Abstract

In modern conditions of the agricultural industry, the plant growing industry comes to the fore. The main task of any enterprise is to control the level of costs. The role of accounting as the main provider of information and control is increasing. Methodological issues of cost auditing have been studied for a long time, because this segment is key in accounting in the agricultural industry. However, the existing methods do not reflect the specifics of the agricultural sector, which may adversely affect audit results. The authors developed a method for auditing crop production costs using the in-house audit standard "Documenting crop production cost auditing", which improves the quality of audits, reduces auditing time and labor intensity. The research subject is methodological and organizational aspects of the crop production audit. The authors developed templates for the auditing documents that can be used to collect information and prepare audit evidence in order to form an opinion on the reliability of cost accounting. The method can be used by audit firms and higher and secondary educational institutions.

Keywords: Audit, accounting, costs, crop production, documents

Introduction

Agriculture is one of the most important sectors of the Russian economy; it satisfies needs for food and is aimed at growing and processing agricultural products. Agriculture is related to non-slip industries, among which crop production occupies one of the most significant places. This industry acts as the basis of the national food security and provides the population with food (Shumakova et al., 2018). The plant growing directions are diverse, but among them the leading role belongs to the grain farming, which is based on the cultivation of various grain crops. This industry provides jobs for other industries, such as animal husbandry (Shumakova et al., 2016).

In the context of development of the agricultural sector and implementation of national projects aimed at supporting agriculture, the role of accounting is increasing. The accounting information serves as the basis for analyzing and making appropriate management decisions (Golova et al., 2020). However, only a high-quality and timely audit can assess the reliability of the information obtained. Cost audit is one of the most important auditing segments, since the main problem in collecting information is imperfect accounting and analytical support for accounting in agricultural organizations. Audit documents can reduce time for obtaining auditing information, which is an important aspect given the amount of work in the crop production industry (Uvaleyeva, 2019).

Many scientists have dealt this issue: A. F. Aksenenko, V. D. Andreev, I. N. Rich, S. M. Bychkova, Y. A. Danilevsky, D. A. Endovitsky, V. B. Ivashkevich, H. A. Kazakova, A. N. Kizilov, M. L. Makalskaya, E. H. Makarenko, E. A. Mizikovsky, M. V. Melnik, E. M. Merzlikina, N. V. Parushina, V. I. Podolsky, T.M. Rogulenko, V.V. Skobar, Y. V. Sokolov, A. E. Suglobov, V. P. Suits, A. A. Terekhov, H. H. Khakhonova, A. D. Sheremet, et al. Among foreign authors are R. Adams, E. A. Ahrens, M. Benis, R. Dodge, J. Lobbeck, D. R. Kraimichael, J. Richard, J. Robertson, et al. (Kubar, 2015). The study of audit issues in the crop production industry was carried out by R. A. Alborov, N.G. Belov, A. Y. Bazhov, M. F. Bychkova, S. M. Bychkova, F.I. Vaskin, N. A. Kokorev, A. D. Larionov, G. M. Lisovich, M. 3. Pizengolts, A. I. Pavlychev, M. Z. Pizengolts, D. N. Written, L. I. Horuzhy, N. N. Khorokhordin, M. Y. Steinman, V. G. Shirobokov et al. Assessing the contribution to the development of crop production cost issues, it should be said that the methodological support of audit has been understudied (Mosunova, 2004).

Problem Statement

The success of agricultural activities depends on the correct and complete crop production cost accounting (Blinov et al., 2020). Correctly organized cost accounting increases the degree of reliability of accounting and reporting, on the basis of which appropriate management decisions are made (Gapon, 2013). However, cost accounting has a number of features that affect the audit process:

1) Cost accounting is uneven in different seasons (Golova & Goncharenko, 2018);

2) The objects of cost accounting are plant crops, agricultural works, costs, which are further distributed;

3) Costs are initially reflected and accounted for in structural units – brigades - and then they are collected and brought together;

4) Accounting is carried out using account 20 "Main production", to which a sub-account "Crop production" is opened by cost items (Zarypov & Blinov, 2013).

5) During the year, the finished products are accounted for according to their planned costs;

6) It is possible to determine the amount of actual costs only at the end of the year, when the accountant closes the accounts of auxiliary production, general production costs, determines the costs of dead crops and distributes amounts for liming, irrigation, etc.

7) Accordingly, account 20 "Main production" is closed at the end of the year.

8) Accounting is carried out for different works: preparation for sowing; sowing and harvesting; harvesting (Goncharenko & Eremina, 2019).

All these features necessitate the development of a method for auditing crop production costs which, in contrast to the existing ones, would reflect peculiarities of costs and highlight areas that will be accompanied by the development of auditing documents to make the audit process less time-consuming (Suits, 2009).

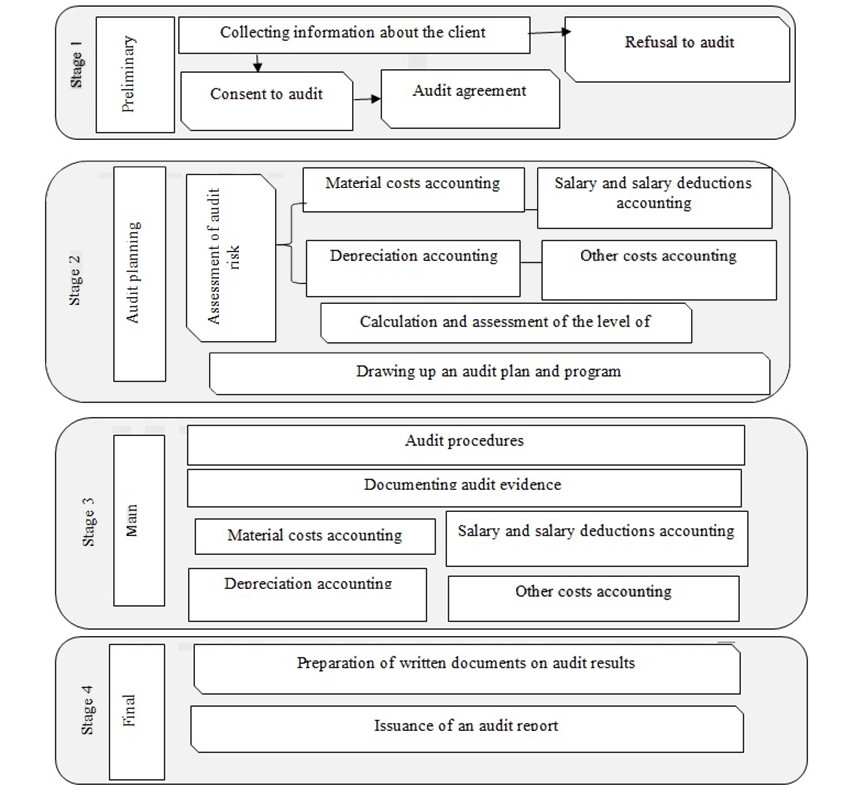

Auditors are often university graduates trained in accounting and auditing or undergraduate students. Many auditors face the same difficulties that arise in the cost audit process: the regulatory framework is very large, and it is undergoing changes; there is no single approach to auditing, which results in different types of results of checking cost accounting in crop production and difficulties of interpreting the results when making a conclusion. The problem of developing a unified approach to audit of cost accounting in crop production is crucial. The main condition is universality (Kazakova, 2018). Many authors provide only a general sequence; however, there is no method for auditing crop production cost accounting in accordance with the internal audit standard "Audit of crop production costs", which contains a full range of auditing documents (Nosyreva, 2007). The use of the auditing documents in combination with the auditing methodology will improve the auditing quality (Figure 01).

The need to use this method is due to the fact that during the auditing, the time resources are usually limited, since the auditor has to check this segment more thoroughly, and other segments are checked more superficially (Khakhonova et al., 2016). The use of templates at the main stage will make it possible to save time for other equally important accounting areas.

Research Questions

The research subject is the issues of methodological support of the crop production cost auditing in agricultural organizations.

According to the Law "On Auditing" No. 307 - FZ dated 30.12.2008, the main auditing purpose is to establish the reliability of information; all facts discovered by the auditor are recorded in the working documents (Parushina & Kyshtymova, 2019). The standard of auditing activities "Requirements for internal standards of audit organizations" allows audit organizations to develop their own internal audit standards, which is a positive factor for audit organizations and audit quality control. The internal standard "Audit of crop production costs" can unify the audit process. Requirements for the preparation of working documents are established by the current federal standard No. 2 "Auditing documents audit", according to which there are only general requirements for the preparation of working documents (Kobozeva & Dunaeva, 2020). However, their content is not limited and depends on the scope of works, characteristics of the subject being checked and the state of accounting. The working documents developed by the authors can be divided into groups according to cost elements: material costs, salaries with deductions, depreciation, and other costs. It is necessary to indicate the name of an audit firm and an agricultural organization; the date of preparation of the document; auditing period; data on individuals who filled out the document, the name of a procedure. The most convenient form is a table. The structure of the standard is as follows: general provisions and basic concepts; the standard and its purpose; appendices (working documents on the assessment of audit risks by cost elements; a list of regulatory documents; sources of information; working documents).

The current legislation does not contain any requirements on the numbering of auditor's documents. Numbering is useful because when filling out one document, you can make a cross-reference to another document. All documents are divided into four groups based on cost elements according to the Methodological Recommendations for accounting of crop production costs approved by the Ministry of Agriculture of the Russian Federation on October 22, 2008:

1. Working documents on material costs accounting: seeds and planting materials; fertilizers; plant protection products; fuels and lubricants; fuel and energy; works and services of suppliers and contractors.

2. Working documents on salary and salary deductions accounting.

3. Working documents on accounting for depreciation and maintenance of fixed assets;

4. Working documents on accounting for other costs: crop insurance, travel costs, deferred costs, commissioning, etc.

Working documents are structured to assess their economic feasibility, correctness of the correspondence of crop production costs accounts; reliability. It is necessary to present all applications as annexes to the standard.

Purpose of the Study

The purpose of this study is to substantiate the methodological provisions and develop recommendations for improving the documentary support for the audit of crop production costs in agricultural organizations.

Research Methods

General scientific methods were used: analysis and synthesis, induction and deduction, logical and systemic approaches, generalization used to cognize socio-economic phenomena and study audit issues. The information base was works by domestic and foreign scientists on, regulatory documents on audit and cost accounting in crop production, periodicals and conference proceedings (Kasyanova, 2020).

Findings

Documentation is one of the integral processes of any audit; it reflects the level of auditor's skills. The in-house standard “Audit of costs in crop production” developed allows us to implement a more efficient crop production cost auditing method, which will improve the quality of the auditing. Working documents are used to draw up auditor's reports based on the auditing results. These documents make it possible to carry out an analysis as one of the aspects of the internal and external quality control (Nosyreva, 2007).

Conclusion

The implementation of the method based on the in-house standard "Auditing of crop production costs" can reduce the labor intensity of the audit, time spent on auditing procedures, and the document templates take into account the specifics of cost formation in crop production. In addition, the existing regulatory documents require standards developed by the audit firm, which saves time for the auditor and is an indicator of his professional growth. This method is aimed at

- involving auditor assistants;

- improving the quality of audit;

- reducing labor intensity;

- increasing the volume of works performed;

- making the audit technology more rational.

Thus, the development and implementation of new documents into the auditing practice taking into account peculiarities of crop production costs has a significant impact on the auditing technology and reduces labor intensity (Nosyreva, 2007).

References

Blinov, O. A., Baetova, D. R., Golova, E. E., Goncharenko, L. N., Dmitrenko, E. A., Zaitseva, O. P., Kozlova, O. A., Remizova, A. A., Nardin, D. S. S., & Nardina, S. A. (2020). Assessment of social development of rural areas (on the example of the Omsk region). OmSTU

Gapon, M. N. (2013). Influence of transaction costs on the economic profit of poultry enterprises. Basic research, 6(2), 411-415.

Golova, E. E., & Goncharenko, L. N. (2018). Documenting the calculation of the cost of crop production. Basic research, 12(2), 240-244.

Golova, E., Baetova, D., Zaitseva, O., & Novikov, Y. (2020). Modernization of the Social Sphere in Terms of the Development of the System of Preschool Education of Children in Rural Areas. In International Scientific Conference the Fifth Technological Order: Prospects for the Development and Modernization of the Russian Agro-Industrial Sector (TFTS 2019) (pp. 103-108). Atlantis Press.

Goncharenko, L. N., & Eremina, E. N. (2019). Features of cost accounting and calculating the cost of services at elevator complexes. Electronic scientific-methodical journal of Omsk State Agrarian University, 4(19), 5.

Kasyanova, S. A. (2020). Audit. Tutorial. Moscow, Publisher: Vuzovskiy textbook

Kazakova, N. A. (2018). Audit for masters according to Russian and international standards. Textbook. Publisher: INFRA-M

Khakhonova, N. N., Khakhonova, I. V., & Bogataya, I. N. (2016). Audit. Textbook, Publisher: RIOR

Kobozeva, N. V., & Dunaeva, V. I. (2020). Quality of audit services: concept, methodology, tools. Monograph. INFRA-M

Kubar, M. A. (2015). Development of methodological support for the audit of accounting for production costs in agricultural organizations. https://rsue.ru/avtoref/KubarMA/KubarMA.pdf

Mosunova, E. L. (2004). Organization and methodology of management accounting in flax growing (on the example of the Udmurt Republic). https://www.dissercat.com/content/organizatsiya-i-metodika-upravlencheskogo-ucheta-v-lnovodstve-na-primere-udmurtskoi-respubli

Nosyreva, E. E. (2007). Audit of fixed assets in agricultural organizations. https://www.dissercat.com/ content/audit-dvizheniya-osnovnykh-sredstv-v selskokhozyaistvennykh-organizatsiyakh

Parushina, N. V., & Kyshtymova, E. A. (2019). Audit: the basics of audit, technology and methodology for conducting audits. Tutorial. FORUM

Shumakova, O. V., Blinov, O. A., Khrabrykh, S. L., Mozzherina, T. G., & Kryukova, O. N. (2016). Disclosure of assets of the agricultural enterprises in the financial reporting under international financial reporting standards. International Journal of Economics and Financial Issues, 2, 172-178.

Shumakova, O. V., Gapon, M. N., Blinov, O. A., Epanchintsev, V. Y., & Novikov, Y. I. (2018). Economic aspects of the creation of mobile units providing everyday services in off-road conditions in Western Siberia. Entrepreneurship and Sustainability Issues, 5(4), 736-747.

Suits, P. V. (2009). Organization and methods of operational audit. https://www.dissercat.com/content/ organizatsiya-i-metody-operatsionnogo-audita

Uvaleyeva, Z., Mukhiyayeva, D., Baranova, I., Valieva, M., & Kopylova, O. (2019). Positioning of Post-Soviet Universities in International Ratings: Case of Entrepreneurship Education. Journal of Entrepreneurship Education, 22(6), 1-15.

Zarypov, R. R., & Blinov, O. A. (2013). Organization of management accounting in grain production. Bulletin of the Omsk State Agrarian University, 3(11), 62-66.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 July 2021

Article Doi

eBook ISBN

978-1-80296-112-6

Publisher

European Publisher

Volume

113

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-944

Subjects

Land economy, land planning, rural development, resource management, real estates, agricultural policies

Cite this article as:

Golova, E. E., Baranova, I. V., & Gapon, M. N. (2021). Crop Production Cost Accounting Audit. In D. S. Nardin, O. V. Stepanova, & V. V. Kuznetsova (Eds.), Land Economy and Rural Studies Essentials, vol 113. European Proceedings of Social and Behavioural Sciences (pp. 72-78). European Publisher. https://doi.org/10.15405/epsbs.2021.07.10