Abstract

The outbreak of pandemic, the official Brexit and the trade friction between China-US have a great impact on the development of global value chain. Therefore, for Chinese government, the upgrading of industrial structure is a pressing problem to be addressed. As a channel to get foreign capital, financial opening can not only bring benefits but also have disadvantages. In previous studies, scholars selected different countries as samples and concluded different opinions on the relationship of financial opening and economic growth. New structure economics indicates that Long-term sustainable and inclusive economic growth is a process of industrial structure upgrading. Therefore, this study mainly examines the role of financial opening in China’s industrial structure upgrading. Adopting the theory of New Structure Economics as research paradigm and historical analysis as research methods, this study finds financial opening is neither a necessary nor a sufficient condition to economic growth. The critical point is the degree of financial opening must match with the industrial structure. Different industrial structure has different characteristics and constraints, so the degree and focus of financial opening at different stage should be different too.

Keywords: Financial openness, Industrial structure, economic globalization, economic growth

Introduction

The concept of financial opening comes from the concept of financial liberalization. The evolution of financial liberalization theory can be divided into two stages. Initially, Gurley and Shaw (1960) Goldsmith (1969), McKinnon (1973) and Shaw (1973) think that the governments of developing countries generally adopt compulsory administrative methods to control interest rates, which hinders economic growth, that is so-called financial repression. They advocate financial liberalization and suggest the government should deregulate and let the market dominate the economic operation. Nevertheless, during the 1980s, after some developing countries implemented financial liberalization, it led to financial risks instead of economic development. Therefore on the basis of summarizing practices of financial reform in developing countries, McKinnon (1993) and Maxwell (1997) put forward the sequence of financial liberalization. They outline the necessity of a gradual evolution process to move from a "repressed" to an open economy and indicate that if financial liberalization is carried out in a certain order, the stability of economic development in developing countries will be guaranteed.

In recent years, many economists have analysed the impact of financial opening on the domestic economy. Such studies were made by Huang (2018); Ghazouani et al. (2019); Castiglionesi et al. (2019); Furceri et al. (2020); Inekwe and Valenzuela (2020); Arif-Ur-Rahman and Inaba (2020). Although they analyze from different aspects and have different views, all of them regard the economy as a whole and don’t distinguish between real economy and virtual economy. Nevertheless, the upgrading of industrial structure is mainly about real economy.

In recent years, there are also mechanism researches of industrial structure upgrading from the perspective of host country in the works of Jiang and Zhao (2020), but they are about educational-input, venture capital, innovation respectively, which are all belonged to production factors. Although Ding (2014) and Sun (2017) have noted that finance can promote industrial structure upgrading, they haven’t specifically focused on financial opening. Wang et al. (2020) explore the spatial effects of foreign direct investment (FDI) on the upgrading of China's regional industrial structure, but FDI is just one static consequence of financial opening. Both financial opening and industrial structure upgrading more emphasize on the dynamic process. Therefore, to date there is no literature directly researching on the relationship between financial opening and industrial structure upgrading.

Problem Statement

Since opening-up to the outside world, China has embedded into the global value chain through processing trade, and gradually grown into a "world factory". Under the background of “anti-globalization” in the current world, the US-China trade friction, Brexit, and the outbreak of pandemic have a great impact on the development of global value chain. Due to the rising cost of labour and resources, part of the low-end manufacturing sector is moving from China to other developing economies (Myanmar, India, Vietnam). Some parts of the high-end manufacturing sector are going back to the European Union and United States under their "re-industrialization" economic strategy. So, both emerging economies but developed countries as well pose danger for Chinese economic growth. Therefore, with the increasing restriction of resources and the gradual disappearance of population dividend, the upgrading of industrial structure in China is a pressing problem to be addressed.

Research Questions

This study mainly examines the relation between financial opening and China’s industrial structure and analyses the role of financial opening in the upgrading of China’s industrial structure. In the past few years, China has never stopped steps to financial opening. Especially after China got access to the WTO, China's financial opening has been accelerating. With the development of The Belt and Road Initiative, financial opening has brought China a new opportunity. In 2018, General Secretary Xi announced at the Boao Forum of Asia that financial opening is the primary task of China's opening to the outside world. Since then, China's financial opening has entered a new stage of development. In March 2021, the two sessions have approved the 14th five-year plan of China’s development. It is also clearly pointed out that all-around, high- level opening to the outside world and the development of modern industrial system should be strengthened.

So, under the current new situation, in order to get China's economy out of the dilemma, how to promote industrial structure upgrading on the strength of financial opening has an urgent practical significance for China's economic development.

Purpose of the Study

The purpose of this study is to try to explore whether the financial opening play a proactive or a negative role in the china’s economic development and how can the financial opening play a proactive or a negative role. To demonstrate our arguments, this study mainly adopts the theory of New Structure Economics. According to the theory of New Structure Economics, the industrial structure upgrading is a dynamic process. But a flexible and smooth industrial structure upgrading process requires simultaneous improvements in the superstructure, including educational, financial, and legal institutions, industrial policies. The superstructure is endogenous in industrial structure and also can react on it. The different industrial structure has different characteristics and constraints and will require different superstructure. Only when the superstructure matches with the current industrial structure, it can promote the industrial structure upgrading mostly.

Research Methods

This study mainly adopts historical analysis. Historical analysis is a method of analyzing objective things and social phenomena from the perspective of development and change. The objective things are always developing and changing. Therefore, we need to link and compare the different stages of their development, so as to clarify their essence and reveal their development trend in future. As for data collection, in order to keep the data consistent, all the data in this study are collected from 1982-the beginning of China’s reform and opening up. On the basis of these historical data, this study tries to explore the nature essence of the relation between financial opening and industrial structure upgrading in china. Hence it will give some revelation to the future.

The overview of industrial structure upgrading

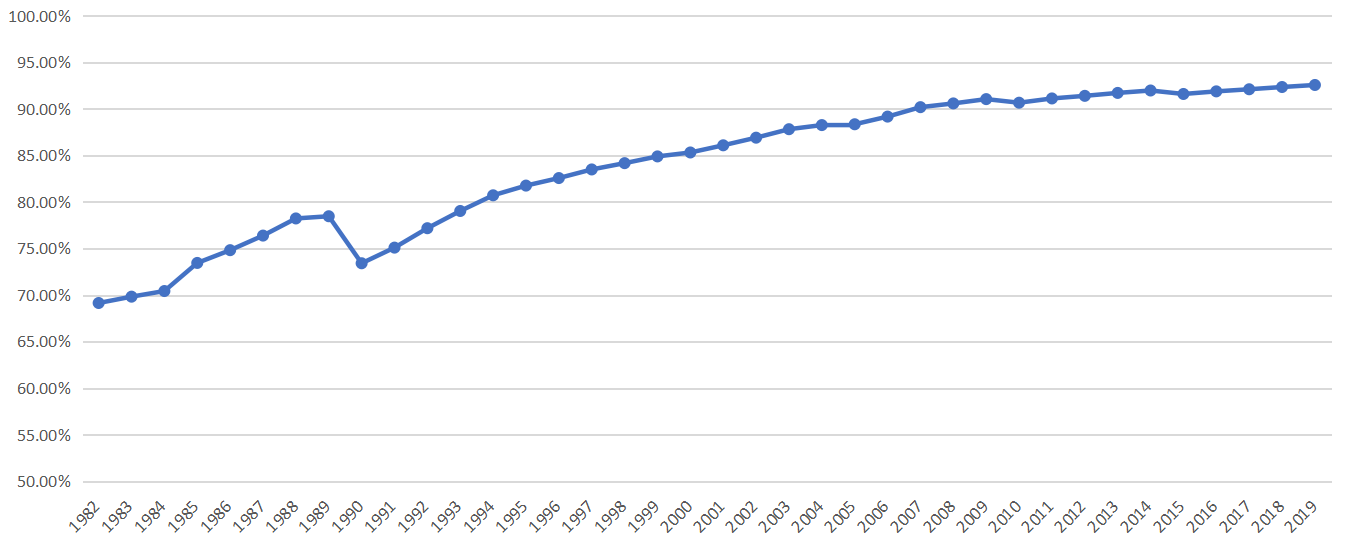

To measure the level of industrial structure upgrading in China, this study divides the GDP into three parts of primary, secondary and tertiary industry and select the proportion of added value of the secondary and tertiary industries in GDP as the indicator. It is presented in Figure 1. It can be seen that the ratio of annual added value of the secondary and tertiary to GDP was just 69.14% in 1982 and continually increased to 92.58 in 2019. Therefore, the China’s industrial structure is continuously optimized from 1982 to now.

The overview of financial opening

Financial openness index is a quantitative index to measure the degree of financial opening in a country, which includes two distinct measures: de facto and de jure. De jure indicators are constructed to measure the grade of regulatory restrictions on cross-border capital flows and financial services. De facto indicators reflect the actual cross-border capital inflow and outflow. Because de jure indicators reflect the subjective willingness of the government, not the real state of the market, this study uses the historical analysis to empirically examine the impact of financial opening on the upgrading of industrial structure, so this study adopts de factor indicators. For a country, financial opening generally includes two areas, related to the financial market and to the financial institutions, respectively. The opening of financial market refers to the expanding of cross-border capital flows with the increase of using different financial instruments based on deregulation of transactions. The opening of financial institutions refers to the relaxation of domestic access to foreign financial institutions engaged in banking, securities, insurance and other financial services (Weili, 2021). Financial market includes capital market and currency market. Accordingly, to measure capital market opening, this study adopts the ratio of financial assets and liabilities to GDP; to measure currency market opening, this study adopts the ratio of net foreign assets of central bank to the total assets of central bank; to measure financial institutions opening, this study adopts the ratio of total amounts of financial and insurance service to total added value of financial industry. Finally, this study endows capital market, currency market and financial institutions opening with same weight. The functions can be presented as follows:

- Financial openness capital market=financial assets/GDP+ financial liabilities/GDP (1)

- Financial openness currency market=net foreign assets of central bank/ total assets of central bank (2)

- Financial openness financial institutions =the amount of financial service/added value of financial industry+ the amount of insurance service/added value of financial industry (3)

- Financial openness=1/3* Financial openness capital market+1/3* Financial openness currency market+1/3* Financial openness financial institutions (4)

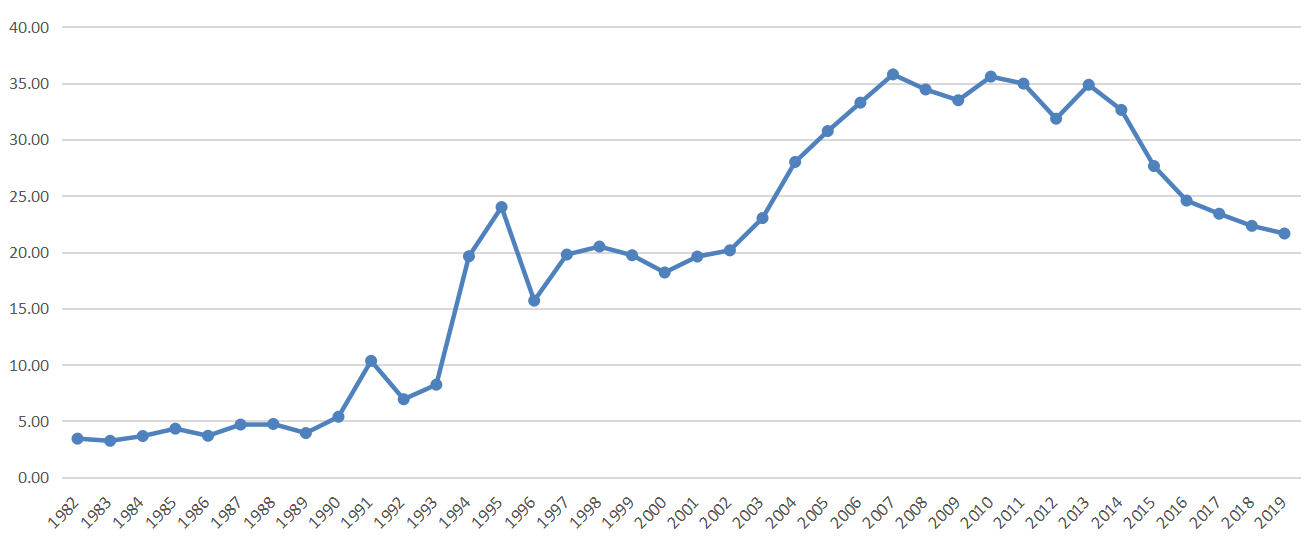

The result is presented in Figure 2. From Figure 2, the degree of financial opening in china was just 3.42 in 1982, it has come to 21.65 in 2019. With the downward of financial openness since financial crisis 2008, the upgrading of industrial structure also became slow. Because of the impact of international hot money, the curve of financial openness seems to be more fluctuated than the curve of industrial structure upgrading, but both of them are in the upward trends and are matched with each other overall.

The co-evolution of financial opening and industrial structure upgrading

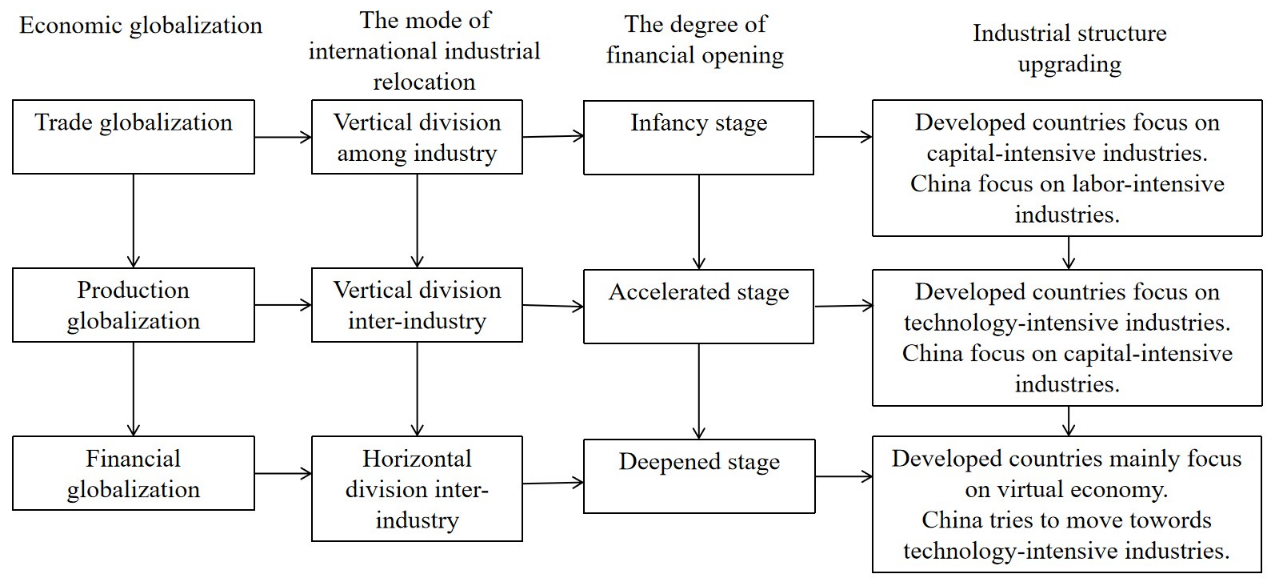

From the perspective of historical development, through international industrial relocation, economic globalization and industrial structure upgrading relate to each other. Initially, economic globalization was in the stage of trade globalization, and the mode of international industrial relocation was mainly vertical division among industry. At this stage, comparative advantage of developed country lied in the capital-intensive industry, while the comparative advantage of china lied in labor-intensive industry. So, the developed countries transferred labor-intensive industry to china. Therefore, at that time, the core objective of financial opening was to increase the export of product of labor-intensive industry and provide supportive policies so as to achieve convertibility of the current account. The degree of financial opening is in the infancy stage.

Gradually, economic globalization evolved to the stage of production globalization, the. mode of international industrial relocation was mainly vertical division inter-industry. At this stage, comparative advantages of developed country were in the producer service industry and high-end manufacturing industry, which are technology-intensive; while China’s comparative advantage lied in the capital-intensive industry. Developed country transferred low-end manufacturing industry to china. At that time, in order to meet the demand of capital for the development of capital-intensive industry in China, the focus of China's financial opening has shifted from current account to capital account, and the pace of financial opening has accelerated.

During the past two decades, economic globalization has entered the stage of financial. globalization, the mode of international industrial relocation begins to move towards horizontal division inter-industry. Western developed countries tend to "de-industrialize”, transfer some high-end manufacturing industry and some R & D segments to China, and focus on virtual economy. China has made rapid progress in many areas and the gap between China and developed countries is narrowing. China's industrial structure has gradually changed from capital-intensive to technology-intensive. The industrial structure upgrading is mainly driven by innovation. Because of the great risk of innovation, in order to introduce more venture capital, in recent years, China began to implement negative list management for foreign investors and promise to give national treatment to foreign financial institutions before admission. China’s financial opening has entered the deepened stage.

From the history, economic globalization has gone through trade globalization, production globalization and now entered in financial globalization. With the degree of financial opening gradually deepened in China and the mode of international industrial relocation changed from vertical division among industry, vertical division inter-industry, finally to horizontal division inter-industry, China's industrial structure has also changed from labor- intensive, capital-intensive, and finally to technology-intensive (Figure 3).

Findings

Through the above analysis, it can be concluded that China's financial opening is not achieved overnight. It is orderly, gradual and prudent. On the whole, it follows the basic principles of "easy first, then difficult; low risk first, then high risk; and trial first, then promotion". It is also accompanied by the process of world economic globalization and matches with China's industrial structure. The focus of foreign exchange reform has changed from the current account convertibility to the capital account convertibility. The opening of financial account is gradually transferred from low-risk direct investment to indirect investment and then to financial derivatives. The opening of the security sector and insurance sector has been preceded by the banking sector.

On the basis of previous research, this study indicates that financial opening is neither a necessary nor a sufficient condition to economic growth. Financial integration is the static consequence of financial opening. Both industrial structure upgrading and financial opening emphasize on the dynamic process. In order to conducive to economy development, financial opening should be not only in a certain “sequence” but also should match with the current industrial structure.

In previous literatures, the views of scholars on the relation between financial opening and domestic economy can be roughly divided into three categories: promotion, conditional, and irrelevant. That is to say, some scholars believe financial opening can promote economic growth; some scholars think financial opening and economic growth just have a proactive relation under designated conditions; while some scholars regard the two are irrelevant. According to the theory of New Structure Economics, long-term sustainable and inclusive economic growth is a process of industrial structure upgrading. Different country at different period has different industrial structure, different industrial structure has different characteristics and constraints. So, it requires the different degree and focus of financial opening. Only when the degree and focus of financial opening match with the industrial structure in a specific country at a specific time, it can promote the upgrading of industrial structure, thus play a proactive role in economic growth.

Conclusion

Collecting the data from china’s reform and opening up, this study provides a time series analysis of the relationship between financial opening and industrial structure upgrading. This study argues that financial opening plays a proactive role in china’s development, but it is in a specific condition, that is, financial opening should be not only in a certain “sequence” but also should match with the industrial structure at different stage of development.

In order to demonstrate our arguments, we mainly adopt historical analysis and the theory of New Structure Economics. New Structure Economics is found on the summarization of China’s economic development experience. Using historical analysis and the theory of New Structure Economics, this study can better present the experience of China’s development and give some revelation to other developing countries.

This study still has some shortcomings. On the one hand, this study only qualitatively summarized the relation between financial opening, industrial structure upgrading based on historical analysis, but have not yet used mathematical models. In the future, it is necessary to adopt a variety of methods to conduct a more in-depth analysis. On the other hand, this study only analyses the role of financial opening in terms of industrial structure upgrading, from a macro perspective. Future research can provide more insights from a micro perspective.

References

Arif-Ur-Rahman, M., & Inaba, K. (2020). Financial integration and total factor productivity: In consideration of different capital controls and foreign direct investment. Journal of Economic Structures.

Castiglionesi, F., Feriozzi, F., & Lorenzoni, G. (2019). Financial integration and liquidity crises. Management Science, 65(3), 955-975.

Ding, Ch. (2014). Constructing efficient financial service system to promote the transfer and upgrading of industrial structure. Advances in Education Research, 51, 83-87.

Furceri, D., Loungani, P., Ostry, J., & Pizzuto, P. (2020). Financial globalization, fiscal policies and the distribution of income. Comparative Economic Studies.

Ghazouani, T., Drissi, R., & Boukhatem, J. (2019). Financial integration and macroeconomic volatility: New evidence from DSGE modeling. Annals of Financial Economics, 14(02), 1950007.

Goldsmith, R. W. (1969). Financial structure and development. Yale University Press.

Gurley, J. G., & Shaw, E. S. (1960). Money in a theory of finance. WBrookings Institution Press.

Huang, Y. P. (2018). Proactively and steadily advancing China's financial opening. China Economic Journal, 11(1), 1-13.

Inekwe, J. K., & Valenzuela, M. R. (2020). Financial integration and banking crisis: A critical analysis of restrictions on capital flows. World Economy, 43(2), 506-527.

Jiang, J., & Zhao, X. D. (2020). A study of the impact of innovation on industrial upgrading in china: a spatial econometric analysis based on China’s provincial panel data. Journal of Advanced Computational Intelligence and Intelligent Informatics, 24(3), 272-281.

Maxwell, F. (1997). In favor of financial liberalization. The Economic Journal, 107(442), 754-770.

McKinnon, R. I. (1973). Money and capital in economic development. The Brookings Institution.

McKinnon, R. I. (1993). The sequence of economic liberalization: financial control in the transition to market economy. Johns Hopkins University Press.

Shaw, E. S. (1973). Financial deepening in economic development. New Yo.

Sun, Y. M. (2017). Analysis on the influence of regional financial development to the upgrading of regional industrial structure. http://dpi-proceedings.com/index.php/dtssehs/article/view/9312

Wang, S. L., Chen, F. W., Liao, B., & Zhang, C. (2020). Foreign trade, FDI and the upgrading of regional industrial structure in China: Based on spatial econometric model. Sustainability, 12(3), 815.

Weili, Z. (2021). Financial Globalization and the Development of China's Economy. In Handbook of Research on Institutional, Economic, and Social Impacts of Globalization and Liberalization (pp. 227-245). IGI Global. https://doi.org/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Shevchenko, D., & Zhao, W. (2021). The Role Of Financial Opening In China’s Industrial Structure Upgrading. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 780-787). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.88