Abstract

The article is devoted to the methodology for assessing the level of financial security of retail enterprises. It has now been established that the determination of the level of financial security of an enterprise can be carried out on the basis of indicators of the financial stability of activities. The existing system of indicators is generalized and does not take into account the industry-specific nature of the activities of enterprises. In the presented article, the object of research is the activities of retail trade enterprises. We tried to find out whether it is possible for such enterprises to use generally accepted indicators of financial stability as a basis for assessing the level of financial security. In the course of the study, we calculated indicators for forty-one retailers. The obtained values of the indicators made it possible to adjust the threshold values for the indicators, taking into account the industry specifics of the analysed organizations. We have proposed a refined system of indicators, which became the basis for assessing the level of financial security of retail trade organizations. The definition of this level was carried out by assigning a specific number of points to all indicators available in the system. The conducted research allowed us to improve the methodology for assessing the level of financial security for retail companies. The proposed methodology makes it possible to assess their level of financial security most correctly and taking into account the industry specifics of the activities of retail trade organizations.

Keywords: Assessment of the level of financial security, indicator method, organization of retail trade

Introduction

In modern economic conditions, the issue of ensuring the financial security of the enterprise arises. In Russian economic publications there is no consensus on the definition of the concept of "financial security", each researcher gives it his own interpretation.

A brief review of publications on this issue (Anikina et al., 2020; Bakulevskaya, 2017; Blank, 2009; Manyaeva, 2019; Roznina & Karpova, 2019; Vagina, 2016) revealed that the concept of financial security is most often interpreted on the basis of a complex approach and has the following features:

- comprehensive measures to protect the enterprise;

- protection from external and internal financial threats and risks;

- sustainable operation of the enterprise;

- focus on the development of the enterprise in the current and future periods.

Blank (2009) was one of the first to reflect on an integrated approach in defining financial security. He pointed out that financial security is a conditional level of the financial condition of an enterprise, which ensures the constant protection of its financial interests from certain external and internal threats (real and potential), and its parameters are set based on financial philosophy and create the necessary conditions for the financial support of a sustainable growth in the reporting and future periods.

It is now well established that the financial security of an enterprise is associated with the stability of its financial condition (Fomin, 2018; Manyaeva, 2019). Various studies (Anikina et al., 2020; Badaeva & Tsupko, 2013; Bakulevskaya, 2017; Mirontseva et al., 2019; Roznina & Karpova, 2019; Vagina, 2016; Zimin, 2017) have demonstrated that the stability of the financial condition can be determined using a system of economic indicators. In this article, the object of research is the activities of a retail trade enterprise. As far as we know, there is no system of indicators that takes into account the specifics of the activities of retail enterprises and can be used to determine the level of financial security of these enterprises.

We tried to find out whether it is possible for such enterprises to use generally accepted indicators of financial stability as a basis for assessing the level of financial security. To assess financial security, it is the indicator method that is most often used (Anikina et al., 2020; Bakulevskaya, 2017; Mirontseva et al., 2019; Roznina & Karpova, 2019; Zimin, 2017). The use of the indicator method is based on a generalized assessment of the financial and economic activities of an enterprise, excludes subjective opinion by setting threshold values of indicators, and is also convenient and understandable. The assessment of financial security was carried out on the basis of well-known indicators with a modification of their threshold values, taking into account the specifics of the activity of a retail enterprise. We made a decision to establish the level of financial security of the enterprise on the basis of a point system. It should be noted that a correctly selected system of quantified indicators helps to identify financial dangers in a trading company in time and take measures to prevent them.

The presented article first describes the methods that were used to carry out the analytical study. The analysis of financial stability was carried out on the basis of a set of generally accepted indicators. To calculate the indicators, it was necessary to obtain data from the accounting (financial) statements. Then the specific results of the analysis are presented, reflecting the answer to the question about the possibility of using the generally accepted system of indicators to assess the financial security of a commercial enterprise in the field of retail. At the end of the study, the level of financial security for the surveyed enterprises was established.

Problem Statement

Methodology for assessing the level of financial security of a retail organization.

Research Questions

- Is it possible to use a generally accepted system of financial stability indicators to assess the level of financial security of a retail organization?

- Is it necessary to adjust the threshold values for the indicators under consideration?

- What indicators should be entered to take into account the specifics of the retail organization?

- How do I establish the financial security level of a retail organization?

Purpose of the Study

Development of a system of indicators, taking into account the specifics of retail trade, to assess the level of financial security of a retail organization.

Research Methods

The current study was aimed at assessing the level of financial security of retail organizations. The analysis of financial security was carried out on the basis of a system of indicators of financial stability (Badaeva & Tsupko, 2013; Bakulevskaya, 2017; Kurmanova & Galimardanov, 2018; Roznina & Karpova, 2019). These indicators were combined into groups for assessing liquidity, financial independence, business activity, profitability and development of the enterprise, which is presented in Table 2. To calculate the indicators, it was necessary to obtain data from the accounting (financial) statements.

The required data was taken from open Internet sources and from the Internet sites of trade enterprises of the Russian Federation from the section “For Investors and Shareholders”. In total, it was possible to collect and process data from the financial statements of forty-three retail organizations for 2017-2019. The list of companies with reference to the placement of financial statements is presented in Table 1.

The collected data were checked for completeness of information presentation for analysis. To analyze the data, we extracted information from the balance sheet and statement of financial results of each company. Based on the completeness criterion, two enterprises were excluded from the sample (Samberi LLC and LLC Titan Company). Thus, for further analysis, we selected the financial statements of forty-one Russian organizations, the main activity of which is retail trade.

In the considered financial statements for the calculation of financial indicators, specific values were selected from the reporting lines. At the same time, the values of the initial data for the lines from the balance sheet were determined as the average values for 2019 and 2018. All information has been transferred to previously prepared Excel spreadsheets. One part of the tables reflected the initial data for the analysis. The second part of the tables contained the results of calculations of typical indicators of financial stability. These results were obtained using the formulas for calculating the indicators under consideration. Formulas for calculating indicators are presented in Table 2.

Our research analyzed the financial performance of retail organizations. With the help of Excel tables and formulas of Table 2, the necessary calculations were carried out and the correspondence of indicators to threshold values was revealed. Threshold compliance testing revealed those indicators whose values deviate from the thresholds for most of the organizations that participate in the analysis, which is presented in Table 3 below.

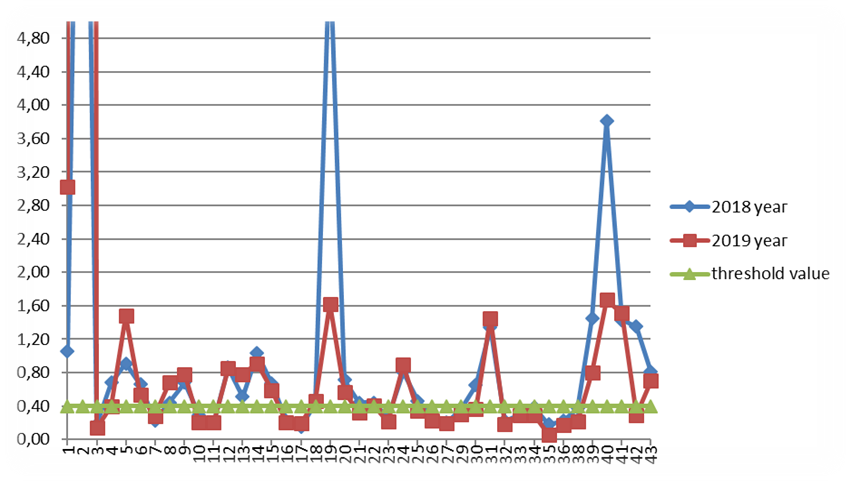

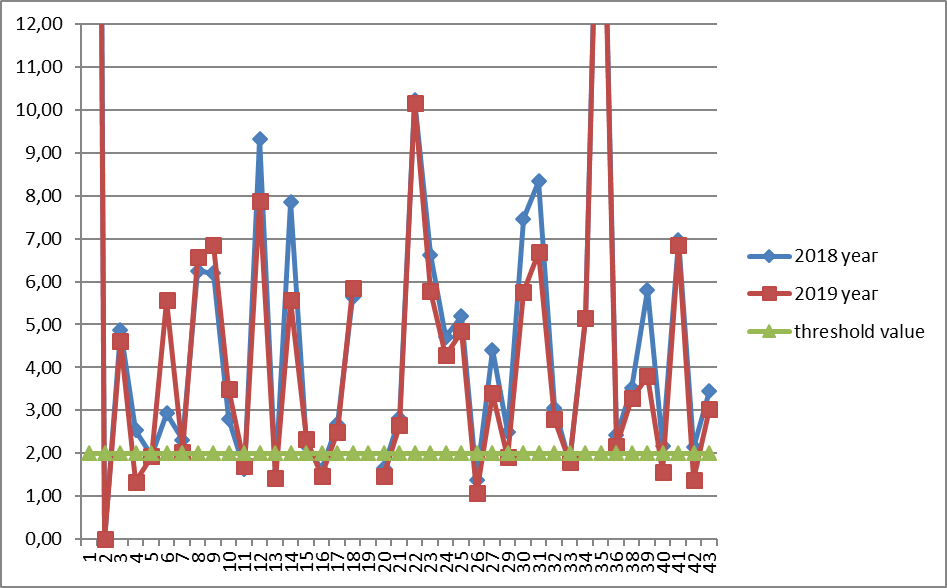

Thus, the threshold value of the quick liquidity ratio (0.5) was not reached in 20 enterprises in 2018 and 2019, and in another 3 organizations - in one of the studied periods. This can be explained by the peculiarity of the activities of the retail organization. This feature lies in the absence of large volumes of accounts receivable, since the sale of goods in most cases occurs simultaneously with the receipt of funds from buyers. In this regard, we considered it possible to adjust the threshold value of the quick ratio. If its threshold value is reduced by 0.1, it is possible to increase the number of enterprises with the corresponding threshold value by 6. Figure 1 (In the figures with graphs, the names of organizations are replaced by their number from Table 1) shows the distribution of the quick liquidity ratio values relative to the adjusted threshold value.

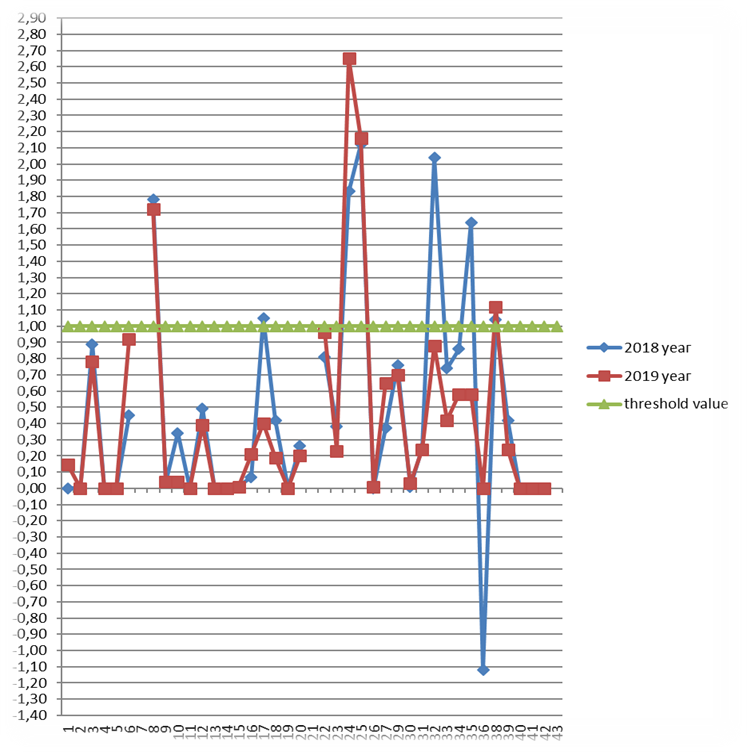

For the financial leverage ratio in the generally accepted method for assessing financial security, the threshold value is set at (Bakulevskaya, 2017; Kurmanova & Galimardanov, 2018). Calculations of this indicator for the companies under study showed that its value did not reach 3, and in most cases is in the range from 0 to 1, which is shown in Figure 2. This observation made it possible to reduce the threshold value of the level of financial leverage for retail organizations to 1. Within this case, the value of the indicator is more than 1, as well as less than 0, should be regarded as an increase in the level of financial risk, expressed in an increase in the likelihood of non-fulfilment of obligations to repay interest on loans and borrowings.

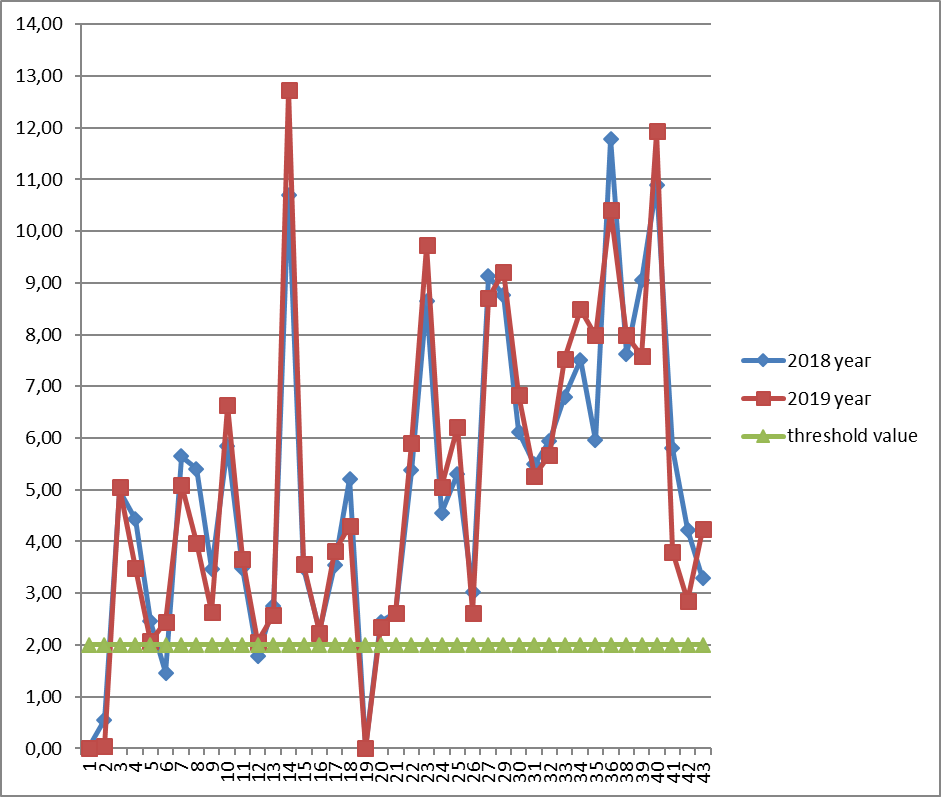

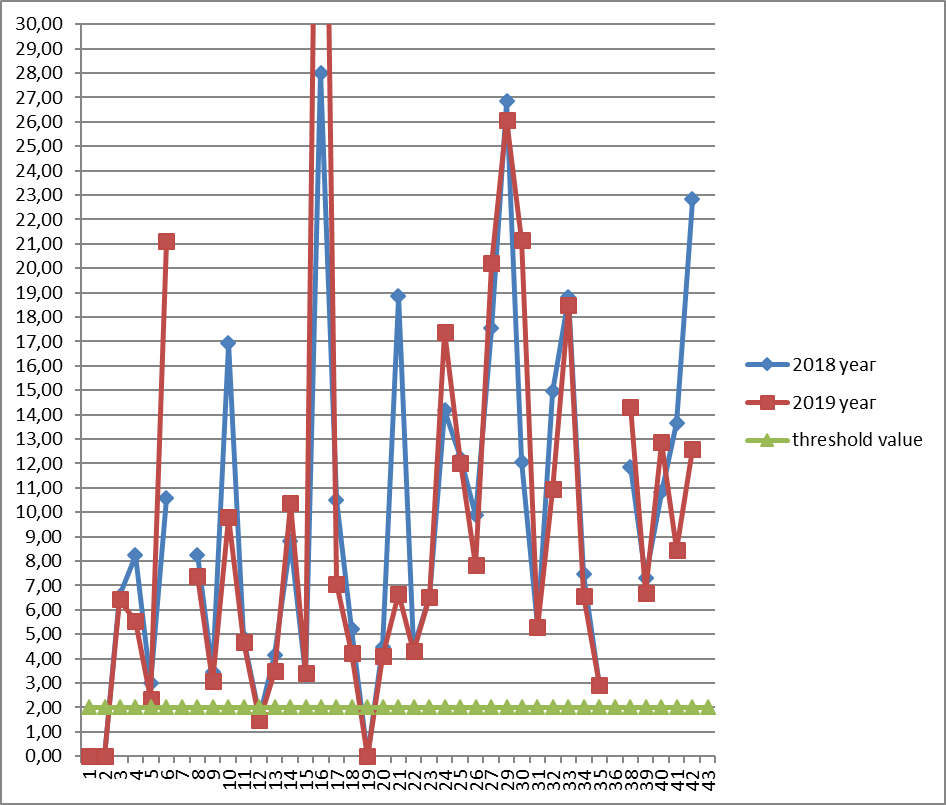

For the turnover ratios of current assets and equity in the generally accepted methodology for assessing the level of financial security, threshold values are not established (Badaeva & Tsupko, 2013). The calculation of these indicators for the studied enterprises allowed us to establish that for most companies their values exceed 2, which is clearly shown in Figures 3 and 4. Therefore, we considered it expedient to set this value as a threshold value. This value suggests that for every ruble of current assets and equity capital accounts for at least two rubles of revenue. Establishing a threshold value for the turnover ratios of current assets and equity capital made it possible to build on specific values, which made the procedure for analysing these indicators more understandable.

Also, our attention was attracted by the results of calculations of the accounts payable turnover ratio. The values of the indicator for the analyzed companies range from 0.02 to 79.77, but most of the values are in the range from 3 to 12. In the generally accepted methodology for this indicator, it has been established that its value should be less than the receivables turnover ratio (Bakulevskaya, 2017; Kurmanova & Galimardanov, 2018). This condition is also met for the analyzed enterprises. But we considered that it should be supplemented by setting a threshold value of 12. This value is due to the fact that the repayment of accounts payable must occur at least once a month (this is due to the need to pay wages, repay arrears on current supplies, pay taxes and insurance premiums).

It is generally accepted that the profitability of products and sales should strive for the maximum value (Badaeva & Tsupko, 2013). The calculation of these indicators for the studied retail outlets revealed a wide range of values. This spread did not allow the determination of the threshold value. However, the establishment of a threshold value is necessary to simplify the interpretation of the calculations. In this regard, we made a decision to select the industry average values of these indicators for the corresponding year as a threshold value for product profitability and sales profitability.

We removed 2 indicators of enterprise development from the system of indicators of the generally accepted methodology: the weighted average cost of capital and the level of investment depreciation. The exclusion of the "weighted average cost of capital" indicator is due to the fact that of all the indicators of the assessment methodology, only it is absolute. The calculated values of this indicator must be compared with each other, to track the dynamics; it is not possible to set a threshold value for this indicator, which complicates the interpretation of the obtained values. In addition, this indicator is most often used to assess the effectiveness of investment, which is not directly related to the assessment of the current financial security of the enterprise.

The investment depreciation rate could not be calculated due to lack of data. We assumed that this metric is not important for the chosen industry. This is due, among other things, to the fact that the bulk of the investment of funds of such enterprises is directed to current assets, and not to fixed assets and intangible assets. However, the exclusion of the indicator "level of investment amortization" from the general system of indicators is legal only for retail trade enterprises.

The specificity of the activities of the retail trade organization is associated with the need to analyze the turnover. The analysis of turnover involves the determination of inventory turnover. With the calculation of the inventory turnover ratio, we proposed to supplement the group of business activity indicators. The value of this indicator was determined by dividing the proceeds by the average annual cost of inventories for the corresponding year. The analysis of the values of the inventory turnover ratio allowed us to set the threshold value in the amount of 2. Figure 5 shows the distribution of the values of the considered coefficient relative to the set threshold value.

Since the activities of the retail trade organization directly depend on the supply of goods, in the field of financial stability, the analysis of the indicator "stock safety ratio" is important. It allows you to establish to what extent the stocks of the enterprise are financed by equity. We also recommended including this indicator in the system of indicators for assessing the level of financial security of retail companies. The calculation of this indicator was made by dividing the difference between the average annual cost of equity capital and the average annual value of non-current assets by the average annual value of stocks for the analyzed period. The threshold value for this indicator was taken as generally accepted - in the amount of 0.6. This value indicates that the formation of stocks at the enterprise should be financed to a greater extent from its own funds.

Thus, in order to assess the financial security of an enterprise, previous studies made it possible to form a list of indicators. The list of indicators is compiled in terms of efficiency and availability of the necessary information. For each indicator from the list, a threshold (normative or critical) value is defined. Comparison of the actual values of indicators with the threshold values, generalization of the results of the calculations made allowed us to draw a conclusion about the level of financial security of the enterprise.

Findings

The results of the study made it possible to define a system of indicators for assessing the financial security of a commercial enterprise associated with retail trade, and to adjust the thresholds for some indicators. This system, indicating the threshold values and conditions that ensure the permissible level of these indicators, is presented in Table 4.

The specified system of indicators formed the basis for assessing the level of financial security of retail organizations. The definition of this level was carried out by assigning a specific number of points to all indicators available in the system. For these purposes, an analytical table was compiled, consisting of three parts - the value of the indicators separately for 2018 and 2019, the threshold value for each indicator, the number of points from the comparison of the calculated and threshold value of the indicator separately for 2018 and 2019.

At the same time, points for indicators were set in the following order:

- if the calculated value of the indicator is better (more or less, depending on the condition that ensures financial security) the threshold value, then it was assigned 0 points:

- if the calculated value of the indicator for the analysed period is equal to the threshold value, then 1 point was assigned to it;

- if the calculated value of the indicator for the analysed period is less or more (depending on the condition ensuring financial security) the threshold value by no more than 50%, then 2 points were assigned to it;

- if the calculated indicator value for the analysed period is less or more (depending on the condition ensuring financial security) the threshold value by more than 50%, or a negative indicator value is obtained, then 4 points were assigned to it.

Diagnostics of the level of financial security of a retail enterprise for the corresponding period was carried out on the basis of summing up the points assigned to each indicator according to the information presented in Table 5.

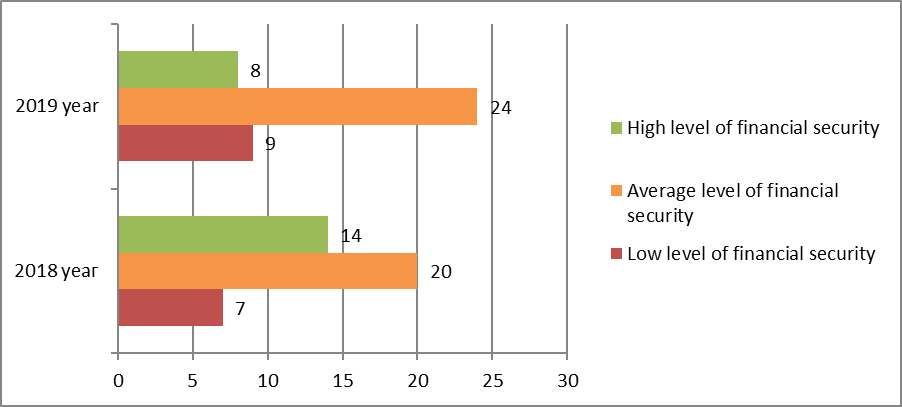

Comparison of the actual number of points with the data in Table 5 allowed the retailers under consideration to be attributed to a specific level of financial security. The results of this comparison are shown in Figure 6.

Thus, the diagram in Figure 6 shows that in 2018 34% of companies from the sample had a high level of financial security, for 49% of enterprises financial security was at an average level and 17% of companies had a low level of financial security. In 2019, the situation changed: 20% of retail organizations were diagnosed with a high level of financial security, most (58%) of companies had an average level and 22% of companies had a low level of financial security.

Thus, we were able to make sure that the generally accepted system of indicators for assessing the financial security of an enterprise can be used for retail companies (taking into account the above adjustments and additions). However, it should be noted that for calculating the indicators, data from the financial statements of 41 retail organizations for 2017-2019 were used. In the future, the study can be expanded and detailed by increasing the number of enterprises and analyzing indicators for 5-10 years.

Conclusion

Based on previous studies (Anikina et al., 2020; Badaeva & Tsupko, 2013; Bakulevskaya, 2017; Kurmanova & Galimardanov, 2018; Roznina & Karpova, 2019), we substantiated a system of indicators that can be effectively used to assess the level of financial security of retail companies. In our study, we checked the relevance of using financial soundness indicators to assess the level of financial security of a retail organization. We found that the thresholds for some indicators should be adjusted to reflect the specifics of the retail business. We have adjusted the threshold values for the quick ratio and the level of financial leverage. The results of calculating the indicators for the studied enterprises allowed us to establish threshold values for the turnover ratios of current assets and equity, as well as for the accounts payable turnover ratio. Also, in the course of the study, two indicators were excluded from the system of indicators (the weighted average cost of capital and the level of investment depreciation), which do not have a significant impact on the financial security of a retail enterprise.

The system of indicators proposed by us can be used by both internal and external subjects of economic analysis. Internal entities, based on the calculation of the presented indicators, will be able to determine the level of financial security of a retail enterprise, which will facilitate the adoption of managerial decisions to improve it. For external actors, the analysis of indicators of the financial security of a retail enterprise will contribute to making a decision on establishing contractual relations, issuing a loan, and investing in the activities of a trading enterprise.

We presented the level of financial security of a retail organization in three categories - high, medium and low. The specific category was allowed to determine the overall score, which is obtained by summing the points assigned to each indicator. The assignment of points to the calculated indicators was carried out on the basis of the deviation of their actual values from the threshold.

First of all, this is the first study known to us in which attention is drawn to the need to clarify financial indicators, taking into account the specifics of a retail company. Our results provide a reliable selection of indicators required to assess the financial security of such an enterprise.

However, some limitations should be noted. Although our hypothesis was statistically confirmed, the data sample covers only 3 years (2017, 2018 and 2019). Therefore, future research should include follow-up work aimed at assessing whether the findings and conclusions are maintained when analyzing indicator values over 5-10 years. You can also increase the number of retailers participating in the study.

The answer to the question whether it is possible to use the generally accepted system of financial security indicators in the analysis of the activities of trade enterprises became the goal of this work. The aim of the study was achieved, which is confirmed by its results. We were able to convince ourselves of the legitimacy of using generally accepted financial indicators for trading activities. At the same time, in some cases, it was necessary to clarify the threshold value of the indicators used, and two indicators were excluded from the list. Thus, our study contributes to the implementation of a reliable assessment of the level of financial security of a retail enterprise, which is important for the management of its activities.

References

Anikina, I. D., Kucherova, E. P., & Kareva, E. S. (2020). Improving the methodology for assessing the level of financial security of agricultural organizations. Accounting, analysis and audit, 2(7), 40-47.

Badaeva, O. N., & Tsupko, E. V. (2013). Assessment of the financial security of small and medium-sized enterprises. Russian entrepreneurship, 14(23b), 71-83.

Bakulevskaya, L. V. (2017). Financial security indicators of the organization. Innovative development of the economy, 6(42), 346-350.

Blank, I. A. (2009). Financial security management of the enterprise. Elga.

Fomin, V. P. (2018). Analysis and assessment of the financial component of the economic security of a commercial organization. Enterprise development problems: theory and practice, 3, 166-171.

Kurmanova, L. R., & Galimardanov, A. R. (2018). Indicators for assessing the financial security of an enterprise. Modern research and development, 6(23), 409-412.

Manyaeva, V. A. (2019). Toolkit for strategic accounting and analysis in the financial security system of a commercial organization. Innovative development of the economy, 5(53-2), 182-184.

Mirontseva, A. V., Kurochkina, E. S., & Telnova, E. V. (2019). Indicators characterizing the level of financial security. European Forum for Young Researchers, 198-202.

Roznina, N. V., & Karpova, M. V. (2019). Assessment of the level of financial security of the organization. Topical issues of the modern economy, 5, 13-125.

Vagina, N. D. (2016). Financial security of the enterprise: practical aspects. Economy and society, 31(12), 411-423.

Zimin, N. E. (2017). Assessment of the financial security of enterprises by indicators of capital utilization. International scientific journal, 2, 34-37.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Romanova, I., & Berdnikova, N. (2021). Improvement Of The Financial Security Level Assessment Methodology For Retail Trade Organizations. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 2302-2315). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.257