Abstract

Solving the problem of developing a promising investment policy for the economic growth of industrial enterprises, managing investment complexes, creating an investment infrastructure. At the same time, the solution of the problem under consideration is impossible without a detailed study of the methodological foundations of developing a strategy for a prospective investment policy for the economic growth of industrial enterprises, including the study of the methodological foundations of analysis, methods of assessment, modeling and forecasting of investment activity in economic systems. At the same time, the current world economic crisis, due to its specificity, significantly complicates the already difficult process of forming and implementing a strategy for a promising investment policy for the economic growth of Russian industrial enterprises, which have largely lost their production potential and, therefore, have lost their competitiveness in the world market. This article discusses the general characteristics of investment activities, goals and objectives of investment. The article substantiates an systems approach to the study of the influence of external and internal factors on the prospects for the strategic investment development of economic systems. The modeling of investment activity with based on the theory of systems.

Keywords: Investment activity, analysis, assessment, modeling, forecasting

Introduction

The world economic crisis, which is increasingly affecting the Russian economy, has once again confirmed the relevance of the shift in the focus of the country's socio-economic development to the sphere of domestic production and its basis - industrial enterprises.

According to Nosova et al. (2017) the erroneous orientation of the development of industrial enterprises towards short-term development programs, caused by the crisis, is basically unable to ensure their economic growth, since it is aimed exclusively at localizing losses during the crisis.

Thus, we agree with the point of view of Nosova et al. (2019) that the implementation of anti-crisis measures does not deny the need to develop a strategy for a promising investment policy for the economic growth of industrial enterprises.

Problem Statement

Consider the general characteristics of investment activities in economic systems. Mazur and Shapiro (2008) believe that investment can be viewed as a temporary refusal of the economic system from the current consumption of available investment resources (capital) in order to use these resources to improve its well-being in the future.

At the same time, spending money on the purchase of non-current assets, for example, equipment, reduces the liquidity of the assets of the economic system.

From the point of view of Voronov (1999), the main features of investment activity that determine the approaches to its analysis are:

- irreversibility associated with the temporary loss of the consumer value of capital (for example, liquidity);

- expectation of an increase in the initial level of well-being;

- uncertainty associated with the long-term allocation of results.

Proceeding from the fact that, in general, it is customary to distinguish between two types of investments (real and financial) when developing a strategy for a promising investment policy for the economic growth of industrial enterprises, we will consider mainly real investments.

In the case of real investments, the condition for achieving the intended goals, as a rule, is the effective use of acquired (or created) non-current assets for the production of demanded products and their subsequent sale on the basis of obtaining the desired profit. With expanded reproduction, investment activity is associated with the formation of organizational and technical structures of a newly created business for making a profit in the course of the statutory activities of an enterprise created with the attraction of investments.

In cases where the volumes of investments necessary for the development of the economic system turn out to be significant in terms of impact on the current and future financial condition, the adoption of appropriate management decisions, as a rule, is preceded by the stage of planning investment activities, called pre-investment, which most often ends with the development of an investment project.

An investment project reflects a program of measures related to the implementation of investments, their subsequent reimbursement and profit. The task of developing an investment project is to prepare the information necessary for informed decision-making regarding the feasibility and efficiency of investment.

According to the approach developed by Akhmedov (2009) modeling of investment activities within the framework of the project is carried out on a time basis with the allocation of stages on the research horizon in the form of scenarios of a probabilistic nature. Each stage is characterized by a description of the planned budget outflow and cash inflow, which characterize the cash flow of the investment project, both in terms of particular values and in total, taking into account discounting.

In the aggregated structure, the cash flow of an investment project consists of the following main elements: investment costs, proceeds from product sales, production costs, taxes.

Technically, the task of investment analysis is to determine what the cumulative total of cash flows will be at the end of the established research horizon.

In investment analysis, the concepts of profit and cash flow, as well as the related concept of depreciation, play an important role. According to the point of view of Volkov and Gracheva (2004) the economic meaning of the concept of "profit" is that it is a capital gain that demonstrates an increase in the welfare of an economic entity that disposes of a certain amount of resources, and is calculated as the difference between income received from the sale of products and services in a given time interval and the costs associated with production of this product (provision of services).

In investment activities, the fact of making a profit is preceded by the reimbursement of the initial investment, which corresponds to the concept of "depreciation". In the case of investing in non-current assets, this function is performed by depreciation deductions.

The substantiation of the fulfilment of the main requirements for the project in the field of real investments is based on the calculation of the amounts of depreciation and profit within the established research horizon. In the most general case, this amount will be the total cash flow of the operating period.

The value of investments lies in their ability to create added value, that is, to make a profit. This value in the financial market, including the money market and the capital market, determines the value of investment resources.

Thus, the value of the invested capital is the rate of return that determines the value of disposing of an investment over a period of time. It is expressed in the form of an interest rate determined on the basis of market conditions, that is, from the alternative options for using capital and the degree of risk of existing options. Inflation is one of the constant components of the market value of capital.

The calculation of investment flows adjusted for inflation is carried out using a modification of the Fisher formula:

where n - is the nominal interest rate; r - is the real interest rate; i - inflation rate.

To compare the values of cash receipts and payments, spaced over time, discounting is performed. The key criterion of investment efficiency - net present value (NPV) - is the sum of all cash flows (receipts and payments) arising during the period under consideration, reduced (recalculated) at one point in time, which is usually the moment when the investment begins.

The value of the discount rate can be determined as: the minimum profitability of an alternative way of using capital (for example, the rate of a deposit in a reliable bank); the existing level of return on capital (for example, the weighted average cost of capital of the company); the cost of capital that can be used to implement this investment project (for example, the rate on investment loans); the expected level of return on invested capital, taking into account all the risks of the project.

The above options for rates differ mainly in the degree of risk, which largely determines the value of the investment.

The main purpose of evaluating an investment project is to substantiate its commercial (entrepreneurial) viability, including: full reimbursement (payback) of invested funds; making a profit, the amount of which justifies the abandonment of any other method of using investment resources and compensates for the risk arising from the uncertainty of the final result.

When performing investment analysis, the task of assessing the effectiveness of investments determines the fate of the project as a whole.

Research Questions

The following questions were raised during the study:

- What is the role of investment for Russian industrial enterprises?

- Factors affecting the investment activity of enterprises?

- The validity of a systematic approach to investment management in enterprises?

Purpose of the Study

Supposedly, the answers to the issues raised above will help achieve the goal and contribute to the

development of recommendations for investment management at industrial enterprises.

Research Method

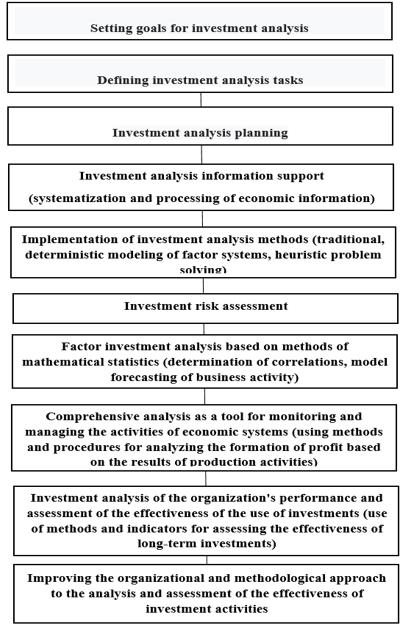

Let us consider in more detail the methodological foundations of the analysis of investment activity in economic systems, which are traditionally based on the modern concept of economic analysis. On the basis of this concept, the methodological base and methodological approaches to the analysis and assessment of the dynamics and structure of assets, capital, liabilities, income and expenses, to the assessment of cash flows of economic entities of a market economy, their investment activities are substantiated (Figure 1).

The methodological foundations of the analysis of investment activity in economic systems determine the development of optimal management decisions related to the output of products and the assessment of the final results of the activity of economic systems.

In order to identify and evaluate the overall picture of the investment activity of the economic system, to ensure the planning and distribution of its financial resources, taking into account the maintenance of constant readiness for market changes, it is advisable to use specialized tools and analysis methods. According to research conducted by Bondarenko et al. (2018) one of the most productive approaches is to analyze the investment flows of economic systems. It examines the streams of income and investments, asset build-up and distribution of profits, individual investment transactions and their series.

It provides a holistic view of the investment activity of economic systems, the development of operational and strategic plans, including the preparation of individual important investment operations.

It is generally accepted that the ideology of investment flows is one of the fundamental foundations of modern financial management.

The ITHINK structural modeling package as a representative of dynamic modeling software based on the international standard IDEF 1 allows to quickly analyze various options for investment strategies, develop plans for investment operations and present them in a sufficiently visual form.

The peculiarity of the ITHINK package is that it provides the construction of a picture of the movement of investment resources in real time. At the same time, schemes of investment operations are formed in the form of visual diagrams of financial flows, which are considered not only financial calculations, but also a series of investment operations and the movement of various types of assets, values, securities, contracts, orders, etc.

One way to use ITHINK models is to do the following:

- development of options for reference investment strategies;

- input of forecast data and variables, including the schedule of investment resources investment;

- calculation for all variants of strategies;

- formation of a scheme that best meets the investment objectives.

At the same time, the package provides the construction of derived analytical indicators. At the same time, weighting the investment flow by risk factors opens the way for risk management. That is, it is possible to build a cumulative flow of the net present value of investments. In general, experts note that the use of ITHINK-type models is extremely promising for planning investment activities of economic systems in modern Russian conditions.

Since investment activity involves the separation in time of the stages of investment and their return, there is a risk of uncertainty of future events. Uncertainty is understood as the ambiguity of the development of events of interest in the future, associated with the impossibility of accurately predicting the main indicators of the development of investment activity. Thus, uncertainty is an objective phenomenon of entrepreneurial activity, which can bring both a positive effect (speculative risk) and a negative one (pure risk).

It is the pure risk associated with the probabilistic manifestation of the negative effect of investment activity that is the primary object of management.

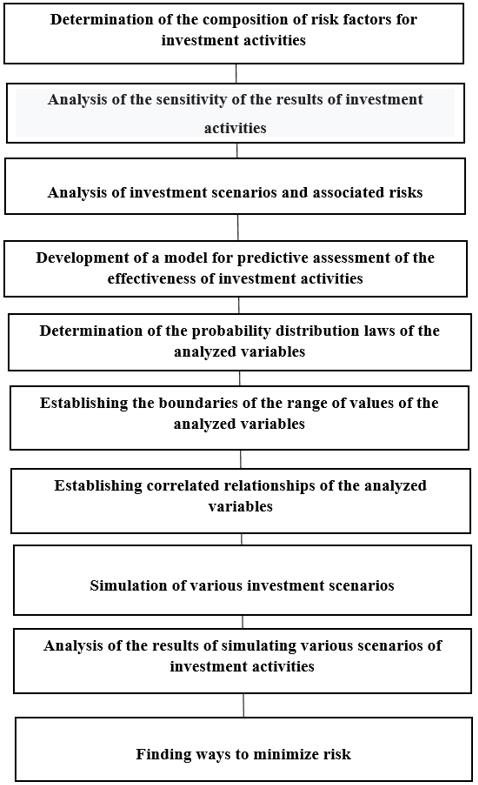

In general, the analysis of risks of investment activity in economic systems can be presented in the form of an algorithm (Figure 2).

Thus, risks are an inherent property of investment activity. Risk analysis provides investors with the necessary data on the feasibility, degree of investment efficiency and the necessary measures to protect investments from the likelihood financial losses based on the use of tools of probability theory and mathematical statistics.

In general, the following main directions of risk analysis of investment activity in economic systems can be distinguished:

- analysis of the sensitivity of investment activities to risk factors;

- analysis of scenarios for the development of investment activities;

- analysis of the level of uncertainty of the expected results using probabilistic and statistical methods.

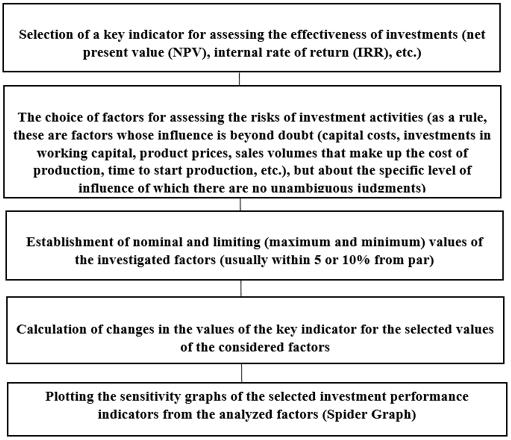

A typical algorithm for the sensitivity of investment activity to risk factors is shown in Figure 3.

Scenario analysis of investment activity is a risk analysis, which, along with the basic set of initial data on investment activity, considers a number of other sets of data, mainly of an external nature, which may have an impact on the development of investment processes. In the simplest case, it boils down to choosing the three most probable scenarios: optimistic, realistic, and pessimistic. Moreover, if the expected values of investment activity correspond only to the optimistic scenario, then this option of investment activity should be abandoned.

Additional opportunities for analyzing and assessing the risks of investment activities are provided by the Monte Carlo simulation method, which is based on the hypothesis of the independence of the influence of most of the factors influencing investment activities, which allows generating random scenarios for investment activities.

The use of information about the possible impact of uncertainty associated with influencing factors on the analyzed key indicators of investment activity allows one to move from point estimates to the probability distribution of all possible values of the analyzed indicators. This enables the investor to make a more informed investment decision based on an analysis of the likely risk values.

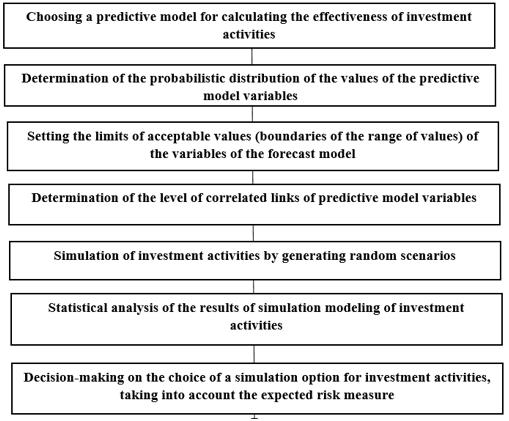

Simulation of investment activity by the Monte Carlo method, which provides statistical information for the analysis of a risk measure, can be presented in the form of an algorithm (Figure 4).

According Dmitriev and Dubanevich, (2020) Monte Carlo simulation of investment activity is a procedure by which a mathematical model for determining a key indicator (for example, NPV) is subjected to a series of simulation runs. In the course of the simulation process, sequential scenarios are built using the initial data, which, within the meaning of the project, are uncertain and therefore are assumed to be random variables in the analysis process. The simulation process is carried out in such a way that random selection of values from certain probability distributions does not violate the existence of known or assumed correlation relations among the variables. Simulation results are collected and analyzed statistically in order to assess the measure of risk.

Findings

Modeling investment activity in economic systems is not limited to analyzing the risks associated with the variation of the values of individual parameters within the specified scenarios.

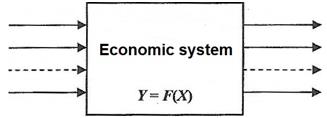

Considering the issues of modeling investment activities at the enterprise level, one should agree with Dmitriev et al. (2020) approach about the advisability of considering modeling investment activities in economic systems from the standpoint of general systems theory, when the functioning of the system is generally described by the relationships between the states of its inputs and outputs (Figure 5).

Thus, the input actions on the system x1, x2, ... xm, forming the input vector {X}, correspond to the output reactions y1, y2, ... yn, which are components of the output vector {Y}.

As calculations showed Dmitriev et al. (2020) the relationship between the states of the inputs and outputs of the system, describing its functioning mathematically, can be represented as a transformation of the vector {X} into the vector {Y}:

Y=T(X) (1)

where T - is the transformation operator.

The matrix representation of the transformation (1) reflects the particular effect of changing the value of the j - th component of the vector X (xј) on the change in the value of the i - th component of the vector Y (yi):

(2)

where is the partial effect coefficient.

The set of coefficients ay, in the general case, forms the transformation matrix:

(3)

Conclusion

System analysis allows to rationalize the management decisions taken on investment issues in the process of implementing the capital circulation. Using a systematic approach makes it possible to protect investment policy from market instability.

Quantifying key investment performance indicators process requires the construction of a structure for a comprehensive analysis of the parameters specified in the system, taking into account the susceptibility of projects to various external influences. The basis for a systematic analysis of the rationalization of investment activities is the completeness of the performance evaluation. Formation and study an integral object in the form of investment activities of an industrial enterprise is a final system that takes into account the maximum number of factors.

The essence of investment activity from the standpoint of systems analysis is the transformation of capital investments in the form of outflows and tributaries, which makes it possible to quantitatively evaluate this indicator. It is also necessary take into account the relative indicators of investment efficiency, reflecting the return on investment. The author's economic-mathematical model takes into account the systemic relationship of a set of alternative variables through the use of the indicator.

Since both external uncontrollable and poorly regulated factors and internal controllable factors can act as input influences хј, the use of model (1) to construct matrix (3) may well serve as a basis for studying the influence of external and internal factors on the prospects for strategic investment development of industrial enterprises. The construction of matrix allows one to assess various scenarios of the investment activity of an enterprise, taking into account the results of analysis, modeling and forecasting.

Indicators of the economic and mathematical model must be chosen taking into account economic factors. Objective use of the model will allow assessing management decisions on investment activities and will also provide an opportunity to explore alternative methods of assessing, taking into account the sensitivity of the project to changes in the external environment. Separately, it should be said that economic and mathematical modeling based on a systematic approach will solve many problems of increasing the competitiveness of economic entities and ensure the development of production.

References

Akhmedov, N. A. (2009). Metodologicheskiye osnovy razrabotki strategii perspektivnoy investitsionnoy politiki ekonomicheskogo rosta promyshlennykh predpriyati [Methodological foundations for developing a strategy for a prospective investment policy of economic growth of industrial enterprises]. Transport Business in Russia, 3, 34. [in Rus.].

Bondarenko, T., Orekhov, S., Sokolnikova, I., Soltakhanov, A., & Khmelev, I. (2018). Analysis of the performance efficiency of the largest corporations in Russia. Espacios, 39(36), 124.

Dmitriev, N., & Dubanevich, L. (2020). Formirovaniye osnovnykh investitsionnykh tseley predpriyatiya v strategicheskoy perspektive [Generation of the basic investment objectives of the enterprise in a strategic perspective]. Bulletin of the Surgut State University, 1(27), 39. [in Rus.].

Dmitriev, N., Dubanevich, L., & Tyutyunnikova, I. (2020). Ratsionalizatsiya investitsionnoy deyatel'nosti promyshlennogo predpriyatiya s ispol'zovaniyem sistemnogo podkhoda [Rationalization of investment activities of an industrial enterprise using a system approach]. The success of the modern economy, 4, 63. [in Rus.].

Mazur, I. K., & Shapiro, V. D. (2008). Upravleniye proyektami [Project management]. Omega-L, 115. [in Rus.].

Nosova, S., Kolodnyaya, G., Bondarev, S., Verigo, S., & Kudryashov, A. (2019). Espacios, 40(24), 120.

Nosova, S., Sorokina, G., Lyubimtseva, S., Afanasyev, A., & Zvezdichev, G. (2017). Conceptual approaches to overcoming turbulence in the innovative development of Russian industrial enterprises. International Journal of Applied Business and Economic Research, 15(13), 225.

Volkov, I., & Gracheva, M. (2004). Proyektnyy analiz [Project analysis]. Infra-M, 234. [in Rus.].

Voronov, K. (1999). Osnovy teorii investitsionnogo analiza [Fundamentals of the theory of investment analysis]. Urait, 23. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

25 September 2021

Article Doi

eBook ISBN

978-1-80296-115-7

Publisher

European Publisher

Volume

116

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2895

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Zvezdichev, G. U., Dubanevich, L. E., Bondarev, S. A., Stytsiuk, R. U., & Artemeva, O. A. (2021). Methods For Assessing And Forecasting Investments In A Production Enterprise. In I. V. Kovalev, A. A. Voroshilova, & A. S. Budagov (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST-II 2021), vol 116. European Proceedings of Social and Behavioural Sciences (pp. 91-101). European Publisher. https://doi.org/10.15405/epsbs.2021.09.02.10