S., Lavrov, S.V. and Pavlenko, S.P. (2020). Movable or immovable property. Tax policy or practice, 1, 50–54.

Malis, N. I. (2018). Improving tax policy at the regional level: main directions. Financial journal, 1, 51–60.

Maslennikova, E. I. (2020). On the procedure for the application of tax incentives for the tax on the property of organizations. Tax policy and practice, 1, 35–38.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 November 2021

Article Doi

eBook ISBN

978-1-80296-116-4

Publisher

European Publisher

Volume

117

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2730

Subjects

Cultural development, technological development, socio-political transformations, globalization

Cite this article as:

Basnukayev, M. S., Klyukovich, Z. A., & Elzhurkaev, I. Y. (2021). Economic Prerequisites For Tax Revenues Generation In Region. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Social and Cultural Transformations in The Context of Modern Globalism, vol 117. European Proceedings of Social and Behavioural Sciences (pp. 209-215). European Publisher. https://doi.org/10.15405/epsbs.2021.11.28