Abstract

Regional inequality is the main problem of economic development and is defined as significant in the process of making managerial decisions. The study of regional differentiation will allow assessing the possibilities of development of regions. The study of production and investment opportunities of the territory and their impact on the level of inequality will clarify the degree of impact of production and financial resources on heterogeneity in the regional context. Differentiation analysis is carried out using the Gini coefficient calculation method, which allows determining deviation of the analysed indicator from the state of absolute equality. The application of the methodology will make it possible to assess the level of regional inequality. The result of analytical work will be revealing differentiation of Russian regions by the territory investment activity indicator. The study found that the economic indicator - investment in fixed assets within the Russian regions diverges during the research period, increasing regional inequality. The territories have a high level of investment, the specialization of whose economy is oriented towards the resource component or the territory has a high share of the financial sector. Within the framework of research results we can speak about the importance of such factors as the availability of natural resources and a developed infrastructure component in the process of attracting financial capital. The obtained results can be used in writing program documents of the regional format aimed at changing and improving the existing economic conditions and creating favorable conditions for the development of the territory.

Keywords: Gini coefficient, Russian regions, regional heterogeneity

Introduction

The economic development of the territory within the framework of modern conditions is ensured by the existing economic potential. The economic potential of the territory consists of various directions - financial, industrial, political, economic component ensuring spatial development. Russian regions have a high level of heterogeneity observed in most economic and social indicators (Zubarevich, 2019).

Problem Statement

The regional heterogeneity observed within the Russian Federation leads to a situation where some regions show stable economic development, while the other part is developing slowly and economic growth in such areas is ensured by state allocations (Malkina, 2015).

Research Questions

Uneven economic development of Russia has a regional focus: economically developed regions (outsiders) in the territory of the state coexist with a large number of underdeveloped (depressed) regions (Gubanova, & Mite, 2017).

Studies on differentiation issues are based on theories and methods of regional development of territories. The basic theories of regional development are applicable for different regional processes and allow estimating the level of regional differentiation by a number of social and economic indicators. One of such directions is the interregional convergence hypothesis, which is based on the works of famous economists of neoclassical theory of international trade (Heckscher, 1949; Samuelson, 1948; Samuelson, 1949).

The analysis of differentiation and research of regional differences is carried out on the basis of construction of models of economic growth which consider various factors determining economic development of territory. Barro and Sala-i-Martina’s model and statistical analysis of economic and social factors allow estimating the level of regional inequality (Barro & Sala-i-Martin, 1995; Barro, & Sala-i-Martin, 1991).

In a number of research papers (Styme & Jackson, 2000), the authors use the traditional method of calculating the Gini coefficient and Atkinson's index, the Teyla index, which makes it possible to analyze estimates of the population's well-being and quality of life (Theil, 1967).

Purpose of the Study

The purpose of this study is to assess the development of the level of heterogeneity of production and investment potential. The purpose of this study is to assess the development of the level of heterogeneity of production and investment potential.

Research Methods

The main purpose of the study is to assess the dynamics of territory development by investment potential, which forms the main directions of economic development of the territory. The research being conducted has two main directions.

The first one is the analysis of Russian regions on the dynamics of growth of the indicator under study - the index of the physical volume of investment in fixed assets. The array of regional data, within the framework of this direction, is divided into 3 groups: the first group includes territories, where decrease of the investigated indicator is observed, the second group includes insignificant growth, the third group includes steady growth. The conducted comparative analysis in the regional context will allow understanding and evaluating the changes taking place within Russian regions in the context of the indicator under study.

The second direction focuses on assessing the level of regional heterogeneity, which is determined within the framework of the clustering exercise. Dynamics and the level of regional differentiation are determined on the basis of the Gini coefficient (Moroshkina, 2016), which allows one to estimate the level of regional asymmetry and the variation of regional values from absolute equality.

The main object of the study is the level of economic development of regions, estimated by the indicator of investment in fixed assets. The Gini coefficient is used as a measure of regional differentiation, which determines the degree of stratification of countries or regions with respect to an economic or social indicator (Glushchenko, 2016). The author analyzed the differentiation of Russian regions.

The Gini coefficient is calculated from regional data as follows:

(1)

where xi - the value of the indicator in region, is the average, N - number of regions.

The conducted research is based on the use of Rosstat statistical data, the source of statistical information is the collection "Regions of Russia".

Findings

Assessment of the dependence of production and investment activity of the territory will allow one to consider regional trends in economic growth (Kolomak, 2013). The study of the index of physical volume of investment and the ratio of this index to the specialization of the region's economy will make it possible to assess their impact on each other. Comparative analysis of Russian regions by the index of physical volume of investment in fixed assets allowed us to form a classification of Russian regions and make a correlation with economic specialization (Table 1).

The relationship between investment potential and economic specialization makes it possible to conclude that investment activity is observed in regions with natural resources and opportunities to attract investment. The border regions turned out to be among the leading regions, which confirms the fact that the geopolitical factor influences the process of investment attraction - the Republic of Karelia, Kaliningrad Oblast, Murmansk Oblast. The leading regions are joined by territories, the economy of which has a raw material, export component - Tyumen region, Khanty-Mansi autonomous district.

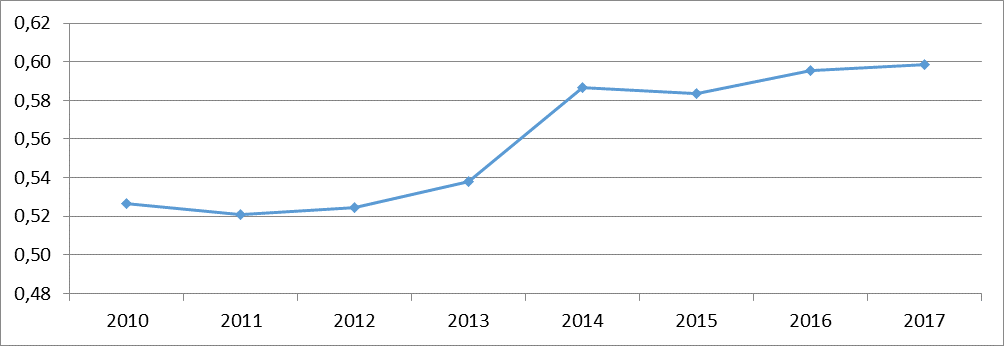

Regional inequality on the investment component can be investigated using the Gini coefficient, which allows estimating the level of deviation from absolute equality on the investigated indicator. Using the Gini coefficient (formula 1) we determine the level of regional heterogeneity. The research period is 7 years and makes it possible to draw conclusions about the dynamics of regional inequality.

Dynamics of Gini coefficient change will allow one to determine trends of regional inequality in the indicator of investment in fixed assets and to assess prospects of convergence of Russian regions (Table 2).

As a result of the analysis of the dynamics of the Gini coefficient change, an increasing trend has been determined. The growth of the coefficient suggests an increase in the concentration of investments in certain regions. The results obtained suggest a trend of divergence among Russian region (Moroshkina, 2017).

Factor dynamics are divided into 3 time-periods. The period from 2010 to 2012 is a period of stability, characterized by minor changes in the coefficient. Between 2012 and 2014, there was a steady increase in regional disparities and a widening gap between regions, leading to an increase in the Gini ratio. Further period of 2014-2018 is characterized by slow convergence of regions (Figure 1).

Conclusion

The study of the Russian regions on the ratio of the investment component to the specialization of the economy in determined impact of specialization on the level of investment activity. In the framework of the conducted research the presence of regional differentiation was revealed, the dynamics of the regional investment component is influenced by the structural factor, which is determined by the specialization of the territory's economy. The process of regional stratification by indicator of investments in fixed assets depends on the general economic situation, which has an impact on the processes of convergence and divergence of Russian regions.

Acknowledgments

The study is being carried out with the financial support of the Russian Foundation for Basic Research under scientific project No. 19-010-00549 "Interregional Differentiation of Russian Regions".

References

Barro, P. J., & Sala-i-Martin, X. (1991). Convergence across states and region. Brooking Papers on Economy Activity, 1, 58-107.

Barro, P. J., & Sala-i-Martin, X. (1995). Economic Growth. MIT Press.

Glushchenko, K. P. (2016). On the application of the Gini coefficient and other indicators of inequality. Statistical issues, 2, 71-80.

Gubanova, E. S., & Mite, V. S. (2017). Methodological aspects of analysis of the level of heterogeneity of socio-economic development of regions. Economic and social changes, facts, trends, forecast, 10(1), 58-75.

Heckscher, E. (1949). The Effect of Foreign Trade on the Distribution of Income. Ekonomisk Tidskrift, Cambridge: MIT Press, 272-300.

Kolomak, E. A. (2013). Uneven spatial development in Russia: explanations of the new economic geography. Economic issues, 2, 132–150.

Malkina, M. Y. (2015). Assessment of Factors of IntraRegional Differentiation of Incomes of the Population of the Russian Federation. Spatial Economy, 3, 97-119.

Moroshkina, M. V. (2016). Differentiation of Russian Regions by Level of Economic. Development Forecasting Problems, 4(157), 109-115.

Moroshkina, M. V. (2017). Territorial differentiation of income adjusted for inflation. Actual problems of economics and law 11, 2(42), 48-66.

Samuelson, P. A. (1948). International Trade and the Equalization of Factor Prices. Economic Journal, 58, 84-163.

Samuelson, P. A. (1949). International Factor-Price Equalization Once Again. Economic Journal, 59, 97-181.

Styme, S., & Jackson, T. (2000). Intra-generational equity and sustainable welfare: a time series analyses for the UK and Sweden Ecological Economics, 33, 219-236.

Theil, H. (1967). Economics and Information Theory North-Holland.

Zubarevich, N. V. (2019). Spatial Development Strategy: Priorities and Tools. Economy questions, 1, 135-145. https://doi.org/10.32609/0042-8736-2019-1-135-145

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Moroshkina, M. V. (2021). Heterogeneity Of Russian Regions Production And Investment Potential. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 569-574). European Publisher. https://doi.org/10.15405/epsbs.2021.07.69