Abstract

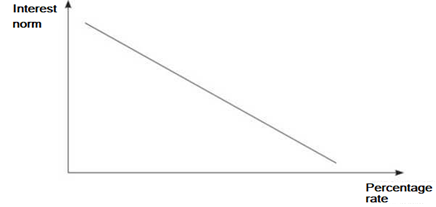

The article examines factors that affect the investment activity, provides the interest independence rate and return rate graph, as well as analyzes how foreign investment growth occurs. An important component of the economy is the investment process. Macroeconomic factors are such conditions that are directly related to the economy at the national level and capture a large part of its population. When the investment plan is being developed at the enterprise, the principles below should be followed: accounting of the risks and inflation; economic investments justification; reliable and cheaper financing methods. Summarizing, we can state that all these factors as have a common goal to influence the investment activity, and this already implies an impact on the entire country economy. In general, we can conclude that all these factors as a whole have a common goal that is to influence investment activity, and this already implies an impact on the entire country economy.

Keywords: Factors, government, investment activity, investors, investment climate

Introduction

An important component of the economy is the investment process. Investment - is money allocation with the purpose of obtaining some benefits. At present, this earnings type is quite popular, but you should not forget the nuances that affect the profitable investment (Krasilnikov, 2010; Sokolnikova et al., 2020; Voropai et al., 2019).

Usually, the following groups of factors are distinguished:

- objective and subjective;

- macroeconomic and microeconomic.

Microeconomic factors are a part of economic theory that studies economic processes at the level of individual subjects (Podshivalenko & Kiseleva, 2008; Lastovsky, 2010). Microeconomic factors include:

Enterprises scale. The sets of institutions norms significantly depend on the organization size and form the necessary assets for carrying out all activities types at the profit expense under equal conditions. Such companies directly have a greater impact on investment activity.

- Scientific and technical policy of the organization. If a company has a scientific and technical policy, then this company kind is more often competitive - very important quality in the economic market.

- Amortization calculations are equally important factor in investment financing, which consist of a special financial set that will be spent on worn-out equipment replacement in the future.

- Organizational and legal business form. Its essence lies in the lenders confidence level to borrowers.

Macroeconomic factors are such conditions that are directly related to the economy at the national level and capture a large part of its population (Konyuhov et al., 2019).

This group also includes:

1. tax system and its improvement degree;

2. money depreciation degree;

3. lack of financial savings;

4. legal investment activities support;

5. general state and development of the country;

6. existence of a limited territory with a special legal status in relation to the rest of the state;

7. government support for small and medium-size businesses;

8. foreign investors attachment;

9. cash deposits risk standards;

10. country's direct investment activity indicator.

Problem Statement

Objective conditions include situations that are independent from organizations and from the government in general case, bearing such problems as monetary crisis, natural disasters, etc. (Gozbenko et al., 2019; Gozbenko et al., 2020; Kargapol'tsev et al., 2019; Podshivalenko & Kiseleva, 2008). On the contrary, subjective factors directly depend from the enterprises and the state activities, for example, the investment and monetary policy (Balanovskiy et al., 2019; Krasilnikov, 2010; Kuznetsov et al., 2019; Yuzvovich et al., 2016).

Research Questions

The authors are trying to answer the following questions: how factors affect the investment activity and which factors are most important.

These criteria are somehow interrelated, but they have an impact not only on the investment activity, but also on the entire state economy. The economic conditions are determined by such indicators as gross domestic product and gross national product, national income, which determine the state ability to allocate necessary resources for investment. Inflation also have an important role in the investment project. Inflation is a stable trend of the overall price level growth. We should not forget that this process is closely related to the bank interest rate, which determines expected net profit rate (for investments with the growth of the bank interest rate, the demand for investment becomes lower) (Figure 1).

It should be noticed that the real bank interest rate not the nominal one has the greatest impact on the decision-making stage, and forms the following relationship:

where AVGr – real rate of the bank percentage, Rn – nominal rate; Ld - inflation rate.

Foreign capital attraction as an essential condition for reviving investment activity

There is one caveat in the fact that the Russian law system is unfavorable for another country citizens investment. Foreign investors identify the following negative factors:

- high level of corruption;

- low citizens rights protection level;

- accounting rules do not meet international standards.

The law adopted in 1999 "About foreign investment in the Russian Federation" states that in order to reduce the negative impact of the factors above, a number of conditions and guarantees are introduced to allow foreign entrepreneurs invest money in the national economy. Table 1 shows how foreign citizens investments in the Russian Federation economy increased from 2001 to 2005.

Purpose of the Study

The aim of the paper is to examine factors that affect the investment activity, provide the interest independence rate and return rate graph, as well as analyze how foreign investment growth occurs.

Research Methods

All the factors above also affect the attractiveness and efficiency of investments in general (Figure 2).

There are several methods for economic efficiency calculation, and the most common is the comparison method. This method proposes the calculations. The minimal cost per year is compared with the minimal investment cost per year, the payback time and inventory savings data are taken into account. The only disadvantage of this method is that it does not analyze risks and cash flows, and does not sum up the financial result (Konyuhov et al., 2018).

Findings

The purpose of the investment climate is to introduce the most comfortable economic conditions that will attract investors from all countries. All the investment stages in any sphere of life are inherently linked to the investment climate. The only thing that always should be taken into account is the presence of the negative factors such as mass strikes, military threats, political and social processes, etc. Table 2 below (based on the example of Russia) shows the factors that affect investment climate.

We can't consider investment policy if the investment plan entrepreneur does not have its own business plan, which takes into account all the strategic goals of today and the future when it’s possible to eventually calculate financial stability. The government, in turn, can influence the investment activity in the following ways: by implementing the industrial, financial, tax or credit policies; by providing tax benefits to businesses that invest money; by implementing depreciation policy; by implementing the most convenient conditions for foreign investors to carry out their activities in our market, etc.

Conclusion

When developing an investment plan in an enterprise, the following principles should be followed:

- all risks and inflation accounting;

- investments economic justification;

- reliable and cheaper financing methods.

In summary, we can conclude that all these factors as have a common goal to influence the investment activity, and this already implies an impact on the entire country economy.

References

Balanovskiy, A. E., Shtayger, M. G., Karlina, A. I., Kargapoltsev, S. K., Gozbenko, V. E., Karlina, Yu. I., Govorkov, A. S., & Kuznetsov, B. O. (2019). Surface hardening of structural steel by cathode spot of welding arc. IOP Conference Series-Materials Science and Engineering, 560, 012138.

Gozbenko, V. E., Kargapol'tsev, S. K., Kuznetsov, B. O., Karlina, A. I., & Karlina, Yu. I. (2019). Determination of the principal coordinates in solving the problem of the vertical dynamics of the vehicle using the method of mathematical modeling. Journal of Physics Conference Series, 1333, 052007.

Gozbenko, V. E., Korchevin, N. A., Kargapoltsev, S. K., Strakhov, V. M., Karlina, A. I., & Karlina, Yu. I. (2020). Replacement of Graphite by Petroleum Coke in Rail Lubricants. Coke and Chemistry, 63(4), 183-187.

Kargapol'tsev, S. K., Gozbenko, V. E., Kuznetsov, B. O., Karlina, Yu. I., & Karlina, A. I. (2019). The effect of the periodic driving force on a system with two degrees of freedom. Journal of Physics Conference Series, 1333, 052009.

Konyuhov, V. Y., Gladkih, A. M., & Chemezov, A. V. (2019). Evaluation of the economic feasibility of the introduction of plasma hardening technologies in the Far North enterprises. IOP Conference Series-Materials Science and Engineering, 560, 012147.

Konyuhov, V. Y., Stefanovskaya, O. M., & Shamarova, N. A. (2018). Investment in alternative energy sources. European proceedings of social and behavioural sciences, 50, 1124-1129.

Krasilnikov, A. (2010). The investment activities analysis (Moscow: Laboratory workbook) pp. 5-37.

Kuznetsov, B. O., Gozbenko, V. E., Kargapol'tsev, S. K., Karlina, Yu. I., & Karlina, A. I. (2019). Dynamic vibration protection of the railway carriage. Journal of Physics Conference Series, 1333, 052018.

Lastovsky, M. (2010). Investment policy. http://www.knigafund.ru/books/189265

Podshivalenko, G. P., & Kiseleva, N. V. (2008). Investment activity (Moscow: Konus) pp. 34-78.

Sokolnikova, P., Lombardi, P., Arendarski, B., Suslov, K., Pantaleo, A. M., Kranhold, M., & Komarnicki, P. (2020). Net-zero multi-energy systems for Siberian rural communities: A methodology to size thermal and electric storage units. Renewable Energy, 155, 979-989.

Voropai, N., Ukolova, E., Gerasimov, D., Suslov, K., Lombardi, P., & Komarnicki, P. (2019) Simulation Approach to Integrated Energy Systems Study Based on Energy Hub Concept. IEEE Milan PowerTech Conference (Milan, ITALY).

Yuzvovich, L. I., Degtyareva, S. A., & Knyazeva, E. G. (2016). Investments (Yekaterinburg: Ural Federal University).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Gladkih, A. M., Konyukhov, V. Y., & Zott, R. S. (2021). Factors Affecting Investment Activity. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 884-889). European Publisher. https://doi.org/10.15405/epsbs.2021.07.105