Abstract

The article is devoted to the problems and prospects of functioning of the Russian National Payment Card System (NSPK). The author discusses the background of NSPK, peculiarities of its functioning, strengths and weaknesses of the system, the main problems faced by operators and system users, and develops recommendations for improving the effectiveness of NSPK. The paper contains a brief overview of the Russian payment card market, analysis the competitive positions of the NSPK and the MIR payment card issued by this system. The dynamics of the MIR card emission is estimated, and the main consumer segments are considered. The author proposes the following key recommendations for improving the effectiveness of the National Payment Card System: preferential tariffs for operational services and payment clearing services charged to member banks in favour of the operator of the payment system; development of competitive loyalty programs, cash-back and the accrual of interest on the balance; establishing a cheaper annual fee, preferential rates for payroll services; negotiating with various countries for use MIR cards in their territory; providing contactless payment at all points where MIR cards are accepted; providing preferential conditions for making payments to state budgets of all levels; accumulating individuals’ funds on card accounts in banks, and directing them to the implementation of investment projects at the regional level.

Keywords: National Payment Card System, NSPK, card MIR, Visa, MasterCard, Russian market of payment cards

Introduction

The national payment system is one of the key components of the financial infrastructure of any national economy. Through this system, the overall monetary demand in the economy is formed, public confidence in the national currency is maintained, and monetary policy is implemented. The development of a reliable and efficient national payment system is of great importance for Russia when working with foreign partners. That is why the improvement and constant modification of the payment systems used is a priority task of Russian Federation.

In Russia, the idea of creating payment systems arose in the early 1990s. The Purpose of the creation was to unite banks and centralize the banking system in the country. Over 25 years, there have been several attempts to introduce cards of national payment systems into circulation, including Golden Crown, Sberbank, UnionCard UEC and STB card. These were fairly small payment systems that combined several banks, and there was simply not enough funding for a huge centralized payment system (Grigorieva, 2019).

In 2014, Russia created the National Payment System of the Russian Federation (NPS), whose main goals were to ensure the sovereignty and security of the payment space of Russia, as well as the continuity of transactions carried out on its territory. In July 2014, the NPS operator National Payment Card System (NSPK) was founded, which implements and supports the NPS and promotes the national payment card MIR (Antonenko, Mandron, 2020).

MIR card is the first Russian payment card that does not depend on foreign payment systems. Transfers using MIR cards cannot be suspended by an external party, and no economic or political factors can affect payments made using these cards. The development of MIR card, as well as the Russian payment card system in general, was planned for a long time. But the US and EU sanctions in 2014 (the introduction of restrictions on operations on Visa and MasterCard cards of some banks in the Russian Federation) (Portansky, 2014) have increased the relevance of this issue. On December 15, 2015, the first MIR cards were issued.

Today, the development of the Russian National Payment Card System is particularly relevant. It is necessary to propose new approaches to creating a unified system of electronic retail payments in Russia based on the principles of economic efficiency and security. These approaches should determine the competitiveness of the NSPK in the Russian and foreign markets.

Problem Statement

In recent years, there has been a rapid growth in the scope of NSPK activities, in particular, the volume of production and use of MIR cards. However, there are still some serious problems with the development and expansion of this payment system.

Such problems include, for example, the dominant position of the international payment systems Visa and MasterCard in the Russian market. And despite the growth of NSPK's share, the positions of foreign systems remain leading.

Another problem is the low growth rate of MIR cards share in the total volume of non-cash payments. Despite the active promotion of NSPK on the national market and significant volumes of MIR cards issued, the volume of transactions on these cards is significantly lower than that of Visa and MasterCard. That is, Russians who have MIR cards prefer not to use them in payments. Presence of these cards on the market is determined mainly by the mandatory receipt of salaries by civil servants on the MIR cards. Most of the operations performed are operations of transferring funds to cards of other payment systems (Naumova, 2019).

The cost of making MIR cards is still higher than the cost of making cards from foreign payment systems (Dobrovolskaya, Zakharian, 2020).

The main users of national cards are public sector employees, as well as pensioners and students. This implies certain risks associated with low income of these population segments.

The most important tasks of NSPK development are: improving the reliability and security of payments and transfers, improving the quality of customer service, as well as creating a convenient, reliable and high-tech infrastructure of the payment services that meets all modern requirements and is able to quickly respond to changes.

Research Questions

1. What are the prerequisites for creating a Russian National Payment Card System?

2. The specifics of the NSPK?

3. What are the advantages and disadvantages of the system?

4. What are the main problems facing operators and users of the NSPK?

5. What are the prospects for the development of the system?

Purpose of the Study

The purpose of the study is to analyze the state and trends in the development of the National Payment Card System and develop recommendations for the development of this system.

Research Methods

This research is aimed at forming an understanding of the key issues of the functioning of the Russian National Payment Card System. The research strategy is to collect, analyze and interpret information from various sources, paying attention, first of all, to those aspects that characterize the functioning of the NSPK in the context of national security of the Russian Federation.

The methodological basis of the research is a systematic approach. The work used general scientific methods: analysis and synthesis, induction and deduction, ascent from the abstract to the concrete.

In the process of preparing the work, the methods of desk research were used to collect and evaluate information contained in sources (statistics, reports, etc.) prepared for any other purpose. As sources, the author used the normative acts of the Russian Federation, scientific literature, articles, Internet publications on the problems of the payment card market, etc.

An informal method of document analysis was used. There were no standardized methods for selecting information units from the document content. The author conducted a painstaking analysis of each source. The unformalized method implies the usual ‘understanding’ perception of the text, the allocation of semantic blocks of ideas and statements in accordance with the goals of analysis. The research was based on general logical laws and rules of analysis, comparison, definition, and evaluation.

The author has studied the theoretical basis for the functioning of card payment systems, using which a general overview of the current situation on the Russian payment card market is made. In order to form the most complete picture of the studied area, both theoretical and practical material was used.

Findings

The main function of using the NSPK is to process bank card transactions, which is performed independently of foreign processing centres. The subjects of the NSPK are settlement, operating, clearing and payment divisions. The settlement units perform payment orders of the participants of the NSPK, generate withdrawal / transfer of funds from account to account. They are also responsible for managing risks, ensuring the security of money transfers, and ensuring regular operation of the entire system. Operational divisions interact with banks to ensure timely transmission of information. Clearing divisions are responsible for conducting non-cash interbank settlements. Authorized banks, the Central Bank of the Russian Federation and VEB perform the functions of money transfer operators (Gerasimenko, 2017).

As with most other payment systems, both debit and credit cards are issued under the NSPK. These cards are issued with chips of both Russian and foreign production. Over time, it is planned to completely switch to Russian chips and abandon imports.

Analysis of the NSPK rules shows that this system is designed specifically for the Russian consumer, taking into account economic and national characteristics. Another important point is that money for banking operations remains inside the country. The fact is that the American side receives 4 % of each transaction on MasterCard and Visa made in Russia. According to available data, this is about 4 billion roubles a year (Denisova, 2019). The NSPK allows reducing the amount of money withdrawn from the country.

Table 1 shows that the MIR card is now almost as functional as the cards of international payment systems. Even if some services are launched a little later, this does not affect the ability to use the card with its basic functions.

NSPK implements the most popular services that make the MIR card even more interesting. This applies, for example, to the implementation of projects for issuing social cards for regional residents with various information, payment and identification services (Sokolova, 2020). These services allow cardholders to receive state, municipal, and socially important services (such as transportation) electronically.

NSPK has developed its own contactless payment technology. The corresponding payment application can be installed not only on a bank card, but also on any modern device: smartphone, watch, etc (Idrisova, Shalbuzov, 2018).

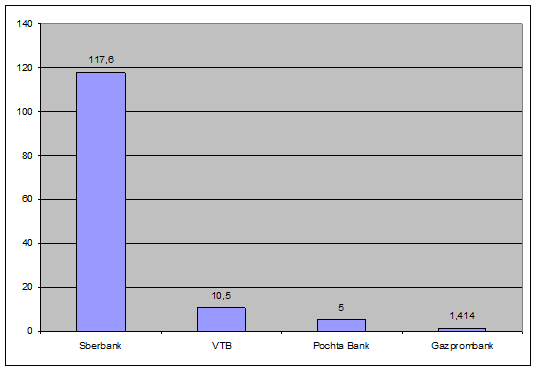

To date, 146 banks issue the MIR card, 337 banks are members of the NSPK, that is, they accept and service the card on their devices. For comparison, there are 260 banks that issue and acquire Visa cards in Russia, and 291 banks that issue MasterCard. In total, 338 banks issue cards in the Russian Federation, and 245 service them. Sberbank is the leader in issuing MIR cards, which has issued 117.6 million MIR cards. Data on the volume of issues of other banks are shown in Figure 01.

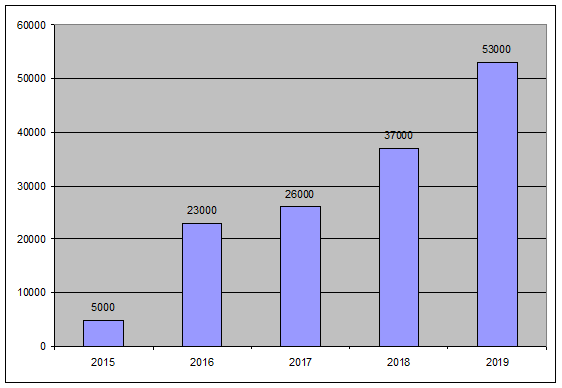

It should be noted that the NSPK is in constant development: in 2019, the issue of MIR cards amounted to 53 million pieces. The dynamics of card issuance is shown in Figure 02.

The active development of the National Payment Card System is connected with the need to protect Russian residents from external threats that may arise when using international systems. Since 2017, all employees of state organizations have switched to using the MIR card.

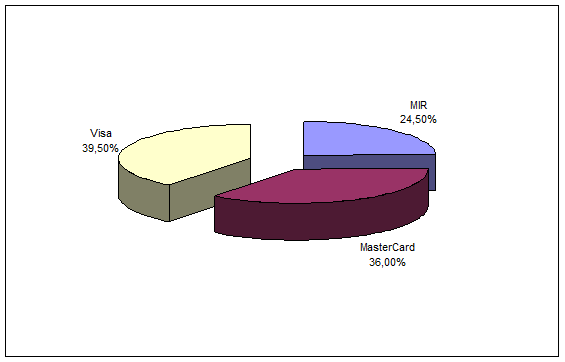

The intensive development of the NSPK is also evidenced by the fact that at the end of 2019, the share of MIR cards in the total volume of the Russian payment card market was 24.5 % of all issued cards (Figure 03).

Currently, MIR cards are accepted for payments in the CIS countries: Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Uzbekistan.

To use MIR cards in other countries, a user needs a cobaging card, such as MIR-Maestro, MIR-JCB, or MIR-UnionPay. These cards are joint products of the NSPK and world payment systems. NSPK plans to launch a joint card with AmericanExpress (Karyakina, Tyan, 2020).

It is planned to make MIR cards available for use in 12 countries by 2021. Currently, this card is accepted in the banking and retail network of Turkey. NSPK is currently integrating its services with those of one of the oldest banks in Turkey, ZiraatBank (Dobrovolskaya, Zakharian, 2020).

Working with regional governments of the Russian Federation, major banks and private companies, NSPK provides MIR payment cards with additional functionality, which makes it possible to increase the attractiveness of cards and encourage their use in the country. For example, NSPK has already signed a number of agreements with the governments of some regions to issue a multifunctional smart card based on MIR technologies.

Table 2 shows the main regional projects implemented by the NSPK in cooperation with state bodies, banks and private companies.

Thus, a multifunctional card based on the MIR card can combine the convenience of using financial and non-financial tools, targeted social support and transparency of state budget spending. It is important that these and other applications can function independently of each other, which provides a wide range of opportunities for their developers and users.

Let's consider the main problems of NSPK development.

Most of the population does not see the need to switch to the MIR card. According to a VTSIOM survey conducted in 2019, 22 % of Russians are willing to voluntarily get a MIR card, and 71 % of respondents do not plan to start one. Of these 71 %, 25 % do not see any need for it, and another 23 % do not understand why it is needed (Tsarenko, 2020).

Limited use in foreign online stores. Many popular online stores in the world, such as Amazon.com and Ebay.com do not accept MIR cards.

Sometimes there are technical difficulties when using the card. According to users, sometimes there are problems with withdrawing money from e-wallets, as well as with transferring money from card to card from one individual to another.

As mentioned above, the NSPK and its foreign partners created cobaging (joint) cards. However, these cards have their disadvantages. First of all, the offered cobaging cards are debit cards, they have small limits on cash withdrawals and transactions both for one-time operations and for temporal periods (Moneyinformer, 2020). Secondly, in some countries, not all types of transactions and payments may be available for such cards.

All these difficulties with cobaging cards reduce the popularity of the MIR card among those users who often travel abroad and are used to paying with payment cards.

Forced introduction of the MIR card and elimination of its competitors is fraught with the fact that in the absence of competition, its quality will suffer greatly.

The MIR card can be used as a tool for collecting taxes. Since a significant part of the Russian population is obligatorily transferred to these cards, there is a risk that tax amounts will be deducted from the card accounts automatically. In this regard, the user is difficult to track whether were charged in the case, if deducted incorrectly, will be difficult to return (or to pay) the required amount.

Despite the existing problems, in the current economic and political conditions, the creation of the Russian National Payment Card System was a logical step, since international payment systems are subject to political influence from foreign governments. Processing transactions of international payment systems on the territory of Russia has been transferred to the NSPK, which makes it possible to protect the sovereignty of the payment space.

The following additional measures can help attract more participants to the NSPK (cardholders and banks) and increase the intensity of payment card settlements in Russian regions:

- Establishment of preferential tariffs for operational services and payment clearing services charged from participating banks in favour of the payment system operator. This way banks can be encouraged to develop infrastructure.

- Increase the attractiveness of loyalty programs, cash-back and accrual of interest on the balance.

- Establishing a cheaper annual service (below 90 roubles for a standard debit card). For comparison, the service of the most inexpensive Visa and MasterCard cards varies from 200 to 600 roubles.

- Application of preferential rates for salary projects for corporate clients of banks that are members of the NSPK.

- Negotiating with other countries for the possibility of using MIR cards on their territory.

- Provision of contactless payment in all points where the MIR cards are accepted.

- Providing preferential conditions for making payments to budgets of all levels, as well as municipal, federal unitary enterprises and other state organizations using a national payment instrument (for example, the State information system on state and municipal payments, when paying for public transport, housing and utilities services, etc.).

- Accumulation of individuals’ funds on card accounts in banks, and directing them to the implementation of investment projects at the regional level

- Activation of financial flows within the regions by promoting various social programs to the population based on the MIR technologies.

State measures to support the development of the NSPK at the legislative and administrative level can be considered justified only at the initial stage. These measures should not replace economic incentives for a wider and more intensive use of national payment cards, nor should they neutralize market competition in the payment market.

In order to encourage more intensive use of MIR cards, the NSPK needs to maintain rates that are attractive to participants in the payment system, credit organizations need to improve the infrastructure for accepting and paying for payment cards, and support the unified loyalty program being developed by the NSPK. In addition, it is necessary to increase confidence in financial institutions among the population and their level of financial literacy. The first steps in this direction are being taken by the Bank of Russia and the Ministry of education of the Russian Federation, introducing financial literacy classes in educational institutions.

In general, the NSPK will be able to successfully compete with international systems in the Russian payment market only if it is able to create more attractive conditions for MIR card users and introduce innovations in the field of payment acceptance and processing. For example, the system should provide its users with the ability to make fast transactions on the Internet using more secure and reliable data storage technologies, as well as offer pricing, structural and functional advantages for its payment products to different participants

Conclusion

As a result of the research on the development of the National Payment Card System in Russia, the following conclusions can be drawn.

The formation of the NSPK is due to the potential risks associated with the threat of loss of state financial security, which was manifested after the introduction of economic sanctions by Western countries. Unlike international card payment systems, the Russian NSPK has to solve the problem not so much of international scaling of its business, but of gaining a share in the Russian payment market, which is dominated by Visa and MasterCard.

Currently, the NSPK is not sufficiently developed in terms of both the number of issued cards and the intensity of their use. Therefore, the NSPK should now be considered as a specialized, rather than a universal payment system.

At the current stage of development, the NSPK pays special attention to the implementation of multifunctional payment, transport and social projects in various Russian regions.

In a highly competitive environment, the NSPK must use new technologies and advanced approaches to customer service. In the future, this payment system will be able to improve the security of payments and expand its presence in the national and foreign payment services markets.

There is no doubt that further successful development of the NSPK will allow Russia to reach a new level in the global financial arena and increase its competitiveness. The development of the NSPK does not stand still, innovations are being introduced that are aimed at improving the quality of services. Universal electronic cards are being actively introduced that serve as identity cards for the Mandatory Health Insurance Fund, pension certificates, payment cards for housing and utilities services and other purchases. Such cards allow centralized accounting and control of all relations between the state, citizen and business, and, consequently, reduce the volume of cash payments, possible abuse, and corruption.

Based on the results of the analysis of the National Payment Card System functioning, it should be noted that the system is currently at a stage of continuous and dynamic development, and it is very important that the NSPK effectively solves current problems, responds to user wishes, so that this payment system can eventually become on a par with the world's payment systems at the national market.

References

Antonenko, A.A., Mandron V.V. (2020). Bank cards in Russia: analysis of the current state and development trends. Concept, 2019, 6. Retrieved from: https://cyberleninka.ru/article/n/bankovskie-karty-v-rossii-analiz-tekuschego-sostoyaniya-i-tendentsii-razvitiya

Denisova, I.O. (2019). Development of forms of non-cash payments using plastic cards in the Russian Federation. Current issues of ed. and sci., 4, 78–82.

Dobrovolskaya, D.S., Zakharian, A.V. (2020). National payment system of Russia: problems and prospects. Econ. and busin.: theory and pract., 5-1. Retrieved from: https://cyberleninka.ru/article/n/natsionalnaya-platezhnaya-sistema-rossii-problem-i-perspektivy

Gerasimenko, O.A. (2017). Financial management. Textbook. Kazan: Publ. house Buk.

Grigorieva, O.S. (2019). National payment system of the Russian Federation at the present stage. Retrieved from: https://ozlib.com/814512/eko- nomika/natsionalnaya_platezhnaya_sistema_ sovremennom_etape

Idrisova, S.K., Shalbuzov, Z.N. (2018). Problems and tendencies of development of the bank cards market. Econ. and manag.: probl., solutions, 8, 45–48.

Karyakina, I.E., Tyan, E.M. (2020). Analysis of the current state of the Russian payment system market and its development trends. Econ. and busin.: theory and pract., 4. Retrieved from: https://cyberleninka.ru/article/n/analiz-sovremennogo-sostoyaniya-rossiyskogo-rynka-platezhnyh-sistem-i-napravleniya-ego-razvitiya

Moneyinformer (2020). Joint cards MIR. Retrieved from: http://www.moneyinformer.ru/chto-takoe/cobage-card.html

Naumova, A.S. (2019). Problems of functioning of the National payment system of the Russian Federation. Colloquium-journal, 12(36). Retrieved from: https://cyberleninka.ru/article/n/ problemy-funktsionirovaniya-natsionalnoy-platezhnoy-sistemy-rossiyskoy-federatsii

Portansky, A.P. (2014). Anti-Russian sanctions measures destructive or counterproductive. Money and credit, 10, 8–10.

Sokolova, E.M. (2020). Modern payment system of Russia. Finance and credit, 4, 18–23.

Tsarenko, I.A. (2020). National payment system – risks and prospects. Banking, 11, 66–68.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2021

Article Doi

eBook ISBN

978-1-80296-106-5

Publisher

European Publisher

Volume

107

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2896

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Khetagurov, G. V. (2021). Potential And Problems Of The Russian National Payment Card System Development. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization - ISCKMC 2020, vol 107. European Proceedings of Social and Behavioural Sciences (pp. 2739-2750). European Publisher. https://doi.org/10.15405/epsbs.2021.05.365