Abstract

This article presents an assessment of the state and development perspectives of the pharmaceutical substances market in Russia. The pharmaceutical industry occupies a significant place — its share in the total industrial production is 1.3%. In this work, the features of the Russian pharmaceutical market, objects of export and import of pharmaceutical substances are considered, and also forecasts of the development of the market of pharmaceutical substances for the near future are presented. Providing the production of drugs of pharmaceutical substances is the key to the stability of the industry and an important factor in ensuring the national security of the country. Currently, in the context of economic sanctions, the revival of the production of domestic (Russian) substances is relevant. The pharmaceutical industry uses about 9.7 thousand tons of substances per year, of which about 1.9-2.4 thousand conventional tons are produced by Russian enterprises. The obtained results can be used in the pharmaceutical industry to improve the reliability of forecasts of the situation on the pharmaceutical substances market, as well as to build more general models.

Keywords: Substance, drug market, marketing research, pharmaceutical market

Introduction

Nowadays the pharmaceutical market is an important component of the economy of any country. 2020 demonstrated that the developed markets survived the quarantine much easier than underdeveloped ones. Obviously, the crisis makes it possible to identify the weaknesses of both the entire pharmaceutical industry and individual enterprises. The Russian pharmaceutical market is one of the ten biggest world markets (Beloborodova et al., 2020). One of the main reasons for this is the increased attention of citizens to their health, an increase in the average age of the population and the state's tendency to import substitution of products (Fedorova & Fedotova, 2015).

All firms involved in this industry should pay special attention to marketing research in order to increase the profit of the enterprise. Currently, the problem of market research is extremely relevant for all enterprises and organizations. Turning to international practice, it can be noted that for successful and progressive development, it is necessary to use new approaches aimed at meeting the needs of society. For example, in a number of European countries, special attention is paid to the development of digital sales channels (Pieriegud, 2019). At the same time this market is highly regulated, therefore the review made by Marcão and his colleagues (Marcão et al., 2020) deals with the introduction of elements of gamification in the development of methods for assessing product quality. The latter approach is directly related to the motivation of employees, which is directly related to the efficiency of the company in such a competitive and at the same time highly regulated market. At the same time, the Asian and Middle Eastern experience in this area is important in analyzing the development of the industry in the Russian realities. An analysis of the development of the Indian pharmaceutical market (Gubina, 2019) showed that government support in the country can lead to colossal positive results. But it should be borne in mind that the strategy of import substitution and support of domestic manufacturers should have clear boundaries and operate for a limited time. The experience of Iran (Mamedyarov, 2018) has shown that even in the presence of external sanctions, the development of this industry is undoubtedly possible. This may be additional development triggers after the removal of external restrictions on international cooperation, which obviously may be relevant in the future for Russian manufacturers as well.

Turning to the state of the market of pharmaceutical substances in Russia, it is necessary to consider the whole range of problems revealed by researchers in this market segment (Bondarenko et al., 2020; Golikova et al., 2020a, b; Krylova et al., 2020; Manturov, 2018; Melnik & Golysheva, 2017; Merkuryeva & Smirnovc, 2019; Mingazov et al., 2019; Zhilyakova et al., 2020). Attention is paid not only to the marketing and production component, but also to the educational one in this area (Golikova et al., 2020a, b), which connected well with the similar publications (Marcão et al., 2020). The main trend is closer cooperation between educational organizations and production sites. It also emphasizes the need to familiarize with international experience in this area.

An analysis of the development of pharmaceutical industry is considered by Manturov (2018), where the current transformations of the industry are highlighted. The main trend there is the transition to personalized medicine, regenerative medicine, as well as an interdisciplinary direction of general development. The study of the experience of individual companies (Bondarenko et al., 2020; Krylova et al., 2020; Zhilyakova et al., 2020) makes it possible to assess the state of the industry after making global decisions within the framework of international agreements and regional policy of the country.

When organizing a company's marketing strategy, it is necessary to take into account the competition in the market (Mingazov et al., 2019), be able to predict demand (Merkuryeva & Smirnovc, 2019), as well as taking into account current trends, in particular technological innovations (Melnik & Golysheva, 2017). Communication with the end consumer moves to the Internet, which must be considered when promoting the company's products. Analysis of the marketing environment and assessment of the market opportunities of firms occurs in the process of comprehensive marketing research, the purpose of which is to collect data on the market and study it to improve production processes and product sales.

Problem Statement

A number of problems must be solved for the development of a pharmaceutical industry enterprise. The most significant of these are:

Russian enterprises are unable to spend more than 1–2% of their proceeds on research and development, as they produce branded low-profit Russian analogues of medicines (generic drugs). In addition, there is practically no production of pharmaceutical substances in the country, which forces manufacturers to purchase low-quality foreign substances, mainly of Asian origin. It should be noted that none of the existing programs can solve the problem of creating substances. Asian enterprises are pursuing a dumping policy that helps oust domestic firms from the internal market, which, as a whole, complicates the access of the population and the health care system to Russian-made drugs and thereby reduces the country's drug safety.

In Russia, there is a technological lag in production capacities in comparison with the world's leading manufacturers of medicines. Domestic enterprises experience a shortage of their own working capital (the turnover of production of substances is 150-180 days), and price regulation complicates the attraction of the required amount of financial resources for the development of production, this, in its turn, contributes to a reduction in wages, a decrease in the prestige of the profession and technological re-equipment of production.

Research Questions

- What are the features of the Russian pharmaceutical market?

- What is the volume of exports and imports of pharmaceutical substances?

- What is the forecast for the development of the pharmaceutical substances market in the near future?

Purpose of the Study

The purpose of this work is to assess the market of pharmaceutical substances in Russia. To achieve the goal, we should complete the following tasks:

- to develop a clear algorithm for marketing research of the demand for pharmaceutical substances;

- to analyze the market of pharmaceutical substances;

- to assess the perspectives for the development of the industry.

Research Methods

To achieve the purpose of this study, we developed a clear algorithm for marketing research:

Information from databases:

- The Federal Customs Service of the Russian Federation;

- The State Drug Tariff;

- The Ministry of Economic Development of the Russian Federation, etc.

Monitoring of printed and electronic specialized publications:

- data from reports of the "Agency of Industrial Information";

- data from "Pharmexpert" reports;

- data from industry associations;

- government regulations that directly or indirectly affect the state of the pharmaceutical market;

- expert assessments of specialists and market experts;

- monitoring of the state of affairs in the industry;

- reports on the production and economic activities of enterprises in the industry.

- Processing and analysis of research results. The following methods are used to process the collected marketing information: frequency distribution, graphical presentation of the market, distribution of a variable, calculation of statistical indicators — arithmetic mean, variation, variance, factor analysis, cluster analysis, trend analysis, etc.

- Formation of conclusions and recommendations.

Findings

The capabilities of industry in cooperation with scientific advances in the field of pharmaceuticals show the country's ability to overcome threats, both external and internal, including the threat of a global pandemic (Kondratiev, 2021).

The organization of the market in Russia differs significantly from the markets of Western and Eastern countries. As a result, domestic consumers overpay for drugs that may already be outdated and less effective. Due to the insufficient development of the health care system, the patient himself buys drugs, and he chooses them unprofessionally, mainly under the influence of advertising. The existing promotion system encourages pharmaceutical manufacturers to invest more in marketing and sales, rather than in the development of new effective substances, which significantly slows down the industry development rate.

Domestically developed drugs cover 68% of the needs of national healthcare (72% in the hospital sector). The base products are low-margin generic drugs, which does not allow pharmaceutical manufacturers to spend more than 1-2% of their revenue on research (Buran, 2021). Thus, analyzing the market, we can say that the needs of modern health care will not be satisfied, and therefore the growth in morbidity and mortality of the country's population does not decrease.

Pharmaceutical substances are substances possessing pharmacological activity which determine their effectiveness. These are drugs in the form of active substances of biological, biotechnological, mineral or chemical origin (plant, animal, microbial, synthetic, etc.) intended for the production of medications.

To assess the state of production of the products under consideration, experts usually resort to statistical reporting. At the moment, this statistical form does not contain information on production capacities for the production of pharmaceutical substances; only finished pharmaceutical products in ampoules and packages are monitored. This circumstance complicates the current assessment. Today about 30 domestic enterprises are focused on the production of substances for the pharmaceutical market.

Since 2000, the volume of production of pharmaceutical substances as a whole has been steadily declining. The determining factors for restraining the development of production in Russia are:

- Low level of competitiveness in comparison with Asian manufacturers;

- High level of investment;

- Availability of cheap imports;

- High threshold for entering the market;

- Bureaucratic procedures for registration of substances.

For the profitability of the production of pharmaceutical substances, it is necessary to ensure the production line load at the level of 70%. A decrease in volumes leads to unprofitable production and makes the operation of the enterprise economically inexpedient. This makes the development of the domestic pharmaceutical industry dependent on the supply of pharmaceutical substances from abroad.

Let's highlight some of the features in the production of pharmaceutical substances:

- science intensity of production;

- long-term development;

- multistage technological processes.

Consider such a segment on the Russian pharmaceutical market as "Angro" substances. The development of this area is an important component of the country's national security. In connection with the complex economic transformations in the entire system, a rather uncharacteristic situation has developed (Table 1).

The development of Asian companies associated with the localization of production in China and India poses a serious threat to domestic manufacturers. These countries are the main global suppliers of pharmaceutical substances. This was facilitated by the flexible policy of those countries in the field of environmental safety, i.e. they allow production with a large amount of toxic waste. However, it should be noted that over the past five years, the number of high-tech industries that meet high environmental safety requirements and GMP quality standards has increased there.

At this time, in the presence of sanctions from the Western partners of the Russian Federation and the course on import substitution, there is a redistribution of consumers between foreign and domestic producers. At the same time, the Russian pharmaceutical industry uses about 9.7 thousand conventional tons of substances per year and about 1.9–2.4 thousand conventional tons are produced by Russian enterprises. The share of high-tech substances (more than 6 stages of synthesis) is 35% (including 15% produced in the Russian Federation) in quantitative terms, 34% (including 5% produced in the Russian Federation) in monetary terms, and the share of biotechnological substances is 39% in monetary terms (only 2% is produced in the Russian Federation). Today, less than 8% of drugs sold in the Russian Federation are made from domestic substances. The resulting deficit is covered by the import of substances.

The cost of pharmaceutical substances produced abroad according to the GMP standard is often higher or comparable to those produced in Russia. Thus, the competition for our products is mainly made by manufacturers from countries where this production standard has not been implemented, mainly Asian countries. In international markets, the share of domestic products of pharmaceutical substances is extremely low (less than 0.04% of total sales). In monetary terms, this is about 6 billion rubles, which is undoubtedly not enough. However, with the active introduction and promotion of a domestically developed coronavirus vaccine on the world market, the Russian market can become one of the leaders in Europe.

The export of domestic medicines is hindered by the lack of standards that comply with international GMP rules governing production and quality control and which are mandatory for the pharmaceutical industry. As of 2019, up to 97% of the domestic market is provided by supplies from other countries. This also determines the dependence of the price of the final product on the exchange rate. So over the past 2020, prices have grown by an average of 10-15%.

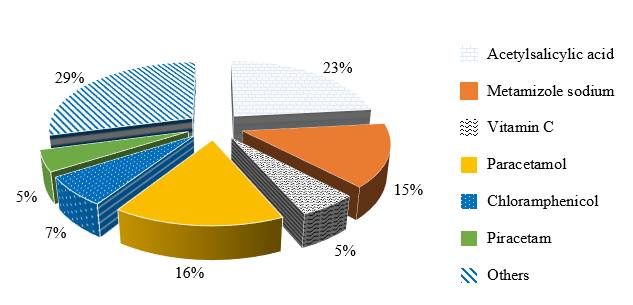

After analyzing the data on the market of pharmaceutical substances, a chart was drawn up by name and market share, shown in Figure 1. The data are given for the most popular substances.

This market has the peculiarity that the maximum substances in terms of import volume cover up to 55% of the market in monetary terms. Accordingly, there are a number of substances imported in small volumes, but at the same time expensive. These include, for example, insulin, pipecuronium bromide and a number of others. Restoring our own production of pharmaceutical substances is a matter of national security. This thesis is supported by the fact that such substances are supplied outside the country on a residual basis. A striking example was the situation in those countries where their own vaccine against COVID-19 has not been developed, and supplies from other countries will be carried out only after meeting the domestic needs of the country. Improving the quality of substances is a priority because this largely determines the factor of independence in drug provision. In addition, on the territory of the Russian Federation, full control is possible at all stages of production and sale of substances, while it is impossible to control all stages during import. Undoubtedly, the organization of the production of substances on its own territory has an economic effect consisting in the organization of high-tech and highly qualified jobs. This has a multiplier effect on the development of related industries. In addition, there is a stimulation of scientific research on the basis of pharmaceutical companies and industries, which in the future increases the quality of products and reduces costs.

We have already noted that the leading suppliers of substances to the Russian Federation are India and China. At the same time, there is a well-established distribution of the market, in which India leads, since there are more highly qualified technologists and marketers working in this direction. China, in its turn, is focused more on the mass production of common substances.

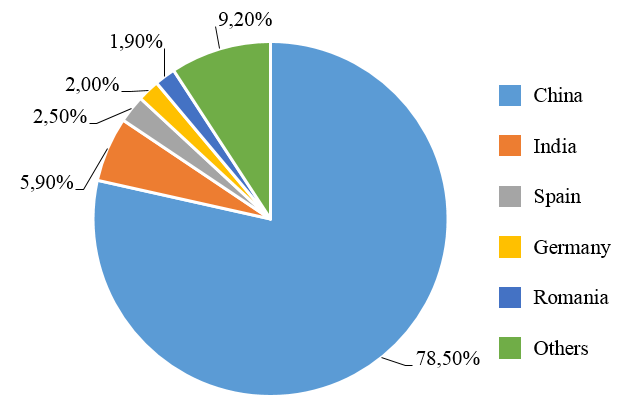

The market of the Russian Federation of pharmaceutical substances can be characterized by a moderate concentration — eight importing countries almost completely meet the demand (94.6%). Among them are China (78.5%), India (5.9%), Spain (2.5%), Germany (2.0%), Romania (1.9%), England (1.4%), Switzerland (1.3%), and Italy (1.1%). Figure 2 shows market shares based on product volume.

From the available data, it is obvious that China is the leader in imports of products. It has a largest share of imports — 71.8%. If we talk about the entire volume of the market, then 80% in value terms is provided by the countries represented by Germany, Spain, India and China. The ratio of the specific weight, calculated by cost and physical indicators, shows that Chinese substances are much cheaper than similar products from other countries.

If we consider the dynamics of the market for the export of pharmaceutical substances in the Russian Federation, then at the moment the main market share is occupied by China, although in 2010 its share was 54.8%, and by 2020 it reached 80%. Other countries have lost part of the market, primarily India, but it is losing its position from 9.9% in 2015 to 5.9% in 2020. Spain is in the third place with 2.5%. Next countries are Germany and Romania, respectively, with 2.0% and 1.3%.

The course towards import substitution has been adopted since the imposition of the sanctions, however, market analysis shows that the bulk of the market is concentrated on imports. This means that the majority of domestic companies buy raw materials abroad.

Considering the reasons for this situation, it is necessary to refer to the structure of demand for the corresponding product. The imbalance in this area determines the market conditions. Many manufacturers produce outdated drugs. There is also a problem in the limited range of anticancer drugs, insulins and other drugs for the treatment of endocrine diseases, cephalosporin antibiotics, anesthetics, manufacturers of certain types of cardiovascular drugs, medicines for the treatment of bronchial asthma, etc.

As noted above, it is necessary to introduce GMP rules into production based on the industry standard GOST 42-510-98 “Rules for organizing production and quality control of medicines”. This will ensure the competitiveness of the manufactured drugs, both in the domestic and foreign markets. For these purposes, the Ministry of Economy of Russia and the Ministry of Health of Russia introduced the industry standard GOST 42-510-98. Order No. 432/512 provides for a complete transition to the production in accordance with this standard at enterprises producing pharmaceutical substances.

The implementation of these plans can only be ensured if there is an appropriate amount of investment in the industry. The main sources of which in the conditions of a budget deficit can be loans and direct investments. Despite the decrease in budget funds for financing research work, several projects were implemented to create economically highly effective substances that serve as the basis for medications.

Let's single out a number of areas financed from the budget. Such projects include the technology for producing the “Tropisetron” substance for the treatment of gastrointestinal diseases. On the basis of microbiological raw materials, a technology has been developed to obtain "Dextran-1000". An important result is the production of a substance for the anti-tuberculosis drug — "Pyrazinamide" and a number of other projects.

In conclusion, we note that the Russian pharmaceutical market remains import-oriented, since 75% of the drugs consumed by the population are produced abroad.

Conclusion

According to DSM GROUP, the market of pharmaceutical substances in the Russian Federation in 2021 will grow due to the production of vaccines to fight the new virus.

At the same time, a number of unresolved problems remains. First of all, this is the presence of outdated and worn out equipment, lack of investment resources for research work. There is also a certain inequality for domestic and foreign manufacturers, which consists in the absence of control over the production of foreign enterprises. Inequality of requirements is also observed in matters of quality assurance of pharmaceutical substances. As a result, cheap and low-quality imports flooded the Russian market.

The presence of state support is gradually leading to a change in the pharmaceutical substances market. The governmental program "Development of the pharmaceutical and medical industry" until 2025 will make it possible to annually increase the production of domestic pharmaceutical products at the level of 10-14% and bring the market share of the use of produced domestic substances to 40-50%. The presented forecasts are largely optimistic, and their implementation will also depend on global manufacturers of pharmaceutical substances and their pricing policy.

References

Beloborodova, A. L., Antonchenko, N. G., Pavlova, A. V., Hajrullina, A. D., & Soldatov, A. A. (2020). Analysis of the General Development Trends and the Level of Digitization of the Pharmaceutical Market in the Russian Federation. In: Ashmarina, S., Mesquita, A., Vochozka, M. (Eds), Digital Transformation of the Economy: Challenges, Trends and New Opportunities. Advances in Intelligent Systems and Computing, 908, 280-290. Springer, Cham.

Bondarenko, T. G., Zhdanova, O. A., Maksimova, T. P., Prodanova, N. A., & Bokov, D. O. (2020). The effectiveness of the pharmaceutical area companies in the conditions of modern challenges, International Journal of Pharmaceutical Research, 12(3), 1910-1919.

Buran, A. A. (2021, March 21). The main directions of state control of pharmaceutical substances. https://www.alppp.ru/law/hozjajstvennaja-dejatelnost/promyshlennost/34/statja--osnovnye-napravlenija-gosudarstvennogo-kontrolja-farmacevticheskih-substancij.html [in Rus.]

Fedorova, Yu. V., & Fedotova, L. S. (2015). Import substitution as a factor in the development of the Russian pharmaceutical market. Bulletin of Udmurt University. Series Economy and Law, 25(6), 55-58. [in Rus.]

Golikova, N. S., Prisyazhnaya, N. V., & Prodanova, N. A. (2020a). Professional Competence of Pharmacists: Expectations of Russian Pharmaceutical Industry Employers, International Journal of Pharmaceutical Research, 12(1), 2094-2101.

Golikova, N. S., Prisyazhnaya, N. V., Prodanova, N. A., Pozdeeva, S. N., & Dikih, V. A. (2020b). Comparative Analysis of Pharmaceutical Education: Russia and Europe Case Study, International Journal of Pharmaceutical Research, 12(1), 941-949.

Gubina, М. А. (2019). Import Substitution and/or Export Orientation: The Case of Indian Pharmaceutical Industry. St Petersburg University Journal of Economic Studies, 35(2), 197-222. https://doi.org/10.21638/spbu05.2019.202 [in Rus.]

Kondratiev, V. B. (2021, March 21). Global Pharmaceutical Industry. https://www.perspektivy.info/print.php?ID=96421/ [in Rus.]

Krylova, O., Litvinova, T., Babaskina, L., Babaskin, D., & Savinova, O. (2020). Analysis of the Internal Environment of the Pharmaceutical Distributor Operation in Russia Using SWOT Analysis. Open Access Macedonian Journal of Medical Sciences, 8(E), 382-388.

Mamedyarov, Z. (2018). Pharmaceutical Sector in Iran: Current Status and Prospects. World Economy and International Relations, 62(7), 57-62. https://doi.org/10.20542/0131-2227-2018-62-7-57-62 [in Russ.]

Manturov, D. (2018). Industrial Policy in the Pharmaceutical Industry of the Russian Federation, Economic Policy, 13(2), 64-77. https://doi.org/10.18288/1994-5124-2018-2-04 [in Rus.]

Marcão, R. P., Pestana, G., & Sousa, M. J. (2020). Knowledge Management and Gamification in Pharma: An Approach in Pandemic times to Develop Product Quality Reviews. The Electronic Journal of Knowledge Management, 18(3), 255-268.

Melnyk, Yu. M., & Golysheva, I. O. (2017). Features of the marketing complex in the system of innovative development of pharmaceutical companies, Marketing and innovation management, 4, 27-39.

Merkuryeva, G., & Smirnovc, A. (2019). Demand forecasting in pharmaceutical supply chains: A case study. Procedia Computer Science, 149, 3-10.

Mingazov, M. V., Tufetulov, A. M., & Khadiullina, G. N. (2019). Development features of pharmaceutical industry and its role in securing the future development of Russian economy, International Transaction Journal of Engineering, Management, & Applied Sciences & Technologies, 10(19), 1-8.

Pieriegud, J. (2019). The Development of Digital Distribution Channels in Poland’s Retail Pharmaceutical Market. In: Piotrowicz, W., Cuthbertson, R. (Eds), Exploring Omnichannel Retailing, 139-167. Springer, Cham.

Zhilyakova, E., Sen, T. V., Lysykh, E. G., Novikov, O. O., Malyutina, A. Y., Timoshenko, E. Y., & Abramovich, R. A. (2020). At the Threshold of Technological Solutions: Analysis of Russian Market of Medicines Used for the Treatment and Prevention of Periodontal Diseases, International Journal of Pharmaceutical Research, 12(2), 1623-1630.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Bavykina, E. N., Zakharov, P. V., Eremeev, E. A., & Makarova, O. N. (2021). State And Development Perspectives Of The Pharmaceutical Substances Market In Russia. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 218-227). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.23