Abstract

The paper considers the problems and risks associated with transnational corporations. It is proved that the decrease of negative factors connected with the presence of transnational corporations affecting economic and national security of the country is associated with the level of economic development and financial independence of the state. The study investigates and analyses the policies and growing superiority of multinational companies in the world. It is concluded that, if transnational corporations have economic and political influence, they will form the globalisation and integration process erasing barriers between states. It is established that in addition to the negative scale of activities of multinational companies, their activities create prerequisites for the functioning of small and medium-sized businesses (in the form of contracts), which has a positive effect on the economy of the regions and countries of presence. The creation of mechanisms for regulating the activities of multinational companies, at the international level, will make it possible to establish uniform requirements for control and punishment.

Keywords: Network economytransnational economytransnational corporations

Introduction

The transnational corporations’ impact on the economies of individual countries and regions is at the centre of the scientific discussions of the world economy scholars and is under consideration in political circles. The scale of the transnational corporations’ economic activity allows enforcing their policies in the regions and countries of their interests. Governments of the countries interested in expanding their markets and establishing their influence on the political processes in the region are often behind the TNCs activity (as a rule, it is behind the scenes). All these facts force the governments to take measures preventing economy control by TNCs and the national security threat on the part of the multinational corporations represented by other countries (Liu, 2013). Having a billion-dollar income and highly qualified specialists, TNCs easily manoeuvre in the legal field, both of individual states and international associations.

Problem Statement

The problems of TNCs have been repeatedly raised by the international community and discussed on the sidelines of the UN. Possessing colossal financial resources, TNCs can manipulate political and economic processes in countries and regions contributing to the adoption of laws necessary for themselves. They have branch networks around the world and occupy a large part of the goods and services market; TNCs can manipulate pricing policies in violation of the antitrust laws of countries, thereby crowding out competitors and capturing new markets.

Research Questions

Purpose of the Study

Purpose of the Study: the investigation of consequences of TNCs presence in countries and regions, of TNC control problem and risks for the state and national enterprises caused by TNCs presence in their region. The study, the countries with the largest world TNCs concentration were examined. The process of their globalisation and attempts to oust national TNCs from the market were analysed. It is necessary to develop a mechanism. In the course of classifying a company as a TNC to establish legal standards and control over the TNCs activities.

Research Methods

The theoretical basis of the study was the fundamental works of national and foreign scientists who made a significant contribution to the research of globalisation, economic security and multinational corporations’ problems. In the course of the study, the authors used scientific publications, legislation, statistics and economic literature.

Studying the TNCs impact on the economies of countries, dialectic, system, integrated, and objective-subjective approaches were used. A comparative analysis was used for determining the proportions of the TNC market situation; the method of statistical analysis, an activity system analysis and graphical interpretation were also used. The method of interdisciplinary research was applied to assess the impact of transnational corporations on political changes in the countries of presence.

Findings

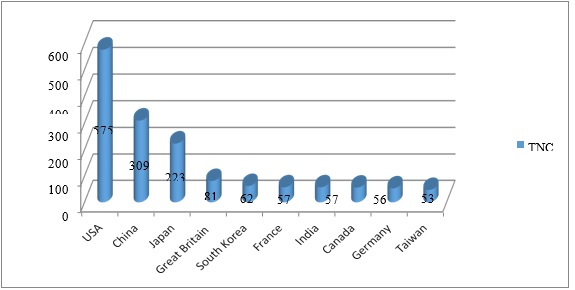

In the global ranking of transnational corporations, the leading positions are occupied by the companies having headquarters in the USA, Japan, China, India, Germany, Great Britain and France (Ventura, 2019).

Figure

If we compare the parallels of influence on global politics, then it can be seen that the ability of individual countries to influence world political processes is similar to the states ranking according to the number of TNCs, as it is shown in Figure

The growing dominance of TNCs in the global economy challenges national interest. Manipulating financial flows and innovative strategies, TNCs did not only create favourable legislative activity in the regions of their concern but also erased the borders of entire states under the guise of world trade expansion. Whereas TNCs operate in a de facto borderless world created by technological ingenuity, de jure political and legal distinctions still mark the boundaries on a world map composed of nation-states. (Transnational Corporations, 2020).

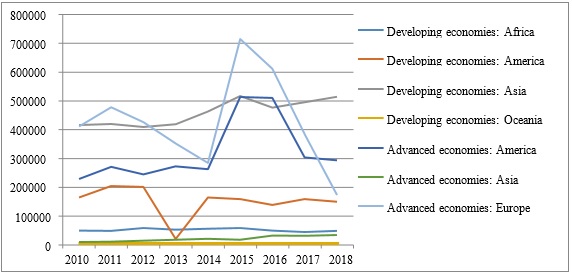

In terms of economic security, TNCs pose the greatest threat to developing countries because TNCs possess colossal financial resources. Offering to the states a flow of direct investment, creation of jobs, infrastructure and budget replenishment (in the form of tax deductions) TNCs become internal manipulators in the country (Duran, 2005). Foreign direct investment statistics presented by the United Nations Conference on Trade and Development (UNCTAD) are presented in Figure

Source: https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx

The chart indicators show that the movement of investment flows towards the Asian region. The empires of TNCs are expanding, capturing new markets and increasing multi-billion dollar profits. The annual income of many corporations is so enormous that it exceeds the economic indicators of many countries in the world (Table

Source: Companies that have more money than entire countries, 2018, https://www.rt.com/business/434516-companies-countries-gdp-revenue/

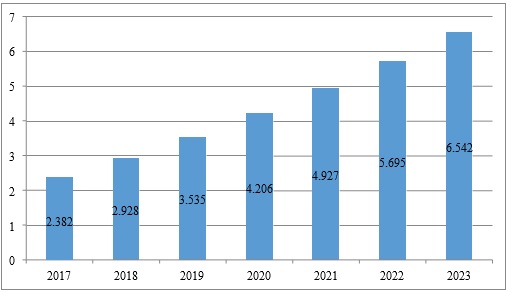

The global transition plays an important role in strengthening TNCs to a network economy. Year after year, large trading corporations, such as Alibaba, eBay, Amazon, are pushing traditional stores out of the market, offering a more diverse assortment of goods delivered directly to your home. Figure

Source: Global Ecommerce 2019 https://www.emarketer.com/content/global-ecommerce-2019

For Russia, such a progressive development contributes to the withdrawal of a large amount of money from the country to the accounts of foreign Internet Rottweilers, since the largest corporations in the field of electronic commerce have headquarters in other states (Alibaba – China, Amazon and eBay – USA) (Riccaboni et al., 2013).

It is quite problematic to create a security barrier from transnational corporations in the age of global economic integration. The only adequate deterrence condition is the development of national TNCs; they will be able to protect the interests of the country (with the state support) in case of security threats.

For example, Unilever and Nestle occupying the majority of the food market in the world were unable to compete for the Chinese market with the Chinese China Mengniu Dairy (14 % of the market) and Inner Mongolia Yili Industrial Group (19 markets) and managed to have only 7 % of the country's market.

In China, this trend can be observed in almost all areas: Chinese washing powder manufactures Nice Group (16 %) and Guangzhou Liby Enterprise Group (15 %) have pushed the previously leading Procter & Gamble Company to 11 % of the market; the home appliance market is occupied by Haier Group (29), Midea Group (12) and Guangdong Galanz Group (4) having replaced Germany’s Robert Bosch GmbH and Japan’s Sanyo Electric, leaving them only 4 % of the market (Santos & Williamson, 2015).

The policy of hidden protectionism and the gigantic capacity of the domestic market in parallel with the growth of solvency provide China with its security and independent foreign policy.

The world practice declares to abandon the protectionist policy because such processes seem unacceptable, taking into account the globalisation of economic processes and joining various international unions (WTO, EU, Andean Community, NAFTA). In reality, the situation is quite the opposite. Export mercantilism and other forms of selective subsidisation are persistent features of modern measures to protect national companies in the domestic market (Evenett, 2019).

The problem of monitoring the TNCs activities became obvious 50 years ago. In 1974, the United Nations Centre on Transnational Corporations (UNCTC) was established under the UN Council. It sought to formulate a comprehensive, multilateral instrument, the UN code of conduct on TNCs (Kovarda & Makarov, 2015). This indicates the need to be aware of the TNCs presence in a region or country when determining economic security. It should also be borne in mind that most TNCs, ignoring the laws of countries, are trying to divert their profits to offshore zones in order to avoid paying taxes. This is due to the significant difference and complexity of the TNCs corporate structures (Pereira et al., 2019).

The structure of TNCs is quite complex, and it is difficult to classify if a firm is a TNC. Modern legislators and economists ask with increasing frequency whether the world's largest banks, including banking supermarkets, are transnational corporations (Industrial and Commercial Bank of China, China Construction Bank Corporation, Agricultural Bank of China, Bank of China, Mitsubishi UFJ Financial Group). This issue has arisen due to the expansion of the non-financial services sector by banks (telemedicine, a banking store and parcel delivery services), taking into account the extensive branch network (Das, 2020).

The environmental impact of transnational corporations is well traced on the example of developing countries. This is due to the loyal system of environmental regulation and incomplete environmental legislation. As the country economic develops, the environmental legislation improves there (for example, when Mexico signed the Agreement on the Free Trade Zone, it resulted in the strengthening of the environmental legislation).

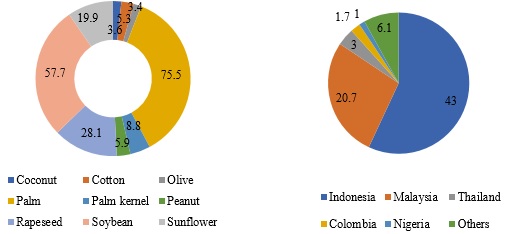

An example of another environmental disaster is the expansion of oil palm in Indonesia and Malaysia. The increase of oil palm plantations has led to widespread environmental damage and a reduction of other important crops acreage, e.g., cocoa beans production; it happened in connection with natural forests reduction, environmental pollution and the reduction in the number of peat bogs and wild world fauna. However, at the same time, it served as a growth booster for the Indonesian and Malaysian economies (Tang & Al Qahtani, 2020).

Palm oil is mainly delivered to Russia from Indonesia; it is connected with settlement schemes for the Russian weapons supplies (the last contract involved the supply of 11 Su-35 fighter jets). The increase in palm oil imports (by 19 %) is the result of its import ban on the EU (Figure

Figure

Despite the loyal national legislation in the field of ecology and nature management, many companies are transformed into transnational crime syndicates. An illegal logging business has formed, increased demand for rare wood furniture from developed countries (West, 2018).

The most affected regions from uncontrolled cutting of valuable tree species are South America (Brazil in particular) and Southeast Asia (Indonesia in particular).

Vietnam is considered one of the world leaders producing furniture from rare species of trees. Vietnam has practically captured the furniture market importing smuggled raw wood (rosewood and teak) from neighbouring countries (mainly from Laos) and using cheap labour. The main importers of “exclusive” furniture are the USA, China, Japan and the EU, and environmentalists from all over the world call for the introduction of legislative regulation on the import of such furniture in these countries. (Platov, 2014).

The Monsanto Corporation specialising in the production of GM crops is considered one of the largest TNCs manipulating the laws of countries. In 2013 Monsanto Co. decided to invest $140 million in the economy of Ukraine in order to produce (non-genetically modified) wheat seeds since GM production activity is prohibited by law in Ukraine. By the end of 2013, some amendments to the biosafety law were proposed; they offered to legalise the use of GMO seeds since they had been certified in the USA (Nelson, 2014).

Despite the negative factors of TNCs affecting economic security, there are some positive aspects of their presence, and they should also be evaluated. TNCs bring new technologies of goods and services produced to the country, in addition to new jobs, infrastructure and direct investments. They also contribute to the accelerated enforcement of international standards and international law, providing the country with a positive image in the international arena.

Conclusion

Studies report that TNCs have economic and political influence on the activities of the states where they are located. Moreover, the presence of TNCs in the regions reveals the country’s weaknesses in the legal field. TNCs are expanding towards countries with attractive labour and natural resources, as well as with loyal environmental regulations. In the process of their development, TNCs are shaping the processes of globalisation, and they are interested in universal integration. In the initial stages of TNCs activity in a new country, the interests of the state and TNCs are interconnected. In the process of economic development, the situation is going to change dramatically; the state will face the challenge of protecting the national economy subjects from the TNC activities.

Acknowledgments

The reported study was funded by RFBR and EISR, project number 20-011-31686.

References

- Das, B. (2020). 15 Largest Banks In The World By Total Assets | 2020 Edition. https://www.rankred.com/largest-banks-in-the-world/

- Durán, J. J. (2005). The Financial Capital of Multinational Companies. In Internationalisierung und Institution (pp. 277-296). Gabler Verlag, Wiesbaden.

- Evenett, S. J. (2019). Protectionism, state discrimination, and international business since the onset of the Global Financial Crisis. Journal of International Business Policy, 2(1), 9-36.

- Kovarda, V. V., & Makarov, V. I. (2015). Analysis of multinational companies influence on national economies. Young sci. 22(102), 415–416. https://moluch.ru/archive/102/23151/

- Liu, Y. (2013). Research on Sole Proprietorship of Transnational Corporations in China. In Proceedings of the 2nd International Conference on Green Communications and Networks 2012 (GCN 2012): Volume 4 (pp. 239-244). Springer.

- Nelson, J. (2014). Monsanto and Ukraine. Inform. and Analyt. Portal Global Politics. https://geopolitikym.org/monsanto-i-ukraina/

- Pereira, V., Temouri, Y., & Jones, C. (2019). Identity of Asian Multinational Corporations: influence of tax havens. Asian. Bus. Manag. 18, 325–336.

- Platov, V. (2014). The illegal wood market of Southeast Asia. New Eastern Outlook Intern. Magaz. https://en.journal-neo.org/2014/04/25/nelegal-ny-j-ry-nok-drevesiny-yugo-vostochnoj-azii/

- Riccaboni, M., Rossi, A., & Schiavo, S. (2013). Global networks of trade and bits. Journal of Economic Interaction and Coordination, 8(1), 33-56.

- Santos, J. F. P., & Williamson, P. J. (2015). Why are multinational corporations vulnerable. https://mybiz.ru/articles/pochemu-transnacionalnye-korporacii-uyazvimy/

- Tang, K. H. D., & Al Qahtani, H. M. (2020). Sustainability of oil palm plantations in Malaysia. Environment, Development and Sustainability, 22(6), 4999-5023.

- TransnationalCorporations,Encyclopediasalmanacstranscriptsandmaps(2020). https://www.encyclopedia.com/social-sciences/encyclopedias-almanacs-transcripts-and- maps/transnational-corporations

- Ventura, L. (2019). World’s Largest Companies 2019. Global news and insight for corporate financial professionals. https://www.gfmag.com/global-data/economic-data/largest-companies

- West, J. (2018). Combating Asia’s Economic Crime. Asian Century… on a Knife-edge (pp. 247-277). Palgrave Macmillan.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

27 February 2021

Article Doi

eBook ISBN

978-1-80296-101-0

Publisher

European Publisher

Volume

102

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1235

Subjects

National interest, national identity, national security, public organizations, linguocultural identity, linguistic worldview

Cite this article as:

Beloshitskii, D. S., & Patlasov, O. (2021). Transformation Of Transnational Corporations Influence On The Economic Security Of Countries. In I. Savchenko (Ed.), National Interest, National Identity and National Security, vol 102. European Proceedings of Social and Behavioural Sciences (pp. 111-118). European Publisher. https://doi.org/10.15405/epsbs.2021.02.02.14