Abstract

This paper sheds light on how current levels of the shadow economy in the post-soviet countries deeply rooted to the way institutions and government objectives were formed in the past. The study covers the evolution of the shadow economy over more than half century to identify principal institutional determinants thereof. Since, once political and government institutions get organized in a certain way they have a tendency to maintain over time and shape perception of market-players about merits and demerits of the formal and informal economy provided by the existed institutions. We conducted empirical analysis for eight FSU countries over the period 1996-2015. The Ordinary Least Squares (OLS) regression model is used to draw general conclusion, along with iteratively reweighted least-squares (IRLS) regression estimations to check for robustness and the second stage least squares (2SLS) estimations to control for possible endogeneity. All regression results provide strong and persistent negative correlation between the size of the shadow economy and institutional quality measures of control of corruption, government effectiveness and rule of law. Similarly, the state-induced distortions, due to the high government intervention, less business and fiscal freedoms, also demonstrate significant impact on the share of underground economy in these countries.

Keywords: Shadow economy, institutions, economic freedom, JEL classification: H41, D02, E62

Introduction

The shadow (informal) economy has existed in more or less magnitude in almost all economies over a long period of time. Yet it has been begun conceptualizing since the early 1970s and has become central for both economists and policy-makers, due to its distorting effect on the accuracy of the official economy and reliability of major economic indicators (Charmes, 2012). The hidden nature of the underground economy, however, causes ambiguity in identifying potential determinants of it (Schneider & Enste, 2000). There are two distinct school of thoughts, first of which put forward fiscal and social security burden as the main drivers (Frey & Pommerehne, 1984; Kanniainen et al., 2005; Schneider, 1994a, 1994b; Tanzi, 1983, 1999), while researchers like Choi and Thum (2004), Friedman et al. (2000), Johnson, et al. (1998), and Rose-Ackerman (1999) consider economic, legal, and political institutions as well as corruption as principal causes. Thus, to identify reasons “going underground” requires comprehensive studies considering origins and historical development of the shadow economy over a longer period (Ɖurić, 1999; Schneider & Enste, 2013).

That is why, to understand nature of the informal economy in the former USSR countries, it is important to evaluate and discern historical and contemporary contributors, and their impact on the size of the shadow economy. Since studies on concealed forms of activities in these countries have been dormant for decades, thereby causing scientific gap. The importance of this paper lies in investigating early literatures to find out triggering circumstances of the shadow economy in the post-soviet republics and analyze them in various dimensions.

Problem Statement

The earliest studies of the shadow economy in the Post-Soviet states began to be studied after Grossman`s (1977) pioneering research on the second economy (the term used for shadow economy). The hidden economic activities were widely believed to be non-existent under Stalin`s control and just started emerging under Khrushchev and further developed in the post-Khrushchev period (Rutgaizer, 1992). As for earlier studies, the reasons for concealed form of activities defined as conscious intention to make private gains by substituting formal protection with the informal risks` payoff (Grossman, 1977).

Sampson (1987) characterizes virtue of the underground economy in the Soviet Union as “lubricating” and “corrosive” to the formal economy. It is “lubricating” because, high level of market control by the government brought bureaucratic bottlenecks that disrupted the production cycle and insufficient allocation of resources, which could be avoided through hiding part of the supply chain or bribing procurement channels. Earlier Grossman (1982) defined these deficiencies as “the Four B`s effect: barter, black market, bribe, and “blat” (russian phrase for “connections” or “influence”). In the late 1970s, on average 33% of people in the USSR made a quarter of all their income informally (Grossman, 1982). Similarly, Sampson (1987) links flaws of the formal economy with structural inadequacies, especially “where the control organs are less effective due to either laxity at the center … or to the resistance of a hostile periphery or ethnic minority” … or “[large] degree of corruption [accounted for 15-20% of all illegal earnings as for Simis (1982 p. 166) - bribes to planners, hush money to police, nepotism and influence peddling”. The rigid state regulations of the market through fiscal and societal norms as well as with the combination of resistance to the existing political institutions created a gap for the underground economy to rise (Böröcz & Portes, 1988).

Rutgaizer (1992) points out that the expansion of the shadow economy coincided with the development of the corruption, which was rising together with the transformation from a rigorous authoritarian regime to more relaxed thereof, in 1950-70s. Such transition required modification of operating administration-and-command economic system in order to manage underground sector. These reforms were phased in through constructive and the liquidatory approach: former addressed legalization and privatization of hidden activities by creating leasing and cooperatives to incentivize their production. Initially, services sectors were focused due to its informality prone nature. Latter dealt mostly with the liquidation of economic crimes, such as abuses, embezzlement, misappropriation, and money laundering. Besides, these reforms directed against the loss of production which stemmed from the inefficient leverage of the workforce due to collectivism.

The USSR Statistical Committee in 1985, conducted a survey to study public perception regarding main causes of illegal income (Rutgaizer, 1992). The survey confirmed that the pervasive shortage of consumer goods and organized crime (with authorities) are the main reasons for shadow economy. About 51 percent of respondents stated that a lack of foodstuffs and apparel as well as corrupted system made them break the law to obtain necessary goods. This perception emerged due to “…violations of economic links, the ruin of consumers markets, attempts of local authorities to administer the markets by noneconomic methods, breaches of deliveries and distribution of the consumer goods, and creation of artificial deficits” (Treml & Alexeev, 1993, p. 9).

In the same vein, Kim and Shida (2014) in their analysis of Soviet republics from 1965 to 1989, found out a significant positive relationship between informal economy and shortage of consumer goods which caused by the centrally planned economy`s incoordination and incomprehensive knowledge on the nature of firms and their production capacity. Furthermore, the study reveals the impact of exogenous variables, including economic, governance, and socio-demographic factors.

In brief, the emergence and development of the second economy was characterized mainly by the scarcity of consumer products, corruption, and organized crime in misappropriating state-owned property, inadequate public goods, no incentives for private gains and production expansion, as well as ineffective enforcement of set regulations.

After the dissemination of the Soviet Union in 1991, some of the republics were successfully in the transition from central-planning to well-functioning market institutions, whereas others maintained communist legacy of rigorous political control over private enterprises. Russia, Kazakhistan, Tajikistan, Armenia, Uzbekistan, Turkmenistan, Azerbaijan, Belarus, Kyrgyzstan, and Moldova are typical examples of the latter, wherein political power has been monopolized, and established political institutions have intervened market operations. Such intervention manifested through various constraining regulations, ranging from market entry to the price, exchange rate, and international trade controls, which, in turn, has violated basic terms of the market economy (Johnson et al., 1997).

Furthermore, a study by Kaufmann and Kaliberda (1996) reveals that a huge reduction in potential profits due to the exorbitant generalized tax rates (e.g. aggregate burden of regulations, taxation and bribery), lack of public goods (e.g. imperfect law and order, and ineffective regulatory institutions) and misappropriation of budget revenue have made official economy precarious for legal entities to operate in. As a consequence, firms have found operating informally less burdensome and profitable, even they have been deprived of using most of the public services. However, they could still use other market-supporting public goods, such as infrastructure and others for no official charges. Although, Johnson et al. (1997), Kaufmann and Kaliberda (1996) distinguished the major rationals behind firms moving to the underground economy, they failed in appraising accurate volume of that. They considered repressive enforcement mechanisms as the most likely restriction, which violated the assumption of the total electricity consumption model of free mobility of firms between two alternative ways of running a business.

In contrast, Lacko (2000) explains limitations in Johnson et al. (1997) and Kaufmann and Kaliberda`s (1996) study with the FSU countries excessive reliance on a particular product at the beginning of its sovereignty (due to regional specialization during USSR), which, together with tight state control, led to a biased calculation. Employing household electricity consumption approach Lacko (2000) managed to provide more credible figures. Her findings show a rising tendency of the shadow economy in the FSU countries, from 15.7 percent to 29.5 percent in 1990 and 1995, respectively. Despite disagreeing on the share of the shadow economy provided by Johnson et al. (1997), Kaufmann and Kaliberda (1996), Lacko`s (2000) findings on potential determinants complies with their results.

Slow privatization reforms during that period also created unfavourable conditions and disconnections in business nexus, causing less private production share in GDP than the share of unofficial production (Lacko, 2000). The burdensome fiscal and social security systems on employment prevent firms also from hiring officially, since the utilization of illegal labour force appeared to be not only more profitable but also more productive, due to incentives for high current economic benefits and future savings (Schneider, 2002). Besides, fierce regulatory load in the country, Schneider`s (2007) empirical analysis reports that the higher corruption level signifies more unequal laws and enforcement of thereof, which overburdens the majority of economic actors and privileges few monopolies, thereby leading rising level of informality.

Research Questions

In this study we investigate empirically to what extent institutions and government distortions effect on the size of shadow economy. So that based on above-stressed factor effects we formulate following two core hypotheses:

- Hypothesis 1. A higher level of institutional (political, legal, and economic) quality reduces the size of the informal economy, ceteris paribus.

- Hypothesis 2. A lower degree of economic (business, trade, and fiscal) freedom increases the size of the shadow economy, ceteris paribus.

Purpose of the Study

This study seeks to empirically identify and evaluate shadow economy determinants considering the revised pieces of literature. Thus, we analyze the significance of institutional factors on the development of the shadow economy in the post-soviet countries due to the existence of general institutional, regional, demographic similarities throughout the period (Rakhimov, 2018).

Dependent variable

The data on the scope of the shadow economy in GDP is retrieved from Medina and Schneider`s (2018) MIMIC (Multiple Indicator and Multipmatle Cause) approach estimations. Due to limited data availability analyses cover Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyz Republic, Moldova, Russian Federation, and Tajikistan over the period 1996-2015.

Independent variables

The research focuses on mainly the efficiency and equity matters of the political, economic, legal and government institutions` impact on the shadow economy. Thus, we analyze fundamental institutional factors and relevant proxies drawn from WDI and The Heritage Foundation, along with the set of controlling variables from World Bank database, in order to avoid omitted related variables bias (Psychoyios et al., 2019; Quintano & Mazzocchi, 2013; Schneider, 2007; Torgler & Schneider, 2009).

As a proxy for the institutional quality, we use the most study relevant four worldwide governance indicators developed by Kaufmann et al. (2010), based on multiple sub-components drawn from 25 different sources. Kaufmann et al. (2010) place these four indicators into two subgroups out of three as follows:

1.The capacity of the government to effectively formulate and implement sound policies:

- Government Effectiveness (GE) – measures the quality and viability of political and economic institutions in creating and delivering public goods, and

- Regulatory Quality (RQ) – captures capacity and willingness of a government to produce equal sound policies and legal base to lessen the regulatory burden and accommodate private-enterprise prosperity.

2. The respect of citizens and the state for the institutions that govern economic and social interactions among them:

- Rule of Law (RL) – gauges the lawmakers` and enforcement agents` compliance with social rules and independence from political pressure and interest in formulating and introducing socially and economically preferable regulations, and

- Control of Corruption (CC) – gauges inclination of public agents to abuse power for private gains, and monopolization of politics by elites for private interests.

The scores range between -2.5 and 2.5, higher score implying better institutional quality (Kaufmann et al., 2010).

Alongside governance variables, the study includes a set of economic freedom indexes to test the extent to which political and economic institutions can provide a better market-friendly condition. We use the following four indexes from four broad groups (in parenthesis):

1.Government intervention (Rule of law) – over-regulation of the economy by government undermines free-market conditions and leads an unpredictable business environment, inefficient resource allocation, and constrains economic actors to pursue their best economic interests;

2. Fiscal Freedom (Government Size) – the larger the after-tax income the larger incentive to undertake the formal activity.

3.Business Freedom (Regulatory Efficiency) – The less burdensome and redundant regulations the higher productivity and profitability in the formal sector.

4. Trade Freedom (Market Openness) – The less marketing restrictions (tariffs, export taxes, trade quotas, or outright trade bans) the greater opportunity to follow economic goals and maximize productivity.

Indices lie between 0 and 100 percent, latter indicating higher economic freedom and regulatory burden but the reverse is true for government intervention.

Also, we employ a set of following macroeconomic indicators (Omri, 2020; Quintano & Mazzocchi, 2013; Torgler & Schneider, 2009): 1) GDP per capita – a proxy for income level, 2) unemployment – a proxy for labour market conditions, 3) ratio of export and import to GDP to proximate economic openness and 4) the goss capital formation – a proxy for provision of (physical) public infrastructure.

Summary statistics in Table 1, reports the average size of the shadow economy (41.6% of GDP) and mean values for independent variables. Control of corruption (-0.9), rule of law (-0.8), government effectiveness (-0.6) and business freedom (61.6 percent) are expected to have a significant impact on economic actors decision making-process to stay in or exit the formal sector, due to smaller mean values.

To check for possible collinearity between independent variables we report the result of the Variance Inflation Factor (VIF) in Table 1. The regressors have VIF values below 10, implying there is no serious multicollinearity problem (Gujarati & Porter, 2009).

Research Methods

To estimate the extent of correlation and impact of regressors on the regress and we use longitudinal data, due to its high econometric efficiency, larger degrees of freedom, and lower multi-collinearity problems (Hsiao, 1986).

To carry out the analyses, the pooled Ordinary Least Squares (OLS) regression model employed, together with the set of robustness tests (Baum et al., 2010; StataCorp, 2017). The baseline econometric model is:

SEit = α + β2Inst.Qit + β3Econ.Fit + β3CTRLit + εi (1)

where SEit denotes shadow economy in the country i over the period t; α and εi stand for intercept and error term, accordingly; slope are denoted by β; Inst.Q and Econ.F represent the set of institutional and economic freedom variables suggested by empirical literature, and CTRL indicates controlling variables.

Findings

Empirical results of the first regression analysis

Table 2 illustrates basic OLS robust regression results with the individual variable effect (Eq. (1) - Eq.(5)) and with the Breusch-Pagan and Ramsey-Reset test results for heteroskedasticity and omitted variable bias, respectively. The R-squared provide higher values after controlling for country fixed effects (Eq. (1)) but for all levels, the F-statistics reports sufficient overall fitness and predictive power of the specified model (Gujarati & Porter, 2009).

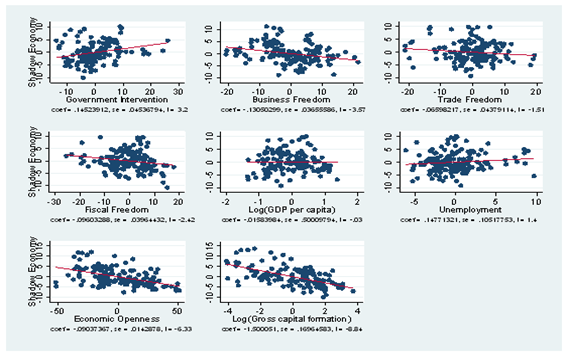

First, we explore the impact of economic freedom indicators separately Eq.(1) to see their contribution to the overall fitness and the size of the shadow economy. As expected, government-induced distortions have a positive effect and it is statistically significant at the .01 level, while all other three: business, fiscal and trade freedom provide negative signs, with the first two one having .01 and .05 significance levels, respectively, and trade liberalization being insignificant at the level. Included controlling variables also report theoretically expected signs, with economic openness and gross capital formation (physical infrastructure proxy) being significant at level, whereas GDP per capita and unemployment are not. Figure 1 presents scatterplots and estimated coefficients of Eq.(1).

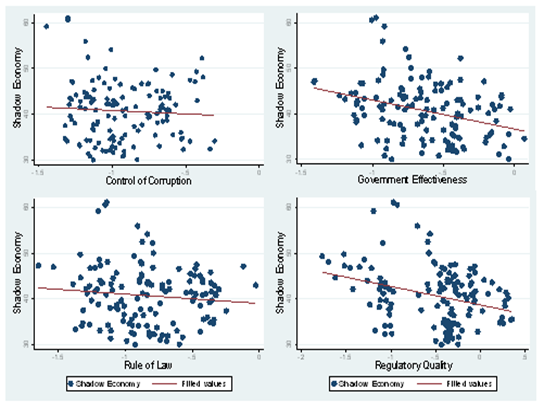

Eq.(2) Eq.(5) declare institutional instability effect in combination with other variables and country dummy variables. The standardized coefficients of all economic freedom and macroeconomic (controlling) variables, and institutional quality indicators are statistically significant at the .01 level (except trade freedom), having signs inline with theoretical expectation, except regulatory quality (positive and insignificant at level). The corruption level in post-socialist countries appeared to be still one of the main informality contributors (statistically significant at the .05 level (see Eq.(2))) as it was in pre-independence period (Rutgaizer, 1992; Schneider, 2007). A study by Friedman et al. (2000) reveals that corrupted system causes erosion of economic freedom and increases insecurity and uncertainty of the official sector, thereby motivating legal entities to seek profit maximization opportunities in an unofficial economy. Dreher and Schneider (2010) show empirically that corruption has a complementary effect to the shadow economy in low-income countries. Government effectiveness tested in the third specification (see Eq.(3)) and confirms its significant inverse relationship (at .05 level) with the informal economy. Well-functioning government is assumed to provide effective policies and public services which decrease the legal sector burden, and at the same time, increase the probability of getting caught while operating in the illegal sector (Dreher & Schneider, 2010). As for Regulatory Quality included in Eq.(4), it did not have consistent predication sign and high importance. Among all the other three governance quality indicators Rule of Law appeared to have the greatest influence on mitigating magnitude of the underground economy (see Eq.(5)). It provides the highest parameter estimates of beta, and significance level (at the .01 level) of all four. Johnson et al. (1998) and Friedman et al. (2000) pointed out that lack of credible rule of law reinforces corruption in the official economy, thereby acts as a catalyst for unofficial economy development. Findings by Torgler and Schneider (2009) evidenced citizens are more unwilling to undertake legal activities under the imperfect quality of contract enforcement, judicial effectiveness, property rights, and arbitrary exercise of power, which are subcomponents of weak rule of law (see Figure 2).

Robustness checks

In this section, we run five specifications to check the robustness of our previous findings in Table 2. Table 3 provides an iteratively reweighted least-squares (IRLS) regression estimations, that withstand the pull of outliers, and produce more efficient results (contributing them better-than-OLS efficiency), applying iteratively reweighted least squares with Huber and bi-weight functions tuned (adjusted) for 95% Gaussian efficiency (Hamilton, 2004). According to Hamilton (2004), IRLS obtains robust estimations, firstly by automatically removing any observations that have a strong influence (due to having Cook`s D values above 1), and then, it performs weighted least squares by employing Huber and bi-weight functions to down weight observations that have greater residuals, thereby weighting more extreme outliers less heavily in regression testing. The IRLS regression results in Table 3 (Eq. (6) – Eq. (10)) support strongly our core hypotheses and preceding findings. All economic liberty indices and controlling variables have signs and significance levels that are consistent with in Table 2, with minor deviations in the standardized coefficients. As for Control of Corruption, it complies sign consistency but it is now statistically significant at the .1 level and has smaller parameter estimates of β = -1.382 (Eq. (7)).

The negative sign and statistically significance level of Government Effectiveness stays in line with previous results (Eq.(8)), but its coefficient also drops (1.787). Eq.(9) reports results with Regulatory Quality, which is still statistically insignificant and has a positive sign. Rule of Law shows greater importance in reducing the size of the shadow economy among all other institutional quality sub-indices (Eq.(10)), as seen in earlier estimations in Table 2. In both analyses, it is at the .01 significance level and has the highest quantitative impact.

Causality test

To evaluate the direct impact of institutional quality and economic freedom on the size of the shadow economy, we employ instrumental variables (IV) method, which allows controlling for possible endogeneity and obtaining asymptotically normal estimates (Hall et al., 1996). To deal with endogenous errors we instrument our main independent variables with legal origin (Egnlish, French, German dummies) from La Porta et al. (1999), the legal system (political rights) and civil liberty from Freedom Hause (2020), and from Drazanova (2019) ethnic fractionalization indexes (Alesina et al., 2003; Bai & Wei, 2000; La Porta et al., 1999). The logic behind employing aforementioned instruments is that cultural values, historical base and development of these factors shape and determine the quality of the institutions, as well as the perception of citizens on their credibility (Hall & Jones, 1999).

Table 4 provides five second stage least squares (2SLS) estimations with diagnostic tests. To assess the validity of the moment Sargan (1958) and Hansen`s J-test (1982) statistics are insignificant in all cases, declaring that chosen instruments are valid and there is the absence of overidentification. As for Anderson canonical correlations, LM and Kleibergen-Paap rk LM tests also support the relevance of our instruments in three cases out of four. In Eq. (11) – Eq. (15), the coefficients` signs match previous results and all instrumented variables are statistically significant at the conventional levels, except Regulatory Quality.

However, Business freedom index is significant only in Eq. (11) and Eq. (13), and in the former equation, after controlling for country fixed effects we receive a significant and negative parameter of interest for Trade Freedom index. The findings in Table 4 are consistent with Schneider`s (2012) summary of studies on major informality drivers, in which average contribution of the state institutions quality accounts for 10-12 percent, while regulatory burden amounts to 7-9 percent of the total. An empirical study by Johnson et al. (1997) reports that intense state economic regulations substantially increase the fiscal and regulatory burden and discretion costs which fall on employers, therefore forcing them to choose “exiting”. Similarly, Johnson et al. (1998) associate high level of underground economic activities with the “exclusion” of economic agents from public goods and services due to inadequate rule of law, and prevalence of corruption in government sector.

Conclusion

This study investigated significance of fundamental institutions on the size of the shadow economy. Our study used panel data of 20 years (1996 – 2015) from eight post-socialist countries with the least institutional and government performance quality which have been maintaining elements of authoritarianism. Due to general similarities in the way how fundamental state institutions established, findings can also be applied for other FSU countries which have been excluded from the analysis. The empirical analysis in this study shows a strong and significant correlation between the size of the shadow economy and two sets of factors. The first set of indicators is characterized as “exclusionary” factors in which Control of corruption, Government effectiveness and Rule of law are included to measure institutional quality (Perry et al., 2007). The state failure in creating and enforcing effective and legitimate institutions deprive market-players of public goods, which may occur directly through mechanisms inclined toward certain groups or indirectly by putting bribery, bureaucracy and formality barriers. As a consequence, perception of citizens about the credibility of the state representatives deteriorates and this provides moral justification to stay out of the “truncated welfare systems” of social security (de Ferranti et al., 2004; Perry et al., 2006). The second groups of indices are Government intervention, Business freedom, and Fiscal freedom. As for Hirschman (1970), these factors capture the reason behind the choice of the “exit” option, because limited freedom in economic choices and regulatory burden imposed by state frustrate market participants to stay formal and motivate to opt for revenue-raising norms in the underground economy. To sum up, more inclusive and legitimate institutions, enforced by well-functioning legal mechanism is a prerequisite for a lower level of informal economy in the Post-Soviet states.

References

Alesina, A., Devleeschauwer, A., Easterly, W., Kurlat, S., & Wacziarg, R. (2003). Fractionalization. Journal of Economic Growth, 8(2), 155-194.

Bai, C. E., & Wei, S. J. (2000). Quality of Bureaucracy and Capital Account Policies. World Bank working paper, 2575.

Baum, F., Schaffer, E., & Stillman, S. (2010). ivreg2: Stata module for extended instrumental variables/2SLS, GMM and AC.HAC, LIML and k-class regression. Boston College Department of Economics.

Böröcz, A., & Portes, J. (1988). The Informal Sector under Capitalism and State Socialism: A Preliminary Comparison. Social Justice, 15(3-4), 17-28.

Charmes, J. (2012). The Informal Economy Worldwide: Trends and Characteristics. The Journal of Applied Economic Research, 6(2), 103-132.

Choi, J., & Thum, M. (2004). Corruption and shadow economy. Michigan State University.

de Ferranti, D., Perry, G., Ferreira, F., & Walton, M. (2004). Inequality in Latin America and the Caribbean: Breaking with History? World Bank.

Drazanova, L. (2019). Historical Index of Ethnic Fractionalization Dataset.: Harvard Dataverse.

Dreher, A., & Schneider, F. (2010). Corruption and the shadow economy: an empirical analysis. Public Choice, 144, 215-238.

Ɖurić, D. (1999). The Shadow Economy: Between Authority and Crime. Journal for Labour and Social Affairs in Eastern Europe, 2(1), 59-68.

Freedom Hause. (2020). Freedom in the world. freedomhouse.org

Frey, S., & Pommerehne, W. (1984). The hidden economy: State and prospect for measurement. Review of income and wealth, 30, 1-23.

Friedman, E., Johnson, S., & Kaufmann, D. (2000). Dodging the grabbing hand: the determinants of unofficial activity in 69 countries. Journal of Public Economics, 76, 459-493.

Grossman, G. (1977). The Second Economy of the USSR. Problems of Communism, 25-40.

Grossman, G. (1982). The Shadow Economy in the Socialist Sector of the USSR. The CMEA five-year plans (1981-1985) from a new perspective, 99-115.

Gujarati, D., & Porter, D. (2009). Basic Econometrics. (Fifth edition). McGraw-Hill/Irwin.

Hall, A., Rudebusch, G., & Wilcox, D. (1996). Judging instrument relevance in instrumental variables estimation. International Economic Review, 37(2), 283-298.

Hall, R., & Jones, C. (1999). Why do some countries produce so much more per worker than others? Quarterly Journal of Economics, 114, 83-116.

Hamilton, L. (2004). Statistics with STATA. Brooks/Cole.

Hansen, L. P. (1982). Large Sample Properties of Generalized Method of Moments Estimators. In Econometrica, 50, 1029-1054.

Hirschman, A. (1970). Exit, Voice, and Loyalty: Responses to Decline in Firms, Organizations, and States. Harvard University Press.

Hsiao, C. (1986). Analysis of Panel Data. Cambridge University.

Johnson, S., Kaufman, D., & Zoido-Lobaton, P. (1998). Regulatory discretion and the unofficial economy. The American Economic Review, 88, 387-392.

Johnson, S., Kaufmann, D., & Shleifer, A. (1997). The Unofficial Economy in Transition. Brookings Papers on Economic Activity, 2, 159-239.

Kanniainen, V., Pääkkönen, J., & Schneider, F. (2005). Determinants of shadow economy: theory and evidence. mimeo Johannes Kepler University Linz.

Kaufmann, D., & Kaliberda, A. (1996). Integrating the Unofficial Economy into the Dynamics of Post Socialist Economies: A Framework of Analysis and Evidence. Policy, Research working paper. World Bank Group.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2010). The worldwide governance indicators: Methodology and analytical issues. World Bank policy research working paper, (5430).

Kim, B., & Shida, Y. (2014). Shortages and the Informal Economy In the Soviet Republics: 1965-1989. The Russian research center, RRC Working Paper Series, 43, 1-29.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (1999). The quality of government. Journal of Law, Economics, and Organization, 15, 222-278.

Lacko, M. (2000). Hidden economy – an unknown quantity? Comparative analysis of hidden economies in transition countries, 1989–95. Economics of Transition, 8(1), 117-149.

Medina, L., & Schneider, F. (2018). Shadow Economies around the World: What Did We Learn Over the Last 20 Years? IMF Working Papers, African Department: International Monetary Fund. WP/18/17.

Omri, A. (2020). Formal versus informal entrepreneurship in emerging economies: The roles of governance and the financial sector. Journal of Business Research, 108, 277-290.

Perry, G., & Maloney, W., Arias, O., Fajnzylber, P., Mason, A., & Saavedra-Chandvi, J. (2007). Informality; Exit and Exclusion. The World Bank.

Perry, G., Arias, O., Lopez, J., Maloney, W., & Servén, L. (2006). Poverty Reduction and Growth: Virtuous and Vicious Circles. World Bank.

Psychoyios, D., Missiou, O., & Dergiades, T. (2019). Energy-based estimation of the shadow economy: The role of the governance quality. Discussion Paper Series 2019_07, Department of Economics, University of Macedonia. revised Nov 2019.

Quintano, C., & Mazzocchi, P. (2013). The shadow economy beyond European public governance. Economic Systems, 37(4), 650-670.

Rakhimov, M. (2018). Complex regionalism in Central Asia: Local, regional, and global factors. Cambridge Journal of Eurasian, 2, 1-12.

Rose-Ackerman S. (1999). Corruption and Government: Causes, Consequences, and Reform. Cambridge University Press.

Rutgaizer, M. (1992). The Shadow Economy in the USSR. Berkeley-Duke Occasional Papers on the Second Economy in the USSR.

Sampson, S. (1987). The Second Economy of the Soviet Union and Eastern Europe. The Annals of the American Academy of Political and Social Science, 493, 120-136.

Sargan, D. (1958). The estimations of economic relationships using instrumental variables. Econometrica, 26, 393-411.

Schneider, F. (1994a). Measuring the size and development of the shadow economy: Can the causes be found and the obstacles be overcome? Essays on economic Psychology, 49, 193-212.

Schneider, F. (1994b). Can the shadow economy be reduced through major tax reforms? An empirical investigation for Austria. Public Finance, 49, 137-52.

Schneider, F. (2002). The Size and Development of the Shadow Economies of 22 Transition and 21 OECD Countries. IZA Discussion Paper, 514.

Schneider, F. (2007). Shadow Economies and corruption all over the world: New Estimates for 145 Countries. Economics-journal, 9, 3-47.

Schneider, F. (2012). The Shadow Economy and Work in the Shadow: What Do We (Not) Know? IZA Discussion Papers, 6423.

Schneider, F., & Enste, D. (2000). Shadow economies: size, causes, and consequences. Journal of Economic Literature, 38, 77-114.

Schneider, F., & Enste, D. (2013). The shadow economy: An international survey. Cambridge University Press.

Simis, K. (1982). USSR - the corrupt society: the secret world of Soviet capitalism. Simon and Schuster.

StataCorp. (2017). Stata: Release 15. Statistical Software. College Station, TX: StataCorp LLC.

Tanzi, V. (1983). The Underground Economy in the United States: Annual Estimates, 1930-80. Staff Papers (International Monetary Fund), 30(2), 283-305.

Tanzi, V. (1999). Uses and Abuses of estimates of the underground economy. Economic Journal, 109, 338-400.

Torgler, B., & Schneider, F. (2009). The impact of tax morale and institutional quality on the shadow economy. Journal of Economic Psychology, 30(2), 228-245.

Treml, V., & Alexeev, M. (1993). The second economy and the destabilizing effect of its growth on the state economy in the Soviet Union: 1965-1989. Berkeley-Duke Occasional Papers on the Second Economy in the USSR, 36.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Rakhmonov, A., & Elmurodov, S. (2021). Institutional Determinants Of Shadow Economy In The Former Soviet Union Countries. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 1047-1060). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.116