Abstract

The article discusses the issues of digital transformation of the banking system under the influence of banking innovations. The approaches to defining this category in the banking environment are analysed. The author's understanding of this category is given. The evolution of the banking system of the Russian Federation, as well as the role of the digitalization process in the transformation of the banking system, aimed at increasing the technological potential of the sector, has been investigated. The assessment of the impact of the digitalization process on the organization of banking activities. It is concluded that the introduction of banking innovations in the context of the digitalization of the economy is characterized by the following: there is an evolution of the national payment system, which acts as a basic element for ensuring efficient banking activities and is based on digital technologies, providing an increase in the profit of the banking business when the margin in banking services falls. The conducted research helped the authors substantiate three basic approaches to digital transformation of the banking sector. The introduction of banking innovations is the result of the mutual merger of two global trends - the digitalization of society and the introduction of fintech. These trends are global trends. This means that the transformation of the banking sector of the economy based on the introduction of banking innovations into the activities of banks is a systemic and large-scale phenomenon, a new stage in the development of banking.

Keywords: Digital transformation, banking system, banking innovation, fintech, ecosystem

Introduction

The modern world economy is in a transformational state due to the growing and more and more embracing effect of the influence of the introduced digital technologies, primarily on the financial market. This technological direction is usually called digitalization, which affects both individual links in technological chains and covering entire processes. The economic result from the introduction of digitalization is a reduction in the used labour resources and, as a result, all interrelated costs arising from a reduction in the used human resource.

Currently, the banking system of Russia is undergoing transformation, which is moving to the next quality level that meets the technological requirements of the national digital economy. Digital transformation contributes to the evolutionary development of business models, the introduction of modern conceptual solutions in the banking sector, from the improvement of Internet banking technologies to the maximum transformation of traditional monetary transactions.

The introduction of digital innovative technologies is a sustainable platform to ensure stable and long-term growth in the efficient operation of banks and financial institutions. It is digitalization that is a modern strategic priority in banking technologies in the global economy. Financial technologies are the driver of changes in the banking sector. However, the banking system is on the initial path of transformation and digital transformation, in the context of the introduction of banking innovations (Table 1).

Considering the approaches of various researchers to understanding the essence of innovation, one can see that many of them consider innovation activity as a product and result of scientific activity, while others - as the creation of a new product for which there is a demand in the market. Another group of scientists is in the position of considering innovation as a process that increases the efficiency of project implementation.

Problem Statement

The study of the role of the digitalization process in the transformation of the banking system, aimed at increasing the technological potential formed at the intersection of sciences, has caused scientific controversy over the past ten years. Researchers assessed the significance and importance of introducing innovations in the banking sector, and the subsequent impact on the national economy. Scientists - Popova (2011), Koch (2010), Zubchenko (2009) and others.

Russian economic science does not provide a unified concept of the term “banking innovations” in the digital economy. The concept incorporates a set of implemented measures, which are distinguished by advanced technological features used for certain groups of users of innovative technologies. Domestic economic science identifies four approaches for defining this category in the banking environment.

Within the framework of the first approach, banking innovations introduced in the digital economy are considered as a source for the development and implementation of modern banking products. Zhukov (2008) noted that banks and financial institutions are analysing innovations with the aim of their subsequent implementation into existing financial instruments, into operating product lines, and permissible financial transactions, with the sole purpose of forming additional financial funds and resources for the final growth of profits.

Financial and credit encyclopedic dictionary, ed. Gryaznova (2004) defines financial innovation as a kind of newly developed financial product or financial instrument. This conceptual approach defined directly implemented products and technologies that became derivatives for issued securities for the purpose of securitizing assets for subsequent use in the secondary financial mortgage market, starting from the last quarter of the XX century, affecting all segments of the global financial market. Koch (2010) pointed out that "... banking innovations are innovations developed for direct users and applied by the customers themselves, transformed from earlier technological innovations, transferred to modern infocommunication technologies, which are part of the banking process" (p. 21). A similar point of view is shared by Zubchenko (2009), Marenkov (2005), Spruzhevnikova (2002) and others.

The second approach determines the segment to which banking innovations are directed in the context of the digitalization of the economy, how the traditional technological process is changed, consisting in certain financial technological solutions, in the existing software shell, while introducing more advanced methodologies and techniques that form the final data when conducting a financial transaction that includes one or more enlarged operations of analysis, accounting, control, planning, budgeting, etc. The reformatting of the used banking innovations in the financial technological process has significantly changed the essence of the operating infrastructure and its banking essence taking place within the processes. This can be clearly visualized in the context of world financial markets in comparison with the pre-digital era. The comparisons made indicate that it is simply impossible for Russian financial institutions to join the emerging global digital space without technological penetration and connection to the global financial system bypassing the stage of digitalization of the national financial sector.

This view is close to Nazipov (2007), who emphasizes a high degree of integration of information and banking innovations aimed at expanding the client base, the availability of digital processing to ensure the growth of economic efficiency and profits of financial institutions, ensured by the introduction of digital technology. This confirms the relevance of research aimed at studying and solving scientific and methodological issues of both the implementation of digital processes and the digital transformation of existing banking technologies in the environment of digital and telecommunication technologies.

The third approach examines banking innovations in the digital economy through the prism of the formed business processes of a direct financial institution.

The globalization of the world economy and financial markets occurs due to the decisive role of the global Internet network, the global information coverage of society by electronic communications, characterized by a significant increase in the volume of processed and transmitted information, which allows us to talk about the formation of a financial ecosystem of banks, which makes it possible to solve the emerging problems of banking processing, transfer solutions to rails of innovative methods in the construction of business processes.

Popova (2011) calls the entire process for the development and pilot implementation of digital innovations in banking as a complex, multi-stage and multi-level, costly process. In this regard, the implementation of digital innovations is carried out primarily by the largest Russian banks, including in the format of state support for digitalization projects.

The fourth approach involves the introduction and change of organizational and managerial forms of interaction.

The distribution of functional responsibilities through outsourcing occurs due to the need for innovative updating of the banking product line, non-identical services and the development of tools for administrative and financial management carried out in a credit institution. The basis of all of the above is the competitive struggle carried out in specific areas: the formation of customer-oriented products and services; achieving universalization in the spectrum of financial activities; inclusion in the process of world globalization; carrying out organizational consolidation, which is possible in various directions; ensuring the possibility of transforming technological forms of banking processing and the business itself.

Research Questions

The analysis carried out in the modern scientific financial literature shows that there is no unified approach to the content of the term “fintech”. The most common interpretation of it sounds like this: "a complex system that unites the sector of new technologies and financial services, startups and the corresponding infrastructure" (Maslenikov et al., 2017, p. 6). Numerous sources interpret the term financial technology almost equally, but with variations. Filippov (2018) defines the concept of "fintech" as: "an industry consisting of companies that use technologies and innovations to compete with traditional financial institutions such as banks and intermediaries in the banking services market" (p. 1432).

Pshenichnikov (2018) discloses the composition, which includes companies - these are banks and other financial institutions, expanding the list and detailing the markets by the direction of their activities (the financial services market, including payment systems, trust capital management, lending, insurance and foreign exchange transactions).

PwC experts and analysts (Global FinTech Report, PwC, 2017) characterize fintech, together with a number of other authors (Pertseva, 2019): it is a dynamically developing, mutually intersecting segment of the financial services and digital technologies that uses technology startups to develop new participants market of modern innovative approaches to the development of modern products and services, and modernization of existing traditional financial services.

The International Financial Stability Board in its documents in 2017 defined "fintech" as projects and actions that are "technological innovation of financial services", including in this concept products/services that use digital retail payments, digital wallets, fintech loans, robo-advisors, digital currencies based on basic technologies.

The disclosure of the concept of "fintech" shows that it covers not only financial markets, but also extends much wider than these areas and spheres. This allows us to assert that there is a process of convergence of the financial sector and other sectors of the economy, taking place on the basis of financial technologies. The formation of a multi-format development of the banking sector is observed, which includes not only classical approaches to organizing banking.

Purpose of the Study

The purpose of the study is to study the impact of the process of introducing banking innovations on the process of transforming the banking sector of the economy.

What are the benefits of digitalization of banking for the end consumers of banking services, banks and the state?

Research Methods

The article is methodologically based on the study of mainly practical sources on the stated topic and considers the need for the impact of banking innovations on the digitalization of the banking sector.

A retrospective analysis of financial and credit institutions of various types shows the growth and further merger of financial and industrial capital, which forms the institutional conditions for the transnationalization of banks, the creation of technology concerns and holdings that grow according to the principle of possible expansion, takeover and merger. All this together creates conditions for the interweaving of technologies with different types of financial and credit organizations, leading to the introduction of banking innovations. “Russia is characterized by a high proportion of banking groups, including financial (insurance and leasing companies, investment and non-state pension funds) and non-financial organizations. As of January 1, 2019, 86 banking groups operated, controlling 89% of the banking sector's assets” (Information and analytical review of the Association of Russian Banks, 2019 p. 46).

The analytical method of the study made it possible to generalize various interpretations of understanding the essence of banking innovations, and to reveal that they are all due to the lack of a single criterial approach. Within the framework of the first approach, banking innovations are considered as a source of development and implementation of additional banking products, the second and third approaches show the specifics of development and further functioning. The fourth approach assumes that the direct transformation of the functions performed by commercial banks in the world financial market is, in principle, an innovative process, and their various properties manifested are due to the conditions for their formation and further development of institutional and organizational forms characterized by a more global feature - banking technologies.

Based on the above research, within the framework of this work, we offer the following understanding of the essence of "banking innovations" as an innovative process that changes the institutional and organizational forms of organizing banking activities in the context of the introduction of information financial technologies and the creation of modern banking products.

The analytical method of the study made it possible to generalize various interpretations of understanding the essence of banking innovations, and to reveal that they are all due to the lack of a single criterial approach. Within the framework of the first approach, banking innovations are considered as a source of development and implementation of additional banking products, the second and third approaches show the specifics of development and further functioning. The fourth approach assumes that the direct transformation of the functions performed by commercial banks in the world financial market is, in principle, an innovative process, and their various properties manifested are due to the conditions for their formation and further development of institutional and organizational forms characterized by a more global feature - banking technologies.

Based on the above research, within the framework of this work, we offer the following understanding of the essence of "banking innovations" as an innovative process that changes the institutional and organizational forms of organizing banking activities in the context of the introduction of information financial technologies and the creation of modern banking products.

The analytical method of the study made it possible to generalize various interpretations of understanding the essence of banking innovations, and to reveal that they are all due to the lack of a single criterial approach. Within the framework of the first approach, banking innovations are considered as a source of development and implementation of additional banking products, the second and third approaches show the specifics of development and further functioning. The fourth approach assumes that the direct transformation of the functions performed by commercial banks in the world financial market is, in principle, an innovative process, and their various properties manifested are due to the conditions for their formation and further development of institutional and organizational forms characterized by a more global feature - banking technologies.

Based on the above research, within the framework of this work, we offer the following understanding of the essence of "banking innovations" as an innovative process that changes the institutional and organizational forms of organizing banking activities in the context of the introduction of information financial technologies and the creation of modern banking products.

Digitalization of the banking sector allows banks to implement a differentiated approach to clients, taking into account the characteristics of client groups, and to maximally focus the offer of banking products according to individual consumer preferences. The introduction of innovative technologies is aimed at creating the most accessible and transparent banking service regardless of time and place, increasing the efficiency of service due to the growth of the quality of formed banking services. This vector of development of the banking sector suggests that, as a result, competition in the banking environment will intensify against the background of the formation of the most accessible and customer-oriented banking products.

The introduction of information technologies in the field of finance creates the need to assess modern challenges and study the concept of "banking innovations", to determine their place and content as the basis for the development of modern banking (Table 2).

The innovative approach to banking used today forms the conditions for the expansion of banking products and services, presupposes the evolution of customer service in the bank, which determines the level of efficiency in the development of the banking services sector. The growth of quality and expansion of the banking product line are based not only on their development, but also on the growth of information transparency in terms of obtaining information by bank customers, directly by banks.

The introduction of banking innovations has a dual effect:

- on the one hand, the introduction of banking innovations ensures the modernization of banking services, expands their availability and increases their speed, ensuring an increase in demand for them, increasing the profitability of financial institutions to determine the optimal level of margin, and reducing operating costs;

- on the other hand, a massive transition to operations in the digital field will lead to an increase in cyber threats and a decrease in the level of security of ongoing operations associated with the active transition to a remote digital format of banking operations.

At the same time, the preservation of the traditional form of banking with minimal introduction of banking innovations will lead to even more negative results.

The technologies implemented by the banking sector are the process of penetrating innovations into work with customers and their data, to increase efficiency and optimize customer service.

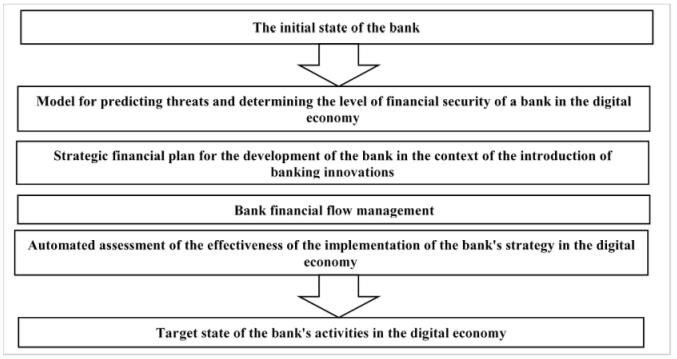

The development of banking activities in the context of the digitalization of the economy creates the need to develop the following elements of the program to achieve the target financial state of the bank's activities: a model for predicting threats and determining the level of financial security of the bank in the context of digitalization; financial plan for the development of the bank in the context of the introduction of innovations; the strategy for managing the bank's financial flows; automated assessment of the effectiveness of the implementation of the bank's strategy. The mechanism for forming a program to achieve the target state of the bank's activities in the digital economy is shown in Figure 1.

The introduction of banking innovations in the development of additional banking products allows us to meet the growing needs of the client sector, which, in comparison with traditional banking services, will make it possible to form priority areas: development of low-cost quick operations; creation and implementation of custom products and financial services; formation of the bank's presence in all forms of interaction with the consumer; building algorithms for obtaining smart solutions; coverage of new social groups of consumers of banking services in the financial market through telecommunication networks.

In accordance with the study of the implementation of mobile banking services (experts from the IT company CROC) in the modern Russian banking system, all major banks have implemented this technology.

The main advantage of introducing banking innovations in the context of the digitalization of the economy based on mobile banking technologies is undoubtedly the reduction in banking costs for customer service. According to experts, “customer service in the application is 40 times lower than the cost of customer service in a branch, and 2 times lower than in Internet banking. In 2019, mobile banking penetration in Russia is more than 71%, a higher indicator is typical only for the emerging markets of Brazil, India and China. The penetration of breakthrough technologies into mobile banking also cannot be called ubiquitous yet: only 2 banks out of 25 have synchronization with a voice assistant; thematic collections and personalized recommendations in the format of stories (stories), formed on the basis of "big data" (big data), have 3 banks out of 25; full-fledged chat bots on the first line of support are implemented only in 3 out of 25 banks (Information and analytical review of the Association of Russian Banks, 2019).

The formation of a list of banking services that bring an increase in the profitability of operations allows banks to attract significant investments in the development and implementation of banking innovations. The change in the setting of tasks in the banking sector took place in stages, starting from the earlier main tasks of the IT departments of banks, consisting in the aligned priorities of the top management of banks, aimed at shaping business goals using digital technologies, the further transformation of services put the heads of IT departments deeper tasks consisting in cardinal solutions leading to the transformation of the business itself. The introduction of remote access and remote banking service channels through automated systems of access to banking services, stimulation of an increase in the number of participants or users of remote banking services, the rapid growth in the volume of processed information led to an increase in the load on the IT department.

On the other hand, in whole areas of banking services, there was a decrease in the volume of work due to the transformation of the banking business process based on the introduction of banking innovations in the context of the digitalization of the economy. The changes taking place concerned, in particular, the expansion of the functionality of the IT department and the reduction of the workload of other departments of the banking structure.

There was a redistribution of the structural significance of the subdivisions during the transformation of the IT architecture of banks due to the introduction of innovative information technologies, such as: intelligent software (especially machine learning); cloud technologies; Big Data, including "data lakes" and working with data in RAM (in-memory); resource virtualization; Open API; Open Source; distributed ledger technology; microservice architecture.

The introduction of banking innovations in the context of the digitalization of the economy significantly changes the structure and methods of providing banking services based on the transformation of the bank's relationship with customers. The developed algorithms for providing services to the bank's clients are based on the analytical work of the program, which collects information about the client and his preferences, aimed at anticipating client requests, optimizing client interaction, correcting and eliminating possible potential problems; the use of polling chat bots and virtual assistants orientate the conversation with the client in any financial plane, responding to the client's inquiries about his accounts, right down to the history of expenses. The use of robot-consultant programs makes it possible to conduct client consultations on all financial issues of interest, providing initial consulting on the client's investment opportunities and completing with personalized proposals for accumulating savings. Using virtual reality capabilities in terms of visualizing expenses, allows predicting savings, offering options for optimizing the use of savings, taking protective measures in terms of introducing biometrics in the banking sector for the purpose of identifying and authenticating a client or a client's representative; the integration of video with personalized interactive services is quite useful.

Pshenichnikov (2018) believes that it is this technological component in the banking sector that has made it possible to form a modern model of banking services, which consists in the formation of a whole ecosystem of value exchange. The main differences between traditional and digital banking models are summarized in Table 3.

Tougher competition in the banking sector leads to the introduction of the latest technologies that ensure the flow of customers by changing the banking service algorithm.

Banks focused on providing services to retail customers run the risk of losing 20-60% of their profits in the next 10 years (Belous & Lyalkov, 2017). The dynamic development of banking requires a complete digital transformation of the banking sector.

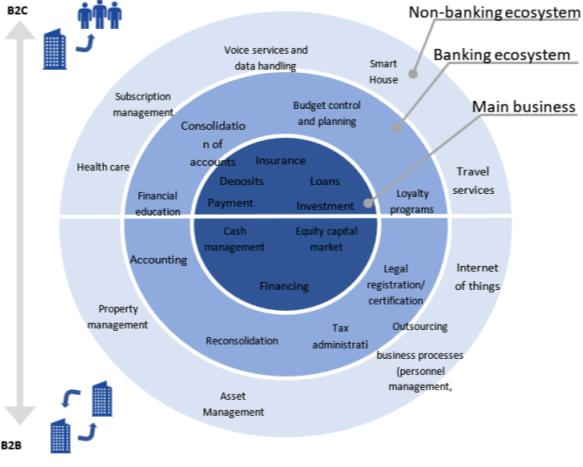

Timely implementation of banking innovations in the context of the digitalization of the economy will create a single digital space that includes the banking business and the digital environment. Expanding the concept of digital innovation, we are introducing a broader concept of a "single space" called "digital banking ecosystem". The conceptual definition of a digital banking ecosystem includes a bank's business model, the construction of which provides the formation of the next evolutionary model of cooperation and an area of competition in shaping the best customer experience aimed at establishing partnerships between producers of goods and services.

As part of the development of a theoretical approach to understanding the essence of digital banking ecosystems, it is necessary to say that this format allows the user - the bank's client to access all the resources of not only the financial organization itself, but also its accompanying financial projects: insurance, investments in the stock market, bonus program with partners, etc.

The digital banking ecosystem allows counterparties and partners to enter into effective interaction with the client, outstripping the emerging needs and expectations with the supply (Figure 2). An expert environment is being formed that provides the client with advisory assistance, which turns into the delegation of his rights by the client to a professional expert and assistant in making a decision. This expert should be a bank. The bank becomes the center of the ecosystem, being the coordinator of possible actions and operations of the client. The forecast option assumes that by 2025 banking ecosystems will consolidate about 30% of the total gross revenue of organizations and enterprises.

The differences inherent in the principles of the formation of digital banking ecosystems allow banks, unlike fintech companies, to take a central place in the national economy, taking into account its digitalization:

- fintech companies do not have an extensive client base with established long-term relationships, unlike banks;

- there are no organizations with a rigid control structure and performing the functions of compliance control;

- banks have created and implemented advanced IT platforms, which required significant financial and time costs;

- The volume of financing for software development of the financial technologies market is carried out by banks in the amount of 20%, the next part of financing in the amount of 20% is financing by credit institutions.

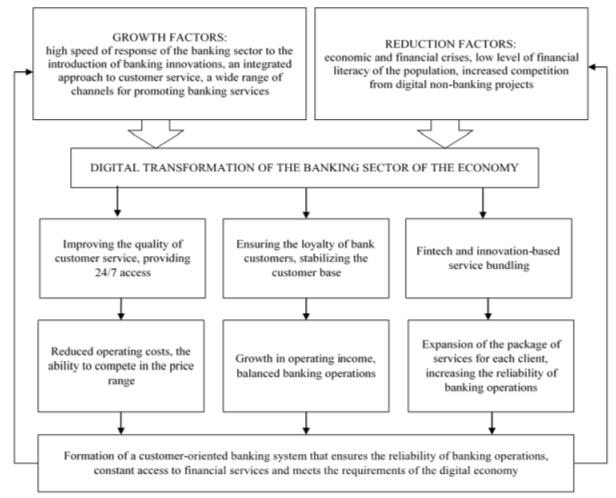

The global, step-by-step goal of developing modern banking services in the context of digitalization is the formation of a barrier-free environment for the provision and receipt of services by the bank's clients and their needs. The main obstacle to the growth of the number of innovative digital banks is the current legislation. The insufficient development of digital customer service channels is hampered by the low financial literacy of customers, and their fears to transfer all their settlements and interaction with the bank to a cashless format. The expert opinion speaks of a low readiness to carry out the transformation of banking automation tools and software that does not have a high degree of customization, coordination with new software, which complicates their full-fledged functioning, complicates the personnel shortage of highly qualified engineers and developers. The presented mechanism, showing the transformation of the Russian national banking system in the light of the influence of significant factors, is shown in Figure 3.

Findings

Research (Kearney, 2014) has helped substantiate three basic approaches to digital transformation of the banking sector.

The first approach is based on the implementation of banking innovations, which are their own project, which does not include the functions of transformation into the digital environment being built, the ongoing digital transformations are implemented in stages, based on long-term planning and development of pilot projects, this approach is followed by 26% of banks in the global financial environment (Going Digital: The Banking Transformation Road Map, 2014).

The second approach is implemented through pilot projects, the development of which and the field of implementation are subsidiary financial companies, activities and software are built on the basis of the requirements of the digital economy. 42% of banks pass this way through digital transformation. The main advantage of this approach is customer focus, focusing on the needs of customers for the long term. This approach brings high flexibility to the built organizational structure, allows testing of innovative directions within the structure, without prejudice to the working directions.

The third approach to digital transformation of the banking structure is to recognize the primacy of the introduction of banking innovations - which are the main value of the organization. A detailed construction of the structure can use elements of other approaches, but within the framework of the full implementation of the digital strategy, through the transformation of both internal and external technological processes of the bank. This direction of digital transformation is carried out by 32% of banks.

Digitalization holds great potential for the development of financial services and the entire banking sector, but it is necessary to remember the increasing risks and dangers associated with the growth of electronic networks. The main risk is the loss of national digital sovereignty with all the ensuing consequences, which indicates the need to strengthen and ensure cybersecurity in the digital banking ecosystem being built. It is necessary to carry out the calculation and constant monitoring of the increasing risks when introducing new technologies, not to get carried away by playing ahead. At the same time, financial technologies are risk management tools for banking specialists who make informed decisions on most of the problems and issues that arise.

In modern times, a limiting factor in the development of the digitalization process of the banking sector in Russia is low investment activity and modest financial investments in fintech technologies. Analyzing the volume of investments in the latest financial technologies, there is a large gap between the projects of large, medium and small banks. The main banks of the top ten in Russia are investing in modern financial technologies and are starting the process of digital transformation. Medium and small banks in Russia are in the state of trial launches and pilot projects to launch digitalization of banking services, this group also includes fintech companies that form their needs and prepare for digital transformation, go through the expansion of digital competencies.

Banks and financial companies failing to close the digital divide will need to merge or leave the market. Expert opinion shows that the main reasons for passive participation in digitalization are the lack of the necessary level of funding; the presence of regulatory restrictions that prevent the introduction of the latest digital technologies in banks; backward software, automation tools in banks, which do not allow the introduction of new subsystems into existing ones, which becomes a new restriction on the path of digitalization (Bakhareva, 2017).

The market leaders are established fintech divisions (Alfa-Laboratory, Sberbank Technologies) investing in digital innovations, in innovative software developments, in organizing large data arrays on the basis of a single platform (for example, DataLake), based on optimizing the coverage of the territory a network of branches, based on dynamic modeling and end-to-end analysis of customer flows, with the current updating of the branch format.

The emerging digital banks require in-depth research, their pilot projects are a noticeable phenomenon in the domestic banking sector, these are banks of a new generation. Digital banks are represented in the retail sector, such as Rocketbank, TouchBank, in the segment of small and medium-sized businesses, representatives of such banks are Modulbank, Tochka. Digital banks compete with technologically advanced banks that operate without opening branches, for example, Tinkoff Bank, but also with traditional lending institutions. An interesting pilot project is TalkBank - the first bank in the world that organized communication between clients and the bank through chat bots.

Conclusion

Thus, we came to the conclusion that the introduction of banking innovations is the result of the mutual merger of two global trends - the digitalization of society and the introduction of fintech. These trends are global trends, due to their irreversible nature, going along with globalization and informatization, virtualization and building and connecting networks, etc. This means that the transformation of the banking sector of the economy based on the introduction of banking innovations into the activities of banks is a systemic and large-scale phenomenon, a new stage in the development of banking.

The impact and development of the introduction of banking innovations, the penetration of digitalization into all areas of banking, will inevitably lead to the transformation of the banking sector of the economy. The digitalization of banking has significant benefits for the end consumers of banking services, banks and the state. Innovative and technological development in the banking sector creates the preconditions for the formation of a perfect financial system, which inevitably contributes to the growth of socio-economic development. In the process of developing optimal innovative and technological strategies for the development of banking services and technologies, it is necessary to calculate positive advantages, but it is also necessary to forecast possible negative consequences and take into account the requirements for a safe transition of banking operations to digitalization and electronic settlements.

Acknowledgments

The article was carried out within the framework of a grant from the Russian Foundation for Basic Research, project number 20-010-00101 А.

References

Bakhareva, A. A. (2017). Prospects for the development of the banking sector in the context of the introduction of modern financial technologies. Symbol of Science, 1. 12-14.

Belous, A. P., & Lyalkov, S. Yu. (2017). Banks development vector in the digital revolution stream. Banking, 10. 16-19.

Filippov, D. I. (2018). On the influence of financial technologies on the development of the financial market. Russian Entrepreneurship, 19(5). 1437-1464.

Global FinTech Report, PwC. (2017). https://www.pwc.com/jg/en/publications/pwc-global-fintech-report-2017.pdf

Going Digital: The Banking Transformation Road Map. (2014). https://www.atkearney.com/documents/10192/5264096/Going+Digital+The+Banking+Transformation+Road+Map.pdf/60705e64-94bc-44e8-9417-652ab318b233

Gryaznova, A. G. (Ed.) (2004). Financial and credit encyclopedic dictionary. Finance and Statistics.

Information and analytical review of the Association of Russian Banks. (2019). Russian banking system today Interaction of the real and financial sectors in the context of the digitalization of the economy.

Kazarenkova, N. P., & Svetovtseva, T. A. (2018). Transformation of the Russian banking system under the influence of the digitalization of the economy. Bulletin of the South-West State University. Series: Economics. Sociology. Management, 8-4(29), 188-195.

Kearney, A. T. (2014). Financial Stability Implications from FinTech. Supervisory and Regulatory Issues that Merit Authorities’. https://www.fsb.org/wp-content/uploads/R270617.pdf

Koch, L. (2010). Principles and mechanisms for increasing the efficiency of banking activities based on the use of innovations: abstract. Ivanovo.

Marenkov, N. L. (2005). Banking innovations and new banking products. Secondary vocational education, 9, 49-52.

Maslenikov, V. V., Fedotova, M. A., & Sorokin, A. N. (2017). New financial technologies are changing our world. Financial University Bulletin, 22(21), 6-11.

Nazipov, D. A. (2007). From automation to profit: information technology as a key factor in increasing the competitiveness of Russian banks. Bank lending, 6, 376.

Pertseva, S. Yu. (2017). Fintech: functioning mechanism. Management innovation, 12, 50-53.

Pertseva, S. Yu. (2019). Digital transformation of the financial sector. https://mgimo.ru/upload/iblock/2ef/Инновации%20в%20менеджменте.pdf

Popova, T. Yu. (2011). Evaluation of the effectiveness of financial innovations implemented by banks with state participation. Financial analytics: problems and solutions, 6, 177.

Pshenichnikov, V. V. (2018). Influence of financial technologies on changing the model of banking customer service. Service theory and practice: economics, social sphere, technologies,1(35), 48-52.

Rybakov, A. (2019). Digitalization of classical banks. Technologies in Finance and Banking. https://controlengrussia.com/innovatsii/cifrovizacija-bankov/

Spruzhevnikova, M. K. (2002). Modeling the process of introducing new banking products on the example of plastic cards. Finance and credit, 22, 51-59.

Zhukov, E. F. (2008). Stocks and bods market. Unity-Dana.

Zubchenko, L. A. (2009). Financial innovation, monetary policy. INION RAS.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Magomaeva, L., & Galazova, S. (2021). Banking Innovations As The Basis For Digital Transformation Of The Banking Sector. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 1809-1823). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.202