Abstract

In solving managerial problems, management lacks operational and analytical information on costs characterizing real financial and business processes at the time of making managerial decisions at various levels of company management. To do this, it is necessary to study in more detail what costs are and how they can be influenced, to obtain a detailed description of the relationship between costs, output and profit. To manage costs, it is necessary to make a competent grouping of overhead or indirect costs. The article outlines analyze the current cost accounting system at the enterprise and develop proposals for improving the organization of cost accounting, which will improve the quality of financial information, based on which the enterprise management makes management decisions. As a result of the study, proposals were developed for the management of the company that contribute to reducing costs, with the condition that the level of quality of manufactured products, safety equipment and social conditions of staff is maintained.

Keywords: Costs, cost analysis, cost accounting organization, enterprise

Introduction

In modern economic conditions, the correct accounting and calculation of costs is the most important economic indicator of the production and economic activities of companies. Calculation and management of this indicator is necessary to determine the profitability of the entire production and individual types of products; assessing the implementation of the plan and its dynamics; identifying reserves for reducing certain costs; setting prices for products; assessment of the applied technique, technology and organizational and technical measures; justification of the decision on the production of these costs and the withdrawal of unreasonable costs.

The successful implementation of the company's cost management tasks requires from the management and managers not only high competence and experience in specific areas of economic activity, but also the ability to economically adequately assess, in real time, the influence of external and internal factors affecting economic processes.

Problem Statement

Studying the economic literature, you can see that accounting systems measure the costs required to measure profits, estimate the cost of inventories, make decisions, measure the performance of people and companies.

The term “cost” is rarely used without a preceding adjective or other auxiliary word, and therefore it is often necessary to clarify what type of cost is being discussed (Drury, 2015).

In the economic literature and in practice, along with the term “costs”, such as “charges” and “expenses” are also commonly used (Lebedev et al., 2015). However, when comparing these categories, we can talk about their serious difference. For example, an “expense” as an economic category under IFRS is recognized in the income statement if there is a decrease in the future economic benefits associated with a decrease in an asset or an increase in a liability that can be measured reliably. In practice, this means that the recognition of expenses in the income statement occurs simultaneously with the recognition of an increase in liabilities or a decrease in assets.

In view of the fact that taxation problems are very relevant for national accounting, the national accounting standards of the Republic of Uzbekistan introduce the criterion,

Expenses are recognized in accounting if the following conditions are met:

- consumption is made in accordance with a specific contract,

- the requirement of laws and regulations,

- the terms of business turnover. (Karimov et al., 2019a p. 350, 2019b, p. 238)

Thus, expenses, according to national legislation, cannot be recognized only on the basis of the professional judgment of the accountant about the confidence in the reduction of economic benefits and must be documented: by an agreement, a regulation, etc. (Jumanazarov & Mukhammedova, 2015). This approach is traditional for companies in Uzbekistan and, despite the recognition in the Conceptual Foundations of the principle of the prevalence of essence over form, in fact it contradicts this principle.

Cost carriers are the types of products of the enterprise intended for sale. This grouping is necessary to determine the unit cost (Khasanov et al., 2019).

In the cost management system for companies, the task of preventing unnecessary costs, which could have been avoided, is considered more and more urgent than the task of accurately and completely determining the cost (Sorokina, 2017). The solution to this problem was the appearance at the beginning of the twentieth century.

Research Questions

The study of the development of cost management procedures in the process of integrating the Uzbekistan economy into the global economic system inevitably leads to the following questions:

- What is the role of cost information in making management decisions?

- How to characterize the essence of the cost management system, its main elements?

- What needs to be done to improve the organization of cost accounting?

Purpose of the Study

In this paper we study to analyze the current cost accounting system at the enterprise and develop proposals for improving the organization of cost accounting, which will improve the quality of financial information, based on which the enterprise management makes management decisions.

Research Methods

The work used such empirical research methods as observation, description, comparison, as well as general logical methods and techniques, in particular, analysis and synthesis, and factor analysis. The conceptual provisions of the analysis methodology are confirmed by calculations using certain techniques of economic analysis. The most significant place in the management system of any company is the cost management process. It can be stated that the cost management process is an integral part of the tactical or current policy of the company, the main goal of which is the uninterrupted provision of the necessary resources for their current production and economic activities (Xusinov & Jumanazarov, 2018). Having studied the cost accounting systems used in foreign practice, we can single out the most common for the purposes of managing the results of companies' activities (Drury, 2015; Volkova, 2019):

- system of accounting of full costs (Absorption-costing);

- variable cost accounting system (Margin accounting or Direct-costing);

- system of accounting for standard costs (Standard-cost);

- cost accounting system according to the "ABC" method (Activity Based Costing);

- cost accounting system for cost centers;

- production organization and accounting system "Just in Time", JIT.

For many companies in Uzbekistan, from the part of the management apparatus, such a priority direction is set as the organization of effective cost management in order to optimize them, increase the competitiveness of products and, ultimately, make a profit and ensure their stable financial condition.

Findings

Managing company costs will lead to a reduction in ineffective costs and expenses, which will also be reflected in an increase in the company's profits.

Each company should provide for planned measures to increase profits by reducing unreasonable costs.

In general terms, these activities can be of the following nature:

- increase in production output;

- improving product quality;

- selling or renting surplus equipment and other property;

- reduction of production costs due to more rational use of material resources, production facilities and areas, labor force and working time;

- diversification of production;

- expansion of the sales market;

- rational use of economic resources;

- reduction of production costs;

- increasing labor productivity;

- elimination of non-production costs and losses;

- raising the technical level of production.

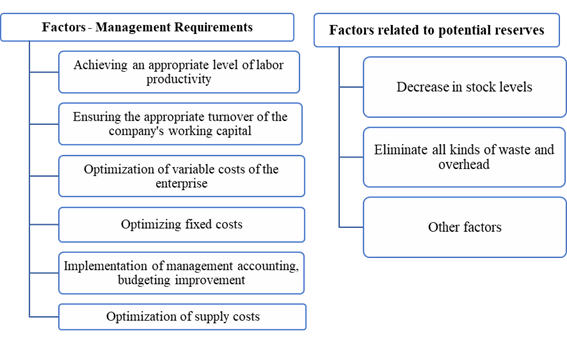

Thus, the way is to reduce the cost, the main factors of which are shown in Figure 1.

The desire to make a profit orients manufacturers to increase the volume of production of products needed by the consumer, to reduce production costs. With developed competition, this achieves not only the goal of entrepreneurship, but also the satisfaction of needs (Abdullaev & Ochilov, 2021). Despite the fact that profit is the most important economic indicator of an enterprise's activities, it does not characterize the efficiency of its work.

To determine the efficiency of the enterprise, it is necessary to compare the results (in this case, profit) with the costs or resources that provided these results.

To manage costs, it is necessary to make a competent grouping of overhead or indirect costs, they can be attributed to conditionally variable, since they combine the costs of energy resources necessary to set in motion production equipment, machines, mechanisms and vehicles; expenses for routine maintenance of equipment and workplaces (cost of lubricants and cleaning materials, salaries of adjusters, repair and other auxiliary workers). The size of these costs largely depends on the volume of production, which cannot be said about the second group of indirect costs - general economic.

General production costs consist of:

- expenses for the maintenance and operation of equipment;

- general management costs.

What both groups have in common is that they:

- consist of complex articles;

- arise in production units;

- are planned and accounted for according to the places of their occurrence;

- controlled by the budget and estimate method;

- are distributed indirectly between types of finished goods and work in progress.

At the same time, each of the groups under consideration consists of expenses of different economic content. The differences should determine the choice and justification of the bases for the distribution of costs and the sources of their recovery. And from these positions, the importance of the classification of overhead costs adopted within the company increases.

Texnouskuna LLC uses the following standard nomenclature of cost items:

- The content of the management apparatus.

- Maintenance of other personnel.

- Maintenance and repair of production equipment.

- Maintenance and repair of production facilities.

- Expenses for ensuring normal working conditions and safety equipment.

- Moving goods and raw materials within the company.

- Losses from downtime, damage to property and others.

- Other general production costs.

- General production costs of non-productive nature.

Conclusion

In the cost management system for companies, the task of preventing unnecessary costs, which could have been avoided, is considered more and more urgent than the task of accurately and completely determining the cost. The result of all the studies of economists was that cost accounting focused not on the cost of finished products (works and services), but directly on the production process that requires costs.

When developing measures to improve the efficiency and effectiveness of the enterprise, it is possible to recommend:

- develop measures and ways to increase sales proceeds (by increasing product output; improving product quality, diversifying production and sales processes; expanding the sales market; eliminating non-production costs and losses; increasing the technical level of production);

- to find internal reserves to direct them to reduce costs;

- expand the search for directions to identify sources and options for generating additional income;

- development of measures to reduce all kinds of other costs, except for the costs of sales;

- participate in localization programs, implementation of investment projects for the modernization and diversification of production, to reduce the amount of tax payments;

- consider possible ways to increase equity capital;

- in order to improve payment discipline, take measures and develop measures to eliminate the growth of receivables and inventories;

introduce the use of various types of planning and internal control to optimize the amount of non-circulating capital.

References

Abdullaev, A., & Ochilov, O. (2021). Accounting and analysis of investments under active investment policy: necessity, purpose and objectives. International Finance and Accounting, 2, 29.

Drury, C. (2015). Managerial and production accounting. UNITI.

Jumanazarov, S. A., & Mukhammedova, D. A. (2015). Managerial accounting (for practical training). Economics and Finance.

Karimov, A. A., Kurbanbaev, J. E., & Jumanazarov, S. A. (2019a). Accounting: Textbook. Economics and Finance.

Karimov, A. A., Kurbanbaev, J. E., & Jumanazarov, S. A. (2019b). Financial accounting and reporting. Textbook. Economics and Finance.

Khasanov, B. A., Mukhammedova, D. A., & Ganiyev, Z. U. (2019). Managerial Accounting: Textbook. Economics and Finance.

Lebedev, V. G., Drozdova, T. G., Kustarev, V. P., & Krayukhin, G. A. (2015). Enterprise Cost Management: Textbook. Peter.

Sorokina, K. O. (2017). Cost Management in the Company. International Journal of Humanities and Natural Sciences, 2(3), 187-191.

Volkova, O. N. (2019). Managerial accounting: Textbook and workshop. Yurayt Publishing House.

Xusinov, I. I., & Jumanazarov, S. A. (2018). Budgeting in business entities. Finance Journal, 4, 44-49.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Jumanazarov, S. A., & Kurbanbayev, J. E. (2021). Cost Management In A Company. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 992-998). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.110