Abstract

This article studies the mechanism of investment policy at the enterprises of the energy complex through a leasing form of financing. The authors considered the influence of leasing policy on the development of the energy industry in the Russian Federation. The article provides the analysis of statistical data on the volume of a new business taking into account the leasing form of financing in the Russian Federation, as well as the amount of new leasing agreements. The authors identified the factors that negatively affect the activities of energy enterprises in the field of financial leasing. The authors determined the specific reasons that restrain the development of the leasing market in the constituent entities of the Russian Federation. First of all, it is the lack of a sufficient level of free cash for long-term investments, the bulk of which is accumulated in the European part of the country. It is the low level of local leasing companies. The article reveals the degree of depreciation of fixed assets in the Russian Federation at enterprises of the energy complex. The relevance of the topic is associated with the importance of the leasing form of financing for updating the fixed assets of energy enterprises. In order to modernize the main production equipment, it is necessary to have tools that allow creating leasing methods with the aggregated approach.

Keywords: Investment policyleasingenergyfixed assetsleasing agreementmodernization

Introduction

Today, one of the most pressing problems facing Russian energy companies is the attraction of investments for the modernization of worn-out fixed assets of industry. Internal sources (stocks, reserves and profit) and external sources (long-term and short-term borrowed funds, accounts payable) can be investors. It is considered important to create an investment structure of budget financing, which will have the minimal weighted average cost of funds, and the amount of resources attracted from each source should correspond to modern market trends and criteria of financial stability. The energy industry is an important infrastructure sector of the economy, which has the development, production, testing, repair and disposal of fuel and energy equipment (Nechaev, Romanova, & Tyapkina, 2018).

Today, the leasing market in the Russian Federation is in the process of formation. In this regard, there is a positive dynamics in the value of property in the leasing sector, as well as an increase in the number of personnel in the leasing sector.

In modern conditions, the technical re-equipment of an enterprise is a complex multilayer process that requires solving complex problems, one of which is the search for sources of financing for new investments. Such investments can be made:

at the expense of budgetary funds;

at own expense;

by attracting bank loans;

at the expense of own funds and bank loans;

by the leasing mechanisms.

As a rule, when the management of the company has insufficient funds and the lack of budget financing, it faces a dilemma: is it more profitable to rent fixed assets or purchase them at the expense of a bank loan?

It is necessary to justify the decisions on the use of leasing transactions in energy industry due to the variety of conditions for leasing operations.

Problem Statement

The field of consumption has a rather pessimistic situation with demand, which is the most important factor for leasing companies. The leasing market is a key indicator of the Russian economy. It is quite unstable. The sharp ups and downs of the Russian economy indicate that it is still underdeveloped and insufficiently regulated by the Russian government. Some leasing companies are state-regulated and cannot be regarded as an integral part of the market.

To determine the method of calculating lease payments, it is necessary to take into account the current situation in the Russian leasing market. There is an unstable situation in the foreign exchange market, and there are risks that can do serious damage to ongoing and future projects of leasing companies. Such risks include a decrease in access to finance, a decrease in the solvency of clients, a general decrease in business activity and demand for leasing services as a result of a reduction in state financing of companies and limited interactions with foreign business (Tyapkina, Ilina, & Mongush,, 2016).

Research Questions

Power equipment refers to a high-tech facility of fixed assets. Reliability, efficiency and environmental friendliness of energy supply depend on the state of fixed assets of energy organizations.

Leasing of power equipment and facilities is one of the most complex and time-consuming segments of the leasing services market. It faces high responsibility of the industry. Responsibility creates serious requirements for the reliability and safety of equipment and facilities, as well as for the professionalism of participants in the process of their construction and financing. At the same time, complexity gives rise to additional opportunities and allows revealing all the advantages of leasing as a full-fledged investment mechanism. Electric power projects are interesting in the scale of facilities under construction. Large projects are the best way to demonstrate the financial and non-financial effectiveness of leasing and compare it with other financing options. Both Russian and foreign sources can be used to finance the leasing transactions with power equipment (Nechaev, Romanova, & Tyapkina, 2018).

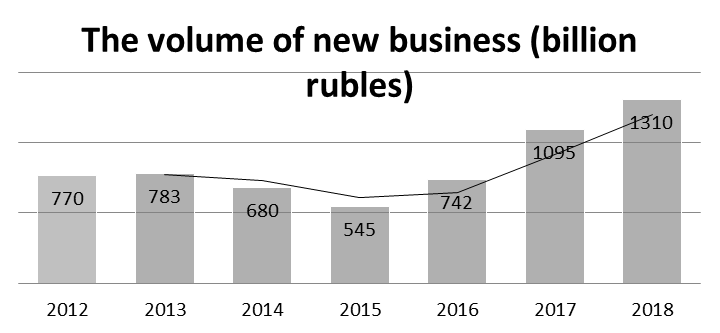

Consider a Figure

The data presented in Figure

A lease agreement differs from a simple renting in a number of characteristic features: it is signed by three parties to the transaction (lessor, lessee and seller of property); the subject of the transaction is expensive property; drawn up in triplicate (one on each side of the transaction); the main obligations to comply with the agreements are assigned to the lessor, while the lessee is fully responsible for untimely payment of rent.

It is impossible to conclude a leasing agreement without the participation and knowledge of the seller of the property. The owner must be aware of the transaction and the transaction should be financially beneficial for him.

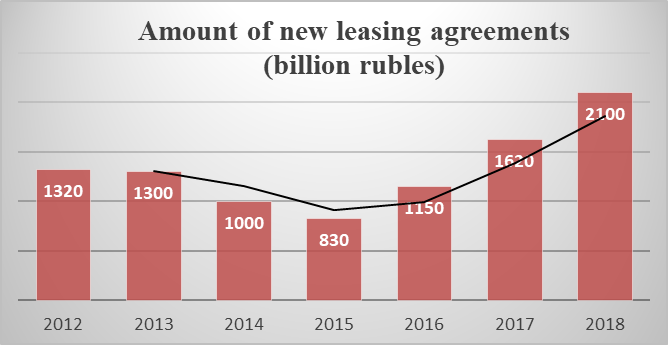

Next, consider a Figure

The Figure

The Russian Federation has a number of factors holding back the development of the leasing business. Common causes that impede the development of leasing in the country include:

1) contradictions in the leasing legislation regarding the definition of the subject of leasing;

2) low awareness of business entities about all the available benefits of leasing operations;

3) unwillingness of financial and credit institutions to carry out additional work on the implementation of leasing operations (lending is preferred);

4) difficulty in predicting leasing interest as well as leasing premium;

5) lack of specialists who are well versed in the intricacies of conducting leasing operations;

6) poorly developed secondary equipment markets (Barykina, 2019).

It is necessary to pay due attention to a sufficiently significant factor that impedes economic growth. It is the deterioration of fixed assets of Russian energy enterprises. The process of updating them is financed mainly by the retained earnings of enterprises and is constrained by the lack of available borrowed capital. Leasing as an alternative financing mechanism can play an important role in fulfilling this strategic task facing the Russian economy (Tyapkina, Ilina, & Mongush, 2016). This task is the re-equipment of fixed assets of energy enterprises.

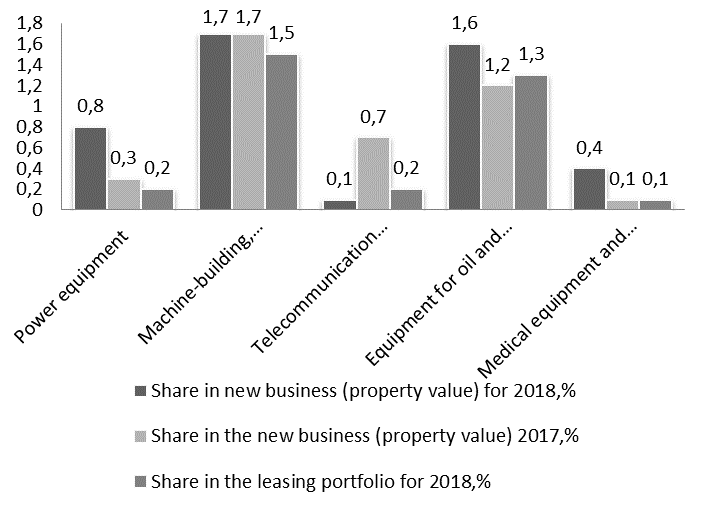

Next, we consider the structure of the leasing market in Figure

The decisive fact of increasing the introduction of power equipment, including modernization using leasing schemes, would be the centralization of leasing operations with the direct participation of RAO UES. This would allow subsidiaries with an unstable financial situation to renew the fixed assets of the energy sector enterprises. The enterprises of energy sector have the opportunity to attract investment resources to the form the market relations.

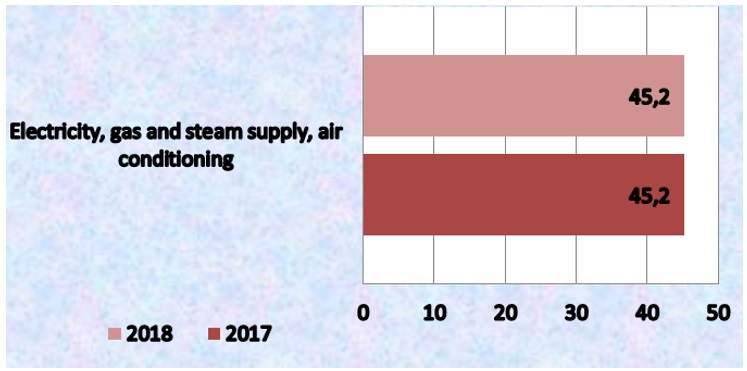

Next, we consider the degree of depreciation of fixed assets in the Russian Federation at the enterprises of the energy complex.

Figure

Meanwhile, the deterioration of electric networks and equipment averages about 65–70 %. If we compile a rating of the regions of the Russian Federation by the deterioration of electric networks and equipment, then all federal districts will have the entities where the capacities developed their resources by 70, 80, and somewhere around 90 %. The results of such statistics are frequent cases of emergency power outages and sudden accidents in various regions. Aging of equipment leads to accidents, as well as to a significant increase in energy losses during transmission, which ultimately is reflected in the electricity tariff. In addition, wear affects the reliability, number and scale of accidents.

Purpose of the Study

The main purpose of the study, as well as managing financial leasing, is the minimization of the flow of payments for servicing each leasing operation. One of the main disadvantages of leasing, which reduces its economic efficiency, is the low level of methodological elaboration of the calculation of leasing payments.

Research Methods

The methods of comparative analysis, synthesis and graphic data processing were used in the process of research and analysis of this article. The authors also made a comparative analysis of the use of leasing and gave the statistical data on the volume of new business in the Russian Federation (Tyapkina, Ilina, & Ilyashevich, 2017). The problems of development of leasing at the enterprises of the energy industry were also identified.

In general, leasing is characterized as the most effective credit tool for the purchase of special equipment, equipment, as well as the modernization of fixed assets at the enterprise.

Based on statistical data, the article presents an analysis of the amount of new leasing agreements concluded in the Russian Federation from 2012 to 2018, and also identifies risks in concluding a leasing agreement for all parties to the transaction. It is necessary to highlight significant. It is a refusal to buy property by the lessor. Non-fulfillment of obligations to lease payment is quite rare, but, nevertheless, the tenant still has such a problem (Barykina, Puchkova, & Budaeva, 2018). For example, the tenant can choose the right property, enter into a lease agreement and pay the rent, but the lessor will not buy the property within the specified time. This is an untimely payment of leasing. The tenant may not calculate his financial capabilities or incur losses. This will contribute to the creation of a debt to pay rent. These are operational risks. The leased property may fail. In this case, the lessor will no longer be able to receive rent.

Thus, it is necessary to correctly approach the drafting of the contract in order to reduce the above risks for the transfer of property on lease.

Findings

According to the above mentioned aspects, it can be concluded that the leasing demand is falling in the country because of a lack of financial resources. A lack of financial resources is directly related to the difficulty of obtaining a loan, and there is a lack of insurance for the risks of leasing activities. The Central Bank's discount rate and inflation rate are high enough for profitable leasing transactions.

To determine the method of calculating lease payments, one cannot ignore the current situation in the Russian leasing market. It includes a decrease in access to finance, a decrease in the solvency of clients, a general decrease in business activity and leasing demand. As a result, there is a reduction in state financing of companies and limited interactions with foreign business.

Conclusion

In conclusion, it is necessary to note that the development of the leasing industry needs state support, especially in the context of a constantly changing external environment. At this time, the Russian Federation has favorable conditions for the development of leasing, but it is necessary to apply a number of measures. First of all, these are improvements in the legislative framework, solving the problem of VAT refunds, as well as encouraging companies themselves to increase their own capital, reduce reporting volumes in companies and paperwork, and call to the increased transparency. These measures will lead to the increase in the share of leasing in the country's GDP (approximately 9 % by 2020), they will help businesses reduce their tax base, upgrade fixed assets, take a step towards diversification and scale up. This will lead to the strengthening of the country's economy as a whole and its stability in times of crisis.

It can be noted that the leasing market in the Russian Federation has great prospects. They are caused by the acute need of economic entities for updating the production base, an acute shortage of investment resources of energy enterprises and excessively high bank loan rates. Therefore, leasing, as a method of financing investments, has special hopes for overcoming the investment crisis and ensuring sustainable economic growth in the country.

References

- Barykina, Y. (2019, November). Risks of long-term leasing transactions for construction industry development. In IOP Conference Series: Materials Science and Engineering, 67(1), 012011.

- Barykina, Y. N., Puchkova, N. V., & Budaeva, M. S. (2018). Analysis of innovation activity financing methods in Russian economy. In RPTSS 2018 International Conference on Research Paradigms Transformation in Social Sciences (pp. 120-127).

- Barykina, Y. N., & Velm, M. V. (2019, July). Improvement of Methods and Forms of Innovative Activity Investment. In " Humanities and Social Sciences: Novations, Problems, Prospects"(HSSNPP 2019). Atlantis Press.

- Nechaev, A., Romanova, T., & Tyapkina, M. (2018). Author’s toolkit of the state regulation of the development of leasing. Int. Sci. Conf. “Investment, Construction, Real Estate: New Technologies and Special-Purpose Development Priorities” (ICRE 2018). EDP Sciences, France. Vol. 212 (Irkutsk, Russia, April 26–27).

- Nechaev, A. S., Barykina, Yu. N., & Puchkova, N. V. (2017). Actual issues of research of fixed assets of operating enterprises in the territory of the Russian Federation. Management of Economic System. 10, 46–60.

- Tyapkina, M. F., Ilina, E. A., & Ilyashevich, D. I. (2017, June). Optimization model of production and product sales within profit maximization. In International Conference on Trends of Technologies and Innovations in Economic and Social Studies 2017. Atlantis Press.

- Tyapkina, M. F., Ilina, E. A., & Mongush, J. D. (2016). The effect of innovative processes on the cyclical Nature of Economic Development. International Electronic Journal of Mathematics Education, 11(6), 1519-1527.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Barykina, Y. N., & Chernykh, A. G. (2020). Mechanism Of Investment Policy In Energy Sector. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 58-64). European Publisher. https://doi.org/10.15405/epsbs.2020.12.9