Abstract

The use of universal approach to trends and characteristics of various economies development is relevant as it provides an effective typology for economic systems and contributes to the increase of controllability degree of their development by subjects of economic relations. The goal of this paper is to report the authors` methodological results as foundations for intersectoral structural analysis of economy of any scale and to proves theoretical findings at the macro- and meso levels. The principal methods used in the study are methods of statistical analysis and systematic approach in the framework of aggregation or decomposition of the subject of inquiry. The main research outcomes include a new approach to measuring intersectoral and cross-industry proportions of economic systems, formation of indicators system for the purpose of economic structural analysis and development and testing of a new typology of economic systems. The research results take account of economy development by measuring and assessing the degree of its industrialization or service development using the theory by Fisher-Clark. The approach allows us to talk about a new theoretical approach to the study of inter-sectoral and cross-industrial structures. The main research conclusions include the following: national economy can be represented as a superposition of various types of meso-economics; each meso-economy type can be quantitatively characterized by evolutionary development degree of cross-industrial structure and the development vector of indicators revealing industrialization and service development degree at each level of national economy.

Keywords: Gross Value Added, Intersectoral Structure, Industrialization and Service Development Degree, Structural Dynamics, Economic Systems Typology

Introduction

Modern global market, rules of international exchange and economic activity lead to smoothing out the influence of historical features on countries development. To some extent, this can be explained by integration of national economies into global unified institutional mechanisms.

On the one hand, combination of national and universal institutional factors increases economic activity efficiency of each system. On the other, structural features of national and subnational economies are formed due to their position on the global stage was defined by access to resources and potential sales markets.

Nevertheless, national economies possess certain institutional features correlating with evolutionary leaps or development bifurcation periods. The system analysis method allowed the authors to implement their research goals and to develop a new typology of economic systems from national to meso-scales, providing both appropriate perception of the developed method by specialists from different countries, and the ability to receive new analytical information about structural changes and the "movement" of meso-economics from one type to another amid low growth in value added and GDP.

In his works, Nobel laureate Simon Kuznets showed the relationship of economic dynamics and structure and found that basis of real (potential) economic growth are long-term structural shifts (trends), determined by many factors. The authors of this article are of the opinion that qualitative economic growth is accompanied by progressive structural changes in the economy. The main factors behind such changes are resources, technologies and institutions.

Problem Statement

When describing typical features of economy at micro and macro levels, the authors rely upon experts opinions works by (Baumol, 2001; Elsner et al., 2014; Mitchell, 2009; Omerod, 2009; Standish, 2006). The subject of inquiry of economic analysis got more complicated due to its ontological nature. Secondly, new scientific approaches of epistemological nature emerged enabling to analyze such a complex, nonequilibrium, hierarchical and a nonlinear system as an economy and the processes occurring in it. If the development of the economy is understood as the evolution of a system that is irreversible and requires formation of interconnected institutions with stable intersectoral relations, financial ties, movement of resources, including labour, then structural analysis used to develop the appropriate economic policy and to manage this development is of high importance. Systematic approach to the study of various spatial scale economics (from global to micro level) requires analysis of its social and economic structure. In social sciences, economy structure is usually considered as combination of relations between its components of various levels, ensuring integrity and the achievement of goals. Some analysts, particularly those from the field of technical and natural science fields think that the concept of “structure” includes totality of connections and the composition of the system.

The composition and structure are different in various economies. The authors of the paper consider that the system structure is a complex set of relations of system components. System composition may change as well as its integrity, but its purpose is preserved.

The study of the structure includes spatial and territorial factors. The composition including branches of the economy, types of economic systems is essential for meso-economics.

The number of meso-levels of national economies depends on decomposition degree of the corresponding grouped economic feature into its simplified features. Sectors of the economy are divided into relevant types of economic activity (TEA) or sectors of the economy (for example, the distribution of GDP by foreign economic activity and territorial-administrative units of the country).

The last statistically observed mesoscale is the level of institutional units such as households and enterprises. This level is called the micro-level of the national economy. It is possible, theoretically and at the level of individual applied research, to carry out the decomposition of a given level of the economy into sub-micro levels.

Today, in some countries, public statistical agencies do not provide such statistical data. In a sense, the macro level of the national economy can also be regarded as the mesoscale of world or global economy.

The division of the economy into different mesoscale levels is relative as it is associated with large-scale invariance of certain economic categories such as value added. The indicator of gross value added (GVA) is formed by the method of aggregation from micro to macro levels of the economy. Statistical data provided by state statistical authorities allows it to be disaggregated both by international economic activity and other social and economic indicators, including spatial and territorial characteristics.

Thus, various types of meso-economic systems of national economy can be distinguished. The number of meso-economic structures of national economy will be determined by the number of features selected as the basis for its typology. Not all typologies can have theoretical or applied value for meso-economic research. GVA is one of the most important economic characteristics of economic systems functioning at various levels.

According to the model by Clark (1957) the GVA intersectoral structure determines the degree of evolutionary development of the studied economy (Buletova et al., 2016; Clark, 1957; Fisher, 1935; Inshakov et al., 2006; Krasilnikov, 1999; Sukharev, 2010, 2013; Sukharev & Ilyina, 2012). The study of the intersectoral structure of the national economy at the macro level is abstracted from the spatial aspect of its functioning. The influence of the spatial factor on the interbranch structure of the national economy is traditionally carried out at the meso-economic level, corresponding to the functioning of regional economic systems.

The researchers focus mainly at meso-economic level in order to develop scientifically sound recommendations for regional economies growth and justify managerial decisions aimed at regional competitiveness increase and quality of life improvement. The typology of regions according to many quantitative criteria is the main analytical tool in such.

Cluster analysis determines social and economic types of regions and then ranked distributions of their social and economic development are built based on integrated ratings. Depending on the type of region, managerial decisions are suggested in order to boost the development. Dynamics of integrated and private ratings enhance effectiveness of regulatory measures on regional development.

This approach leaves unanswered a number of research questions.

Firstly, whether meso-economic level of national economy located between macro-level and meso-level of regional systems can be determined.

Secondly, most regional typologies drafted according to the level of social and economic development can be applied only on national level and do not compare regions of different countries.

Thirdly, ranking regions by integral and partial social and economic ratings allows us to study the dynamics of regional social and economic growth only within the boundaries of the studied statistical population of the regions. In the latter case, the question of the progressiveness of structural changes in the studied economic systems, in particular, in intersectoral proportions, remains unanswered.

Research Questions

It was proved in previous work of the authors (Buletova et al., 2016; Buletova & Sharkevich, 2018) that cross-industry structural analysis of GVA at various levels of decomposition of the national economy allows an evolutionary and statistical study of the dynamics of interindustry proportions.

Therefore, in the study presented in this paper, GVA and its structural characteristics are used as a grouping feature to build the appropriate typology. Economic entities or agents that ensure the reproduction of the corresponding components of GDP and their interconnection will form this mesoscale of research on the national economy.

Further disaggregation of GDP components will lead to the formation of new mesoscale levels and corresponding economic entities. Such a procedure can formally continue up to the classical level of microeconomics.

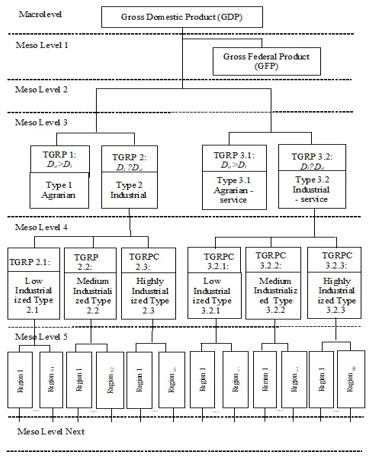

Currently, statistically observable meso-scale is the level of the regional economy (meso-scale 5 in Figure 1) according to which public statistical agencies provide relevant data.

In this regard, economic and statistical study of the mesoscale economy lying between the macro-level and regional mesoscale 5 will be carried out using the inverse method which is aggregation model of GVA values of the underlying mesoscale, starting from meso-level 5.

Such model of aggregation will require determination of the appropriate economic entity that forms part of GVA at this mesoscale, and the type of meso-economic system. Therefore, a hierarchical typology of economic systems allowing model aggregation of GVA values by any criteria or features is to be constructed.

Statistically valid identification of social and economic types of national economy allows us to determine the composition and its structure at the corresponding meso levels.

At each level of disaggregation, types of economic systems can be considered as separate meso-economies. Superposition or interaction of meso-economics will mainly determine national economy.

Therefore, the question arises of realistic determination of meso-economic types which national economy is composed of at each level (see Figure 1). GVA is formed at the economy micro level and because of aggregation becomes statistically observable and generally available to researchers at the municipal, regional and national levels. Aggregation is carried out using territorial and administrative criteria by relevant types of economic activity (TEA).

Aggregation of GVA of regions with different sectoral structures leads to an increase in the heterogeneity of statistical data. As a result of which, their further analysis is advisable only at the macro level, since data are aggregated by region belonging to different types of economic systems. A systematic approach as a model tool for the study of complex objects, involves the decomposition of national economies and the corresponding disaggregation of any indicators from top to bottom.

This approach allows to build a variety of hierarchical typologies of economic systems at various levels of decomposition of national economy.

This approach provides arguments for the study of evolutionary trajectory of production development of entire national or regional economy based on the aggregation of parts of gross value added as follows:

- firstly, agricultural sector emerges and its development is accompanied by an increase in automation and decrease in the share in gross value added, in GDP or GRP;

- industrial sector is higher labor productive and has its own evolution of development. Its predominance over the agricultural sector in the structure of economy indicates a higher level of development in the chosen trajectory accompanied by successes in scientific and technological progress or due to active colonial policy on the wave of globalization of the world market;

- service sector is rapidly developing and highly profitable sphere of economic activity, its division into material and intangible services details the evolutionary trajectory, dividing it into different types and levels of economic development in the post-industrial stage.

It can be argued that such trends were institutionalized in current practice, in the accepted norms for formal and informal identification of national economies.

Laws and principles of economic development stipulate the change of intersectoral priorities firstly towards the increase of industrial production share, then towards services sector and namely intangible services. This is established institutionalization in the standards and criteria for assessing the level of global economies. The authors` method is fundamentally different from existing practices, for example, those of the United Nations. The adopted system of indicators for conducting structural analysis of national economies includes such indicators as:

- mass of structural shift (difference in the share of structural indicator in the current Р1 and the base Р0 period) (Krasilnikov, 1999);

- structural shift index (ratio of the difference sum in the shares of growing sectors in production, employment, investment at some point in time and at the initial moment of time to the number of growing sectors multiplied by the total duration of time) (Sukharev, 2013);

- rate of structural shift (ratio of the mass of structural shift to the period of time during which it occurs) (Sukharev & Ilyina, 2012);

- coefficient of structural independence (ratio of exports to imports) (Sukharev, 2013).

The authors’ approach to evolutionary and statistical study of the interbranch structure dynamics of national economy is based on the following conditions and order:

- industry structure of gross value added (GVA) classification is applied, it is traditional for macro statistics, national accounts, and includes the division of the GVA into 15 sections, starting from section A “Agriculture” and ending with section P “Household activities”;

- aggregation of the elements presented in the GVA is carried out according to the following scheme:

- agricultural sector (Da) includes sections A and B (fishing, fish farming);

- industrial sector (Di) includes section C “Mining”, D “Manufacturing” and E “Production and distribution of electricity, gas and water resources”;

- service sector (Ds) consists of ten sections of the GVA structure, starting from section G “Wholesale and retail trade, repairs, etc.” and ending with section P (It should be stated that section F “Construction” is not included in any of these sectors, but participates in the formation of Dg additional indicator of the analysis which accumulates all the goods produced within the framework of the national or regional economy.) .

- study of the intersectoral structure of regional economic systems using coordination indices allows the use of two structural characteristics to describe these systems:

tα = Di /Da (1)

tβ = Ds /Di (2)

Indices or relative indicators of coordination are used in statistics to quantify the structure of economic phenomena (Kevesh, 1990). Coordination index shows the quantitative ratio between the parts of the aggregate, or how many dollars of one-part fall on one unit of the other taken as the basis for comparison.

The industrialization degreeα shows the degree of industrialization and demonstrates how many dollars produced by industry account for 1 dollar produced by the agricultural sector.

For the first time, a similar approach to structural analysis was presented in the work by Inshakov et al. (2006).

In the course of the study, it was determined that the more basicand values exceed 1, the more economically developed the country will be according to its structural changes over the period.

Purpose of the Study

The purpose of the study determined the choice of typology and the corresponding grouping characteristics. In order to study structural dynamics of economy and its relationship with the quality of economic growth, a number of authors use the model by Clark-Fisher based on the disaggregation of the GVA indicator by sector of the economy (Buletova et al., 2016; Buletova & Sharkevich, 2018; Inshakov et al., 2006). The sectoral model by Clark-Fisher is one of the approaches reflecting trends and priorities of economic development based on a three-sectoral model of economy. Economic evolution is defined as transition from one priority branch of economy to another in accordance with technological capacities of economic activity, mass production and developing area of improving the quality of life of consumers, ensuring social security and comfortable life in current social and economic conditions.

Research Methods

Division of national economy into spheres, sectors, types of economic activity is supported by various institutions through appropriate organizational structures. Thus, a priori, GVA production occurs in certain institutional conditions, which can be reflected indirectly in relevant typologies.

A sectoral structure of the national economy

Aggregating values of grouping attribute of regions belonging to the same meso-economic type, a new economic entity (“macro-region”) is determined. National economy can be considered as a superposition of various types of meso-economics at a given level. In the spatial and territorial representation, each type of meso-economics corresponds to the geographical location of real regions included in this meso-economic type. These regions may not have common territorial borders within the framework of one national economy and interspersed with regions through which another type of meso-economics of the same level of decomposition is realized.

The following analogy from crystal physics can be given as an example for spatial representation of the distribution of meso-economic systems. It is known that sodium Na and chlorine Cl in the solid state can have cubic crystal lattices at the sites of which these atoms are located. When these lattices are mentally combined, a body-centered cubic lattice can be obtained, which is a superposition of the two initial cubic lattices Na and Cl. This superposition describes the crystal lattice of sodium chloride NaCl which is another substance. The combination or superposition of possible spatial and territorial realizations of meso-economies of various types determines national economy structure and functioning mode. Meso-economic structural characteristics of national economy determine the level and the vector of its evolutionary development. They also help to assess economic growth in comparison with other countries and shape public structural policy.

Next, we go on to describe the hierarchical typology of the national economy by the degree of GDP disaggregation by structural characteristics presented in Figure 1.

The hierarchical typology of national economy developed in this study consists of five meso-economic levels of its decomposition. Each mesoscale corresponds to a certain degree of disaggregation of GVA value according to a selected attribute. In many countries the main share of GDP is produced in its regions (for the Russian Federation it is more than 80%), the state of the national economy and its dynamics will be determined by production of GVA in the regions, that is, the total gross regional product (TGRP) for this country. The remaining part of GDP is created by supra-regional federal structures and is designated as gross federal product (GFP). As a result of the decomposition of GDP, the mesoscale level 1 is formed on the TGRP and GFP. Since one of the typologization goals is to study the evolution of intersectoral proportions up to regional level (mesoscale 5 in Figure 1), further typology of the meso-economies will follow the branch of disaggregation of the TGRP by types of economic activities. The aggregate GRP of the country is disaggregated by sectors of national economy at meso-level 2. The commodity-oriented type (COT) of the meso-economics includes that part of the country's economy for which the share of production of goods in the TGRP will be greater than the corresponding share of the production of services: >.

The service-oriented type (SOT) of the meso-economics will include regions for which ≥. Predominance of service sector ( ≥) in the economic system does not mean that the regions belong to SOT and is more economically and technologically developed than the COT regions. Therefore, in the context of sectoral structure theory by Clark-Fisher (theory of structural changes) (Clark, 1957; Fisher, 1935), it is necessary to disaggregate the TGRP by sectors of the national economy into the agrarian (), industrial () and service () sectors, which were defined above and the designation of their shares in GRP. As a result, a third level of decomposition of the country's economy is formed, on which 4 types of meso-economics are defined (see Figure 1). In contrast to three-sector model by Clark-Fisher, services production in the national economy is represented by two service sectors with correspond to meso-economic types: agricultural-service (type 3.1) and industrial-service (type 3.2).

We need two service types due to the logic of a systematic approach to constructing a typology, applying uniform criteria for disaggregating the GVA and comparing the different-sized parts of the national economy at each mesoscale of its decomposition (economy → sphere → sector → TEA → ...). Three-sector economy model by Clark-Fisher l enables us to compare different-scale components of the economy: agricultural, industrial and services sector related to the upper mesoscale 2 (see Figure 1). Clark-Fisher’s theory of the sectoral structure of the national economy is based on the hypothesis that in the process of social evolution there is a gradual redistribution of the production of the highest GVA value from the agrarian to the industrial sector and then to the services sector.

Types of Evolutionary trajectories

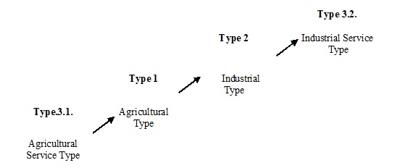

Statistical data analysis conducted by the authors in the Russian regions takes into account selection criteria for agrarian-service type 3.1. () shows that this type of economy should be less developed and historically first to emerge. It can be assumed that for type 3.1 at the initial stages of social production,, i.e., the share of the industrial sector of the total GVA, could be neglected (0) and development proceeded along the following evolutionary trajectory (Figure 2):

This evolutionary scheme of economic systems development (Figure 2) is consistent with the reciprocating or spiral-like nature of changes in complex objects. Thus, national economy at the third level of its decomposition can be described by means of a four-sector model, which is a superposition of four meso-economic types. Prior to mesoscale 4, national economy typology was of qualitative nature, since strict and non-strict inequalities between its shares () were used to disaggregate the GVA to group regions into the corresponding meso-types. This allows us to conclude that the typology or classification of regional economic systems according to meso-economic types is universal. Let us turn to the characterization of the types of economic systems presented at the mesoscale 4. Industrial sector is basic for any country`s economy. The state and functioning of other sectors of the economy depend on the level of its development. the level of industrial development of a country or region can quantitatively be measured using, as a structural indicator which we described earlier (see formula 1). This indicator can be considered as a quantitative characteristic of the degree of economic system evolutionary development within the boundaries of the type of meso-economics under consideration. If1, then the economic system can be unambiguously referred to as agrarian type 1. The authors study shows that possible values of can be characterized by a significant range of variation and heterogeneity, especially for countries consisting of a large number of territorial and administrative units.

Findings

Based on the principle of minimizing the definition of new types, which facilitates their meaningful interpretation, using cluster analysis or other grouping methods in the typology proposed in this paper, each type of economy corresponding to mesoscale 3 is decomposed into a low- industrialized, medium-industrialized and highly- industrialized type. According to the formal decomposition procedure at mesoscale 4, 12 types of economic systems should be defined. In the above diagram of the hierarchical typology of the national economy, only six types of meso-economics of meso-level 4 are shown. For agrarian type 1 and agrarian-service type 3.1. by definition, the degree of industrialization ranges 01.

This leads to a small range of variation of indicator and uniformity of its values. The uniformity of the values of the indicator increases due to possible errors in the determination of the GVA itself from foreign economic activity during their statistical observation. Therefore, an estimate of accurate to hundredths of 1 requires statistical justification. Formally, one can divide the range 01 into three parts, mapping each to one of the three industrial types of the mesoscale 4. For the convenience of perception and understanding of the scheme in Figure 1. the decomposition of agricultural type 1 and type 3.1 is not given.

GVA disaggregation of the corresponding type of economy at the mesoscale 4 leads to the formation of the classical mesoscale 5. At this level, the national economy is decomposed into a set of regional economies. GVA is disaggregated to GRP and its industry values for a particular region. The number of regions that make up the meso-economic type of level 4 or occupancy is indicated as, where = 1, ..., 6. Thus, meso-level 5 is the level of initial data on GRP, by aggregating which to meso-level 1 it is possible to construct a specific typology of the national economy according to the scheme in Figure 1. Such a typology will facilitate the identification of ongoing changes in the structure and nature of economic development. And even with the changing composition of economic systems by components, the results of structural analysis and the “movement” of regions by meso-economic types will allow us to correctly evaluate their development along the chosen evolutionary trajectory.

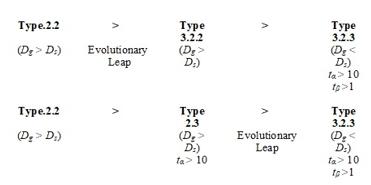

The degree of industrialization of types 3.2.2 and 3.2.3 is comparable with those for the industrial types 2.2 and 2.3, which are part of the COT, but noticeably exceeds the latter types in terms of their degree of servicing. The revealed evolutionary trajectories of the regions constituting type 3.2.3 can be represented using the following scheme (Figure 3).

In this way, in order for meso-economic system at the regional level or higher to be able to implement this evolutionary development trajectory (see Figure 3), the average development vector in the space of indicators (,) must be composed of a simultaneous and / or alternating growth of structural indicators and.

Conclusion

Beyond such a development trajectory, the economic system is in structural fluctuations state or a multidirectional change in the indices and (see Buletova et al., 2016). The authors distinguish between two types of structural changes: structural fluctuations and shifts. Under fluctuation, we can understand economic cycles (in the works of Erokhina, 2003; Fisher, 1925; Zarnowitz, 1972). In the phase space of structural indicators and, these cycles will be represented by closed or almost closed strongly nonlinear trajectories in a certain limited area of this space. This type of sequence of elementary structural changes is defined in the work as the region of structural fluctuations of the studied economic systems. An elementary structural change in the work (Buletova et al., 2016) refers to a change in the structural parameters and over one period of time (year).

The region of structural fluctuations is approximated by a rectangle, because the exponents and can generally have a different scale of fluctuations of their values. Geometric parameters of the rectangle reflect the quantitative characteristics of the scale of the revealed structural fluctuations. National economy can be seen as a superposition of meso-economics at the corresponding level of its decomposition. Each meso-economics can be partially analyzed using analytical tools of macroeconomic methods.

It is known, the growth of GDP and the TGRP may be accompanied by negative phenomena in the structure of the national economy. It seems to us that the main task of meso-economic analysis is to structure the transition from the micro level to the macro level of the country's economy.

References

Baumol, W. (2001). What Alfred Marshall Did Not Know: The Contribution of the Twentieth Century to Economic Theory. Economic Issues, 2, 73-107.

Buletova, N. E., & Sharkevich, I. V. (2018). Comprehensive typological and structural analysis of the meso-levels of the national economy: theoretical foundations, measurement and interpretation of structural changes. Deposition of the article. JSC "National Register of Intellectual Property", Moscow.

Buletova, N. E., Sharkevich, I. V., & Meshcheryakova, Ya. V. (2016). An assessment of growth quality and economic structure: a regional perspective. Asian Journal of Applied Sciences, 4, 889-898.

Clark, C. (1957). The Conditions of Economic Progress. Macmillan Press.

Elsner, W., Heinrich, T., & Schwardt, H. (2014). The Microeconomics of Complex Economies. Elsevier/Academic Press.

Erokhina, E. A. (2003). Patterns of Economic Development: a System-Self-Organization Approach. Bulletin of Tomsk State University, 280, 127-129.

Fisher, A. G. (1935). Clash of progress and security. Macmillan and Co. Limited.

Fisher, I. (1925). Our unstable dollar and so-called business cycle. Journal of the American Statistical Association, 20, 181-198.

Inshakov, O. V., Sharkevich, I. V., & Shevandrin, A. V. (2006). Analysis of Structural Changes and Development Prospects of Regional Economic Systems. Bulletin of Volgograd State University Series 3: Economics. Ecology, 10, 56-67.

Kevesh, P. (1990). Theory of Indices and Practice of Economic Analysis. Moscow, Finance and Statistics.

Krasilnikov, O. Yu. (1999). Structural Economy Shifts: Theory and Methodology. Saratov, Publishing house "Scientific Book".

Mitchell, M. (2009). Complexity: A Guided Tour. Oxford Univ. Press.

Omerod, P. (2009). Keynes, Hayek and Complexity. In: Faggini, Marissa and Thomas Lux (editors): Coping with the Complexity of Economics (pp.19-32). Springer. https://doi.org/

Standish, R. K. (2006). Theory of Nothing. Charleston. Booksurge.

Sukharev, O. S. (2010). Structural Problems of the Russian Economy: Theoretical Justification and Practical Solutions. Moscow, Publishing House of Finance and Statistics.

Sukharev, O. S. (2013). Structural Analysis and Structural Changes in the Russian economy. Investments in Russia, 1, 29-35.

Sukharev, O. S., & Ilyina, O. B. (2012). Analysis of the Dynamics Of Structural Changes in Regional Economic System such as Special Economic Zone. Bulletin of SRSTU (NPI). Series: Socio-economic sciences, 4, 79-100.

Zarnowitz, V. (1972). The Business Cycle Today: An Introduction. Economic Research: Retrospect and Prospect, 1, The Business Cycle Today, l-38.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Buletova, N. E., Stepanova, E. V., Sharkevich, I. V., & Abdelsamiea, A. T. (2021). Statistical Study Of Inter-Sectoral Structure At Macro- And Meso-Levels Of National Economy. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 16-27). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.3