Abstract

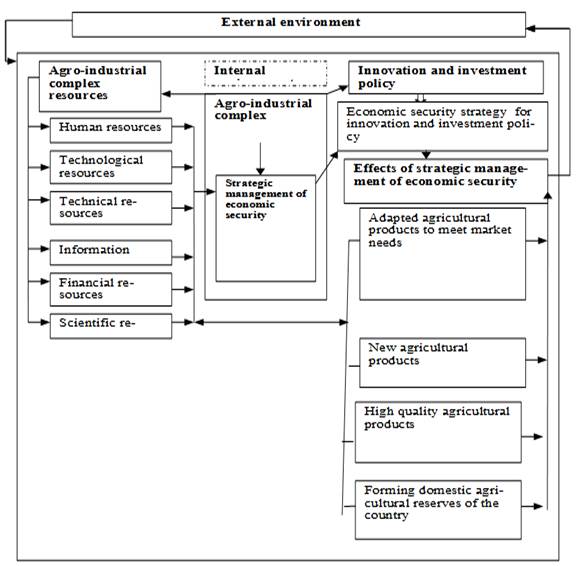

The article develops stages of testing a model for ensuring security and the investment policy of the agro-industrial complex (ESIPAC). Methods and approaches of management theory with the direction towards the agro-industrial complex are analyzed. An adaptive structural model for security of the investment policy of the agro-industrial complex has been developed and the components of this policy are presented. The problems and prospects of the policy of investment security in the field of agriculture are highlighted. The modern system of a market economy provides for the implementation of the requirements necessary for maintenance and sustainable development of market competitiveness of agricultural enterprises. In most cases the conditions for ensuring competitiveness are based on the wide diversification of the organization, the development and use of relevant production technology and advanced equipment. The popularization of agricultural products with a modernized type of delivery or packaging, the introduction of high technology, the organization of modern agricultural business management systems - all these factors become crucial while ensuring the development and capitalization of agricultural enterprises. However, agricultural enterprises must comply with the appropriate quality of the organizational system of firms management. Particular attention should be paid to testing the model for ensuring security of the investment policy of the agro-industrial complex.

Keywords: Agro-industrial organizationsstrategic economic security

Introduction

All this is necessary to create and implement a model for ensuring security of the investment policy of the agro-industrial complex (ESIPAC), especially in conditions of closure of borders with other countries and a need to provide food from domestic agricultural reserves.

At the same time, the key principles of testing the model for ESIPAC are:

- determination of a temporary implementation period with possible adjustment;

- choice of the testing methodology (definition of the method in the process of testing: expert methods, extrapolation, modeling, systematization of information);

- the scientific validity of testing (the model for ensuring strategic economic security should be supported by scientifically based conclusions and calculations);

- the principle of systematic testing (interconnection, inter pervasion and subordination of the developed model of the economic security strategy and the forecast of changes in external conditions);

- the principle of variability (development of alternative options for the future state of the strategy based on scenarios for the development of the agro-industrial complex).

Discussions

Thus, the testing of the model for ensuring the policy of innovation and investment economic security of agricultural organizations is carried out on the basis of the use of modeling methods, forecast scenarios and managerial components. The model should take into account external parameters affecting the development of agriculture, such as inflation, GRP growth rates, consumer price index, quarantine measures, the period of their implementation. The model should be developed in conditions of a logical interconnection of indicators based on correlation and regression analysis, taking into account balance ratios and development scenarios. Based on the finished model, forecasting and planning estimates are identified. The presented principles cannot be implemented without using existing approaches. It’s essential to study them.

The process approach is aimed at examining approbation of the strategic economic security model as a set of consecutive directions, implementation of which ensures achievement of target goals to reduce the risk level of the enterprise and ensure its economic security. The process of testing the model for ensuring security includes identifying the components of this security, developing a strategy, evaluating it, choosing the means and technologies for influencing the associated risks, taking into account factors that can change the implementation of the strategy and evaluating the effectiveness of risk management measures.

The quantitative approach involves testing the model for ensuring strategic economic security by assigning quantitative values to selected variables. This allows to objectively compare and describe each variable and the relationship between them.

The systematic approach involves presenting approbation as a whole created from potential and existing risks, measures to reduce them, determine the links between them, creating integrity and unity of directions of the policy of economic innovation and investment security, building them in a structure and hierarchy with relative independence and clearly defined management.

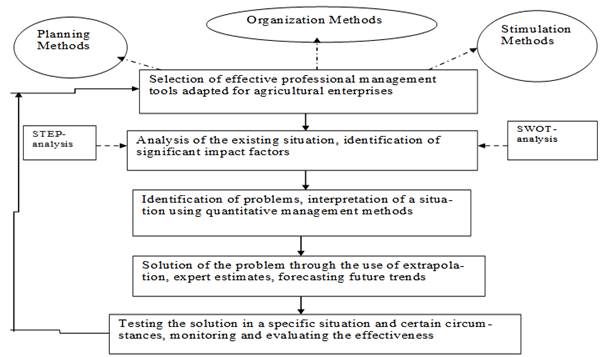

The situational approach expands the practical application of control theory by defining the main internal and external variables that affect the organization of the agro-industrial complex. According to this approach, it is necessary to analyze a specific situation and think situationally, that is, so it is impossible to use just one method of testing. The methodology of the situational approach can be explained as a four-step process (Figure

Materials and methods

Situational forecasting and testing involve a description of how to adapt an agricultural enterprise to specific requirements, how to mark changes and make permutations in the most rational and painless way, how to create and develop adaptive potential. It denies existence of universal approaches to management, the presence of generalized, comprehensive principles of construction and implementation management. The methodology for approving management policies can be based on the following methods.

1. The methodology for assessing strategic risk management developed by Rabyko (2015), which involves the selection of information for the formation of evaluation criteria; development of criteria for assessing strategic risk, assigning points to each criterion on the basis of professional judgment and a point grading, recalculating each quantitative criterion into points for comparability of the use of criteria, calculating the final value of the assessment; assignment of the calculated assessment to one of the ranges, determination of the degree of bank strategic risk management efficiency, development of measures to improve the bank's strategic risk management system.

2. Methods for assessing corporate governance risks, developed by Brunswick UBS Warburg in 1999, were published in the analytical report “Assessing the Risk of Corporate Governance in Russia” (Ivanova, 2013; Melnikova et al., 2019; Shokhnekh et al., 2020). According to these methods, ranking is based on an analysis of the real and potential risks of corporate management in the organization which is being studied. All risks associated with corporate governance are divided into eight categories and 20 subcategories, each of which corresponds to a clearly defined risk factor and instructions for its use. Evaluation of each type of risk is carried out by giving penalty points. The higher the rating of a corporation in terms of the total score is, the greater the degree of risk and, therefore, the lower the level of corporate governance (Gomayunova et al., 2019; Merzlikina & Timofeev, 2006).

If the company received more than 35 penalty points in the rating, this indicates an extreme risk, and companies with less than 17 points are relatively safe. But when rating agricultural enterprises, it is necessary to pay attention to the specifics of the agro-industrial complex.

The analyzed methods make it possible to evaluate the company’s management policy taking into account the influence of risks and factors of the external and internal environment, which require adaptation when forming a model for ensuring the strategic economic security of the innovation and investment policy of agro-industrial organizations.

The research part

The policy of investment economic security in the field of agriculture is aimed at maintaining economic security by means of implementing the innovation and investment strategy.

The main economic and internal factors hindering innovation, especially in the context of the global pandemic, remain a lack of own funds, high cost of innovation, high economic risk, and a poorly developed institutional environment. Therefore, the development of science and innovation in the agricultural sector is one of the main directions of the state agrarian policy, which is reflected in the concepts of modern economic policy, as well as in the investment policy (Volodina, 2015).

To ensure economic security in the formation of investment policy in the agricultural sector while building a model, it is necessary to develop human resources for the agricultural area. However, this issue is difficult to solve since most of the workforce seeks to find work in the city.

Investment development in agricultural production is ensured by the integrated use of foreign equipment and technologies. Let us single out several goods in demand, in which large sums of money are most often invested:

1. Supply management technology;

2. Robots and various equipment;

3. Farm management, sensors and IoT;

4. Biotechnology.

Due to the global pandemic one of the most effective method for the development of agricultural enterprises is to use to the limit the capabilities of scientific and technological progress and for the real sector of the economy to aim at the innovative development (Tkach & Gabdullin, 2012).

Achieving sustainable growth of agricultural production in the region, increasing the competitiveness and investment attractiveness of the agricultural sector of the region is possible only through the introduction of advanced achievements of science and technology. As we see in Russia there have been created necessary reserve stocks of raw materials and products. In the case of even the most severe restrictive situations such stocks will ensure that domestic consumption is provided with everything needed.

Today the marketing side of the investment policy in the agro-industrial complex has suffered greatly. According to RBC (2020) a real disaster occurred in the field of offline marketing. Event marketing fell due to the total ban on mass events; consumer promo dropped to zero due to sanitary restrictions and the current market situation; sport marketing decreased by 80%; production decreased by 80%; trade marketing so far experienced a reduction to 30%; creative services were faced with 50% reduction”.

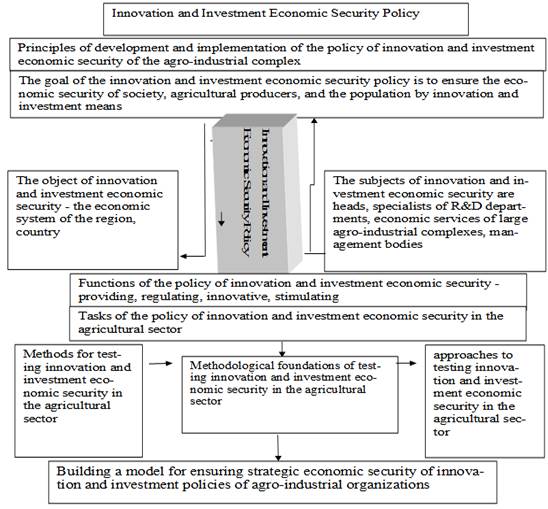

It’s vital to consider the components of investment economic security in the agricultural sector (Figure

In figure

Table

Effective part

According to the Table

Stage 1. Expert assessment on the importance of indicators of ESIPAC based on statistics and monitoring data of agricultural enterprises.

Stage 2. Analysis of evaluation results and calculation of the implementation level of directions of ESIPAC with the identification of development problems.

where

aij– importance of i-direction of ESIPAC of j – agricultural enterprise;

bij – expert evaluation of implementation efficiency i- direction of ESIPAC of j – agro-industrial organization;

Сj – actual integral assessment of ESIPAC of j – agro-industrial organization

where

Сjmax – the highest possible integrated assessment of ESIPAC of j – agro-industrial organization

bimax = 5 — the highest possible assessment of ESIPAC of j – agro-industrial organization.

where

Кj - coefficient characterizing the level of ESIPAC of agro-industrial organizations

where

K

i=1 to n — number of directions of ESIPAC

j=1 to m – number of analyzed agricultural organizations

Stage 3. Identification of problems of testing the model for ESIPAC.

Stage 4. Conducting corrective actions and selecting directions for further development based on the analysis of opportunities, threats, and risks.

Conclusion

Thus, in order to attract investment funds in the agricultural sector, it is necessary to stabilize the financial sustainability of domestic agricultural producers, as well as creating a competitive environment in the lending market for farmers. All efforts should be directed to the development of online marketing. The losses incurred in the agro-industrial complex due to the pandemic will be returned in a period longer than one year in order to achieve pre-crisis results.

Acknowledgements

The reported study was funded by the Russian Foundation for Basic Research grant No. 19-010-00985 A. “Development of innovative and investment policy as a concept of strategic economic security of agricultural organizations in the conditions of the modern technological transformation”

References

- Gomayunova, T. M., Melnikova, Y. V., & Shokhnekh, A. V. (2019). The structure of the innovation and investment policy of the agro-industrial complex in the context of the cycle development of the economy: monograph. Audit and financial analysis, 4, 156-159.

- Ivanova, E. A. (2013). Assessing the quality of corporate governance of industrial companies. Bulletin of the North Ossetian State University named after K. L. Khetagurova, 1(23), 239.

- Melnikova, J., Shokhnekh, A., & Gomayunova, T. (2019). The concept of managing the innovation and investment policy of the agro-industrial complex in the conditions of cycle development of economies. Audit and financial analysis, 5, 132-137.

- Merzlikina, G. S., & Timofeev, A. A. (2006). Methods for assessing the effectiveness of managing corporate structures. Bulletin of the Volgograd State Technical University, 7(23), 106.

- Rabyko, I. N. (2015). Methodological foundations of identification and control of strategic risk of a bank. Bulletin of the Belarus State Economic University, 2(109), 79-86.

- RBC. (2020). https://www.rbc.ru

- Shokhnekh, A. V., Agapov, S. Y., Melnikova, Y. V., Mironova, I. B., & Matvienko, K. V. (2020). The Genesis of Innovation and Investment Policy in Terms of Technological Transformation of Agricultural Organizations. E3S Web of Conferences, ICEPP-2020, 161, 01104, 8.

- Tkach, A. V., & Gabdullin, R. R. (2012). Marketing in the activities of agricultural cooperative organizations. Fundamental and applied research of the cooperative sector of the economy, 4, 63-69.

- Volodina, S. O. (2015). Priority areas for the development of the innovation and investment process in agricultural organizations. National interests: priorities and security, 41(326).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

08 March 2021

Article Doi

eBook ISBN

978-1-80296-102-7

Publisher

European Publisher

Volume

103

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-644

Subjects

Digital economy, cybersecurity, entrepreneurship, business models, organizational behavior, entrepreneurial behavior, behavioral finance, personnel competencies

Cite this article as:

Gamayunova, T. M., Shokhnekh, A., Melnikova, Y., & Agapov, S. Y. (2021). Methods Of Testing The Model Of Investment Policy Of Agricultural Organizations. In N. Lomakin (Ed.), Finance, Entrepreneurship and Technologies in Digital Economy, vol 103. European Proceedings of Social and Behavioural Sciences (pp. 273-280). European Publisher. https://doi.org/10.15405/epsbs.2021.03.35