Abstract

The efficiency and sustainability of economic development have been measured by indicators of the average annual growth rates of real GDP and the standard deviation of these rates over the economic cycle. The resulting distribution area includes four sectors: development, mafia (institutional autism), theft (kleptocracy) and degradation. In the development sector, aggressive and conservative, egalitarian and elite development are highlighted. The pairs of leaders and first pretenders were investigated: Great Britain and Germany, USA and Russia, China and India. The general pattern of their interaction is revealed. A pretender for leadership must have available development resources and innovate. In the case of increased risks, it is necessary to develop institutionally, reducing the risk of development, as the USA, USSR and China did. With reduced risks, to accelerate development, the pretender needs to break down the old institutions that dialable innovation, as did Germany and India. This is what modern Russia needs. The leader reaches the area of egalitarian development when resources are used most optimally, but loses the ability to maneuver resources. The leader and the first pretender exhaust each other, successively move into the areas of conservative elite development, mafia, degradation, and the second pretender, who escaped the struggle, takes the place of the leader. To enter the struggle for leadership between China and India as the second pretender, Russia has free resources, but their implementation requires institutional reforms that are authentic to the culture to create a networked society: domination of consumer property, direct democracy.

Keywords: Sustainability of economic development, institutional development, innovative development, culture, world economy

Introduction

The current change of the leader of world economic development is discussed at all levels: from scientists to politicians, from business communities to bloggers. The study of the signs of macroeconomic development of the leaders of the world economy enables to identify the patterns of this process. The results of the study potentially have a great potential and allows adjusting the development strategy of the societies.

The possibility of such a study arose in the framework of our research on the processes of the influence of culture on economic institutions, and the latter on economic development. The methodological-ontological and theoretical foundations of institutional modeling in different cultural environments are presented by us in our studies (Savelyev, 2015, 2016), the statement of the problem for game-theoretic modeling of these processes in the article (Savelyev, 2020b), evidence of the influence of culture and institutions on economic development is presented in phenomenological (Savelyev, 2015) and empirical publications (Savelyev, 2020a; Savelyev et al., 2020a; Savelyev et al., 2020b; Savelyev et al., 2021a, 2021b, 2021c, 2021d).

Maddison (2006) was a pioneer in calculating the results of economic activity over long historical periods. He studied in detail the phenomenon of the change of long-term economic leaders. In particular, using the example of Western Europe and China, it is shown that the Western economy came to its present state not only as a result of the “take-off” that occurred as a result of the industrial revolution, but also the previous active development of universities and printing, as well as institutions of the bourgeois world order, free exchange of knowledge.

The work presents an original multivariate statistical model designed to explain fundamental cross-country institutional differences based on a limited set of economic, geographic and cultural-historical factors. Simultaneously, a chronic lag in legislation from economic realities is observed.

Large-scale cross-country comparisons of the quality of public administration and its impact on economic growth were carried out by Kaufman, Cray, and Zoido-Lobaton using their KKZ index (by the names of the authors), as the sum of six institutional characteristics reflecting cross-country differences in the quality of institutions (Kaufmann et al., 1999a, 1999b).

In the work (Myasoedov, 2009), on the one hand, it is shown that during the reign of the Democrats in the United States from 1949 to 2013. higher GDP growth rates of the American economy were achieved, but on the other hand, with reference to the Nobel laureate Krugman (1994) and the study of Blinder and Yellen (2001), it is concluded that democrats were just lucky to rule in those periods when the economy was in the upper phase of the cycle. And the reasons for luck, including the rise in oil prices in the 1970s and early 2000s.

Many works have been devoted to studies of economic development and competition among the leaders of the world economy. So, studies of the economic development of Great Britain are devoted to works (Brock, 2011; Clark, 2012; Crafts, 2018; Hobsbawm, 1999; Lloyd, 1996; Tomlinson, 2020). Studies of the German economy are devoted to works (Evans, 1986; Olczyk, 2019; Ridley, 1968; Savelyev et al., 2020a; Tsedilin, 2005), the US economy (Butorina, 2015; Grigoryev, 2013; Kapeliushnikov, 2015; Klinov, 2013; Porokhovsky, 2005), Russia and the USSR (Baranov, 2012; Drobyshevsky et al., 2018 Savelyev 2020a, 2020b; Savelyev et al., 2021c), China and India (Karlusov, 2009; Klinov, 2010; Lin, 2011; Lopatkin, 2014; Kheyfets, 2020; Savelyev, 2020a; Savelyev et al., 2021d), etc.

Problem Statement

Any system in terms of the systems approach is characterized by controllability - the ability to achieve a target state, stability - the ability to maintain a state under adverse external influences, structure - the composition of the system's elements, connectivity - a form of communication between elements. The first two characteristics relate to interaction with the external environment, the last - to the internal structure of the system. In economics, these characteristics are usually described as the basic criteria of economic activity: efficiency, risk, complexity and consistency.

Researchers pay the least attention to sustainability of the four types of macroeconomic development. There are many indicators that characterize the ability of an enterprise to maintain its state in adverse events: liquidity, solvency, financial strength in fundamental analysis and risk indicators in technical analysis.

To assess sustainability, the risk assessment, which is popular in technical analysis, is used in the terms of the standard deviation of profitability for the period (hereinafter - SD). This approach, in comparison with the analysis of the macroeconomic balance, has all the advantages of technical analysis in comparison with fundamental analysis, has high information content, comparability of phenomena, availability of initial data. This indicator is applied to the annual growth rates of real GDP of the studied countries. In this study, out of four signs of economic development, the growth rate of real GDP and SD were used that characterize the efficiency and sustainability of development, respectively.

Research Questions

Two-dimensional range of possible values created by the indicators of growth and risk has some structure. Certain points and sectors of this structure are characterized as leadership. Changes in indicators before and after reaching a leadership may have some regularity, and specific actions of people and decision-making centers that bring the territory closer or away from the leadership state these actions in terms of their compliance or non-compliance with some characteristics of the territory to be classified.

If the same actions applied to different territories give different results, this difference is associated with the features of the territory. It is also possible to identify actions that are invariant to the territories. The actions that change institutions should be considered with regard on the risk, and actions related to innovation - on growth indicators, but cross and mutual influence of these actions is possible.

Purpose of the Study

The aim of the study is to identify patterns of change in economic growth and the development risk of leaders of the world economy.

Research Methods

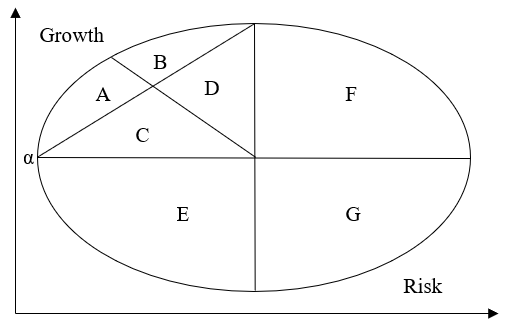

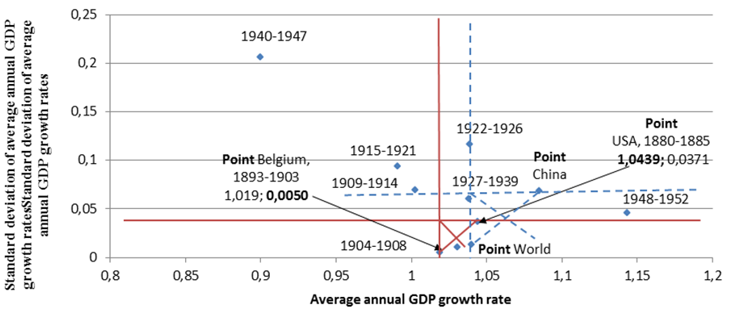

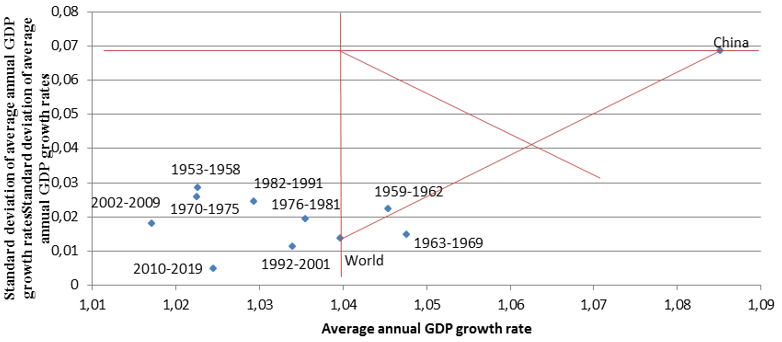

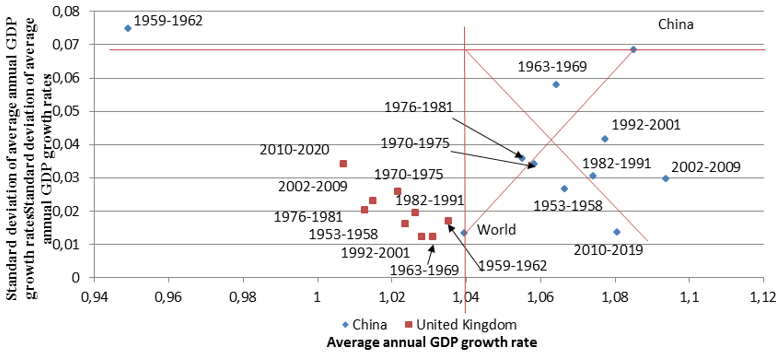

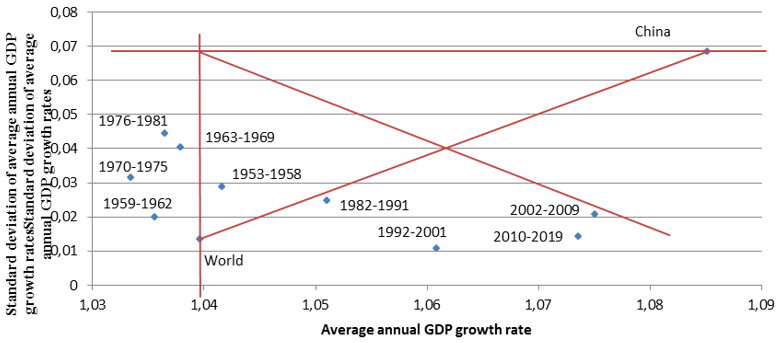

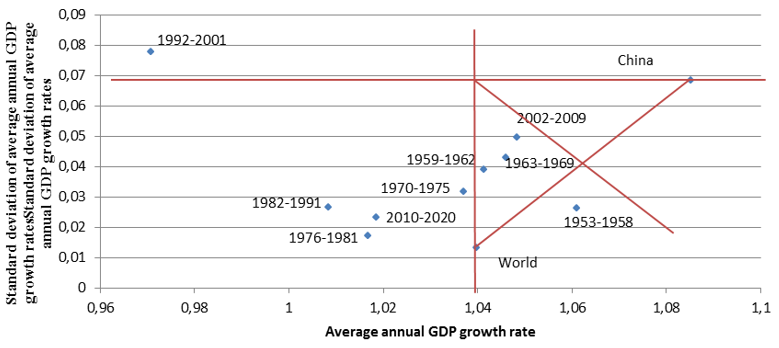

All possible values of indicators of growth and risk of economic development will occupy the area shown at Figure 1. Characteristics of individual parts of this area are in Table 1. Thus, we are able to determine the type of economic development of countries in a particular period.

Deceleration of the economic growth implies innovative development or degradation. Changing risk corresponds to institutional development. If the subsequent period compared to the previous one has a lower risk indicator and a higher growth rate, the changes in economic development are considered progressive (growth of innovation and development of institutions), the reverse change is regressive (decrease in innovation and degradation of institutions). If risks and growth are falling, the development is conservative (a decrease in innovation and the development of institutions), and if they grow, it is aggressive (an increase in innovation and degradation of institutions). Changes in economic development are named the development policies (Savelyev, 2020a).

Findings

Research base line

To study the subject of research, due to the existing limitations of the initial data, the period over the past 190 years was studied. In this regard, the struggle for hegemony in Europe between the Austro-Spanish Empire of the Habsburgs, France and England, as well as the struggle of the European powers with China and the Ottoman Empire were outside the scope of our study. The objects of research included the confrontation between Great Britain and Germany, the USSR and the USA, as well as a possible confrontation between India and China.

Initial data for analysis: for the period up to 2008 - database Angus Maddison Historical Statistics (Bolt et al., 2014; Maddison, 2008), after 2008 – The Conference Board, Total Economy Database (2019).

Information base for the analysis of data on the Russian Empire – Nominal GDP historical series (Dincecco & Prado, 2013). This source contains data on nominal GDP. For correct comparison for the period 1900-1913 according to Maddison (2008), the average annual inflation index was evaluated and the values of nominal GDP reduced by this index were obtained. This indicator can be considered the closest analogue of real GDP. Actual inflation by years may differ significantly, but for the purposes of this work, longer periods than a year are studied, and deviations of real GDP from the calculated one due to the deviation of the actual annual inflation index from the average annual level are leveled, which allows us to calculate growth data reduced by the average annual inflation nominal GDP comparable to real growth.

Determination of analysis standards

To normalize the point of minimum risk and maximum growth, the following methodological principle was formulated (Savelyev, 2020a):

- the country with the smallest growth was selected from the group of countries with the lowest risk,

- from the group of countries with the highest growth, the country with the highest risk was selected.

In accordance with this principle, in the study of newly industrialized countries (Savelyev et al., 2021d) in the period since 1950, the following points were selected: maximum - China according to official data of national statistics from the source TED1 (2021) for the period 1951-2019 and the global indicator for 1951-2008 according to Maddison (2008). The latter indicator clearly defines the long-term boundary between old and newly industrialized countries.

In examining global indicators since 1930, this method has been applied to every global economic cycle (Savelyev, 2020a). The linearization of these data showed very close characteristics with the line adopted in the study of newly industrialized countries (Savelyev et al., 2021d), with the maximum discrepancies revealed in the period before 1950. For the purposes of our study, the standards for the period since 1950 are taken from the source (Savelyev et al., 2021d).

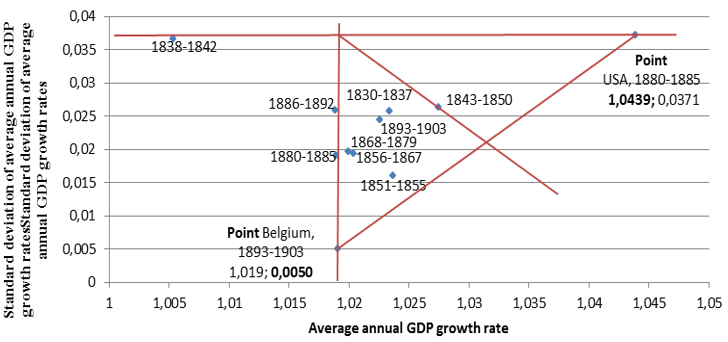

An analysis of the indicators of the first half of the 20th century showed that it is not possible to determine the standards in this period in a similar way due to the incompleteness of the data of most countries and the very large scatter of data due to the two world wars. The period 1830-1900 turned out to be much more stable, if we exclude from it the data of countries where mass colonization has just begun (Australia, Canada, etc.), and data on countries that did not begin industrialization in this period are practically absent. For the purposes of this study, data from Belgium for 1893-1903 with the minimum risk of the 19th century were selected as the standards, and the USA for the period 1880-1885 was selected as the point of maximum growth, due to the fact that countries with high risk and growth are countries of mass agrarian colonization. In addition, the thus defined line turned out to be parallel with the line of the period after 1950, which is additional evidence of the correctness of the choice of this standard.

Based on the results, the definition of the standards of the 19th century and after 1950 suggests that the first half of the 20th century is a period of transition from one rate of development to another. And the first industrial country to make this transition was the United States, soon supported by the USSR (Savelyev, 2020a; Savelyev et al., 2020b).

The periods of the study cover economic cycles from the first year of economic growth (growth acceleration) to the last year of economic recession (growth slowdown). Due to the fact that generally accepted reliable world data on GDP has been available only since 1950, in order to compare the results, the economic cycles of Great Britain, as the countries with the most complete statistics and deeply integrated into the world economy, were adopted to determine the periods.

19th century

The development of Great Britain in the 19th century is shown in Figure 2. The Great Economic Reform of the early Victorian Conservatives brought the economy to the brink of aggressive and conservative elite development. And this is the best state of the economy for the 70 years of the 19th century known to us. In other periods, the economy mostly found itself in the area of elite conservative development, regularly crossing the border of institutional autism.

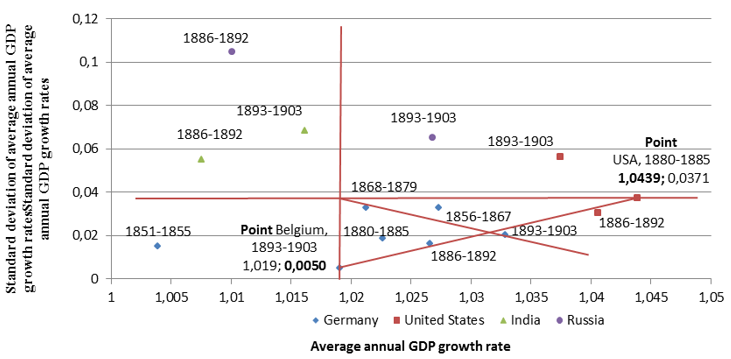

Germany during this period demonstrated a transition from the institutional autism of the fragmentation of the country to aggressive egalitarian development (see Figure 3). The United States, having completed its agrarian colonization, fluctuated at the level of egalitarian aggressive development and kleptocracy. India, being in colonial dependence, degraded. After the elimination of the institutions of serfdom, Russia turned out to be unprepared for the usual unfavorable weather conditions that entailed hunger and epidemics: in the Black Earth Region, former serf owners shifted all the risks of a crop failure to the landless peasants, and they had no reason to care about free people. More favorable weather conditions for the next economic cycle, while maintaining institutional underdevelopment, moved Russia into the area of theft.

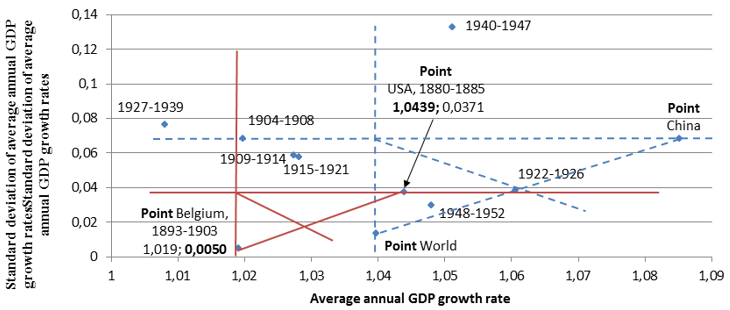

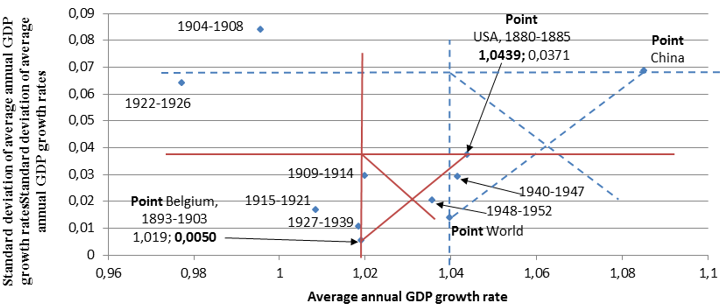

Early 20th century

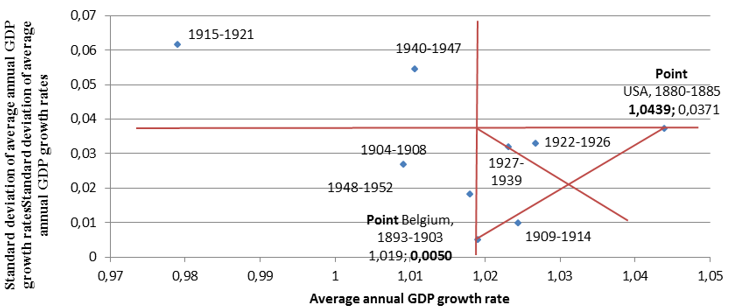

Losing its hegemony in Europe, Great Britain, in order to prepare for war with Germany, pursued a policy of new liberalism and a “popular” budget: social reforms rallied the nation before the war, and military spending accelerated economic growth so much that the economy was in the area of conservative egalitarian development (see Figure 4). This maneuver, in fact, repeated the reforms in Germany in the previous economic cycle (see Figure 5). World wars led the country into a state of degradation, and in the interwar period, Labor reforms allowed the transition to a short aggressive elite development, which was soon curtailed by the conservative elite. From the point of view of the norms of the second half of the 20th century, the whole period of the first half of the 20th century was spent by Great Britain in the field of institutional autism, which ultimately excluded it from world leadership.

Germany at the beginning of the 20th century demonstrated a conservative egalitarian development, but before the First World War it found itself in a zone of degradation, faced with limited resources, which pushed it to a two-fold world military conflict. The interwar period, even according to the standards we have chosen, of the second half of the 20th century is close to kleptocratic. The economic miracle of post-war reconstruction due to the division of the country and dependent political status had no effect on the revival of Germany's lost leadership ambitions (see Figure 5).

At the beginning of the 20th century, according to the standards of the 19th century, the USA demonstrated a kleptocratic development (see Figure 6). But it was the economic boom of 1922-1926 that, in fact, shifted the criteria of world development: this point is on the border of kleptocratic and egalitarian aggressive development according to the standards of the 19th century, and in the center of the development area in terms of the norm of the second half of the 20th century, setting a model for a new reality. The Great Depression was a payback for the inability to manage such a reality, but the post-war situation returned the country to the development area in accordance with the understanding of the speed of change and innovative activity already assimilated by society. The United States has become the new world leader.

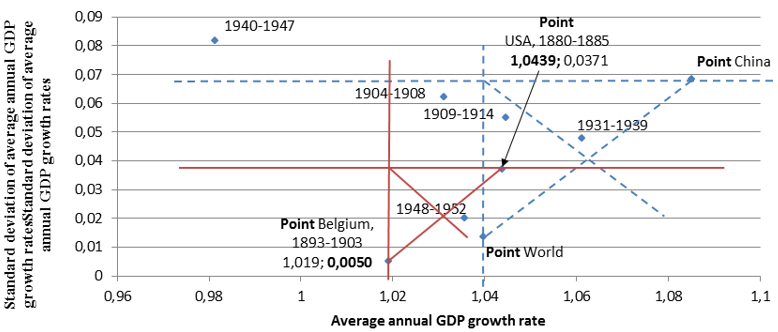

India during the world wars was in the areas of rejection of innovation (see Figure 7): degradation or mafia (foreign colonial administration). Only during the Second World War the country crossed the border of development and demonstrated the most modest conservative elite development. The division of the country after independence pushed countries back into the realm of institutional autism. Although, according to the standards of the 19th century, both of these periods already correspond to aggressive egalitarian development.

At the beginning of the 20th century, according to the standards of the 19th century, Russia was in the field of theft, and according to the standards of the second half of the 20th century, it moved from the area of institutional autism to the area of elite conservative development (see Figure 8). It was not possible to find reliable data on the annual change in real GDP for the periods of the First World War and the Civil War and the NEP. The period of industrialization in the USSR already corresponded to the norms of elite aggressive development. The Great Patriotic War shifted the economy to the area of degradation. It is noteworthy that the risks of this catastrophe development turned out to be lower than during the peacetime crop failure at the end of the 19th century. This comparison shows the qualitative difference between the institutional development of the USSR and the Russian Empire. Post-war reconstruction and conversion of military production moved the USSR to the area of institutional autism.

There is a noticeable similarity between Russia and the United States of the period before the start of the struggle for leadership: both countries began with a situation of poorly used resources and institutional underdevelopment. In this they differ from Germany, where, before the start of the struggle for leadership, excessive institutional development, expressed in the fragmentation of the country, held back innovation and economic growth.

Second half of the 20th century - early 21st century

The development situation was maintained in the United States until the end of the 1960s (see Figure 9). But due to the consolidated actions of developing countries, primarily oil exporters, and exhausting competition with the socialist bloc, the United States moved into the zone of institutional autism.

Great Britain after the Second World War is consistently in the area of institutional autism (see Figure 10) with a pronounced tendency to shift into the area of degradation, and does not claim any leadership. It was only Tetcherism and New Laborism that reversed this trend for two decades. Since the beginning of socialist construction, China has demonstrated an egalitarian development, but the policies of the Great Leap Forward and the Cultural Revolution have consistently shifted it into the field of degradation and elite development. The course towards a mixed open economy dominated by a planned economy returned China to egalitarian development and world leadership.

India until 1981 was in the area of institutional autism (see Figure 11). Only since 1982 has there been a leap towards egalitarian development, but the course towards a mixed economy dominated by the private sector generated less development dynamics than the Chinese model, although it showed low conservative risks. Taking into account the superiority of India over China in terms of the number of labor resources not employed in modern industries, it is possible to predict the already outlined acceleration of the development of India and the slowdown in the development of China, which makes them the main world competitors for sales markets and natural resources.

A significant difference between India's transition to the status of a pretender from the United States, the USSR and China is the low level of risks, which is associated with an inauthentic Indian culture, but a developed institutional model inherited from the colonial authorities of Great Britain. In this way, India of the period of the beginning of the struggle for leadership is similar to Germany, where low risks were due to the presence of institutions holding back innovation in many German states. With the abandonment of colonial institutions, the country's innovative capabilities increase.

Analysis of data from the second half of the 20th century for the USSR shows three completely different socio-economic systems (see Figure 12):

- the post-Stalinist governments of Malenkov and Bulganin under the conditions of the end of repressions, but while maintaining the strategy of technological leadership (advanced development in the field of labor productivity) ensured conservative egalitarian growth and the possibility of fighting for world leadership;

- the governments of Khrushchev and Kosygin reoriented development towards the growth of production at the achieved technological level with a sharp increase in export potential, in fact, switching to the strategy of exporting energy resources, which subsequently made the economy vulnerable to external influences and moved the country into the area of elite conservative development;

- after the termination of the Kosygin reforms and under the governments of Tikhonov and Ryzhkov, there was a rejection of the struggle for leadership, a transition to an import substitution strategy and a shift to the area of institutional autism.

- The results of the liberal reforms were comparable to the Great Patriotic War: the economic contraction was even deeper, and the risks were slightly lower. Russia has degraded and completely abandoned its leadership claims. The policy of the "vertical of power" moved the country into the area of elite conservative development. Failed modernization, but successful "nationalization of the elite" and a new confrontation with the United States moved Russia into the area of institutional autism.

Conclusion

As a result of the study, we received the following conclusions:

- The use of two indicators of economic development (economic growth and development risk) makes it possible to econometrically determine innovative and institutional development.

- The area of distribution by growth and risk parameters was normalized by points of minimum risk and maximum growth. This made it possible to distinguish 4 parts of the distribution area: development, theft (kleptocracy), mafia (institutional autism) and degradation, and in the development area 4 types of development: elite, egalitarian, conservative and aggressive.

- When analyzing the types of development of the leaders of the world economy, the following pattern was revealed: the leader lags behind the pretender in the dynamism of development, but due to the superiority in the size of the economy imposes on him a fight according to his own rules. As a result, both sides are depleted, and the second pretender, who did not initially claim the leadership, reaps the fruits of victory. This happened in the struggle between Great Britain and Germany, when the USA turned out to be the winner. This also happened in the struggle between the USA and the USSR, in the course of which China is the winner. The next pair of antagonists is likely to be China and India. This pattern can also be traced in more distant eras of the struggle for local leadership: in the east of Europe, the struggle of the Habsburg and Ottoman empires led to the dominance of the Russian Empire, and in the west, the struggle of the Habsburgs with France - to the dominance of the British Empire.

- The general trend of movement of the world leader in the sectors of the studied area of the distribution of economic development can be characterized by the following scenario model. The second pretender must have some kind of surplus of development resources, which he does not manage very effectively, being outside the development area. Because of this, the leader does not perceive him as a threat to himself. With a complementary culture of institutional development, the risks of the second pretender are reduced, and more efficient use of resources accelerates growth, as was the case in the history of the United States and Russia before their collision during the Cold War or in China after the Civil War and failed development experiments. If the risks of the second pretender are low, then this means that he has excessive institutional development, institutions are non-complementary or inauthentic to culture and inhibit innovation, as in the cases of the fragmentation of Germany and the colonial institutions of India.

- After an authentic culture of building or changing institutions and accelerating innovation, the second pretender moves into the area of egalitarian aggressive development against the background of exhaustion in the mutual struggle between the leader and the first pretender. As the free development resource is exhausted, now the new leader slows down in development and moves into the area of elite conservative development and enters into a struggle with the new first pretender. Such a transition is inevitable, since society in the field of egalitarian development loses its margin of safety and the ability to maneuver resources. In the course of the exhausting struggle, the leader and the pretender move into the area of institutional autism and further into the area of degradation, turning into a resource for the development of new pretender and fighters for leadership.

- From the point of view of this model, the Russian Empire, after the abolition of serfdom, became the owner of a whole set of labor, natural, infrastructural and other poorly used development resources. Industrialization as a strategy of import substitution was a leap into aggressive development, and after the war, the strategy of technological leadership put the USSR in the position of the first pretender and ensured egalitarian development. An attempt at quantitative competition in foreign markets in the 1960s meant a transition to a raw material export strategy and corresponded to the conservative elite development. This strategic mistake later led the USSR to collapse. In the 1970s-1980s, the USSR returned to the policy of import substitution and moved to the area of institutional autism, having lost its claims to leadership.

- In the 1990s, Russia was in an area of degradation: liberal reforms turned out to be inauthentic to the country's culture. But, possessing a huge number of natural resources, getting rid of social obligations to its own population and from subsidized union republics of the USSR, Russia has retained a high development potential. However, due to the institutional constraints of the liberal economic model, inauthentic to culture and constraining innovation, Russia could not become a new second pretender during the period of the “vertical of power” and after the failure of the policy of “modernization” and a new confrontation with the United States, it turned into a resource for the new leader, China.

- The presence of huge unused natural resources allows Russia to retain the potential of the second pretender. After the expected collapse of the United States, the new leader - China and the first pretender - India, with potentially the largest number in the world and cheap labor resources, will compete for Russia's natural resources. In these conditions, Russia will have a new chance to become the second pretender. But due to the country's presence in the mafia management sector, to accelerate innovation, the country needs to rid of the liberal institutions that are inauthentic to the culture.

- To move from the area of conservation (mafia and degradation), bypassing the area of theft directly into the area of development of Russia, institutional reforms are necessary corresponding to its culture, comparable in scale with the change in the socio-economic system and political and legal structure. We have substantiated such a transition in a number of publications (Savelyev, 2015, 2016). It consists in creating a networked society based on national value principles of trust and solidarity. These values are institutionalized in the economy in the form of the dominance of consumer ownership of organizations, and in direct democracy. These institutional reforms also require a new institutional status for investors, workers and managers, including politicians and civil servants. Only such an institutional model corresponds to the local culture and is capable of accelerating innovative development and increasing the quality of life.

Acknowledgments

The reported study was funded by RFBR, project number 20-010-00869.

References

Baranov, A. O. (2012). Macroeconomic Analysis of Key Results economic development of Russia in the post-Soviet period. ECO, 6, 23-41.

Blinder, A. S., & Yellen, J. L. (2001). The Fabulous Decade: Macroeconomic Lessons from the 1990s. The Century Foundation Press.

Bolt, J., & van Zanden, J. L. (2014). The Maddison Project: Collaborative research on historical national accounts. Economic History Review, 67(3), 627-651.

Brock, W. R. (2011). Britain and the Dominions. Cambridge University Press.

Butorina, O. (2015). Dollar’s triumph in Bretton Woods: how was it done? Voprosy Ekonomiki, 8, 58-72.

Clark, G. (2012). "The Enlightened Economy: An Economic History of Britain 1700-1850. Review Essay." Journal of Economic Literature, 50(1), 85-95.

Crafts, N. (2018). Forging Ahead, Falling Behind and Fighting Back: British Economic Growth from the Industrial Revolution to the Financial Crisis. Cambridge University Press.

Dincecco, M., & Prado, M. (2013). “Nominal GDP Series, 1870-2000,” Technical Report. Global Prices and Incomes Database 2013. http://gpih.ucdavis.edu/GDP.htm (04.07.2020).

Drobyshevsky, S. M., Trunin, P. V., & Bozhechkova, A. V. (2018). Secular stagnation in the modern world. Voprosy Ekonomiki, 11, 125-141.

Evans, R. (1986). The German Empire 1871-1918. German History - GER HIST, 3. 89-92.

Grigoryev, L. (2013). The USA: Three Socio-economic problems. Voprosy Ekonomiki, 12, 48-73.

Hobsbawm, E. (1999). Industry and Empire: From 1750 to the Present Day. Abacus.

Kapeliushnikov, R. (2015). The idea of secular stagnation: Three Versions. Voprosy Ekonomiki, 5, 104-133.

Karlusov, V. (2009). China and the Global Crisis. Voprosy Ekonomiki, 6, 125-136.

Kaufmann, D., Aart, K., & Pablo, Z-L. (1999a). Aggregating governance. Indicators world bank research working paper, 2195.

Kaufmann, D., Aart, K., & Pablo, Z-L. (1999b). Governance matters world. Bank research working paper, 2196.

Kheyfets, B. A. (2020). Technological rise of China: New challenges for Russia. Voprosy Ekonomiki, 6, 104-120.

Klinov, V. (2010). Peculiarities of Modern Dynamics of the Global Economy. Voprosy Ekonomiki, 9, 78-92.

Klinov, V. (2013). Problems of the US Economic Policy. Voprosy Ekonomiki, 5, 129-143.

Krugman, P. (1994). The myth of Asia's miracle foreign affairs, 73(6), 77.

Lin, J. Y. (2011). Demystifying the Chinese economy. Cambridge University Press.

Lloyd, T. (1996). The British Empire 1558–1995. Oxford University Press.

Lopatkin, G. (2014). Economic Culture of the East: China. Voprosy Ekonomiki, 3, 50-160.

Maddison, A. (2006). The World Economy, 1. A Millennial Perspective, 2. Historical Statistics, OECD. (Paris).

Maddison, A. (2008). Historical Statisticsofthe World Economy: 1-2008 AD. http://www.ggdc.net/MADDISON/Historical_Statistics/horizontal-file_02-2010.xls (accessed 04.07.2020).

Myasoedov, M. (2009). How do the economic programs of democrats and republicans differ - and why do the former manage the economy more successfully? Macroeconomics. http://welfare-economy.com/article.php?idarticle=140

Olczyk, G. (2019). Elements of economic culture as informal institutions in the economic development of Germany. Ekonomia i Prawo, 18, 233.

Porokhovsky, A. (2005). Evolution of the Structure of the American Economy. Voprosy Ekonomiki, 11, 84-96.

Ridley, F. (1968). The Economic Causes of the German Empire. Business History, 10, 121-125.

Savelyev, M. Y. (2015). Multicultural institutionalism: General economic theory of civilizations. The political economy of traditionalism. Network Society Project, 488. http://cognitiofluctus.ru/science/s001/001.htm

Savelyev, M. (2016). Neoinstitutionalism: methodological contradictions and multicultural means of overcoming them. Science of Udmurtia, 3(77), 47-56.

Savelyev, M. (2020a). Methods for researching the sustainability of economic development of territories. Problems of regional economy, 3-4 54-62.

Savelyev, M. (2020b). Problem statement for modeling innovative development of territories with different cultural environments. Problems of regional economy, 3-4, 133-140.

Savelyev, M., Gruzdeva, T., Savchenko, A., Koretsky, V., & Pushina, N. (2021a). Assessment of the Competitiveness and economic development policies of the countries of the Former French Empire. In SHS Web of Conferences (Vol. 101, p. 02005). EDP Sciences.

Savelyev, M., Kutyashova, E., Savchenko, A., Koretsky, V., & Polyakov, Y. (2021b). Diversity of economic development in Portuguese-speaking countries. In SHS Web of Conferences (Vol. 101, p. 02004). EDP Sciences.

Savelyev, M. Y., Pushina, N. N., & Bryndin, A. B. (2021c). Search for Effective Governments in Post-Soviet Russia While Excluding the Factor of World Oil Prices from the Results of the Country’s Economic Development. In IOP Conference Series: Earth and Environmental Science (Vol. 666, No. 6, p. 062092). IOP Publishing.

Savelyev, M. Y., Sokolova, N. G., & Polyakov, Y. N. (2021d). Newly Industrialized Countries: Is There an Alternative to the Golden Billion? In IOP Conference Series: Earth and Environmental Science (Vol. 666, No. 6, p. 062093). IOP Publishing.

Savelyev, M., Ivanov, V., & Polyakov, Y. (2020a). The effect of institutional differences on the economic development of German-speaking countries. In E3S Web of Conferences (Vol. 222, p. 05009). EDP Sciences.

Savelyev, M., Pushina, N., & Savchenko, A. (2020b). Assessment of the sustainability of economic development under the governments of Russia. In E3S Web of Conferences (Vol. 208). EDP Sciences.

TED1. (2021). This filecontains time seriesdata on GrossDomesticProduct (GDP), Population, Employment, Total HoursWorked, Per Capita Income and Labor Productivity (measuredas GDP per Person Employedand GDP per Hour Worked). Data isavailablefor 130 countries, plus a secondversionof Chinese databased on alternative data, coveringtheperiod 1950-2021. https://conference-board.org/data/economydatabase/total-economy-database-productivity (accessed 27.04.2021).

The Conference Board, Total Economy Database. (2019). Available at: https: //www.conferenceboard.org/retrievefile.cfm?filename=TED_1_APR20191.xlsx&type=subsite (accessed 04.07.2020).

Tomlinson, J. (2020). De-industrialization: strengths and weaknesses as a key concept for understanding post-war British history. Urban History, 47, 199.

Tsedilin, L. (2005). The EU Enlargement and the Prospects of Eastern Germany Lands. Voprosy Ekonomiki, 4, 23-42.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Savelyev, M., Kozyrev, M., Perevedentsev, D., Savchenko, A., Koretsky, V., & Polyakov, Y. (2021). Typification Of The Economic Development Of The Leaders Of The World Economy. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 831-847). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.94