Abstract

The article is devoted to the issues of identifying the distinctive features of Islamic financial institutions and traditional lending institutions focusing on loan interest. The problems of the Russian financial market necessitate the search for new sources to attract investment capital. The authors have proved the need to search for new forms of financing in the context of the global financial crisis caused by the collapse of the structured financial market. This study also defines the category “partner banking” as a form of banking based on a synthesis of traditional and individual principles of Islamic banking. The features of Islamic banks in Russian practice are studied and highlighted. The results of the research conducted by the authors have shown that during the crisis and in the post-crisis period, the growth of assets of Islamic banks exceeded the indicators of traditional banks by more than two times. The analysis of partner forms of financing proves the growing interest in non-traditional banking services and the high importance of partner banking as a part of the international financial market. For Russia, it represents a stable sphere of capital investment to diversify risks during the crisis. The absence of the conditions necessary for the implementation of partner financing through Islamic banking has been proved by the lack of a well-developed accounting system, taxation and a legal framework.

Keywords: banks, banking system, funding sources, partner banking, Islamic bank, banking system stability

Introduction

This topic is a talking point at various discussion platforms. Many agree that the creation and development of Islamic banking is one of the ways to attract funds to finance the reproduction process in economic sectors. Application of Islamic financial mechanisms based on the prohibition of usury, loan interest, unjustified wealth, etc. in the financial system of the Russian Federation would enable transforming the current banking system and exerting a stabilizing effect on the economic situation as a whole (Zaripov, 2015). According to many academic economists, partnership finance can become an alternative to the traditional banking system of Russia and provide financial resources for the development of the state economy.

Problem Statement

Islamic banking as an alternative form of financial services is widely used in the countries of Southeast Asia and the Middle East. Special attention is paid to the problem of partner banking development, which is reflected in the works of not only scientists from the Middle East but also in the works of Russian and Western scientists-economists (Trunin, Kamenskikh, Muftyakhetdinova, 2009). However, despite the substantive research of this problem, the real development of alternative banking services in Russia has practically not been considered, which confirms the relevance of the study and scientific novelty of this problem.

Research Questions

The main tasks set in this research are as follows:

1. To study partner bank as an additional source of ensuring banking system stability.

2. To reveal the peculiarities of Islamic banks activity (experience of foreign countries and Russia).

3. To identify possible barriers hindering the development of Islamic banks in Russia.

Purpose of the Study

Alternative banking provides new opportunities for the Russian banking sector, which will contribute to the further development of the banking system as well as ensure its stability. The purpose of this work is to describe the basic principles of the Islamic financial system and its impact on the banking system stability.

Research Methods

The study has used general scientific research methods such as the method of comparison, theoretical generalization, description, analysis. The features typical for partner banking have been studied and identified. The functions of Islamic banks have been considered and studied, criteria determining the status of an Islamic bank have been determined.

The basics of the traditional banking system are familiar to everyone and are as follows: attracting, accumulating and distributing funds. Islamic banks also attract financial resources from individuals and institutions and channel them to commercial firms that need financial support to operate. Thus, Islamic banks perform the same functions as traditional banks (Hasan, Dridi, 2010).

A characteristic feature of Islamic banks is cooperation, specifically, participation in project profits and risks together. The Islamic banking system built on principles consistent with Sharia law makes institutions more prudent in choosing projects. For example, it is forbidden to invest in socially harmful projects. A conservative approach to business minimizes the risk of losing savings. Islamic banking does not provide default sanctions; hence, client funds are invested with caution. Therefore, preference is given to long-term reliable transactions, and speculating transactions are prohibited.

There are the main principles on which the activities of Islamic banks are based. These principles are as follows:

- absence of any kind of interest on deposits and loans;

- strict division of bank investments spheres into halal and non-halal;

- prohibition on making a profit by chance;

- dealing only with transactions ensuring collateral guarantee;

- absence of futures and derivatives transactions;

- not applying to transactions with sinful goods and services, etc.

For these reasons, there are no housing bubbles and pyramid scheme in Islamic countries.

The distinguishing feature of Islamic banks with regards to traditional ones is that they are more like savings and investment institutions. They are the most adapted to and focused on the real economy.

The source of Islamic banks profit is the main three types of operations, specifically, musharaka, mudaraba, kard ul hasan. Musharaka is cooperation in the financial sphere, cash pooling aimed to finance projects; profit is divided according to a pre-determined order, losses are incurred with regards to share participation. Mudarabah is a partnership agreement concluded between two parties, where one party provides the necessary funds to finance a project, and the other is involved in project management. Kard ul hasan is a type of interest-free loan, which is provided in the form of welfare assistance for the implementation of specific activities.

Islamic Bank offers a wide range of services differing from traditional banks. The main products of the Islamic bank are as follows:

1) Bai Bithaman Ajil is a deferred payment transaction.

2) Bai Salam is advance payment.

3) Bai ul-Ina is sale with right of redemption.

4) Wakala is agency services.

5) Wadia is keeping valuables in a bank.

6) Ijara is leasing.

7) Ijara Tumma Al Bai is lease purchase.

8) Sukuk is Islamic securities.

9) Takaful is Islamic insurance

Thus, the principles underlying the activities of Islamic banks allow economic entities to form long-term relationships that contribute to the growth in prosperity of society as a whole and ensure the sustainable development of the country.

Islamic banks participated in lending twice as much as traditional banks. This suggests that Islamic banks have made a huge contribution to financial stability through more affordable lending (Lemeshko, Danchenko, 2016).

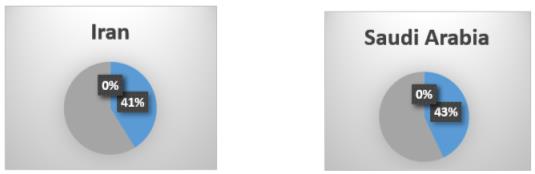

The opinion that Islamic banks are more stable than traditional ones is confirmed by a study of the impact of the global financial crisis of 2008–2009 regarding Islamic and traditional banks. It was held by the IMF and showed that the situation with the growth of loans and assets of Islamic banks in 2008 and 2009 was better than that of traditional banks, which contributed to financial and economic stability. Islamic banks have also withstood a number of events since 2010, specifically, fall in the global prices of physical assets, commodity prices, fluctuating macroeconomic indicators of the world economy, geopolitical tensions, political conflicts. At the same time, the annual growth of financial institutions during the years of crisis was about 15 %. Table 1 shows the ranking of the largest Islamic banks in the world.

In recent years, Islamic banking has developed in the countries of Great Britain, France, Kazakhstan.

In August 2004, the Islamic Bank of Britain (IBB) was established in London. It is an Islamic bank operating within the framework of banking legislation and operating in accordance with the canons of Sharia. Largely due to its historically close ties with the Middle East, Islamic finance has gained particular relevance in the UK. And today the UK is a leader in the European market for Islamic financial services. For this, everything necessary has been provided for transactions under Islamic agreements. As well, legislative amendments ensuring the unhindered development of the Islamic financial infrastructure have been made. And this work is being in progress, the system of regulation and supervision over the entire banking system is being improved.

Al Hilal Bank established in 2010 in Kazakhstan was the first Islamic bank in the CIS. The Bank operates under an agreement between the Government of Kazakhstan and the UAE and provides banking services in accordance with Sharia rules. In May 2019, Al Hilal Bank became part of one of the largest banking groups in the UAE being the ADCB (Abu Dhabi Commercial Bank) group, the key shareholder of which is the Abu Dhabi Investment Council (investment arm of the Government of Abu Dhabi).

Findings

Partner banking will contribute to the development of the real sector of the economy in the regions of the Russian Federation. The resources of Islamic banks can be used as fixed capital expenditure in the North Caucasus. Such resources will be in demand among clients who prefer to deal with halal money. Transition from traditional banks to partner banking based on the creation of long-term trusting relationships will become the basis for a stable banking system development (Razumova, 2015).

Thus, the main trends in the banking system development should be as follows: improving the quality of corporate governance and risk management in banks; improving banking regulation, increasing competitiveness in the banking sector; expanding opportunities for consumers of banking services, creating long-term trusting partnerships. Such development of the banking system will contribute to reaching a qualitatively new level, contributing to its growth and sustainable development.

According to a joint report of the World Bank and the Islamic Development Bank Group, the assets of Islamic banks by 2022 will amount to about 2.4 trillion US dollars, most of which will fall on financial institutions of the Gulf countries (Table 2), which will once again enable Islamic banks to demonstrate its sustainability in development.

Unfortunately, a partner banking system is not developed in Russia yet. Many financial institutions claim the need to create such institutions but so far everything is at the stage of reflection. There are a number of problems, one of which is the problem of implementing the projects which will have to comply with all Sharia norms (Tashtamirov, 2020).

At the same time, Russian economic history had the experience of introducing Islamic banking. In 1991, the first commercial bank “Badr-Forte” based on the principles of Islamic law in its activities and making a profit began its functioning in Russia. At the same time, it embodied both the principles of an Islamic financial institution in accordance with Sharia and fulfilled the norms of Russian banking legislation concerning banking operations. However, Badr-Forte Bank’s license was revoked by the Bank of Russia by Order No. OD-658 dated December 4, 2006. The reason for the revoke was a violation of banking legislation in the part concerning the Federal Law “On Counteracting Legalization (Laundering) of Criminally Obtained Incomes and Financing of Terrorism.” One more reason was the failure of the Islamic bank to comply with the norms of the Central Bank. However, the chairman of the bank board, Adalet Nurievich Dzhabiev, told an IN correspondent that the decision to close the bank was taken by the people not interested in developing trade relations with the Islamic world. It is quite possible that the country’s only institution of partner banking was shut down due to an attempt taken by ill-wishers to prevent the penetration of finances from the Islamic world into Russia. (Tashtamirov, 2015)

Conclusion

Among the main obstacles to the development of partner banking is the civil aspect. Russian legislation does not contain provisions regulating the use of Islamic contracts by trade participants on the territory of the Russian Federation. This significantly hinders the development of this area in the Russian circumstances. Consequently, it would be appropriate for Russian legislation to establish a base of Islamic financial contracts, which would make it possible to give a most complete content of key provisions, give a description as well as the specifics of individual Islamic contracts. Therefore, for the development of Islamic banking in Russia, it is necessary to recognize this type of banking at the legislative level. Also among the significant problems hampering the development of partner banking are their competitive disadvantages, underdeveloped infrastructure of the Islamic financial services market, a high degree of regional fragmentation, and an imperfect system of banking supervision and regulation.

The social significance of Islamic banks acting as investors in low-profit infrastructure projects that stimulate the development of small and medium-sized businesses, increase the availability of financial resources including the poorest segments of the population through special microcredit programs should be noted. Consequently, the partner banking system could solve the problem of overcoming a number of social problems of society since in a crisis the most acute issue is social justice in all its manifestations. The use of foreign experience in the creation and development of Islamic banking would contribute to the development of the real sector of the economy. Attracting investments from the Middle East countries as well as using the opportunities of the Muslim part of the population could control inflation and minimized the risks of soured loans.

Acknowledgments [if any]

The study was carried out with the financial support of the Russian Foundation for Basic Research within the framework of scientific project No. 19-310-90035/19. The reported study was funded by RFBR, project number No. 19-310-90035/19.

References

Hasan, M., Dridi, J. (2010). The Effects of the Global Crisis on Islamic and Conventional Banks: A Comparative Study. IMF Working Paper. Monetary and Capital Markets Department & Middle East and Central Asia Department. September, 46 p.

Lemeshko, O.A., Danchenko, E.A. (2016). Partner banking as a basis for sustainable development of the banking system. Modern trends in the development of the financial system of Russia (pp. 28–31).

Razumova, I.A. (2015). Islamic banking: world experience and opportunities for Russia. Scholarly Notes of the Int. Banking Inst., 11-1, 162

Tashtamirov, M.R., Adamanova, Z.O., Kelekhsaeva, M.V., Muskhanova, Kh.Zh. (2020). Islamic securities as a tool to overcome sanctions and attract investment in the economy. Int. Sci. Conf. Social and Cultural Transformations in the Context of Modern Globalism.

Tashtamirov, M.R., Saralieva, E.R. (2015). A brief history of the formation of Islamic banking and development prospects in Russia. Publ. house Sci. and inform. Publ. center and editorial office of the journal Actual probl. of the human. and natural sci. Moscow, 197–202.

Trunin, P., Kamenskikh, M., Muftyakhetdinova, M. (2009). Islamic financial system: current state and development prospects. Scientific works: Institute of Economics in Transition, no. 122R. Moscow: IET.

Zaripov, I.A. (2015). Islamic finance: first experience and development problems in the banking sector, insurance and financial markets in Russia. Property manag.: theory and pract., 1, 2–20

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2021

Article Doi

eBook ISBN

978-1-80296-106-5

Publisher

European Publisher

Volume

107

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2896

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Muskhanova, K. Z., Tavbulatova, Z. K., & Tapaev, R. V. (2021). Partner Banking As An Alternative Source Of Ensuring Banking System Stability. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization - ISCKMC 2020, vol 107. European Proceedings of Social and Behavioural Sciences (pp. 2551-2557). European Publisher. https://doi.org/10.15405/epsbs.2021.05.342