Abstract

This article in the context of the ongoing large-scale reforms in the Republic of Uzbekistan and the need for an accelerated renewal of fixed assets, leasing is of particular importance as a form of financing the investment activities of economic entities. It is advisable to use state private enterprise mechanisms to support agricultural producers. Lease financing is an effective tool for increasing the competitiveness of agricultural producers. The competitiveness of domestic agricultural producers is largely determined by their technical equipment. Low profitability, reduced production efficiency, lack of funds, significant debt of many agricultural organizations hinder the implementation of programs for the long-term development of the agricultural sector. The effective functioning of the modern economy is largely determined by the quality of interaction between the state and business. In the national economy, as in the economic systems of a number of foreign countries, the concept of public-private partnership (PPP) is being actively implemented.

Keywords: Financing the investment activities, digital economy, small business and entrepreneurship, innovative development, information and communication technologies

Introduction

In the context of the ongoing large-scale reforms in the Republic of Uzbekistan and the need for an accelerated renewal of fixed assets, leasing is of particular importance as a form of financing the investment activities of economic entities. Leasing is one of the types of investment activities. Without requiring large one-time expenses of their own funds from enterprises, leasing will allow attracting into various sectors of the national economy previously unused opportunities of the domestic capital market, as well as funds from foreign investors. The effective functioning of the modern economy is largely determined by the quality of interaction between the state and business (Belitskaia, 2012). In the national economy, as in the economic systems of a number of foreign countries, the concept of public-private partnership (PPP) is being actively implemented. In a broad sense, any interaction between the state and business, involving co-financing from the state, participation in capital, delegation of authority to manage the object of the agreement, transfer of property rights to a private partner, etc., can be interpreted as a PPP, which makes it possible to attribute the implementation of targeted programs and national projects, special economic zones, technoparks and technopolises, the formation of integrated structures (state corporations), clusters, investment and venture funds for the forms of PPP (Alimova, 2020a). The form of interaction between partners in PPP in practice represents not only a legal, but also an organizational, financial basis for the implementation of a theoretical model. The variety of forms and mechanisms of PPP allows using not only single, but also combined management models.

Problem Statement

Small business organizations in the private sector require the state's attention to support its efforts in the implementation of socially significant tasks (Alimova, 2020b). The Constitution of the Republic of Uzbekistan defines the right of citizens to vote and to be elected, the foundations of the national electoral system, the basis of which are the Universal Declaration of Human Rights, the International Covenant on Civil and Political Rights and ratification by Uzbekistan, constituting the principles of democracy, including independence, legitimacy, transparency and fairness, enshrined and recognized in other international legal instruments (Madumarov et al., 2021). A private company during the period of the PPP contract can increase its financial stability and the overall profitability of the business both through technological, production, management innovations, and through the use of state assets. In partnership with business, the state acts as an exponent of socially significant interests and goals, and controls the implementation of public interests by participants in public-private partnerships. The state, being a participant in the economic turnover, is interested in the effectiveness of the overall results of PPP projects, and in obtaining its own commercial effect. Leasing is one of the most significant forms of PPP acceptable for the implementation of cooperation.

Research Questions

The study of economic relations in the use and application of prerequisites for the development of a leasing mechanism in public-private partnership.

Purpose of the Study

The aim of the study is the use and application of prerequisites for the development of a leasing mechanism in public-private partnership.

Research Methods

During the study, methods of observation, methods of induction and deduction, time series, economic statistics, analysis and synthesis, statistical grouping, research monograph, structural analysis, comparative analysis and other methods were used.

Findings

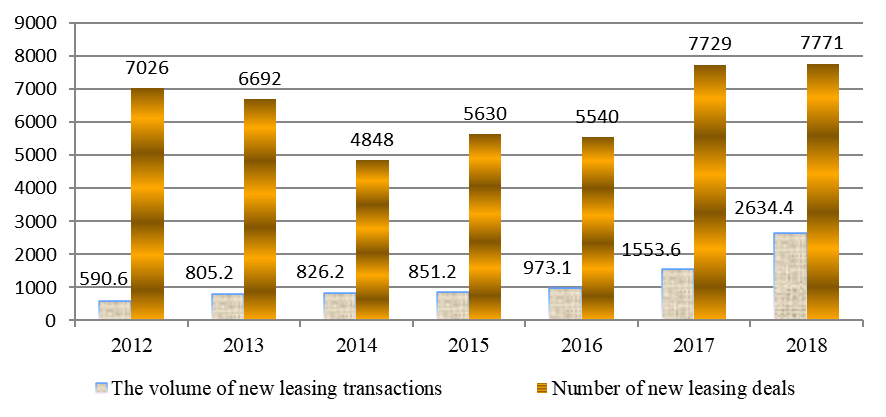

Leasing activity as a type of investment activity has significant financial, practical, service organizational and operational advantages. The use of leasing mechanisms strengthens the position of the private sector, which, entering into partnerships with the state, not so much seeks to apply innovative management technologies, but rather to invest capital more profitably and extract maximum profit. In general, the use of public-private partnership projects is not yet sufficiently conducive to the formation of partnerships between business and the state, on the one hand, and the sustainable development of the leasing market in Uzbekistan. The development trend of the domestic market for leasing services determines the fact that the demand from the small business sector and private entrepreneurship for modern high-tech equipment should contribute to the development of leasing relations in the republic. The analysis of the leasing market in the Republic of Uzbekistan was prepared on the basis of official data provided to the Association of Lessors of Uzbekistan by leasing companies and commercial banks. The number of lessors in Uzbekistan was found to be actively engaged in leasing activities of 47 lessors, of which 15 are banks (Umarov, 2021). At the end of 2018, the volume of new leasing transactions amounted to 2.6 trillion. soums, the total portfolio of leasing operations exceeded 4.0 trillion. soums., however, in the aggregate portfolio, the portfolio of the National Bank for Foreign Economic Affairs of the Republic of Uzbekistan was not taken into account for a total of 1 trillion. sum. The volume of new leasing transactions at the end of 2018 increased by 69.6%, which is 1080.8 billion soums more compared to the same period last year and amounted to 2,634.4 billion soums. It is also worth considering that at the end of 2017, there was a liberalization of foreign exchange policy in Uzbekistan, which almost doubled the exchange rate of foreign currencies against the national currency “soum”. The market leaders in 2018 were primarily the agricultural sector, real estate and road transport, in particular freight transport. The strong market size was also supported by growth in the process equipment sector. The number of concluded leasing transactions in 2018 increased slightly and amounted to 7771 transactions (see Figure 1).

Compared to 2017, the number of new leasing transactions increased by almost 1%, or rather 42 more transactions. The growth trend in the volume of new leasing transactions is distributed among the “players” in the leasing market as follows. At the end of 2018, the trend in the distribution of the leasing market among lessors changed; currently, 73% of the market belongs to leasing companies. As for commercial banks, compared to the results of 2017, the volume of leasing services provided decreased, and their market share in 2018 was 27.4%. However, PPP parties should strive to find new and develop positively proven forms of effective cooperation (Umarov, 2018).

And the growth potential of public-private cooperation will largely be determined by the role of the private sector in solving social problems formulated by state bodies, and primarily by regional ones.

Support for small businesses and private entrepreneurship is aimed at business activity and the growth of efficiency, a number of tasks are envisaged, including:

- forming innovative activity in the small business environment;

- support for the modernization of production technology and the growth of capital labor ratio at small business facilities;

- assistance in financing effective innovative projects of organizations;

- forming the export-oriented potential of small and private businesses;

- support for beginner STARTAP projects;

- assistance in the organization of new jobs;

- quality development of infrastructure to promote entrepreneurship;

- introduction of progressive forms of business activities, etc.

To achieve the goal, financing measures are needed that would be made on the basis of budget funds:

- support of existing innovative firms - subsidies to small businesses and private entrepreneurship associated with the production and sale of products;

- subsidizing leasing transactions for those business entities that actively and effectively modernize technological processes and replenish fixed assets, reimburse part of the cost of lease payments;

- reimbursement of part of the costs of paying the first installment;

- start-up entrepreneurs are provided with targeted grants for the payment of the first installment on the terms of equity financing;

- support for start-up small innovative firms and entrepreneurs by providing grants for the creation of innovative companies with the participation of a leasing financing mechanism;

- creation of the Fund for the Promotion of Investment in Small and Private Entrepreneurship;

- popularization of entrepreneurial activity. Subsidizing leasing transactions aimed at modernizing technological processes and replenishing fixed assets;

- compensation for part of the costs of lease payments, for the payment of the first installment;

- provision of targeted grants to novice businessmen on the terms of equity financing for the payment of the first installment. Provide in accordance with the financing procedure for subsidizing lease payments, which provides for a reduction in the cost of leasing services: for lease payments - no more than 2/3 of the Central Bank's refinancing rate at the time of payment of lease payments (Odiljon, 2021);

- for the first installment - 50% of the amount actually paid for the first installment under the lease agreement. Newly registered business entities and operating for less than one year at the time of granting the subsidy, the grant was provided in the form of a gratuitous and non-refundable subsidy for equity financing of targeted expenses for paying the first installment under a lease agreement in the amount of 50%, per recipient of funds - an individual entrepreneur or legal entity.

It is advisable to use state private enterprise mechanisms to support agricultural producers. Lease financing is an effective tool for increasing the competitiveness of agricultural producers. The competitiveness of domestic agricultural producers is largely determined by their technical equipment. Low profitability, reduced production efficiency, lack of funds, significant debt of many agricultural organizations hinder the implementation of programs for the long-term development of the agricultural sector. This is largely due to the deterioration of the material and technical components of the business. The low level of technical equipment and the high level of deterioration of the machine and tractor fleet are the reasons for the decrease in the volume of agricultural production, the reduction of acreage and the number of livestock. In cases when decisions of an election commission are declared invalid, the election commission that adopted them shall be obliged to prove the circumstances on which these decisions were based (Madumarov & Turdiyeva, 2020). There is a need to implement measures in the current conditions to solve the problem of financing the technical re-equipment of agricultural producers without state support is practically impossible.

Conclusion

The special status of agricultural production as an activity that ensures food security in Uzbekistan during a pandemic and quarantine necessitates the establishment of leasing in the agro-industrial complex (AIC). Especially in recent years, we can see an increase in women's participation in entrepreneurship, private and family business. In the current conditions, significant financial support from government agencies is required. The development of lending to agricultural producers, low self-sufficiency of rural enterprises, high dependence on natural conditions further increase the need for state support in the leasing process. Thus, one of the promising forms of state support for agricultural producers with the use of budgetary funds is the provision of the agro-industrial complex with machine-building products and pedigree cattle on the basis of leasing under the conditions of a state private enterprise.

References

Alimova, G. A. (2020a). Foreign Experience In Indexing The Amount Of Pensions. The American Journal of Social Science and Education Innovations, 2(11), 472-477.

Alimova, G. A. (2020b). Increasing The Effective Use Of Human Capital In The Digital Economy. The American Journal of Applied sciences, 2(11), 127-130.

Belitskaia, A. V. (2012). Pravovoe regulirovanie gosudarstvenno-chastnogo partnerstva: monografiia [Legal regulation of private-public partnership: monograph]. Statut Publication.

Madumarov, T. T., & Turdiyeva, S. R. (2020). Protection of women's rights. International journal of discourse on innovation, integration and education, 1(5), 175-178.

Madumarov, T. T., Samatov, D. T., & Gulomjonov, O. R. (2021). The Institutional Mechanisms Of The Development Of The Electoral System In Uzbekistan. European Journal of Molecular & Clinical Medicine, 7(8), 4378-4384.

Odiljon, G. (2021). Stages of combating corruption in the Republic of Uzbekistan. Middle European Scientific Bulletin, 8.

Umarov, I. (2018). Analyzes of Consumption of Food Products in Gross Domestic Production in Uzbekistan. International Journal of Science and Research (IJSR), 7(12), 490.

Umarov, I. (2021). Ways To Develop Entrepreneurship In The Food Industry. The American Journal of Applied sciences, 3(01), 153.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Madumarov, T. T. (2021). Prerequisites For The Development Of A Leasing Mechanism In Public-Private Partnership. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 2283-2288). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.255