Abstract

The main goal of research is to study how investments influence national agrifood system’ level of acquired competitive advantage and to justify a frame of conceptual statements in the field of national its agro industrial complex (AIC) competitiveness strategy. While credit investment resources availability is still fairly low, a search for strategic possibilities of alternative to credit funding methods becomes actual, for example, by agrifood goods production subsidizing with investment subsidies accrual on every unit of supported commercial output, as seen in this article. A sample of agrifood system organizations was tested. Sample study approved a hypothesis that investments into production technological modernization significantly influence its competitiveness, and influence mentioned was given a quantitative evaluation. The novelty if idea offered for discussion among scientific community lies in that in agrifood system competitiveness sustainable increasing strategy investment provision it is appropriate to notice both quantitative (support volume) and structural aspects, primarily in order to obtain the maximal possible convert of support into investments. We offer to include investment-purpose subsidies to every unit of supported branches commercial output with participation of support actor in funds of support receiver based on support accrual in practice of state regulation of AIC’ competitiveness.

Keywords: Investmentscompetitive advantagecost capacitycompetitivenessagrifood complexinvestment stimulation

Introduction

Today Russia’s agro industrial complex (AIC) faces difficult and diverse objective to substitute agrifood import and strengthen its export potential. Many of agrarians, economists and statesmen agree that this objective is actual and reachable (Altukhov et al., 2016; Drokin & Zhuravlev, 2018; Neganova & Dudnik, 2018; Shagaida & Uzun, 2018). Thus Decree of the President of the Russian Federation by 7th may 2018 “On national goals and strategic tasks of Russia’s development up to 2024th year” states a bundle of tasks in AIC’ development field. In particular, must be noticed tasks to form “globally competitive non-resource sectors” in agriculture, to create in Russia’s AIC “high-performance export orientated sectors developing upon a base of modern technologies”, and, finally, to achieve an agrifood export volume of $45 billion per year. It seems obvious that most of these tasks are, in fact, a subset of strategic direction to increase a competitiveness of national agrifood system. A problem of competitiveness increasing is extremely complicated. Possible ways of its solving lay in close interrelation with such national economy functioning aspects like food security and food independence provision, preserving and increasing of employment, both suppliers of labor services and capital proprietors income increasing by expanding an export of produced additional afgrifood goods (Shagaida & Uzun, 2018).

To achieve not simply higher competitiveness, but to create a conditions for its sustainable growth is possible only in terms of long-run strategy based upon a system approach, taking into account an array of internal and external environment factors of national AIC. Strategy, in its turn, usually is built on a basis of more or less explicit conceptual footing that consists of interrelated system of views on competitiveness and its regulation, a definite way to understand a process of agrifood system competitiveness regulation. The core of our conceptual statements strongly corresponds with M. Porter’s competitive advantage theory (Neganova & Dudnik, 2018). The most important moment in this theory is, in our opinion, separation of acquired competitive advantage in the whole mass of advantages, and further question of how to acquire those advantages faster, and what may be a role of government strategy for regulated branch in that case (Porter, 1990). A necessity to accumulate advantages caused by life itself: less favorable conditions for Russian agriculture in comparison with other competitors negatively affects level of “essential” advantages, placing domestic agriculture in a knowingly vulnerable position (Delyagin, 2003). There are some noteworthy interregional comparisons done by Ural’ economists. According to them, any agrifood production under Russia’s North-West region, can’t equally compete with the same production from Krasnodar region (Shagaida & Uzun, 2018). Land productivity in crop production in Krasnodar region is 2.6 times higher than in Vologda region and 9-16 times more profitable (Shagaida & Uzun, 2018). Also should be noted that the very Krasnodar region seems more favorable only in comparison with the rest regions of Russia, while looks far more moderate being compared with some other regions of our planet (Golubev, 2019). Among acquired advantages may be allocated organizational, marketing and sales and technological advantages (Panfilov, 2015). Nowadays the most important advantages lie in the field of technology. This may be explained, on the one hand, by gradual alignment of other parameters of Russia's AIC with world standards, and, on the other hand, by fact that any acquired organizational or marketing advantage demands appropriate layer of technology and technical support (Cobb & Douglas,1928; Emvalomatis et al., 2008; Kabakova & Kabakov, 2019; Neganova & Dudnik, 2018).

As for technological filling, the past decade was quite effective for Russia’s AIC. A situation with technical equipment in agriculture sufficiently improved, the technical level of means of production got evidently higher than before (Kormakov, 2019; Stadnik et al., 2018). A certain success was achieved in implementation of 5th technological mode elements, for example, production automation, precise agriculture and biotechnologies (Averbukh, 2010; Kalinina, 2020). Still, there’s much to do. As far as full transition to 5th technological mode in all AIC branches will obviously be finished lately compared to developed economies, the replacement of catching up modernization paradigm to outgoing transition to 6th technological mode becomes more and more actual (Averbukh, 2010; Glaz'yev, 2013; Pavlova & Sigova, 2017; Rykova et al., 2019). Technological advantages accumulate due to investments into production technological level improvement, so investment component is an inalienable part of competitiveness increasing strategy. From the state regulation of competitiveness perspective an important question that needs its answers, is how investments in AIC affect its competitive advantage level. To get closer to a possible answer is one of the goals of this article.

Theory

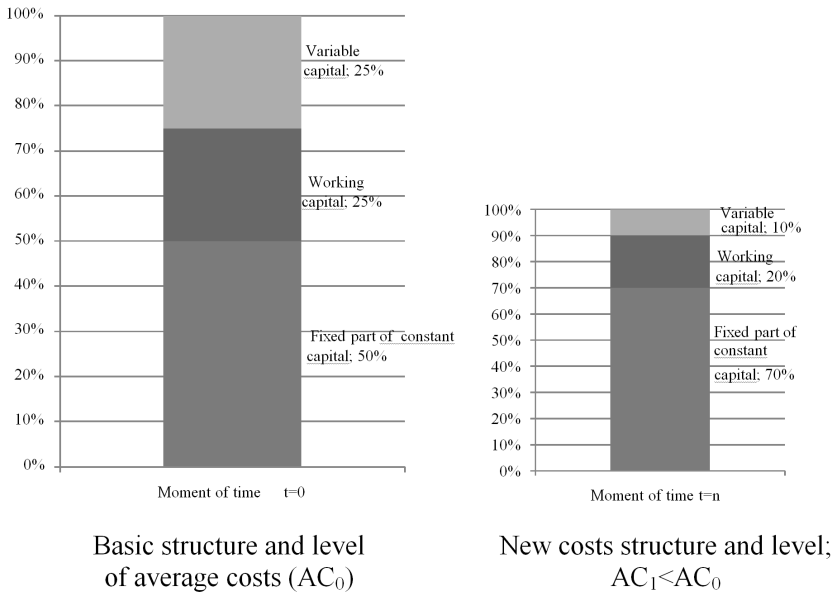

As known, economic nature of labor productivity increasing is that total amount of labor per unit decreases, while the share of past labor in this amount goes higher and share of living labor becomes relatively less (Marx, 1952). Hence, if spread this approach into our field, accumulation of acquired advantages may be shown as process of increasing of the past labor share shaped in fixed assets combined with outgoing decrease of share of the past labor shaped in current assets, so, in fact, this is about making lower production’ material consumption and energy intensity as well as share of living labor bound with assets operation, service and management. In other words, investments into acquired advantages accumulation may be reduced to relative substitution of variable capital and working part of constant capital by more productive fixed part of constant capital (Figure

Problem statement

Existing structural parameters of partial substitution of itemized amount of unit current costs (UCC) by unit capital investments (UCI) may be described with the following equation:

At current stage of our research it is possible to give only a first approximation of quantification of this interdependence. As far as the tested sample of organizations will be enlarged, and more comparability of parameters reached, a more precise estimation may be given.

Estimation results obtained may be used for further work in grounding state competitiveness regulation measures for AIC in strategic perspective with appropriate detalization of these measures at regional and national level.

Methodology

To reveal possible correlations between noticed parameters we decided to use methods of statistical sample analysis. The sample was formed out of profitable (at least in 4 of 5 last years) agriculture organizations that performed investments in their primary field of occupation. A sample volume is 70 organizations of Ural Federal District.

Data series for regression analysis formed by methodology according to which unit capital investment (UCI) used as independent variable, and unit current costs capacity (UCC) used as dependent variable, both calculated with 2 years lag.

Results

Processing an array of experimental data using the Statistica 6.0 software and statistical complex allowed us to obtain the following results.

First, we realized that there’s a statistically reliable reverse correlation between chosen parameters (Multiple R=-0.271).

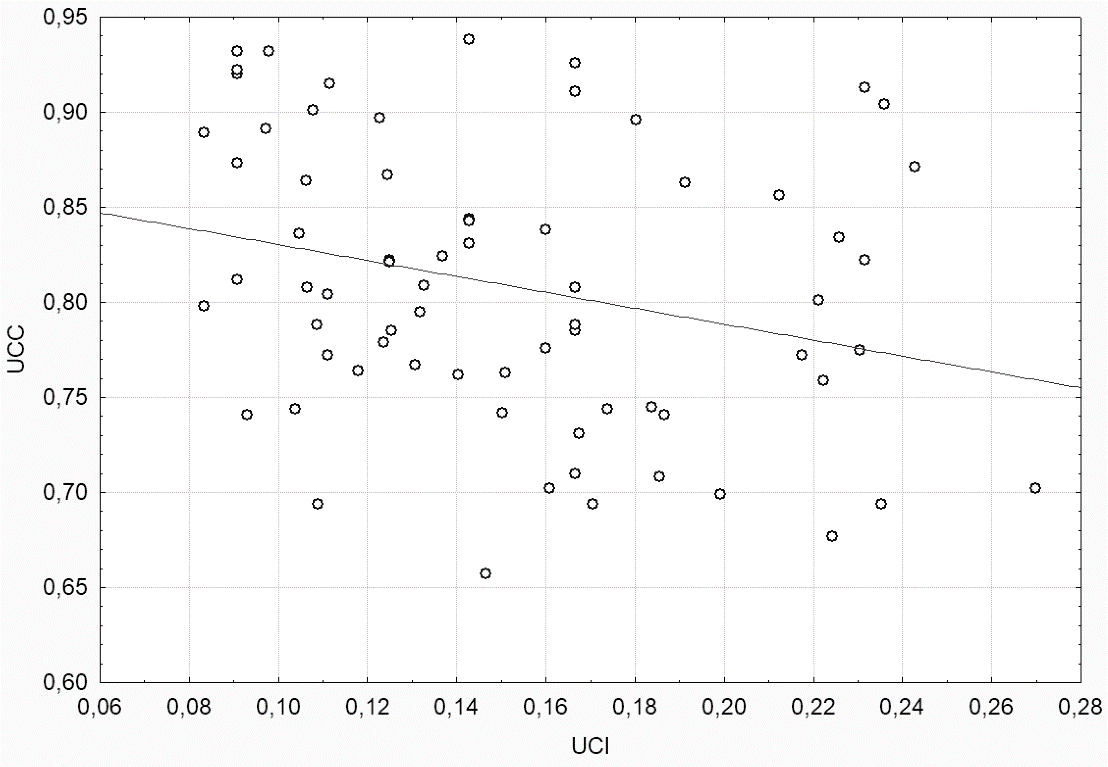

Scatterplot of parameter pairs (Figure

Performed research allowed us to form the following linear regression equation:

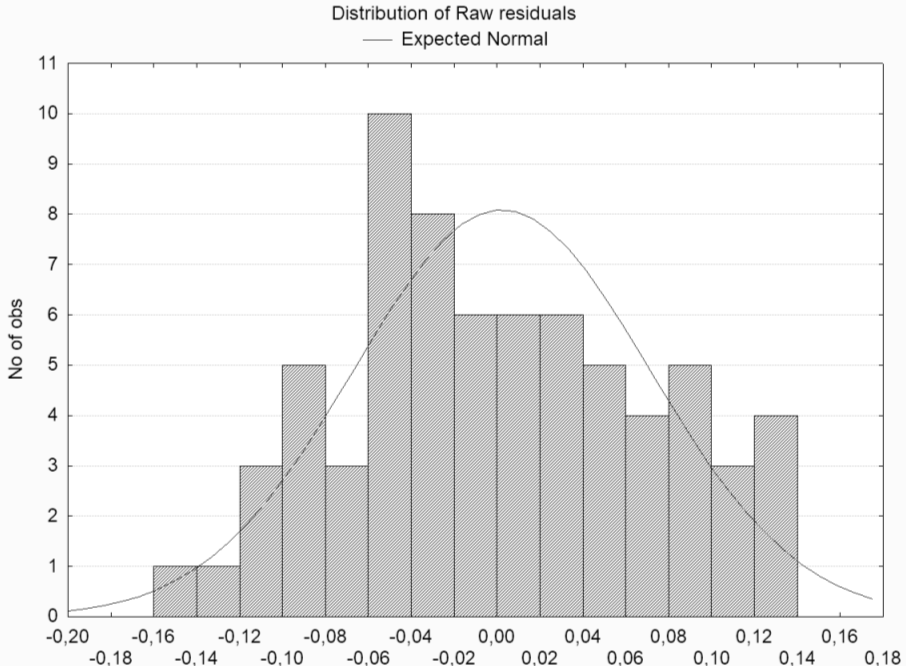

Adequacy of model built is approved by Student’s t-criteria (p<0.05) and close to normal residuals distribution which may evaluated by degree of polygons’ proximity to normal residuals distribution curve, where polygons represent observed residuals (Figure

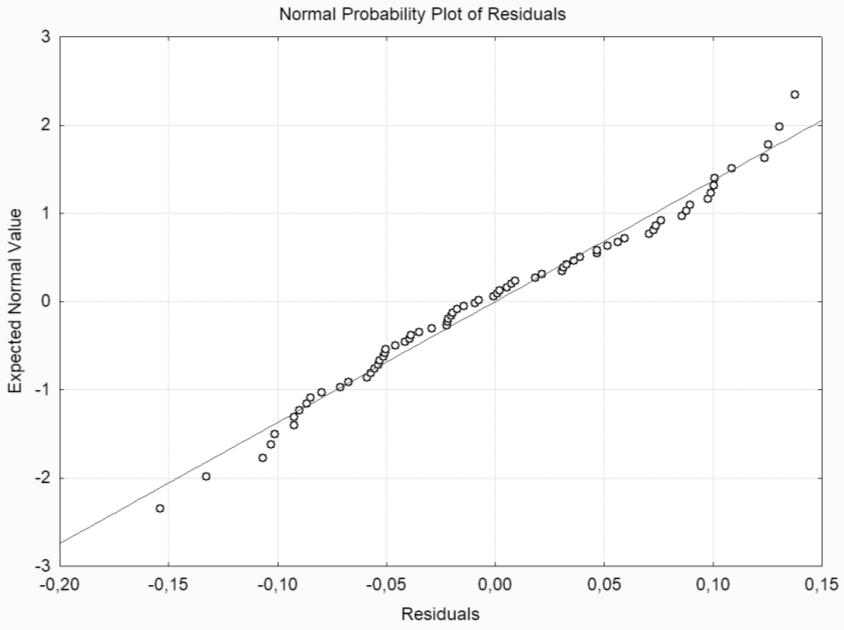

Another way to estimate model adequacy is to consider the degree of proximity of actually observed residues to the normal distribution line, and it also shows that distribution of residuals is quite close to normal (Figure

We tend to interpret the results as follows. In a prevailing investment practice and constant technological efficiency (in short-run term; in middle-run term it is possible to expect a tendency to its growth) every ruble of UCI counted per adjourned commercial output may cause 0.4188 ruble economy of unit current costs. Taking a time of active part of assets exploitation of 6-8 years, a summary economy of UCC (before discounting) may reach 2.51-3.35 rubles.

Obtained results may be used to state some conceptual proposals in the field of national AIC competitiveness strategic regulation.

First, as far as our research allows (at least in the first approximation) to bound unit capital investments and unit current costs as the main indicator of acquired competitive advantages, it seems possible to bound UCC volume with the volume of AIC state support after converting the last one into investment equivalent (IESS):

In particular, subsidies accrual per unit of commercial goods without obliged investments purpose attribute (USCG) and hectare subsidies (HS) as a partial compensation of current costs spent by AIC producers may be recounted in unit capital investments growth with factually observed save rate in supported branch (SR; SR<1):

Second proposal logically continues the first: as well as mentioned support instruments (both USGC and HS) are recounted into IESS’ component with save rate that is knowingly less than 100%, their budgetary effectiveness will be deterred by this circumstance.

Third proposal touches multicomponent subsidies per unit of supported commercial afgrifood goods, which in their second component may be used exclusively for investment in agriculture technological modernization (USCGI). These subsidies were shortly introduced in our previous work (Neganova & Dudnik, 2018). For those subsidies the equality of inclined unit capital investment and second component of state support will be observed:

That means subsidies used exclusively for investment in agriculture technological modernization don’t touched by reducing influence of save rate, so every ruble spent for support will cause maximal possible investments.

To provide the further increase in AIC support activity we suppose appropriate to consider more closely subsidies of unit commercial output with participation of supporter in capital of support receiver.

The main peculiarity of these subsidies is they give supporter an opportunity to join the capital of support receives thus to obtain a right to get a share in its profit by dividends mechanism. This share may be later be directed into further support with participation in capital, and so on. In time, this peculiarity may lead to reduction of initial budgetary support spending because a sufficient part of spending may be funded by state’s income out of support previously done. From the perspective of producer, joining a subsidizing program with state participation in its capital promises a bundle of benefits in comparison with borrowed funds. The main benefit is in different type of default risk: single non-payment of dividends in favor of support actor (state) is much safer for organization than single non-payment of commercial credit.

Conclusions

A certain interest is in further research of rational proportion between strictly investment and non-investment subsidies within a cumulative support measure, that would prove maximal involvement of support receivers in subsidizing programs with state participation in their capital.

Application of investment-assigned subsidies of unit commercial output in agriculture provides maximal possible increase in ruble investments in Russia’s AIC and be seen as one of new investment cycle beginning. Still, it should be noted that taken alone, mentioned support measures won’t significantly influence technological effectiveness of capital assets; they just make them more available to buy.

A further increase of effectiveness of state support of AIC by acquired competitive advantage accumulation may be possible only with active usage of non-financial instruments and approaches. For example it may be achieved by realization of non-controversial strategy of AIC competitiveness increasing, being organically integrated into the scientific, technical and industrial policy of the development of the national economy.

References

- Altukhov, A. I., Drokin, V. V., & Zhuravlev, A. S. (2016). From the food sovereignty ensuring strategy to the strategy of improving the agro-food complex competitiveness. Economy of Region, 12(3), 852-864.

- Averbukh, V. M. (2010). Sixth technological order and prospects of Russia (brief review). Science, Innovation, Technology, 71. (In Russian). Retrieved from https://cyberleninka.ru/article/n/shestoy-tehnologicheskiy-uklad-i-perspektivy-rossii-kratkiy-obzor (accessed: 22.02.2020).

- Cobb, C. W., & Douglas, P. H. (1928, March). A Theory of Production. Supplement, Papers and Proceedings of the Fortieth Annual Meeting of the American Economic Association. The American Economic Review, 18(1), 139-165. Retrieved from http://www.jstor.org /stable/1811556 (accessed: 04.01.2020).

- Delyagin, M. G. (2003). World crisis: a general theory of globalization. Second Edition. Moscow: INFRA-M.

- Drokin, V. V., & Zhuravlev, A. S. (2018). The competitiveness of the agro-food complex is an important link in the systems of ensuring national security, preservation and development of rural territories. Management of economic systems: electronic scientific journal, 12. Retrieved from http://uecs.ru/zemleustroystvo/item/5249-2018-12-12-09-45-20 (accessed: 03.02.2020).

- Emvalomatis, G., Oude, L., Alfons, G. J. M., & Stefanou, S. E. (2008). An Examination of the Relationship Between Subsidies on Production and Technical Efficiency in Agriculture: The Case of Cotton Producers in Greece. Sevilla: European Association of Agricultural Economists. Retrieved from http://purl.umn.edu/6673 (accessed: 05.01.2020).

- Glaz'yev, S. Yu. (2013). The strategy of advanced development and integration based on the formation of the sixth technological order. Partnership of Civilizations, 1-2, 195-232. (In Russian). Retrieved from http://www.intelros.ru/pdf/Partnerstvo/2013_1/19.pdf (accessed: 03.02.2020).

- Golubev, A. V. (2019). Explicit and implicit impacts of state support for agriculture. Agricultural and processing enterprises economics, 9, 13-17.

- Kabakova, O. G., & Kabakov, V. M. (2019). Assessment of the influence of factors on increasing the technical equipment of agricultural production in the region. Bulletin of the Kursk State Agricultural Academy, 2, 134-137. (In Russian).

- Kalinina, M. (2020). Technical equipment of agriculture in the region. (In Russian). Retrieved from https://uldelo.ru/2019/01/22/b-tekhnicheskoe-osnashchenie-b-br-selskogo-khozyaistva-regiona (accessed: 22.02.2020).

- Kormakov, L. F. (2019). Russia in the WTO: Impact on the Course and Results of Technical and Technological Modernization of Agriculture. Agricultural and processing enterprises economics, 2, 2-7. (In Russian).

- Marx, K. (1952). Capital. Criticism of Political Economy. M.: State Publishing House of Political Literature. [In Russ.]. Retrieved from http://kapital-marks.ru/wp-content/uploads/2010/03/marks_karl_kapital.rar (accessed: 03.01.2020).

- Neganova, V. P., & Dudnik, A. V. (2018). Improving the State Support of Agriculture in a Region. Economy of Region, 14(2), 651-662.

- Panfilov, V. A. (2015). Russia’s food security and sixth technological mode in agro-industrial complex. Scientific journal Tidings of KGTU, 39, 77-84. Retrieved from http://www.klgtu.ru/upload/science/magazine/news_kstu/2015_39/ panfilov.pdf (accessed: 08.02.2020).

- Pavlova, I. P., & Sigova, M. V. (Ed.) (2017). Opportunities for Russia's entry into the sixth technological order. Scientific notes of the International Banking Institute, 19, Scientific articles based on the materials of the XVI International Scientific and Practical Conference “Actual Problems of Economics and Innovation in Education” – “Smirnov Readings – 2017”, SPb.: IBI Publishing, 150. (In Russian). Retrieved from http://www.ibispb.ru/docs/2017/conir/uchenye-zapiski/№19.pdf (accessed: 22.01.2020).

- Porter, M. E. (1990). The competitive advantage of nations. Harvard business review, 68 (2), 73-93. Retrieved from https://hbr.org/1990/03/the-competitive-advantage-of-nations

- Rykova, I. N., Shkodinskiy, S. V., & Yur'yeva, A. A. (2019). A comparative analysis of the technical and technological equipment of agricultural sectors in the Russian Federation. Economics, Taxes, Right, 4, 39-49. (In Russian). https://doi.org/10.26794/1999-849X-2019-12-4-39-49. R

- Shagaida, N., & Uzun, V. (2018). Development trends and the main challenges of the agricultural sector of Russia. Moscow: Center for Strategic Research.

- Stadnik, A. T., Kabakov, V. M., & Kabakova, O. G. (2018). Technical equipment of agricultural production in the region and ways to improve it. Bulletin of the Novosibirsk State Agrarian University, 1(46), 166-174.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

08 March 2021

Article Doi

eBook ISBN

978-1-80296-102-7

Publisher

European Publisher

Volume

103

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-644

Subjects

Digital economy, cybersecurity, entrepreneurship, business models, organizational behavior, entrepreneurial behavior, behavioral finance, personnel competencies

Cite this article as:

Dudnik, A., Neganova, V., & Marfitsin, S. (2021). Investment Aspects Of Agrifood Complex Competitveness Increasing Strategy. In N. Lomakin (Ed.), Finance, Entrepreneurship and Technologies in Digital Economy, vol 103. European Proceedings of Social and Behavioural Sciences (pp. 427-434). European Publisher. https://doi.org/10.15405/epsbs.2021.03.53