Abstract

The article has ranked and systematized some factors influencing business decisions on future capital investments. The research is based on sociological studies related to decision-making process on investments made in modern Russia. Factors’ systematization was carried out by the authors in accordance with the established modern economic methodology and theory which makes compromise solutions between investor’s requests and the ability to customize the economic system possible. The article proves the necessity of investment processes state regulation in Russia which can mainly be achieved by improving institutions, including tax sphere, and by regulating macro parameters mainly with the help of the Central Bank of Russia. This regulation is necessary since investors do not have the full information, and requests for cheap loans can cause macroeconomic balance disruption, as well as the national currency depreciation. Besides, according to the authors, the modern digital economy state should stimulate investments in innovation projects in this sphere.

Keywords: Investmentsdigital economicseconomic growthmacroeconomicsmicroeconomicsrational expectation theorygovernment regulation of the economy

Introduction

Nowadays the investment problem is getting topical. The states and their leaders are concerned about investment processes intensifying within the country for the reason that fixed assets investments themselves play a role of the development driver in the whole country, and it causes economic growth and development. A country's economic growth within a macroeconomic process leads to a higher realization of its production capabilities level. At the same time, economic growth can be considered to be a component of the economic cycle (Akayev et al., 2011). Economic growth is a phenomenon which is studied on the basis of some data such as gross national product dynamics or gross domestic product, both in absolute size and per capita. This dynamics is characterized by annual growth rates (or gain).

Theoretical and methodological bases of the study

A polymethodological approach based on modern macroeconomic models and theory of rational expectations.

Results

The economic growth and investments studies is based on two main approaches: Keynesian and neoclassical (Grabova, 2018; Sharaev, 2006).

Savings and investments play an important role in the

The multiplier effect can also develop in the opposite direction: with a reduction in investment and a large-scale decline in production.

Keynes's multiplier is a coefficient that is equal to a fraction there is one in the numerator and the so-called MPS indicator (marginal propensity to save) in the denominator, therefore, the smaller it is, the higher the multiplier effect becomes; this phenomenon is called the “thrift paradox”.

There exists a well-known Harrod-Domar economic growth model within the framework of the Keynesian concept. The mechanism of economic growth as a factor in increasing supply and demand in economics in this model, is positioned as investment growth. Equilibrium economic growth is achieved when aggregate demand and aggregate supply are equal (AD = AS), and based on formulas logics, the investment growth rate should be equal to the product of the marginal capital productivity and the marginal propensity to save.

The most famous in classical theory was the model of Robert Solow, which allows to reveal the relationship of the three economic growth sources - investment, labor force and technological progress. The state influence on economic growth is possible, according to neoclassicists, through its influence on the rate of savings and on the speed of technological progress.

The development of scientific and technical progress caused new factors inclusion into the model. The Tinbergen model is the most famous, including not only capital and labor, but also the rate of scientific and technological progress in the considered time period. J. Mead transforms Tinbergen’s economic growth model into an equation of growth in which the overall growth rate of GNP is the sum of the growth rate due to capital, labor and technological progress. Thanks to a new production function version the Ministry of Foreign Affairs managed to solve a very important problem: how to make the economic steady balanced growth possible without government interference.

The neoclassical models practical application of economic growth based on the Cobb-Douglas function should also be guided by the diminishing returns law of production factors (the law of diminishing returns), which has never been strictly proved, i.e. this approach is heuristic. This law says that under the increasing of one production factor (in our case, investment in fixed assets) and keeping the remaining production factors unchanged, the marginal product will begin to decrease from a certain stage. This is significant not only at the micro level for one business entity, but also investment business decisions will depend on previous investments of other business entities in the industry, which are characterized by high capital intensity. The law is applicable in the short term and for a particular technology. It does not apply to intellectual property objects that are transformed into intangible assets that can cause technological shifts in the industry, and, as a result, shifts in the production function.

This conclusion is confirmed by the outstripping growth of the so-called “Digital economy”, based on the introduction of “digital intellectual” innovations and on the capture of a new market associated with the technologies of the fourth industrial revolution and new economic patterns. It is one of the practical conclusions from the theory, which should determine priorities in state investment policy and should be a guide for business.

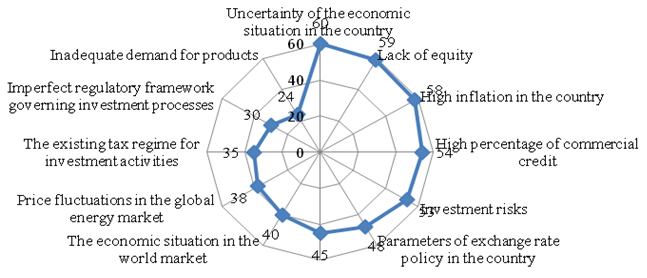

Further we will show what factors limit investment activity in Russia according to potential and real investors (Figure

Investors analyze the situation according to the rational expectations theory. Their activities are rational in terms of processes at the micro level, but may conflict with macroeconomic equilibrium. So, two factors - high inflation and a high percentage of commercial credit are two interrelated reasons. High inflation (we call it relatively high for Russia) is partly justified by the fact that it allows Russia to balance between this inflation rate and low unemployment rate. A commercial credit high percentage also has its own macroeconomic explanation: a great number of cheap loans can be the reason of investment return on as well as the national currency depreciation. The first limiting factor: the economic situation uncertainty in the country is most likely to be a factor that we can define as lack of trust to the authorities, although it contradicts with some objective economic points: in Russia, equilibrium has been observed for quite a long time at the macro level in the tax sphere. The state policy is predictable and stable, modern digitalization economic processes are very actively and efficiently used by government structures, including fiscal ones, in order to ensure transparency and control of financial and tax flows.

From the point of view of determining the possibilities of the state investment policy, it is important not only to rank, but also to systematize the limiting factors in conjunction with theory and methodology.

-

-

-

-

Discussion

Such a systematization allows us to determine the instruments for regulating investments (Nitsevich et al., 2020), as well as to seek compromise solutions between investor requests (Cejnek & Randl, 2016; Fu & Yu, 2018; Gambetti & Giusberti, 2019; Gogoleva et al., 2018; Gromova et al., 2019;) and the possibilities of customizing the economic system (Armand & Mendi, 2018; Kogan, 2016). A sociological study confirms the importance of institutional conditions in Russia to ensure increased investment including foreign (Izotov, 2019; Skvortsova et al., 2018; Ślusarczyk, 2018; Vysotskaya et al., 2018), this is the potential that can be used (Grabova et al., 2018; Kormishkina et al., 2016; Pinkovetskaia et al., 2019).

Conclusion

Thus, this study demonstrates the necessity for the interconnection of theory, methodology and practice in economic research. The polymethodological approach allows to choose tools for solving economic problems, in particular the problem of activating investments. The limitedness of rational expectations the theory in making decisions in the capital investments sphere, which contradicts macroeconomic proportions, is shown. Investment decisions sociological studies - is the factual, empirical material, the analysis of which on the basis of modern economic theory and methodology allows us to identify reasonable trends in state investment policy.

References

- Akaev, A. A., Rumyantseva, S. Y., Sarygulov, A. I., & Sokolov, V. N. (2011). Ekonomicheskie tsikly i ekonomicheskiy rost [Economic Cycles and Economic Growth]. St. Petersburg.

- Armand, A., & Mendi, P. (2018). Demand drops and innovation investments: evidence from the great recession in Spain. Recerch Policy, 47(7), 1321-1333.

- Cejnek, G., & Randl, O. (2016). Risk and return of short-duration equity investments. Journal of Empirical Finance, 36, 181-198.

- Fu, K.-A., & Yu, C. (2018). On a Two-Demensional Risk Model with time-dependent claim sizes and risky investments. Journal of Computational and Applied Mathematics, 344, 367-380.

- Gambetti, E., & Giusberti, F. (2019). Personality, decision-making styles and investments. Journal of Behavioral and Experimental Economics, 80, 14-24.

- Gogoleva, T. N., Golikova, G. V., & Kanapukhin, P. A. (2018). Economic analysis of investments as a source of economic changes. Studies in Sistems, Decision and Control, 135, 107-122.

- Grabova, O. N. (2018). Theory and prognostic models of regional development. Economics and Management: Problems, Solutions, 3, 4-7.

- Grabova, O. N., Suglobov, A. E., & Karpovich, O. G. (2018). Evolutionary institutional analysis and prospects of developing tax systems. Espacios, 39(16), 40.

- Gromova, E. V., Gromov, D. V., & Lakhina, Y. E. (2019). On the solution of a differential game of managing the investments in an advertising campaign. Proceedings of the Steklov institute of mathematics, 305(1), S75-S-85.

- Izotov, D. A. (2019). Russia's regions: potential and risk factors. Economic and Social Changes: Facts, Trends, Forecast, 12(2), 56-72.

- Kogan, A. B. (2016). Method for assessment of sectoral efficiency of investments based on input-output models. Global Journal of Pure and Mathematics, 12(1). 19-32.

- Kormishkina, L. A., Kormishkin, E. D., & Koloskov, D. A. (2016). Multiplier and accelerator effects of investments in the Russian economy (facts, trends and prospects). Indian Journal of Science and Technology, 9(29), 99443.

- Nitsevich, V. F., Sudorgin, O. A., Stroev, V. V., & Moiseev, V. V. (2020). Actual problems of investments in Russia. Smart Innovation, Systems and Technologirs, 138, 717-728.

- Pinkovetskaia, I. S., Nuretdinova, Y. V., Neif, N. M., & Treskova, T. V. (2019). Specialization and concentration of investments in fixed assets of enterprises: information from Russia. Amazonia Investiga, 8(21), 52-61.

- Sharaev, Yu. V. (2006). Theory of economic growth: studies manual for universities. Publishing, House of the Higher School of Economics.

- Skvortsova, T. A., Mosiyenko, T. A., Fedorenko, Y. V., & Dzyuba, L. M. (2018). Formation and development of the legal regulation of foreign investments in Russia. European Research Studies Journal, 21(Special Issue 1), 432-442.

- Ślusarczyk, B. (2018). Tax incentives as a main factor to attract foreign investments in Poland. Administratie si Management Public, 18(30), 67-81.

- Vysotskaya, N. V., Sayfieva, S. N., Afanasiev, I. V., Dembitsky, A. A., & Nicolaeva, G. N. (2018). Mathematical modelling of the dependence of foreign direct investments on the protection level of property rights. International Journal of Simulation: Systems, Science and Technology, 19(6), 37.1-37.3.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

08 March 2021

Article Doi

eBook ISBN

978-1-80296-102-7

Publisher

European Publisher

Volume

103

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-644

Subjects

Digital economy, cybersecurity, entrepreneurship, business models, organizational behavior, entrepreneurial behavior, behavioral finance, personnel competencies

Cite this article as:

Grabova, O. N., & Grabov, A. V. (2021). Digital And Intellectual Economics Potential As A Result Of Modern Investment Processes. In N. Lomakin (Ed.), Finance, Entrepreneurship and Technologies in Digital Economy, vol 103. European Proceedings of Social and Behavioural Sciences (pp. 351-356). European Publisher. https://doi.org/10.15405/epsbs.2021.03.44