Abstract

In context of digitalization of the economy, credit institutions need to effectively manage client flow using the electronic queue management system. The article considers the main concepts and composition of the electronic queue, worldview goals of the development of a digital platform in banks in the Russian Federation. Steps of queue management in banks in all areas of activity of credit institutions are presented. Process description is given and software and hardware complex of electronic queue control system is considered. The implementation effect and functionality of the electronic queue management system were investigated. The article considers the main risks of starting the system at the level of a credit institution, gives their assessment and the degree of influence. Implementation phases and areas of responsibility of the system at service start-up are considered. The necessary conditions and digital prerequisites for creation of electronic queue management system in commercial banks based on the latest digital technologies and skills are analyzed. Modular processes of the system are considered and the main channels of access to the electronic queue control system are presented. A brief description of the capabilities of employees to work in the system was given and conclusions were drawn from the results of a scientific study on the feasibility of using a queue management system in the banking sector.

Keywords: Electronic queue management system, digitalization, pre-recording, digital channels, remote banking

Introduction

In the conditions of competition for clients in the banking sector, for each credit institution, the most pressing issue is the development of industrial solutions for remote and centralized management of client flow in bank branches, with the possibility of remote recording of customers in branches through service channels (Russia's Alfa Plans to Take on Rival Tinkoff by Creating a Digital Bank, 2020). One such solution is the electronic queue management system. A commercial bank is an organization where a queue is inevitable. Today, technologies have been developed that allow you to manage client flow processes and organize the process of pre-registering customers to offices without being physically in a credit institution (Vaganova et al., 2018). Currently, the electronic queue management system has been introduced and is functioning safely in many government and commercial structures, which allows us to talk about the effectiveness of digital processes for managing client traffic.

Problem Statement

Today, credit organizations are modern complexes that include specialized equipment, modern interior, a comfortable atmosphere in offices for which the client is the highest value. The presence of large queues in offices is unacceptable for customer service services of credit organizations. Today, customers, based on a huge number of credit organizations, as well as a large number of remote services, have a significant choice based on key parameters, and if there is a long waiting time in the queue, they can go to another banking institution for service. The introduction of the electronic queue management system in the credit organization is a promising solution to the problems with the waiting time of customers in internal structural divisions, since the queue is made invisible and the conditions of stay in it are improving.

Research Questions

Monitoring of the waiting time of clients in the queue is usually carried out by the client service at the bank, for analysis and monitoring of the process in order to draw specialized conclusions, and make proposals for improving the process. With the help of monitoring over a certain period, causes are identified, as a result of which a queue is formed. To improve the quality of service, it is necessary to take steps to preserve and increase the customer base, without compromising the customer service, and reduce the waiting time of customers in the queue, starting the standard service time for each individual service operation, according to the bank's operations menu. By analyzing the service time of a single operation by group, it is possible to investigate service time segments and identify the most problematic areas of operations. As a result of the research, many credit organizations launch a project with the help of the project office of the bank to implement the electronic queue management system, where the system is controlled through the central server of the bank and the functions of the system administrator, are carried out through the head office, centrally. Using the functions of the system administrator, you can manage a single information unit, monitor office workload remotely through online monitoring of all internal structural units, conduct analysis and observation instead of field inspections and timing, to target the use of employee time and eliminate most of the cost of travel expenses.

Purpose of the Study

Combination of the above features allows you to develop an industrial solution for remote and centralized management of customer flow in credit organizations, with the ability to remotely record customers through the main channels of access to the electronic queue management system, such as banking site, remote banking service, contact center and branches of the internal structural unit.

Research Methods

The article uses the following research methods: graphic, comparative.

Findings

The electronic queue management system is the largest software and hardware complex that organizes customer service and distributes client flow in commercial banks (Carol, 2018).

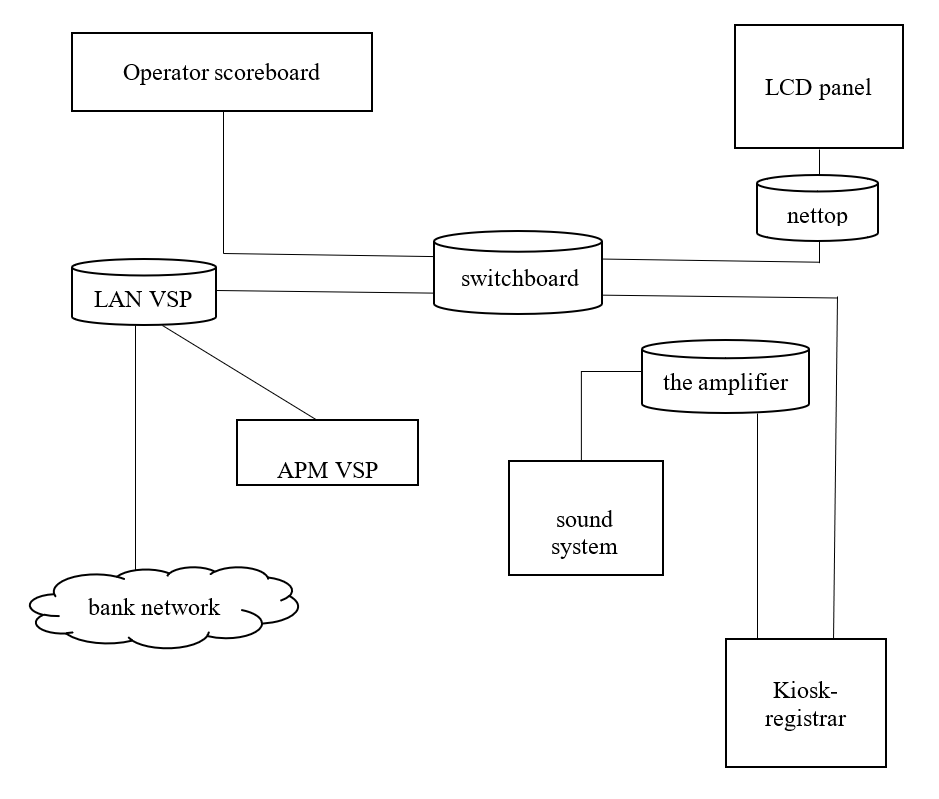

The process organization and software and hardware complex of the electronic queue control system consists of the components presented in Figure 1.

When entering the bank's operating office, the client first selects the necessary service on the screen of the registration kiosk, according to the bank's operations menu, and registers in the electronic queue.

When receiving a ticket with a registration number, which also indicates the reference information (service name, predicted waiting time, etc.), the client waits for service in the customer service area, and focuses on the alert controllers, waiting for his call (Solodilova et al., 2020).

Based on this, we can conclude that the electronic queue independently automatically distributes customers, and eliminates the queue and uncertainty in the service office.

The main positive factors of the electronic queue system to date are:

- the uniform distribution of client flow leads to the implementation of control algorithms and redistribution of customers according to the time of the office operation mode and the number of operators (Votintseva et al., 2019);

- expedite client flow maintenance through established service standards and flow prioritization rules;

- record reporting on customer service history, which is an important argument when dealing with customer complaints and offers (Carol, 2018);

- the social effect is achieved due to the fact that customers lose the need to track their place in the queue, which in turn reduces conflicts and the level of tension in the bank's office.

The unique software of the electronic queue system provides an opportunity to organize a complex on standard information equipment, which all customers work with (Developing the Digital Economy in Russia, World Bank, 2016).

The main functionality of the system, in addition to the standard set of capabilities, today are:

- organization of pre-registration in the bank's offices via Internet channels;

- SMS-notification of clients about office registration and quality of service assessment;

- possibility of placing media content of the bank and advertising on alert controllers, kiosks, coupons.

Providing the bank's top management with all kinds of statistical reports on employee performance, quality assessment of CSI and their customer service standards (Leventsov et al., 2017). Today, in many large-scale commercial banks, a centralized system for managing client flow is used, and there is also the possibility of pre-remote recording to bank branches through the largest digital channels: bank Internet sites, contact centers, remote banking services of credit institutions. The electronic queue management and remote pre-recording system is a modern and scalable solution that allows you to provide service in all branches of banks according to uniform service standards. With its help, a solution is developed and implemented that allows you to centralize the principles of working with customer flow in all commercial banks, as well as be able to remotely sign up for bank branches to customers and receive innovative products and services for yourself according to the same and highest standards.

The use of the electronic queue management system includes:

- the modular process of the electronic queue system in the form of software, which is installed on employees' workplaces, dispensers and alert controllers in each branch of banks, with the possibility of managing individual elements centrally, according to standard role models (Lavrinenko & Shmatko, 2019);

- modular process for remote pre-recording with the possibility of tracking time cells for remote recording. The module includes an API for combining with an omnichannel platform;

- module for automatic notifications of clients through various channels, such as SMS, e-mail, push notifications;

- module for obtaining statistical information using the reporting system and the reporting designer from WS;

- output of media content on alert controllers of the electronic queue system (Vaganova & Bykanova, 2019).

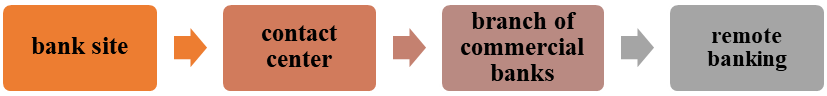

The main channels of access to the electronic queue control system, today are the channels presented in Figure 2:

Pre-registration in the offices of banks is carried out through such channels as a banking site, a contact center, branches of commercial banks and a remote banking software complex.

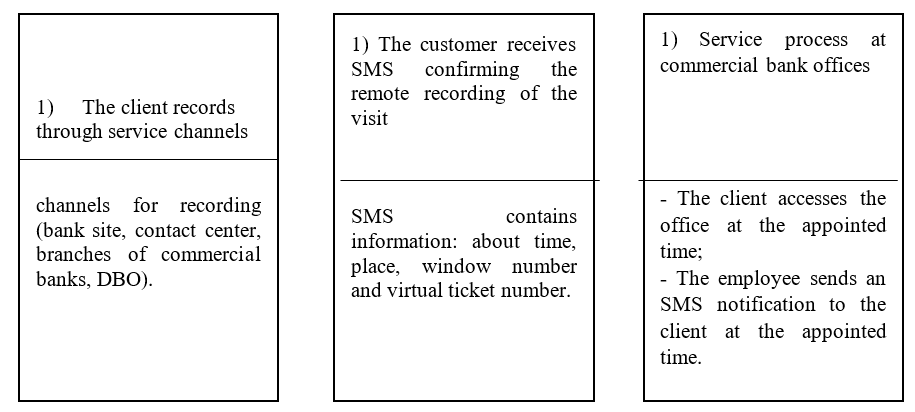

Let's take a look at the main steps in remote recording customer service processes, as shown in Figure 3:

Through remote banking systems, the customer can pre-record. In this process, the customer can choose the desired office, date/time, topic, and then the system will automatically upload the customer data (Leventsov et al., 2017). The client in remote banking service sees information about the upcoming visit to the office, can manage the upcoming visit, pass surveys on the assessment of the quality of service.

The system is flexible and versatile for office staff. Employees have the following capabilities when working with the system:

- review the schedule, detail the issue of cases, monitor the status of work, redirect customers, upload the necessary reports;

- employees see all planned customer visits and have the opportunity to make a preliminary customer record;

- generate reports on certain specified topics: measurement of service standards for each topic;

- change work statuses and service times such as lunch, document handling, customer call, technical break.

In order to effectively implement the electronic queue management system, it is necessary to assess the risks of starting the system. By the degree of influence, high, medium and low risks are distinguished. The high risks of starting the system primarily include additional costs associated with testing, updating, creating contours and solving problems that are not planned by the project budget, which affect the timing and cost of the project as a whole. An equally important high risk is also the failure of the vendor to develop the functionality.

Medium and low risks include the timing of the implementation (the solution for online recording for the transaction is not typical, it requires refinement of the box product), the license policy can be for one workplace or for one office. Affects the possible budget.

The project launch responsibility areas can be divided into commercial bank units, such as retail business, which includes a customer service service, an operating unit that includes operating system support, a network development department that directly works with the network, and an information technology department that launches office dispensers and alert controllers.

For the development of business requirements, a matrix of priorities, flow prioritization rules, customer service logic, it is more advisable to assign a retail business. For the development of the current documentation for equipment, IT system support - the department of information technology. Application administration (changing users, changing offices, changing topics and their priorities, updating the product line, updating media content - operating block. Control of the situation in the offices for the quality of work of network employees with clients - employees of the network development department.

Every year, there is a significant increase in the number of customers who prefer online banking services. Without leaving home, it is possible to use remote banking, which is a key factor in the field of banking digitalization and reduces the density of electronic queues. Accordingly, with the introduction of the electronic queue management system, to reduce the waiting time for customers and improve the quality of services provided, credit organizations should not forget about other, equally important digital banking products and services

Conclusion

Thus, based on the research conducted on the electronic queue management system, it can be concluded that the implementation of the system improves the aggregate CSI of the banking network across all offices, as well as allows managing the client flow in terms of waiting for customers in the queue. With this system, the target is to reduce the waiting time in the queue for prewritten and unwritten clients. With the introduction of the electronic queue management system, there is a positive trend in the profitability of customers for credit transactions, for opening deposits/accounts, issuing bank cards, using remote recording of a visit.

References

Banki.ru. (2020). Information portal "Banks.Ru". Electron. text. Dan. Moscow, 2005-2021. http://www.banki.ru/

Carol, C. (2018). Fintech does not disrupt banks, they just fill in gaps, Computerworld Hong Kong Fourth. Deloitte Digital. EMEA Digital Banking Maturity 2018. Deloitte Development LLC. https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/central-europe/ce-digital-banking-maturity-study-emea.pdf

Developing the Digital Economy in Russia, World Bank. (2016). http://www.worldbank.org/en/events/2016/12/20/developing-the-digital-economy-in-russia-internationalseminar-seminar-1(In Russian).

Lavrinenko, A., & Shmatko, N. (2019). Twenty-First Century Skills in Finance: Perspectives of Profound Jobs Transformation. Foresight and STI Governance, 13(2), 42-51. DOI:

Leventsov, V. A., Radaev, A. E., & Nikolaevskiy, N. N. (2017). The aspects of the «Industry 4.0» concept within production process design. St. Petersburg State Polytechnical University Journal. Economics, 10(1), 19-31. DOI: 10.18721/JE.10102 23

Russia's Alfa Plans to Take on Rival Tinkoff by Creating a Digital Bank. (2020). https://themoscowtimes.com/articles/alfa-bank-plans-to-create-a-digital-bank-59164

Solodilova, N. Z., Malikov, R. I., Grishin, K. E., & Shaykhutdinova, G. F. (2020). Regional business ecosystem: institutional capacity. European Proceedings of Social and Behavioural Sciences EpSBS. Krasnoyarsk Science and Technology City Hall, 103-111.

Vaganova, O. V., & Bykanova, N. I. (2019). Introduction of the latest digital technologies in the banking sector: foreign experience and Russian practice. Humanities & Social Sciences Reviews, l7(5), 789-796.

Vaganova, O. V., Bykanova, N. I., Grigoryan, A. S., & Cherepovskaya, N. A. (2018). Directions of development of bank technologies applied in the Russian market of retail credit services. Revista Publicando, 15(2), 1365-377. https://www.rmlconsultores.com/revista/index.php/crv/article/ view/1457

Votintseva, L., Andreeva, M., Kovalenin, I., & Votintsev, R. (2019, March). Digital transformation of Russian banking institutions: assessments and prospects. In IOP Conference Series: Materials Science and Engineering (Vol. 497, No. 1, p. 012101). IOP Publishing.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Samarina, E. A., Khrushchev, R. V., & Khairullina, A. R. (2021). Electronic Queue Management System In Commercial Banks In Conditions Of Economy Digitalization. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 1824-1830). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.203