Abstract

The foreign economic sector plays an important role in the development of the Russian economy. Over the twenty-year period since 2000, the structure of foreign trade relations of the country has undergone a number of changes. The article analyzes the geographical orientation of Russian foreign trade turnover, as well as its relationship with the commodity structure of exports and imports. It is revealed how the restrictions on economic activity introduced in 2020 affected the state of foreign trade of the Russian Federation. The main consequence of the COVID-19 pandemic was the acceleration of the downward trend in hydrocarbon consumption in the global economy, which makes Russia's position very vulnerable. In this regard, it is of particular interest to find export destinations that could partially offset the decrease in energy exports. According to the results of 2020, such areas were the export of precious metals, as well as food and agricultural raw materials. The latter direction seems to be the most promising, since it allows you to increase the degree of redistribution of products exported from Russia, as well as attract investments in the agricultural sector. In addition, the largest consumers of Russian agricultural raw materials and food are the countries of the Asia-Pacific region, which gradually takes the position of priority in Russian foreign trade.

Keywords: Foreign trade relations, regional and commodity structure of foreign trade, export, import, the COVID-19 pandemic

Introduction

Foreign trade relations are an important component of the development of any national economy. The strengthening of globalization processes in the world leads to the fact that the creation of an effective system of economic relations with other states becomes a must for the sustainable development for any country. In the Russian economy the foreign trade sector essentially affects the welfare of the population as the contribution of trade surplus made from 5 to 10% of the GDP in the period from 2011 to 2020. It caused the interest of many authors in the research of trends of development of the Russian foreign trade sphere and development of the directions of its improvement in the future (Schkolyar, 2020; Trade in Russia, 2019).

Problem Statement

The year 2020 is characterized by the deep recession of the world trade caused by the considerable restrictions of economic activity introduced by the states for counteraction against the COVID-19 pandemic. The result was a breakdown in existing trade and logistics links, as well as major structural shifts in the world trade. The downward trend in global demand for hydrocarbons is becoming clearer, due to the growing environmental component of developed countries’ policies, on the one hand, and on the other hand, because of the transformation of the type of employment, namely the increasing proportion of workers working remotely. These major changes in the world trade pose the task for Russia to summarize and analyze the accumulated experience of foreign trade cooperation in the search for new development projects.

Research Questions

The study raised the following questions:

- What changes in the regional and commodity structure of trade occurred in Russia during the period from 2000 to 2020?

- How the COVID-19 pandemic influenced on the commodity structure of trade of the Russian Federation?

- What promising areas of development of foreign trade cooperation can be identified as a result of the analysis?

Purpose of the Study

The answers to the questions raised will help to achieve the goal of the study: to identify the main trends in Russia's foreign trade from 2000 to 2020 and to determine its development prospects.

Research Methods

To conduct a comparative analysis of the foreign trade of the Russian Federation, there was used the data from the Federal State Statistics Service for a twenty-year period, starting from 2000, which eliminates the impact of the crisis in the transition stage of the Russian economy on the results.

Analysis of the regional structure of trade of the Russian Federation

In the course of the analysis, the country’s 10 largest trading partners were selected for the period from 2000 to 2020, the share and place in goods turnover of which are presented in Table 1. As can be seen from the table, the regional structure of Russia's foreign trade by 70% formed in 2000 and remains constant for 20 years. Changes in the composition of leading trading partners occurred in several areas. The share of the Ukraine, which until 2010 occupied 6% of Russia's trade turnover, decreased to 1.7% in 2019-2020, due to the cooling of bilateral relations (Federal State Statistic Service Russia in figures, 2003; Russia in figures, 2020). As a result, only two countries of the former Soviet Union remained in the 10 leading partners of the Russian Federation: Belarus and Kazakhstan. Since 2010, the importance of Asian countries cooperating with Russia has noticeably increased. The share of China in the country’s foreign trade increased almost 4 times compared to 2000, and the ratio of the Republic of Korea increased.

With regard to China, it should be noted that the growth of its share in trade was due to a sharp increase in imports. So in 2000, the share of Chinese products in imports was 2.8%, in 2010 - 17%, in 2020 - 23.7%. While for exports these figures were 5.1% respectively in 2000 and 2010, 14.6% in 2020 (Federal Customs Service, 2020; Federal State Statistic Service Russia in figures, 2003).

Analysis of the commodity structure of foreign trade of the Russian Federation

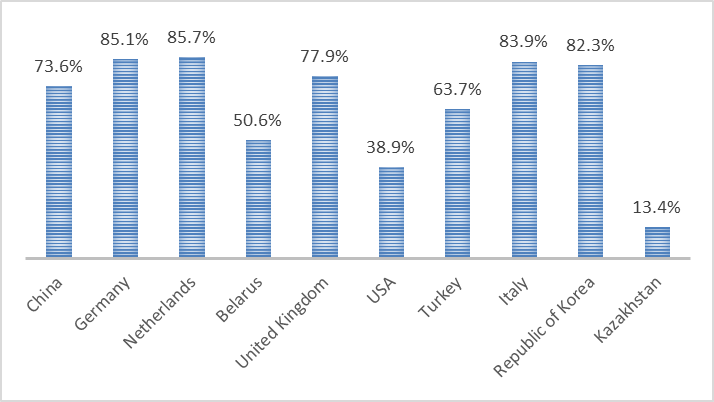

The persistence of the regional structure of foreign trade is largely due to the continuing commodity structure, as these countries are the largest and most permanent markets for domestic energy. Figure 1 shows the share of exports of Russian fuel and energy products in the total volume of exports of 10 leading foreign trade partners. These figures show that only for Kazakhstan, the USA and Belarus the export of Russian hydrocarbons is not more than 50%, for other countries exports from Russia by 70% or more are formed by goods of this group.

Findings

The year 2020 had a serious impact primarily on the commodity structure of Russian exports. The share of mineral products (95% of which are oil, oil products, pipeline gas and liquefied gas, 5% - ores, salts, chalk, sands, gravel) decreased to 51.2%. Table 2 shows that this is the minimum indicator for the last 20 years.

For the first time between 2000 and 2020, direct energy resources exports (oil, gas, coal) accounted for less than half of total Russian exports (49.6%). The volume of sales of Russian crude oil abroad in 2020 decreased by 11% by volume and by 41% in value, pipeline gas - by 10% in volume and by 40% in value (Tkachev, 2021).

The fall in oil and gas exports was offset by an increase in export for two items: food for agricultural raw materials, precious metals. According to the Table 2 a six fold increase in the share of agricultural products exported in 2020 compared to 2000 was observed. The growth in sales of wheat, vegetable oil, pork, poultry meat abroad for the first time in the history of Russia made it possible to practically equalize the import ($ 29,717) and export ($ 29,616) of food and raw materials for its production. This can be seen as a major success in promoting food and agricultural exports. The main increase falls on the supply of grain and fat and oil crops, the leading of which were oilseeds (sunflower seeds, soybeans) and beet sugar. Countries purchasing oilseeds and sugar in Russia mainly represent the Asian region. Sales of soybeans, oils and wax to China and India are increasing, sunflower oil to Iran, sugar to Central Asia and Azerbaijan. An important role was played by the fact that in 2020, as part of the implementation of the national project “International Cooperation and Export”, the government allocated 3.75 billion roubles of subsidies to support the production of oilseeds (Minchichov, 2020).

Conclusion

Conducted analysis allows for the conclusion that in the next decade China and Asian countries will represent the main direction of Russia’s foreign trade strategy. The Chinese market will remain the main one for Russian foreign trade, and its share in trade will only increase. Russia’s expansion of trade with European countries (Germany and the Netherlands) will be constrained by dependence on a single EU foreign trade practice. Among other Asian foreign trade partners, the importance of countries such as the Republic of Korea, Japan, India and Vietnam will undoubtedly grow, the share of these countries in Russian trade in 2020 was 2.8%, 1.6% and 1%, respectively. It can be assumed that these states will be included in the 10 largest trading partners of Russia by 2030.

The growth of exports of food and agricultural raw materials is a great achievement of the Russian foreign trade policy, since the export of processed products allows not only to increase the inflow of foreign exchange earnings, but also to sell medium and high processed production abroad, that is, the value added in Russia. Since 2018, the structure of world-wide agricultural products has been changing due to trade wars between the United States (one of the main exporters of oilseeds, primarily soybeans) and China (the most important importer). This creates favorable conditions for other manufacturers - including Russia, which today provide the main increase in the production of these products.

References

Federal Customs Service. (2020). Statistics Foreign Trade of the Russian Federation in terms of goods, countries, time. https://customs.gov.ru/statistic

Federal State Statistic Service Russia in figures. (2003). https://www.gks.ru/

Minchichov, V. V. (2020). Pandemic period in international tourism - new drivers. Russian newspaper - Economics Central District 242(8296). https://rg.ru/2020/10/27/reg-cfo/kak-pandemiia-izmenila-strukturu-vneshnej-torgovli-rossii.html

Russia in figures. (2020). Stat. sb. Rosstat. https://istina.msu.ru/collections/332702068/

Schkolyar, N. V. (2020). Russian Foreign Trade: the situation is an advanced new strategy. Russian Council on International Affairs. https://russiancouncil.ru/analytics-and-comments/analytics/vneshnyaya-torgovlya-rossii-situatsiya-pered-novoy-strategiey/

Tkachev, I. (2021). How Russia’s trade with other countries has changed over the year. https://www.rbc.ru/economics/15/02/2021/6028f9c79a794754fdb4362e

Trade in Russia. (2019). Stat. sb. Rosstat. https://rosstat.gov.ru/folder/210/document/13233

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Verbina, V. V. (2021). Russian Foreign Trade In The 21st Century: Trends And Prospects. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 748-752). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.84