Abstract

Social infrastructure is rarely considered the region’s most important manufacturing sector. More often it has a supporting role, the purpose of which is to ensure the functioning of more profitable sectors of the economy. However, the development of social infrastructure can significantly increase the efficiency of the entire economic system due to a quick increase in labour productivity and the number of labour capital. The source of the rapid development of the sectors of social infrastructure can only be the investment process. The main subject of the investment process in the social sphere is traditionally the state. Private investments do not run into the social infrastructure due to the uncertain financial result and mechanisms of interaction with government that continuously monitor this sphere. Nevertheless, investments in social infrastructure are beneficial to the state, population and private investor. To achieve a synergistic effect, an effective mechanism for their interaction is needed. The concepts of "social investments" and "investments in social infrastructure" are defined in the paper, a statement is made about the possibility of efficient use of investment resources of institutional investors in several sectors of social infrastructures. It is proposed to use public-private partnership (PPP) as the main mechanism of interaction between private business and the state with allocation of the most suitable forms.

Keywords: Social infrastructureinvestmentspublic-private partnership

Introduction

Increasing investment activity in the Russian economy is an important issue. Investments have major potential in solving socially significant problems. Attracting private and public investment in the social sphere will help to bring it out of the crisis and create conditions for the successful reproduction of human capital. However the public investments have statistically a positive influence on personal income, but investments are not always efficient and it is important not to spend more but to spend wisely (Alamá-Sabater, & Cantavella, 2019).

Problem Statement

Human capital is exhaustible, subject to physical deterioration and obsolescence. This is a common sign of all factors of production, economic resources. The achievement of high rates of growth of efficiency and its absolute values serves as a guarantee of a successful demographic situation and a decent quality of life of the population (Yaschenko & Nikiforova, 2019, par. 1, p. 344). The state and private business are forced to invest in the reproduction of human capital. They have to make social investments.

Research Questions

The concepts of “social investment” and “investment in social infrastructure” have differences. Social investments are divided into direct and indirect in accordance with the primary focus. Direct social investments are investments in a human in order to improve personal indicators. Such personal indicators primarily determine the characteristics of human capital. Indirect social investment is a form of social investment. They are not aimed at the “bearer” of human capital (person). Their goal is elements affecting human capital and the quality of life of the population. Social infrastructure is a good example of such an element. Therefore, the concepts of “social investment” and “investment in social infrastructure” are different levels of the same classification.

Purpose of the Study

In this paper, the purpose consider a social infrastructure as an object of investment by institutional investors, to identify attractive investment sectors, as well as to propose mechanisms for interaction between government and private investors in the investment filling of social infrastructure sectors.

Research Methods

To achieve the purpose of the study, the following scientific methods were used: a comparative analysis, a retrospective analysis, a method for identifying cause-effect relationships, analysis of regulatory documentation, system analysis, forecasting, a practice-oriented approach.

Findings

Social investments should be implemented in the form of investments in social infrastructure. Social infrastructure is part of the region’s integrated infrastructure. The main task of social infrastructure is to ensure the required quality of life and reproduction rates. The main goal of social infrastructure is to create conditions for the reproduction of human capital, to meet the material and spiritual needs of society, to form new needs for improving the quality of life, building and developing human potential. Social sustainability is the capacity of local communities to reproduce themselves, preserving their social habits and customs (Jover & Díaz-Parra, 2020).

Social infrastructure creates a huge investment and innovation space conducive to generating knowledge, innovation and investment directed to improve the quality of life of society. The higher the level of development of social infrastructure, the higher investment and innovation activity of economic entities and the competitiveness of the region.

The government should ensure a decent quality of population’s life. People must have the access to subjects of social infrastructure and the results of its operation (Nikiforova, Polyakov, & Yaschenko, 2019). Social investments can be made by private investors, the state and jointly. The current trend in the development of social investment is the excess of the part of private investment over the state. The objects of social investment are a person, households, organizations, institutions. Social infrastructure can be successfully included in this list.

The role of social infrastructure is to provide conditions for the development of the structure of the economy and impact on the efficiency of the modern economic system (Lomovceva, Tkhorikov, Gerasimenko, Sobolev, & Merezhko, 2019). Social infrastructure consists of many sectors. Some of them have a significant impact on the parameters of human capital in the region.

The quality and accessibility of health services, the level of its development obviously directly affect human capital. The physical capabilities of a person are associated with his state of health. Labor productivity and the ability to reproduce human capital are directly dependent on the effectiveness of healthcare. Health care affects the quantitative characteristics of human capital and its labor productivity. In 2018 1.4 % (246.9 billion rubles) of all investments in fixed assets were directed to activities in the field of healthcare and social services in Russia. Annual growth is 14.4 % (Rosstat, 2018).

Accessibility and quality of education services is a requirement for human development and the realization of its potential. Education is closely linked to the qualitative characteristics of human capital. As a part of the social protection floor, quality education needs to be provided to all by investing in teachers’ education and training, school equipment and infrastructure (Nagesh Kumar, 2019). In 2018 1.5 % (270.8 billion rubles) of all investments in fixed assets were allocated for education in Russia. Annual growth is 14.7 % (Rosstat, 2019).

Transport infrastructure is a source of socio-economic development and expansion of territories. It creates and expands the successful functioning of the remaining branches of social infrastructure. The transport network contributes to the efficient allocation of human capital in the region and its mobility. The successful infrastructure is achieved when it can deliver as many positive benefits as possible and reduce the negative impact on the community (Rohman, Doloi, & Heywood, 2017, par. 6, p. 32). Investments in transport accounted for 16.4 % (2416.3 billion rubles) of total investments in fixed assets in 2016. Annual growth is 12.7 % (Rosstat, 2018).

The development of these sectors of social infrastructure is the main way to increase the efficiency of human capital and its reproduction level. Investment is the main way of such development. The basic form of the realization of the social space is the relationship and interaction (Lomovceva & Mordvincev, 2012). But the state cannot cope alone and budgeting has rigid character and no flexibility in use of resources (Lomovceva et al., 2018). Investments by institutional investors are one effective way to achieve this. Since 2018 social infrastructure has been demonstrating high rates of annual growth in investment in fixed assets.

Institutional investors are collective holders of securities. They form investment reserves by combining temporarily free financial resources of the population and enterprises. They invest in securities and investment projects, act as intermediaries between owners of funds and objects of investment. The main goal is to obtain an increase in equity and investor capital.

Characteristic features of institutional investors:

- implementation of the collective investment model;

- focus on the growth of equity and investor capital;

- intermediary role in the investment process.

They include investment funds like mutual funds and ETFs, insurance funds, and pension funds as well as investment banks and hedge funds.

Such investors are able to give the individual and the business entity the status of an agent of an investment institution. This is the main feature of an institutional investor (Inshakov & Lebedeva, 2001).

For example, there were 66 non-state pension funds in Russia in 2017. The total number of their participants was 6007.8 thousand people. Despite the decrease in the number of these funds in recent years, the number of participants increases. This indicates an increase in the potential of non-state pension funds. The enlargement of companies is taking place and their financial capabilities are increasing. Non-state pension funds capital and reserves increased to 154.4 billion rubles by 2017. Annual growth is 48.6 % (Rosstat, 2018). The development of a private pension system forces companies to look for new investment objects.

Institutional investors are strategic investors. They are capable of implementing long-term and large-scale investment projects, the need for which is high in the sectors of social infrastructure. Cooperation of institutional investors with the state is the best option for implementing such investment projects. For the development of social infrastructure, it is important to coordinate the construction processes of new infrastructure facilities with the territorial planning of the region. Otherwise, inconsistency of actions at the regional level leads to losses for entities of infrastructure sectors and limits the attraction of investment entities to the region (Ulyanova & Yaschenko, 2014).

Public-private partnership (PPP) is an institutional mechanism of relations between the state and private business in investment activities. The mechanism of PPP allows leveling high risks of implementation of infrastructural projects under guidance of the state (Mohammed, Shokhnekh, Glinskaya, Shokhnekh, & Chusov, 2019). This is a medium-term or long-term institutional and organizational alliance between the state and private business in order to implement any socially significant projects on the basis of sharing results and risks between partners. Signs of PPP include urgency, certainty of an object, co-financing, equal rights, distribution of responsibility, risks and results. Forms of PPP are contractual relations, joint ventures, rent, leasing, concessions, production sharing agreements, etc.

Concession is the most effective form of PPP in social infrastructure. It is well suited for institutional investors and the state for many reasons:

- long term;

- the object is owned by the grantor at any time during the implementation of the agreement;

- a private partner is determined by the results of the competition;

- simultaneous consideration of the interests of the public and private parties to the PPP, as well as direct consumers of services.

Risk transfer in PPP contracts encourages private partners to manage project risks effectively. But delays and interruptions encounter when there is insufficient or inexperienced project management resources (Nisar, 2013).

Rent and leasing often cause a conflict of interest between the state and private partners, as the transferred property may be used by a private party for other purposes. This method cannot simultaneously take into account the interests of the public and private parties to the partnership. Negative consequences are possible for direct consumers of services.

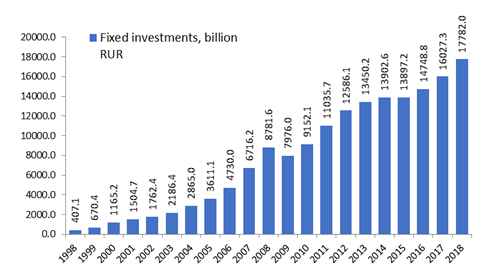

During the first 9 months of 2019 in Russia the share of borrowed funds in the total volume of investments in fixed assets amounted to 40.9 %. The total volume of investments in fixed assets in Russia in 2018 amounted to 17782 billion rubles. The growth dynamics of the indicator since 1998 is presented in Figure

Nevertheless, the share of investments from extrabudgetary funds remains negligible: 0.2 % in 2018 (Rosstat, 2019).

Conclusion

Russian and foreign institutional investors have sufficient long-term financial capital. In social infrastructure they get the opportunity to diversify their investments in low-risk assets. At the same time, it is possible to obtain tax, legal, economic preferences from the state. Positive public opinion and a constructive attitude to the brand of the company are also present.

Such activities of the state and private business will increase the standard of living of the population, increase human capital and the ability to reproduce it. The mechanism of public-private partnerships (PPP) will make it profitable, able to generate income for both private investors and the state.

References

- Alamá-Sabater, L., & Cantavella, M. (2019). Spatial income and public capital: a case of a Spanish region. Applied Economics, 51(48), 5297-5309.

- Inshakov, O. V., & Lebedeva, N. N. (2001). Institutional theory in modern Russia: achievements and development tasks. Russ. Acad. of Sci., Depart. of Econ., Southern Sect. for the Promotion of the Development of Econ. Sci. Volgograd: Publ. House of Volgograd State Univer.

- Jover, J., & Díaz-Parra, I. (2020). Who is the city for? Overtourism, lifestyle migration and social sustainability. Tourism Geograph.

- Kumar, N. (2019). Closing the Gaps in Social and Physical Infrastructure for Achieving Sustainable Development Goals in Asia and the Pacific. Millennial Asia, 10(3), 372-394.

- Lomovceva, O. A., & Mordvincev, A. I. (2012). Conditions and vectors of development of the social infrastructure of Russian regions. Vest. of Astrakhan State Techn. Univer. Ser. Econ., 2, 46–53.

- Lomovceva, O. A., Tkhorikov, B. A., Gerasimenko, O. A., Gukova, E. A., Soboleva, S. Y., & Mamatova, N. A. (2018). Spatiotemporal Aspect of the Cluster Systems Evolution. HELIX, 8(1), 2621-2625.

- Lomovceva, O. A., Tkhorikov, B. A., Gerasimenko, O. A., Sobolev, A. V., & Merezhko, A. A. (2019). Project management implementation in governing institutions of Russia: aims and results. Human. & Soc. Sci. Rev., 7(5), 921–926.

- Mohammed, Y. O. A., Shokhnekh, A., Glinskaya, O., Shokhnekh, M., & Chusov, I. (2019). Regional Mechanisms of Modernization of Infrastructure of Regions and the Country in the System of Innovational Development. Specif. of Decis. Making in Modern Busin. Syst., 209–227.

- Nikiforova, M. E., Polyakov, V. G., & Yaschenko, S. O. (2019). Regional planning of socio-economic development (including the industrial construction and social infrastructure). Int. Sci. Conf. “Social and Cultural Transformations in the Context of Modern Globalism” (SCTCMG 2018). The European Proceedings of Social & Behavioural Sciences (EpSBS) (pp. 794–797).

- Nisar, T. M. (2013). Implementation constraints in social enterprise and community Public Private Partnerships. Int. J. of project manag., 31(4), 638–651.

- Rohman, M. A., Doloi, H., & Heywood, C. A. (2017). Success criteria of toll road projects from a community societal perspective. Built Environment Project and Asset Management.7(1), 32–44.

- Rosstat (2018). Finances of Russia. Moscow: Rosstat.

- Rosstat (2019). Russia in numbers: short digest. Moscow: Rosstat.

- Ulyanova, O., & Yaschenko, S. (2014). Strategic image of development of the regional social infrastructure in Russia. Montenegrin Journal of Economics, 10(1), 75-83.

- Yaschenko, S. O., & Nikiforova, M. E. (2019). Assessment of efficiency of functioning of social infrastructure on the basis of calculation of complex indicator. Economy of stable development, 1(37), 341–344.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Yaschenko, S. O., Polyakov, V. G., & Nikiforova, M. E. (2020). Investment Activity In Social Infrastructure. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 698-703). European Publisher. https://doi.org/10.15405/epsbs.2020.12.91