Abstract

The paper examines the economic development model in Krasnoyarsk Krai of Russia, which is a new oil and gas producing region. Depending on the role of oil and gas sector in regional economy, there are two alternative models of economic development for oil and gas producing regions: a resource enclave or a resource cluster. The resource enclave and resource cluster models have opposite long-term consequences for sustainable socio-economic development of regions. The paper provides the methodological framework for exploring the development model of oil and gas producing regions, which includes a set of indicators to assess socio-economic impacts of oil and gas activity. The results demonstrate that a resource enclave rather than a resource cluster has been formed in Krasnoyarsk Krai. A significant increase in oil and gas production did not have appreciable socio-economic benefits for the region and led to increased resource dependence of the regional economy. Thus, the resource enclave development model results in the region’s inability to create the foundation for sustainable socio-economic development after the depletion of non-renewable natural resources.

Keywords: Cluster, enclave, oil and gas producing region

Introduction

In literature, a debate has persisted on the resource curse existence. The resource curse theory argues that resource-rich economies tend to grow slower than resource-poor economies (Auty, 1993; Sachs & Warner, 2001). Researchers confirm (Damettie & Serhir, 2018; Haggerty et al., 2014; Satti et al., 2014) or disprove (Arin & Braunfels, 2018; James, 2015; Ouoba, 2016) this theory by studying the dependence of the growth rate of gross domestic product on natural resources. However, for a region dependent on non-renewable resources such as oil and gas, the main problem is not the current economic growth rate, but how it will develop after the depletion of its oil and gas fields. Opportunities for further sustainable socio-economic development largely depend on whether a resource enclave or a resource cluster is formed in a region.

A resource enclave is characterized by weak linkages of export-oriented extractive sector with regional economy and modest socio-economic benefits from increased resource extraction.

An alternative to resource enclave is the cluster development model. According to this model, the development of extractive sector generates significant multiplier effects in regional economy, creates development opportunities for non-extractive industries and encourages increased innovative activity.

Despite of the issue importance, the overall corpus of studies on the resource enclave and cluster development models remains small. There is a significant gap in determining the main differences between a resource enclave and a resource cluster and identifying development model of oil and gas producing region.

The paper examines development model for Krasnoyarsk Krai of Russia. There are a number of reasons why the paper focuses on the analysis of Krasnoyarsk Krai. First, Krasnoyarsk Krai is a new oil and gas producing region of Russia, where the industrial exploitation of oil and gas fields started in 2009. Most of the necessary data are available to compare the main economic indicators before and after oil and gas production. Second, Krasnoyarsk Krai has large reserves of crude oil and natural gas, and can be considered as a representative of oil and gas producing economy in Russia. Third, since the development of oil and gas fields started recently and the region has great prospects for a significant increase in oil and gas production, there are enough opportunities to change the development model.

Problem Statement

A resource enclave and a resource cluster are alternative models for the development of oil and gas producing region (Arias et al., 2014; Bas & Kunc, 2009; Lagos & Blanco, 2010). The core of both a resource enclave and a resource cluster is oil and gas sector. However, its role in regional economy differs.

In a resource enclave, oil and gas sector focuses on extensive oil and gas production and exports the bulk of crude oil and natural gas without any processing (Levin et al., 2015). Technology, goods and services that require a high level of human or technological capital are purchased by oil and gas companies from foreign producers. Linkages with regional firms are limited to minor contracts and low-tech services with low added value such as transport, food and cleaning services. The managerial functions are concentrated outside the region and most skilled workers are recruited from other regions using shift work system. There is no transfer of knowledge and innovation from oil and gas sector to regional firms (Arias et al., 2014). The enclave development model results in increased resource dependence of regional economy, a low innovative activity, and unsustainable development.

In contrast, the main characteristics of the cluster development model are strong forward and backward linkages of oil and gas companies with regional economy, the use of mainly local skilled workers for the development of oil and gas fields, and knowledge and innovation spillovers from oil and gas companies to other actors of regional economy (Arias et al., 2014; Bas & Kunc, 2009). As a result, a resource cluster generates significant multiplier effects and stimulates diversification of regional economy.

Thus, the possibilities for sustainable socio-economic development of oil and gas producing region are largely determined by whether the region has the resource enclave or cluster development model. Therefore, for a new oil and gas producing region the crucial issue is to evaluate the forming development model and to promote a resource cluster.

Research Questions

In the paper, the following research questions are addressed. How can the enclave or cluster model be identified? Does oil and gas activity enhance the economic growth in non-extractive sectors of the regional economy? Does oil and gas production stimulate innovative activity in the region?

Purpose of the Study

The purpose of the paper is to explore the economic development model of the oil and gas sector in Krasnoyarsk Krai of Russia and to identify whether it is a resource enclave or a resource cluster.

Research Methods

The methodological framework for investigating the development model of oil and gas producing region includes the following dimensions: (i) the impact of oil and gas activity on employment and income per capita; (ii) forward and backward linkages with regional firms; (iii) the impact of oil and gas production on innovative activity.

To estimate the development model of oil and gas producing region, the paper uses the indicators presented in Table 01.

The dynamics of the selected indicators was compared with the dynamics of oil and gas production.

The study covers the period from 2007 to 2018, because in 2009 the industrial development of oil and gas fields was started and 2007 was chosen as the base year for comparison since this is the year before the start of oil and gas production.

The data for the study were obtained from the Federal State Statistics Service of Krasnoyarsk Krai, Republic of Khakassia and Republic of Tyva. All value indicators were brought to constant 2007 prices.

Findings

Oil and gas production in Krasnoyarsk Krai began in 2009 when Vancorneft Oil Company put into development the Vankor oil and gas field. In 2016, the industrial exploitation of the Suzunskoye oil and gas field was started. As a result, crude oil production increased from 77 thousand tons per year in 2007 to 24632 thousand tons in 2018. Natural gas production rose from 756.3 million cubic meters to 9459.1 million cubic meters in 2018.

The impact of the oil and gas sector development on employment and income per capita

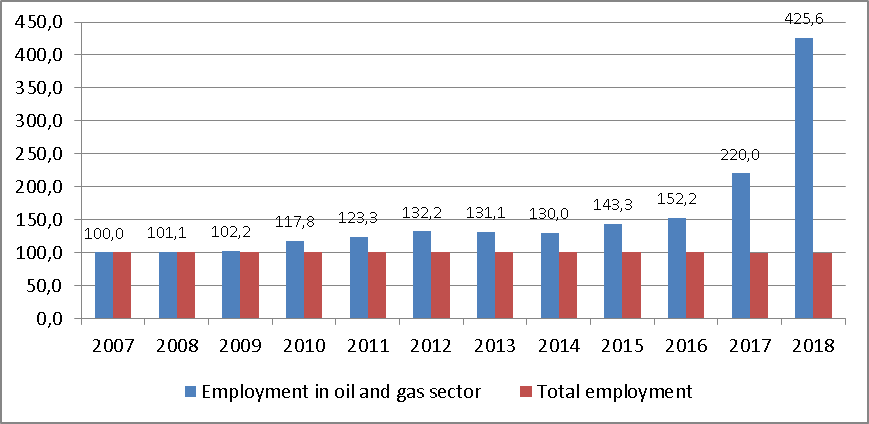

The number of employees in the oil and gas sector of Krasnoyarsk Krai increased more than 4 times from 9 thousand people in 2007 to 38.3 thousand people in 2018 while the total employment did not noticeably changed and in the last two years, it experienced a downward trend (Figure 01). A possible explanation is that only about 50% employees in the oil and gas sector are residents of Krasnoyarsk Krai, other workers come from outside the region. The second explanation is the decline in employment in other sectors of the regional economy.

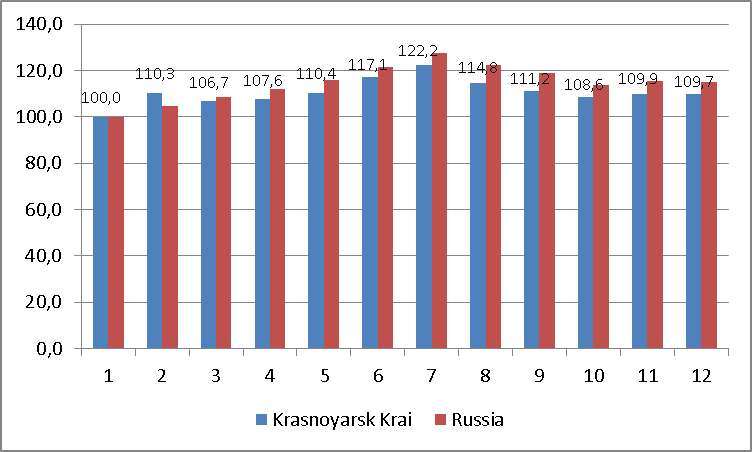

Oil and gas activity also did not lead to a significant increase in income per capita. The changes in per capita income in Krasnoyarsk Krai are associated with general macroeconomic factors rather than with the increase in oil and gas production since the region has the same dynamics of this indicator as in the country in general (Figure 02).

The salary in the oil and gas sector is more than twice the average salary of the region. However, a high proportion of shift workers from other regions means that a high salary has a little impact on the average income of the local population and is not spent in the regional economy.

Forward and backward linkages with other sectors of the regional economy

Oil and gas activity may generate multiplier effects through forward and backward productive linkages to regional firms. Development of forward productive linkages is possible if there are industries refining crude oil and natural gas in a region. Backward linkages are determined by purchases of goods and services for oil and gas sector from regional producers. The extent to which the backward linkages develop in a region relates to the ability of local producers to meet the demand of oil and gas sector for goods and services (Söderholm & Svahn, 2015). The stronger forward and backward productive linkages are, the higher the multiplier effects of oil and gas activity are in a region.

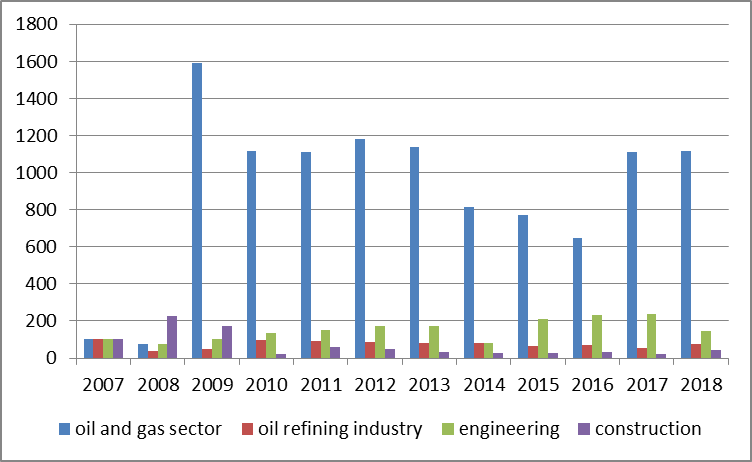

In Krasnoyarsk Krai, the annual volume of investment in the oil and gas sector significantly increased but this did not cause a similar increase in investment in other sectors of the economy for the period 2007-2018 (Figure 03). On average, $1 investment in the oil and gas sector accounts for only $0.03 investment in the oil refining industry, $0.04 investment in the engineering, and $0.04 investment in the construction.

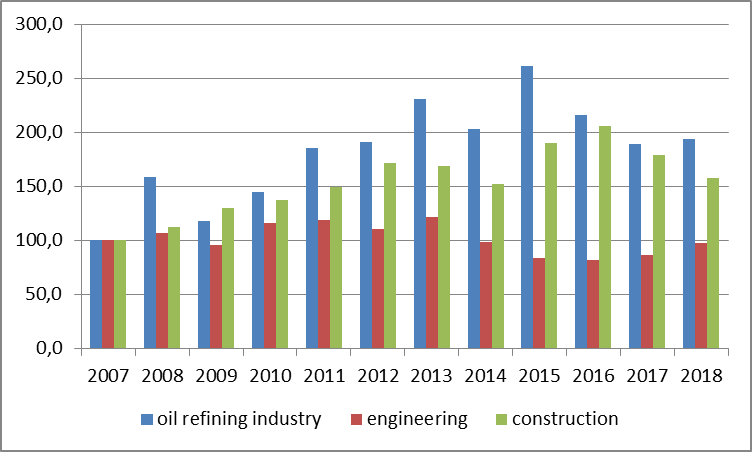

The growth of oil and gas production was accompanied by an increase in production of the oil refining industry and the construction, while production in the engineering declined (Figure 04).

In Krasnoyarsk Krai, Achinsksky refinery and two mini-refineries operate. They have the total capacity of 9.7 million tons of oil per year. However, during the period 2007-2018, these refineries processed less than 15% of the crude oil produced in the region, since the bulk of crude oil was exported. It should be noted that export duties on crude oil were a revenue source for the state budget, and not for the regional one. In Krasnoyarsk Krai, there are no gas processing and petrochemical industries generating products with high added value. Thus, we can conclude that forward linkages of the oil and gas sector to regional firms are not strong.

According to oil and gas companies, purchases from regional producers accounted for less than 8% of the total demand of the sector for goods and services. The oil and gas sector purchased most of its high tech goods and services from foreign companies. Linkages with regional firms were mainly related to activities with low added value and low level of innovation.

Thus, the oil and gas sector had weak productive linkages with other sectors of the regional economy which did not generate any opportunities for the development of non-extractive industries and resulted in low multiplier effects.

Impact of oil and gas production on innovative activity

The location of oil and gas fields in the northern territories of Krasnoyarsk Krai with a harsh climate and the complex composition of reserves necessitate the use of effective innovative technologies. Over the study period, the number of applied innovative technologies increased by more than 3.5 times in the oil and gas sector. The share of oil and gas companies implementing technological innovations increased from 3.4% in 2007 to 10% in 2018.

A resource cluster feature is the transfer of knowledge and innovation from the oil and gas sector to regional firms and the promotion of innovative activity. However, increased oil and gas production did not result in increased innovative activity in Krasnoyarsk Krai. The share of companies implementing technological innovations decreased from 8.4% in 2007 to 5.7% in 2018.

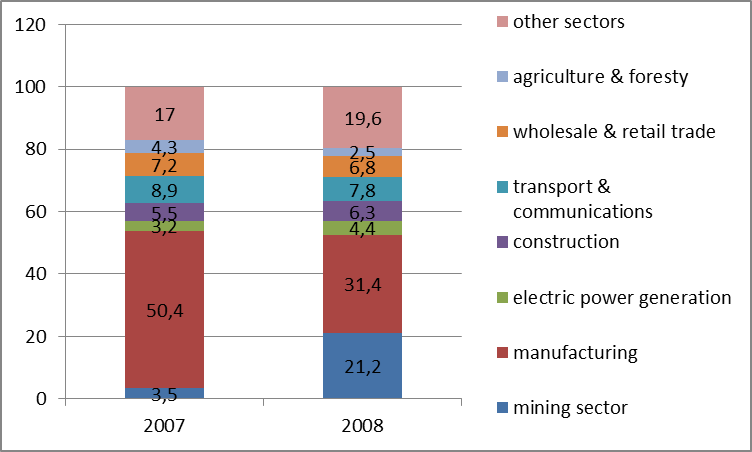

The study also revealed significant changes in the sectoral structure of Krasnoyarsk Krai which indicate an increased resource dependence of the regional economy (Figure 05).

Thus, we can conclude that a resource enclave rather than a resource cluster has been formed in Krasnoyarsk Krai. In 2017, the Taishet-Kuyumba oil trunk pipeline connecting the oil and gas fields of Krasnoyarsk Krai with the Eastern Siberia-Pacific Ocean pipeline system and facilitating access to the Asia-Pacific oil market was launched. As a result, the development of other oil and gas fields has been planned to start and oil and gas production will increase. However, in the enclave model, an increase in oil and gas production will not result in increased socio-economic benefits for the region, but it will increase economic dependence on the oil and gas sector and jeopardize further sustainable socio-economic development of the region.

Conclusion

In oil and gas producing region, the enclave or cluster model of development can be formed with opposite long-term socio-economic consequences. A resource enclave results in a high dependence of regional economy on oil and gas sector, insignificant socio-economic benefits from increased oil and gas production and leads to unsustainable development. While a resource cluster stimulates the development of non-extractive industries producing high value-added goods and services, it generates an innovative process in regional economy and lays the foundation for further sustainable socio-economic development.

The results presented in the paper demonstrate that in Krasnoyarsk Krai, the resource enclave has formed with limited linkages to the regional economy and modest benefits of increased oil and gas production.

However, a resource enclave is not an inherent characteristic of oil and gas activity. Adequate regional policy and natural resource management may promote the cluster development model in the region (Adedeji et al., 2016; Morris et al., 2012).

Acknowledgments

The research was carried out according to the plan of the research work of IEIE SB RAS, project XI.174. 1.1. «Economy of Siberia and its regions with external and internal challenges and threats: methods, trends, forecasts», № АААА-А17-117022250133-9.

References

Adedeji, A. N., Sidique, Sh. F., Rahman, A. A., & Law, S. H. (2016). The role of local content policy in local value creation in Nigeria’s oil industry: A structural equation modeling (SEM) approach. Resources Policy, 49, 61-73.

Arias, M., Atienza, M., & Cademartori, J. (2014). Large mining enterprises and regional development in Chile: between the enclave and cluster. Journal of Economic Geography, 14, 73-95.

Arin, K. P., & Braunfels, E. (2018). The resource curse revisited: A Bayesian model averaging approach. Energy Economics, 70, 170-178.

Auty, R. (1993). Sustainable Development in Mineral Economies: The Resource Curse Thesis. London: Routledge.

Bas, T. G., & Kunc, M. H. (2009). National system of innovation and natural resources clusters: Evidence from copper mining industry patents. European Planning Studies, 17(12), 1861-1879.

Damettie, O., & Serhir, M. (2018). Natural resource curse in oil exporting countries: A nonlinear approach. International Economics, 156, 231-146.

Haggerty, J., Gude, P. H., Delorey, M., & Rasker, R. (2014). Long-term effects of income specialization in oil and gas extraction: The U.S. West, 1980-2011. Energy Economics, 45, 186-195. DOI:

James, A. (2015). The resource curse: A statistical mirage? Journal of Development Economics, 114, 55-63. DOI:

Lagos, G., & Blanco, E. (2010). Mining and development in the region of Antofagasta. Resources Policy, 35, 265-275.

Levin, S. N., Kagan, E. S., & Sablin, K. S. (2015). “Resource type” regions in the modern Russian economy. Journal of Institutional Studies, 7(3), 92-101. https://doi.org/10.17835/2076-6297.2015.7.3.092-101[in Russ.]

Morris, M., Kaplinsky, R., & Kaplan, D. (2012). “One thing leads to another” – Commodities, linkages and industrial development. Resources Policy, 37, 408-416.

Ouoba, Y. (2016). Natural resources: Funds and economic performance of resource-rich countries. Resources Policy, 50, 108-116.

Sachs, J. D., & Warner, A. M. (2001). Natural resources and economic development: the curse of natural resources. European Economic Review, 45, 827-838.

Satti, S. L., Farooq, A., Loganathan, N., & Shahbaz, M. (2014). Empirical evidence on the resource curse hypothesis in oil abundant economy. Economic Modelling, 42, 421-429.

Söderholm, P., & Svahn, N. (2015). Mining, regional development and benefit-sharing in developed countries. Resources Policy, 45, 78-91.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Nagaeva, O. S. (2021). The Development Model Of Oil And Gas Producing Region: Enclave Or Cluster. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 548-555). European Publisher. https://doi.org/10.15405/epsbs.2021.07.66