Abstract

The socio-economic space of the Russian Federation is heterogeneous both in terms of economic development and living standards. There are many large and small territorial entities located on the territory of the state, in which the most acute are economic, demographic, ethnic, geopolitical and other problems. Of these, the largest number are subsidized and depressed regions, which have a serious negative impact on the development of the entire economy. Developing a methodology for bringing such regions out of the backlog is an important task. Despite considerable attention from Federal and regional authorities to the strategic planning of regional development, the level of development of the methodology of this process remains insufficient, in particular, in the scientific literature and practice of the subjects of the Russian Federation there is no unified approach to the essence and content, structure of the territory development strategy, the principles and logic of the development of forecast and analytical documents are not defined.

Keywords: Socio-economic developmentdevelopment strategyeconomic transformationnational security

Introduction

Regions develop sequentially and consist of certain elements. The combination of these elements leads to the appearance of new qualities.

It should be noted that the system can be structured in parts, and it is also possible to apply a multidimensional approach to parts of the hierarchical structure (performers, methods of work, information, etc.). In this part of the system, they differ in the degree of stability in time and space, and are characterized by their behavior and status (Budget code of the Russian Federation No. 145, 1998; Raizberg et al., 2007).

Research on the scientific foundations of the stability of socio-economic systems has shown that the sustainable development of regions is ensured by achieving social and economic stability, the systematic development of productive forces and social relations, providing conditions for material well-being, spiritual development and social self-realization of people, preserving and rational use of the environment without compromising the interests of future generations.

Methods

The problems of studying the level of socio-economic development of regions are covered in the works of many scientists, such as A. G. Granberg, T. G. Morozova, B. L. Leksin, A. N. Shvetsov, A. L. Gaponenko, V. G. Polyansky, and others. This issue is given an important place, since improving the level and quality of life of the population is not possible in the absence of economic growth, in turn, a low level of social development negatively affects economic development.

The influence of certain factors on the economic characteristics of regions was considered in the works of V. p. Zhdanov, D. S. Lvov, A. G. Porshnev, Yu. N. Persky, and others. However, there is currently insufficient elaboration in the direction of quantitative interrelation of factors of socio-economic development.

The theoretical and methodological basis of the research is the works of domestic and foreign scientists, which reflect the problems of socio-economic development of regions and their deep differentiation.

The research is based on system, process and strategic approaches. The application of a systematic approach has ensured the need to consider regions as a set of complex, heterogeneous and dynamic components in the system-forming structure of the economy and its management, with a clear justification for the resource, material, organizational, personnel, financial and investment support for regional development. The study of regional development from the point of view of the process approach allowed us to analyze the structure of regional processes, to study the features, forms and directions of relations between processes and their groups. The strategic approach has provided justification for the development of mechanisms for self-determination of regional socio-economic systems in the external environment, which focus the strategic settings of systems on development, rather than solely on growth, in addition to managerial rationalism associated with the identification of internal reserves of economic growth based on improving the efficiency of the use of all types of resources.

To achieve the required quality of work, the following methods were used: methods of strategic planning; method of expert assessments; methodological approaches to welfare Economics, neo-institutional Economics; method of comparative dynamics; economic and mathematical method; statistical methods; complex-target method.

The basis for further evolutionary development of the regional socio-economic development management system should be based on new flexible regulatory mechanisms that provide the possibility of self-development of the territory based on the use of competitive advantages and access to self-sufficiency. Among them are: providing greater independence in the formation of the regional budget; developing inter-budgetary relations; using Federal and regional property, land; developing direct international economic ties, etc. To solve these problems, the present study clarifies and justifies methodological approaches to smoothing regional disparities based on the context of their self-development (Danilov et al., 2017a; Sokolov, 2016).

Results

Within the framework of geopolitical reasoning, the international system is built under the influence of the processes of interaction of sovereign States in conditions of chaos. Therefore, it should be noted that the international system is the result of a collision of geopolitical strategies of different States aimed at establishing a certain way of life or order and is accompanied by such a phenomenon as international cooperation.

Today, among the geopolitical processes that affect the international order, we can distinguish the globalization of the world economy, international integration, and regionalization. It is also important to note that international relations at the present stage are being transformed from traditional relations between sovereign countries into more complex, complex and multi-level systems of relations (Danilov et al., 2017b; Tumanov & Urusova, 2014).

Among the prerequisites for international cooperation between Russia's regions, the geographical principle stands out in particular. Russia has more neighbouring States than any other country, namely, 16 countries border Russia in one way or another. Moreover, the simultaneous location in two parts of the world makes the geographical aspect decisive.

Along with the unique geographical characteristics, the national aspect of the international activities of Russian regions is of great importance. The administrative structure of the Russian Federation provides for the existence of subjects formed on a national basis. International cooperation in this area is focused on interaction with national diasporas and faiths in other countries.

Historically, some regions of Russia include those that already have potential partners abroad, such as the regions of the Far East and Japan, Tatarstan and Turkey, as well as other countries of the Islamic world, historical ties between Karelia and Finland, etc. In General, the traditional partners for the regions of the Russian Federation are the countries of the near abroad that have preserved economic ties since the existence of the Soviet Union. Such communications require support and deepening, comprehensive development, which requires a moderate decentralization of international relations (Dikinov et al., 2016; Nikonorov, 2016; Social Atlas of Russian regions, 2020).

Subjects of the Russian Federation, in General, have no special restrictions and actively participate in foreign economic activity from the positions of their interests. However, there is no agreement among the heads of regions on the need to expand international cooperation. Some regions are in favour of expanding and opening borders, while others are aimed at narrowing or even tending to close borders, so this issue has not been resolved in a clear way.

Regional external relations are carried out through interregional agreements, which play an important role in the comprehensive development of the regions. Within the framework of such agreements, cooperation programs in the field of joint production and other forms of relationships are formed, supervised by special bodies.

The largest number of agreements are usually developed in all respects donor regions with strong export potential. The cities of Moscow and Saint Petersburg are the leaders here, and Tatarstan signs direct contracts with foreign countries. Tomsk region has interregional relations with French Lorraine in the area of establishing cooperation between enterprises. In General, the geography of relations is mainly historical and extends to the former republics of the Union. There are also extensive contacts with foreign countries, such as China, France, Finland, Germany, etc. (Gumerov et al., 2016; Progunova et al., 2018)

At the same time, the sphere of foreign investment remains one of the least protected by Federal and regional authorities. This is due to the fact that polarization in Russia is characterized by a lack of proportionality, invariance and immutability at the regional level of development, due to the widespread and continuous transformation of most socio-economic indicators.

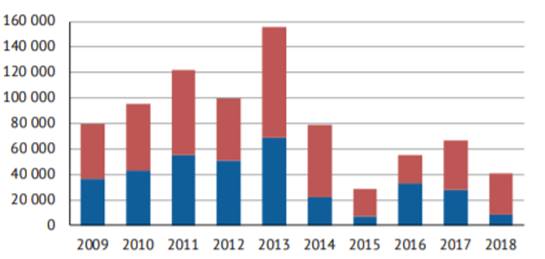

According to the Central Bank of Russia, in 2018, the outflow of foreign direct investment from the capital of Russian companies amounted to $ 6.46 billion. However, the global average is also characterized by a 19% decrease in capital investment. The inflow of foreign investment to Russia is complicated by the presence of political risks. In General, the indicators of foreign direct investment decreased by more than three times compared to 2017. This indicates a decrease in the investment attractiveness of Russian economic entities, which is due to the unforeseen consequences of the US and EU sanctions policy, as well as a drop in demand for Russian government bonds in 2018 (Figure

Foreign direct investment is distributed very unevenly across the territory of the Russian Federation, which is related to the volume of the gross regional product (GRP) of the Russian regions. According to available data, at the beginning of 2019, out of 36.5 thousand Russian enterprises with a foreign owner, the largest share was in such regions as Moscow, the Moscow region, Saint Petersburg and the Leningrad region.

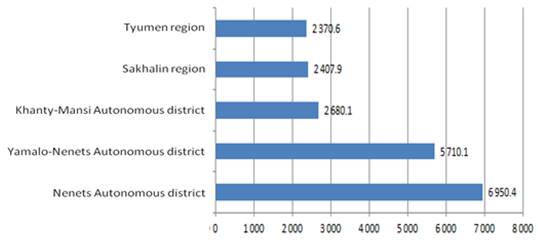

Socio-economic problems and sharp differentiation of regions within the country, which have become more acute during Russia's transition to market relations, are manifested primarily in the low value of the indicator of the volume of gross regional product (GRP) per capita (Figure

In turn, the polarization of socio-economic development of regions inevitably leads to uneven distribution of foreign investment among the subjects of the Russian Federation, including in the Central Federal district, where there is the greatest localization of investment by region (table

In practice, inter-budgetary relations can be used as a tool to equalize the asymmetry of territorial development, and to Finance the deficit of regional budgets, without changing their proportions in socio-economic development. The experience of using Federal targeted programs to attract financial resources to certain regions has not led to significant changes in the overall picture. Due to significant disparities in the development of Russian regions, a more detailed program of state regulation is needed in relation to subsidized and depressed regions. Accumulated experience in foreign countries shows that developed countries in the market relation widely use methods of state influence on the economic development of their territorial units. Despite this, the widely presented analysis in the domestic literature of the experience of state regulation of foreign countries in relation to overcoming territorial disparities, as well as domestic research in this direction, shows that there are many unresolved problems.

In this regard, scientific developments in this area should be continued, since overcoming the asymmetry of regional development is crucial for the state system. All opportunities and resources are at the disposal of the state. It is only necessary to develop a state regional strategy for managing the socio-economic development of backward regions, where the key element is the issues of budget and tax regulation.

A unified political space, a stable society and a developed economy are impossible without solving the problem of subsidized and depressed regions. Among the main reasons for the asymmetry of regional development, we can distinguish, first, the transition from one economic system to another and the resulting long-term cyclical crisis phenomena. Over the past 20 years, Russia has significantly lagged behind in terms of the development of production factors and has ceased to meet modern requirements of STP, the level of industry diversification has decreased. Secondly, as a result, there was a long demographic crisis and mass migration of the population, which led to overpopulation of some territories and to the devastation of others. All this is compounded by extremely unfavourable climatic conditions (Marcon & Puech, 2017; Tumalanov et al., 2017).

Economic problems in certain regions are specific, so approaches to solve them can be very diverse. In developed countries, among the most applicable instruments of state influence is the use of fiscal policy.

The mechanisms for such a policy can be presented in the form of special budgetary regimes and methods of normative calculation. With the help of special budget regimes, a certain investment climate is created to activate private investment initiatives and attract foreign capital. The methods of normative calculation include the transfer policy of the state. The Arsenal of applying the methods of the budget mechanism is laid down in the country's development strategy and depends on the problems on the ground.

Within the framework of the transfer policy, problems of budget differences are solved manually, which makes it possible to maintain the balance of the tax base of the regions. This takes into account the need for finances of the territory, and provides state guarantees for the provision of a certain standard of services to the population, depending on the place of residence. Transfers can also be targeted and directed to specific tasks. The experience of advanced countries shows the effectiveness of equalizing and targeted transfers.

Budget revenues of the Russian Federation in 2019 sharply decreased in 4 regions of the Russian Federation, in the Khanty-Mansi Autonomous district, Kemerovo region, the Republic of Khakassia and Sevastopol. The highest growth in income can be noted in the Chukotka Autonomous district (+ 55%), the Sakhalin region (+29%), the Jewish Autonomous region (+25%), the Amur region (+24%), and the TRANS-Baikal territory (+23%).

According to the law on the budget for 2020, the volume of transfers to the subjects of the Russian Federation should increase almost 4 times. In 2019, gratuitous receipts increased by 14% overall.

Almost twice the volume of transfers increased in the Chukotka Autonomous district, which amounted to about 37.5 billion rubles. The Nenets Autonomous district (+75%) and the Jewish Autonomous region (+45%) also see a high growth in gratuitous receipts from other budgets of the budgetary system. Transfers increased in the Irkutsk region (by 43%), the Vologda region (by 42%), and the city of Baikonur (+39%). These regions are difficult to classify as problematic, since the distribution system is not transparent and operates on the basis of lobbying.

The reduction in transfers is observed in 5 regions. The decrease occurred in the Kaluga region (by 17%), Sevastopol (-10%), the Republic of Tatarstan (-2%), and the Astrakhan region (-2%).

It should be noted that transfer payments were more often reduced in the richest (oil-producing) and highly-subsidized regions. The increase occurred mainly in regions with a stronger economic downturn and / or more acute budget problems (Central, Volga, and Siberian Federal districts).

Despite the fact that the regions have expanded their rights to use the received funds and sources of income, in the conditions of macroeconomic instability, tax revenues are reduced, and the subjects will not be able to concentrate enough financial resources for their investment projects.

Incentive measures need to be further improved, including by reducing the centralization of Finance. It is necessary to strive for conditions when incentives become endogenous rather than exogenous. Moreover, it is necessary to correct not only the measures of budget redistribution, but also the taxation system, where it is necessary to expand the tax means of stimulating the investment process.

To stimulate the development of subsidized and depressed regions, it is necessary to look for internal regional reserves for the growth of tax revenues, as well as local budgets. Tax policy in Russia is primarily fiscal in nature, while the incentive function of taxes is not fully engaged. The reform of the tax system should be directed towards reducing the tax burden on the economy and thus stimulate economic growth, and the reduction in tax revenues should be compensated by the tax base.

All world practice clearly shows that increasing investment flows in the economic system is impossible without the use of an indirect and effective tool of public administration, such as taxation. The issue of accelerating economic growth is on the agenda in Russia. This process in developed countries was accompanied by the provision of tax incentives for industries that were considered priority for national economies. Reasonable tax policy during recessions has always been based on the introduction of incentives for investors and reducing the tax burden on the population in order to maintain effective demand (Li & Zhang, 2014).

However, it should be noted that in Russia in recent years there has been a growing trend of investment in fixed assets, but their ratio to GDP remains low. The problem of insignificant rates of renewal of fixed assets in industries that are basic in industry has become a nuisance. Therefore, to create investment incentives in the economy, tax incentives are needed for industries and regions where investments are made in the real economy. But at the same time, the equalization policy will act as a disincentive factor and put at a disadvantage the regions-the locomotives that bear the main tax burden (Kontokosta, 2018).

In our opinion, the improvement of tax mechanisms should go the way of rationalization and increasing the efficiency of tax administration through the introduction of IT technologies, reducing tax reports and simplifying them, and entering into partnership relations between the state and tax agents in the field of tax relations. This way can significantly reduce the transaction costs of tax control. However, the theoretical and methodological issues of tax incentives for investment are not well developed, which determines the relevance of the research in this direction.

Conclusion

A crucial role in strengthening the regulatory function of the tax system, for the purpose of equalizing the socio-economic development of regions, belongs to measures to encourage investment activities of tax agents who make the largest deductions. This requires identifying the nature of the impact of taxes on investment activity in the economy as a whole that will allow to systematize used in Russia methods of tax regulation and to develop a system of measures stimulating investment for the purpose of overcoming of asymmetry of development of economic space of Russia.

Today, two different vectors prevail in the field of economic regulation. On the one hand, the state seeks to balance the budget and reduce the deficit with the help of taxes, and on the other hand, there is an acute problem of increasing production efficiency, eliminating asymmetries in the development of the territory and, which is particularly important for society, improving the standard of living of the population. The regions ' transition from security balancing to development depends on searching for internal reserves of tax revenues.

It is necessary to identify unused sources of increasing tax revenues to regional and local budgets, as well as develop measures to improve the regulatory framework. It is from solving these tasks that we can significantly increase the revenue part of the budgets of regions and municipalities, which will allow the authorities to fulfill their obligations.

Acknowledgement

The reported study was funded by RFBR, project number 20-010-00683.

References

- Budget code of the Russian Federation, 145-FZ, part 1. (1998, 31 July). http://base.garant.ru

- Danilov, I., Ladykova, T., Morozova, N., & Ilyina, E. (2017a). State policy of staffing of global reindustrialization of national economy. Phil. Journal of advanced research in law and economics, 1-8, 18-22.

- Danilov, I., Ladykova, T., Morozova, N., Ilyina, E., & Nikiforov, Y. (2017b). Re-industrialization and innovative development of Russia. Phil. Journal of advanced research in law and economics, 2-8, 437-443.

- Dikinov, A., Ivanova, Z., & Shevlakov, V. (2016). Mechanisms of development of industrial sectors in the development of the Russian economy and its regions. Phil. Izvestiya of Kabardino-Balkar scientific center of RAS, 2(70), 70-77.

- Gumerov, A., Ladykova, T., Minsabirova, V., Temirbulatov, R., Makhotkina, L., Mitrofanova, M., Litvinova, E., & Kharisova, G. (2016). The analysis of regional development on the basis of corporate structures’ activity. Phil. International review of management and marketing, 1, 101-105.

- Kontokosta, C. E. (2018). Urban informatics in the science and practice of planning. Journal of Planning Education and Research, 0739456X18793716.

- Li, B., & Zhang, J. (2014). Subsidies in an economy with endogenous cycles over investment and innovation regimes. Phil. Macroeconomic Dynamics, 6, 1351-1382.

- Marcon, E., & Puech, F. (2017). A typology of distance-based measures of spatial concentration. Phil. Regional Science and Urban Economics, 62, 56-67.

- Nikonorov, S. (2016). From strategy of social and economic development to strategy of sustainable development of regions of Russia. Phil. Management and business administration, 4, 28-35.

- Progunova, L., Satsuk, T., Slavin, A., Veynbender, T., Perova, A., & Sokolova, G. (2018). International standards of the public sector financial reporting in ensuring economic security. Phil. Revista Publicando, 18-2, 330-340.

- Raizberg, B., Lozovskiy, L., & Starodubtseva, E. (2007). Modern economic dictionary. INFRA-M.

- Social Atlas of Russian regions. (2020). http://www.socpol.ru/atlas/overviews/social_sphere/kris.shtml

- Sokolov, A. (2016). Model of management of sustainable balanced development of the region. Phil. Scientific review, 5, 68-76.

- Tumalanov, N., Tumalanov, E., & Ivanov, V. (2017). Conditions of implementation of key factors of creation of competitive advantages on new growing markets. Phil. Eurasian Journal of Analytical Chemistry, 5b, 735-740.

- Tumanov, N., & Urusova, N. (2014). Impact of economic interests and institutional structures on economic development. Phil. Bulletin of Chuvash University, 1, 245.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

08 March 2021

Article Doi

eBook ISBN

978-1-80296-102-7

Publisher

European Publisher

Volume

103

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-644

Subjects

Digital economy, cybersecurity, entrepreneurship, business models, organizational behavior, entrepreneurial behavior, behavioral finance, personnel competencies

Cite this article as:

Gazieva, L. R., Magomaev, T. R., & Magomaeva, L. R. (2021). The Impact Of E-Commerce On The Digital Economy. In N. Lomakin (Ed.), Finance, Entrepreneurship and Technologies in Digital Economy, vol 103. European Proceedings of Social and Behavioural Sciences (pp. 121-126). European Publisher. https://doi.org/10.15405/epsbs.2021.03.16