Abstract

This paper examines customs control of timber, which is one of the core commodities to exported through borders administered by the Far Eastern Customs Department (FECD). When it comes to the exportation of Cat. 44 commodities under the Foreign Economic Activity Commodity Nomenclature of the Eurasian Economic Union (FEACN EAEU), the most common violation is the failure to duly declare such commodities. Whether such declaration is false or absent, it is always associated with inaccurate or overdue reporting. The emergent shadow trade of timber coupled with unauthorized logging jeopardizes not only the customs, but also the whole economy of Russia. By reporting inaccurate data, declarants cut their costs associated with international trade; they deliberately use inappropriate classification codes to reduce the customs value of the exportables. The Ministry of Natural Resources and the Environment reports that unauthorized logging results in a loss of about one million cubic meters of timber per annum, which means the federal budget has a shortfall of 10 billion rubles. This puts customs under pressure. A better regulatory framework for customs control of timber will help prevent illegal trafficking thereof. The findings of this research lay the foundations for more efficient customs control of exported timbers, both in the FECD-administered area and across Russia. This paper presents an interim study, the results of which could be of use for customs offices, whether in the context of clearance or post-release control.

Keywords: Customs control, declaration, classification, illegal trafficking, timer

Introduction

Customs clearance is a mechanism that guarantees full payment of customs duties as well as a correct calculation of customs value. Being an instrument of customs, value calculation helps ensure compliance with the law at the stage of clearance. The classification of many items has loopholes that enable the declarant to choose such FEACN EAEU code, for which customs duties will be lower. Doing so is technically legal. At the clearance stage, it is critical to check whether customs value has been calculated in due manner, and the commodities to be exported have been duly and accurately classified. In this regard, Cat. 44 commodities are a twilight zone that has methodological flaws, which enable the declarants to declare their exports in a manner that reduces the customs duties.

The Far Eastern Federal District has expansive forests, and the exportation of timber from this part of Russia is rising. In the FEFD, forestry as an industry lacks advanced timber processing technologies. Nearly all merchantable timber is exported, making the whole industry dependent on the prices in China and Japan. Russia’s Far East contains nearly 70% of the country’s conifers, including larch, spruce, and fir. The southern regions of the Far East are dominated by Quercus mongolica, Fráxinus mandshurica, Tilia amurensis, and Ulmus propinqua. The local forests are well-preserved because since virtually as far back as neolithic times, the economy here has been based on agriculture and fishing, both of which were of roughly equal importance (Shvedov et al., 2015).

Problem Statement

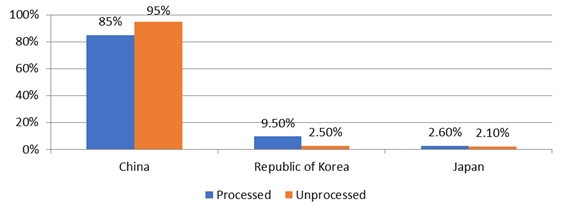

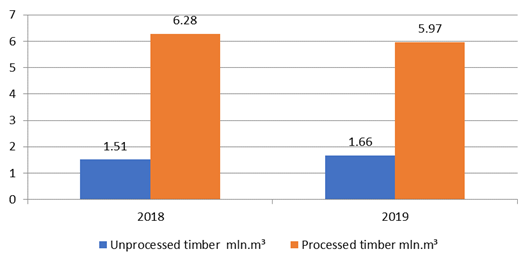

To date, the FECD processes ~30% of unprocessed timber and 7% of processed timber exported from Russia. As shown in Figure 01, unprocessed timber is mostly exported to China (95%), the Republic of Korea (2.5%), and Japan (2.1%). Figure 02 shows that in 2019, the exportation of unprocessed timber dropped YoY, whilst that of processed timber rose.

This happened due to an increase in customs duty on unprocessed timber. Processed timber is also mainly exported to China (85%), the Republic of Korea (9.5%), and Japan (2.6%).

This is also the core reason why illegal timber trade is on the rise in the Far East. From the standpoint of customs, Cat. 44 (Timber, wood products, and charcoal) is a challenge for parties involved in international trade as well as for customs offices; the ambiguity inherent in this category complicates labeling, declaration, and customs control (Rudneva & Neverov, 2017). False declaration, failure to declare, and illegal trade of timber produced by unauthorized logging are the main problems facing the Far Eastern Federal District. As shown in Table 01, harm associated with illegal timber trafficking affects the economic, social, political, and legal processes.

Negative forestry-related processes jeopardize the financial security of Russia in the Far East. This industry is flawed, as it is currently only able to deliver unprocessed timber to China, Korea, and Japan. Consumerist attitude threatens forests; among other parties, such attitude is shown by international companies that require joint logging and exportation of timber that is further processed abroad and reexported back to Russia. The situation clearly hurts Russia’s financial interests. Apparently, such predatory attitude results in a considerable budgetary shortfall for Russia. This shortfall must be taken into account when projecting the costs of improving the risk management system in the context of budgetary revenues from customs duties. Planning and execution are important parts of budget management (Kuklin & Naslunga, 2018). International firms tend to impose such terms and conditions that will minimize the costs for them, since processing takes place abroad. Then goods and products made of Russian wood are reexported back to the country with a considerable markup.

Timber smuggling is a large-scale problem and is in most cases a crime. Data reported on the official website of the Federal Customs Service (FCS) suggests that in 2019, 222 illegal timber exportation cases were filed under Articles 199 and 226.1 of the Criminal Code, an increase of 29% from 171 such cases in 2018.

Most administrative offence cases are filed by the Ussuri, Blagoveshchensk, and Khabarovsk Customs. Most violations pertain to the failure to declare, inaccurate declaration, and illegal exportation. Therefore, a set of measures must be taken to tackle this problem; the measures are discussed further in this paper.

Research Questions

Customs control is a system of interconnected activities under a legal framework that calls for imperative action on the part of parties involved in international trade. Unprocessed timber is a challenging commodity with regard to customs control. Therefore, more efficient customs control of timber exports is crucial for the Far Eastern economy.

Purpose of the Study

The goal hereof is to find out how customs control of the exportation of Cat. 44 commodities under FEACN EAEU.

Research Methods

This research is based on economic analysis, statistical and economic research methods, analysis and synthesis methods.

Findings

The proposed customs control improvements need to make a well-designed and efficient system. We believe it necessary to toughen the punishment for illegal timber trafficking. This will reduce the profits unscrupulous traders make from timber sales. False declaration needs to be criminalized. Part of the challenge comes from the fact that China, Japan, and Korea are not EAEU members states. Any effort pertaining hereto should be based on the EAEU integration practices. Use of the opportunities and instruments available to nation states towards integrational development is a strategically appropriate way to such development (Pimenova, 2019). To make timber sales more transparent, legal frameworks must be in place that govern the whole supply chain from logging to the end buyer. Such a framework needs to be tailored to the national laws on the states involved in the international trade of timber. The EAEU has to be capable of withstanding external shocks by joining the efforts of its member states while also progressing towards technological advancement and making the member states more competitive—if this integration is to be viable (Greenberg & Pylin, 2020). It should be borne in mind that as the EAEU economies become more and more integrated, it becomes critical to have uniform regulatory frameworks that govern the public relations affected by, or pertaining to, such integration (Yakovleva, 2019). It is important to incentivize and reward such parties to international trade that document their transactions duly and pay their taxes and customs duty in full. Those can make up a separate category of international trade participants when it comes to classifying such parties for the purposes of risk management.

It is imperative to further implement automations and IT for customs control of timber. The existing timber quantification guidelines rely on geometric measurements and calculations that use the simplest instrumentation; a guidelines update is long overdue. Officers do not have time for complex math. Besides, a complicated procedure often results in failure to meet the clearance deadlines. Advanced timber trafficking measurement techniques can speed up and facilitate the overall control whilst enabling a more detailed identification of this commodity category. Logging and improvement cutting in the Far East is mechanized. Best international practices could be of help here. For instance, Scandinavian countries have long and efficiently been using grading machinery for improvement cutting (Grigoryeva & Grigoryev, 2019). Use of advanced machinery will prevent tampering with grades and quantities as early as during logging. This means that customs control officers will have access to objective data for their purposes. That will prevent the stress that officers often experience due to being afraid to wrongly quantify timber, since they, in fact, have to do it visually. We also believe it important to consistently update the rates of customs duties and adjust them to the regional context of trading Cat. 44 commodities. Commodity markets in fact call for quarterly rather than yearly updates of bellwether prices. The Federal Customs Service needs to cooperate closely with the Forestry Union and maybe even to establish specialized departments for such purposes.

Better customs control means a longer list of persons reporting to the customs. To date, customs offices only communicate with the parties directly involved in international trade. It would be unreasonable to count on the integrity of declarants, since they are in fact motivated to cut the clearance-associated costs. Therefore, the situation calls for a closer cooperation with forest management services. This will enable monitoring the utilization of forest reserves allocated for logging and give the customs a better idea of where the exported timber came from. Satellite navigation, which provides digital data on forested areas, will further improve the process. Best international practices should be considered as well, as they revolve around digital monitoring of forests (Ivanchenko, 2017). Digital law is still at infancy in Russia. Digitalization alters the traditional system of entities under information law, as new entities emerge (Chubukova, 2019). Despite being tightly integrated in today’s society, the theory behind digital economy is yet to be properly formalized in academic research and interstate documentation (Zvereva et al., 2019). We believe that special licensing and certification of fleets involved in timber transport will help no only track the movement of cargo, but also prevent loading extra cargo or reloading it. At the same time, licenses should be harder to obtain for persons known to have breached the law.

Human resources employed in customs must improve if customs control is to be improved. HR improvement herein does not mean any kind of optimization or restructuring, which would constitute a layoff. We believe that in an extreme continental climate, if officers need to inspect cargo in the open air, their working hours need to be cut. A layoff would result in the opposite. What must be updated is the requirements to the officers’ education. When hiring, preference should be given to people who majored in Customs.

These efforts will help improve customs control and prevent loss of budgetary revenues from timber exports.

The findings of this research are therefore as follows:

— the authors have covered the distribution of timber exports from the Far East, namely the breakdown into processed and unprocessed timber.

— the paper also cites statistics on cases filed under Articles 199 and 226.1 of the Criminal Code of Russia that refer to illegal timber trafficking in the FECD-administered area.

— the paper also discusses how the customs control of timber exportation could be improved.

Conclusion

Loopholes in forestry and customs enable unscrupulous international trade participants to breach the law when exporting timber. False declaration, illegal trafficking, and failure to declare are the key issues when it comes to timber exports, as these factors result in a budgetary shortfall. The government tries to tackle smuggling; however, responsibility for the management and control of exports lies with the local authorities. This leaves the forests virtually unprotected from illegal logging. Therefore, customs have an ever greater role to play in the prevention of illegal international trafficking of timber. Thus, the conclusions hereof are as follows:

The exportation of processed timber is on the rise, and so is the filing of cases under Articles 199 and 226.1 of the Criminal Code, which means that illegal trafficking of timber is on the rise as well.

The following needs to be done to optimize the customs control:

– toughen the punishment for illegal timber trafficking;

– further implement automations and IT for customs control of timber;

– consistently update the rates of customs duties and adjust them to the regional context of trading Cat. 44 commodities;

– improve the human resources employed in customs.

References

Chubukova, S. G. (2019). Sistemy subyektov informatsionnogo prava: napravleniya tsifrovoy transformatsii [Entities under information law: the aspects of digitalization]. Bulletin of Moscow University. Series 26: State Audit, 3, 17-27. [in Russ.].

Greenberg, R. S., & Pylin, A. G. (2020). Evrazysky ekonomichesky soyuz: osnovnye trendy razvitiya na fone globalnoy neopredelyonnosti [Eurasian Economic Union: core trends on top of global uncertainty]. Economy of Region, 16(2), 340-349. [in Russ.].

Grigoryeva, О., & Grigoryev, I. (2019). Problemy i perspektivy rubok ukhoda za lesom v Rossii [Challenges and prospects of improvement cutting in Russia]. LesPromInform, 8(146), 70-72. [in Russ.].

Ivanchenko, V. D. (2017). Dalnevostochny lesnoy kompleks: otsenka i problemy pravovogo regulirovaniya protivodeystviya nezakonnoy vyrubki i oborota drevesiny [Far Eastern forestry: assessment and issues of regulatory frameworks for the fight against illegal logging and timber trafficking]. Vlast i upravleniye na Vostoke Rossii = Power and Governance in the East of Russia, 4(81), 200-208. [in Russ.].

Kuklin, А. А., & Naslunga, К. S. (2018). Metodicheskiye osobennosti otsenki sostoyaniya regionov [Status of regions: specific assessment methodology]. Economy of Region, 14(2), 395-407. [in Russ.].

Pimenova, O. I. (2019). Pravovaya integratsiya v Yevropeyskom soyuze i Yevrazyskom ekonomicheskom soyuze: sravnitelny analiz [Comparative analysis of legal integration in the EU vs. the EAEU]. International Organisations Research Journal, 14(1), 76-93. [in Russ.].

Rudneva, Z. S., & Neverov, I. E. (2017). Osobennosti tamozhennogo kontrolya drevesiny i izdely iz neyo [Special aspects of customs control of timber and wood products]. Tamozhennoye delo i vneshneekonomicheskaya deyatelnost kompaniy = Customs and International Trade, 1(2), 104-114. http://customs.esrae.ru [in Russ.].

Shvedov, V. G., Stelmah, E. V., Solovchenkov, S. A., & Golub, A. B. (2015). The formation of a reclamation region around the Amur River) in the late Neolithic period. Bylye Gody. Russian Historical Journal, 35(1), 14-21. [in Russ.].

Yakovleva, M. A. (2019). Perspektivy ekonomicheskoy integratsii na postsovetskom prostranstve i vneshnyaya politika Rossyskoy Federatsii [Prospects of economic integration in the post-Soviet space and the foreign policy of the Russian Federation]. Bulletin of Moscow University. Series 26: State Audit, 2, 68-81. [in Russ.].

Zvereva, А. А., Belyaeva, Zh. S., & Sohag, K. (2019). Vliyaniye tsifrovizatsii ekonomiki na blagosostoyaniye v razvitykh i razvivayushchikhsya stranakh [How economic digitalization affects the prosperity of developed and developing economies]. Economy of Region, 1(4), 1050-1062. [in Russ.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 June 2021

Article Doi

eBook ISBN

978-1-80296-110-2

Publisher

European Publisher

Volume

111

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1168

Subjects

Social sciences, education and psychology, technology and education, economics and law, interdisciplinary sciences

Cite this article as:

Stelmah, E. V. (2021). More Efficient Customs Controls On Exported Timber. In N. G. Bogachenko (Ed.), Amurcon 2020: International Scientific Conference, vol 111. European Proceedings of Social and Behavioural Sciences (pp. 974-980). European Publisher. https://doi.org/10.15405/epsbs.2021.06.03.128