Abstract

The modern process of financial sector modification defines new directions for organizations to implement solutions in the field of building their activities based on digital mechanisms. In this context, the transition to a conceptually new concept of conducting their activities is becoming relevant among financial organizations, as well as its integration into fintech companies. Fintech firms are customer-centric firms, bridging the gap between what finance companies currently offer and what today's customers want. Fintech targets industry niches with the best products and services to fill the gaps left by employees throughout the customer journey. Fintech firms are now infiltrating almost all segments of financial services, driving both innovation and disruption. FinTech's core businesses include digital payments (PayTech), fully digital insurance (InsurTech), banking (BankTech), asset management services (WealthTech), and creating markets for the sale of financial products. In this context, it becomes necessary to create an innovation ecosystem for the integration of small and medium-sized enterprises into the fintech infrastructure within the framework of regional development. The formation and development of Smart FinTech centers in the regions of Russia contributes to the development of Russian fintech industry, despite the fact that domestic practice of introducing financial technologies is at an early developing stage and has certain barriers. The scientific novelty of the research lies in the advancement and substantiation of the main aspects of regional financial system transition to digital transformation, as a key determinant that affects the vector of economic development of the region.

Keywords: Digitalization, financial technology, fintech, ecosystem, region

Introduction

Digitization is rapidly changing people's daily lives and the way businesses operate and manage finances around the world, regardless of time and geographic factors. With the rapid development of IoT and artificial intelligence technologies, there are new innovative solutions such as autonomous vehicles emerging.

Digital transformations cover all key areas of human life through the introduction and implementation of technological solutions. In this context, digital transformation is revision of business processes and business models, as well as the creation of new value using the Internet of Things (IoT), artificial intelligence (AI) and other digital technologies (Galazova et al., 2016).

The modern process of financial sector modification defines new directions for organizations to implement solutions in the field of building their activities based on digital mechanisms. In this context, the transition to a conceptually new concept of conducting their activities is becoming relevant among financial organizations, as well as its integration in the company's financial technologies. Financial technology is customer-centric, bridging the gap between what financial companies currently offer and what customers want. Fintech targets industry niches with the best products and services to fill the gaps left by employees throughout the customer journey. Fintech firms are now infiltrating almost all segments of financial services, driving both innovation and disruption. FinTech's core businesses include digital payments (PayTech), fully digital insurance (InsurTech), banking (BankTech), asset management services (WealthTech), and creating markets for the sale of financial products (Ivanova, 2017).

Digital transformation is causing significant changes in the structure of industries. Moving from a typical vertically integrated structure with large corporations at the top of the industry to a decentralized ecosystem structure with customers at the center. Digital technology has the ability to transcend traditional boundaries between different companies and industries. It establishes ecosystems that bring companies, partners and customers together, and create the value users need. Such ecosystems are called digital arenas. Depending on the participants involved, digital arenas can generate a wide range of co-creation value.

Today, new technologies (digital, telecommunications, biometric, etc.) are reshaping the financial services industry, actively replacing traditional players and traditional business models. The integration of new financial solutions allows you to change the structure of consumption, reduce the cost of certain functionality (processing customer bases, loyalty programs, etc.), increase efficiency and quality of business processes (targeting the target audience, scoring, etc.), as well as significantly affect sustainability development of core business, etc. As a result, the financial technology (or fintech) industry is gradually turning into an independent, intensively developing sector of the modern economy (Galazova et al., 2018).

Problem Statement

The largest financial, trade and IT companies in Russia and the world are working on the transformation of their core business into universal platforms capable of providing clients with almost any service. Ecosystem allows them not only to increase the loyalty of existing users, but also to work on attracting new customers, deriving additional profit from this (Ivanova, 2107). The emergence of ecosystems was a consequence of the development of technologies that made it possible to combine many services of a wide variety of profiles on one platformfrom marketplaces and payment systems to lifestyle and education. Financial technologies are one of the key links in most of the existing ecosystems, for this reason, major players in the banking sector are most actively engaged in their development. The two largest banking ecosystems in Russia are created by Sberbank and Tinkoff Bank. Their main goals are omnichannel, that is, combining all information about their users on their platforms with all possible communication channels with them, as well as creating a seamless customer journey. To achieve these goals, banks are constantly increasing the number of services that allow them to accompany their client throughout his entire life cycle (Gnezdova et al., 2019). Companies have chosen different strategies to develop their ecosystems. Sberbank, whose ecosystem already includes more than 20 different companies, prefers to buy services that have already announced themselves on the market: only in 2018–2019 it acquired Foodplexfoodtech company, Intercomp outsourcing service, Dialogue messenger, a search service Rabota.Ru, and also launched SberCloud cloud platform. Tinkoff Bank prefers to create its own services, and is also actively involved in the integration of third-party services: the bank offers its clients more than 120 partner programs. Bloomchain previously wrote that the cost of developing the Sberbank ecosystem is just over 60 billion rubles (Slepakov et al., 2019). However, there is no information what economic effect was achieved due to these costs. In Tinkoff Bank, this effect has already been recorded. According to the bank's report, in 2018, areas of activity not related to lending brought it 30 % of total revenue, that is, about 11 billion rubles. The leaders of Russian IT industryYandex and Mail.Ru Group started developing their own ecosystems too. However, they have a serious difference: banking services themselves became the basis for the development of ecosystems for banks, and Internet companies have their popular projects on the network: search engines, postal services, and social networks as ecosystems.

Research Questions

Financial system formation in the context of global transformation by means of digitalization and automation requires development of a conceptually new model of financial infrastructure, which is based on the formation of financial technologies. The main aspect of this work is that FinTech institutions act as financial technologies, which are the main mechanism implemented in practice for transformation into a new digital era, both within the whole country and in its individual region. As a result, FinTechs act as an auxiliary element for the formation of a regional financial platform. In this context, in the course of the research, the author identified the theoretical aspects of FinTech institutions and identified the key determinants of the formation of modern financial models aimed at digital transformation (Kokodei et al., 2019).

Considering the foreign and domestic practice of the development and development of FinTech institutions, it should be noted that the digitalization of the financial system has common determinants and trends in many countries, but each country has its own trajectory in the field of financial transformation, which implies heterogeneity of the implementation of financial technologies in a global context. It should be noted that in the Russian Federation, the implementation of FinTech methodology is taking place within the framework of the state program “Digital Economy” and has positive short-term results. The leaders in the implementation of financial technologies in practice are the determinants of the banking system, which actively base customer-oriented policies on modern technologies. In this context, there is a need to stimulate economic counterparties to implement the foundations of FinTech in their activities (Novoselova & Novoselov, 2017).

As a result, in the course of the study, a model of an ecosystem of regional FinTech infrastructure was developed, based on the development of regional Smart FinTech centers, which are auxiliary institutions to assist small and medium-sized enterprises in the implementation and development of financial technologies. The formation of Smart FinTech centers is the basis for the transformation of the financial system of the region into a digital financial space. It is achieved through the creation of a collaborative platform for cooperation of the main participants in the digital process and the accumulation of innovative ideas and knowledge within the regional ecosystem (Khubulova, 2019).

Purpose of the Study

The purpose of the study is financial digitalization as a key factor in stimulating regional development through the introduction of financial technologies.

Research Methods

The study used the following methods: statistical, comparative typological, system-logical, analytical, and expert assessment. The complex of statistical data used ensures reliability of the research results and the reasoned validity of theoretical conclusions and practical recommendations.

Findings

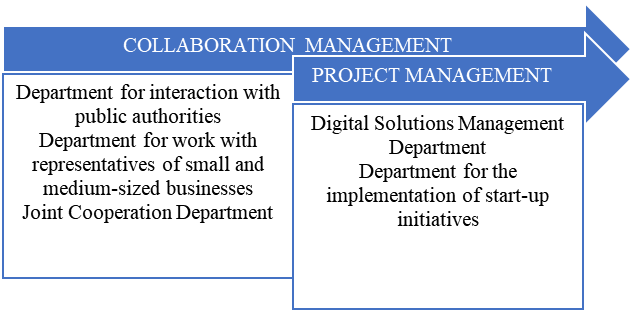

The activities of Smart Fintech Centers will be aimed at collaboration of the main counterparties of digital activities: public sector and small and medium-sized enterprises (Figure 1).

The main target for the implementation of this mechanism is a need to form relationships between the main elements of the digital infrastructure of the region: state, people, finance, business environment and technologies.

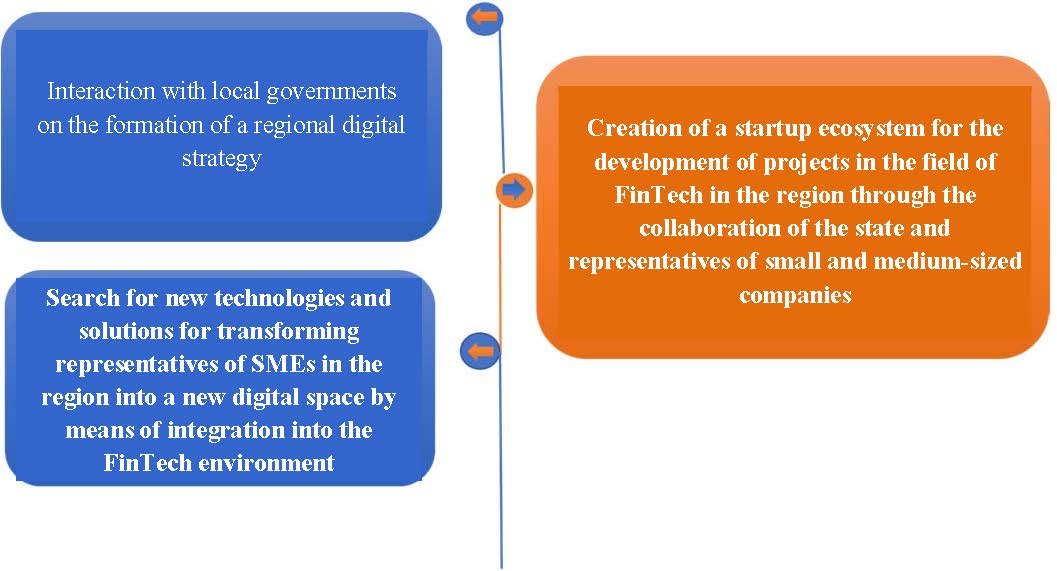

In this regard, it is necessary to determine the areas of activity of the Smart Fintech Center (Figure 2).

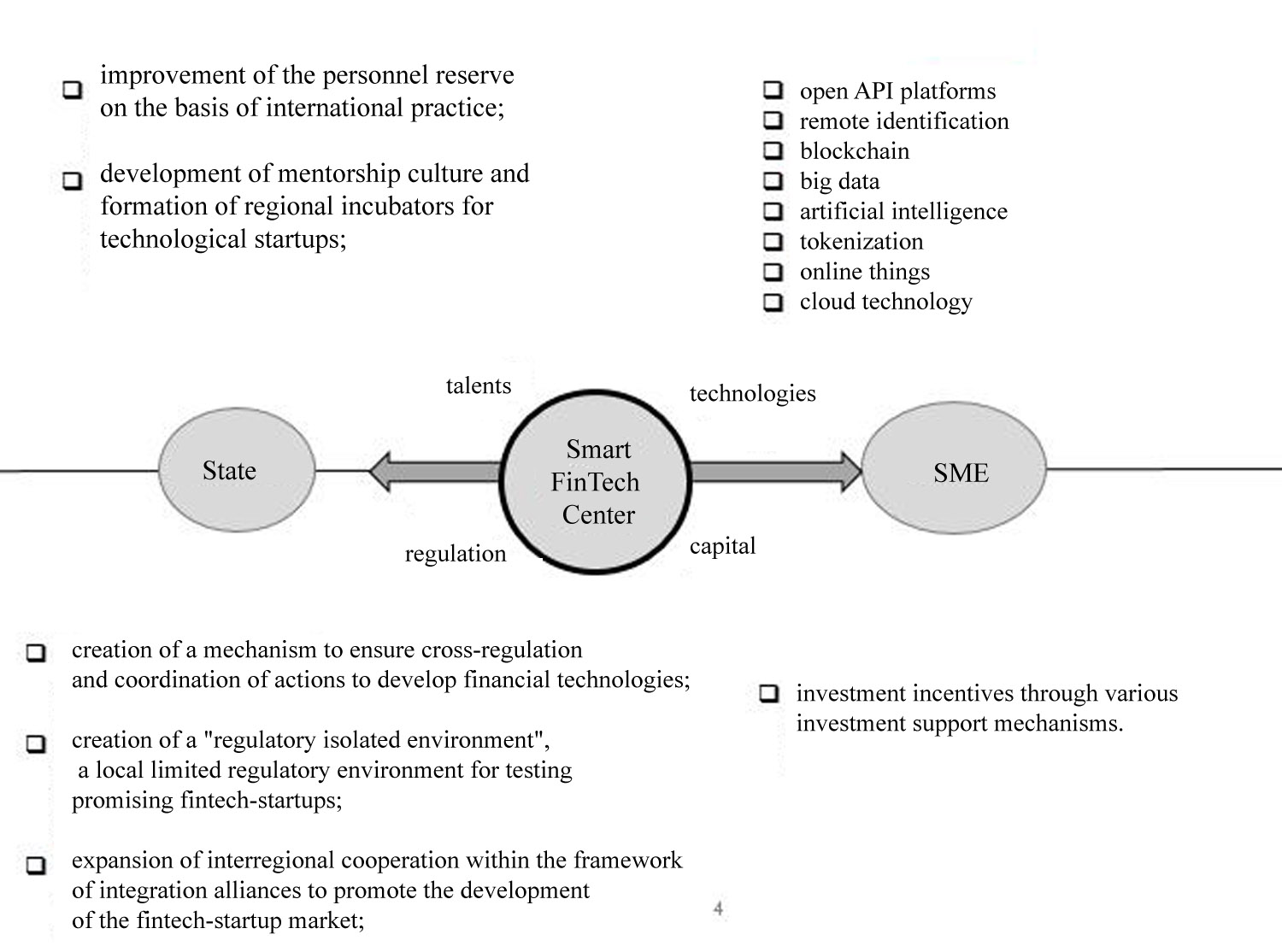

In the course of the study, a model of an ecosystem of regional FinTech infrastructure was developed, based on the development of regional Smart FinTech centers, which are auxiliary institutions to assist small and medium-sized enterprises in the implementation and development of financial technologies. This process is feasible with the help of 4 auxiliary elements: technology, talent, capital and regulation, Figure 3.

Talents are the most important resource, which are necessary for the formation of the creative potential of the region. Having the right team members in the right roles to drive innovation, growth, expansion, and successful collaboration is the formula for success. The most successful groups of people with rich creativity and deep technical experience can join in teams to develop and implement the foundations of fintech in the region through startups.

Capital (allocating optimal capital, expecting reliable returns): Without a defined investment and return model, it can be difficult to formulate a compelling value proposition. Participants need sufficient capital to invest in the partnership and a proven income model to maintain positive cash flow in the not too distant future.

Technology (collaboration tools and technologies): Technology tools need to be secure and provide frictionless interaction and scalability. Affiliate systems must integrate securely through technology. The information available must be accurate, timely, and compliant. It should be scalable without affecting current systems.

The small and medium-sized business sector contributes to the formation of a value creation model for the implementation of financial technologies. Any new business model must address unmet business needs and challenges in the region. Collaboration with people and the public sector should deliver a value proposition with measurable results.

In this context, the state takes an indirect impact on the development of financial technologies in the activities of small and medium-sized enterprises, by means of determining the regional vector of digital development in the long and short term, contributing to the formation of a favorable business climate in the region and encouraging SMEs to integrate into the fintech space.

Conclusion

It should be noted that for the Russian reality it is necessary to carry out a targeted restructuring of the financial system by means of introducing financial technologies into regional systems. In this context, the author proposes the creation of Smart FinTech centers on the basis of financial counterparties.

Thus, the formation and development of Smart FinTech centers in the regions of Russia contributes to the development of the Russian fintech industry, despite the fact that the domestic practice of introducing financial technologies is at an early stage and has certain barriers.

References

Galazova, S. S., Biganova, M. A., & Pronina, A. M. (2016). The energy consumption of domestic industrial production as a key factor in their low efficiency. J. of Econ. and Econ. Ed. Res., 17(spec. iss.), 186–199.

Galazova, S. S., Kasaeva, T. V., & Ashkhotov, A. M. (2018). Functional patterns and operating conditions of regional socio-economic systems in the Russian Federation. Amazonia Investiga, 7(17), 570–578.

Gnezdova, J. V., Rudakova, E. N., & Zvyagintseva, O. P. (2019). Systemic contradictions of modern economic systems that hinder formation and development of industry 4.0 in the conditions of knowledge economy formation and methods of overcoming them. In Industry 4.0: industrial revolution of the 21st century. “Studies in systems, decision and control” (pp. 211–218). Cham.

Ivanova, E. A., Mackay, M. M., Platonova, T. K., & Elagina, N. V. (2017). Theoretical basis for composition of economic strategy for industry development. Europ. Res. Stud. J., 20(1), 246–256.

Khubulova, V. V., Taimaskhanov, K. E., Salgiriev, R. R., & Shakhgiraev, I. U. (2019). Industry 4.0 and building digital space in the context of territorial development. The Europ. Proc. of soc. & behavioral sciences EpSBS, 1644–1651.

Kokodei, T. A., Lomachenko, T. I., & Gnezdova, Y. V. (2019). Modeling the global business environment based on polycyclic theory. Smart technologies and innovations in design for control of technological processes and objects: economy and production proceeding. Int. sci. and technol. Conf. fareastсon-2018 Part of the smart innovation, systems and technologies book series, 139, 487–499.

Novoselova, N. N., & Novoselov, S. N., (2017). Investigation of the directions of development of the regional socio-economic system from the standpoint of institutional component and territorial localization. Int. sci. publicat. Modern fundam. and appli. rese., 1(24), 218–224.

Slepakov, S. S., Novoselova, N. N., & Khubulova, V. V. (2019). Revival and renewal of political economy. Lecture notes in networks and syst., 57, 443–450.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2021

Article Doi

eBook ISBN

978-1-80296-106-5

Publisher

European Publisher

Volume

107

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2896

Subjects

Science, philosophy, academic community, scientific progress, education, methodology of science, academic communication

Cite this article as:

Taymaskhanov, H. A., Khubulova, V. V., Salgiriev, R. R., & Khasiev, S. A. (2021). Ecosystem Of Regional Infrastructure Of Financial Technologies. In D. K. Bataev, S. A. Gapurov, A. D. Osmaev, V. K. Akaev, L. M. Idigova, M. R. Ovhadov, A. R. Salgiriev, & M. M. Betilmerzaeva (Eds.), Knowledge, Man and Civilization - ISCKMC 2020, vol 107. European Proceedings of Social and Behavioural Sciences (pp. 2204-2210). European Publisher. https://doi.org/10.15405/epsbs.2021.05.292