Abstract

The purpose of this study is to identify general and specific features of free economic zones (FEZ) in the BRICS countries by analyzing their economic and legal mechanisms. An analysis of the number of free economic zones in the world and the BRICS countries and the dynamics of the volume of foreign investment in the BRICS countries in comparison with the global identified that the FEZ can be considered as one of the drivers of economic growth. The article discusses features of FEZs, legal regulation mechanisms and economic benefits for FEZ residents. Problems and success factors are described as well. FEZs have a great development potential. The theoretical significance of research results is information on the current state of FEZs in the BRICS countries collected through the analysis of research data and statistical data provided by UNCTAD, OECD, and the World Bank, as well as information from the Internet websites (FEZ websites, special portals containing information on the investment climate and FEZs as elements of its attractiveness). This article is intended for economists, employees of executive authorities and development institutions, as well as other specialists interested in economic development institutions.

Keywords: Free economic zones, BRICS countries, world economy, legal regulation, investment

Introduction

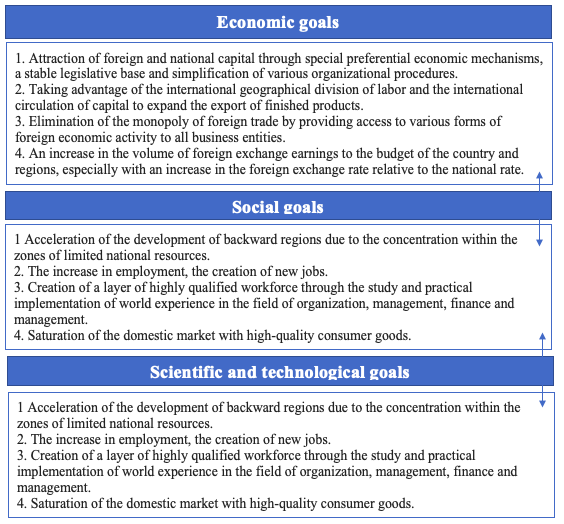

Free economic zones (FEZ) have become an integral part of the world economy, which contributes to the recovery of the national economy at the international, national and regional levels. They also have an effective impact on the socio-economic development of the regions. The degree and depth of the impact of FEZs on the socio-economic development depends on many factors and goals that are set for the territory in which they are located (Cheng, 2019). The classification of general goals of the FEZs is presented in Fig. 1.

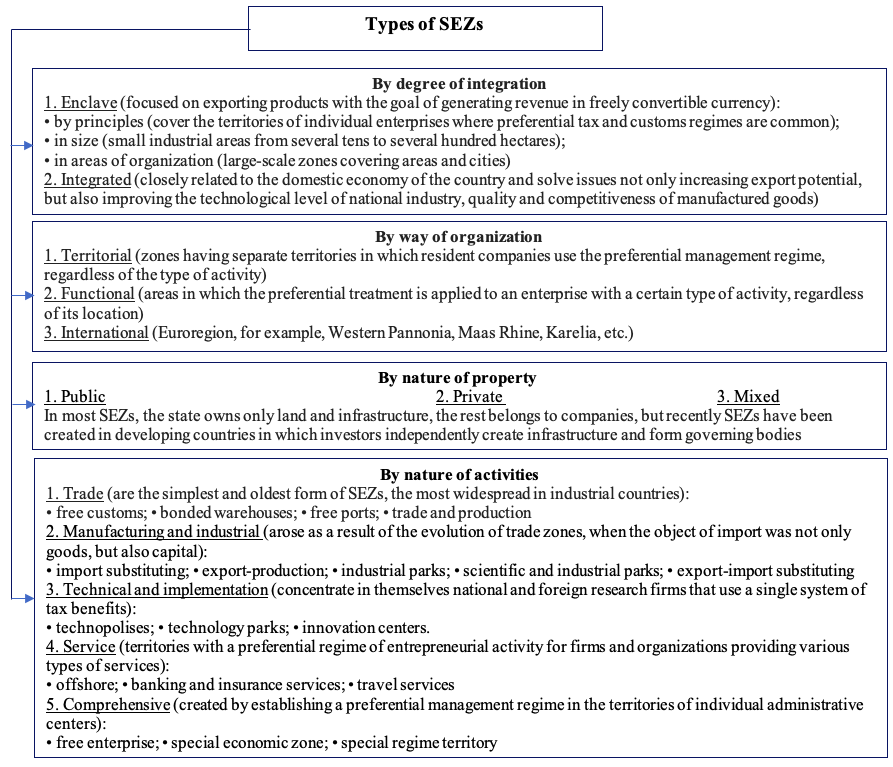

There are up to 30 varieties of FEZs whose classification is presented in Fig. 2.

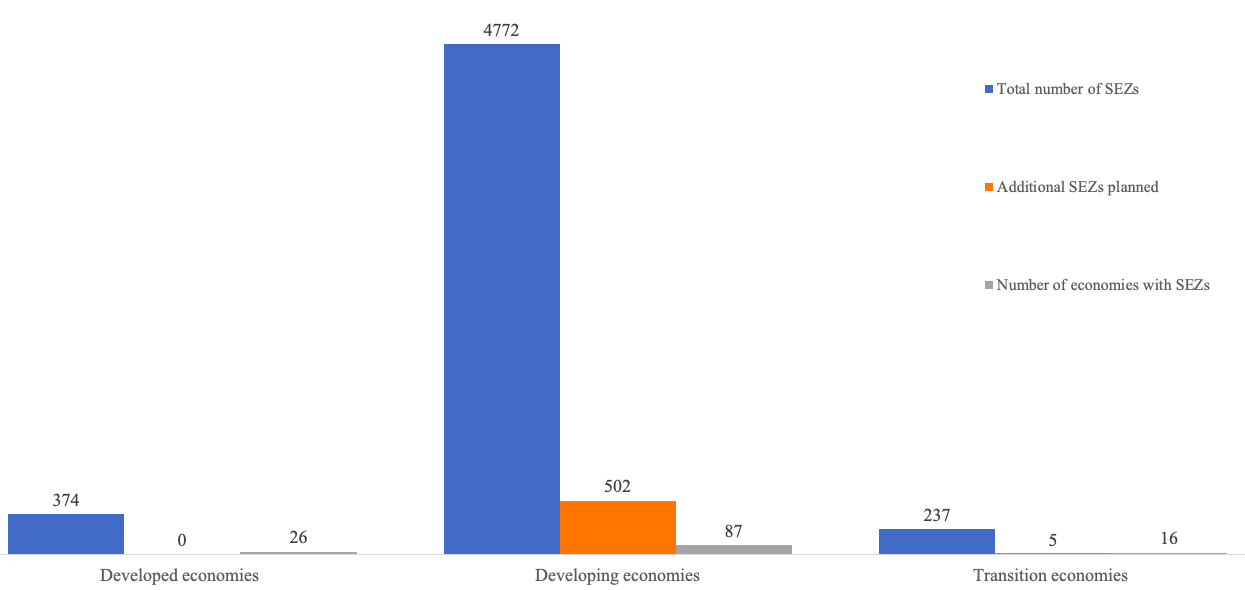

FEZs are spread all over the world. According to UNCTAD reports, in 2019, their number was 5383, more than 1000 of which were created over the past 5 years (Fig. 3). At the same time in the near future about 507 new FEZs will be created, 502 of which will be located in the developing countries, which include the BRICS countries (Brazil, Russia, India, China, South Africa).

According to the Organization for Economic Cooperation and Development (OECD), the volume of foreign investment in the BRICS countries has been growing since 2006 when the BRICs was created (Table 1). At the same time, since 2015, there has been a regular increase in the share of foreign investment in the BRICS countries to the global volume, which reached $ 20.9 billion in 2019.

These indicators indicate the modernization and diversification of the economies of the BRICS countries, flexible response to the needs of the world economy, as well as the development of economic and legal mechanisms of FEZs, which make the business climate more attractive.

Thus, it becomes relevant to analyze the economic and legal features of FEZs, as well as to identify problems and success factors for their functioning in the BRICS countries.

Problem Statement

Based on the studies of other scientists dealing with FEZs as a whole (Beskorovaynaya et al., 2020; Potter, 2020; Streltsov et al., 2020) and their regional aspects in particular (Aggarwal, 2019; Sinenko et al., 2019) the hypothesis was formulated according to which FEZs operating in the BRICS countries are drivers of development of the territories where they are located, and countries in general. They make it possible to create a more favorable climate for attracting foreign investment. Due to the special legal regulation, economic benefits and preferences used, the FEZ resident companies endure crises, develop and increase their export flows.

Research Questions

To test this hypothesis, it is necessary to answer the following questions:

1. Features of legal regulation, as well as economic benefits for FEZ residents in the BRICS countries.

2. Problems and success factors of FEZs in the BRICS countries.

Purpose of the Study

The aim of the work is to identify general and specific features of the FEZs operating in the BRICS countries, based on the study of economic and legal mechanisms of the FEZs in the BRICS countries, which make it possible to consider the FEZs as a driver of economic development, as well as to determine problems of the current structure.

Research Methods

During the study, the methods of comparative analysis and analogy (when analyzing the economic and legal features of FEZs in the BRICS countries), system analysis and synthesis (when identifying the success factors for FEZs that make them drivers of economic growth, and describing problems of their functioning), classification (when determining the types of FEZs), quantitative and qualitative analysis, graphic interpretation of data (when interpreting statistical data considered in the study) were used.

Findings

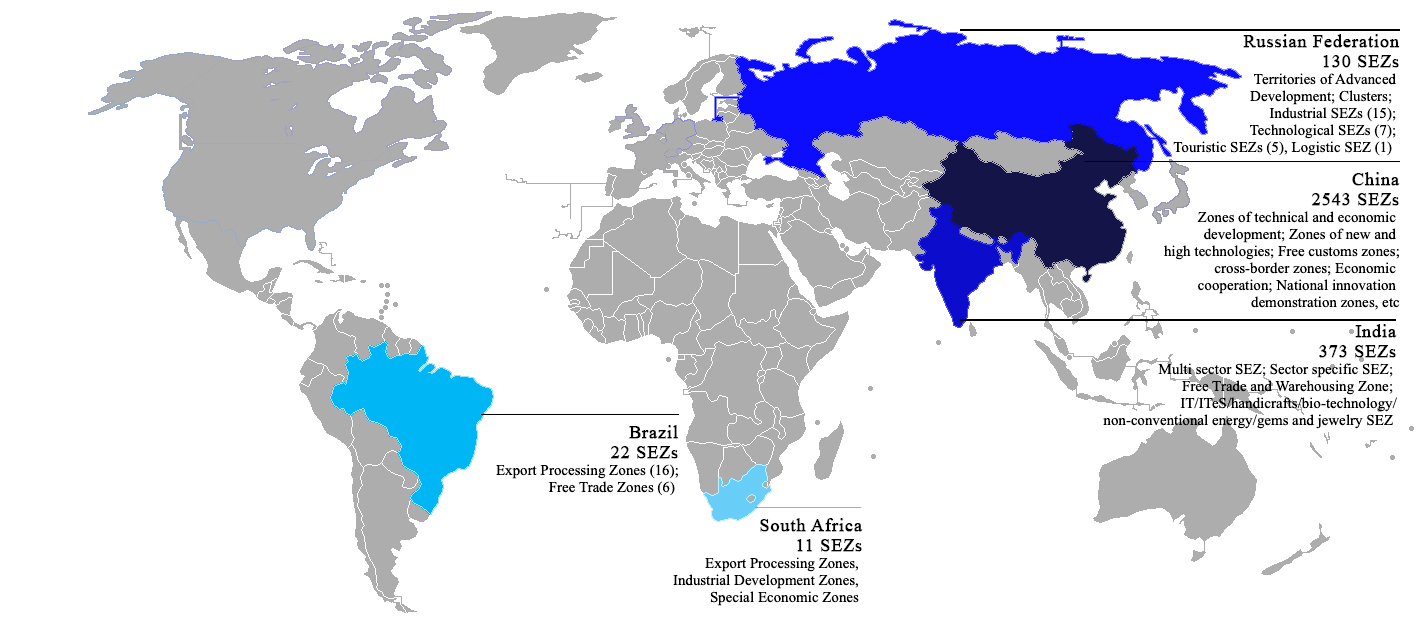

The BRICS was created in 2006, when at the 61st session of the UN, the first meeting of the foreign ministers of Brazil, Russia, India and China was held (since 2011, the Republic of South Africa entered this union). At the same time, the development of free economic zones in these countries began long before that. According to statistical studies, for 2020 the BRICS countries account for 3,079 FEZs, which is 57 % of the global number (Fig. 4).

In each BRICS country, it is possible to highlight features of legal regulation and economic benefits granted to the FEZ residents. The study examined data for each of the BRICS countries.

Brazil

There are two types of FEZs in Brazil: free trade zones and export processing zones. Brazil is a country with a hybrid FEZ system that combines industrial and commercial components. The development of the FEZ began in 1957, when the free port of Manaus began to operate (Teixeira, 2020) on the basis of Law No. 288 of 02.28.1967. Currently, "Manaus" is the largest free trade zone in Brazil; five free trade zones were created in the north are also under the guidance of SUFRAMA (namely, the Main Directorate of the Manaus FEZ).

The development of free recycling zones began in 1988, but these zones became legal only on 20.06.2007 (Law No. 11508). There are 16 free recycling zones in 15 states. Industrial projects implemented in free processing zones attract new investments and have at least 80 % of the total gross sales revenue through exports. The activities of FEZ resident companies are regulated by the administrations of the free processing zone, the National Council for the Execution of Export Procedures, as well as the customs and environmental authorities.

Features of regulation and economic benefits.

There are three types of FEZ advantages: administrative (acceleration of administrative procedures due to the presence of Customs offices), foreign exchange (maintenance of the exchange regime), and tax (exemption from a number of federal and regional taxes on the purchase or import of products) ones.

Free trade zones provide residents with a number of services (including the implementation and operation of tourist and other types of services; storage services for exported products; product support in accordance with the rules established by the Federal Tax Service), and benefits: corporate income tax up to 75 %; exemption from duties on imported products; exemption from payment of license fees for 10 years.

Companies located in the export processing zones are exempted from a number of federal (including import tax, tax on finished goods, social payments from gross receipts and estimated income tax, additional transportation costs for repairing the merchant fleet) and regional taxes (including benefits for the value added tax, the corporate income tax).

Russia

In Russia, according to UNCTAD data, FEZs include technoparks, priority development areas (PDAs), clusters, special economic zones (SEZs) and free economic zones. The greatest state support is provided to territories of advanced development (the Federal Law No. 473-FZ "On territories of advanced socio-economic development in the Russian Federation" of December 29, 2014 and Resolution of the Government of the Russian Federation No. 614 " On peculiarities of territories of advanced socio-economic development in mono-cities" of June 22, 2015) and special economic zones (28 SEZs are regulated by the Federal Law No. 116-FZ" On special economic zones in the Russian Federation" of 22.07.2005; the SEZ in Magadan region is regulated by the Federal Law No. 104-FZ "On the Special Economic Zone in Magadan Region"; the SEZ in Kaliningrad Region is regulated by the Federal Law No. 16-FZ "On the Special Economic Zone in Kaliningrad Region and amendments to certain legislative acts of the Russian Federation" of 10.01.2006) (Pavlov & Vetkina, 2019).

ASEZs were created in Russia in 2016. The first ASEZs were created in Gukovo and Naberezhnye Chelny. Currently, according to the Ministry of Economic Development and Trade, there are 90 ASEZs in Russia (of which 87 ones are located in single-industry towns and three ones are located in closed administrative-territorial areas, which have 639 residents and more than 69 billion rubles of investments.

The development of the SEZ began in 1990 with the creation of the Nakhodka SEZ (in 2006, this SEZ ceased to exist). Currently, there are 30 SEZs (15 industrial-production ones, seven technical-innovative ones, five tourist-recreational ones, one port one, one SEZ in Magadan region, one SEZ in Kaliningrad region) with 760 residents and 422 billion rubles of investment. In June 2020, three more SEZs were created: two industrial-production ones ("Kulibin" in Dzerzhinsk and "Alga" in Bashkortostan) and one technical-innovative one in Saratov region.

Currently, there is a free economic zone whose activities are regulated by the Federal Law N 377-FZ "On the development of the Republic of Crimea and Sevastopol and a free economic zone in the Republic of Crimea and Sevastopol."

Features of regulation and economic benefits.

Territories of advanced development have a territorial focus and are created for 70 years in order to create favorable conditions for attracting investments, ensuring accelerated socio-economic development and creating comfortable conditions for the population. Among the main types of benefits, there are benefits on contributions to social funds, reduced rates for land lease, a special procedure for attracting foreign labor, as well as tax benefits (reduced rates for the income tax – 0–5 % (for up to 5 years); preferential rates for the mineral extraction tax – 0–0.8 % (for up to 10 years); the accelerated VAT refund; reduced rates for the property and land taxes).

Special economic zones have a sectoral focus and are created for up to 49 years with the aim of developing manufacturing or high-tech sectors of the economy, tourism, the health resort sector, as well as port and transport infrastructure. The main types of benefits are aimed at reducing taxation (e.g., a special tax regime: income tax – 2–15.5 % (for up to 49 years), VAT – 0 %, property tax and transport tax – 0 % (for up to 10 years), land tax – 0 % (for 5–10 years); benefits on contributions to social funds; the possibility of applying a multiplying coefficient to the depreciation rate; the right to carry forward losses to future periods within 10 years), a special administrative regime (the principle of "one window"); a special customs regime; availability of the required infrastructure, guarantees in case of unfavorable changes in the Russian legislation.

India

India is one of the first countries which created a FEZ (export processing zone) in 1965. The legislation was updated only in 2000, when the Foreign Trade Regulations came into force, and tax benefits were determined by separate regulatory acts (Chettri, 2020). The first law regulating FEZ activities in India was adopted in 2005 (Parliamentary Act No. 28 of 23.06.2005) and amended in 2019 (Act of the Ministry of Law and Justice No. 8 of 06.07.2019). Currently, there are about 373 FEZs, including free trade zones, export processing zones, free zones, industrial zones, free ports, urban business zones, etc. Depending on the size of the FEZ, there are multi-sectoral FEZs (min. 1,000 hectares of land), sectoral SEZs (min. 100 hectares of land), free trade and storage zones (min. 40 hectares of land) and SEZs for developing IT sectors, biotechnology, traditional energy sources, producing precious stones and ornaments (min. 10 hectares of land).

Features of regulation and economic benefits.

Among the general advantages of a FEZ in India are the principle of "one window", simplified procedures and simplified company registration, the presence of a customs officer on the territory of the FEZ in order to facilitate and accelerate trade processes, and a wide range of tax benefits, including duty-free import and domestic procurement of goods; exemption from the exports income tax (for 1–5 years), 50 % reduction in exports income tax (for 6–10 years); exemption from taxes and fees on goods and services; exemption from electricity duty and electricity sales tax; preferential land prices for the industrial development (in some states).

China

China has the largest number of FEZs (2543 various types of FEZs): administrative regions, geographic regions, zones for intensifying international cooperation, local industrial parks, industrial clusters, entrepreneurial FEZs, etc. (Kuo et al., 2020).

The first four FEZs were created in 1978 with the market reforms in coastal cities to experiment with different policies and stimulate economic growth, primarily through favorable geographic and logistical locations. Until now, there is no legal act that would regulate FEZs in China. The FEZs are controlled by the State Council of the People's Republic of China and the People's Assemblies of the territories.

The Chinese experience of creating FEZs has revealed a number of factors that contribute to the most effective functioning of FEZs: open economy and innovations; government support; research and development, and brand development (FEZ can act as an incubator of ideas through the integration of training, innovation and production); new markets and value chains require the pooling of FEZ resources and government support. Many countries use the experience of Chinese FEZs as the most effective and functional ones (Crane et al., 2018).

Features of regulation and economic benefits.

Among the main advantages are: cheap labor; full autonomy from the central authorities in solving issues related to the activities of enterprises and their work with international investors; raw materials from abroad and orientation to foreign markets; diversification of activities; tax incentives (including a differentiated tax system depending on the territory; tax breaks; 40 % refund of income tax to foreign investors for at least five years; exemption from tax in case of investing more than $ 5 million; reduced rate income tax for citizens; preferential land taxation: 0 % – for the first 1–5 years; 50 % of the current tax rate – for the next years), etc.

The republic of South Africa

In South Africa, the development of FEZs began later than in all other BRICS countries. In 2000, the first industrial development zones were created in order to attract foreign direct investment and develop export-import relations. Currently, there are 11 FEZs, including special economic zones and industrial development zones.

The FEZ are regulated by Law No. 37664 of 05/19/2014, which entered into force after the Proclamation of the President of South Africa No. 39667 of 02/09/2016 had been signed. FEZs have not yet made a significant contribution to the South African economy (see Table 01) due to the low interest of the government (the most successful FEZs are based on the principles of public-private partnership), as well as the lack of economic preferences for FEZ resident companies (Enaifoghe & Asuelime, 2018).

Features of regulation and economic benefits.

The currently available benefits for C ”P resident companies can be divided into the following blocks: reduction of VAT and customs duties (refund of import duties and exemption from VAT on imports of raw materials; cancellation of VAT in case of purchasing goods in South Africa; effective and expedited customs administration); employment tax benefits (granted to low-paid workers); building permits (right to depreciate capital structures); a reduced rate of corporate income tax (if these conditions are met, the company may pay a reduced rate of 15 % instead of 28 %).

Conclusion

For many centuries, countries have been trying to create favorable economic and legal conditions to attract foreign investments and develop certain economic activities. Activities of the FEZs which have gone a long way of development (from free ports and harbors to transnational zones that unite several countries) are successful.

The FEZs are drivers of economic growth due to their ability to intensify characteristics of the countries and territories where they are located; their strategic focus; good management and beneficial propositions for investors; additional economic activities; promoting the export of goods and services, as well as attracting additional foreign investments; creation of additional infrastructure facilities and new jobs.

Currently, in the BRICS countries, the share of foreign investments is 20 % of all world investments due to a large number of FEZs (57 % of the global total). The economic and legal features of FEZs in the BRICS countries indicate their similarity with each other, which makes it possible to create a network of FEZs, which would combine key economic and legal features of individual countries and improve the synergistic effect of their interaction.

References

Aggarwal, A (2019). Leveraging SEZs for Regional Integration in ASEAN A Synergistic Approach. Asian Survey, 5(59), 795–821.

Beskorovaynaya, N. S., Khokhlova, E. V., & Ermakov, I. V. (2020). Special Economic Zone of the Tourist and Recreation Type as a Tool of Regional Policy. Lecture Notes in Networks and Syst., 91, 208–218.

Cheng, T. (2019). Special Economic Zones: A Catalyst for International Trade and Investment in Unsettling Times. J. of World Investment & Trade, 20(1), 32–67.

Chettri, M. (2020). From Shangri-La to de-facto SEZ: Land grabs from ‘below’ in Sikkim, India. Geoforum, 109, 57–66.

Crane, B., Albrecht, C., Duffin, K. M., & Albrecht, C. (2018). China’s special economic zones: an analysis of policy to reduce regional disparities. Reg. Stud., Reg. Sci., 5(1), 98–107.

Enaifoghe, A. O., & Asuelime, R. A. (2018). Southern African regional and economic integration: The free trade zone strategy for South Africa. J. of African Union Stud., 7(2), 85–107.

Kuo, K. -C., Lu, W. -M., Nguyen, D. T., & Wang, H. F. (2020). The effect of special economic zones on governance performance and their spillover effects in Chinese provinces. Managerial and Decision Econ., 41(3), 446–460.

Pavlov, P. V., & Vetkina, A. V. (2019). Special economic zones as a key to sustainable economic development of Russia. The Europ. Proc. of soc. & behavioural sci. EPSBS, 350–357.

Potter, A (2020). The politics of industrial displacement: Evidence from special economic zones. J. of Polit., 82(1), 29–42.

Sinenko, O., Mayburov, I., & Ibragimova, M. (2019). Taxation Incentives for Digitization of Special Economic Zones in the Asia-Pacific Region. In 33rd International-Business-Information-Management-Association (IBIMA) Conf. (pp. 7759–7765). Granada.

Streltsov, A. V., Yakovlev, G. I., & Nikitina, N. V. (2020). Special Economic Zones as Instrument of Industry and Entrepreneurship Development. Lecture Notes in Networks and Syst., 84, 243–251.

Teixeira, L. C. (2020). Labor standards and social conditions in free trade zones: the case of the Manaus free trade zone. Economics – The open access open-assessment e-journal, 14. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2021

Article Doi

eBook ISBN

978-1-80296-106-5

Publisher

European Publisher

Volume

107

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2896

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Pavlov, P. V., Zashchitina, E. K., Tkacheva, L. V., & Basnukayev, M. S. (2021). Free Economic Zones In Brics Countries As Driver Of Economic Development. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization - ISCKMC 2020, vol 107. European Proceedings of Social and Behavioural Sciences (pp. 2390-2398). European Publisher. https://doi.org/10.15405/epsbs.2021.05.319