Abstract

The framework of the general idea of developing the country's competitiveness include a regional competitiveness as issue not just academic interest but also attention of entrepreneurs and politicians. The national security strategy of different countries notes that a competitiveness is a sphere of national interests in long term prospective, and its improvement is a priority task, including creation of a mechanism for reducing the level of interregional differentiation in the socio-economic development of regions. This article contributes to a better understanding of a regional competitiveness through the lenses of potentials in order to cope with increased competition and digitalization of world economy. Existing empirical evidence documents a strong role of financial and monetary potentials while analyzing a diversification of a regional competitiveness. We argue that external and internal factors impact competitiveness by linking financial factors of competitive environment, financial sources of region and financial potential of region. We suggest that financial potential is considered from the standpoint of a structural and functional approach in terms of possible use budget, tax, credit, investment potentials. This paper suggests a theoretical interpretation of regional monetary potential and provides a mechanism of its measurement (based on some implications from empirical measures in the United States Federal Reserve System).

Keywords: Competitiveness, regions, economic growth, monetary potential

Introduction

In order to form the strategy of regional development, it is necessary to rely on a coherent and realistic strategic analysis of region’s international positioning and factors of competitiveness. Also, in recent years, regions more and more invested in strategic territorial intelligence initiatives to diminish regional inequalities. In the study of the problems of regional competitiveness, two interrelated areas of analysis should be differentiated.

Firstly, it was the main focus of many foreign scientists to study general issues of competitiveness, including research of M. Porter, I. Ansoff, P. Kotler and others. They have been concentrated on theoretical and conceptual issues of competition, tried to characterize it and find mechanisms to manage (Porter, 2003).

Secondly, it is an analysis of key sources of a competitive regional economy and comparison of regional competitiveness. Most of the scientists regard regional economic performance (for example investments) as a key source and evaluate specific geographical and institutional contexts (Zenka et al., 2014). This assumes the presence of groups producers with a common economic interest in a specific territory with certain institutional particularities. Finally, the greater mobility of capital and policies in favor of better labor mobility combined with greater openness of national markets oblige regions to implement policies aimed at creating competitive advantages. They are based on technological, social, infrastructural (for example transport accessibility) and institutional achievements that strengthen the competitiveness of companies and the region as a whole (Yang et al., 2019).

In addition to this, there are two conceptual approaches which link regional competitiveness and competition. Much previous research and theoretical literature has argued that regional economy is based on large mass industrial production, include main place of work of the majority of population, bring significant tax revenue for regional budget. This concept reflects an integrated (centralized) region and underline minimum role of competition, as region is only a location and functioning of production process around key organizations. Thus, the position of the region depends on whether it has a large industrial enterprise or not.

The second model of region as a network model has increased rapidly in recent years. Regions are considered to be subject to mobilize resource of the entire network, influencing global exchanges. Regional companies brought together form a cluster (Komarova & Abramenkov, 2020; Porter, 1998) or network (Huggins & Izushi, 2007). A competitiveness of regions is intrinsically bound to competitiveness of the entire network region and an increase in value, then there is a capitalization of the region's assets. Also, decisions on the further extension of existing and new regional assets that are most likely to endow to competitiveness of region need to be made. By definition, a cluster or a network are determined through complex interactions among participants. Accordingly, the region itself has the autonomy necessary to organize and manage its relationship with the environment. Therefore, the environment is used as an important component in which the region acts as an economic agent. The role of the region is manifested not only in the use of already existing local means, but also in ability to make rational economic decisions in the digital economy (Melnik & Antipova, 2019; Rozhkova et al., 2018) and create a special environment for enhancing cooperation.

Problem Statement

For those who monitor the progress of competitiveness of regions research, the search for a distinctive theory of regional competitiveness continues. However, an analysis of financial factors and resources of the competitiveness of regions has not received much attention. On the other hand, a growing body of empirical literature points to the importance of regional financial system, but problems of regional competitiveness from monetary perspective are not considered. The defining characteristic of monetary resources is a special role in the regional economy to quickly and effectively transform into various forms of assets which is a measure of competitiveness (Malecki, 2007).

To date, there are not many studies devoted to finding the relationship between regional economic development and financial leverage. Of course, a mission of any region is to contribute to the economic, social and cultural development of the region in the era of globalization and glocalization (Wathen, 2020). The region defines a regional plan for economic development, innovation and internationalization, which sets out the basic principles of assistance to business, support for internationalization and investment programs, etc. In this regard, the task of scientific research includes the search for a theoretical understanding of these problems and the development of applied aspects of the functioning of decentralized finance in new conditions.

Researchers widely use the term "potential" in the economic literature (as analogue to electric potential in physics). Regional economic potential is a measure of accessibility to economic activity (volume of economic activity, distance, cost of transport) (Keeble et al., 1982). In this case economic potential represents regional income having been divided by the distance costs, thus giving a possibility to manage a regional companies concentration. Innovation potential includes quantification of product and process innovation relying on innovation input and innovation output (Aiman-Smith et al., 2005; Koschatzky et al., 2001). In general, market potential refers to measuring demand for goods produced in a region as a sum of purchasing power in other locations, weighted by transport costs (Hanson, 2005). Thus, the economic and market potentials are quite similar. Entrepreneurial potential demonstrates the creation of new businesses and describes individual’s outcomes and reasons for its diversification (Elert et al., 2019; Jayawarna et al., 2014).

Research Questions

We follow the path and think about of an importance of monetary and financial potentials of regions. A number of conceptual and methodological approaches to determining the financial capabilities of the subjects of the Russian Federation remain controversial. Moreover, until now, there is no generally accepted interpretation of the categories "financial potential", "financial resources", "monetary potential", "territorial capital". The last concept includes public, tangible and intangible goods (Camagni, 2019). The principles and methods that implement in practice the essential foundations of these concepts are interpreted in different ways. By concentrating on the region as the relevant unit of analysis, the concept of "monetary competitiveness of the region" is not used. The current investigation attempt to overcome these shortcomings by distinguishing financial potential and develop a mechanism for its measurement in a regional level.

In our opinion, the competitiveness of the region should also be considered in terms of monetary potential. With these issues in mind, the present paper addresses the following set of research questions:

- What financial factors affect regional competitiveness?

- How we can assess the regional financial potential and its transformation?

Purpose of the Study

The financial system of the region was chosen as the object of research. The financial sector mediates between savings and investment. Thus, in the context of glocalization, the efficiency of the financial sector and financial system mediates the strengthening of regional competitiveness. A developed financial system and low transaction costs contribute to a more efficient allocation of resources. In addition, regional financial and credit resources are the basis of monetary potential. It acts as the most mobile and liquid part of the financial potential. Note that the monetary potential is one of the key factors in the competitiveness of the region.

The aim of this paper is to enrich research by theory and methodology of monetary potential of the region within the context of theories of region competitiveness and creditworthiness growth in the context of network interaction.

Research Methods

During our research we have used methods of theoretical reasoning which include induction, prediction, or analogy. The literature was reviewed in order to clarify the different underlying conceptual assumptions about regional competitiveness, financial and monetary potential.

The relationship between external and internal financial factors of competitiveness

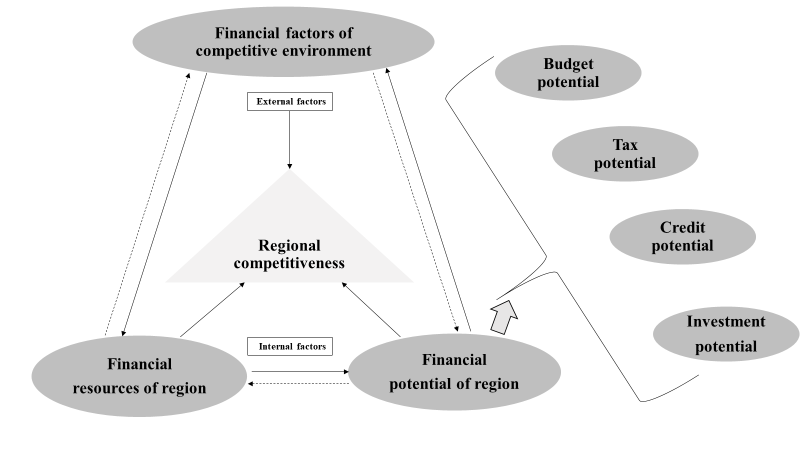

Let us emphasize that competitiveness as a condition for the development of regions is formed in each specific case under the influence of a combination of external and internal factors. The variety of external factors is determined by the characteristics of the competitive environment: a set of economic and social conditions in which a particular product is produced and sold. The analysis of this environment is limited by the financial conditions for the development of interregional competition. Internal factors include real and potential sources of increased competitiveness. The relationship between external and internal financial factors of regional competitiveness is shown in Figure 01.

Taking into account the lack of special studies on the financial aspects of interregional competition, we will take the methodological approach used in the reports of the World Economic Forum on the competitiveness of countries as a basis for studying external factors of competitiveness (Global Competitiveness Report).

The indicators concerning the financial factor of competitiveness are ordinarily is characterized by: the state of the banking system, the state of the stock market, the nature of macroeconomic monetary policy, macroeconomic indicators, and ratings. Internal sources of financial capacity include: financial resources of business entities conducting commercial activities in the production and non-production areas; financial resources of credit and financial regional organizations (branches); financial resources of public organizations and institutions engaged in non-commercial activities in the region; financial resources of the population, including current monetary incomes and accumulated in one form or another; financial resources of the regional administration.

By explicitly addressing these dimensions we attempt to link a financial potential to a structural and functional approach in terms of possible utilization but not as sources of its formation. Structural elements of the financial potential of region are budget, tax, credit, investment potentials. Indeed, they are relatively independent, but interrelated and closely associated. The use of the concept of “monetary potential of the region” allows us to enrich a concept of regional competitiveness of territory and the concept of “creditworthiness of region” (Caplinska & Tvaronavičienė., 2020), which is closely related to it.

Problems of determining the structural elements of the monetary potential of region

In the economic literature one can find researches which reflects in indirect way the concept of the monetary potential. For example, Pechenskaya-Polishchuk (2020) provides evidence about budgetary resources (income of a subject of federation or a municipal formation). Other investigations consider securities market instruments, resources of the regional banks and household funds. To establish the basic ideas of monetary potential of the territory it is necessary to imagine the complete structure. Although some of its resource are studied in sufficient detail, the creating the whole picture represents a big and challenging task. In this case there is the methodological difficulty as money are very mobile economic substance. Therefore, fixing the monetary potential at a specific date (stock) lacks of an opportunity for in-depth analysis. Fundamentally, a key driver of regional competitiveness should be considered in long-term prospective (as a flow). Indeed, the informal sector of cash circulation flourishes. This is relevant in evaluating the potential effects of the large-scale shadow market (Marmora & Mason, 2020) on the monetary potential of the territory. The list of these difficulties can be significantly expanded. In most general way, one can evaluate the monetary potential of a region by measuring amount of money in a given territory on that date. Specific reasoning would include distinction the term money, quasi-money, virtual money etc.

Findings

The indicator to measure the monetary potential of the region

Using a technique suggested by Boychuk et al., we think that the formula of the monetary potential of the region is (Boychuk et al., 2008):

Mmpr = MOcb – MOar + MOr + М0un + М0о+ Mv (1)

where Mmpr is monetary potential of region, MOcb – all non-cash funds of the territorial administration of the Bank of Russia of a particular region, MOar – non-cash funds (deposits) of branches of nonresident banks, current accounts of divisions of head enterprises and organizations registered in another region, MOr – funds on sub-accounts of bank branches, current accounts of subdivisions of parent enterprises and organizations registered in this region, but located in another region, М0un is unorganized part of cash currency (notes and coins) in circulation in region, М0о is organized part of cash currency (notes and coins) in circulation in region (for example notes and coins in bank vaults), Mv – virtual money. Let us emphasize that we have included the “virtual money” indicator in the formula, which shows money in circulation in virtual payment systems (Sauer, 2016). Despite the fact that the share of this indicator in the current Russian realities is not large, it is impossible to ignore its further development both on a global and Russian scale. Note the possible difficulties in calculating this indicator and need for the development of state regulation.

Exploring the elements that build structure of the region's monetary potential, one can note their qualitative heterogeneity. Thus, the movement of funds on the accounts of the Federal Treasury of the region, as well as on the accounts of the Institutions of the Central Bank of the Russian Federation are more stable than on other accounts. In addition, the transformation of budget money from potential into resources and their further use for socio-economic development of the region is systematic. The unorganized part of cash circulation (М0un) is hardly amenable to government regulation, their movement (transformation into resources) is often stochastic and chaotic. Thus, they can instantly turn into deposits, but they can again be modified into cash if there is a slightest shock in the banking market. In addition, the size of these funds can be calculated only approximately using the indicators of the balance of monetary incomes and expenditures of population of a given territory and other indirect indicators.

Overall, calculation of the monetary potential is not only about measuring the regional monetary resources in absolute value. More specifically, it is associated with a long-run measuring performance of activities of economic entities where the region itself advocates as a main participant in network interaction to improve economic, organizational, institutional, financial mechanisms targeted to capitalization of the region, increasing its competitiveness.

The growth of regional money potential: further implications

As noted earlier, the monetary potential of the region is one of the factors to increase competitiveness. It is not possible to apply the methodology presented in clause 6.1 due to the lack of statistics from the territorial offices of the Bank of Russia…, (2020). However, in the presence of statistical data, the proposed methodology for calculating the monetary potential of the region does not present difficulties for implementation.

Next, we will consider some points that characterize the monetary potential of the region.

Firstly, the assessment of monetary potential can be carried out through the prism of institutionalization. To do this, consider the number of credit institutions in terms of their registration and number. Let us analyze the data in relation to the Far Eastern Federal District. There are only 15 credit institutions registered in the district, and 52 branches of out-of-town banks. Thus, the regional aspect of the monetary potential testifies to the district's weak positions. What will happen to the monetary potential of the region if only branches of banks from other cities operate in it?

Within the framework of the proposed methodology, funds on accounts of nonresident banks do not refer to the monetary potential of this region. Let us emphasize the fundamental difference between the regional monetary potential and its implementation, namely the transformation into various types of assets while process of movement (securities, loans, etc.). The ideal option when all the resources of the branch remain within the given region cannot be ruled out. At the same time, crisis or pre-crisis situations are mediated by the closure of all operations of branches by the head bank and concentration of all monetary resources at bank’s registration. In addition, the head organization often sets credit and other limits for subordinate units. Thus, there is not only centralization of financial resources, but also a significant impact on the financial potential of a particular region.

So, the very existence of the regional banking system, the growth of its capitalization is an objective necessity for increasing the monetary potential of the region. Other conditions include measures to create a branch network of regional banks located in other regions, as well as to minimize cash circulation by attracting cash into the circulation of regional commercial banks.

Secondly, the assessment of the monetary potential can be carried out through the prism of the unorganized part of the cash flow. Of course, it is necessary to consider the initiation of processes associated with network competition, attracting household resources to credit institutions that have correspondent accounts in the Territorial Administration of the Bank of Russia in this region. In Table 1 the data on the volumes of bank deposits of individuals and funds of individual entrepreneurs are presented.

Let us emphasize the positive dynamics of the deposit market, both in terms of deposits and other funds of individuals, and in terms of funds of individual entrepreneurs. Deposits and other funds of individuals increased from 2016 by 60% (from 851,134 million rubles to 1,364,491 million rubles). The growth of funds of individual entrepreneurs in the accounts of banking organizations in the region is observed by 1.5 times (from 25,785 million rubles to 65,723 million rubles). Thus, the analysis of practice shows that depositing money from citizens is a developing process.

To summarize, a reduction in the unorganized part of cash circulation in the region is possible by activating the deposit market. Thus, it becomes possible to attract temporarily free funds of citizens, to develop a market for low-value shares and bonds intended directly for households in the region.

Conclusion

In a globalized economy, territories, not just companies, compete directly with each other. Indeed, unlike countries, regions and cities compete in the international market for goods and factors of production on the basis of the principle of “absolute advantage” rather than competitive advantage. This means that there is no effective mechanism that can automatically provide each region with an increase in competitiveness.

Money is a payment instrument recognized by governments, households and businesses. Passing through several stages in the process of circulation, it is important in the framework of our study that money is constantly transformed into other assets, and then returns to its original form with an increased value. Thus, at the current stage of development, decisive factor is to ensure a sufficient degree of liquidity and mobility of the region's monetary potential. It is the monetary potential that testifies to the high level of economic activity of the subjects of the region (the effectiveness of management and organization, network integration, human capital, etc.) Thus, we argue that the competitiveness of the region increases, combining into a single whole incompatible resource such as banking, financial, industrial and budget systems.

References

Aiman-Smith, L., Goodrich, N., Roberts, D., & Scinta, J. (2005). Assessing your organization's potential for value innovation. Research-Technology Management, 48(2), 37-42.

Bank of Russia. Documents and data. (2020). http://www.cbr.ru

Boychuk, P. G., Grishanova, O. A., Rozhkov, Yu. V., & Chernaya, I. P. (2008). Formirovanie denezhnogo potenciala regiona [Formation of the region's monetary potential]. HGAEP. [in Russ.]

Camagni, R. (2019). Territorial capital and regional development: theoretical insights and appropriate policies. In Capello, R., & Nijkamp, P. (Eds.), Handbook of Regional Growth and Development Theories (pp. 124-148). Edward Elgar Publishing.

Caplinska, A., & Tvaronavičienė, M. (2020). Creditworthiness place in Credit Theory and methods of its evaluation. Entrepreneurship and Sustainability Issues, 7(3), 2542-2555.

Elert, N., Henrekson, M., & Sanders, M. (2019). The entrepreneurial society: a reform strategy for the European Union. Springer. DOI:

Hanson, G. H. (2005). Market potential, increasing returns and geographic concentration. Journal of international economics, 67(1), 1-24.

Huggins, R., & Izushi, H. (2007). Competing for knowledge: Creating, connecting and growing. Routledge.

Jayawarna, D., Jones, O., & Macpherson, A. (2014). Entrepreneurial potential: The role of human and cultural capitals. International Small Business Journal, 32(8), 918-943.

Keeble, D., Owens, P. L., & Thompson, C. (1982). Regional accessibility and economic potential in the European Community. Regional Studies, 16(6), 419-432.

Komarova, S. L., & Abramenkov, M. N. (2020). Rost eksportnogo potenciala regiona i povyshenie ego konkurentnyh pozicij za schet sozdaniya klastera v vedushchej otrasli promyshlennosti [Growth of the region's export potential and enhancement of its competitive position through the creation of a cluster in a leading industry]. E-Management, 3(2), 22-31. DOI: 10.26425/2658-3445-2020-2-22-31 [in Russ.].

Koschatzky, K., Bross, U., & Stanovnik, P. (2001). Development and innovation potential in the Slovene manufacturing industry: analysis of an industrial innovation survey. Technovation, 21(5), 311-324.

Malecki, E. J. (2007). Cities and regions competing in the global economy: Knowledge and local development policies. Environment and Planning C: Government and policy, 25(5), 638-654. DOI:

Marmora, P., & Mason, B. J. (2020). Does the shadow economy mitigate the effect of cashless payment technology on currency demand? dynamic panel evidence. Applied Economics, 1-16.

Melnik, M., & Antipova, T. (2019). Organizational aspects of digital economics management. In International Conference on Integrated Science (pp. 148-162). Springer, Cham.

Pechenskaya-Polishchuk, M. A. (2020). Instruments and Principles of Reallocating Budgetary Resources in the Region. Ekonomicheskie i Sotsialnye Peremeny, 13(2), 71-88.

Porter, M. (1998). On competition. Harvard Business School Publishing.

Porter, M. (2003). The economic performance of regions. Regional studies, 37(6-7), 549-578.

Rozhkova, N., Blinova, U., & Rozhkova, D. (2018). The Concept of Management Accounting Based on the Information Technologies Application. In T. Antipova, Á. Rocha (Eds.), Information Technology Science. MOSITS 2017. Advances in Intelligent Systems and Computing, 724. Springer, Cham. DOI:

Sauer, B. (2016). Virtual Currencies, the Money Market, and Monetary Policy. International Advances in Economic Research, 22, 117-130. DOI:

Wathen, M. V. (2020). A critical glocalization approach: attending to power in the innovation space. Journal of Community Practice, 28(2), 144-159.

Yang, X. T., Qiu, X. P., Fang, Y. P., Xu, Y., & Zhu, F. B. (2019). Spatial variation of the relationship between transport accessibility and the level of economic development in Qinghai-Tibet Plateau, China. Journal of Mountain Science, 16(8), 1883-1900.

Zenka, J., Novotny, J., & Csank, P. (2014). Regional Competitiveness in Central European Countries: In Search of a Useful Conceptual Framework, European Planning Studies, 22(1), 164-183. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 June 2021

Article Doi

eBook ISBN

978-1-80296-110-2

Publisher

European Publisher

Volume

111

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1168

Subjects

Social sciences, education and psychology, technology and education, economics and law, interdisciplinary sciences

Cite this article as:

Rozhkov, Y., Rozhkova, D., Blinova, Y., & Rozhkova, N. (2021). Regional Competitiveness And Monetary Potential: A Conceptual Approach. In N. G. Bogachenko (Ed.), Amurcon 2020: International Scientific Conference, vol 111. European Proceedings of Social and Behavioural Sciences (pp. 806-814). European Publisher. https://doi.org/10.15405/epsbs.2021.06.03.107