Management Of Idea-To-Product Process For Successful New Product Development In Pharmaceutical Industry

Abstract

Increase in world population, changes in disease burdens, creation of new treatment methods, growing interests and quality expectations are enhanced the need and demand for health services and medicine. However, developing original medicines is a challenging and expensive process. For that reason, generally generic drug development activities are carried out in Turkey. On the other hand, technological infrastructure of pharmaceutical industry in Turkey has been strengthened by making the necessary investments in the "Good Manufacturing Practice" framework, which is determined by the World Health Organization. Therefore, the sector has reached a comparable technological level with European countries and nowadays become an important and growing market position. In this study, to examine the process from idea to launch, Abdi İbrahim Pharmaceutical Company's new product development model has been selected and the steps of the model have been defined. Main aim is to examine and evaluate the impact of successful management of the model on the success of new product development which depends on reliability, quality, efficiency, sustainability and profitability. Study revealed that the success of new product development highly depends on not only the effective management of the process but the interdepartmental integration and the value attached to information technologies.

Keywords: New product developmentmanagementpharmaceutical sector

Introduction

Medication is a basic health-related product used in the treatment, prevention, or diagnosis of diseases and is subject to extensive research and strict controls prior to its launch and approval by authorized parties. New drugs based on a patented molecule that has never been considered before are regarded as "original (reference) drugs". On the other hand, "generic drug" refers to products that have the same pharmacological properties as the original drugs and that have been proven by scientific studies to provide the same treatment and can only be introduced after the patent expiry of the original drugs. Alfonso-Cristancho et al. (2015) stated that, in today’s world over the half of total pharmaceutical products is represented by generic pharmaceutical products. Although proportions can vary by region and country (Gorokhovich et al., 2013), it is known that generic drugs are cheaper in the market due to being much less costly than the original drugs, as well as being beneficial to society and economy in terms of easy accessibility, increasing investment and employment.

Shah (2004) stated that the pharmaceutical supply chain used to be seen as a tool to supply products to market in an effective way however rapid changes in the markets directly changes the business models. Therefore, companies should determine new ways of extracting additional advantages so supply chain in the pharmaceutical sector cannot be considered as a simple process distribution. Companies should focus on a value-chain perspective to manage innovation and development. The value chain of the pharmaceutical sector covers the process from production to sale of the drug (Pharmaceutical Research and Manufacturers of America, 2007). During this process, there are several steps such as obtaining the license of the drug following the R&D activities, production, delivering the new drug to the customer through marketing and entering the market in large quantities using sales / distribution channels if positive feedback is received. However, in order to produce both original and generic drugs, R&D activities is the most important part of the value chain and should be given importance since highest added value and the most costly activities are R&D activities. Additionally, context of the pharmaceutical industry changes day by day because of the shortening of patent life periods, generic competition and public health policies (Sousa et al., 2011) thus the importance of R&D activities increase day by day.

Problem Statement

In pharmaceutical sector new product development is considered as a common strategy to overcome the rapidly changing business environment conditions and to survive among competitors (Yousefi et al., 2017). However, almost half of the resources that are used by the companies for new product development are spent on products that may fail (Yousefi et al., 2017) since the development of an original drug is based on clinical trials. One of the most common way to test new methods in terms of diagnosing, treating or preventing health conditions is the clinical trials. The aim of them is to determine whether the new molecule is safe and effective (Pharmaceutical Research and Manufacturers of America, 2007). Drugs, drug combinations and new uses for existing drugs are evaluated through clinical experiences (Revathi, 2015). The process of developing an original drug consists of 4 basic steps (Meadows, 2002). Determination of target, biosynthesis of candidate molecules or obtaining by natural means,

Pre-clinical studies,

Clinical studies,

Approval and licensing.

At the initial stage of the process, there may be thousands of compounds with potential for development as medical treatment. However, only a few of the thousands of compounds after testing can be promising and may require further study. After identifying a promising compound for development, researchers conduct experiments to gather information such as potential benefits and mechanisms of compound, how the compound interacts with other drugs and treatments, optimal dosage for compound and etc. Before testing a drug in humans, researchers must find out whether the compound concerned has the potential to cause serious harm, also called toxicity. These information about toxicity levels, dosages etc. should be provided by preclinical studies thus, after preclinical testing, researchers review their findings and decide whether the drug should be tested in humans.

While preclinical research answers basic questions about the safety of a drug, clinical studies are used to investigate the ways in which the drug interacts with the human body. Clinical research refers to studies or trials in humans and includes 4 phases (Meadows, 2002).

Phase 1: This step covers several months of studies to determine the safety and dosage of the compound by testing 20 to 100 healthy volunteers or people with disease / condition. Generally, after Phase 1, about 70% of the drugs proceed to the next step.

Phase 2: It covers studies that last several months to 2 years to determine the efficacy and side effects of the drug by testing the drugs that successfully pass phase 1 on target patients of several hundred people or people with disease potential. Approximately 33% of the drugs proceed to the next stage.

Phase 3: It covers 1 to 4 years of testing to determine the efficacy and follow-up of drug adverse reactions by testing 300 to 3,000 volunteers. Approximately 25-30% of the drugs proceed to the next stage.

Phase 4: It covers a wide range of studies conducted with thousands of volunteers with disease or disease status to determine the safety and efficacy of drugs that successfully pass phase 3. Drugs that successfully pass phase 4 are included in the licensing process.

Safety, efficacy and quality at the licensing stage are the three main criteria that are taken into account by health authorities around the world. All the information obtained from pre-clinical and clinical studies related to the safety and efficacy of the drug at the licensing stage is summarized in a file called short product information. The potential benefits and risks of the drug are presented with a relatively small sample (4,000 - 5,000 subjects), given the availability of a drug that will be available worldwide (Meadows, 2002). Because of this limitation, drug safety is not as clear as the criteria for efficacy and quality. Authorizing a drug means that the drug has a satisfactory benefit-risk ratio under the conditions defined in the short product information. In other words, at the stage of licensing, the health authority only checks whether the safety of the drug is within acceptable limits. Therefore, surveillance that begins during the drug development process has to continue throughout the duration of the drug's stay in the market. Pharmacovigilance systems are also designed to collect this information and continuously assess drug safety.

The main purpose of the new product development process is to determine the specifications of the product and to identify the processes necessary for the development of the product in compliance with the regulations and quality requirements (Pharmaceutical Research and Manufacturers of America, 2007). In order to achieve the desired product quality, it is necessary to identify possible critical product properties and identify potential critical impacts that may have an impact on the product formulation, production process or product packaging. Furthermore, the laboratory-scale production process and formulation needs to be improved to ensure the desired quality characteristics and product stability. Processes must be moved from laboratory scale to industrial scale dimensions with specific process control and, where possible, with the design area of critical process parameters. Necessary controls should be performed to monitor the product throughout the life cycle, keep it under continuous improvement and ensure its stability (Revathi, 2015).

Research Questions

Developing original medicines is a challenging and expensive process (DiMasi et al., 2003). Even a pharmaceutical company with the fastest, highest production capacity and workforce can only apply for one or more licenses per year. For each drug that comes to the marketing stage, about 10,000 molecules are abandoned until the final stage. One or more of these molecules can be tested in the human body. Developing an original drug requires about 12-15 years and $ 500-800 million (DiMasi, 2001; DiMasi et al., 2003). Due to this long and expensive process, in Turkey generally generic drug development activities are carried out instead of the original drug development activities.

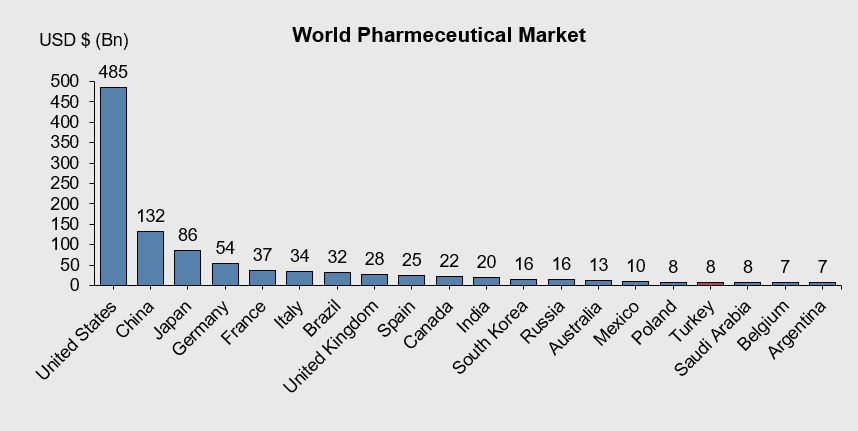

According to the 2019 data of Pharmaceutical Industry Employers Union (IEIS), considering the magnitude of the global pharmaceutical market, Turkey is in the world's 17th largest pharmaceutical market position as it is stated in Figure

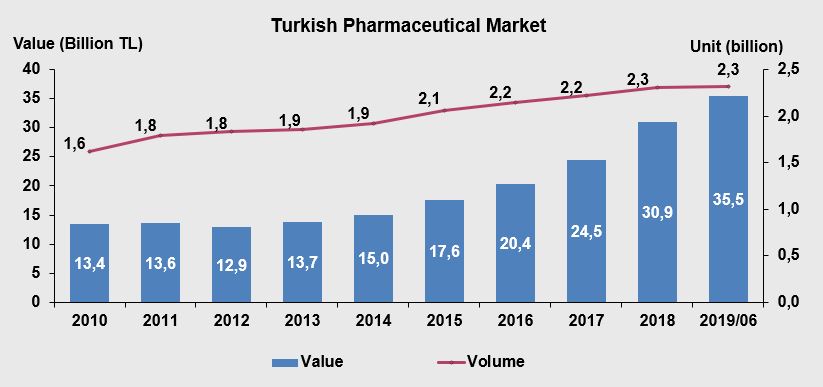

When the data of the last five years are evaluated, the pharmaceutical market grew by close to 60% by the end of 2016, while it was around 12.9 billion TL in 2012. In 2018, the growth of hospital and pharmacy channels of Turkish pharmaceutical market reached almost 30.94 billion TL (IEIS- Pharmaceutical Manufacturers Association of Turkey, 2019). In this regard, 2.30 billion unit sales is achieved which proves a 3.6% rose. From 2010 to 2018, the hospital market raised its value share from 7.5% to 13.5%. In unit terms, the hospital market, which had a share of 8.3% in 2010, rose to 13.3% in 2018. An analysis of the 9-year period between 2010 and 2018 indicates %131 increase in the market which reaches to 30.94 billion TL in 2018. Shifts in the sales volume towards higher-priced products, contributed 6.3 percentage points to growth (1,536 million TL). In 2018, a total of 444 new drugs were launched to the market, of which 418 are chemical and 26 are biotechnological products, and a contribution of 2 percentage points (483 million TL) was made to growth IEIS- Pharmaceutical Manufacturers Association of Turkey, 2019).

According to the industrial production index data in Figure

Analysis of IEIS data (2019) show that number of companies operating in the sector increased in nine years. Nowadays, there are 488 players in the sector and among these 130 of them are multinational companies. Of the remaining 358 companies which are local companies, 26 entered the sector in 2018. Within the span of nine years, market share also changes. In 2010, there are 50 companies which have 90% of the market share in total, however in 2019 the number of the leading companies is increased to 66.

Turkey's pharmaceutical sector has a significant share in the realization of innovation and industry transformation with 32 accredited R&D centres and 1.298 R&D employees as of May 2019. From 2010 to 2017, pharmaceutical R&D spending climbed from TL 92.1 million to TL 314.1 million on a 241% rise. This increase points to 92.3% real growth on a manufacturer price basis, and 19.1% CAGR. As of May 2019, there are 81 production and 11 raw material facilities meeting international standards (IEIS- Pharmaceutical Manufacturers Association of Turkey, 2019). Despite these developments, it is seen that Turkey is still under an innovation activity which is below its potential.

Strengthening state, university and sector cooperation and creating a culture that supports R&D and innovation can be listed as the first steps to be taken to overcome this deficiency. Republic of Turkey Ministry of Development aimed to reach a competitive position in the pharmaceutical field with "Structural Transformation Action Plan for the Health Industry" plan which is a part of the framework of "10th Development Plan" published in 2014. Moreover, it is aimed that Turkey will become a global pharmaceutical R&D and manufacturing centre in the long-term.

Purpose of the Study

New product concept; is a very comprehensive term that includes the original product, the improved product, the modified product. Regardless of the type, developing new products is a long-term and risky process for the company. The success of new products in pharmaceutical production depends on reliability, quality, efficiency, sustainability and profitability.

In this study, to examine the process from idea to launch, Abdi İbrahim Pharmaceutical Company's model “Efficient Management of from Idea to Launch Process” has been selected and the steps of the model have been defined (Abdi Ibrahim…, 2016a, 2016b). Main aim is to examine and evaluate the importance of the “Idea-to-product” process via focusing on the impact of successful management in terms of successful new product development. Study revealed that being successful in new product development in the pharmaceutical sector highly depends on not only the effective management of the process but also the interdepartmental integration and the value attached to information technologies.

Research Methods

Effective management model of idea to product process developed by Abdi İbrahim Pharmaceutical Company and model covers the process from the birth of the idea to the launch stage via detailing each processes for an effective management. Abdi İbrahim Pharmaceutical Company, is the largest player in the pharmaceutical industry among the six pharmaceutical company listed in Istanbul Chamber of Industry Top 500 industry company list. In this study, process were divided and examined into 5 main stages (Abdi Ibrahim…, 2016a, 2016b; Istanbul Chamber of Industry, 2018);

Stage I: The emergence of the idea

Stage II: Preparation and process of new product committee

Stage III: Preparation of registration application file

Stage IV: Licensing

Stage V: Launch

From the idea to the product process, the new product development process is a process involving various departments within the company, requiring professional knowledge and expertise in various fields. The purpose of the process; development of new products that meet the regulations and quality requirements accepted in the market within the given time and cost framework (according to the project plan), obtaining the license and placing it on the market.

Stage I: The emergence of the idea

It covers the process from the start of the new product idea to the Business Development and R&D evaluations. The critical success factor of this stage is the number of ideas serving strategic priorities. New product suggestions can be obtained from all internal and external sources, and there is no filtering about the flow of ideas. All suggestions received are transferred to the New Product Portfolio Manager, which works under the Business Development department, and the New Product Portfolio Manager saves all suggestions to the electronic information flow (eBA) system. Incoming new product proposals are evaluated. The products are categorized according to the expiration date of the original patent of the originator company and the data protection period. The New Product Portfolio Manager takes the status of proposal records which have 4 or more years before the expiry date of the patent, into “monitoring” status. In order to increase the frequency and quality of new product proposals, the following reports and workshops are regularly held.

Global Pharmaceutical Industry Report: Twice a year, Strategic Planning prepares and publishes a report that focuses on general trends and supports the development of new product ideas.

Pharmaceutical Industry Report for Turkey: Twice a year, the Sales Marketing Event prepares and publishes a report that focuses on general trends in areas where the company has and does not operate and supports the development of new product ideas.

Medical Information Systems New Product Ideas Workshop: A workshop is held once a year with the coordination of medical information systems consultants and Business Development with the participation of R&D, Sales & Marketing, Medical and Strategic Planning departments.

New Product Ideas Workshop for Prioritized Areas: Once a year, a workshop focusing on areas prioritized is organized with the participation of opinion leaders, under the coordination of Sales & Marketing Directors and with the participation of Business Development, R&D, Medical and Strategic Planning departments.

Workshop of Expired Patent New Products: The patent department scans molecules that have a certain amount of time left -4-6 years for Turkey, longer years for international markets- before the patent expires, especially for strategic priority areas. Business Development department organizes a workshop every 4 months with the participation of R&D, Sales & Marketing, Medical and Strategic Planning departments.

Stage II: Preparation and process of new product committee

It covers the stages from the medical evaluation to the creation of new product ideas and until the new product committee meeting. The critical success factor of this stage is the ratio of the recommendations submitted to the new product committee to the decision at once.

For new product proposals that are less than 4 years from the expiration of the patent, the New Product Portfolio Manager initiates the workflow through eBA. New product forms are sent to the R&D, Business Development, Medical and Regulatory Departments simultaneously to be completed within 2 weeks. For the products to be evaluated in the new product committee, the licensing periods foreseen within the framework of the prioritization rules of the Ministry of Health are obtained from the licensing directorate and project planning is shaped. After all new product related document are completed, at the new product committee meeting to be held in the following weeks, new product proposals are evaluated multi-dimensionally and the final decision is made.

The new product portfolio manager creates a new project in the system for each new product idea approved by the new product committee, saves the new product form as the first version, defines the project schedule, milestones, budget and team information received from the relevant units. The new product portfolio manager coordinates the project team and manages the entire process up to launch.

Stage III: Preparation of registration application file

It covers the steps until the projects approved in the new product committee are ready for the application for licensing. Critical success factors of this stage;

To be able to take the highest GMP inspection priority in the import projects approved by the new product committee.

Compliance with the project timetable decided at the first project management meeting.

There are three different process possibilities: Import, Technology Transfer and Abdi İbrahim development. Despite any changes in assumptions during these processes, a routine check is carried out every 6 months for all projects. In addition, project prioritization activities are carried out every 6 months with the guidance of Sales Marketing for the correct allocation of resources.

Monthly review meetings are held for all projects in the file preparation processes organized by AGS and R&D Director with the participation of R&D, HR, Licensing, Sales & Marketing, Finance, Domestic Technical Operations, Supply Chain and New product portfolio manager. Projects at critical stages are assessed, inter-departmental questions are answered / agreed and, if necessary, some projects may be prioritized due to changes in time plan, budget or quality.

Imported Product File: The file preparation process of the imported product is carried out by the Business Development Directorate. After approval of the new product committee, the terms of business are negotiated.

Technology Transfer Product File: The Business Development Directorate and the R&D Directorate carry out the process of technology transfer file preparation jointly. At the beginning of each technology transfer project, a start-up meeting is held with the participation of relevant persons from Business Development, R&D, Licensing and domestic Technical Operations departments. The R&D technology transfer and file preparation process is completed within 3-9 months and the file is forwarded to the licensing officer. Domestic Technical Operations accompanies R&D during pilot production

Product Development at Abdi İbrahim: Abdi İbrahim file preparation process is carried out under the leadership of the R&D Directorate. The product development process is completed in 15-21 months if it is for Turkey market 15-21 months; for international markets, the project is completed in 21-27 months. The file is then forwarded to the licensing officer. Development times may vary depending on internal and external factors such as product complexity, clarity of patent status, API availability, required clinical studies, project priority and etc.

Stage IV: Licensing

The Project Regulatory Officer checks the incoming license file, makes the necessary additions and then transfer the project within 2-4 weeks according to its scope to the relevant authority; for example, the Ministry of Health, the Ministry of Agriculture and Livestock or International markets. The licensing phase lasts 18 months. Critical success factors of this stage are (i) speed of response to questions from authorities and (ii) compliance with reimbursement plan.

The pre-examination process lasted between 1-3 months and during this process (i) the necessary corrections are made if the submission resulted negatively, (ii) if the results are positive, P&L checks are carried out for imported products despite the possible changes in the assumptions and the application is completed by paying the license application fee if appropriate. In Technology Transfer and AI Development projects, there is no need for P&L control since large item expenditures have already been completed.

For the new products remaining 6 months before the approval of the license, P&L study is carried out for the last time. This P&L is evaluated with the launch confirming meetings which are held every 6 months with the participation of Regulatory Affairs, Technical Operations, Sales Marketing, R&D, Business Development and Supply Chain departments. According to these meetings two final decision can be occur such as (i) It is decided to go to the market and stage V is started or (ii) it can be decided to not to go to market, in this case, Business Development department is looking for an alternative company to sell the product file.

Stage V: Launch

12 months medical information systems sales forecasts are shared with Demand Planning for the products that are decided to go to the market at the launch confirmation meeting. Demand planning then shares warehouse sales forecasts with Production Planning and launch preparations are initiated. Critical success factors of this stage are (i) Success of products approval at launch confirmation meeting and (ii) Time between reimbursement approval and launch.

Launch Management Meetings are held every two months with the participation of licensing, Technical Operations, Sales Marketing, R&D, Business Development and Supply Chain departments for the purpose of operational follow-up and coordination of launch preparations. Controls are made over the list in the marketing launch tracking file.

Commercial charge size is calculated according to the sales figures in the last P&L study prepared for the launch confirmation meeting, finalized by R&D and Technical Operations and is not changed. After the approvals are completed, the transfer from R&D to production and quality control is completed. Commercial productions take place, optimization series are produced when necessary, are shipped to warehouses following quality approvals and launched in accordance with the plans specified in the marketing launch follow-up file

Findings

Marketing and R&D are two very important departments for a company to survive, compete and develop. The interaction between these two departments, which can be called the lifeblood of the companies, is also important. Strong cohesion between departments, cooperation between functions without competition and solidarity between units will contribute to the fulfilment of the moves that will carry the company forward. The marketing and R&D departments, which play an active role in the development of new products, will influence each other, transfer information to each other and will be in constant relationship.

The success of new products in pharmaceutical production depends on reliability, quality, efficiency, sustainability and profitability. In order to achieve this success, the departments involved in the process from the idea stage to the launch stage of the product, which is decided to be developed, have to interact effectively with each other and fulfil their responsibilities in the job descriptions in a timely and effective manner.

The Effective Management of the Idea-to-Product Process model (Abdi Ibrahim…, 2016a, 2016b) implemented at Abdi İbrahim Pharmaceuticals is designed to achieve new product success and achieve sustainability in the success. The success of the model is mainly based on the integration between marketing and R&D department. In order to ensure integration between the marketing and R&D departments, the company has made effective use of technological information systems such as Electronic Information Flow System (eBA), SAP and Qmex a part of the corporate culture (Abdi Ibrahim…, 2016a, 2016b). In addition, regular meetings between departments are organized and processes are reported in order to effectively manage the processes in the model. Thus, it is able to adapt R&D and marketing strategies to the conditions simultaneously against the rapidly changing market dynamics and achieve sustainable success.

Moreover, the continuous interaction of R&D and marketing departments, which play a key role in the effective conclusion of the model, depends on the effective use of the company's information and technology systems. Otherwise, the weak inter-departmental communication will cause the company's market share to decline by transforming its R&D strategies, which should be aggressive in the face of rapidly changing market dynamics. A company with a reduced market share will reduce the resources it will allocate for R&D activities, which will cause it to lose its competitive advantage in the market.

Conclusion

Increase in world population, changes in disease burdens, creation of new treatment methods, growing interests and quality expectations are enhanced the need and demand for health services and medicine. However, developing original medicines is a challenging and expensive process. According to the literature, almost between 14% and 18% of annual sales of is pharmaceutical firms belongs to R&D which is about five times more than average R&D expenditure in others industries (Subramanian et al., 2010). What is more, pharmaceutical companies generally face to face with many challenges since R&D productivity can be low. Additionally, Blau et al. (2004) claims that high R&D costs, tight regulation, low probabilities of technical success, unsure market, and limited qualified human resources can be other causes to these challenges. This uncertainly put pharmaceutical companies under pressure in new product development processes (Mehralian et al., 2016).

Due to this long and expensive process, in Turkey generally generic drug development activities are carried out instead of the original drug development activities. On the other hand, technological infrastructure of pharmaceutical industry in Turkey has been strengthened by making the necessary investments in the framework of "Good Manufacturing Practice" which is determined by the World Health Organization. Therefore, the sector has reached a comparable technological level with European countries and nowadays sector become an important and growing market position.

The success of new product development in Turkey is measured with drug safety, quality, effectiveness and success at drug's market. The quality, reliability and effectiveness of the new product to be developed require a strong and deep-rooted R&D work. Therefore, detailed examination of success factors of new products might help pharmaceutical industry achieve more successful new products. Adherence of the drug in the market is only possible with the efficient and effective work of the marketing department regardless of innovation model which can be radical or incremental. In Abdi İbrahim Pharmaceutical Company which is the leader of the sector in Turkey, “The Effective Management of the Idea-to-Product Process” model is designed to be able to successful in all these factors since new product development is one of the most important determinant of sustained company performance.

It is a well-known fact that new product development is a high-risk process along with a high cost and there is a significant failure rate (González & Palacios, 2002). For that reason, many researches focused on improving new product development by identifying several success factors (Graner & Mißler-Behr, 2013). For the purpose of this study, the effect of “Effective Management of Idea to Product Process” model that is designed by Abdi İbrahim Pharmaceutical Company on the success of new product was examined. In the light of the information reviewed, it was concluded that the integration of departments to ensure the success of the product to be developed and that the departments involved in the process from the birth of the idea to the launch stage must fulfil their responsibilities in a timely and successful manner.

New product development is one of the key elements of pharmaceutical company in terms of its growth and development among rivals. In a rapidly changing business conditions, success of new product development processes highly depend on the technological knowledge and the company’s ability to transform it into value. Nerkar and Roberts (2004) stated that in addition to these factors, manufacturing, marketing, sales, and distribution of those products should be managed strategically. Yousefi et al. (2017) explained in their study, in which they identified critical success factors of new product development based on the relevant literatures and expert opinions, that managerial capabilities and management commitment to new product development projects are considered as two important factors in in literature. As this study is indicated, the success of new product development in the pharmaceutical sector depends on the effective management of the process from the birth of the new product idea to the launch stage, the interdepartmental integration and the value attached to information technology.

Increasingly, pharmaceutical companies seek to have a unified view of their entire product development lifecycle with the ability to view and trace every product detail throughout the entire process. For that reason, in future studies it is aimed to examine the Effective Management of Idea to Product Process” model that is designed by Abdi İbrahim Pharmaceutical Company in detail to reveal its direct effect on new product development success via considering a sample case study and its performance indicators.

References

- Abdi İbrahim Pharmaceutical Company. (2016a). In-company procedure, Access Date: June 2016.

- Abdi İbrahim Pharmaceutical Company. (2016b). In-company procedure, Access Date: July 2016.

- Alfonso-Cristancho, R., Andia, T., Barbosa, T., & Watanabe, J. H. (2015). Definition and classification of generic drugs across the world. Appl. Health Econ. Health Policy, 13(Suppl 1), 5–11.

- Blau, G. E., Pekny, J. F., Varma, V. A., & Bunch, P. R. (2004). Managing a portfolio of interdependent new product candidates in the pharmaceutical industry. Journal of Product Innovation Management, 21(4), 227-245.

- DiMasi, J. A. (2001). New Drug Development in the United States from 1963-1999. Clinical Pharmacology and Therapeutics, 69(5), 286-296.

- DiMasi, J. A., Hansen, R. W., & Grabowski, H. G. (2003). The Price of Innovation: New Estimates of Drug Development Costs. Journal of Health Economics, 22, 151-185.

- González, F. J. M., & Palacios, T. M. B. (2002). The effect of new product development techniques on new product success in Spanish firms. Industrial Marketing Management, 31(3), 261-271.

- Gorokhovich, L., Chalkidou, K., & Shankar, R. (2013). Improving access to innovative medicines in emerging markets: evidence and diplomacy as alternatives to the unsustainable status quo. J Health Diplomacy, 1(1), 1-19.

- Graner, M., & Mißler-Behr, M. (2013). Key determinants of the successful adoption of new product development methods. European Journal of Innovation Management, 16(3), 301-316.

- IEIS- Pharmaceutical Manufacturers Association of Turkey. (2019). Turkish Pharmaceutical Market 2018. http://www.ieis.org.tr/ieis/tr/indicators/33/turkish-pharmaceutical-market

- Istanbul Chamber of Industry. (2018). Top 500 Large Industrial Organization. http://www.iso500.org.tr/500-buyuk-sanayi-kurulusu/2018/

- Meadows, M. (2002). The FDA’s Drug Review Process: Ensuring Drugs are Safe and Effective. FDA Consumer 36. https://www.fda.gov/drugs/drug-information-consumers/fdas-drug-review-process-ensuring-drugs-are-safe-and-effective

- Mehralian, G., Nazari, J. A., Rasekh, H. R., & Hosseini, S. (2016). TOPSIS approach to prioritize critical success factors of TQM: evidence from the pharmaceutical industry. The TQM Journal, 28(2), 235-249.

- Nerkar, A., & Roberts, P. W. (2004). Technological and product‐market experience and the success of new product introductions in the pharmaceutical industry. Strategic Management Journal, 25(8‐9), 779-799.

- Pharmaceutical Research and Manufacturers of America. (2007). Drug Discovery and Development: Understanding the R&D Process. http://www.astp4kt.eu/downloads/BPL/ Drug_Discovery_ and_ Development.pdf

- Republic of Turkey Ministry of Development. (2014). The 10th development plan. http://www.sbb.gov.tr/wp-content/uploads/2018/11/The_Tenth_Development_Plan_2014-2018.pdf

- Revathi, B. (2015). Drug Discovery: A Complex and Time Consuming Aspect, Research & Reviews in Pharmacy and Pharmaceutical Sciences, 4(1), 1-7.

- Shah, N. (2004). Pharmaceutical supply chains: key issues and strategies for optimisation. Computers & chemical engineering, 28(6-7), 929-941.

- Sousa, R. T., Liu, S., Papageorgiou, L. G., & Shah, N. (2011). Global supply chain planning for pharmaceuticals. Chemical Engineering Research and Design, 89(11), 2396-2409.

- Subramanian, R., Toney, J. H., & Jayachandran, C. (2010). The evolution of research and development in the pharmaceutical industry: toward the open innovation model–can pharma reinvent itself? International Journal of Business Innovation and Research, 5(1), 63-74.

- Yousefi, N., Mehralian, G., Rasekh, H. R., & Yousefi, M. (2017). New Product Development in the Pharmaceutical Industry: Evidence from a generic market. Iranian journal of pharmaceutical research: IJPR, 16(2), 834.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

13 February 2021

Article Doi

eBook ISBN

978-1-80296-100-3

Publisher

European Publisher

Volume

101

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-224

Subjects

National interest, national identity, national security, national consciousness, social relations, public relation, public organizations, linguocultural identity, linguistics

Cite this article as:

Meşepınar, E., Vayvay, Ö., & Kalender, Z. T. (2021). Management Of Idea-To-Product Process For Successful New Product Development In Pharmaceutical Industry. In C. Zehir, A. Kutlu, & T. Karaboğa (Eds.), Leadership, Innovation, Media and Communication, vol 101. European Proceedings of Social and Behavioural Sciences (pp. 1-13). European Publisher. https://doi.org/10.15405/epsbs.2021.02.1