Abstract

The article is devoted to the study of sources of financing for oil and gas industry enterprises. To improve the technical base of these enterprises, only own funds are not enough; additional sources of financing are needed. The main tasks of managing the activity of an oil and gas industry enterprise in market conditions is the need to choose the most effective economic solutions and innovative direction, stimulated by competitive market conditions. The article discusses such sources of financing as factoring, forfaiting and credit. The article provides statistics on fixed assets of investment enterprises in the oil and gas industry. The types of costs, the degree of depreciation of fixed assets, as well as the role of financial investments in fixed assets at the enterprises of the oil and gas industry are considered. The urgent problem remains the elimination of a high degree of depreciation of fixed assets in the oil and gas complex, which reaches from 60 to 80%. The introduction of innovations can have a positive impact on the economic productivity of enterprises in the oil and gas industry. In this case, it is necessary to assess the level of technologies used at the enterprises of the oil and gas industry, and evaluate the economic effect of investments. Financial stability is an urgent task at the state level.

Keywords: Economyfactoringforfaitingcreditoil and gas industryfinancial investments

Introduction

The oil and gas industry is one of the main ways of economic development of the Russian Federation. Oil and gas production is currently a priority in the Russian economy. The oil and gas industry has experienced numerous crisis times, such as the fall in oil and gas prices and international sanctions. Despite this, oil and gas companies continue to invest money in new projects for the development of oil and gas. The current state of the oil and gas industry is characterized by a decrease in the growth of industrial oil reserves, a decrease in the quality and pace of commissioning of production enterprises. Sources of financing are needed to solve these problems. These include credit, forfaiting, factoring, etc. The main costs are the costs of providing the oil and gas industry with labor resources and material base, as well as the use of the budget from fixed assets in the calculation of their growth (Barykina & Velm, 2012).

Problem Statement

The oil and gas industry has tremendous opportunities to effectively develop. But there are external and internal factors that hamper the dynamic development of the industry. This is, first of all, a lack of investment resources, depreciation of equipment, economic crises, monopolism, poor product quality, imperfect tax policy, etc. If external factors are difficult to neutralize, internal problems can be solved by implementing joint efforts of the state and industry companies.The development and functioning of the oil industry of the Russian Federation is affected by sharp fluctuations in prices on world oil markets, the level of domestic inflation, the mismatch between the rates of reproduction of the mineral resource base and production volumes, depreciation of fixed assets, lack of working capital and the imperfection of the legislative mechanism of relations between the state and the oil industry. In such conditions, the mechanisms of formation of costs for petroleum products are of particular importance. They combine the interests of production and consumption in this sector of the country's economy and increase the investment attractiveness of the industry. Modern oil and gas refining is characterized by a fast pace of improvement in production processes, changes in equipment, technology and the organization of economic activity; concentration of production using various plants.

Research Questions

Global markets are currently opening up great opportunities for enterprises. In the struggle for new markets, companies in industrialized countries make extensive use of financial instruments that allow customers to make long-term deferred payments. The most commonly used financial instruments are forfaiting, factoring and credit (Figure

Comparing these financial instruments, it is necessary to highlight their main differences. So, using credit, money is provided to the borrower at a percentage depending on the repayment conditions. The credit role is important for the replenishment of working capital, the size of which varies depending on working conditions: market, natural, climatic, etc., as well as for the reproduction of fixed assets. Using credit, oil and gas enterprises can improve and increase production much faster than in its absence (Тyapkina, Mongush, & Ilina, 2019).

The current Russian economic situation has such relevant financing methods as factoring and forfaiting in domestic and foreign trade. With these operations, oil and gas companies accelerate the turnover of current assets and increase the efficiency of the development of the economic potential of industrial and economic activities. In addition, they support the development of export-import operations and generally stimulate effective economic growth (Vitsko, 2015).

Factoring is a type of unsecured credit for organizations that provide their customers with goods or services subject to deferred payments. It allows many companies to maintain their business continuity and offset the costs of the supply of raw materials, finished products, as well as the performance of certain works without prepayment (Tunygin, 2014). It is this mechanism that allows many companies to simplify accounting and expand their activities, if necessary, without attracting long-term credits (Nechaev, Barykina, & Puchkova, 2017).

Moreover, the effectiveness of factoring allows the supplier to significantly reduce the risk, because the collateral was not required in the factoring program. The benefits of factoring are not limited to financing. Many other functions related to debt management are performed: keeping records of payments, controlling the maturity, ensuring accounting and statistical management of debt, and preparing financial reports. Getting rid of the extra workload allows companies to focus on their core business (Tunygin, 2014). Thus, the use of factoring can significantly reduce organizational costs. The buyer has the opportunity to get an additional deferred payment and a convenient repayment schedule.

Finally, a financial instrument such as forfaiting is the operation of a financial agent (forfeiter) acquiring a commercial obligation of a borrower (buyer, importer) to a creditor (seller, exporter) (Minin, 2011).

Forfaiting is connected with the purchase of debt. Usually it is expressed in such a document as a promissory note (less often a simple one). Therefore, forfaiting involves the presence of a secondary market for promissory notes. Unfortunately, such a market does not yet exist in the Russian Federation, although the development of a secondary market for promissory notes would significantly reduce discount rates. Currently, only single transactions are being considered (for example, for the sale of bills of Russian importers with a good credit rating of Russian banks) (Vitsko, 2015).

A feature of forfaiting is the presence of a guarantor. Forfaiting companies can also be guarantors. The need to obtain a bank guarantee is that many companies and banks may have difficulties in the future prospects of borrowing money at a fixed rate. As a result, if the importer receives a credit in the future at a fixed rate, the interest rate will be extremely high. By issuing a guarantee, the bank gives the importer access to foreign sources of financing (Vitsko, 2015).

Financing using this financial instrument gives the exporter advantages in the form of improved liquidity and balance sheet status, as well as reduced risks, namely: elimination currency and other risks from the moment of purchasing requirements by forfeiter; refinancing of the exporter's receivables; forfeiting financing is provided on the basis of a fixed interest rate (Vitsko, 2015). Thus, the basis for the calculation is created due to the lack of floating interest rates that may occur with other types of lending; simplicity of documentation and speed of its execution; due to the integration of financing, the forfaiting company helps exporters to clearly define a strategy that can increase the likelihood of obtaining a contract, since the distinguishing feature of forfaiting is that the exporters are producers of expensive, high-tech goods and services of medium and large businesses, and buyers for such products may not be so many (Mikhalev, 2019).

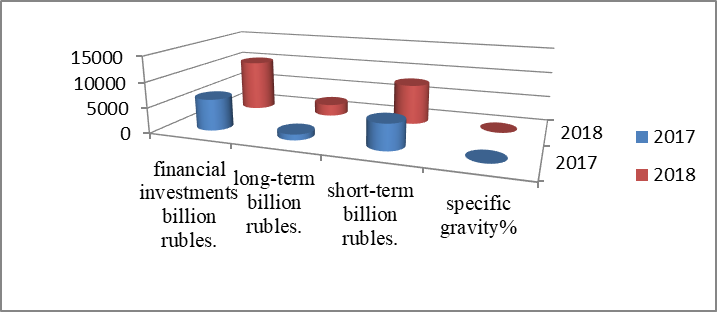

According to statistics, we see the following situation of financial investments in the oil and gas industry on the example of oil and gas production, as well as the production of petroleum products.

In 2018, one can note a growth trend in oil and natural gas production, as well as in the production of petroleum products in relation to financial investments (short-term and long-term). The percentage of long-term investments in the total volume also increases. The industry is recovering after a difficult period (2014–2017), when low prices for industry products have been forming for several years.

In 2018, we can note an increase in financial investments in comparison with 2017, which leads to an improvement in the material base (figure

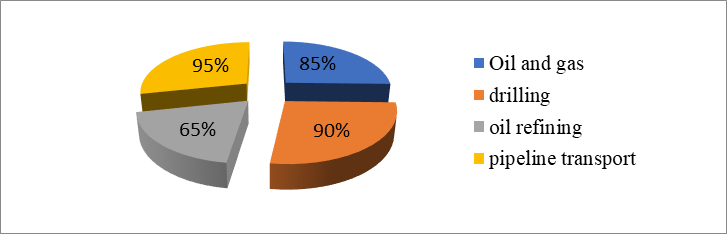

The oil and gas complex is characterized by a high proportion of the active part of fixed assets (figure

The main sources of investment in the oil and gas complex are the own funds of enterprises. Their share, together with borrowed funds, reaches 90 %, of which more than 70 % are depreciation charges and 15 % is profit attributable to the accumulation fund. Bank credits under international loan agreements account for less than 5 % of total investment costs. The state invests money from the budget only for the implementation of particularly important economic and socially significant projects (Table.

The problem of eliminating a high degree of depreciation of fixed assets in the oil and gas complex remains urgent. From 60 to 80 % of equipment is already outdated there. The lack of necessary investments did not make it possible to compensate for the problems of the production capacities of oil and gas complexes. In the oil industry, this has led to a reduction in production drilling and a reduction in oil production capacity.

Purpose of the Study

The purpose of this article was to consider possible ways and forms of financing at enterprises of the oil and gas industry to increase their effectiveness, as well as to analyze their advantages and disadvantages.

Research Methods

The data of the Federal State Statistics Service of the Russian Federation were used as material for the article. The solution of the tasks was carried out as part of a comparative analysis.

Findings

A comparative analysis of factoring and forfeiting operations has led to the conclusion that factoring is more common in the Russian Federation compared to forfaiting operations. This is due to the fact that factoring is mainly used in domestic trade, where counterparties can be informed about each other's activities. Forfaiting also serves international transactions. At the same time, Russian banks and financial institutions are not ready to widely use financial and credit operations because of their specific nature and the risks of non-payment. Although, a money loan agreement makes trade relations more stable in countries with developed market economies.

From the analysis it can also be noted that financial investments are necessary due to the high level of depreciation of fixed assets of the oil and gas industry. The main source of covering the costs associated with the renewal of fixed assets, at present, are the company's own funds. They accumulate over the entire life of fixed assets in the form of depreciation.

Conclusion

The largest oil and gas companies have long preferred to use an investment strategy of limited growth associated with the implementation of large-scale projects, or a growth strategy through mergers and acquisitions. Such companies are cautious in investments and prefer to channel funds into the operation of well-known long-developed deposits where there is no risk.

In this regard, we can say that in the current economic situation, oil and gas enterprises need to use additional sources of financing to improve the technical and material base.

References

- Barykina, Y. N., & Velm, M. V. (2012). Improvement of methods and forms of investment of innovative activity. Advan. in Soc. Sci., Ed. and Human. Res., 793–796.

- Ermoshina, T.V., Yulenkova, I. B. (2000). Financial support of investment process in Russian economy in conditions of limited resources. Moskow. Mysl.

- Mikhalev I. A. (2019). Monitoring the financial stability of enterprises in the oil and gas sector of the economy. Young Scientist, 24, 347–351.

- Minin, D. L. (2011). Investments features in order to ensure sustainable development in the/longterm. Moscow. Mysl.

- Nechaev, A. S., Barykina, Yu. N., Puchkova, N. V. (2017). Actual issues of research of fixed assets operating in the territory of the Russian Federation. Managemnt of econocial system: electricity Science Journal, 10, 46–60. Kislovodsk: Publ. House “Kislovodsk Instit. of Econ. and Law”.

- Tunygin, O. M. (2014). Internal Sources to Increase Financing for Fixed Investments in a Company Economy of reggression, 14(4), 1498–1511.

- Тyapkina, М., Mongush, Y., & Ilina, E. (2019). Cyclical fluctuations of the Russian economy. Conf. ser.: Materials science and engineering. Investments, Construction, Real Estate. New Technol. and Special-Purpose Development Priority, 667. Retrieved from: https://iopscience.iop.org/article/

- Vitsko, E. A. (2015). Development of factoring and forfaiting operations to improve the efficiency of the economy and business in Russia. Sci. J. NRU ITMO. Series Econ.omy and Environmental Management, 1, 9 UDC 336.717. St. Petersburg.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Vyaznikov, V. E., & Krasovskaya, O. A. (2020). Sources Of Financing In The Oil And Gas Industry. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 674-680). European Publisher. https://doi.org/10.15405/epsbs.2020.12.88