Abstract

The corporation's fund network is one of innovative methods of financial turnover management. One of the most relevant procedures of this method is to determine the size of separate segments of the fund network, in particular, its intra-network turnover. This segment includes four financial flows that implement the corporation’s target function and form a closed loop. The purpose of the article is to develop an indicator characterizing the value of the intra-network turnover. The complexity of the problem is caused by the fact that each of the intra-network flows has different value (module). The authors presented three of the most realistic variants of indicator design. On the basis of a comparative analysis of these options they have proved the expediency of determining the intra-network turnover value by the smallest module of its flows, given the formula for determining the indicator. As its name it is proposed to take “value of ordinary activity”. The authors consider the indicator’s significance for corporate finance management. It can not only most objectively reflect the value of the intra-network turnover, but also localize the flow which is the most problematic segment (“bottleneck”) of the intra-network turnover and characterize its output. Comparison of the value of ordinary activities with the modules of remaining intra-network flows allows us to determine additional work performed by the corporation in each phase of its financial turnover. This work is proposed to be considered as losses, as well as reserves for improving the financial turnover management.

Keywords: Fund network, intra-network turnover, flow

Introduction

From the perspective of corporation financial classification, its business process is a financial turnover – a cyclic motion of assets due to current activities (Surkova et al., 2020). The fund network of a corporation is one of the financial turnover models. It is represented by a set of virtual financial funds corresponding to the phases of financial turnover, connected by financial flows with each other, as well as with the external environment (Lapenkov & Lapenkov, 2018).

The fund network is also a fund that relates to the business process as a whole. It has the fund’s qualities, as well as all its attributes. At the same time, it differs in its composite structure from a regular fund corresponding to one of the financial turnover phases. The structure of the corporation's fund network includes four virtual financial funds corresponding to the phases of financial turnover. Fund E corresponds to the Production phase, Fund A to the Sales market phase, Fund K to the Capital market phase, and Fund B to the Supply market phase.

These funds are connected by intra-network financial flows, forming a closed loop, realizing the target function of the corporation.

Funds E and A are linked by the financial flow “Deliveries to buyers”. Its module M (E ~ A) reflects the value of products, works, services, elements of production assets supplied by the corporation to the sales market, payable or paid by buyers, including the cost of sold goods, works, services, taxes, profit-financed expenses.

Funds A and K are linked by the financial flow “Income from buyers”. Its module M (A ~ K) reflects the value of means of payment received by the corporation from buyers and customers.

Funds K and B are connected by the financial flow “Payment for production resources”. Its module M (K ~ B) reflects the value of production resources paid by the corporation. It can also be viewed as the value of means of payment used to pay for these resources.

Funds B and E are connected by the financial flow “Input of production resources”. Its module M (B ~ E) reflects the cost of inventory items, works, services provided to the corporation by its counterparties – suppliers and contractors.

In addition, there is a number of financial flows connecting funds with the external environment, which are not considered in this article.

Depending on the composition of financial flows, the financial turnover represented by the fund network is differentiated into two parts: intra-network turnover and external activity. To manage the financial turnover, we need the indicators characterizing the size of each part.

Intra-network activity implements the target function of the corporation. This is productive activity. It is the result of using the assets complex.

Intra-network flows move assets created and maintained by the fund network that are the most valuable part of financial performance. Under normal conditions, all of the above-mentioned flows should be present in the fund network. The absence of at least one of them may indicate a crisis of the business process intra-network part.

The foregoing proves the relevance of the indicator characterizing the value of the intra-network turnover for corporate finance management. However, there is currently no such indicator in analytical tools for corporate finance departments (Amini, 2019; Prodanova et al., 2019).

Problem Statement

The intra-network turnover is represented by four financial flows forming a closed loop.

Obviously, the indicator characterizing the value of the intra-network turnover should take into account the modules of these flows. Our practical experience (Lapenkov & Sakharova, 2020) shows that a common characteristic of intra-network financial flows is the difference in their modules. Therefore, taking this difference into account is the main problem that needs to be addressed when developing an indicator of the intra-network turnover value.

Research Questions

Indicators used in corporate financial management must meet certain requirements (Golov et al., 2019; Jancik, 2002; Ross et al., 2019). Let us indicate the most important of them for the discussed indicator.

First of all, a quantitative assessment of the object under study is desirable. It ensures the accuracy and unambiguity of the assessment and allows the use of mathematical tools (Batkovsky et al., 2019). It is quite simple to implement this requirement for the developed indicator, since the flows modules of the intra-network turnover are quantitative values.

The indicator should provide a mono criterion assessment of the intra-network turnover, since a poly criterion assessment is usually associated with the use of methods containing a significant subjective factor, such as expert assessments (Amini, 2019; Kamaletdinov et al., 2017). Fulfilment of this requirement is important and the most difficult for the intra-network turnover indicator due to the difference in the modules of the flows that form it.

The indicator should properly reflect the state of the intra-network turnover. The change in the modules of the intra-network turnover flows, their difference, activity absence in any segment should be reflected in its value. Otherwise, it does not provide an objective assessment of the intra-network turnover.

It is desirable that the information base for the indicator calculating is a part of the corporation's financial statements.

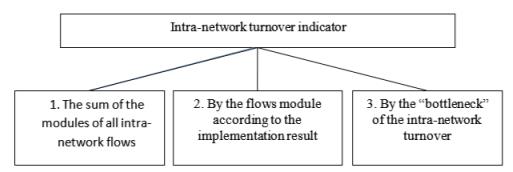

Various methodological approaches can be proposed to create an indicator that meets the listed requirements. The most logical of them are shown in Figure 1. Each of them provides a quantitative mono criterion assessment, takes into account the modules of intra-network turnover flows which are determined on the basis of the corporation's financial statements.

Let's consider these options and determine the indicator that is most appropriate to use to assess the intra-network turnover.

Purpose of the Study

The purpose of the study is to determine the indicator of the intra-network turnover value based on a comparative analysis of its possible options presented in Figure 1.

Research Methods

The first of the options under consideration involves the determination of the indicator by summing the modules of all intra-network flows:

M(S) = M(E~A) + M(A~K) + M(K~B) + M(B~E) (1)

where M(S) is an indicator characterizing the value of the intra-network turnover of the corporation's fund network,

M(E~A) is the module of the flow “Deliveries to buyers”,

M(A~K) is the module of the flow “Income from buyers”,

M(K~B) is the module of the flow “Payment for production resources”,

M(B~E) is the module of the flow “Input of production resources”.

The main advantage of this indicator’s construction is that it takes into account the modules of all intra-network turnover flows.

This summation is logical. Each of these flows reflects different in content result of the activity of a particular financial turnover phase and the corporation’s functional department which is in charge of this phase. Assets’ type in each of the mentioned flows is different from the others. The modules sum is the total amount of various asset’s types, created and stored in the fund network.

Such an indicator is also quite acceptable from the perspective of the corporation's public utility, if the modules of intra-network flows are considered as the benefits brought to its counterparties: M(E~A) is the cost of products, works, services received by buyers and customers; M(A~K) are assets that have entered the financial sector of the economy, for example, that have become resources of the banking system, etc. The corporation often appeals to the category of public utility when it expects to receive a bonus from the authorities, for example, a soft loan.

However, this option is not suitable for practical application for the following reasons:

- The module of each intra-network turnover flow usually reflects the movement of the same value in its different sections. Therefore, at present, the summation of these modules is regarded by specialists as a repeated counting of the same value.

- With a high sum of modules of intra-network turnover flows, some of them may equal 0. That is, even with a crisis state of the business process, expressed in the activity absence in any of its segments, the indicator of intra-network activity can be assessed as satisfactory. This indicator value does not adequately reflect the state of the intra-network turnover.

Therefore, to assess the result of intra-network activity, it is advisable to use the alternative approaches shown in Fig. 1. The second and the third options provide for the estimation of the intra-network turnover value by the only module of its flows. The module of the selected flow acquires the status of the main assessment indicator – criterion. And all the rest of the corporation's intra-network activities are considered to provide this result.

The difference between these options is due to the approach to determining the financial flow, module of which is used to characterize the value of the intra-network turnover.

The second methodological approach is based on modern economic realities, which imply the corporation's performance assessment based on its implementation result. This result is presented in the corporation’s financial statements in the form of its income, the corresponding expenses, as well as the profit or loss generated on their basis (Batkovsky et al., 2019; Prodanova et al., 2019). An example is the corporation's Statement of Financial Results.

In the intra-network turnover, the flow “Deliveries to buyers” fits the implementation result adequately. Therefore, its module M(E~A) can be used as a measure of the intra-network turnover value. The formula for determining the indicator takes the form:

M(S) = M(E~A) (2)

The important advantage is its compliance with modern economic practice.

However, M(S) does not take into account the modules of the remaining intra-network turnover flows that differ from M(E~A). This not only contradicts the above requirements for the indicator characteristics, but also burdens it with the well-known problem of modern corporate finance. Its essence is that a high implementation result, determined by the accrual method, reflected in the financial statements of a corporation, is not a guarantee of a satisfactory financial and economic condition. In particular, with a high shipment and a satisfactory financial result, the corporation may be insolvent if the buyers do not pay for the received products, works, and services.

In the corporation’s fund network, this unconformity is expressed in the difference between the modules of the flows M(E~A) and M(A~K). Moreover, with a significant M(E~A), the modules of other flows of the intra-network turnover can be significantly smaller and even equal to 0. That is, even in a crisis state of the business process outside the segment associated with the implementation activity, the indicator of the intra-network turnover determined by the formula (2) may look satisfactory. It is not able to properly reflect the state of the whole intra-network turnover.

This disadvantage does not disappear if, instead of M(E~A), you use a module of any other intra-network turnover flow, for example, M(A~K), which is associated with payment for corporation products. Due to the considered disadvantage, the module of any single fixed flow of intra-network turnover is not advisable to use as an indicator characterizing the intra-network activity value.

The most successful option is to determine the indicator value by the flow module considered as “bottleneck” of the intra-network turnover, that is, by its most problematic segment. This “bottleneck” is the intra-network flow with the smallest module. This module is proposed to be used as an indicator characterizing the intra-network activity value. The formula for determining the indicator in this case will take the form:

M(S) = min{M(E~A); M(A~K); M(K~B); M(B~E)} (3)

This methodological approach lacks the main disadvantage of the previously considered ones – the overestimation of the real result of intra-network activity. The module of any of the intra-network flows can be the smallest. This flow limits its output. It characterizes that volume of activity that is present in each section of the intra-network turnover. This value is reasonable for each of its phases, and, therefore, for the business process as a whole.

Findings

The intra-network turnover results evaluation according to the “bottleneck” of the fund network ring allows to include the category of ordinary activity in the tools of managing financial turnover. This is the greatest equal value of assets in the module of each intra-network flow in the period under study. Ordinary activity has the following important properties:

- it is present in the module of each of the intra-network turnover flows;

- it is the most valuable part of the corporation's intra-network activity;

- it is equal to the smallest of the modules of intra-network turnover flows;

- it does not change the structure of the corporation's assets stocks.

Formula (3) can be used to determine it. Ordinary activity is precisely the indicator that is recommended to be used to assess a corporation's intra-network turnover.

Given the properties of ordinary activities, it is advisable to consider it as one of the most important indicators of a corporation’s financial activity and use it for assessing the productivity of the business process as a whole. In this case, the growth of ordinary activities becomes an urgent direction of increasing the corporation productivity.

This activity is called ordinary for the reason that every corporation should strive for it under normal conditions. Ideally, the module of each of the intra-network turnover flows should contain only ordinary activities. In this case, the modules of all intra-network flows will be the same.

The uniformity of the modules of intra-network turnover flows is an important goal for a corporation. If they are the same, then all products supplied by the corporation to the market are paid by the buyers. All funds received in this case are used to pay for production resources. All paid resources go into production, where they are completely consumed. Stocks of assets and associated debt liabilities do not increase or decrease. This property is easy to prove, since it follows from the balance equations of funds from the fund network.

Such activities of the corporation are characterized by a high balance, minimum of conflicts with counterparties regarding the current interaction. The corporation is functioning like a single well-oiled machine.

However, in reality, most corporations have different intra-network turnover flow modules. Therefore, the largest equal amount of assets in the module of each of them is equal to the smallest of these modules. Intra-network flow, by the module of which we determine the ordinary activities value, is a “bottleneck” of the business process. And to localize it in the fund network and determine the value, the above the formula (3) is used.

Ordinary activity may be absent in the study period. This happens when the module of at least one of the flows of the intra-network turnover is equal to 0. This means that there is no corresponding type of intra-network activity in the study period and is regarded as a crisis state of the corporation. A well-known example of such a state is non-payment by buyers and customers for the products supplied to them. At the same time, M(A~K) = 0, this module becomes the smallest in the intra-network turnover, and ordinary activity is equal to its value.

Conclusion

As an example, let us define the value of a corporation’s ordinary activities, considered in the work of Lapenkov and Sakharova (2020). Table 01 reflects the modules in the intra-network turnover flows of this corporation’s fund network.

If the value of the intra-network turnover was estimated by the traditional method, that is, by the formula (2) according to the module of the flow “Deliveries to buyers”, then it would be equal to 2455 million rubles.

Using the formula (3), we determine the amount of ordinary activity:

M(S) = min {2455; 2396; 2438; 2472} = 2396 million rubles.

The amount of 2396 million rubles should be considered as an indicator of the corporation's intra-network turnover.

The difference between the traditional and the proposed evaluation methods is: 2455 – 2396 = 59 million rubles. This difference reflects the cost of products supplied by the corporation to buyers and customers, but not paid by them, that is, the increase in receivables from these counterparties in the period under study.

The value of 2396 million rubles limits the output of the corporation's intra-network turnover in the period under study. This value should be guided by, when planning production, marketing, payment and support activities.

On its basis we can determine excessive volumes of the corporation's activity in the period under study, which should be considered as losses, as well as reserves for improving the financial turnover.

As noted above, over-supplied products to buyers and customers led to the increase in their accounts receivable by 59 million rubles.

The excess supply of production resources amounted to 2472 – 2396 = 76 million rubles.

The expenditure of means of payment for these resources exceeded the required amount by 2438 – 2396 = 42 million rubles.

The financial flow “Income from buyers”, according to which module the amount of ordinary activity is determined, is the tensest segment – the “bottleneck” of the intra-network turnover. Measures to improve the corporate finance management should primarily relate to this segment of the intra-network turnover.

References

Amini, A. S. (2019). Entwicklung eines methodenbasierten Modells zur Messung und Bewertung der Produktivität von Dienstleistungsprozessen. Fraunhofer Verlag.

Batkovsky, A. M., Kravchuk, P. V., & Styazhkin, A. N. (2019). Осеnka ekonomicheskoy effektivnosti proizvodstva vysokotehnologichnoy produkcii inovacionno-aktivnymi predpriyatiyami otrasli. [Evaluation of the economic efficiency of the production of high-tech products by innovative and active enterprises of the industry (standards CDIO)], Creative Economy, 13-1, 115-128. [in Rus.] DOI:

Golov, R., Alkhimovich, I., Kazarnovskij, V., & Ermolaeva, E. (2019). Development of a mechanism for assessing the economic sustainability of small enterprises, E3S Web of Conferences, 91, 08052. https://doi.org/

Jancik, J. M. (2002). Betriebliches Gesundheitsmanagement. Vlg Gabler.

Kamaletdinov, A. S., Litvinov, A. N., Danilina, M. V., Kirpicheva, M. A., Delia, V. P., Ivanova, N. V., Surkova, E. V., & Sorokina, A. V. (2017). Management of companies in the digital economy, International Journal of Economic Research, 14(15), 9-13. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85044710528&partnerID=40&md5=38e353715b7dd56f86a1b57a079b097

Lapenkov, V. I., & Lapenkov, I. V. (2018). Fondovaya set biznes-processa korporacii [The stock network of the corporation's business process (standards CDIO)]. INFRA-M, [in Rus.].

Lapenkov, V. I., & Sakharova, N. F. (2020). Ocenka produktivnosti fonda v sostave fondovoy seti corporacii [Evaluation of the fund's productivity as part of the corporation's stock network (standards CDIO)], Discussion Magazine, 102, 18-28. [in Rus.].

Prodanova, N. A., Plaskova, N. S., Dikikh, V. A., Sotnikova, L. V., Nikandrova, L. K., & Skachko, G. A. (2019). Techniques for assessing the investment attractiveness of a commercial organization based on classical methods of strategic economic analysis, International Journal of Economics and Business Administration, 7(4), 35-46. DOI:

Ross, S., Westerfield, R., & Jordan, B. (2019). Essentials of Corporate Finance. McGraw-Hill Education.

Surkova, E., Klonitskaya, A., & Ermolaeva, E. (2020). Modeling business processes of complex organizational systems, E3S Web of Conferences, 164, 10040. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85085252403&doi=10.1051%2fe3sconf%2f202016410040&partnerID=40

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Lapenkov, V. I., & Sakharova, N. F. (2021). Indicator Of Intra-Network Turnover Value In Corporation’s Fund Network. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 2148-2155). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.241