Abstract

The Islamic banking system has been recognized around the world as an alternative to the fast-growing traditional banking system and in the short term has become an integrated mechanism that can fully compete with commercial banks. Unlike commercial banks, Islamic banks have been able to attract entrepreneurs and business people through a balanced distribution of profits and losses among participants in financing. The role and importance of the country's financial and credit system, as well as the implementation of research on the introduction of alternative banking services remain an essential issue. In addition, establishment of Islamic banking services has been waiting for many years for entrepreneurs of Uzbekistan. In particular, the country's financial and credit support in finding solutions to the issues of "expanding the scale of modernization and diversification of regional economies, reducing the gaps in the level of socio-economic development of regions through the rapid development of underdeveloped districts and cities, primarily through industrial and export capacity." The role and importance of the system, as well as the implementation of research on the introduction of alternative banking services remain a as crucial issue yet to be tackled. The article describes alternative Islamic banking services to national banking system in the context of sustainable development.

Keywords: Islamic banking, Islamic window, deposit, riba, Sharia compliance

Introduction

Islamic banks are a bank or a system of banking activities that implements banking services in practice in accordance with the principles of Sharia (Islamic rules). Principles that value moral values in all dealings have a special appeal. The Shari'a prohibits the giving or receiving of money, as well as the payment or acceptance of interest payments for the conduct of trade and other activities that provide goods or services that are considered contrary to its principles. In the past, these principles have been used as the basis for a thriving economy. In the late twentieth century, a number of Islamic banks pushed Muslims to create alternative banking services, which in turn created Islamic banking services not only for Muslims, but for all to use, regardless of nationality or religion.

Chapra (2001) explains Islamic economics is a system that operates on the basis of Shari'ah laws and rules that provide for the needs of the people, enable them to fulfill their obligations to Allah and society, obtain material wealth, and do not allow injustice in its management. The Islamic banking and financial system differ from the traditional financial system in that it is based on a comprehensive ethical system derived from Islam. Unlike traditional financing, Islamic finance is based on the basic principles governing any Islamic economic or financial transactions (Omar, 2013).

At a time when Muslim countries, which have just emerged from colonialism, are defining the next stages of development based on their religious and cultural heritage, the issue of reviewing and developing the economic and financial system has become a serious issue. The concept of “Islamic economics” was widely used by the Indian economist Abul Alo Mawdudi in the 1950s (Nagaoka, 2012). He critically analyzed the existing modern economic institutions and explored Islamic ways of modernizing them. For example, Mawdudi acknowledged the role of government in the redistribution of wealth, but criticized the failure of fiscal policy in the capitalist sphere to correct the gap between rich and poor. Alternatively, he proposed an institutional reform of the income distribution function using zakat, one of the five pillars of Islam.

Iqbal and Mirakhor (2007) explored that muslim scientist began to study ways and means of establishing commercial banks on an interest-free basis in the 1960s, economists were of the opinion that this was nothing more than a fantasy. Nevertheless, in 1963, the first interest-free Islamic bank appeared in Egypt at Mit Gamr. The Gamr region consisted of villages and the population was religious. Knowing that interest was forbidden in Islam, they did not put their deposits in any bank. In this context, the task was set not only to respect Islamic values related to humanity, but also to inform people about the use of banking services.

The Islamic banking system was founded in the 1970s. In a short period of time, it has become an integrated mechanism that can fully compete with commercial banks. Unlike commercial banks, Islamic banks have attracted entrepreneurs and business people through a profit-loss system (credit system). This system, with its fairness and low level of financial crisis, has attracted not only Muslims but also members of other religions.

Thus, in the early 90s, the Islamic banking project began to be applied to the world financial market from the "experimental field". A number of important and favorable factors played an important role in the implementation of this process.

Problem Statement

The population of Uzbekistan constitute 34.7 million people and majority of them are fallow the Islam 94%. It has 30 commercial banks in the country. However, none of them give Islamic banking services. Islamic bank has the ability to raise more funds than the non-Muslim population. it collects deposits. This factor that can attract the savings of the population in the country and invest in its production. The entrepreneur, the bank and the customer will be equally benefit from establishment of Islamic banking services. It also prevents cash from remaining in the hands of the population and ensures its circulation through the bank. It helps to reduce the inflation rate.

Literature development

The authors of many famous works on Islamic banking services and its special aspects are the authoritative jurist Yusuf Qarzavi and Taqi Osmani. In 2013, German scholar Alexander Wolters conducted research on the strategies, institutions, and first experiments of Islamic finance in Central Asia (Wolters, 2013). His research suggests that Uzbekistan, located in the heart of Central Asia, is a closed country, so Islamic finance has not yet developed, and Kazakhstan may have a wide range of opportunities and be a center of Islamic finance.

Baidaulet Erlan, another Islamic scholar who has conducted research in Central Asia, in his book "Fundamentals of Islamic Finance" illustrates the development of Islamic banking in Central Asia on the example of Kazakhstan (Baydaulat, 2019a, p. 52-53). Sheikh Muhammad Sodiq Muhammad Yusuf, one of the scholars of our country, provides information on Islamic banking services in his works “Market and related issues”, “Debt and related issues”. Especially, it is addressed the issues that arise between the seller and the buyer

The Islamic banking system is defined as an organization that operates in accordance with Sharia (Islamic law) in banking and business operations, and Sharia (Islamic law) requires that these operations be legal. That is, it finances production projects that are safe for society as permitted by Sharia and prohibits the payment or receipt of interest on any transactions

One of the first modern scholars to advance the theory of the Islamic economic model was Anwal Ikbar Qureshi in his 1945 book, The Theory of Islam and Interest. He proposed to build the relationship between the Islamic bank and the customer on the basis of partnership. However, he did not give a clear definition of the partnership, believing that capital should be provided by one party and the other party should work, with profits and losses distributed to both. In 1947, Sheikh Mahmoud Ahmad repeated the same view in his book “Islamic Economics” with a proposal to establish Islamic banks as limited liability companies. He believed that the placement of client capital could be done on a partnership basis (Baydaulat, 2019b, p. 78).

A number of important and favourable factors played an important role in the implementation of Islamic banking in to process. They are:

- Acceptance of the idea of Islamic finance by the international community.

- Use of English, which is the world's financial language today.

- growth and expansion of Islamic banks and financial opportunities.

- Emergence and development of Sharia councils in Islamic banks.

- Establishment of various international coordination centers (agencies).

- activation and development of ijtihad in the field of fiqh of commercial agreements.

- Achieving consensus among lawyers of the four sects on most important issues.

- Islamic finance contracts should be clear to both traditional investors and access to international financial markets.

- The role of coordinating organizations and political leaders of countries that have introduced the Islamic banking and financial system and laid a solid foundation for the development of Islamic finance.

Recognizing the potential of Islamic finance, as well as the limited capabilities of classical Islamic finance contracts, a number of major Western banks, law firms and other stakeholders have begun to create complex Islamic finance products and contracts that meet modern requirements and international standards and practices. Thus, the third stage in the development of Islamic banking began the period of change (transformation) and new ideas (so to speak, the period of adaptation). International banking experts and supporters of the harmonization of the Islamic financial system with the global financial system have begun to work closely with lawyers in the field of Islamic financial jurisprudence in order to ensure high growth rates, as well as the creation of new financial products. As a result of joint efforts, the mid-1990s marked the beginning of an era of sophisticated Islamic finance products that could compete with the traditional system in local and global markets.

Research Questions

The research attempt to address the following questions:

- How is Islamic banking different from traditional banking?

- Can it offer real alternative banking services?

- What’s the output of establishment Islamic banking in Uzbekistan?

Purpose of the Study

The purpose of this article is to develop scientific proposals and practical recommendations aimed at improving the efficiency of the financial and credit. system through establishment of Islamic banking services in commercial banks of Uzbekistan. The article describes the formation of Islamic window in the context of sustainable development.

Research Methods

The research has conducted by the systematic way. It structured in the following order: the research has chosen to work with the post-positivism research philosophy, deductive approach and descriptive research design. The chosen philosophy helps to acquire the broad knowledge of the Islamic banking services. The deductive approach contributes to conduct the entire research by comparing it with the previously existing theories and models. Finally, the descriptive research design helps to analyse the entire research accurately. This method outline is for conducting the entire research.

Findings

There are general and specific features according to the function performed by commercial banks and Islamic banks. The main goal in a commercial bank is to increase profits, and in an Islamic bank, the goal is to increase profits in strict accordance with the rules of Sharia.

The main difference between Islamic banks and traditional banks is that in traditional banks, money is traded and non-exchange income is generated, while in Islamic banks, goods are traded and income is generated. Islamic finance has no credit or guaranteed deposits, only capital and loan trading. Islamic Banking is a Sharia-compliant commercial organization. Banking operations belonging to the following groups are prohibited in Islamic banks:

- Ribo (interest)

- Maysir (gambling)

- Gharar (danger, uncertainty)

- Financing of activities (alcohol, casinos and traditional insurance companies) that are prohibited (haram) by Sharia.

Another difference between Islamic banks and traditional commercial banks is that Islamic banks share profits and losses and provide financing based on real assets. In other words, Islamic banking is based on partnership, cooperation. In this case, Islamic banks can build the facility, purchase equipment, goods, raw materials or lease them at the request of the customer. Funding is based on trade practices. Money is seen in the Islamic economy only as a medium of exchange, i.e., it is forbidden to lend money itself as interest or any profit in return.

Traditional banks have also expressed their views on the establishment of Islamic financial institutions in Uzbekistan, the emergence of fair and transparent competition in the banking system, which will lead to an increase and diversification of investment flows into the country. SWOT analysis of the organization of Islamic banking services in commercial banks of Uzbekistan was analysed (See in Table 1).

Nichita et al. (2013) identified that the development, development and introduction of Islamic principles in activities at all levels of banking transactions is the most important task facing the Islamic bank. Other differences between the Islamic Bank and the Commercial Bank are Sharia Supervisory Board and Zakat system.

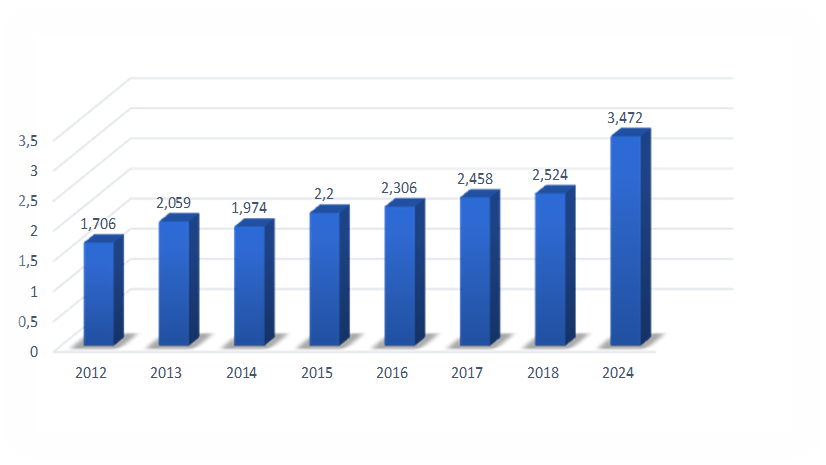

From Central Asian countries, Kazakhstan, Kyrgyzstan, Tajikistan have successfully completed the process of launching Islamic banking services and achieved positive trends. Islamic finance is developing rapidly in Europe, and many European economists consider the use of Islamic banking services as a good opportunity to start a new business. The first attempt at Islamic banking in the Western world took place in Luxembourg in 1978, and an international holding institution of the Islamic banking system was established (Hasan & Bashir, 2005). That same year, Al-Baraka was founded in the United Kingdom. In 1983, the International Islamic Bank was established in Denmark (See in Figure 1).

Nowadays, "Islamic windows" are opening in many major advanced banks of the world (ABN Amro, Bank of America, Barclays Plc., BNP-Paribas, Chase Manhattan, Citibank, Deutsche Bank, Goldman Sachs, HSBC, JPMorgan Chase, Lloyds Bank, Societe Generale , UBS, etc.) and provide all types of Islamic banking services that are a complete alternative to traditional banking products. ICD report.,2019

In order to establish an Islamic window (Islamic window) for commercial banks operating in the Republic of Uzbekistan, which operates in accordance with Islamic law and provides cost-effective Islamic banking services, it is necessary to:

- A commercial bank must first define a strategy and clear goals for the establishment of an Islamic window.

- Appoint a worthy leader to the Islamic banking window.

- Sharia Supervisory Board (SHC)

- Secretary of the Shariah Supervisory Board

- Training, education and advanced training of qualified specialists

- The right choice of Islamic products and services.

The following can be achieved through the establishment of Islamic banking services under commercial banks and the expansion of cooperation with foreign banks:

- creating many new jobs;

- increase the activity of the financial market by increasing the financial literacy of the population;

- establishment of new financial institutions.

Islamic finance is a new direction for the Uzbekistan’s economy, which is needed by both business and the population. The emergence of alternative financing products will help expand the population's access to financial services. However, existing expectations can be seriously distorted due to the lack of experience and knowledge of potential customers in the field of Islamic finance, as well as insufficient improvement of banking and financial legislation. There are also risks associated with the regulation of Islamic financial products in the context of unequal interpretation of Sharia law in Muslim countries, lack of qualified specialists in the field of Islamic finance.

The need for Islamic banking services in our country is reflected in the following.

The distribution of profits and losses between the bank and the customer provides a wide range of opportunities for entrepreneurs and business entities engaged in entrepreneurial activities. It also plays an important role for the socio-economic development of society. For commercial banks, the successful completion of the business of entrepreneurs is very important for commercial banks. Because if the entrepreneur goes bankrupt, the bank becomes a partner in the loss. Therefore, the Islamic bank has an effective system for issuing, controlling and repaying loans.

The organization of Islamic banking services, the creation of financial products that meet the needs and solvency of vulnerable groups and small businesses, the use of information and communication technologies and social financing methods to overcome mass poverty in many countries and attract large sections of the population to the financial and economic process. thereby, it is able to accelerate economic activity and create the necessary conditions for healthy economic growth. In contrast to traditional banking services, usury, gambling (financing of gambling, ie lottery games and similar activities), and speculation (ignorance of information or deception) are strictly prohibited in Islamic banking services. Hence, these principles prevent the types of activities that are harmful to society.

The general similarities between the activities of Islamic banks and commercial banks are as follows:

- collection of temporarily idle funds and their capitalization;

- financing of enterprises, organizations and the population;

- settlements and payments in the economy;

- activity in the financial and foreign exchange market;

- provision of economic and financial information and consulting services, etc.

Today, Islamic banking services cover almost all operations of traditional banks. They are investing most of their capital in manufacturing, agriculture, trade and services. Today, developed and developing countries are launching Islamic banking services in the traditional banking system.

In order to achieve economic development, it is first necessary to develop the country's banking and financial system. Financial development increases the efficiency of capital distribution, which allows for long-term growth. The emergence of the Islamic financial and banking system offers a system of tools to promote social and economic justice and stimulate economic development. The successful introduction of the long-term system in our country will contribute to the development of the banking system.

If we look at the world experience, the most developed country for Islamic banking services is Malaysia. International banks seeking to dominate domestic markets are trying to attract demand for products that meet most Shariah requirements and a large acceptable deposit fund, especially in the Middle East. Their goal is not to develop Islamic finance, but to take advantage of the situation and increase bank profits.

Ahmad Abu-Alkheil (2012) indicated that Malaysia’s experience in Islamic finance is remarkable and first officially began in 1963, when the government set up a Tabung Hajj or Pilgrims Management Fund Council. The idea of Tabungji Haji’s work was introduced by Professor Ungku. Using the Malaysian experience, commercial banks should be allowed to offer Islamic banking services through their existing branches and networks. The study identified factors that save this method time and reduce costs. This is because the development of new Islamic banks will be costly in terms of resources and time from the outset. Similarly, the estimated cost of opening a new branch of an established bank is at least $ 12,000. In addition, additional time is required to recruit new staff to manage the administrative process and branches. Thus, instead of replacing the existing banking system in Malaysia, it would be better to use the method of owning traditional and Islamic banks in dual banking system.

The organization of Islamic banking services in commercial banks will increase the level of financial literacy of the population and the introduction of competitive products from commercial banks that will provide customers with an alternative and optimal choice. Indeed, the active movement of free money in the economy, the use of funds to finance targeted investment projects leads to an increase in the money supply due to the deterioration of macroeconomic indicators, including a decrease in the velocity of money and, as a result, inflation.

Conclusion

Currently, only Uzbekistan and Turkmenistan have not established Islamic banking services in Central Asia. The experience of developed countries shows that the introduction of Islamic banking services will help to implement a coordinated policy to ensure macroeconomic stability in the country, including reducing inflation and achieving the set goals. In order to establish Islamic banking services following tasks should be done:

1. It is necessary to amend the current legislation, ie the Law on Banks and Banking, the Law on the Central Bank, the Tax Code, the Civil Code and a number of other by-laws, using the best practices of Central Asian countries and Islamic banking. In doing so, it is advisable to use the Malaysian experience.

2. Attracting and using available funds at the disposal of the population and businesses through the introduction of Islamic banking services in commercial banks will increase the bank's income and develop the economy.

4. By introducing Islamic finance, commercial banks can attract more customers by supporting business entities by sharing risk in business activities. From the Islamic financing models, it would be expedient to use the Murobaha (the use of this contract only in the initial period was recommended by the scholars) and the Mushoraka methods. The use of Islamic financing methods significantly attracts customers (entrepreneurs).

5. The organization of Islamic banking services will increase the level of diversification and increase competition in the financial market. Islamic Bank is a new banking system that uses digital technologies to provide banking services. This will help reduce costs, provide remote customer service, and make international money transfers.

6. It is necessary to allocate groups for bachelor's and master's degrees in Islamic banking and finance in higher education institutions, including Tashkent State University of Economics, Tashkent Financial Institute and Yodju Technical Institute in Tashkent. The establishment of joint faculties with prestigious international universities is an important step in the training of specialists in this field.

As a result of this research, Uzbekistan has the opportunity to become a center in the field of Islamic finance among the CIS countries. In conclusion, the Islamic banking sector will be an important factor, foundation and prospects for the bright future of Uzbekistan, as a result of which foreign investment will flow into the country, which reflects the deep roots of Islam in its culture, and the government will take full advantage of this opportunity.

References

Abu-Alkheil, A. M. (2012). Ethical Banking and Finance: A Theoretical and Empirical Framework for the Cross-Country and Inter-bank Analysis of Efficiency, Productivity, and Financial Performance. https://opus.uni-hohenheim.de/volltexte/2012/747/

Baydaulat, E. (2019a). Fundamentals of Islamic Finance. Uzbekistan.

Baydaulat, E. (2019b). Fundamentals of Islamic Finance. Uzbekistan.

Chapra, M. (2001). What is Islamic Economics, Islamic Economic Studies, 9(1) 1-17.

Hassan, M. K., & Bashir, A. H. M. (2003, December). Determinants of Islamic banking profitability. In 10th ERF annual conference, Morocco (Vol. 7, pp. 2-31). DOI: 10.3366/edinburgh/ 9780748621002.003.0008

Iqbal, Z., & Mirakhor, A. (2007). An introduction to Islamic finance: theory and practice. John Wiley & Sons (Asia) Pte. Ltd.

Nagaoka, Sh. (2012). Critical Overview of the History of Islamic Economics: Formation, Transformation, and New Horizons, Asian and African Area Studies, 11(2), 114-136.

Nichita, M., Kagitci, M., & Vulpoi, M. (2013). Islamic Banking System: The Case of the Kingdom of Saudi Arabia. Romanian Economic and Business Review, 8, 211-226.

Omar, M. (2013). Islamic banking and finance. Gardners Books.

Wolters, A. (2013). Islamic Finance in the States of Central Asia: Strategies, Institutions, First Experiences. PFH Private Hochschule Göttingen.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Tursunov, A. S. (2021). Establishment Of Islamic Banking In Uzbekistan. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 1026-1035). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.114