Abstract

In modern conditions, when the world economy has no time to get out of one economic crisis falling into recurrent recession, there are increasing needs for new scientific approaches to crisis situation determination. Evidently, the risks that arise in this case can be both predictable and unpredictable. The goal of automation is to identify and calculate as many risks as possible, and to increase the forecasts development effectiveness in order to improve management solutions. A comprehensive solution of the assessment level analyzing and production risks reduction problem focused on solving of the incoming problems and production stabilizing, involves the use of system analysis techniques, as well as the use of an automated approach. For the effective and uninterrupted operation of any enterprise, it is necessary to understand the possible risks and its level scale, as well as to develop a system that would forecast risks occurrence values. The scope of threat is defined according to crisis coverage, displayed by the number of the company financial stability flows, where the critical action formation can be acceptable. The presented automated system allows you to make a forecast for the risks of any complexity degree, calculate consequences characteristics, as well as calculate further options for making management decisions to reduce the degree of risk impact on the company's activities, the probability of level reduction or eliminating subsequent risks.

Introduction

Large industrial organizations of the XXI century are increasingly exposed to risks of various directions and complexity levels, since any business and entrepreneurial activity is impossible without the occurrence of the set of the risks of one or more complexity degree. At the same time, it should be noted that the larger number of total enterprises is taken into account, the higher is the one's existence risks. Therefore, management decisions should take into account the set of risks conditions, which depends on numerous factors. For the effective and uninterrupted operation of any enterprise in conditions of a constantly changing market and its relationships, all enterprise forms should regularly produce and implement modern technical and technological innovations – this directly increases the occurrence probability of the risk event. Risk by its definition is the comparison of the expected results to the sum of the probability not to get the expected income and to get losses increase (Shamarova et al., 2019).

Conditionally, risks are characterized by the following criteria: the uncertainty criteria, the alternative (moreover, one of the choices can be assigned as a refusal of choose itself), the assessment of the candidates’ analysis and selection.

In contrast to uncertainty, risk has the property of solution search by analyzing of the situation. Uncertainty is characterized by a lack of solutions due to the inability to predict the events outcome. Therefore, uncertainty is one of the main risks features as well as risks may have features that are unique to them: inconsistency and alternativeness. Based on the uncertainty, the sources of risk are:

- natural processes and phenomena (natural disasters);

- accidents;

- contradictory tendency;

- different creative interests;

- scientific and technical progress probabilistic nature; insufficient information (Bulatov et al., 2019).

The risks of large enterprises depend on the timing factors (political, economic); the nature of accounting (external, internal) and the nature of consequences (private, dynamic). Starting to analyze the risk nature and the impact degree on the company's activities, it is necessary to understand to which of business activity spheres it belongs to. The company distinguishes four main risk groups: production, financial, commercial and insurance.

Information that is important for qualitative and quantitative risk analysis plays an important role in risk assessment. To solve the problem, currently there is quite a large number of risk assessment methods, the most popular among all are the statistical and the expert assessment methods. The statistical method essence is to study the losses and profits statistics of the analyzed production sphere to establish the magnitude and frequency of both results in terms of the maximum impact on the enterprise performance, and to make the most accurate forecast for the future. This method requires processing of a huge data array, which collecting and processing takes a long time and is quite expensive. Therefore, companies resort to other methods, such as expert evaluation.

Expert method - quantitative risk assessments obtaining based on the specialists or on the opinions of the experienced entrepreneurs. There are cases when the lack of information did not allow to fully modulate a statistical method, so in such cases the expert evaluation method can be used especially effectively (Sivtsov et al., 2020). Both methods are recommended to be combined, since each overlaps the disadvantages of the other. If the statistical method accuracy depends on the information lack, the expert method does not guarantee the estimated reliability.

Thus, a comprehensive solution of the problem analyzing in the field of assessment level and production risks reduction is focused on solving the problems and stabilizing production that also involves the use of system analysis techniques, as well as the use of the automated approach.

Problem Statement

An automated detecting system of the enterprise crisis is a hidden stage by the example of the PJSC «Irkutskenergo» solvency indicators. Risks and the investment strategy are under study.

Research Questions

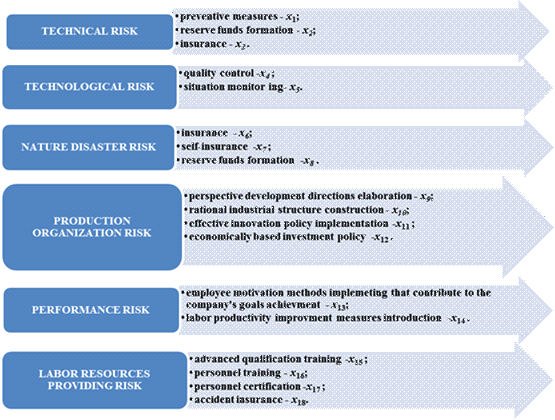

Figure 1 shows the software structure of an automated process control system for thermal vortex enrichment.

The problem is to identify the factors that affect the system of the enterprise efficiency level and its constituent structural divisions-subsystems, taking into account the degree of this influence. The problem solution involves decomposition of research object, considered as a complex system. At the same time, risk factors have their own reduction levers (figure 1).

For the effective and uninterrupted operation of any enterprise, it is necessary to understand the possible risks and their level scale, as well as to create a forecast system of risk occurrence values. The risk level (UR) estimation can be based on the following algorithm:

(1)

where – varying complexity degree of risk occurrence probability according to the obtained forecast values;

– predicted amount of financial losses in the implementation of the varying risk degree.

The signals scale about the crisis danger (then the crisis danger scale according to any financial stability direction, and according to the company as a whole), calculated by formula 2. The threat scope is defined according to crisis coverage, displayed by the number of company financial stability flows, where the critical action formation is valid:

(2)

The signals saturation of the crisis danger (then the signals saturation) according to any work area or characteristics set that displays financial stability, calculated by formula 3. The signals saturation determines the decline according to the coverage depth, i.e. according to the critical events formation depth in the company:

(3)

Based on the acquired values, the following conclusion is made:

Up to 20% - absent

20% - 40% - nascent

40% - 60% - developing

60% or higher – progressive

Purpose of the Study

An automated hidden crisis stage of the detecting system of the enterprise has been developed based on a system of indicators that reflect the effectiveness of one’s enterprise resources use and its solvency position. The automated system based on the initial data allows you to get a complete set of signal states about the crisis danger. For the information reliability, it is divided into five subsets, where each subset has an assigned numerical significance according to a five-point rating scale. If there is no warning, a zero score is assigned.

For any signal from the insignificant signals category about the crisis danger there is a set of a values grid, which allows you to set the signal severity level specifically according to the given scale. According to any characteristics set and in general for the whole company, two integral signs of the signal truth and the total signals value are included to the scale given earlier. Then, according to the example of the PJSC «Irkutskenergo» data sheet balance there was the set of the automated forecast values to calculate risks indicators.

Research Methods

Accounting and internal reporting are considered as an informative basis of one’s enterprise economic stability state and its structural divisions analysing in order to identify a hidden crisis.

The presented formulas allow forecasting the risk values of any complexity degree to calculate the impact characteristics and the future management decisions options to reduce the extent of risk influence on enterprise activity, and to reduce the probability or prevent further risks (Balanovskiy et al., 2019; Shtayger et al., 2019).

Based on the PJSC «Irkutskenergo» activity results, we constructed the particular indicators influence mathematical model of the xi type’s violations on the general state of the system functioning level with the decomposition into subsystems. At the same time, to conduct models "competition" in relation to each of the regression relations, we will use the software package for the automation construction of the regression model process (ACRMP) (Grechneva et al., 2019; Shtayger et al., 2018).

We will note that it uses following criteria for evaluation of the adequacy models: R –multiple determination; t – Student's test; F – Fisher's; DW – Darbin-Watson's; E – average relative approximation error.

Findings

In order to build each regression model, several hundred (depending on the data nature) alternative models were built using the mentioned software package, with the subsequent selection of the best one based on their adequacy vector criterion. In this case, we used the algorithm to form a set of regression models with a use the dependent variable transformation, described in the paper (Sivtsov et al., 2018; Sivtsov et al,. 2019). Forecast performance indicators values of the PJSC «Irkutskenergo» acquired with a use of an automated complex are shown in table 1.

The described regression type of mathematical models as a predictive system is hereinafter used to predict the enterprise security level in the selected operation areas. Based on the forecast values of the obtained results, the complex automatically determines the signals scale about the crisis threat (hereinafter, the crisis threat scale for each economic stability direction, as well as for the organization as a whole). The threat scale characterizes the crisis in terms of coverage breadth that reflects the organization economic stability areas number where the crisis processes appearance is possible:

The signals intensity about the crisis threat for each area of activity or indicators group that reflect economic stability. The signals intensity characterizes the crisis by the coverage depth that reflects the development depth of crisis phenomena in the organization:

Based on these calculations, we can conclude that the PJSC «Irkutskenergo» enterprise has a hidden progressive crisis. The crisis scale is characterized by the fact that 62.5% of the organization's solvency indicators allow the crisis processes development. The solvency decline indicators in the growth rate intensity are 37.5%. If the intensity increases, most solvency indicators may fall below the standard values.

Conclusion

In modern conditions, when the world economy has no time to get out of one economic crisis falling into recurrent recession, there are increasing needs for new scientific approaches to crisis situation determination. Evidently, the risks that arise in this case can be both predictable and unpredictable. The goal of automation is to identify and calculate as many risks as possible, and to increase the forecasts development effectiveness in order to improve management solutions. Otherwise, the result may be opposite of the expected events nature. In order to identify factors that have a significant impact on the enterprise safety, the software package that is based on the automation construction of the regression model process (ACRGP) (Konyuhov et al., 2019; Konyuhov et al., 2018) is used. The analysis of the obtained forecast values makes it possible for the company's managers to introduce an effective policy in the field of ensuring the company’s functional safety.

References

Balanovskiy, A. E., Shtayger, M. G., Karlina, A. I., Kargapoltsev, S. K., Gozbenko, V. E., Karlina, Yu. I., Govorkov, A. S., & Kuznetsov, B. O. (2019). Surface hardening of structural steel by cathode spot of welding arc. IOP Conference Series-Materials Science and Engineering, 560, 012138.

Bulatov, Y., Kryukov, A., Suslov, K., & Shamarova, N. (2019). Ensuring Postemergency Modes Stability in Power Supply Systems Equipped with Distributed Generation Plants. Proceedings Of The 10th International Scientific Symposium On Electrical Power Engineering (Elektroenergetika 2019) pp. 38-42.

Grechneva, M. V., Balanovskiy, A. E., Gozbenko, V. E., Kargapoltsev, S. K., Karlina, A. I., Shtayger, M. G., Karlina, Yu. I., & Govorkov, A. S. (2019). Quality and reliability improvement of "tube-tube plate" welded joints during welding by pulse pressure. IOP Conference Series-Materials Science and Engineering, 560, 012142.

Konyuhov, V. Y., Gladkih, A. M., & Chemezov, A. V. (2019). Evaluation of the economic feasibility of the introduction of plasma hardening technologies in the Far North enterprises. IOP Conference Series-Materials Science and Engineering, 560, 012147.

Konyuhov, V. Y., Stefanovskaya, O. M., & Shamarova, N. A. (2018). Investment in alternative energy sources. European proceedings of social and behavioural sciences, 50, pp. 1124-1129.

Shamarova, N., Suslov, K., Gerasimov, D., Shushpanov, I., Lombardi, P., Altuhov, I., & Komarnicki, P. (2019). Stabilizing the Control of a Plant Material Drying Process in Off-Grid Power Systems. Proceedings Of The 10th International Scientific Symposium On Electrical Power Engineering, (Elektroenergetika 2019) pp. 363-367.

Shtayger, M. G., Balanovskiy, A. E., Kargapoltsev, S. K., Gozbenko, V. E., Karlina, A. I., Karlina. Yu. I., Govorkov, A. S., & Kuznetsov, B. O. (2019). Investigation of macro and micro structures of compounds of high-strength rails implemented by contact butt welding using burning-off. IOP Conference Series-Materials Science and Engineering, 560, 012190.

Shtayger, M. G., Balanovsky, A. E., Kondratiev, V. V., Karlina, A. I., & Govorkov, A. S. (2018). Application of scanning electronic microscopy for metallography of welded joints of rails. AER-Advances in Engineering Research, 158, pp. 360-364.

Sivtsov, A. V., Sheshukov, O. Yu., Tsymbalist, M. M., Nekrasov, I. V., Makhnutin, A. V., Egiazar'yan, D. K., & Orlov, P. P. (2019). Steel Semiproduct Melting Intensification in Electric Arc Furnaces Using Coordinated Control of Electric and Gas Conditions: II. On-Line Control of the State of the Charge and Melt Zones in Electric Arc Furnaces. Russian Metallurgy, 6, pp. 565-569.

Sivtsov, A. V., Sheshukov, O. Yu., Tsymbalist, M. M., Nekrasov, I. V., Makhnutin, A. V., Egiazar'yan, D. K., & Orlov, P. P. (2018). Steel Semiproduct Melting Intensification in Electric Arc Furnaces Using Coordinated Control of Electric and Gas Conditions: I. Heat Exchange and Structure of the Electric Arc Furnace Laboratory. Russian Metallurgy, 12, pp. 1108-1113.

Sivtsov. A. V., Yolkin, K. S., Kashlev, I. M., & Karlina, A. I. (2020). Processes in the Charge and Hearth Zones of Furnace Working Spaces and Problems in Controlling the Batch Dosing Mode during the Smelting of Industrial Silicon and High-Silicon Ferroalloys. Metallurgist, 64, 5-6, pp. 396-403.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Konyukhov, V. Y., Gladkih, A. M., & Zott, R. S. (2021). Automated Detecting System Of The Enterprise Crisis Hidden Stage. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 876-883). European Publisher. https://doi.org/10.15405/epsbs.2021.07.104