Abstract

The article considers the Russian pork market as a part of the world market. It has been determined that over the past 10 years, the market has undergone many changes due to Russia's accession to the WTO, the introduction of sanctions against the country, the introduction of restrictive measures on pork import from some countries. Determining the market's independence from imports required making up a model of the relationship between pork prices in Russia and world pork prices. The data on weekly average market prices for pork in Russia (State Statistics Service) and the data on prices for pork futures on the Chicago produce exchange (prices are given in rubles) have been analyzed. It has been assumed that if the market is not dependent on imports, prices for pork should not depend on world prices, and vice versa. The analysis carried out using the Granger causality concept has shown that in 2014-2019, pork prices in Russia did not depend on world prices. Granger causality tests the hypothesis on whether one of the variables under consideration can be the cause of another variable. There is a logical explanation for the lack of dependence in the fact that pork imports in Russia occupy a small share and were decreasing over the observed period (data are given both in value terms and in volume terms). The proposed method allows us to assess the independence of local food markets from world prices.

Keywords: Granger causality, pork, pricing

Introduction

Pig farming is an important sector of the food market. The share of pork meat in Russia makes about 35% of meat production (2nd place after poultry). The current condition of pig farming should be considered in terms of changes of recent years.

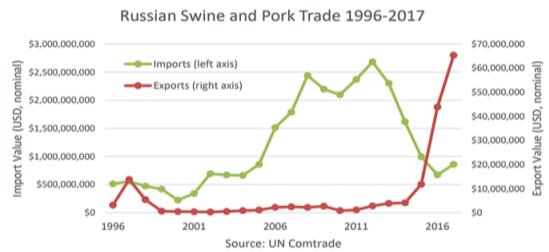

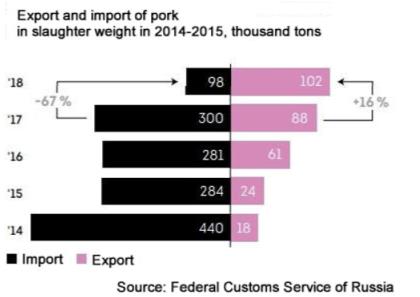

Within the framework of one decade (2010-2020 years), several events and facts that have significantly changed the condition of the pork market and the pig industry in Russia can be singled out. On December 16, 2011, Russia joined the WTO, which imposed certain requirements. In 2014, leading Western countries introduced sanctions against Russia, which still continue to have a strong impact on the Russian economy. In turn, Russia imposed sanctions on pork import from the EU in the same year. Some restrictions seem to be justified. For example, an outbreak of African swine fever was declared as one of the reasons for restrictions. First of all, it affected large importers of live pigs to Russia – Lithuania and Poland (Blanchard & Wu, 2019). Some sanctions should be considered "retaliatory", i.e. introduced in response to sanctions imposed by a number of Western countries on August 7, 2014. Thus, Russia imposed a ban on food imports. These facts affected the Russian pork market, including the volume of exports and imports both in value terms (Figure 01) and in volume terms (Figure 02).

Problem Statement

Many research works are devoted to pork pricing (Brown, 2001; Gervais & Larue, 2009), but the dependence of the country's pork price on world pork prices has not been studied.

On the one hand, prices for pork in a country may depend on world prices, especially when the market is dependent on imports. On the other hand, prices for pork depend on internal factors (producer costs) as well. In terms of costs, researchers use different enterprise performance criteria (Düsseldorf 2013; Hewitt et al., 2018; Stalder, 2017).

Felt said that reductions in tariff barriers, domestic support, and export subsidies contribute to the globalization of agricultural markets. As a result, one should expect agricultural markets to be increasingly competitive (Felt et al., 2011). However, the markets of some countries may function in different conditions, such as export or import restrictions. The restrictions may be caused by disease outbreaks or political decisions (Blanchard & Wu, 2019; Blayney et al., 2006; Brown, 2001).

According to some analysts, prices for products in a country should depend on world prices (Dantas & Weydmann, 2009; Selli et al., 2011). Thus, if the market is not dependent on imports, prices for pork should not depend on world prices, and vice versa.

Research Questions

To test scientific hypotheses, let us consider the pork market in Russia of 2014-2019 using the following assumptions.

The development of the pork market in the country is influenced by external factors. External factors may include economic (demand, supply, prices) and other factors (sanctions imposed due to various reasons).

If the country's pork market does not depend on imports (or does not depend much), then the country's pork prices do not depend on world pork prices.

Purpose of the Study

The present research is aimed at proving the possibility of independence of pork prices in a country from world prices using statistical methods.

Research Methods

Analysis of the dynamics of commodity prices and their mutual influence is used to identify causal relationships (Kolovertnov & Faizullin, 2015). Modern econometric research are characterized by the use of the Granger causality test.

The Granger concept of causality is applied to components of a stationary vector of random processes to test whether one of the variables under consideration can be the cause of another variable. Thus, a variable cannot be considered a cause for a variable if failure to evaluate the impact of past values of the variable does not impair the quality of the value forecast for past values of these two variables.

Let us consider the Granger causality for two variables. The given model has the following form:

(1)

The absence of a causal link fromto means that when . The absence of a causal link from to means that when .

To perform the causality test, a time series must be stationary. The time series is stationary when its expectation value, variance, and autocorrelation are independent of time

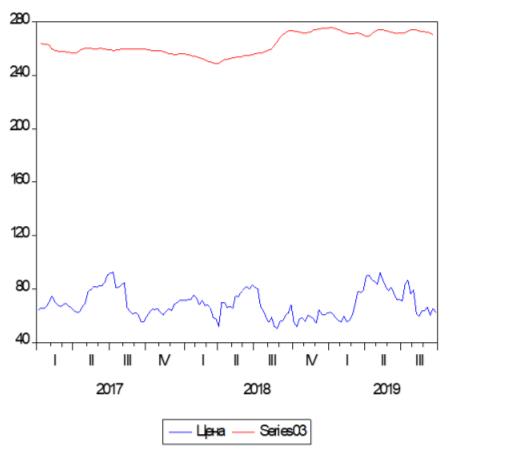

The data on weekly average market prices for pork in Russia (State Statistics Service) and the data on prices for pork futures on the Chicago produce exchange (prices are given in rubles) have been analyzed. The price dynamics is shown in Figure 03.

Findings

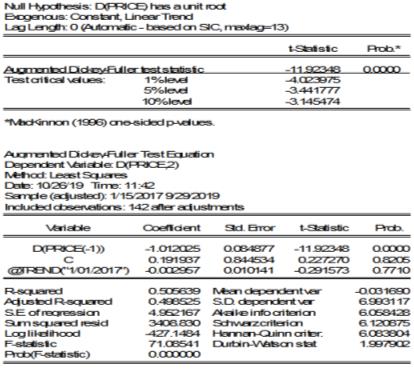

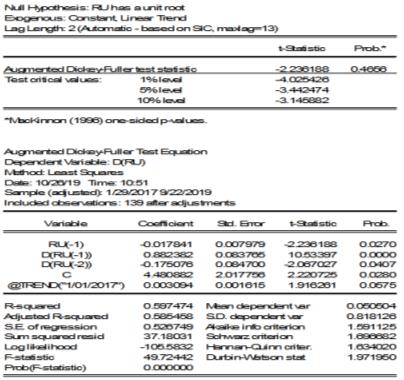

The stationarity of the time series has been determined using the Eviews program (augmented Dickey-Fuller test). The results of the augmented Dickey-Fuller test (ADF) for data on pork prices in the world market are shown in Figures 4 and 5. In general, the results suggest that the series is unstationary. We cannot reject the null hypothesis about the presence of a single root (the probability of its validity is 15.81%).

The figure shows that the world price (PRICE) depends on its previous value (PRICE (-1)), so there is an autocorrelation, which should be checked in the future.

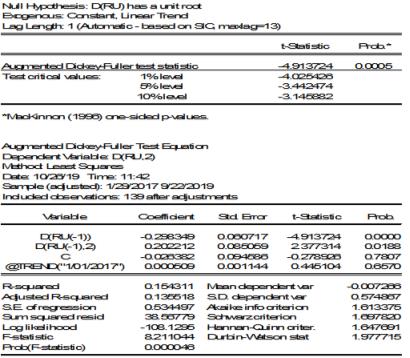

To bring the time series to a stationary form, the standard procedure for moving to the analysis of the first differences in the time series is usually used. In our case, the economic meaning of numbers of the first series of differences shows price changes in relation to the previous period in absolute terms, i.e.

D(PRICE(t))= PRICE(t)- PRICE(t-1). The results are shown in Figures 6 and 7.

The test of the first differences in the time series of world prices for pork proves that the series is stationary.

The same procedure has been used for the analysis of pork prices in Russia. Figures 06 and 07 show the results of the augmented Dickey-Fuller test for the time series of pork prices in Russia and for the first differences in this series, correspondingly.

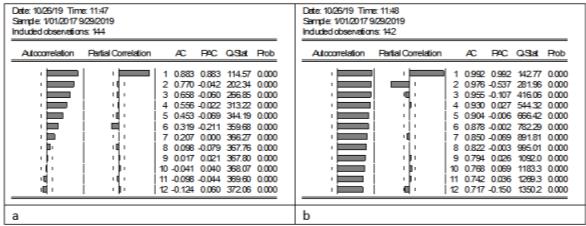

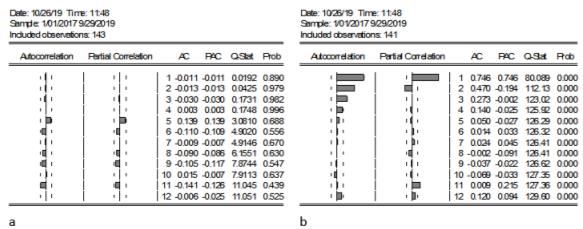

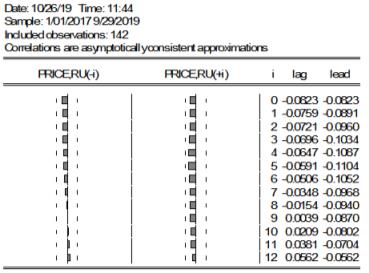

Taking into account the above information about the presence of autocorrelation in time series, we consider autocorrelation diagrams for the initial time series and the series formed by the first differences. For the correlation study of time series of pork prices see Figure 08 and 09.

Analysis of the autocorrelation diagram and private autocorrelation diagram related to the first studied time series – the series of dynamics of the world exchange price for pork, shows that the series is stationary in the first differences, which is confirmed by the lack of grounds for assuming that the expectation value, variance, and single-order coefficient of autocorrelation of the studied process depend on time. As for the second series – the series of dynamics of pork prices in Russia, the analysis of the autocorrelation diagram and private autocorrelation diagram, at a given level of significance, indicates the significance of some coefficients. Therefore, we cannot reject the hypothesis of first-order autocorrelation. Small-scale exceedance is peculiar only of a given significance level, taking into account the already conducted ADF tests. Both series should be considered as stationary in the first differences, i.e. I (1).

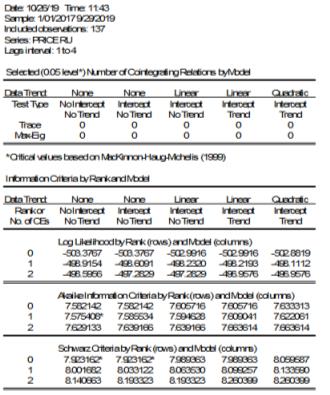

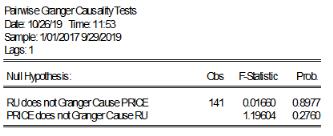

Having revealed the stationary nature of the studied series in the first differences, we have performed the co-integration test (Figure 10). The Johansen test (Søren, 1991) performed using the Eviews statistical programming package has shown the absence of co-integration. It is known that if , ~ I(1) and they are co-integrated, then the Granger causality must be observed in at least one direction. And on the contrary, if the series are not co-integrated, they most likely do not have causal relationships. Let us also perform the Granger causality test for these series. The results in Figure 11.

It turns out that world pork prices neither affect nor depend on pork prices in Russia. The same conclusions can be drawn from the analysis of the cross-correlation diagram. The diagram is shown in Figure 12.

The analysis has shown that pork prices in Russia are resistant to changes in world pork prices. This fact does not prove that changes in the world market do not completely affect the Russian market. However, changes in world prices during the analyzed period did not have a statistically significant impact on retail prices for pork in Russia.

This fact is explained by the fact that the share of imported pork on the Russian market is small and is not able to have any significant direct impact on retail pork prices in Russia.

Conclusion

Thus, it has been proved that Russia's pork market does not depend on imports, i.e. the country's pork prices do not depend on world pork prices. The analysis carried out using the Granger causality concept has shown that in 2014-2019, pork prices in Russia did not depend on world prices. The absence of dependence also coincides with the identified trends observed in the analyzed period. Imports decreased (both in value terms and in volume terms). The proposed method allows us to assess the independence of local food markets from world prices.

References

Blanchard, E., & Wu, M. (2019). Externalities and Agricultural Import Bans: Evaluating Regionalization Measures in Light of the Russia–Pigs Dispute. World Trade Review, 18(2), 173-195.

Blayney, D. P., Dyck J. H., & Harvey, D. J. (2006). Economic effects of animal diseases linked to trade dependency, 23-29. https://doi.org/1490-2016-127902

Brown, J. (2001). Price discrimination and pricing to market behaviour of Canadian canola exporters. American Journal of Agricultural Economics, 83, 1343-1349.

Dantas, F., & Weydmann, C. L. (2009). Chicken meat: an analysis of the relationship between producer prices and export.

Düsseldorf, S. (2013). Concept of key performance indicators controlling consumer oriented quality and herd health management in a Bavarian pork chain. Dissertation. Rheinische Friedrich-WilhelmsUniversität, Bonn.

Felt, M. H., Gervais, J. P., & Larue, B. (2011). Market power and import bans: the case of Japanese pork imports. Agribusiness, 27(1), 47-61.

Gervais, J-P., & Larue, B. (2009). A joint test of price discrimination, menu costs and currency invoicing. Agricultural Economics, 40, 29-41.

Hewitt, S., Green, M., & Hudson, C. (2018). Evaluation of key performance indicators to monitor performance in beef herds. Livestock, 23(2), 72-78.

Kolovertnov, R. A., & Faizullin, R. V. (2015). Methodology for forecasting prices for non-ferrous metal in the Russian Federation based on the dependence on world metal prices. Economics and management of management systems, 18(4.1), 166-173.

Selli, F., Bayaner, A., Akdi, Y., & Sahin, A. (2011). Dynamic Relationships in Meat Market. Electronic Journal of Applied Statistical Analysis, 4(1), 83-90.

Søren, J. (1991). Estimation and Hypothesis Testing of Co-integration Vectors in Gaussian Vector Autoregressive Models. Econometrica, 59(6), 1551-1580.

Stalder, K. J. (2017). Pork industry productivity analysis. http://www.pork.org/wp-content/uploads/2010/04/pork-industry-productivity-analysis-2015-summary.pdf

UN Comtrade (2021). “UN Comtrade” refers to the United Nations Commodity Trade Statistic Database. Retrieved on 29 March 2021 from: https://comtrade.un.org

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Gogolev, I. M., Fayzullin, R. V., & Chichenkov, I. I. (2021). Analysis Of Independence Of Pork Prices In Russia From World Pork Prices. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 268-278). European Publisher. https://doi.org/10.15405/epsbs.2021.07.33