Abstract

Nowadays сompetition for a client requires banks to move to a qualitatively new level of development, to introduce new technologies, new approaches and methods of work into banking practice. One of the ways to develop banking services is to implement the new information technologies for reengineering business processes. The need to improve banking services based on information technologies in order to increase the level of bank security is a very urgent task. The article describes a methodology developed for implementing the Touch ID technology as a pilot project in a Moscow bank. Taking into account the corporate architecture of the bank, the proposed Touch ID technology contributes to obtaining additional profit from the implementation of this method when providing banking services to clients. The authors describe eight stages of the new technology implementation methodology, as well as the benefits of its implementation. Based on the verification of the developed methodology for implementing the Touch ID technology at providing banking services according to the proposed system of indicators for assessing the effectiveness of implementation this technology is considered as the most effective one.

Keywords: New information technology, Touch ID technology, banking services

Introduction

The current stage of world economic development is characterized by an accelerated pace of scientific and technological progress and an increasing intellectualization of the main production factors. The rapid development of information technology covers all spheres of life (Anikina et al., 2019). A radical improvement and adaptation to modern conditions of any activity has become possible due to the massive use of highly effective information and management technologies (Chouprov & Ragozina, 2017).

Along with many advantages, information technologies are fraught with no less danger (Ragozina et al., 2020a). One of them is the possibility of unauthorized access to information and operations. As a result, the most important aspect of information technology is information security, aimed at protecting confidential information from unauthorized actions (Ogloblin et al., 2019).

Modern conditions for development of the banking market and customer requests require the development of existing and new banking services. To develop a new service, special resources, knowledge, organization of activities are needed, so we can talk about a special technology. The Touch ID technology is a significant step in the formalization of the bank's activities, and its implementation is of great importance and benefits for the bank:

- reducing operational risks associated with unauthorized access to information stored on the bank's servers, both about the clients themselves and about their savings;

- improving the quality of service is the right step towards achieving a leading position in the global / national financial market;

- increasing customer satisfaction and, as a result, the growth of the bank's positive reputation;

- increasing profitability of working capital by attracting new customers.

It should be noted that the proposed technology is applicable to both the development of new and modification of existing bank services.

Problem Statement

The rapid development of information technology is associated with all spheres of life of a modern person. A radical improvement and adaptation to modern banking conditions became possible due to the widespread use of highly efficient information and management technologies.

Research Questions

The presence of a large number of independent banks creates a certain environment in which the banking institutions are forced to fight for a client, moving to a qualitatively new level of development, which inevitably requires the implementation of new technologies, new approaches and methods of operation into banking practice (Shcherbatov, 2019). These processes are often accompanied by a revision of the organizational structure (Ragozina et al., 2020b). Besides, they are accompanied by a change in the range of offered banking services, through the introduction of new information technologies for the reengineering of business processes, which consists in a fundamental rethinking and radical re-planning and is aimed at a significant (but not necessarily one-time) improvement in performance indicators: a sharp reduction in costs, an increase in the quality of service and the speed of customer service (Nikulin, 2015).

Purpose of the Study

The purpose of this study is to analyse information technologies used in the provision of banking services and to develop a methodology for implementing the Touch ID technology at providing the banking services.

Research Methods

The theoretical and methodological basis of the study is represented by the works of domestic and foreign researchers in the banking competition theory (Nikulin, 2016). The following methods of scientific knowledge are used: observation, comparison, analogy, synthesis and analysis, induction and deduction, factor analysis.

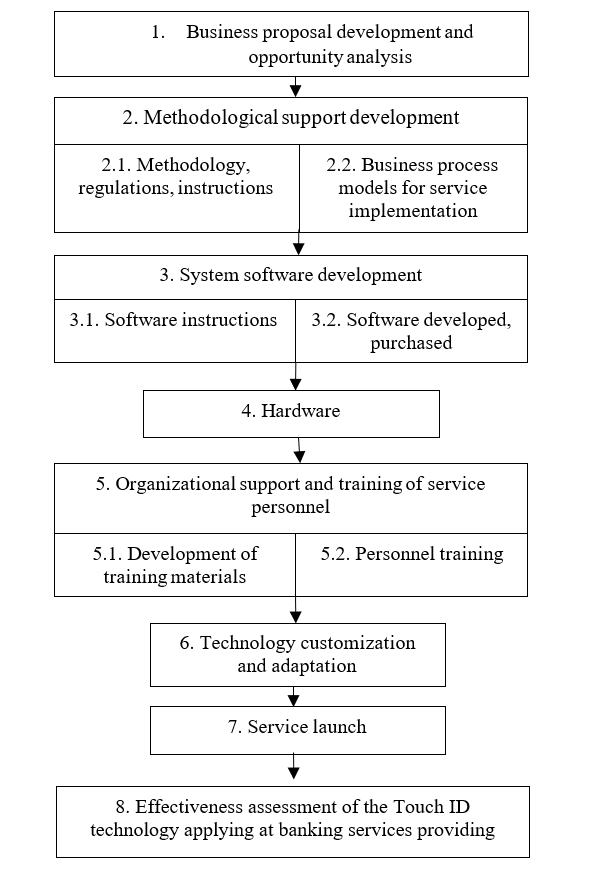

We will highlight the main stages of implementing the proposed Touch ID technology methodology, taking into account the bank's corporate architecture, starting with the development of a business proposal and analysis of opportunities and up to the system for evaluating the effectiveness of implementation (Figure 1).

At stage 1, the business proposal is developed and the financial organization's capabilities are analysed. A business proposal is a document that includes the necessary and sufficient description of a new service to make a decision about its development and implementation. The decision is made on the basis of a comprehensive analysis of this document for the possibility of implementing a new service.

At this stage an analysis is carried out and the expert opinions are made on the following aspects:

- economic feasibility;

- risks: market, credit, operational, etc.;

- feasibility: for business processes, software and hardware, personnel, legal (compliance with legislation);

- security: information, economic, etc.;

- influence on other divisions of the bank;

- compliance with the bank's policy and strategy.

The business offer specifies:

- initiator of the new service development, developer of the business offer;

- objectives of the business proposal, prerequisites and justification for the development of a new service, criteria for evaluating the effectiveness of the implementation of a new service;

- economic model: tariffs, sales forecast, costs, payback, etc.;

- general technology of service implementation;

- plan for developing a new service, performers, deadlines, resources involved;

- results of analysis of the opportunities.

At the end of stage 1, the bank receives a result in the form of a goal, the essence of which is to enter a new segment of low-risk clients with a high standard of living and social status, introduce a competitive product to meet market requirements and customer needs, and, as a result, increase revenue from attracting more customers, as well as establish its position in the financial market.

At stage 2, the development of process and methodological support is carried out:

- Models of the business process of service implementation

It is necessary to describe the end-to-end business process that runs through all the bank's divisions involved in the implementation of the service. The functions and responsibilities of departments in the business process should be clearly defined. Often, when developing a new service, it is enough to modify one of the existing business processes, rather than design it from scratch.

- Methods, regulations, instructions

Regulations, instructions, and memos for performers are written based on business process models. For example, instructions for a back-office employee to implement a product. These documents contain detailed text descriptions and business process specifications that are not available on the models. If necessary, methods are prepared for individual procedures.

At stage 3, the system software is developed. In order for the business process of implementing the service to be effective, you should, if possible, automate its basic procedures. On the basis of the regulations of the business process, preparing technical specifications for the development / revision / customization of the software. After performing the appropriate work with the software, it is tested and the necessary user-friendly information is developed.

It is also necessary to resolve the issue of software licensing (delivery). Licensed software is an essential part of an enterprise's information system and one of its most valuable assets. Proper software management significantly increases the efficiency of the entire business, eliminates the risk of copyright infringement, avoids excessive costs for software purchase and maintenance, and correctly plans expenses.

With a serious and balanced approach to software licensing, the cost of purchasing software can be optimized. Solving these issues throughout the enterprise, determining the volume and planning purchases for a long time, the customer receives huge advantages in the form of significant benefits and discounts from the standard license prices recommended by the developer.

As a result of stage 3, the bank receives the following results:

- a new ABS (automated banking system) module was purchased and implemented “Bank cards with a built-in chip designed to store the fingerprint reference value as a mathematical representation”;

- made additional necessary settings for the ABS module.

The stage 4 is for developing / modernizing hardware, namely, buying new hardware or upgrade existing ones, which ultimately provides a consistent hardware set goals from the implementing.

At the end of stage 4, the following result is achieved in the form of purchasing / upgrading equipment (ATMs and related engineering complexes).

At stage 5 the development of organizational support and training of personnel is carried out. Training the bank's employees to implement a new service is one of the most important stages. No matter how effective the business processes, software, marketing campaign and other components of the new service are, the staff is the main link that directly interacts with the client and performs sales. Training and testing of employees in banks are usually carried out by a specialized division (Corporate University). This division prepares textbooks, e-courses, practical tasks and tests for the new service. These training materials are based on all information and methodological materials developed at the previous stages of this technology.

At the end of stage 5, the bank receives trained service personnel.

At stage 6, the implemented information technology is configured and adapted. The hardware and software complex are being implemented in the existing banking system. Performing corrective settings and testing.

Stage 7 is a launch of service. It means the actual date when the ban-com service was provided. By now, all stages of the implementing Touch ID technology must be completed.

The launch of the new service is accompanied by a decision of the bank's management board and amendments to the relevant regulatory documents of the bank.

Stage 8 is a final one, where the effectiveness of implementing the Touch ID technology at providing banking services is assessed (Nikulin & Ragozina, 2015).

Findings

Based on the results of the implementation, an approbation was carried out, which allows drawing a conclusion about the practical and theoretical significance of the research and the possibility of the implementing Touch ID technology at providing banking services in order to increase the bank's competitiveness in comparison with other banks in order to improve its position in the financial market, improve and implement technologies. The system of indicators for assessing the effectiveness of the implemented Touch ID technology is presented in Table 1.

The implementation of the Touch ID technology has helped the bank:

- significantly increasing the growth of new customers in the bank, as evidenced by the coefficient C1;

- reducing operational risks associated with the implementation of operations by means of remote maintenance, the coefficient C2;

- reducing time of operations, the coefficient C3;

- increasing income per client, the coefficient C4 (Nikulin, & Ragozina, 2016).

Conclusion

Based on the verification of the developed methodology for implementing the Touch ID technology at providing banking services according to the proposed system of indicators for assessing the effectiveness of implementation, we can conclude that this technology is the most effective in all indicators than another technology that has the same purpose.

References

Anikina, Y. A., Ragozina, M. A., Malanina, Y. N., & Kurako, D. V. (2019, December). Assessment of innovative projects in the rocket and space engineering. In Journal of Physics: Conference Series (Vol. 1399, No. 3, p. 033056). IOP Publishing.

Chouprov, E. V., & Ragozina, M. A. (2017). Machine-building production of increased reliability: features and solutions of the economic component. Scientist’s Notes, 3(19), 71-4.

Nikulin, M. V. (2015). Banking services based on information technologies. Actual Problems of Aviation and Cosmonautics Proceedings of the Int. Sci.-Pr. Conf. dedicated to the 55th anniversary of Sib. State Aerospace Univ. named after acad. M.F. Reshetnev, 243-246.

Nikulin, M. V. (2016). Innovations in the banking sector. Scientific and Technical Progress: Actual and Promising Directions of the Future, 2, 394-395.

Nikulin, M. V., & Ragozina, M. A. (2015). The role and modern trends in the development of information technology in the banking sector. Modern Problems of Economic and Social Development, 11, 34-37.

Nikulin, M. V., & Ragozina, M. A. (2016). Instruments of customer-oriented strategy of banking activity. Actual Problems of Aviation and Cosmonautics II Int. Sci.-Pr. Conf. of Students, Graduate Students and Young Professionals, 54-55.

Ogloblin, V. A., Malanina, Y. N., & Vikhoreva, M. V. (2019, December). Improving the management tools of engineering enterprises in modern conditions. In Journal of Physics: Conference Series (Vol. 1399, No. 3, p. 033060). IOP Publishing.

Ragozina, M. A., Anikina, Y. A., Malanina, Y. N., & Levko, V. A. (2020a). Project for implementing an information system as a result of interaction between participants in the cluster for forest waste processing. In Journal of Physics: Conference Series (Vol. 1515, No. 3, p. 032057). IOP Publishing.

Ragozina, M. A., Anikina, Y. A., Malanina, Y. N., Yushmanova, V. A., & Novoselsky, N. K. (2020b). Structural transformation in management of the enterprises of military-industrial complex. In IOP Conference Series: Materials Science and Engineering (Vol. 919, No. 4, p. 042023). IOP Publishing.

Shcherbatov, I. A. (2019). Intellectualization of information for power plants repair management systems. Modern Technologies. System Analysis. Modeling, 3(63), 31-37.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Ragozina, M. A., Anikina, Y. A., Malanina, Y. N., & Yushmanova, V. A. (2021). Methodology For Implementing The New Touch Id Technology At Providing Banking Services. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 1883-1889). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.210