Abstract

In the modern world, almost all countries are faced with the problem of a decline in economic growth or a drop in production. The Russian economy is no exception. Due to its raw materials orientation and a decrease in the consumption of energy resources in the world, the possibilities for ensuring economic growth have been exhausted. It is necessary to switch to an innovative model of the economy, in which the production of high-tech final products should dominate over the extraction of minerals. Small and medium-sized businesses can make a significant contribution to solving this problem. The crisis is a chance and an impetus for development, it forcing to transit to innovations and saving resources as much as possible. The article analyzes the problems of small and medium-sized businesses from the point of view of financial support for their activities. The features and limitations in lending to small businesses in today’s economic conditions have been analyzed. One of the problems is the lack of generally accepted methods for assessing the creditworthiness of small businesses and insufficient information support of this process. The article proposes a new approach to assessing the creditworthiness of small businesses, which is based on the method of “empirical analysis”, which allows the most complete and accurate assessment of the level of creditworthiness of small businesses and associated banking risks. The technique of solving the problem of assessing the creditworthiness of small enterprises is described.

Keywords: Banks, lending, small businesses, credit assessment

Introduction

The difficult geopolitical situation in the world, sanctions pressure on the Russian economy, a decline in production due to the pandemic and the ensuing economic and financial consequences led to a drop in gross domestic product (GDP) and a decrease in the level of economic security in Russia. This had the most significant impact on economic entities of small and medium-sized businesses - in this segment, the decrease in the volume of activity reaches 10 percent or more. The recovery of the Russian economy and its reaching stable levels in the future largely depend on the implementation of a complex of structural reforms, the purpose of which is to move away from the raw material model of the economy to the model of organizing high-tech production of final products. In solving this problem, in our opinion, it is small and medium-sized businesses, which most often have non-raw materials, can play a significant role rubles (Endovitsky et al., 2020).

In the current situation in the Russian economy, an important area of work is to provide support to small and medium-sized businesses, which, on the one hand, are most affected by the pandemic, and on the other hand, they are more resilient in the context of the global crisis, and it is with the development of small and medium-sized businesses. For medium-sized businesses, the state and the government pin their hopes that economic growth in Russia will recover. Such hopes are motivated by the fact that small and medium-sized enterprises can reorient their activities in a short period of time, are maximally mobile and do not require huge capital investments.

For many entrepreneurs, the crisis is a chance for business diversification and an impetus for development, since any crisis sharpens creativity, forces them to innovate and save resources as much as possible. It is in the small and medium-sized business sector that ideas may appear that will be attractive for bank investments. In response to their efficiency, small and medium-sized businesses can quickly fill the rooms that exist in the market, and which continue to form in the market due to the bankruptcy of large companies (Bykova, 2017).

Problem Statement

Credit institutions in Russia are developing various banking products and technologies that take into account the frequent needs of a small business for loans to finance current activities, as well as for the implementation of start-up projects (Shatalova, 2018).

The peculiarities and difficulties of lending to small businesses in today’s conditions include:

- the lack of detailed financial information on the results of a small business in the accounting (financial) statements, often requires additional information from management statements;

- the impossibility of quickly resolving the issue of granting a loan due to the need to analyze the information provided, which is often incomplete or does not meet the reliability criteria;

- limited official information of tax authorities on the state of solvency of small businesses.

The problem of adequately assessing the financial condition of an enterprise in terms of its importance and relevance is one of the main in the Russian economy. The changes taking place in recent years in the corporate lending market, the growing importance of the banking system in the development of the real sector of the economy, and the increase in investment volumes have sharpened attention to the methods of assessing the financial condition of potential borrowers, investment objects, and have introduced new requirements to them.

Russian banks and investors have already accumulated a certain amount of experience in adequate and timely assessment of the financial condition of borrowers and credit risk management in an unstable market economy (Olshany, 2013; Reznichenko et al., 2017).

Research Questions

Analysis of statistical data shows that in Russia as of February 1, 2021, there were more than 5 million 688 thousand small and medium-sized enterprises. According to a study by the National Rating Agency (NRA) on the state of the small and medium-sized business sector, in 2020, due to the pandemic and a 4.8% reduction in the income of Russians, the turnover of small businesses fell by 2.8 trillion rubles (Lavrushin et al., 2020). The most affected industries were travel companies, catering, hospitality and trade. At the same time, the number of small and medium-sized enterprises did not change significantly. The condition of small and medium-sized enterprises in 2020 was relatively stable, primarily due to an increase in the availability of loans and a halving of insurance premiums. From April to November 2020, small and medium-sized businesses received financial support in the amount of over RUB 290 billion.

The largest number of loans issued falls on August 2020, and from January to October the number of enterprises that received loans increased by 80% compared to the same period in 2019. At the same time, the average loan size decreased by 45%, from 7.29 million rubles. up to 3.98 million rubles (Lavrushin et al., 2020). Small businesses during this period applied for loans mainly for solving current financial issues, and not for the implementation of strategic goals.

Despite the economic difficulties, lending to small businesses still remains one of the most promising areas for allocating financial resources. According to expert estimates, 30 - 35% of small businesses use bank loans. The rest meets its needs through private financing and represents a huge potential for banks.

Purpose of the Study

According to experts, the main limiting factor for lending and, as a result, inhibiting the development of small businesses in general, is the lack of transparency of business clients, double-entry book-keeping for tax evasion, lack of systematic accounting for small businesses, lack of documentation required for assessment, unavailability entrepreneurs fully disclose business performance to banks and a number of others. Taken together, this leads to difficulties in assessing the borrower’s financial position when deciding on the allocation of credit funds (Kazakova, 2015).

Small enterprises, fearing to come out of the shadow, hide their indicators even more, contact non-banking organizations, and small enterprises wishing to finance start-ups have no chance of getting money from a bank at all.

A way out of this situation may be to improve the banking methodology for assessing the borrower’s creditworthiness, taking into account not only official data, i.e. “reported” information, but also indirect signs that may relate to “under-the-table” accounting. This will allow banks to more accurately assess the creditworthiness of the borrower and increase their profits by increasing the volume of loans provided (Gumenyuk, 2016; Safonova, 2017).

Research Methods

Authors used the universal scientific research methods as well as methods for empirical and statistical analysis.

Findings

As a rule, under existing legislation, small businesses interested in financing show the hidden side of their business only to the extent that they need it to get a loan. After the use of credit resources, the main part of the profit goes back to unaccounted turnover (Rose, 2013).

Many evaluators of financial condition, both in credit institutions and in investment companies, regularly encounter a situation when an entrepreneur interested in obtaining external financing tries to protect his business from prying eyes to the limit, providing a minimum of information corrected by himself, on the basis of which he believes he can be provided with funds.

Moreover, the data can be either overestimated (in order to present your business in a more favorable light and thereby increase the chance of obtaining funding), and underestimated (if the scale of the activity is large enough and you do not want to show it). In such cases, the bank’s specialists rely on common sense and their own experience when analyzing.

The existing methods of assessing the financial condition cannot be used to diagnose and identify such distortions and inconsistencies. Assessment methods created by various Russian and foreign authors are often based on hypothetical illustrations that do not fully take into account the real state of affairs in business. As a result, a number of assumptions are made that do not correspond to reality. All of them are based on accounting data, which the entrepreneur may not have (Taffler, 2007; Turbina, 2012).

As a result of the application of these methods, it is impossible to assess either the investment risk or the liquidity of the enterprise. A qualitative analysis reveals these shortcomings, but it requires a lot of labor and the availability of qualified specialists.

As noted above, one of the main problems in the development of small business lending is “the lack of transparency”, so it is necessary to work on the creation and implementation of non-standard methods that will not only reduce banking risks, but also optimize the process of assessing the creditworthiness of small businesses. One of the ways out of this situation can be the use of methods formed on the basis of empirical data. This method can be characterized as “empirical analysis”.

At the moment, most banks that are engaged in lending to small businesses have already formed a sufficient information base about their clients. At the same time, most of the data are reliable or close to reliable - that is, they were taken from management accounting through a thorough qualitative analysis (the shortcomings of which were mentioned above). In addition, banks have the opportunity to obtain a credit history from another bank.

Stakeholders have at their disposal a sufficient amount of information that can be effectively used in order to create a better methodology for assessing the creditworthiness of small businesses. The proposed methodology is based on the thesis that enterprises of the same market room, comparable in terms of the scale of their activities, have comparable financial results and efficiency - this will allow to determine the reliability of the provided financial data, and therefore to more accurately assess the creditworthiness of a potential borrower by comparing the efficiency of its activities with competitors in the market.

If we compare the data on the market (for a set of homogeneous enterprises) with the data of one specific company, the likelihood of this company falling into the range of values increases significantly.

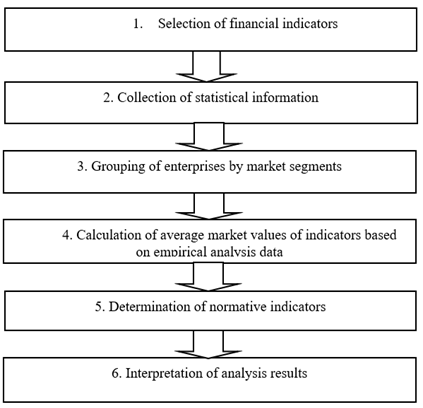

The process of creating such a technique includes (Figure 1):

1. Creation of a methodological basis.

At this stage, it is necessary to determine which financial ratios are the most significant for evaluating enterprises, for which it is possible to conclude about its financial position.

Small business has certain advantages over large and medium-sized businesses - this is the ability to quickly adapt to changes in the external environment, small needs for funding sources, a simplified management system, including accounting and reporting, etc., but it loses to large enterprises in the chances of obtaining loans due to the lack of sufficient information to make a conclusion about the real possibilities of effective use of credit funds.

The number of valuation indicators should be sufficiently complete, and it is not necessary to be determined only on the basis of financial statements.

2. Collection of statistical information.

This stage is largely organizational. At this stage, it is necessary to collect all the necessary financial data to calculate the required indicators.

3. Grouping of enterprises by market segments.

At this stage, a grouping of enterprises takes place, the data on which is planned to be used as an information basis for the methodology. It is necessary to competently, relying on the experience and knowledge of the market, to make a grouping according to certain criteria of similarity.

4. Calculation of the average market values of indicators.

At this stage, up-to-date information on many enterprises is formed as the basis for calculating benchmarks for this data array, which will be used in the future as evaluation criteria.

5. Determination of normative indicators.

Based on the collected quantitative data, a list of enterprises - benchmarks for the empirical analysis of the borrower is determined and the effectiveness of their work is assessed. Based on the results of calculations and empirical analysis, the normative (threshold) values of indicators are determined that are characteristic of the relevant market sectors, and with which the financial data of the specific borrower of credit funds who submitted the application can subsequently be compared.

6. Development of a mechanism for interpreting the results.

At this stage, it is necessary to describe the mechanism for the correct interpretation of the results of the comparative analysis of the borrower’s indicators with the normative (threshold) values for these indicators determined at the previous stage. One of the options for solving the problem of interpreting the results can be the use of a rating methodology, that is, each of the indicators is assigned an appropriate score, depending on what range of standard values it is in.

As a result, the bank receives a methodology that allows it to quickly determine both the financial potential of the small enterprise in question and the reliability of the information provided.

Of course, this approach has a number of disadvantages, including:

- quantitative limitation of the number of enterprises, according to which the indicators are calculated;

- high subjectivity in the interpretation of data at the stage of collection and processing;

- direct proportional dependence of the accuracy of the calculated normative (threshold) values of the estimated indicators on the number of enterprises subjected to empirical analysis;

- the need to take into account the regional characteristics of small business and adjust the methodology for its application in other regions of the country.

At the same time, the use of such an approach will allow solving a number of problems associated with lending to small businesses:

- to evaluate small businesses taking into account the lack of transparency of their activities and in the absence of detailed information about their financial condition;

- promptly determine the reliability of the information provided to the bank on the loan application, without the need to resort to laborious detailed analysis;

- to speed up the process of consideration of applications for a loan;

- to reduce the banking risk associated with a non-professional assessment.

Conclusion

The proposed technique is quite flexible and adaptive. On the one hand, as new circumstances arise, it becomes possible to make adjustments to the normative (threshold) values of indicators without changing the methodology itself; on the other hand, the methodology can be used in various regions, provided that the normative (threshold) values of indicators are calculated “on site” - based on data from enterprises in the respective region.

Therefore, today we can reasonably say that credit institutions are interested in providing bank loans to small businesses and in creating methods that allow them to quickly and reliably assess the creditworthiness of a small business. This issue is especially acute in potentially promising regions, in which the share of small businesses is large and they form the basis of the economic system of the region.

References

Bykova, N. N. (2017). Basic methods of analysis of the borrower's creditworthiness. Journal of Humanitarian Scientific Research, 2, 289-297.

Endovitsky, D. A., Frolov, I. V., & Shirokobokov, V. G. (2020). Pre-rating analysis of the borrower's creditworthiness. Organization and methodology of support. Prospect.

Gumenyuk, P. O. (2016). Foreign methods of analyzing the creditworthiness of borrowers as an important tool in managing the credit risks of a bank. Journal of Economics and Society, 4(23), 510-516.

Kazakova, N. A. (2015). Revealing and analysis of quantitative and qualitative factors of borrowers' creditworthiness in conditions of high banking risk. Journal of Accounting. Analysis. Audit, 1, 92-100.

Lavrushin, O. I., Nurmukhametov, R. K., & Travkina, E. V. (2020). Credit relations in the modern economy. M.: KnoRus.

Olshany, A. I. (2013). Bank lending: Russian and foreign experience. Finance and statistics.

Reznichenko, D. S., Tishchenko, E. S., Taranova, I. V., Charaeva, M. V., Nikonorova, A. V., & Shaybakova, E. R. (2017). Sources of Formation and Directions of the Use of Financial Resources in the Region. International Journal of Applied Business and Economic Research, 23, 203-219.

Rose, P. S. (2013). Banking management. Provision of financial services. Delo.

Safonova, N. S. (2017). Modern methods of assessing the creditworthiness of a borrower enterprise. Collection of articles from a scientific and practical seminar, 84-86.

Shatalova, E. P. (2018). Assessment of the creditworthiness of borrowers in banking risk management. KnoRus.

Taffler, R. (2007). Twenty-Five Years of the Taffler Z-Score Model: Does It Really Have Predictive Ability? Accounting and Business Research, 37(4), 285-300.

Turbina, N. M. (2012). Comparative analysis of the advantages and disadvantages of various methods for assessing the borrower's creditworthiness. Journal of Socio-economic phenomena and processes, 11(045), 242-246.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Mamatelashvili, O. V., & Ahtamova, G. A. (2021). Financing Of Small Business To Ensure The Economic Security Of The State. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 871-877). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.98